We Introduce our new macro models for the Eurozone’s equity earnings, which include sectoral forecasts. Find out what they predict for the next six-to-nine months.

The equity market is back to the 2019 level on an inflation-adjusted basis. However, it is still not cheap as it is not pricing in the possibility of a prolonged and deep earnings recession or a higher interest rates regime. Many…

Since 1970, the track record of US housing recessions as the ‘canary in the coal mine’ for economic recessions is a perfect four out of four: 1974; 1980; 1990; and 2007. If this perfect track record continues, the current US housing…

Executive Summary Analysts Have Little Confidence In Their Forecasts In the front section of the sector chart pack, we conduct cross-sectional comparisons. Profitability: Earnings expectations for the cyclical sectors are…

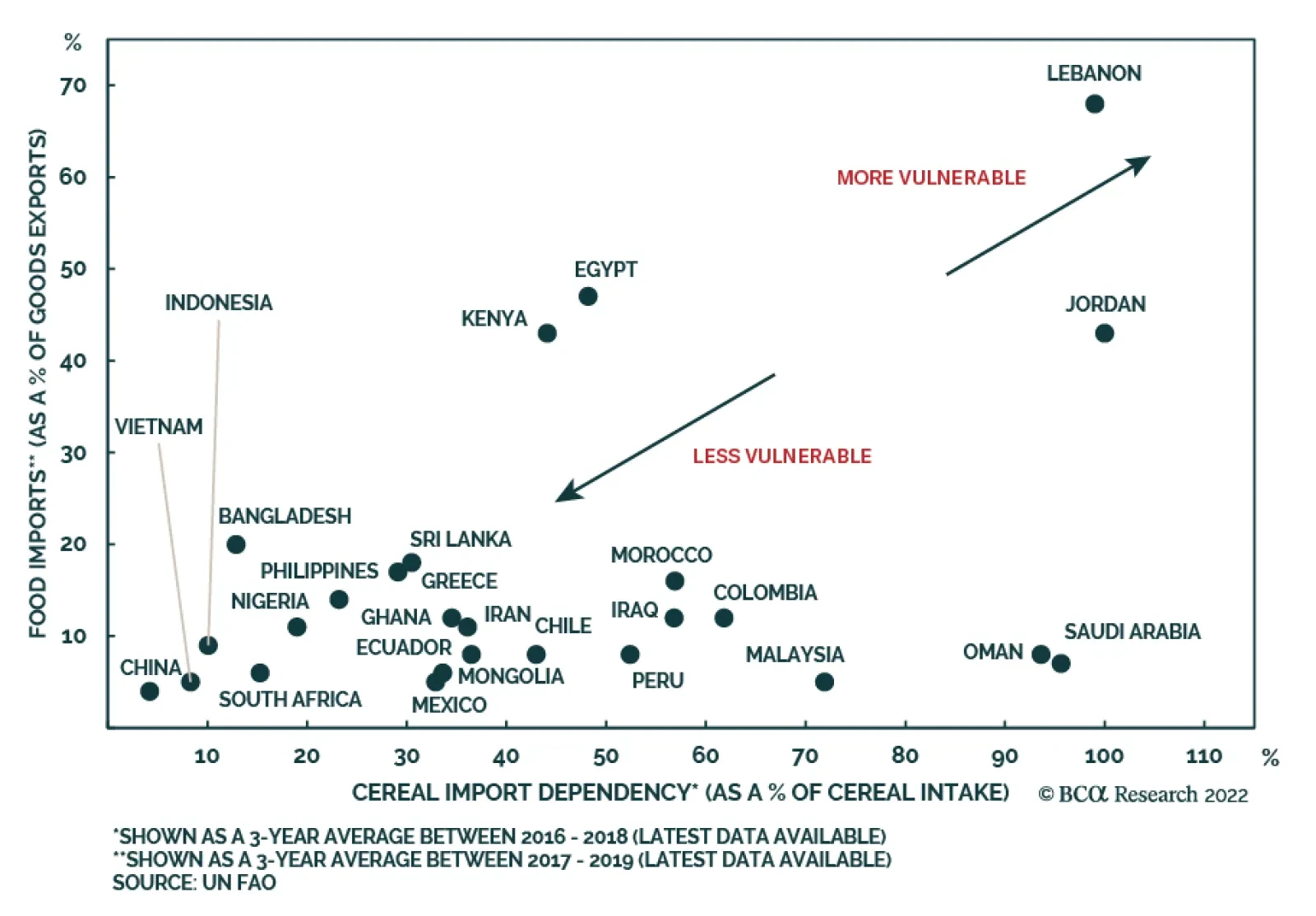

High food and fertilizer prices could morph into food crises in several developing nations. A Special Report from our Emerging Markets Strategy team reckons that Lebanon, Egypt, Kenya, Peru, Pakistan, and Sri Lanka are most at-…

Executive Summary Structural Tailwinds For The Franc Volatility in FX markets is likely to remain elevated, as witnessed by the reaction of a full circle of central bank meetings this week.Policy convergence remains a good bet for…

Executive Summary Investors face a dilemma. The faster that inflation comes down, the better it will be for valuations via a stronger rally in the bond price. But if a collapse in inflation requires a sharp deceleration in growth, the…