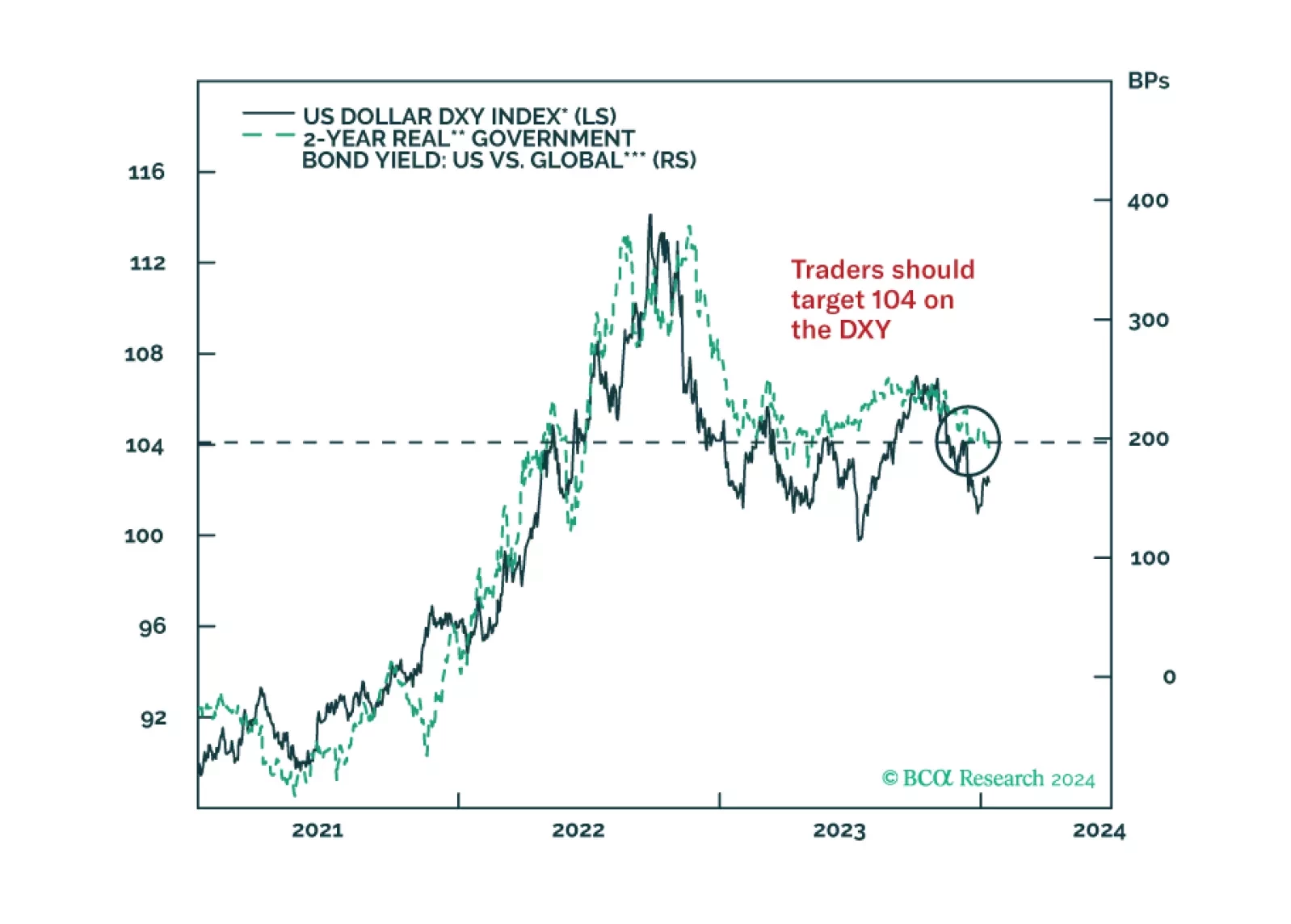

In light of the hotter-than-expected US CPI report, we look at what interest rate currency investors should focus on. Our conclusion largely keeps our existing trades in place, as published in our outlook, a few weeks ago.

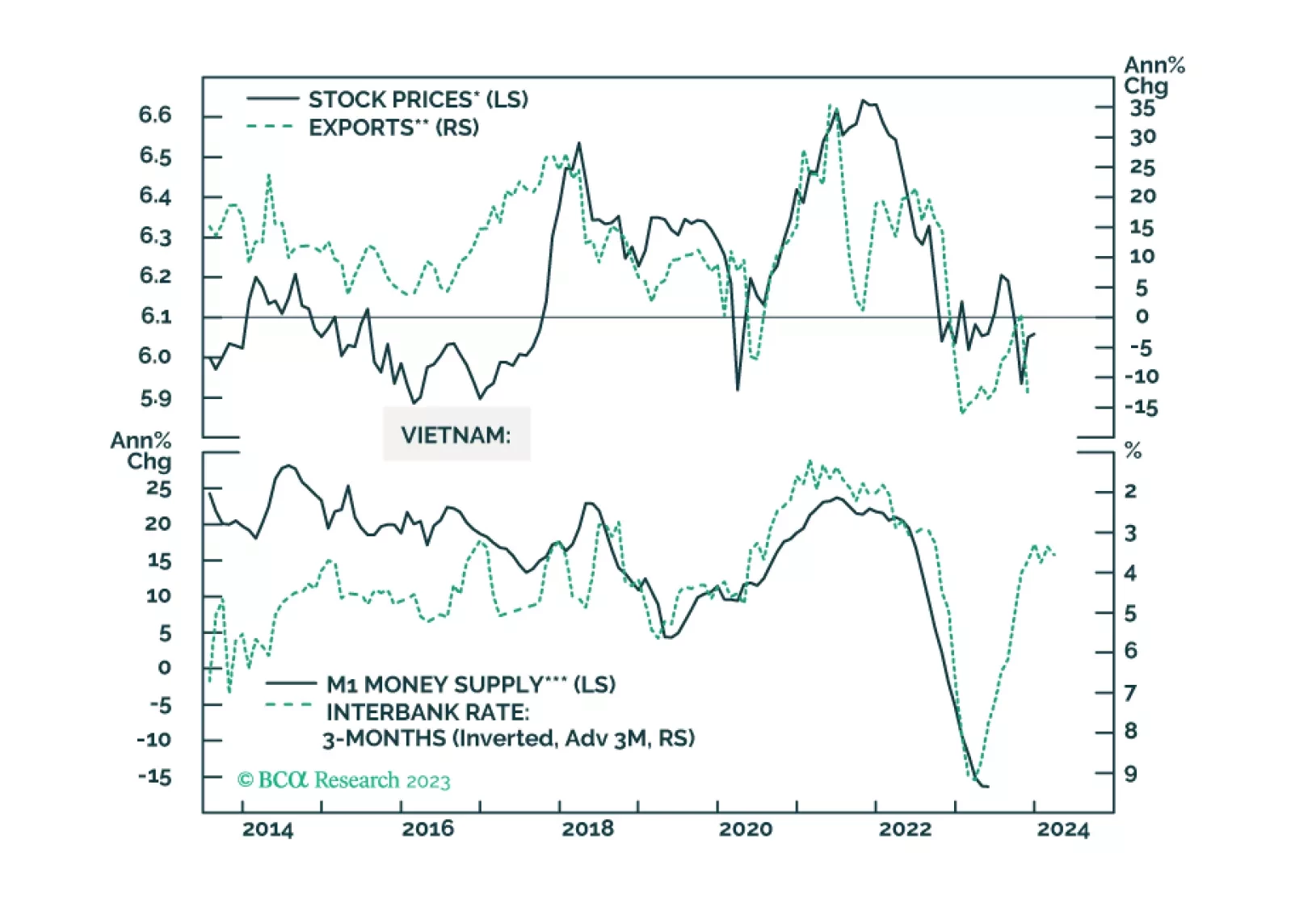

Vietnamese stocks may not see an immediate rally as global manufacturing and exports remain weak. But investors with longer-term horizons should stay overweight this market.

Our political forecasting scored wins in 2023 but we failed to capitalize on it adequately in our trade recommendations.

Today, we are sending you the BCA annual outlook for 2024. The report is an edited transcript of our recent conversation with Mr. X and his daughter, Ms. X, who are long-time BCA clients with whom we discuss the economic and…

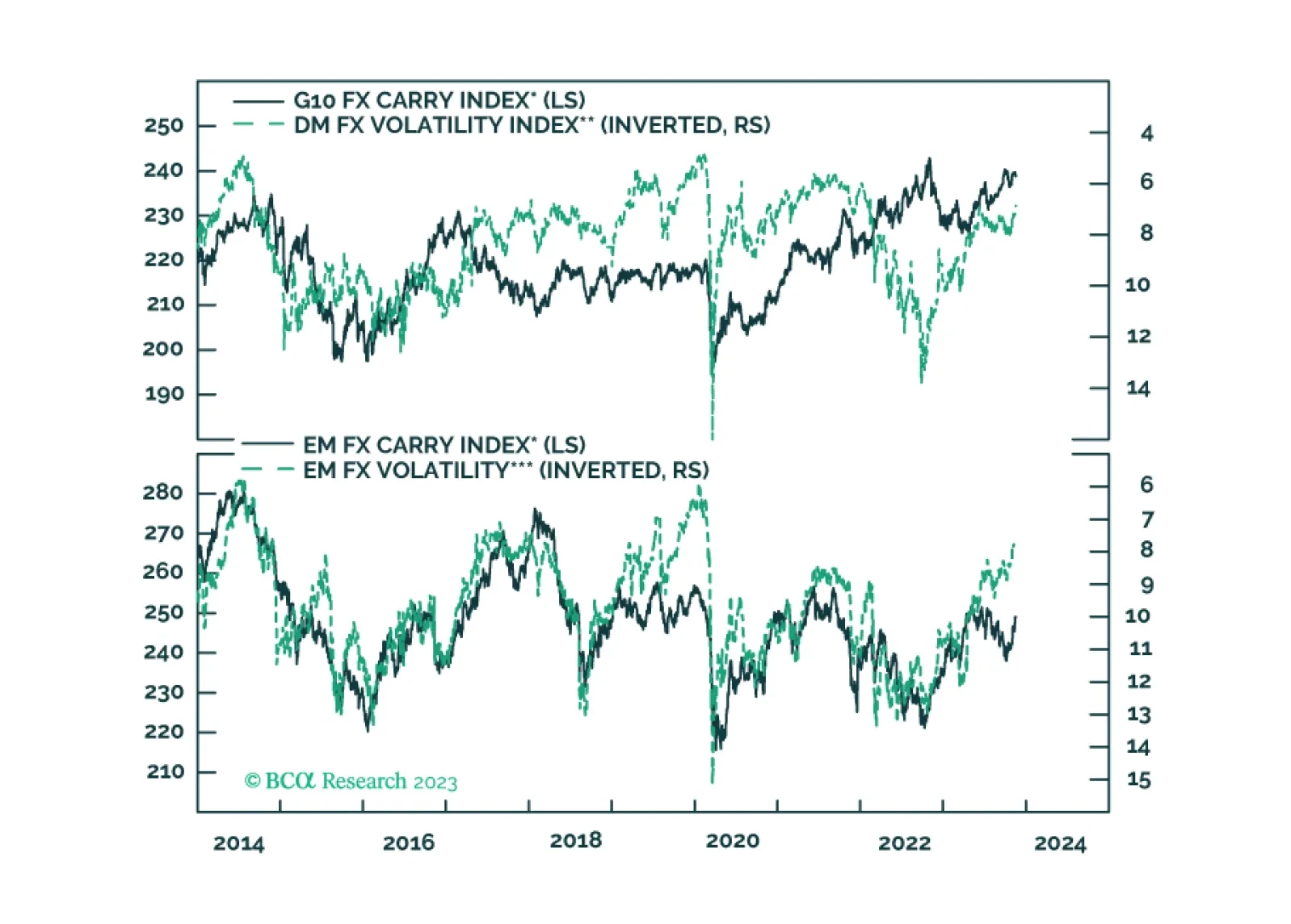

In this report, we evaluate the risk to carry trades in the coming months.

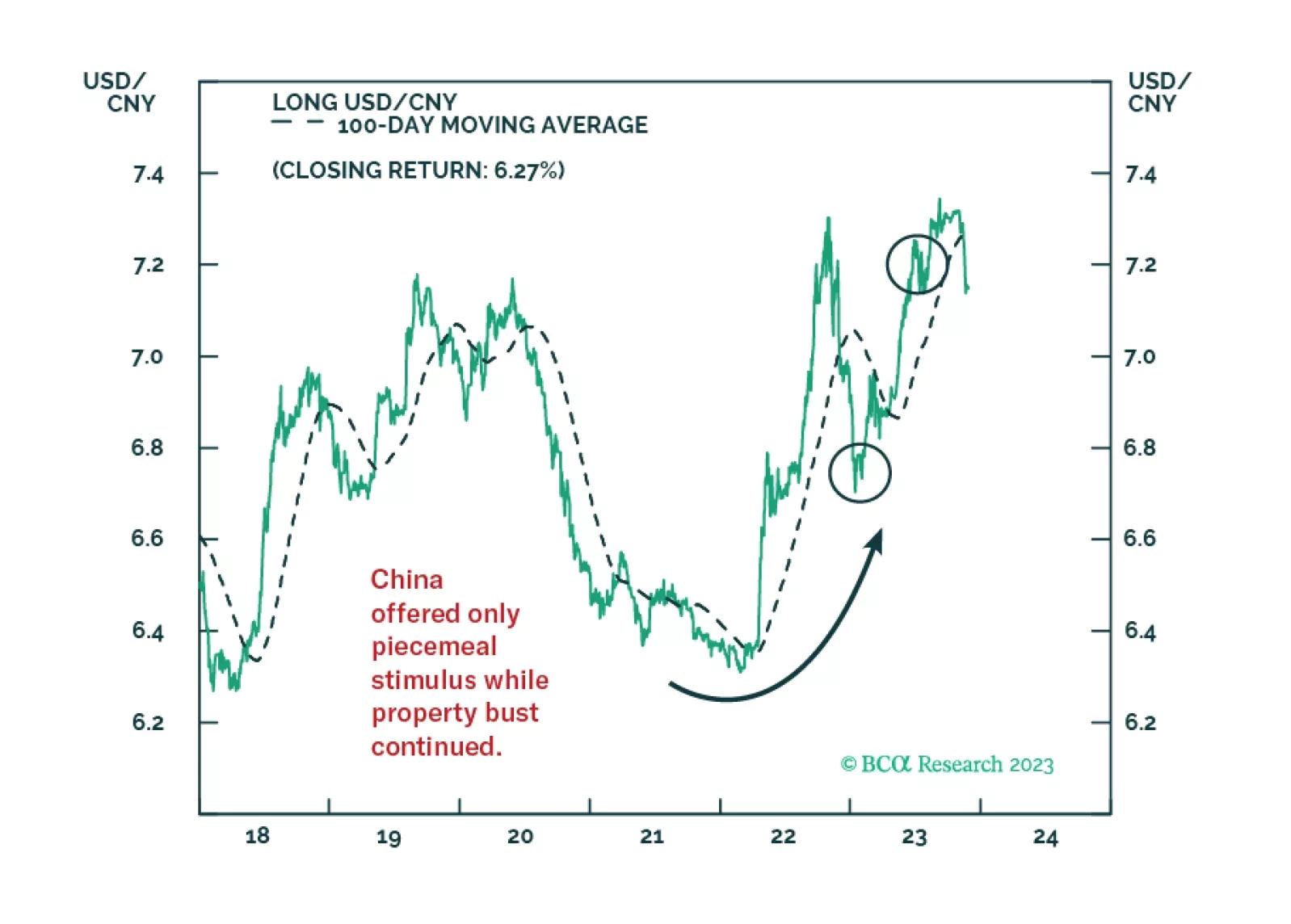

China’s reopening faltered and now it is applying moderate stimulus. OPEC 2.0’s production discipline is getting results, with oil prices climbing. The Fed will not be able to deliver dovish surprises in Q4 2023. Investors should…