Executive Summary China Needs To Create RMB35 Trillion In Credit In 2022 The pace of credit creation in January increased sharply over December. However, the jump was less than meets the eye compared with previous easing…

Highlights Global equities are poised to deliver mid-to-high single-digit returns this year, with the outlook turning bleaker in 2023 and beyond. Non-US markets are likely to outperform. We examine the four pillars that have…

Highlights Fed: The Fed is embroiled in a debate about whether to move more quickly toward rate hikes. Our expectation is that the Fed will remain relatively dovish unless 5-year/5-year forward inflation expectations show signs of…

Highlights In this report, we take a close look at corporate margins by analyzing their key drivers: The general level of economic activity, trends in labor costs and productivity, borrowing costs, tax rates, depreciation charges, the…

Highlights Evergrande has not only crossed regulatory gridlines but also regulators’ bottom lines; the government will use the example of Evergrande to impose discipline on real estate developers. The policy response will likely…

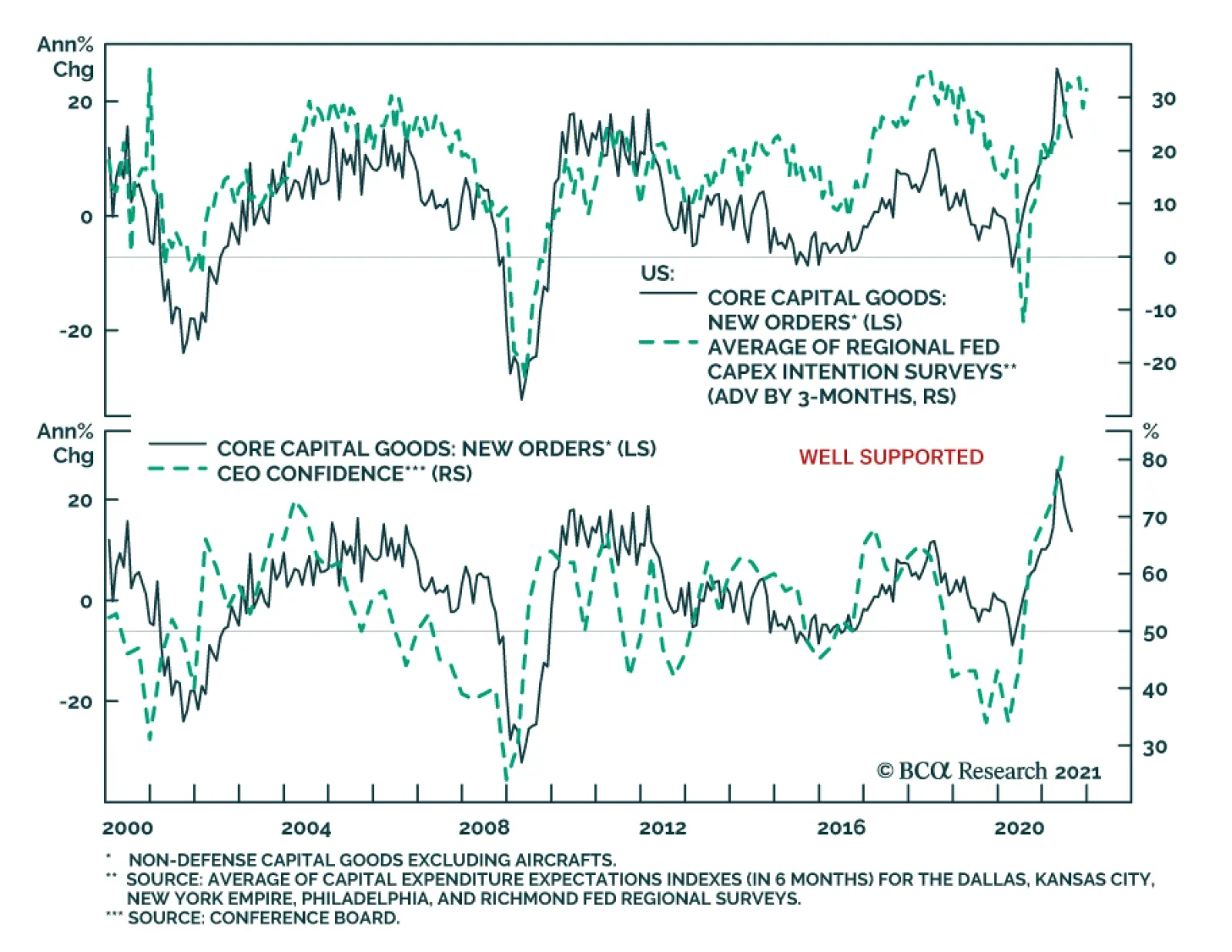

New orders for US durable goods grew 1.8% month-on-month to a record $263.5 billion in August. The increase follows an upwardly revised 0.5% and is more than double expectations of a 0.7% rise. However, a 5.5% month-on-month…

The performance of global risk assets improved somewhat on Tuesday following Monday’s tumble on the back of concerns about the potential implications of an Evergrande default. Nevertheless, risks remain elevated. A key…

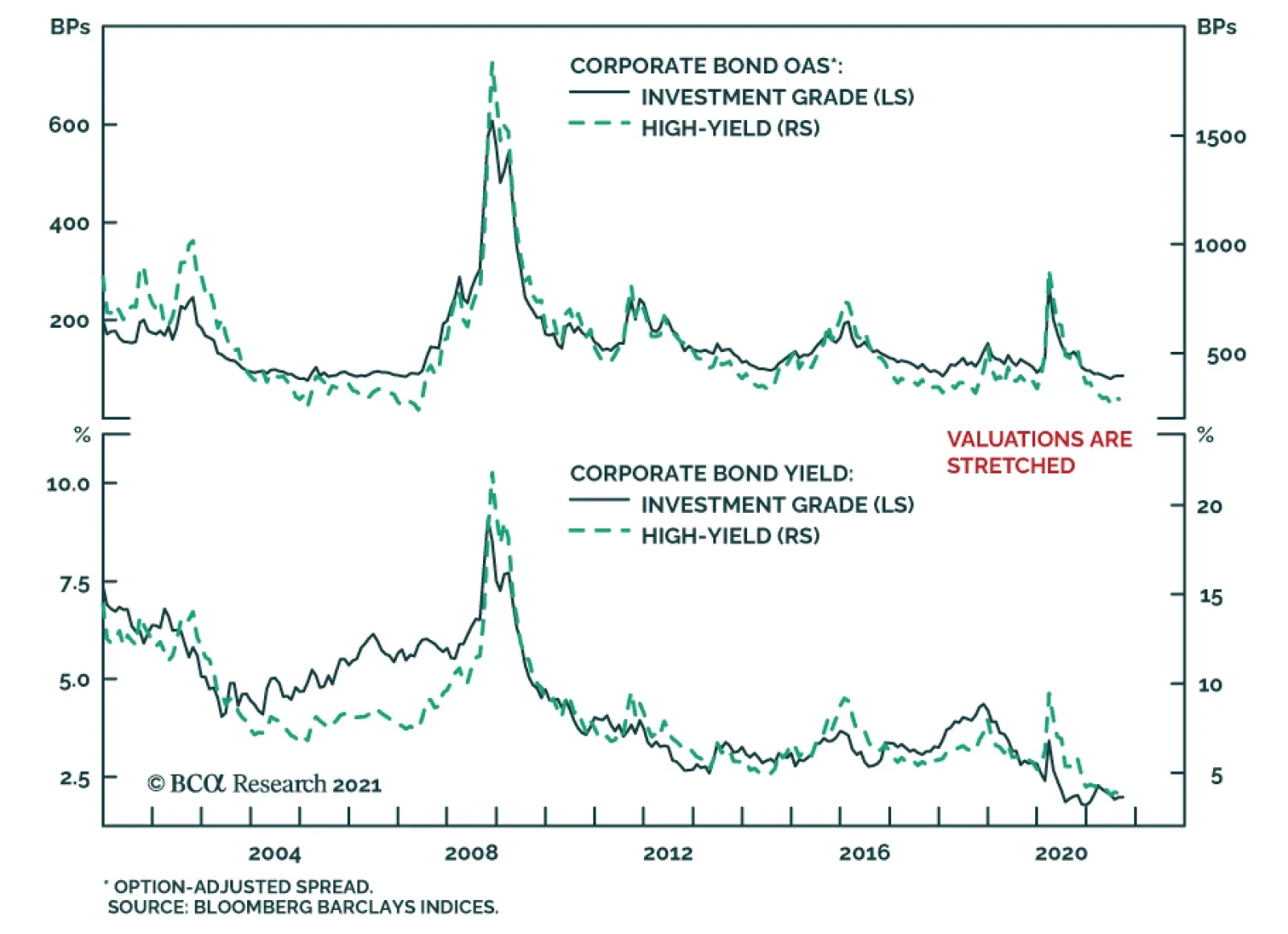

BCA Research’s US Bond Strategy service expects corporate bonds to outperform Treasuries during the next 6-12 month. However, both excess returns and total returns will take a step down. Two broad factors must be considered…