Highlights Equities had a wild ride in October, ... : The S&P 500 has bounced smartly off of its October 29th lows, but the decline that preceded the bounce was unusually severe. ... that unsettled a lot of investors, and made us…

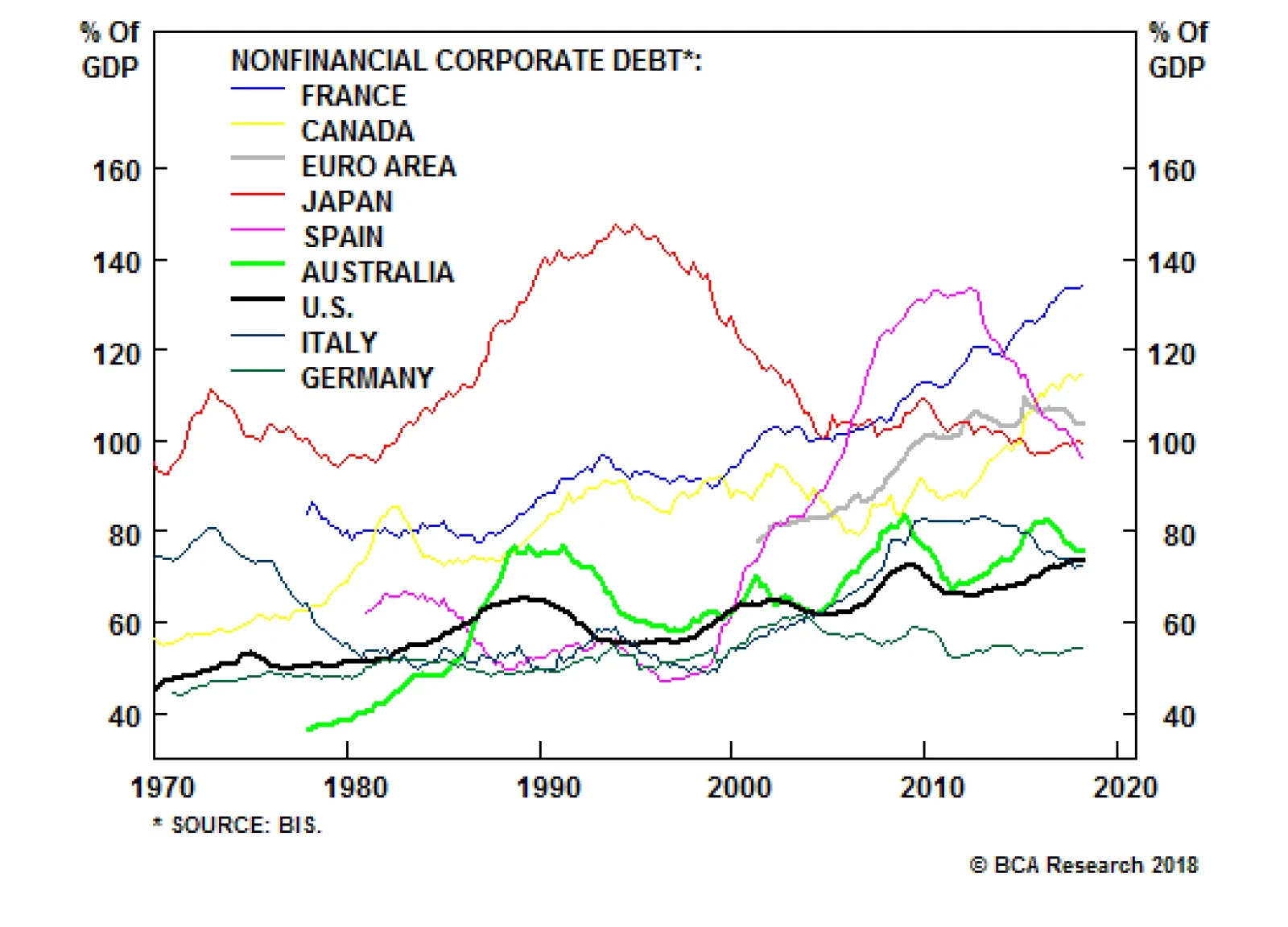

While the corporate debt market has become increasingly frothy, it does not pose an imminent danger to the economy. There are several reasons for this. First, while U.S. corporate debt is high in relation to the past, it is…

Highlights Investors are worrying too much about the things that caused the global financial crisis, and not enough about those that could cause the next downturn. Despite the recent patch of soft data, the U.S. housing market is in…

Highlights Macro outlook: Global growth will continue to decelerate into early next year on the back of brewing EM stresses and an underwhelming policy response from China. Equities: Stay neutral for now, while underweighting EM…

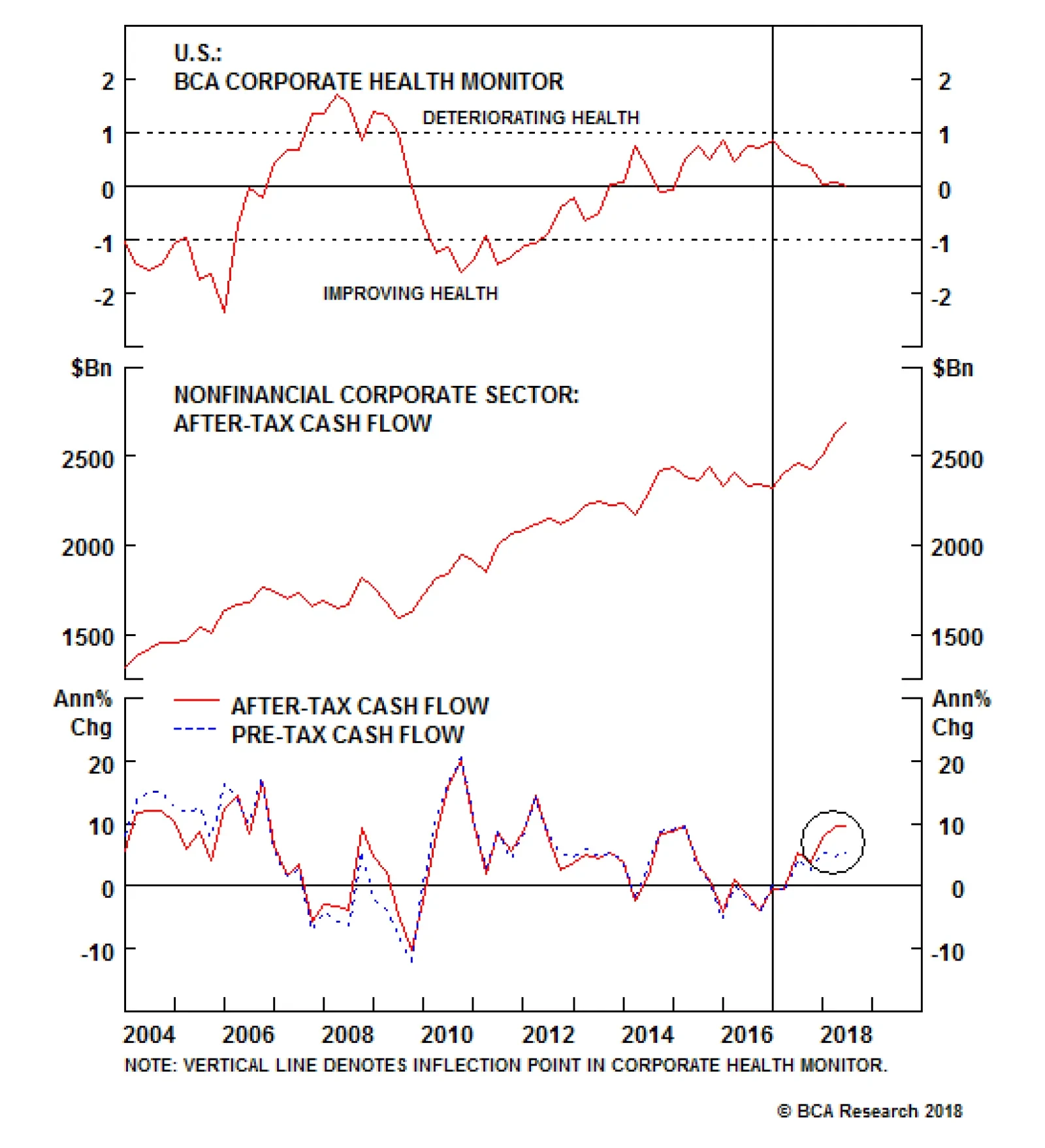

By far, the biggest driver of the CHM's improvement has been the sharp increase in after-tax cash flows. This is partly due to the recent corporate tax cuts, but also reflects a significant rebound in pre-tax cash flows.…

Highlights Duration: The housing market is the key channel through which monetary policy impacts the economy. As such, it is unlikely that Treasury yields will peak until housing shows meaningful weakness. While residential investment…

Highlights Portfolio Strategy Stick with a neutral weighting in the tech sector as rising interest rates, higher inflation and a firming greenback offset improving industry operating metrics on the back of the virtuous capex upcycle.…

Highlights Last week's View Meeting underlined the point that BCA's take on the macro backdrop hasn't changed. Decelerating global growth and the potential for a nasty EM debt episode still argue for slightly cautious asset…