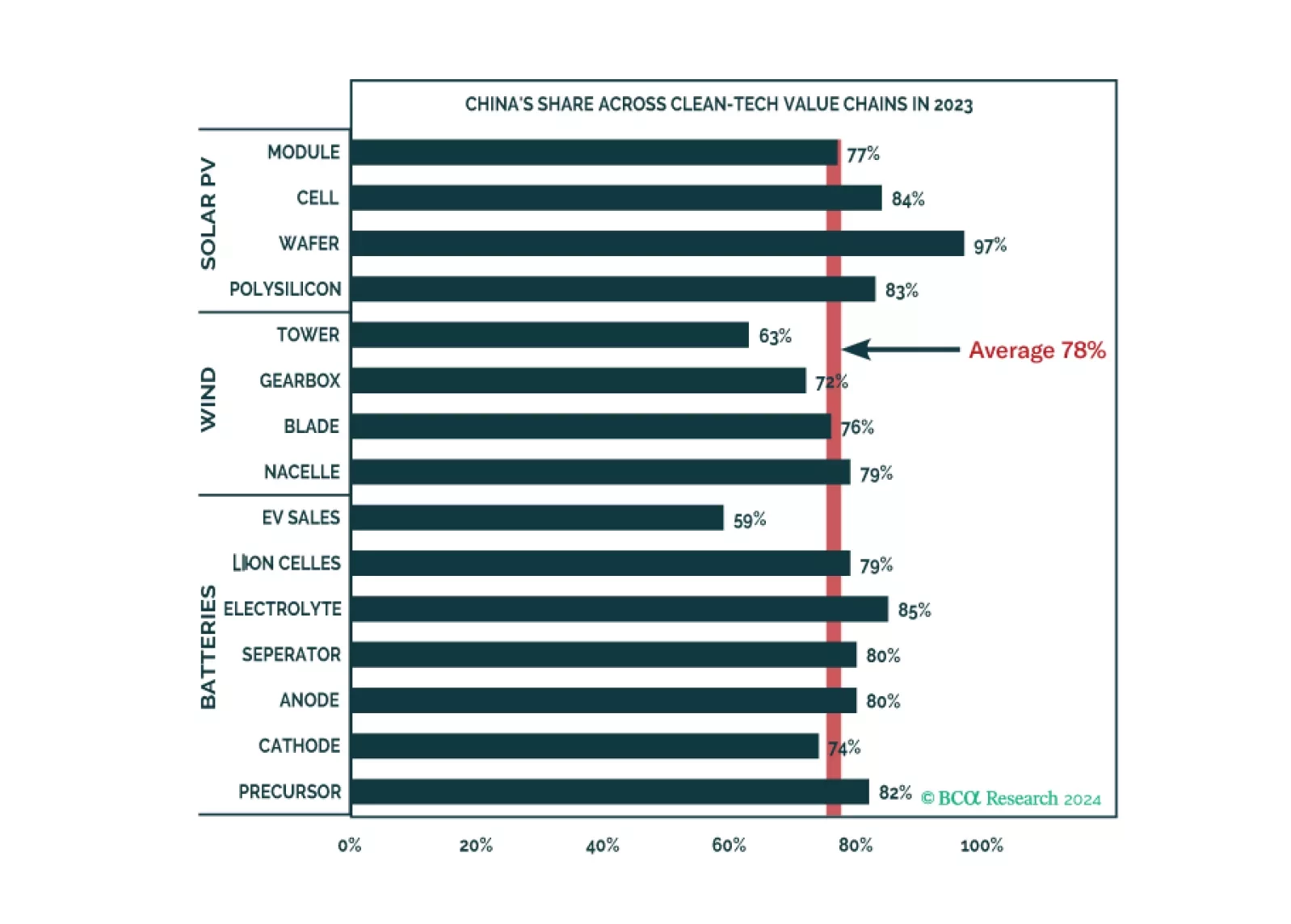

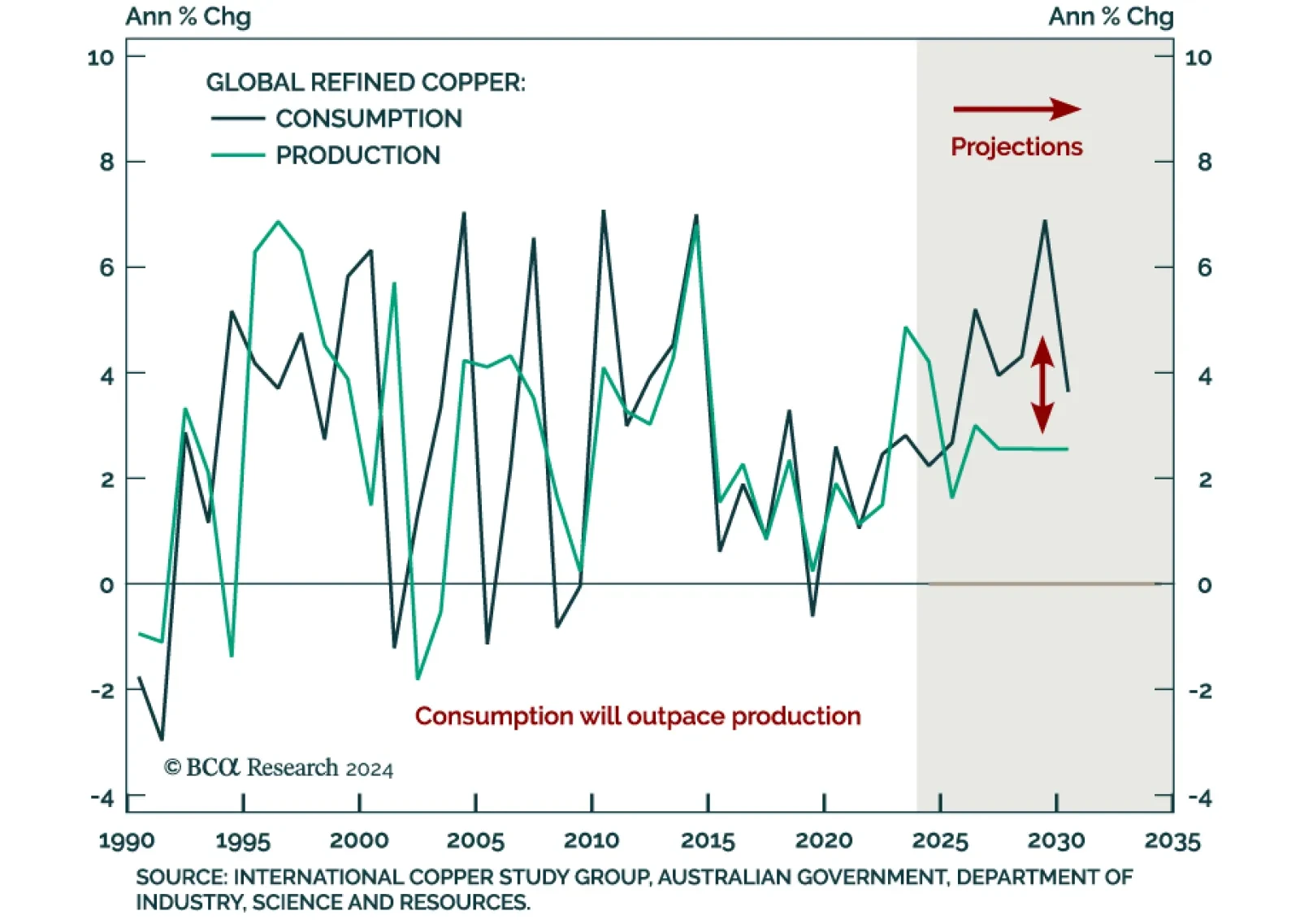

Our Commodity and Energy strategists believe a supply-demand deficit will emerge in 2026, and widen into the end of the decade. Copper demand is set to grow over 4% annually between 2025 and 2030, fueled by the green energy…

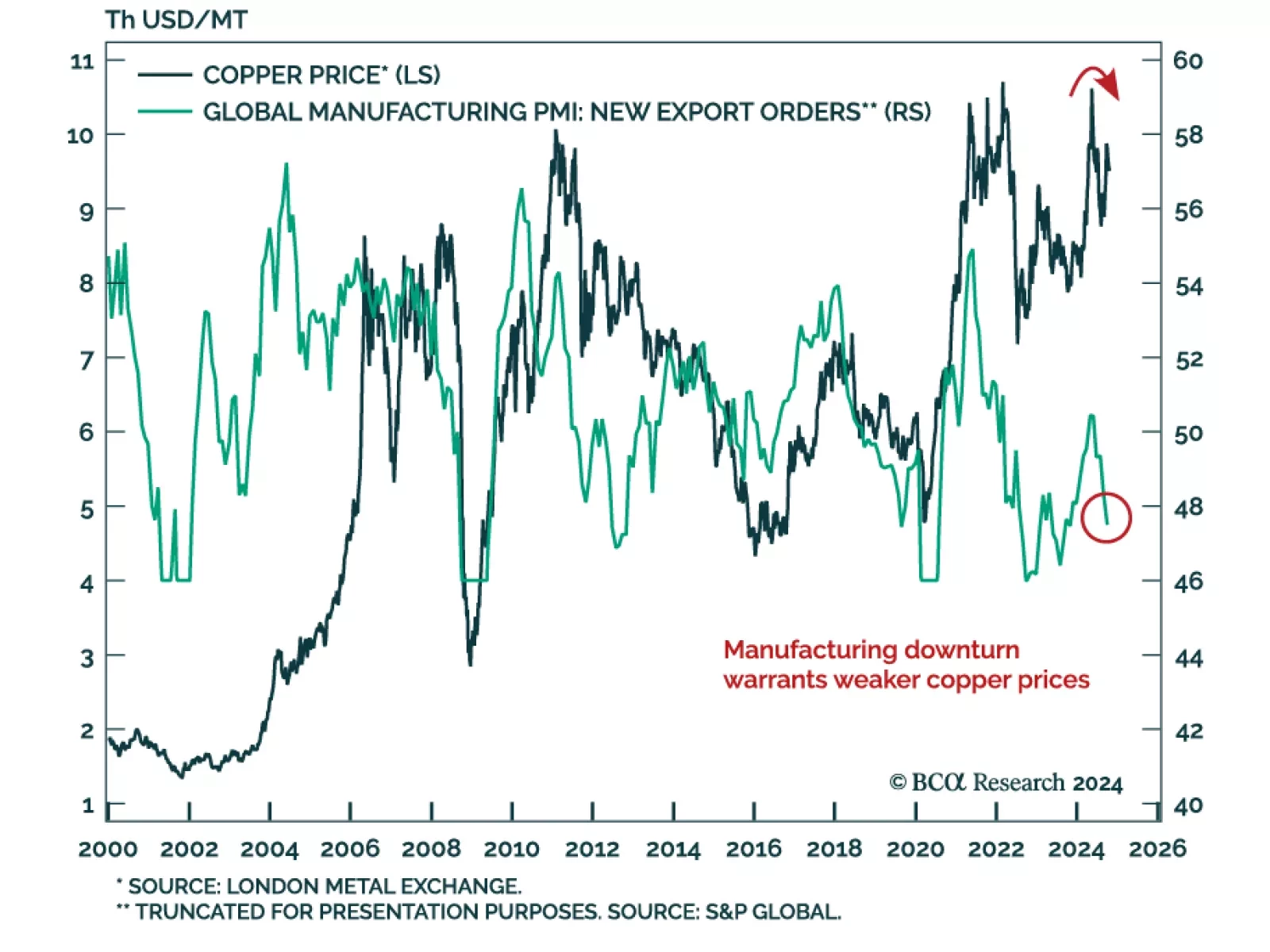

Speculators have supported copper prices as demand growth slowed below the pace of supply growth. Our Commodity and Energy Strategy colleagues believe this does not bode well for the metal. The copper market faces a situation…

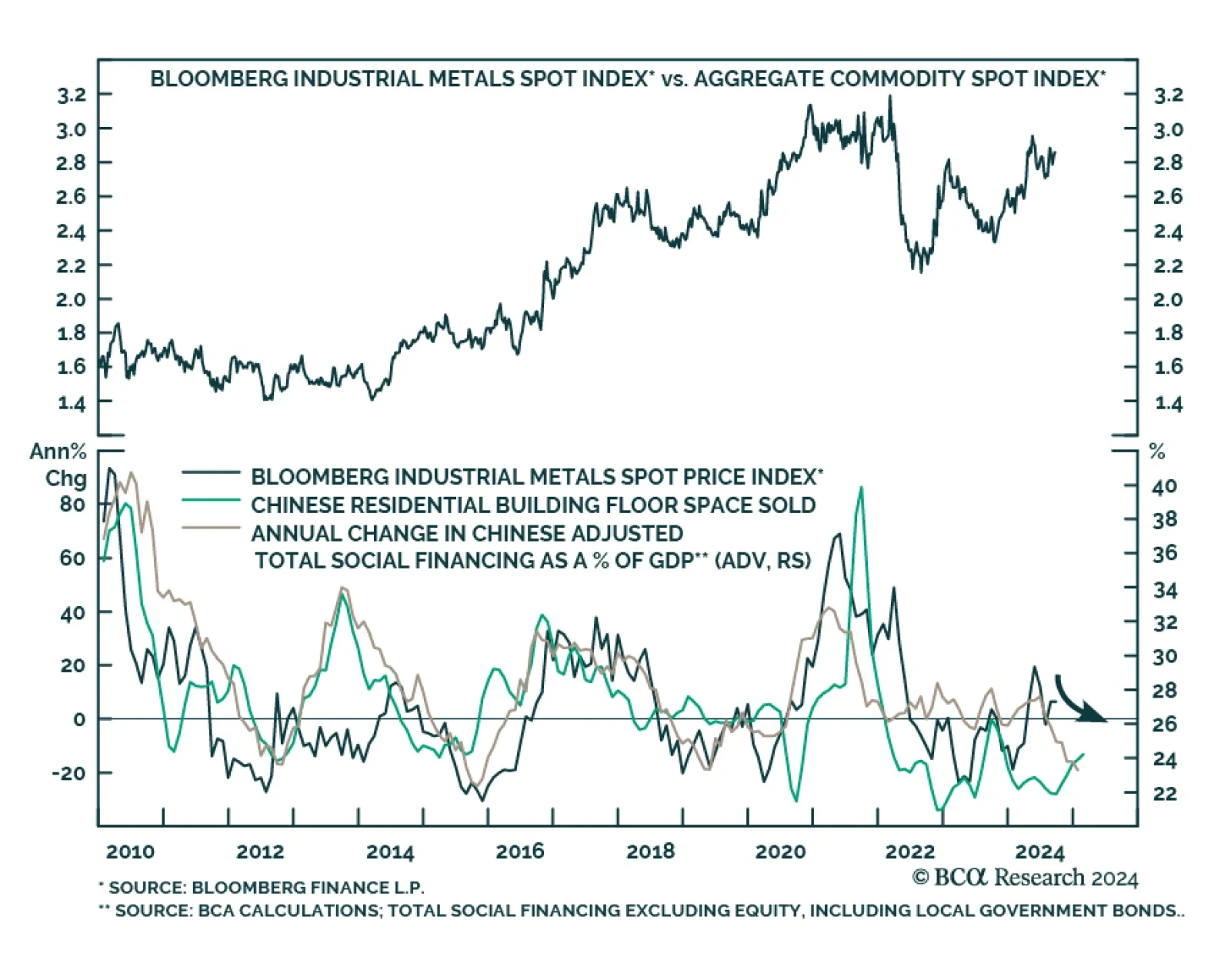

Industrial metals returned a whopping 6% over the past week. Bullish investor sentiment is likely driving these gains. The soft-landing narrative has been gaining traction in recent days with markets pricing in increased odds…

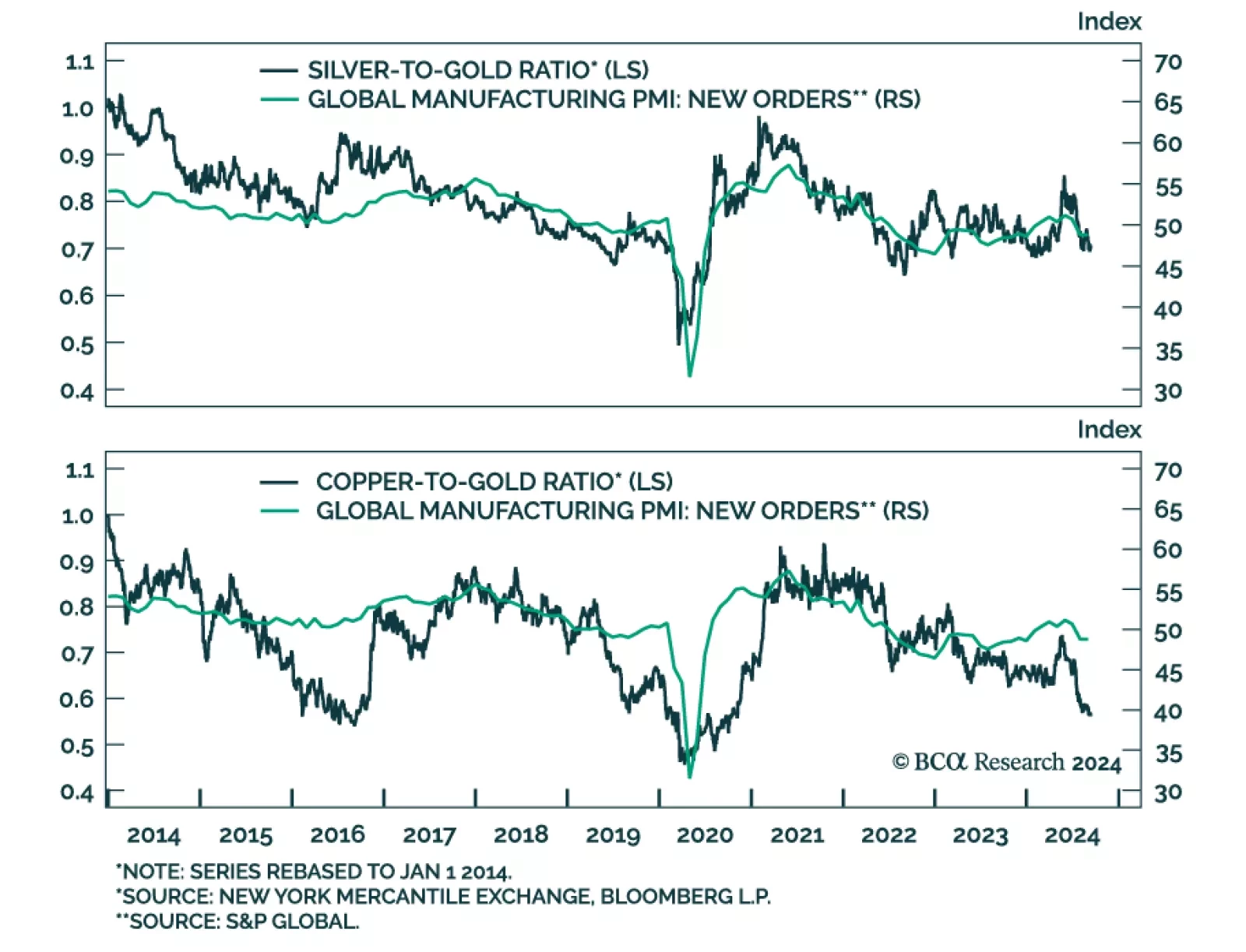

As an industrial metal, copper acts as a barometer of economic activity. Silver and gold are safe-haven assets with inflation-hedging properties, though silver is relatively more sensitive to global growth developments given that…

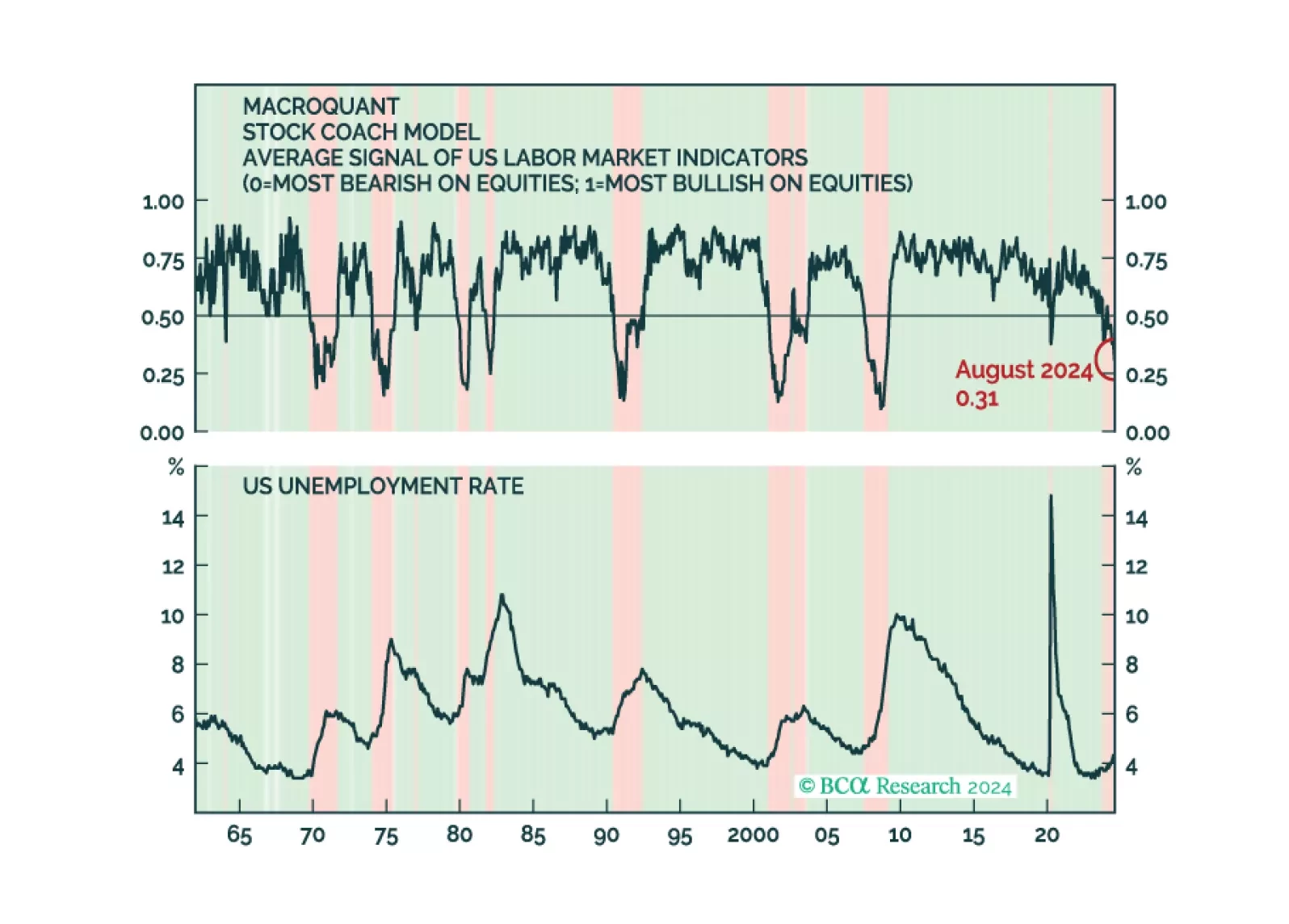

MacroQuant continues to recommend underweighting equities and overweighting bonds. This is consistent with the Global Investment Strategy Team's decision to downgrade global equities to underweight in late June.

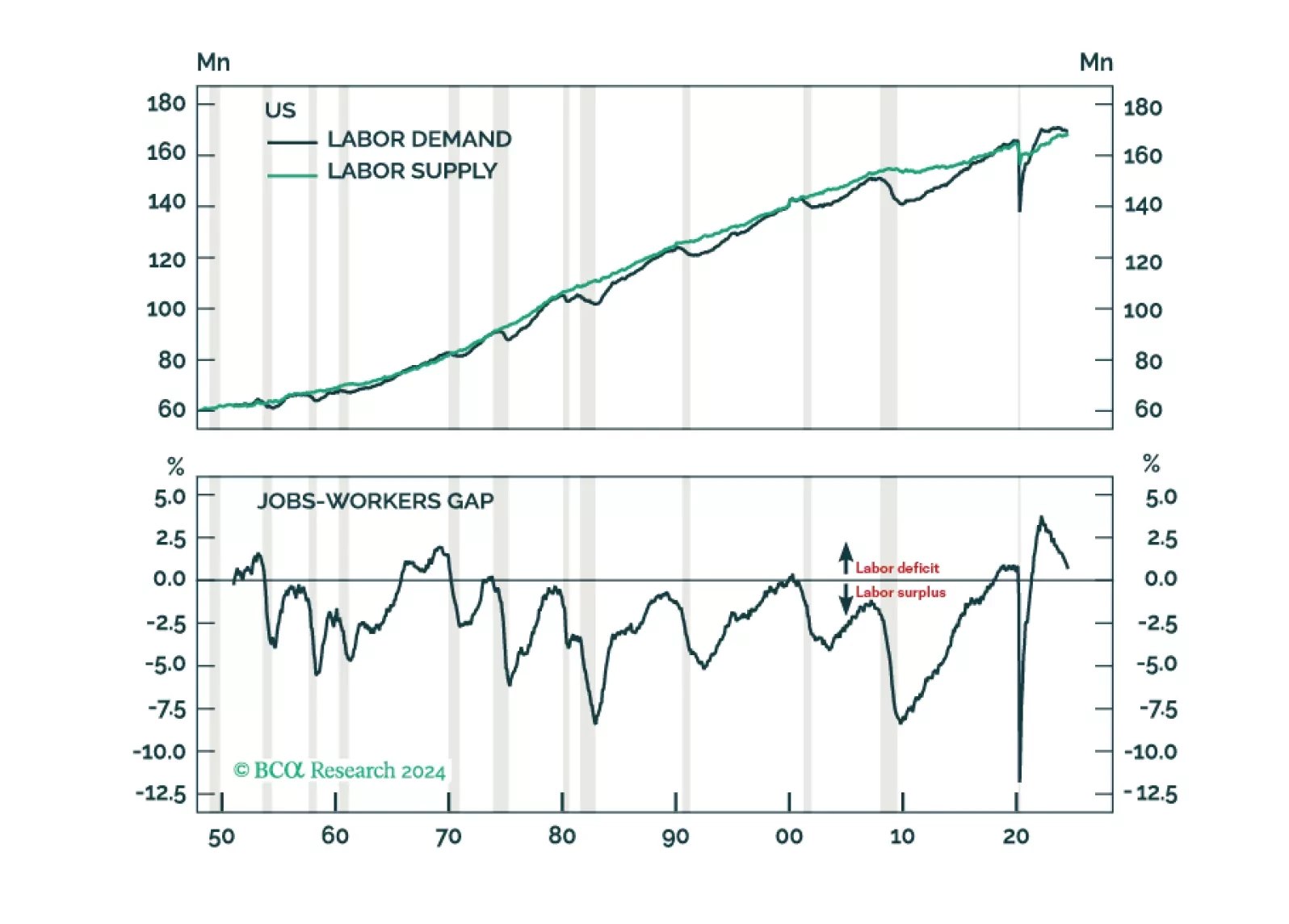

The great US labor market shortage is over. Labor demand will likely fall short of supply by the end of this year, causing unemployment to soar. Neither fiscal nor monetary policy will be able to prevent the coming recession.…

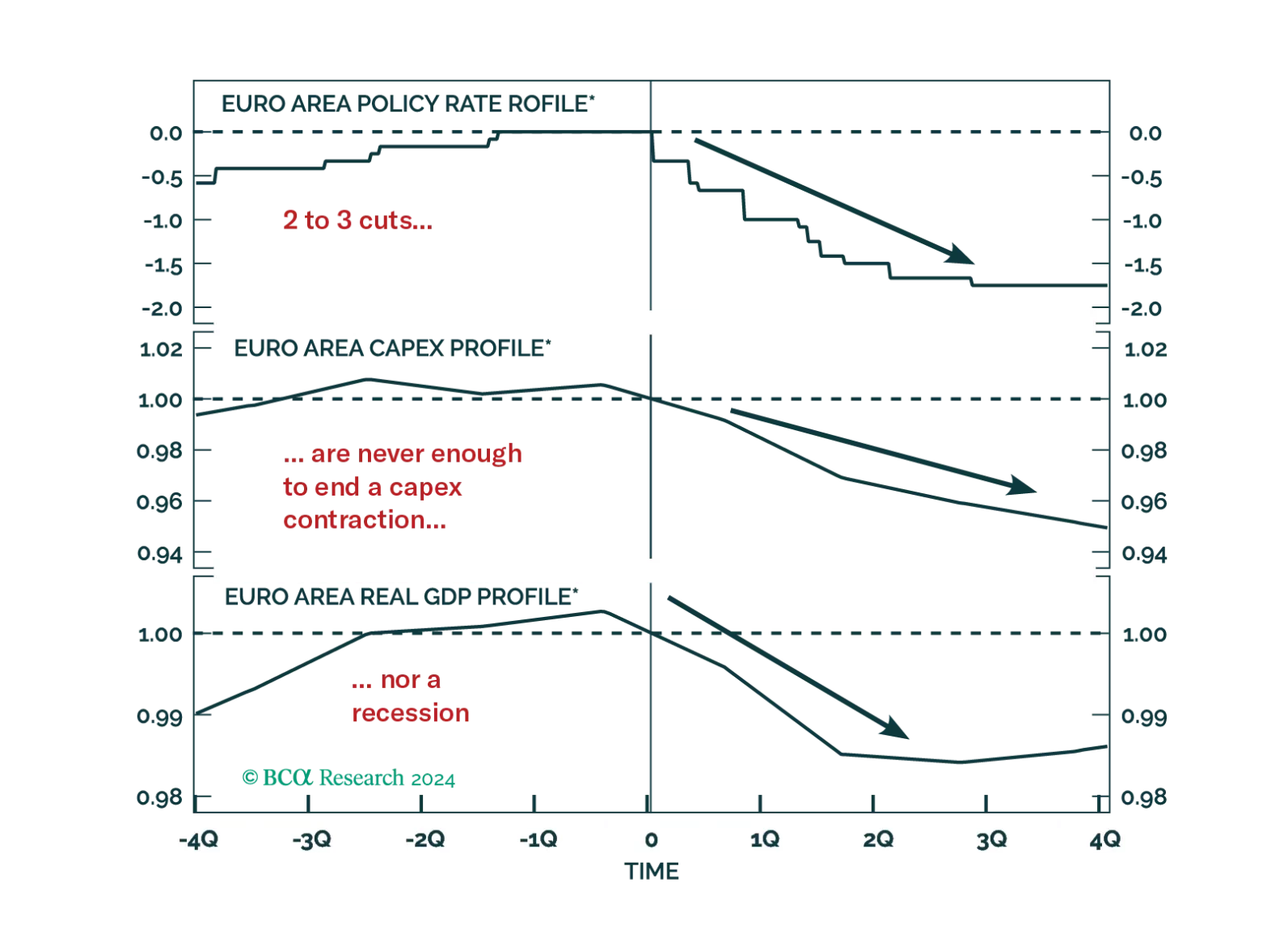

Investors hope that the ECB rate cuts priced into the curve will be sufficient to achieve a soft landing in Europe. History argues against this view, but will this time be different?

Copper has experienced a roller-coaster ride so far this year, with front-month futures on the Chicago Mercantile Exchange gaining nearly 40% from early February to late May, tumbling nearly 15% in just over five weeks, and…

The consensus soft-landing narrative is wrong. The US will fall into a recession in late 2024 or early 2025. We were tactically bullish on stocks most of last year, turned neutral earlier this year, and are going underweight today.…