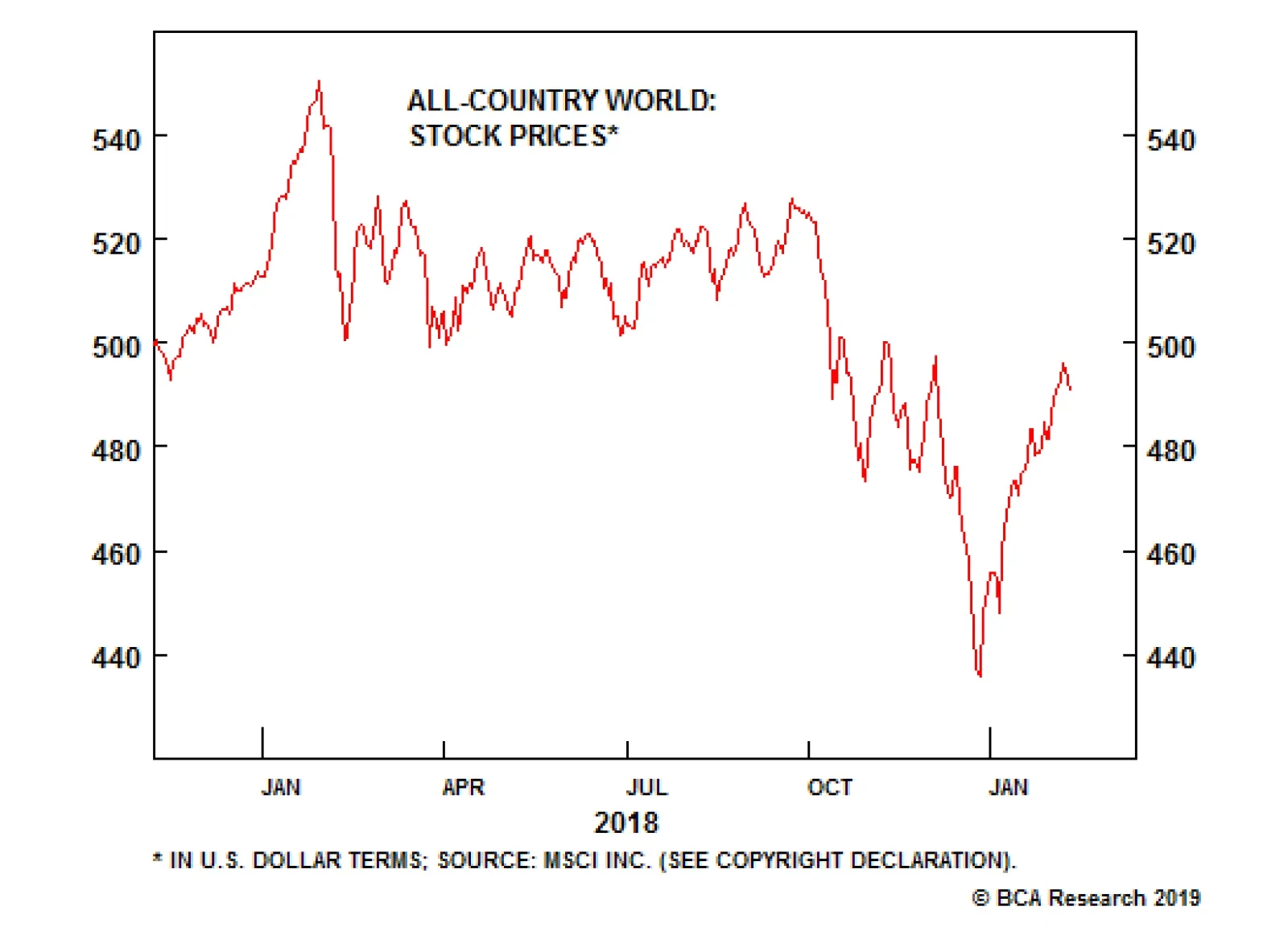

In the February 8th Insight, we highlighted that the broad equity market has been on a journey to nowhere for the past 16 months. Nonetheless, there have been exciting detours of 10-15 percent in both directions, albeit these…

At low yields, bond prices develop the same unattractive negative asymmetry as equities. Therefore, an extended period of ultra-low interest rates removes the need for an equity risk premium, and justifies sharply higher…

Highlights The current trajectory in global share prices resembles what took place in 2000 and early 2001. The early 2001 rebound in global and EM stocks lasted several weeks only, despite ongoing easing by the Federal Reserve.…

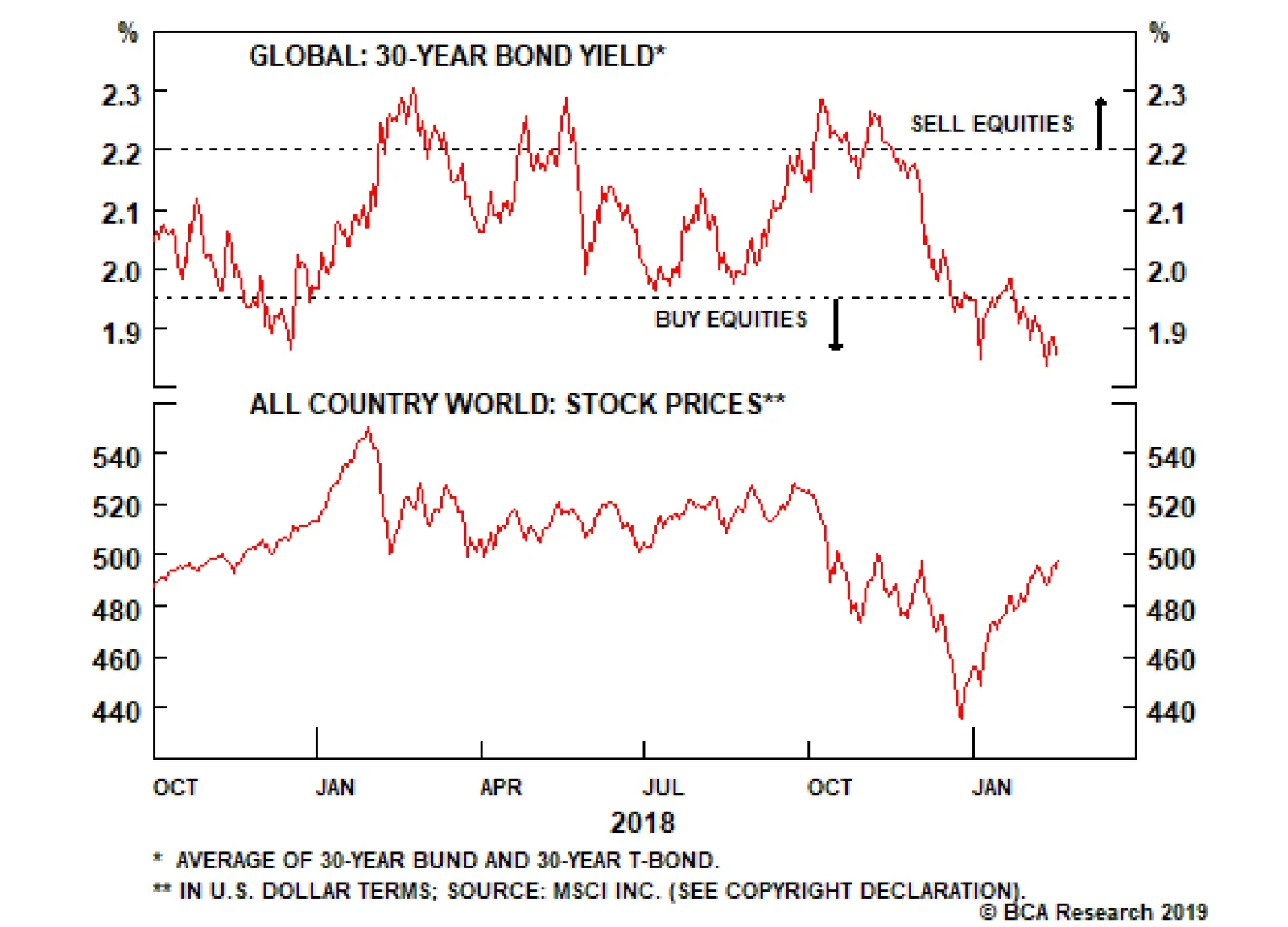

Highlights Investors ran for cover in December as they succumbed to a litany of worries regarding the outlook. The key question is whether the pessimism is overdone or an extended equity bear market is underway. Our outlook for the U.…

Highlights Falling Oil Prices & Bond Yields: Murky trends in global growth data, at a time of tight labor markets and gently rising inflation, are preventing a full recovery of risk assets after the October correction. A new…

Highlights Growth Scare: Despite the recent pickup in global equity market volatility, bond volatility remains subdued. Until there is more decisive evidence of a deeper pullback in global growth that is impacting the mighty U.S.…

Highlights Five risks to our bullish dollar stance need to be monitored: further weakness in the S&P 500; rebounding gold prices; stabilizing EM exchange rates and bond prices; Spanish bank stocks at multi-decade lows; and large,…

Highlights Duration: Our Fed Policy Loop provides a framework for understanding last week's equity market correction and its implications for future Fed policy. So far, the equity sell-off is not severe enough to deter the Fed.…