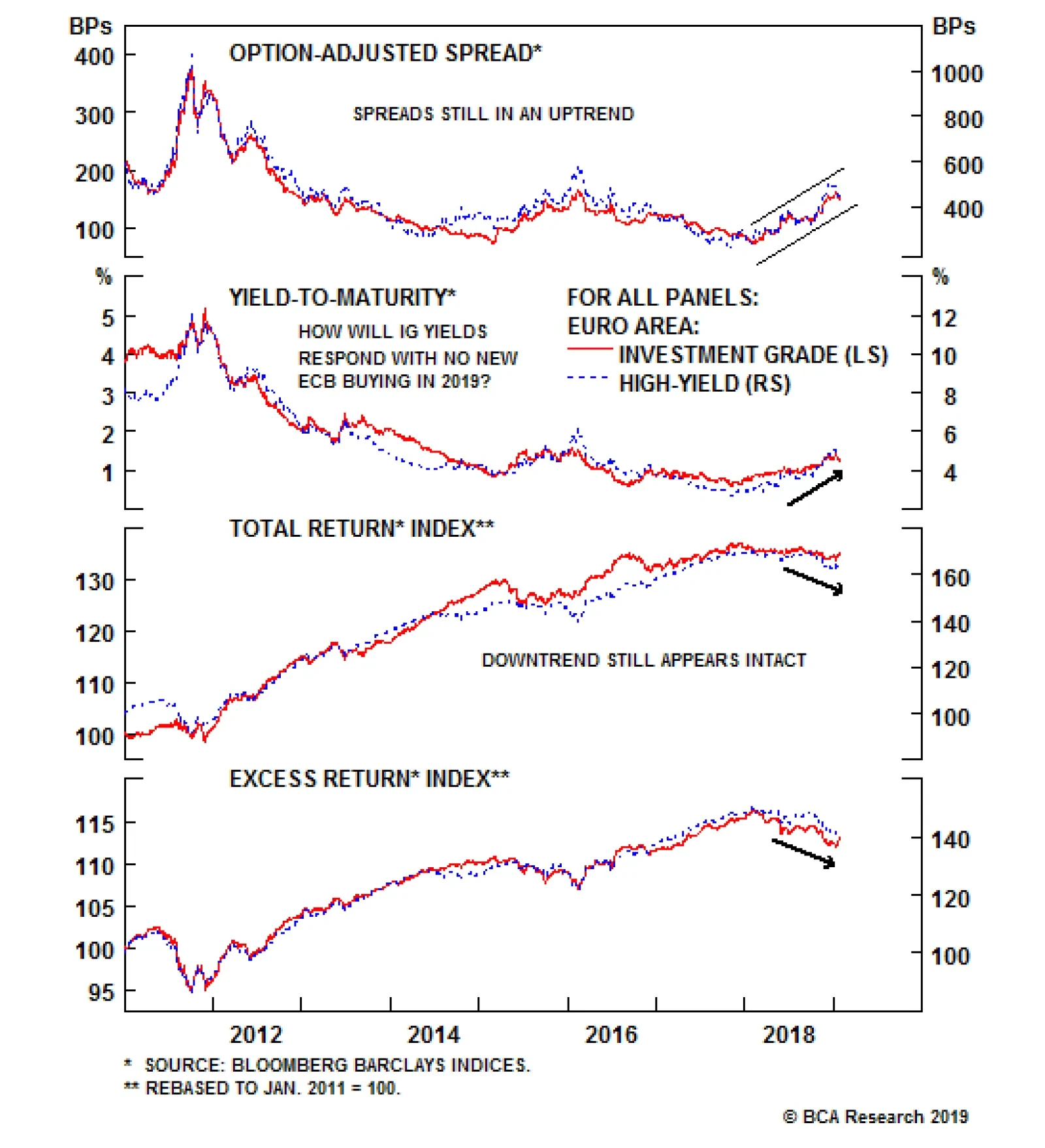

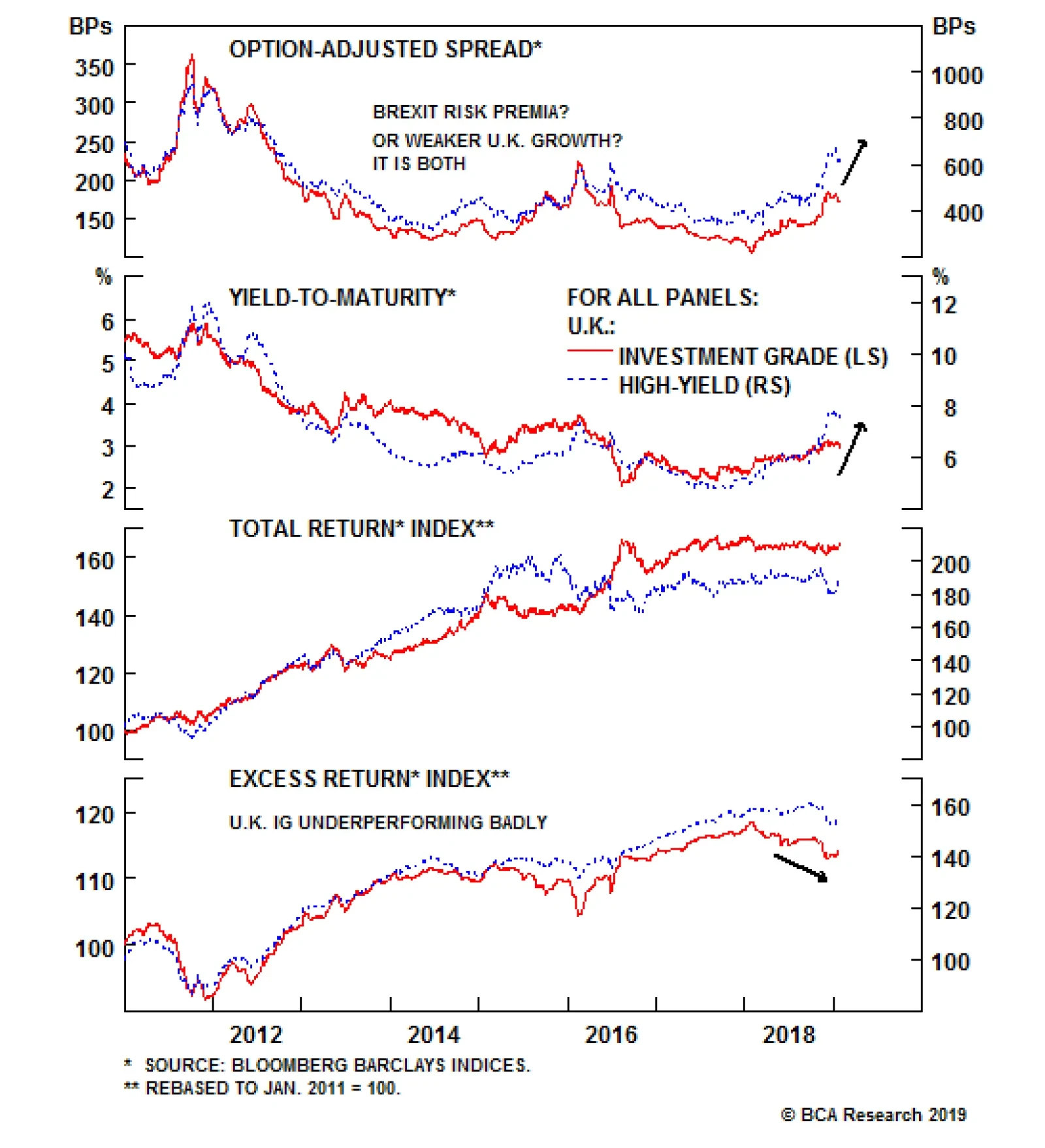

Highlights Spread Product Valuation: Corporate bond spreads don’t look especially cheap relative to average historical levels. But they are far too elevated for the current phase of the economic cycle. Valuations in other spread…

Highlights The current trajectory in global share prices resembles what took place in 2000 and early 2001. The early 2001 rebound in global and EM stocks lasted several weeks only, despite ongoing easing by the Federal Reserve.…

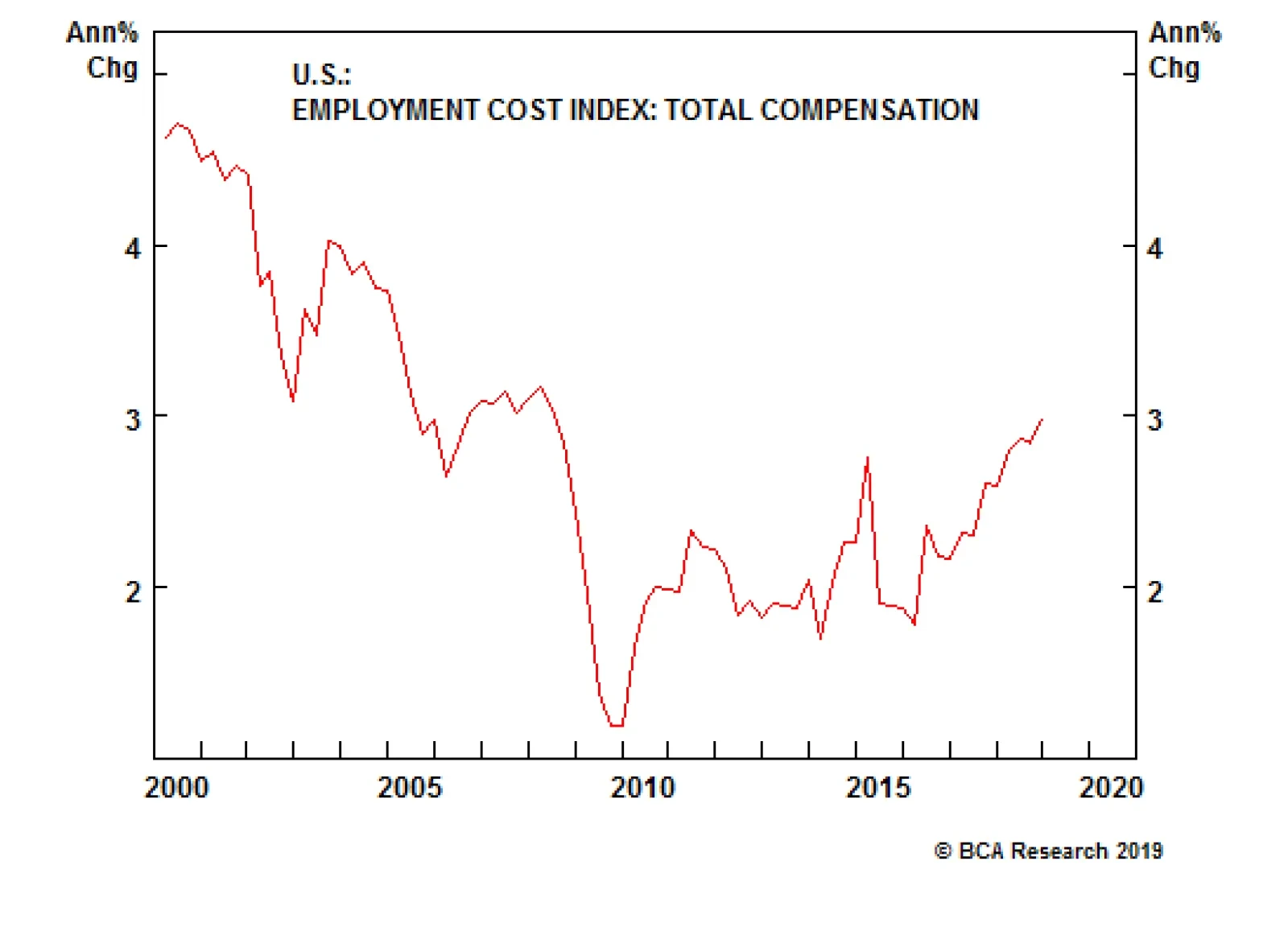

Compensation costs should not hurt margins if they grow at or below the sum of the rate of price-level and productivity gains. If inflation grows at the Fed’s 2% target, and productivity maintains its rough 1.25% growth…

For IG, the gap between domestic and foreign issuers continues to widen, with the former worsening at the margin. For domestic issuers, interest and debt coverage has improved but operating margins and return on capital remain…

All the components of the U.K. CHM have contributed to this worsening trend. Even short-term liquidity, which had been in a powerful uptrend for almost a decade, has started to roll over. The cause for this deterioration can…

Highlights We recently upgraded our recommended investment stance on global corporate bonds to overweight on a tactical (3 to 6 months) basis.1 Feature That change was mostly based on our view that global financial conditions had…

Highlights Portfolio Strategy Vibrant and broad-based bank credit growth, pristine credit quality, pent up bank buyback demand and a V-shaped recovery in bank ROE more than offset the risk of 10/2 yield curve inversion, and suggest…

Mr. X and his daughter, Ms. X, are long-time BCA clients who visit our office toward the end of each year to discuss the economic and financial market outlook. This report is an edited transcript of our recent conversation. Mr. X: I have…