Highlights We remain constructive on the U.S. economy, …: It was another uneven week, but conditions remain broadly favorable for the U.S., and the expansion is intact. … and things seem to be perking up in the rest of…

Highlights Odds are that the recent improvement in Chinese manufacturing PMIs could be due to inventory re-stocking rather than a decisive turnaround in final demand. “Hard” data have not shown meaningful improvements in…

Two weeks ago, we highlighted that S&P 500 profit margins have likely peaked for the cycle and that our margin proxy, weighed down by mounting concerns over wage growth and nil pricing power, was pointing to a further decline (top…

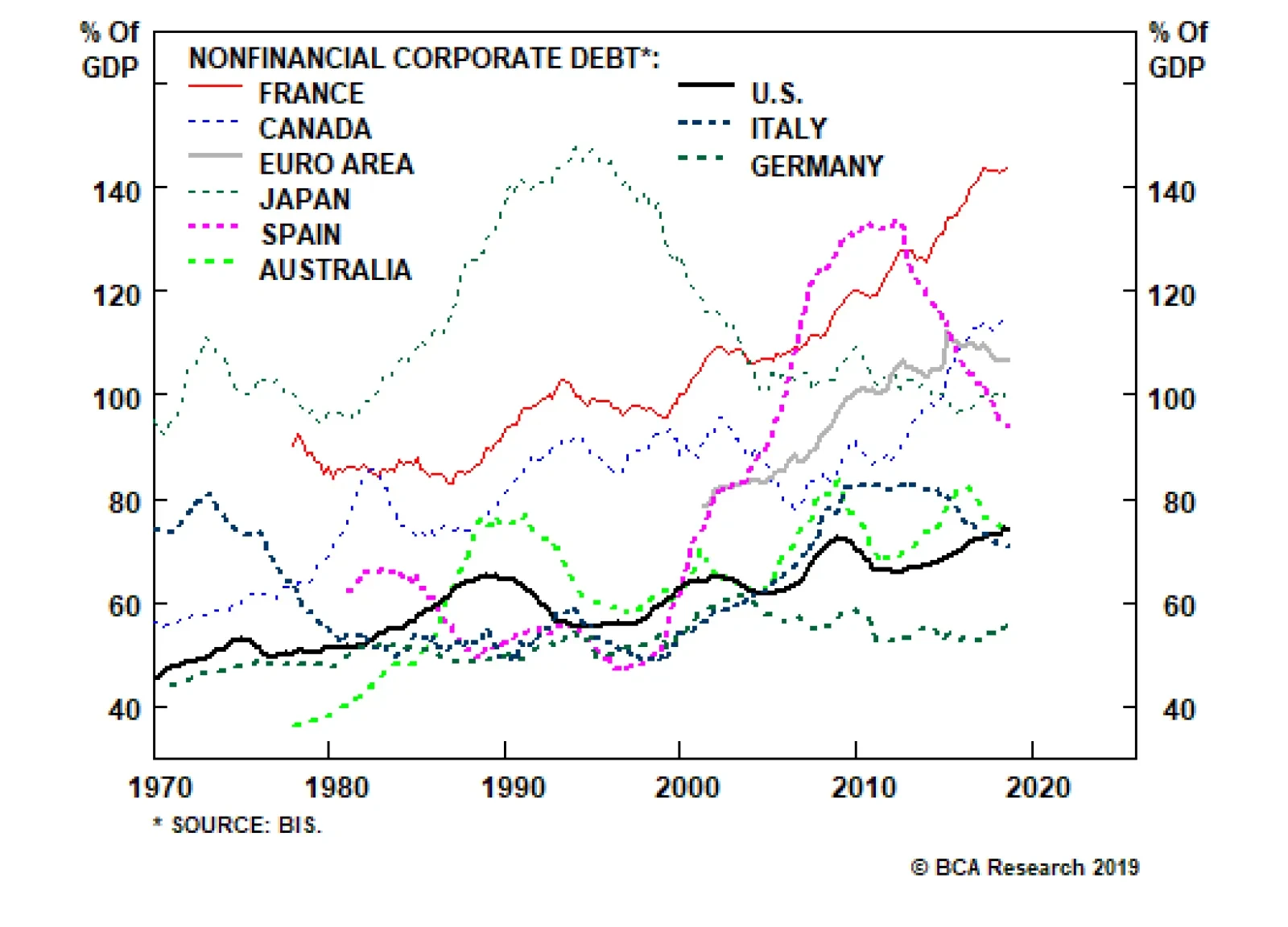

Relative to other countries, U.S. corporate debt is quite low. At 143% of GDP, corporate debt in France is twice that of the United States. This is not to suggest that everything is fine in the French corporate sector; but the…

Highlights Portfolio Strategy Corporate sector selling price inflation is nil while leading wage inflation indicators signal additional labor cost increases in the coming months. The risk is that profit margins have already peaked for…

Highlights Portfolio Strategy As growth becomes scarce, investors flock to sectors that are slated to outgrow the broad market and shy away from the ones that are forecast to trail the SPX’s growth rate. This week we rank…

Highlights Trade talks have been the primary driver of the rally in Chinese stocks and China-related assets over the past five months. While trade is important to China’s economy, Chinese domestic demand is the primary driver of…

Highlights Please note that analysis on India is published below. Even if the recent upturn in the Chinese credit impulse is sustained, there will likely still be a six- to nine-month lag between the impulse’s trough and the…