Highlights The risk to European stocks from higher yields is overstated for 2022. Not only do equities possess a valuation cushion compared to bonds, but also the stock returns/bond yields correlation remains positive. This positive…

Dear Client, We are sending you our Strategy Outlook today where we outline our thoughts on the global economy and the direction of financial markets for 2022 and beyond. Next week, please join me for a webcast on Friday, December 10th…

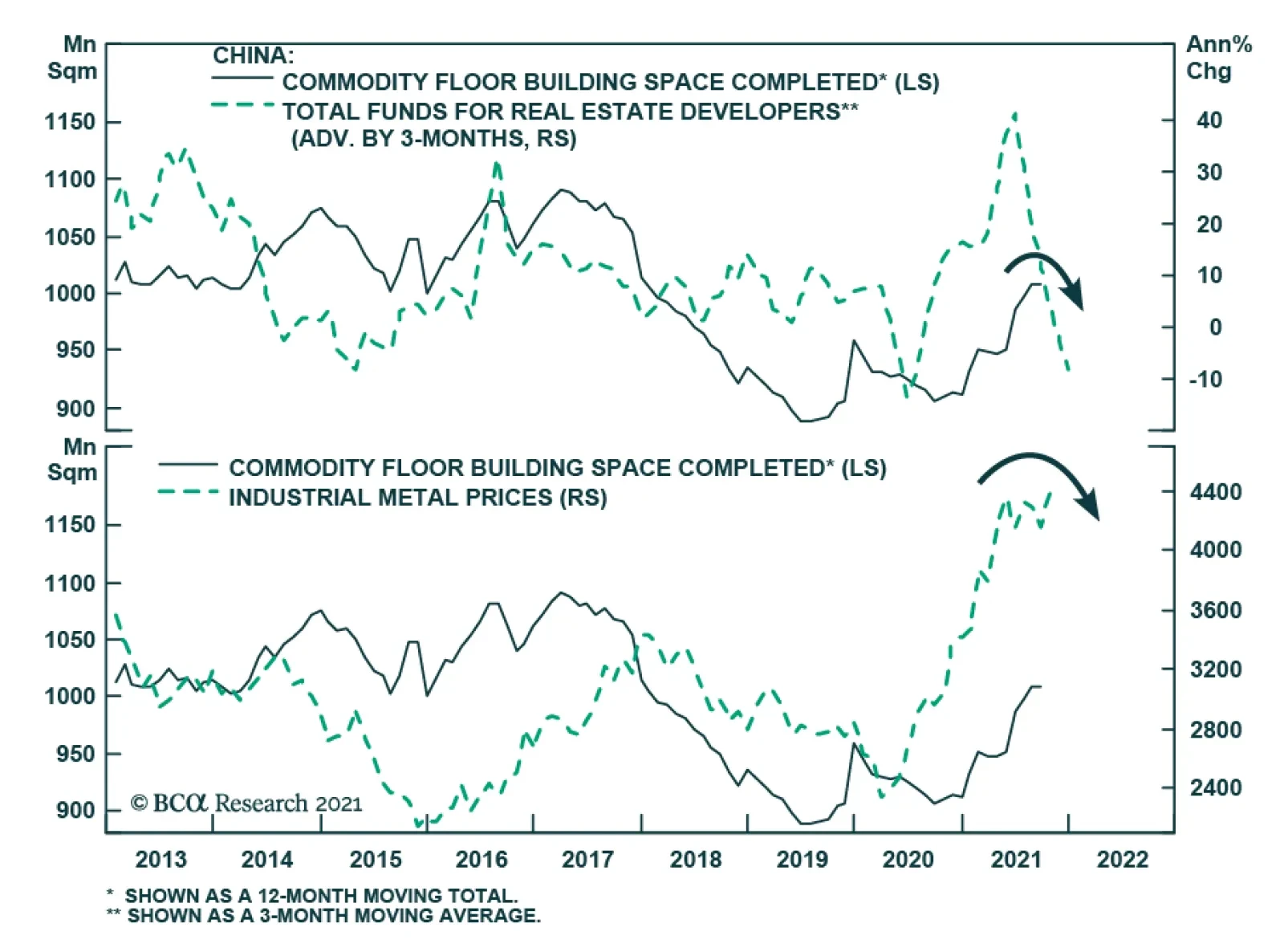

October new home prices fell for the second consecutive month in China (see The Numbers). Given how highly leveraged the Chinese property sector is, a continued decline in home prices would be an unwelcome development for Chinese…

BCA Research’s Global Investment Strategy service concludes that investors need to throw the old playbook for dealing with growth slowdowns out the window. US growth will slow next year, not because demand will falter,…

Highlights Liquidity conditions in Bangladesh are easy and growth has revived. Exports are set to recover as well. Foreign reserve accumulation will continue, which will have positive implications for the economy and stock prices.…

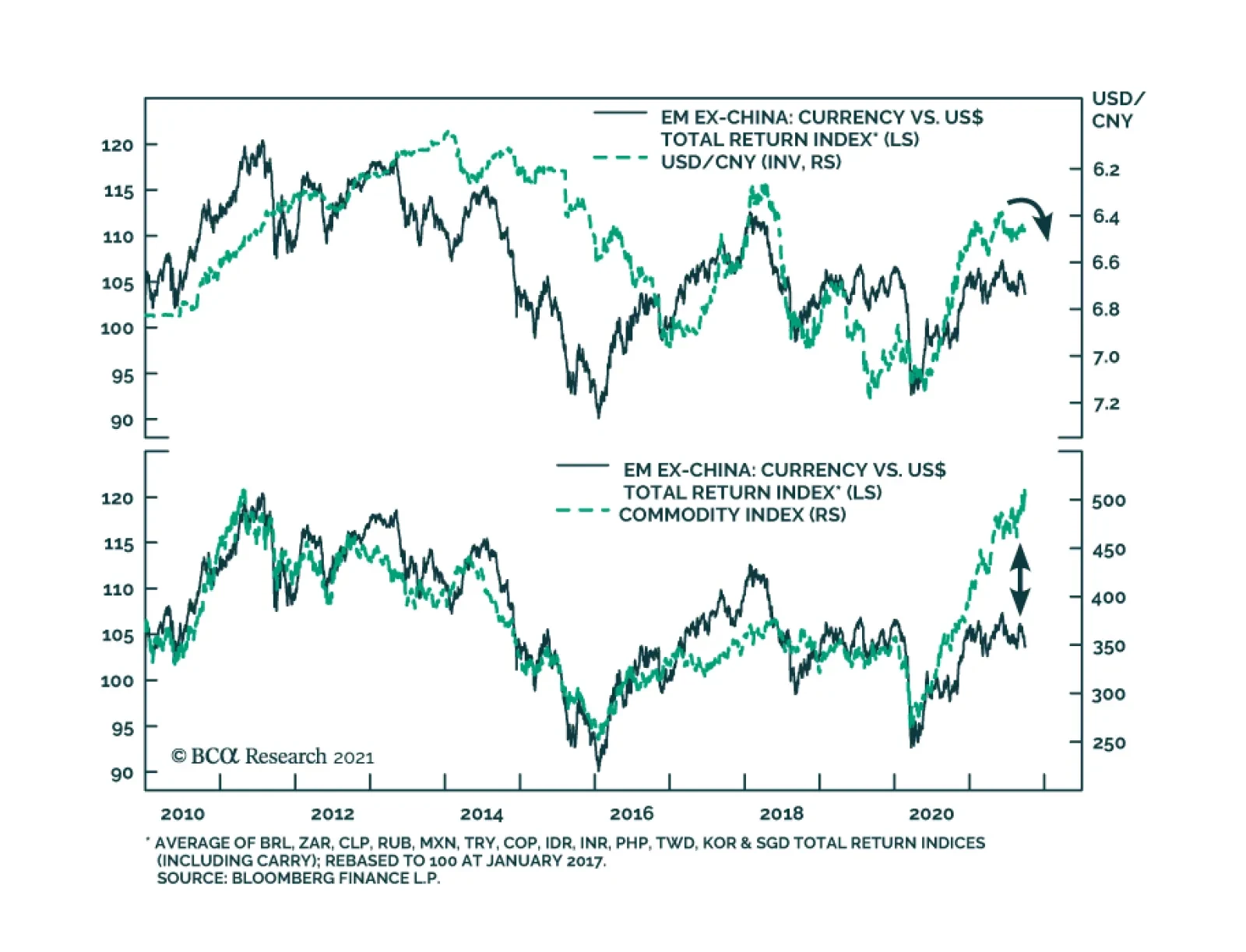

Emerging market currencies have recently rolled over in early-June and are depreciating sharply vis-à-vis the US dollar. Odds are that this downtrend will continue. On the domestic front, it is true that many Emerging Market…

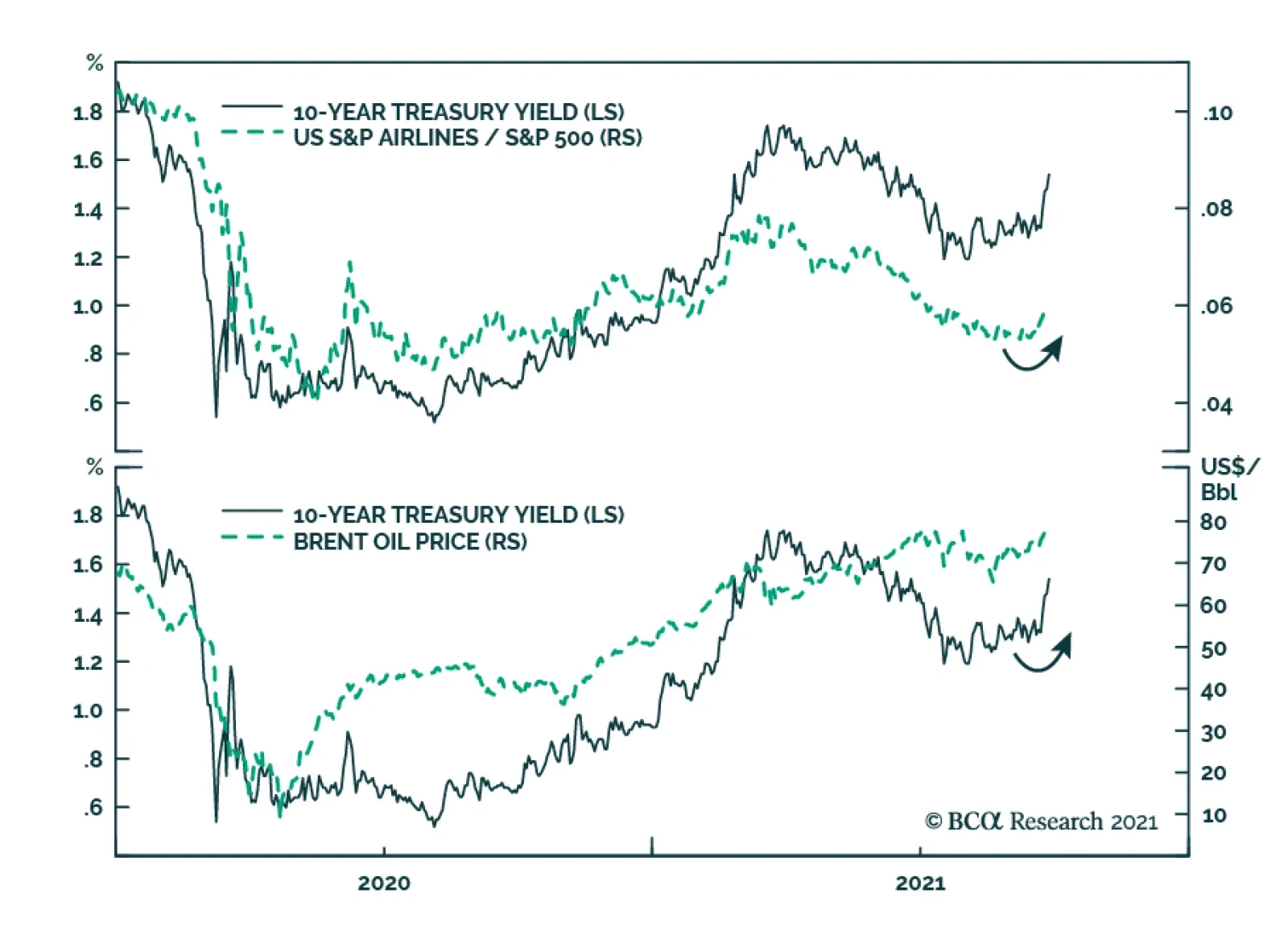

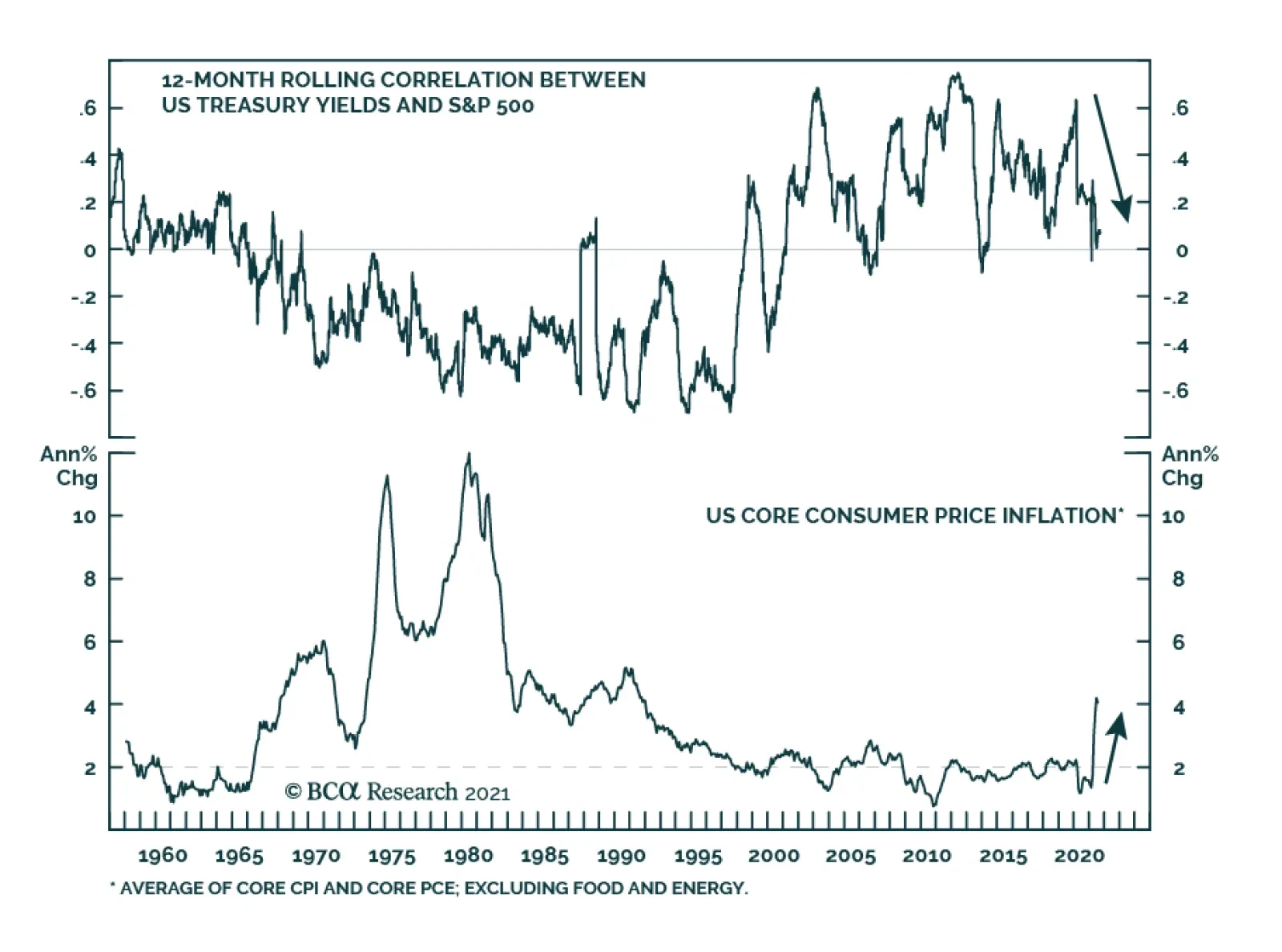

The sharp selloff in Treasurys over the past week has ignited a debate among BCA Research strategists about whether it is attributed to rising fears about inflation (see Country Focus) or is part of the reopening trade. The…

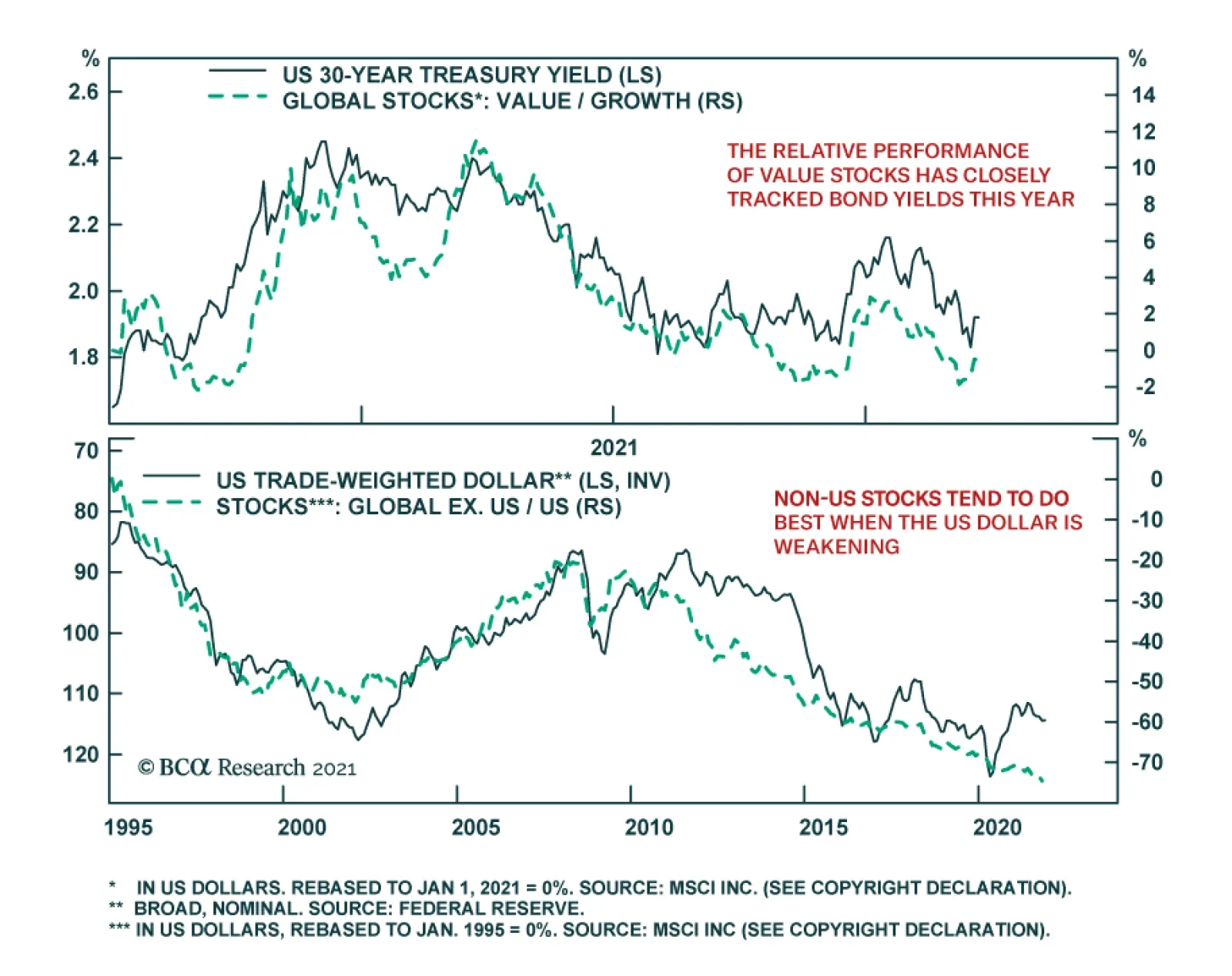

The decline in US government bond yields between April and August was largely put down to oversold conditions in the Treasury market and concerns amid signs that economic growth is moderating in the US. The stock market…

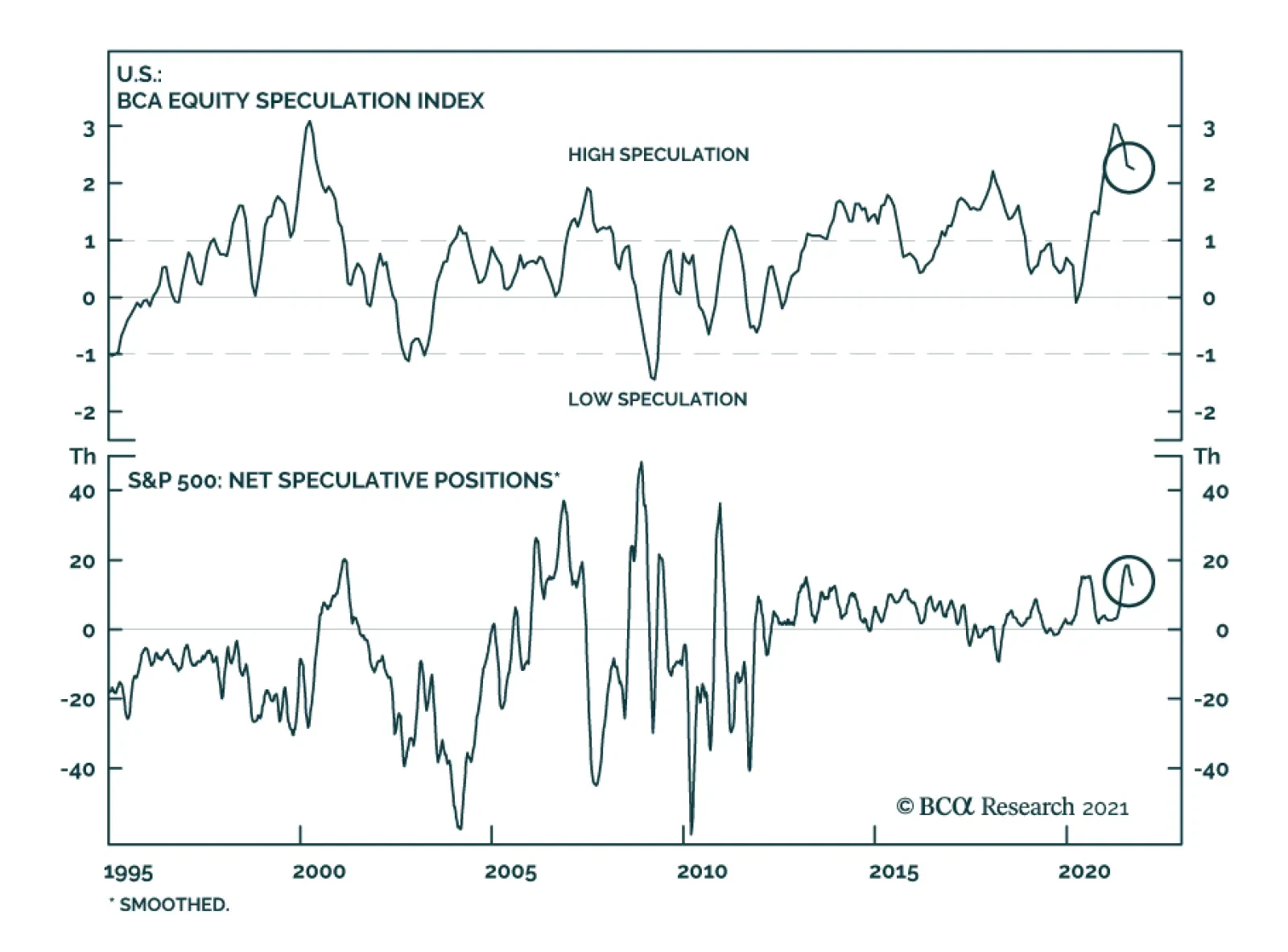

In an Insight last week, we highlighted that the American Association of Individual Investors’ latest survey reveals a collapse in sentiment. Bears now exceed bulls by a wide margin. However, this downbeat assessment is not…