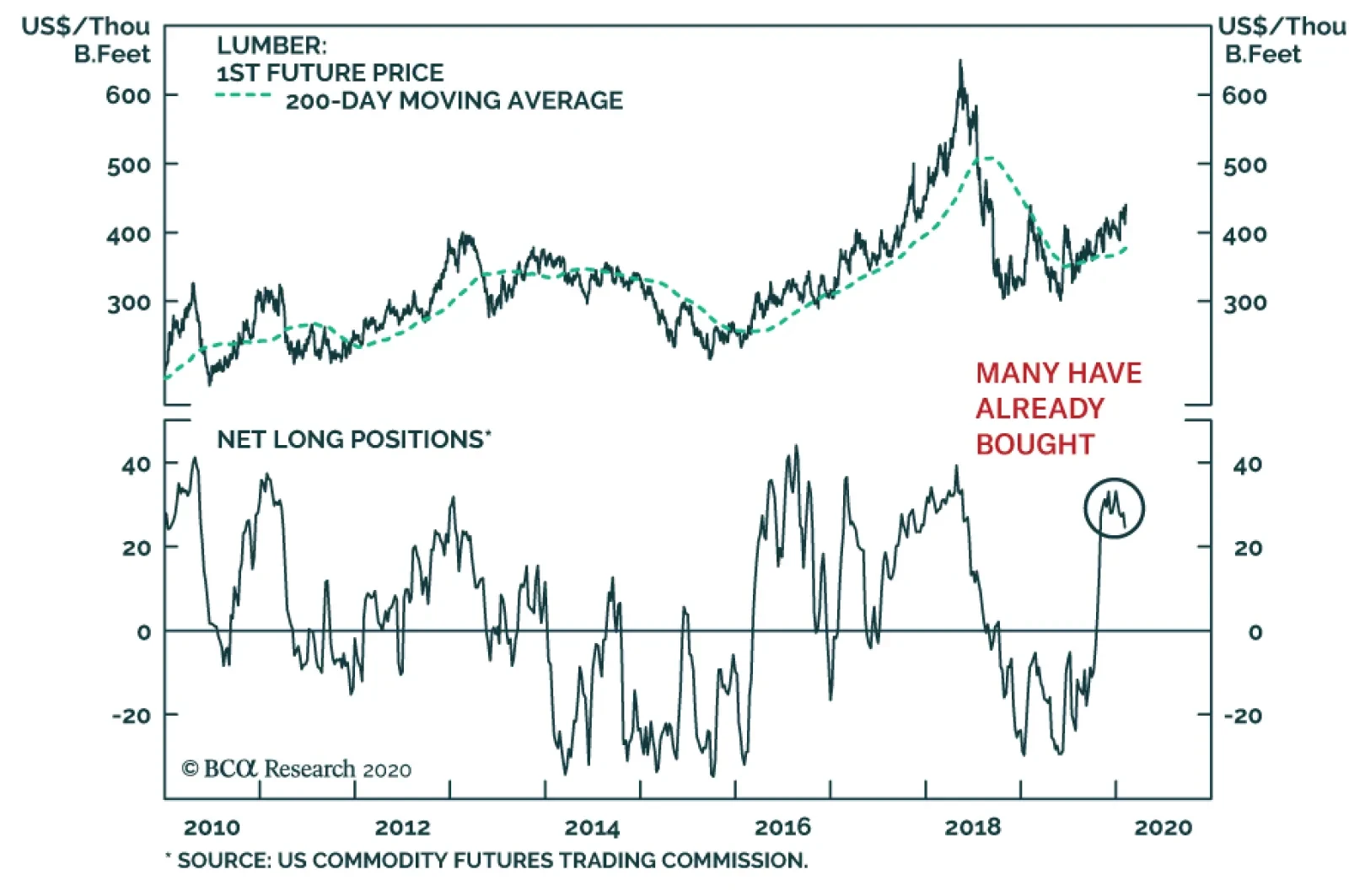

Lumber prices have enjoyed a robust rally since early 2019. A combination of easy US monetary conditions and falling bond yields have created a fertile ground for construction activity, which has forced lumber prices higher…

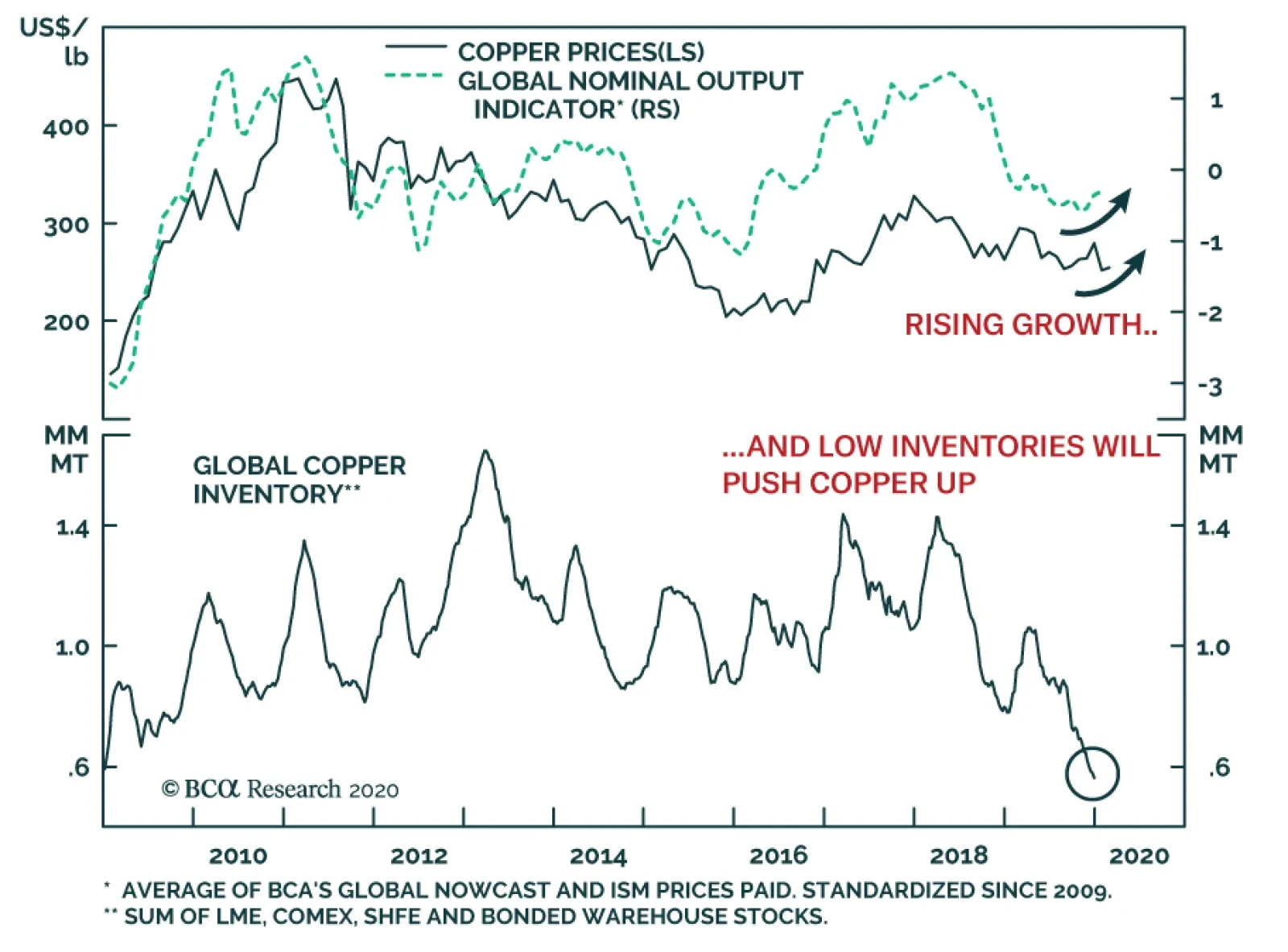

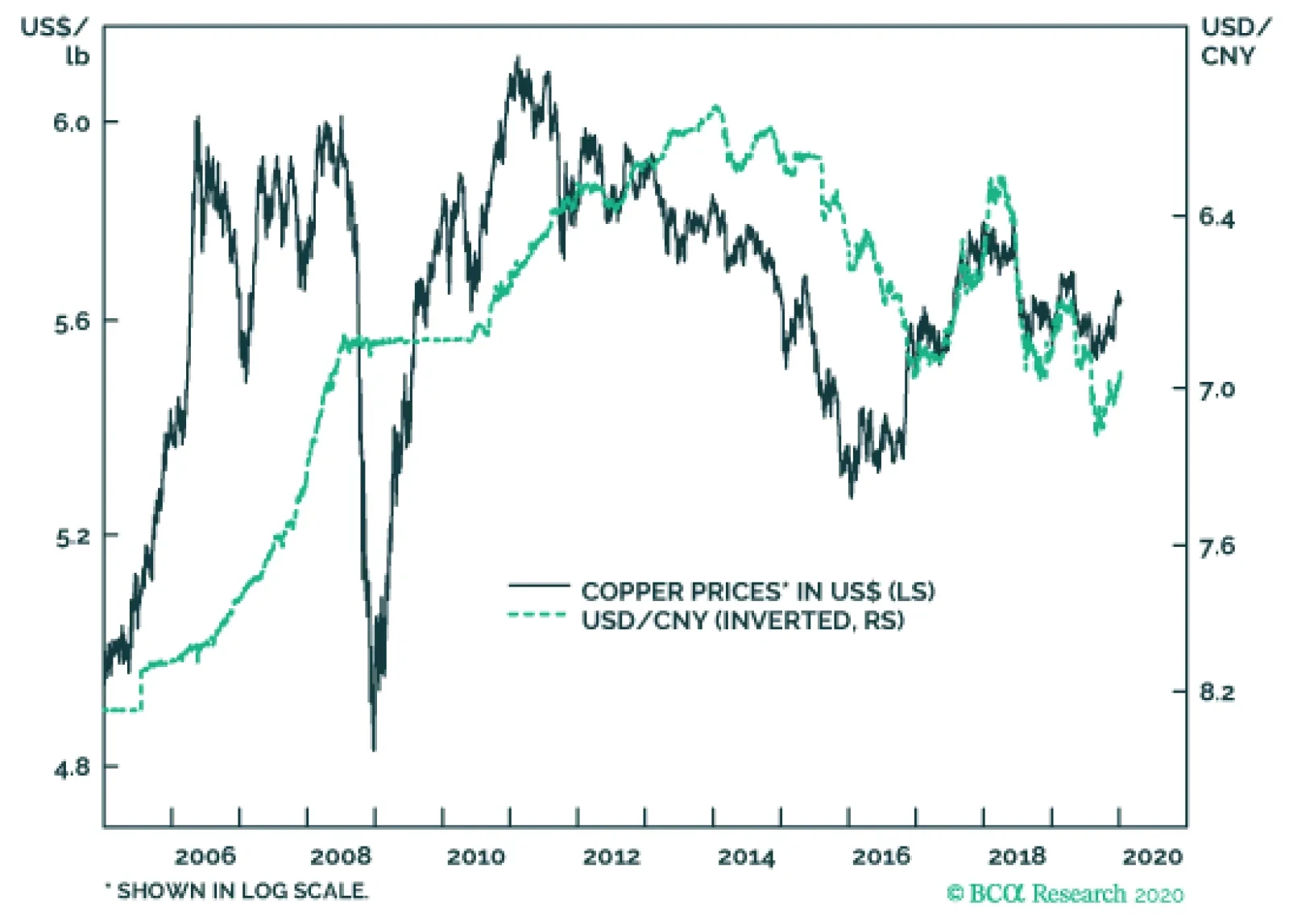

Copper has suffered from the combined assault of a strong dollar, weak global manufacturing activity and, most recently, the dreaded impact on growth from nCoV-2019. However, an opportunity to buy the red metal is emerging.…

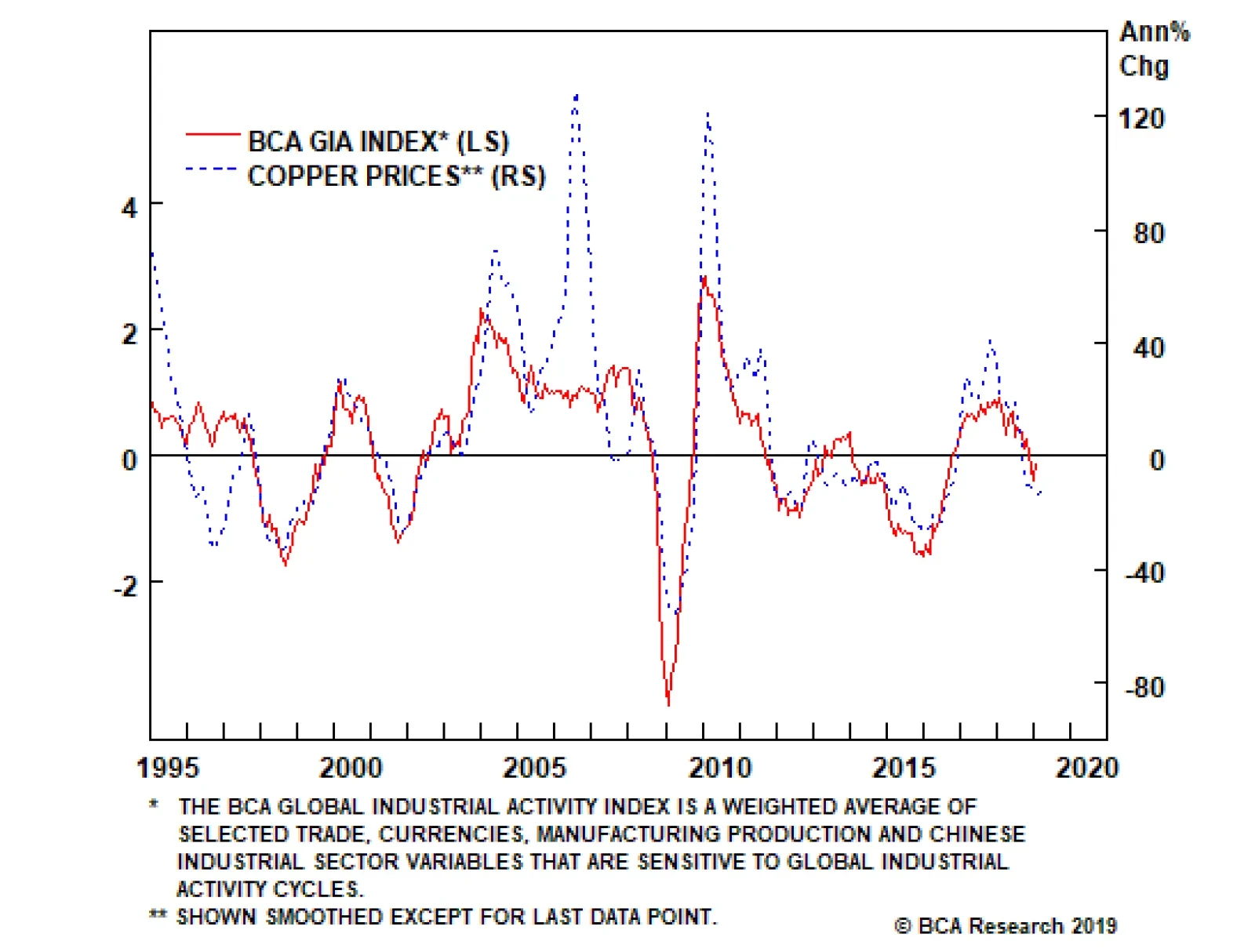

Global money and credit trends indicate that copper is poised for more upside. Our US financial liquidity index is rapidly escalating, which points toward a global economic recovery. Moreover, stronger global growth will harm the…

Highlights OPEC 2.0 production discipline and the capital markets’ parsimony in re funding US shale-oil producers will restrain oil supply growth. Monetary and fiscal stimulus will revive EM demand. These fundamentals will push…

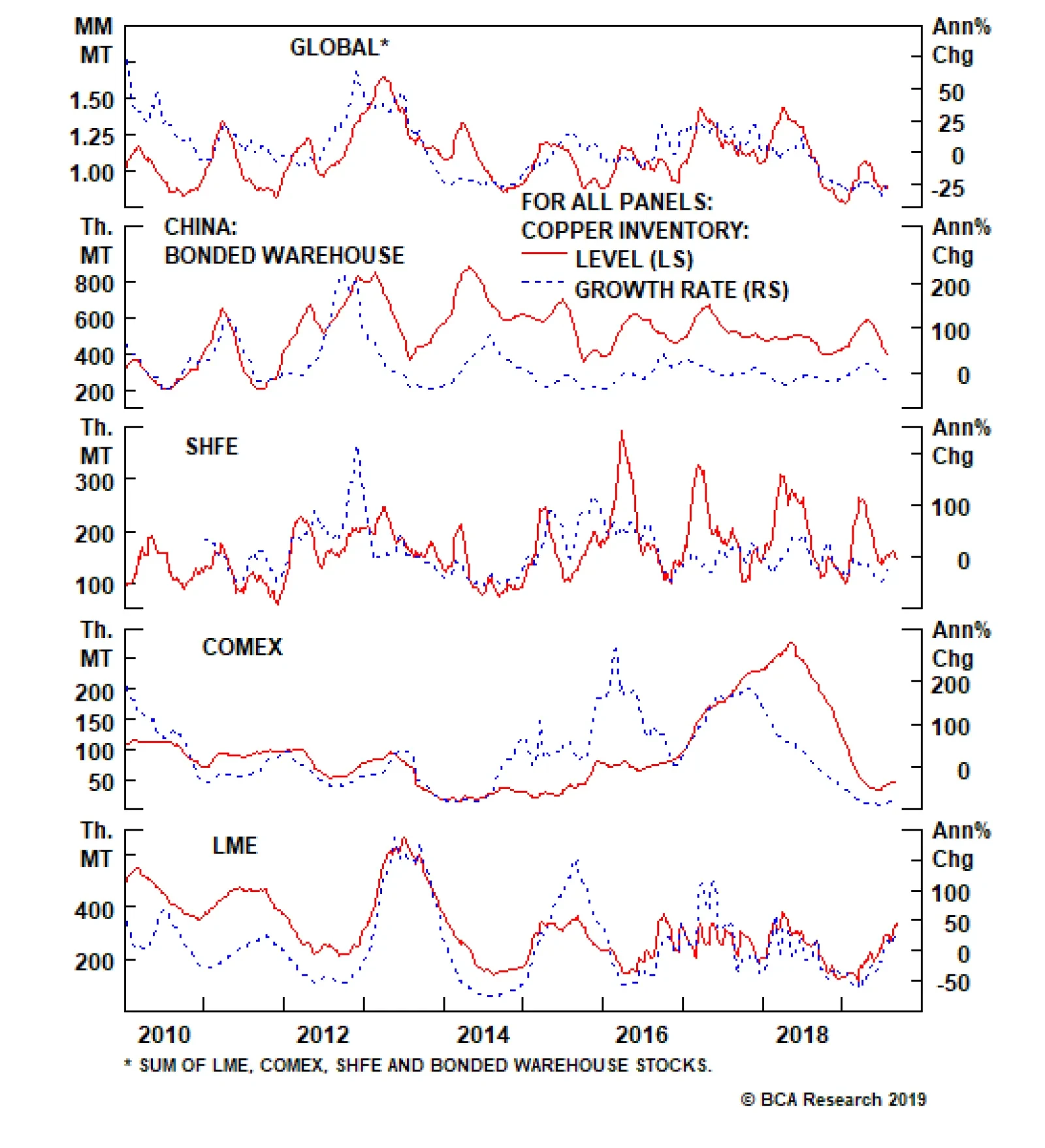

Prices for iron ore and steel have come back to earth, following their impressive rallies this year. However, copper prices languished, and retreated to $2.50/lb on the COMEX. This, despite a contraction of physical copper…

Away from the Sino-U.S. trade-war headlines – and the remarkable commodity price volatility they produce – apparent steel consumption in China is up 9.5% y/y in the first seven months of this year. This is being spurred by…

Highlights Coming up on the deadline for President Trump’s China – U.S. tariff ultimatum, tariffs on $200 billion of Chinese imports could go to 25% from 10% on Friday – the outlook for base metals remains complicated,…

The upturn we anticipated in China’s industrial output in the wake of fiscal and monetary stimulus is becoming more visible. Accommodative central banks, along with a likely resolution of the Sino – U.S. trade war, will…

Our Commodity & Energy Strategy service measures China’s aggregate credit using bank and non-bank claims on non-financial enterprises, households, local and central governments, and non-bank financial institutions. This…

We continue to expect copper prices to increase in the near term, as China’s credit cycle bottoms and DM central banks soften their monetary-policy stance. Fiscal and monetary stimulus in China also will be supportive of base metals…