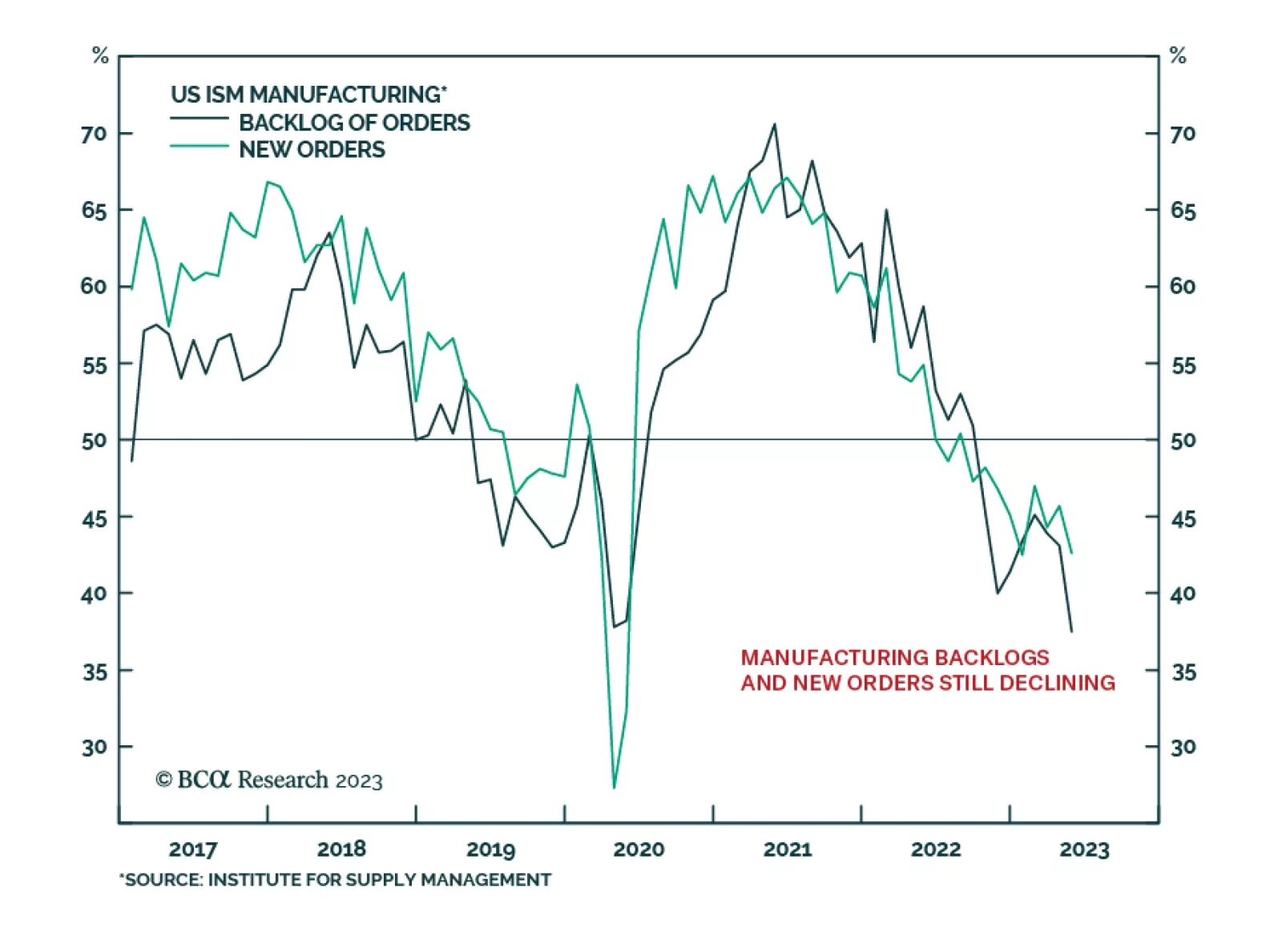

According to BCA Research’s US Equity Strategy service, the earnings contraction is far from over. However, rising productivity, falling costs, or a new restocking cycle could help. Earnings and sales growth beat analyst…

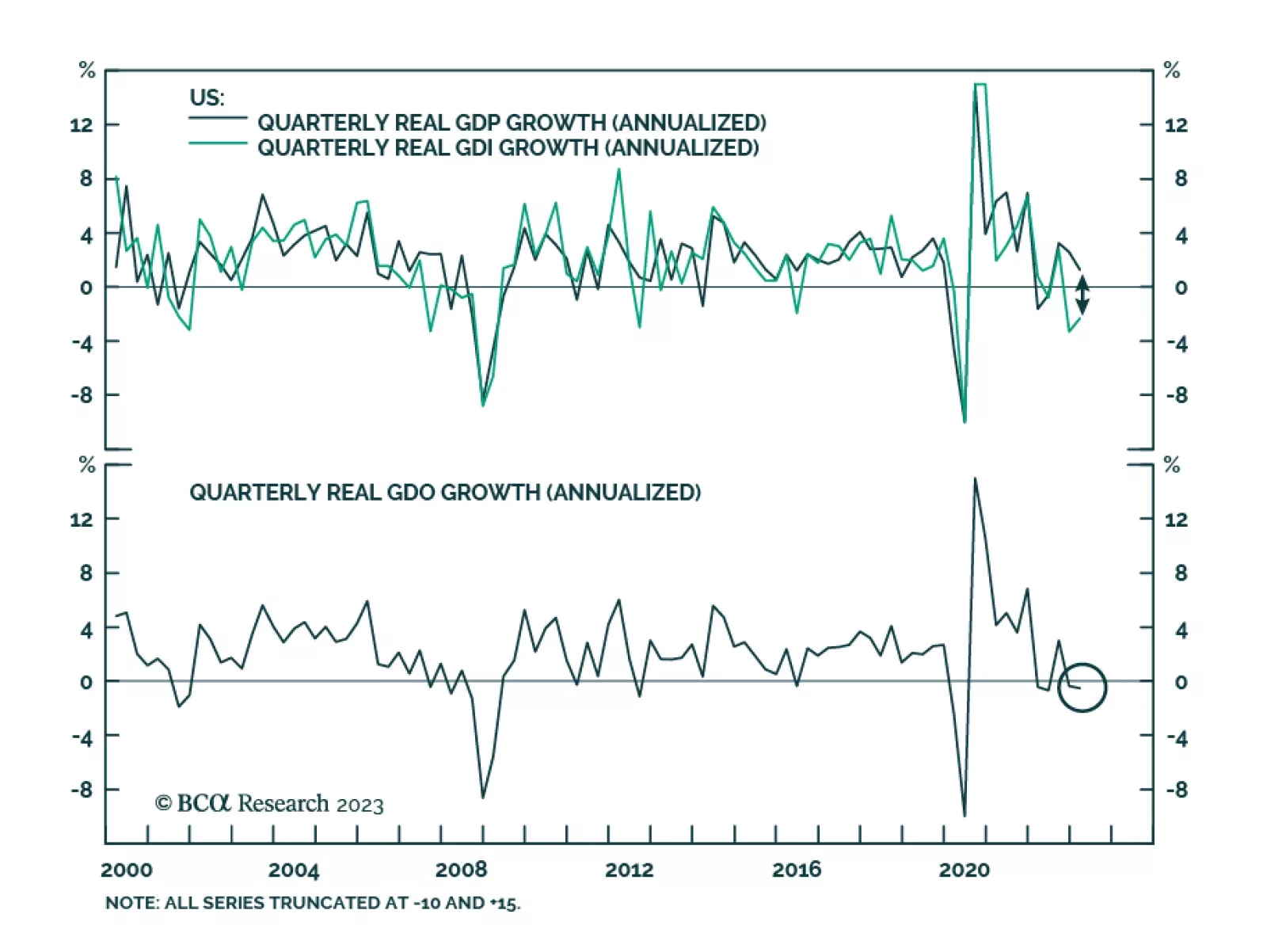

US economic data were mixed on Thursday. On the positive side, Q1 real GDP growth was revised up to 1.3% from the preliminary estimate of 1.1%. In particular, consumption was revised higher by 0.1 percentage points to 3.8%…

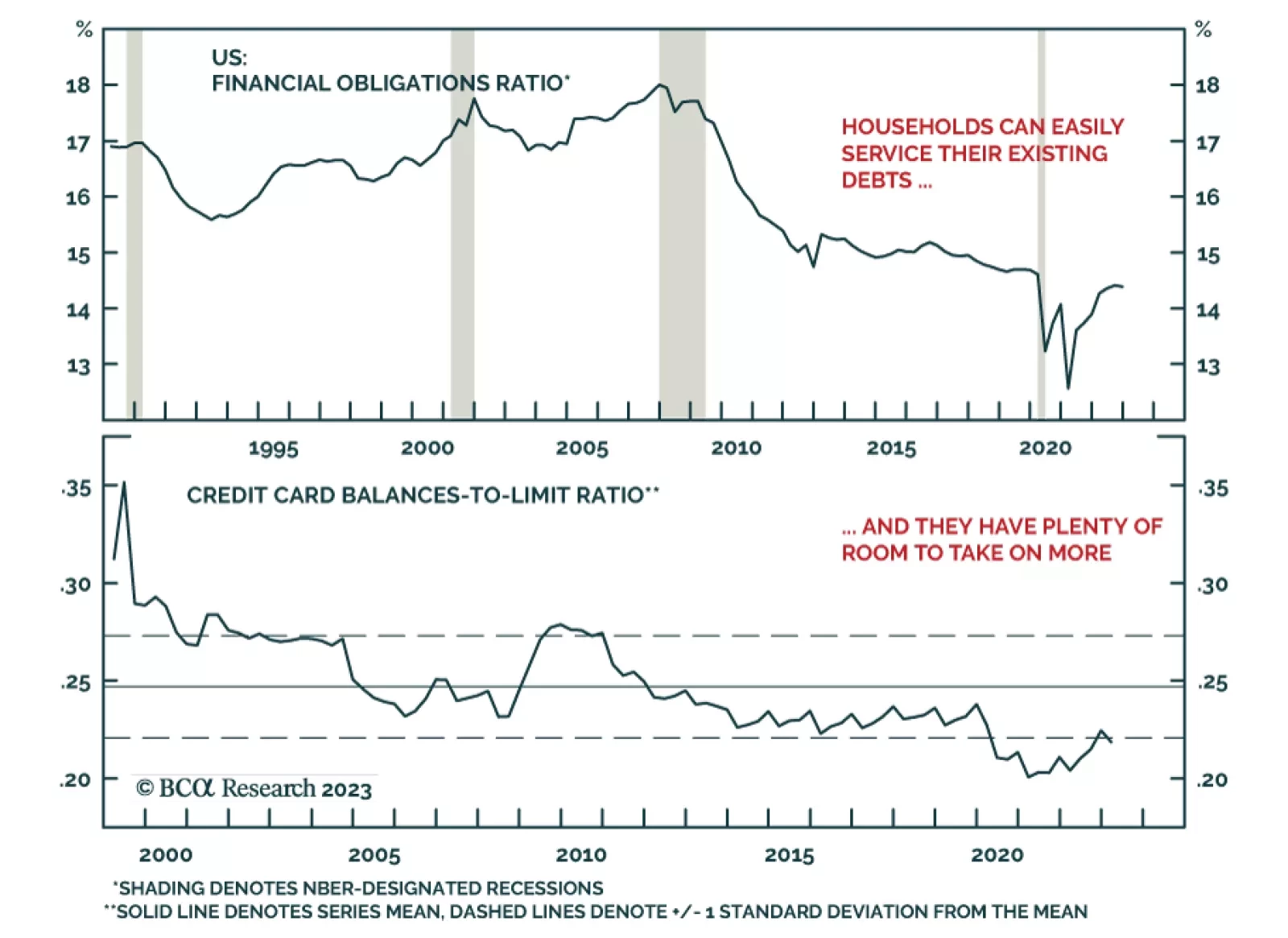

According to BCA Research’s US Investment Strategy service, there are no credit obstacles preventing households from sustaining their consumption growth rate at a level that will keep the recession at bay for the rest of…

For long-term investors, high-yield bonds are an attractive asset class. They behave like low-volatility equities: In the US, they have a 70-80% correlation with equities, but with a beta of only around one-third. The Sharpe…

Indian EPS growth is set for major disappointments vis-à-vis the lofty expectations. Weak domestic demand amid tight fiscal and monetary policy entails more downside in stock prices. Stay underweight.

We Introduce our new macro models for the Eurozone’s equity earnings, which include sectoral forecasts. Find out what they predict for the next six-to-nine months.

Is there a lot of cash on the sidelines ready to be deployed? Would the US recession not be bearish for the US dollar and help EM like it did in the early 2000s? Why can the US investment playbook of the past 15-25 years not be used…

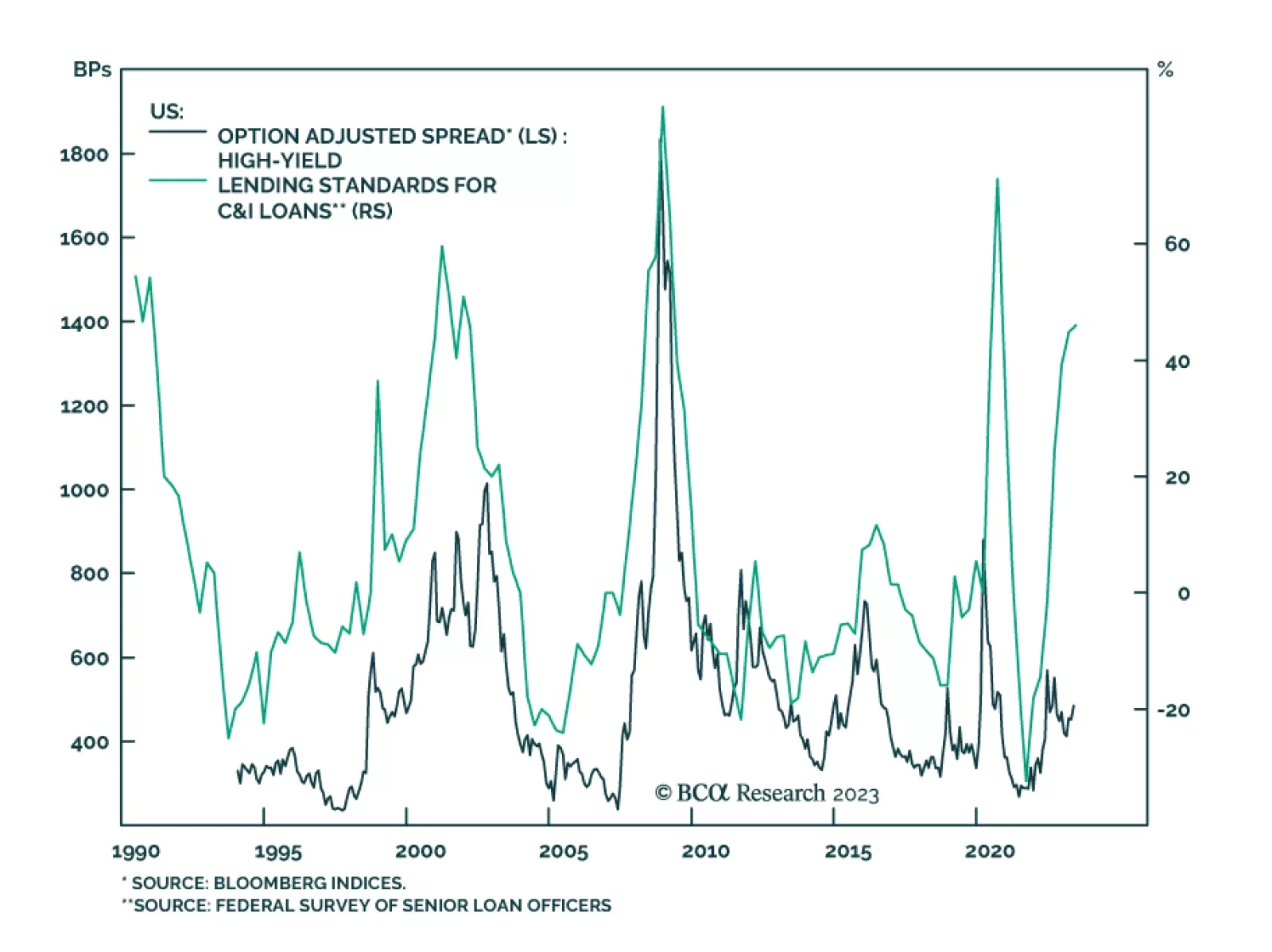

It is a big mistake to think that rate cuts or lower bond yields will ease credit conditions. Quite the contrary. After an aggressive tightening of monetary policy, the first rate cuts always coincide with much tighter credit…