A recent slew of macroeconomic data has reassured us that the runway to a recession is longer than many thought. However, that positive realization comes with two caveats. First, the Fed pivot is not imminent, and the magnitude of…

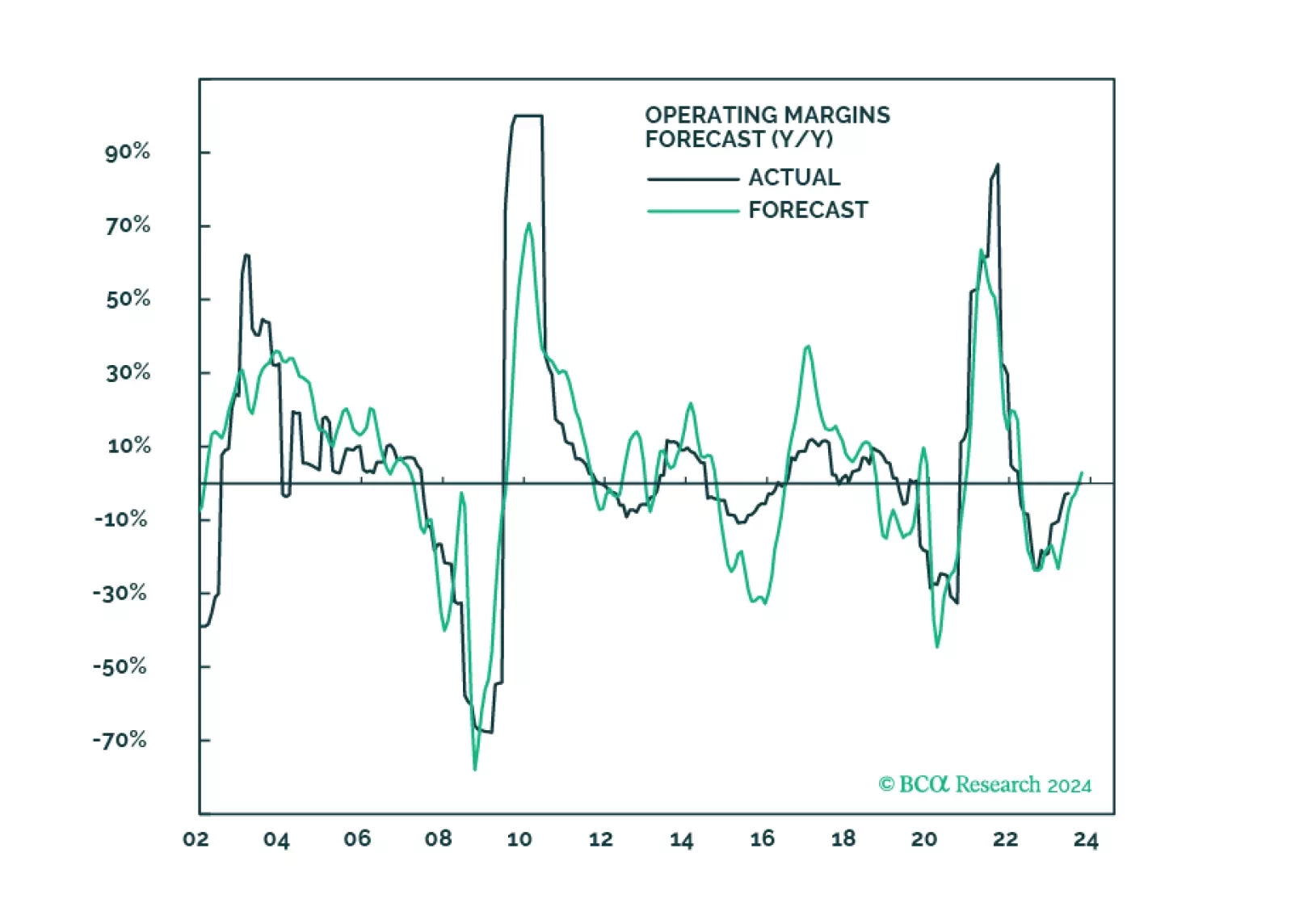

Disinflation coupled with sticky wage growth is likely to result in either a second wave of inflation or layoffs and a recession. In the meantime, market expectations for sales, growth, and margins are overly optimistic and are…

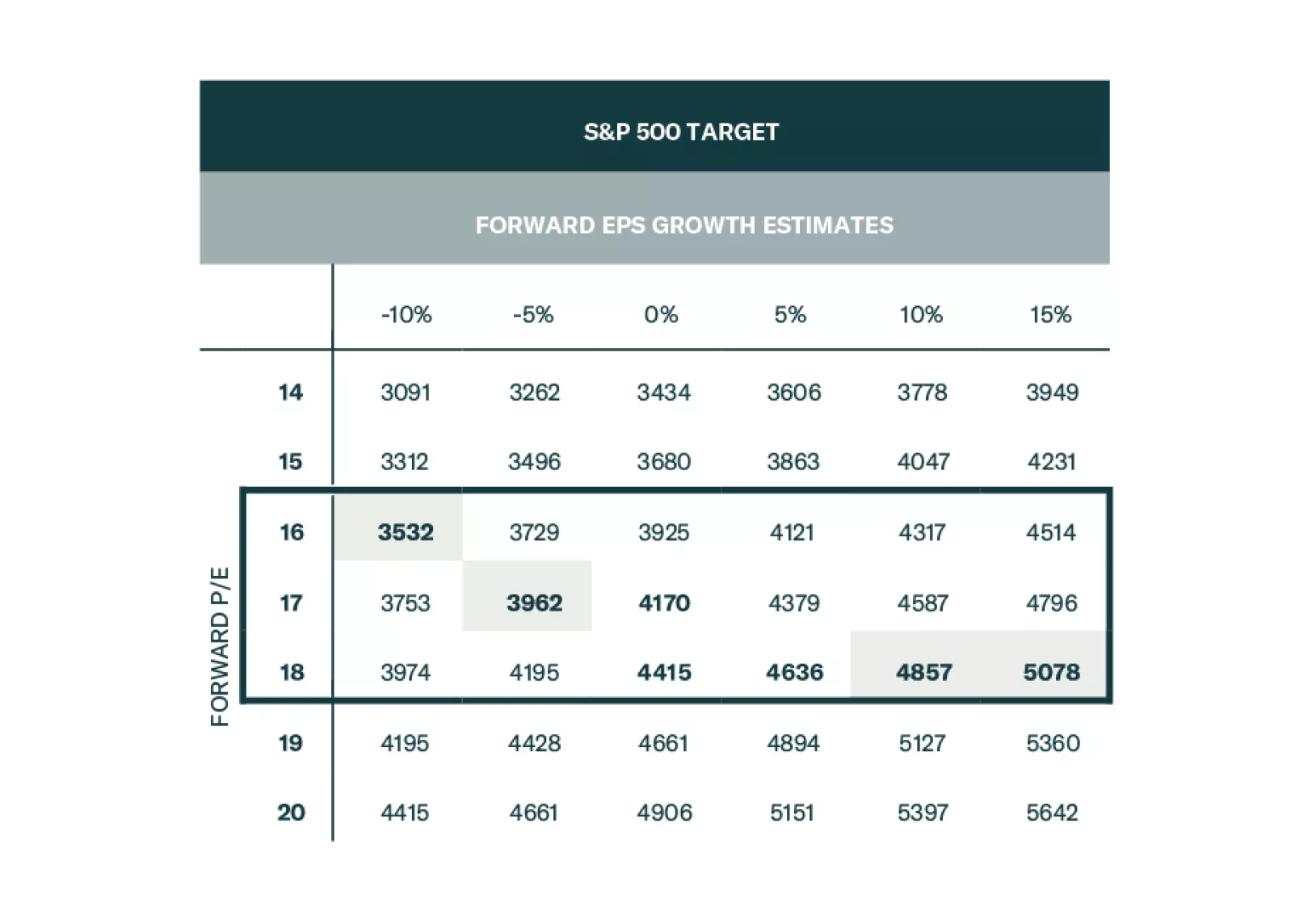

Q3-2023 is expected to mark the end of the earnings recession for the past three quarters, opening the door to positive earnings growth. Whether that would be sustainable or will sputter once the recession settles in as expected in…

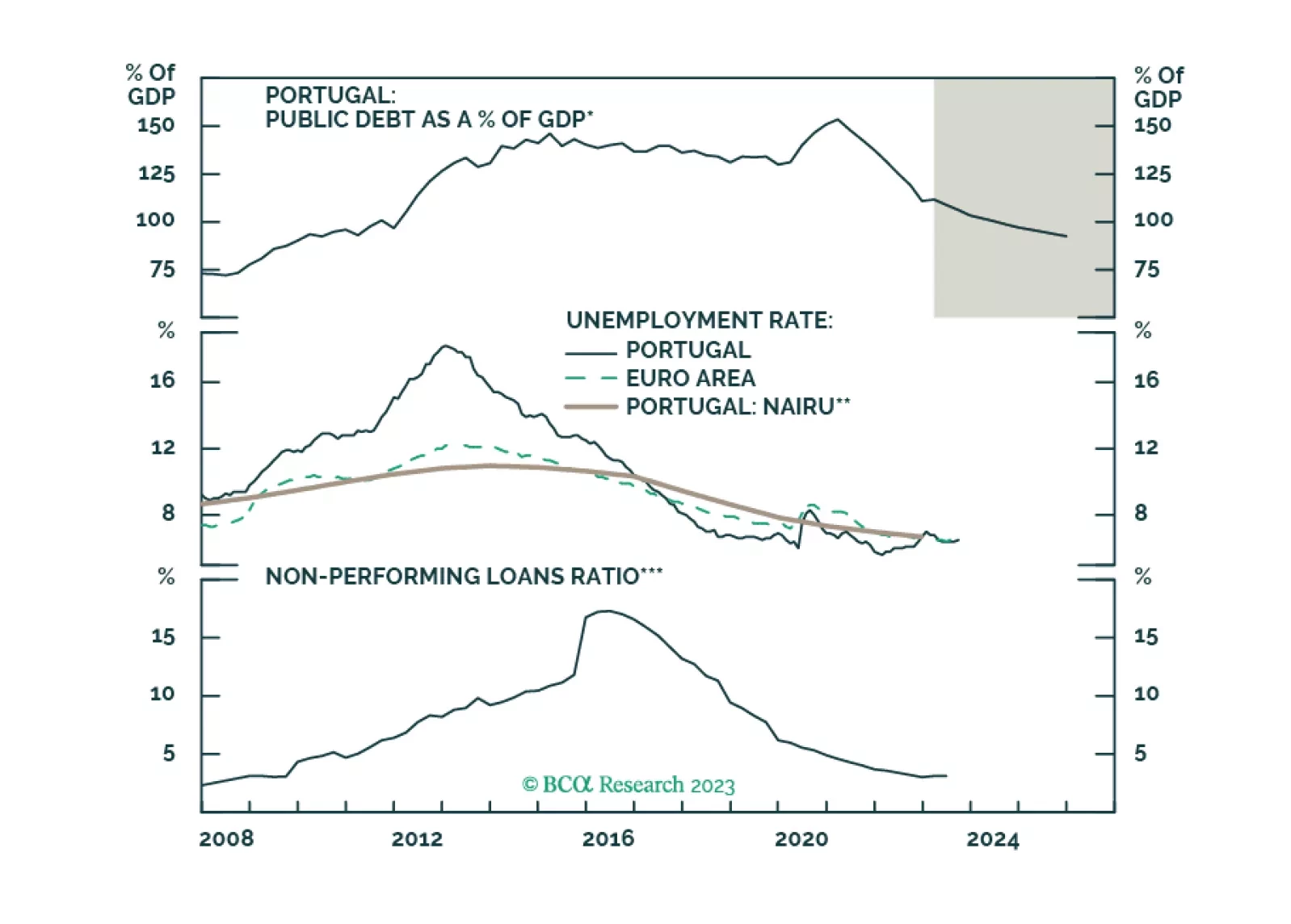

European stocks and the euro continue to weaken; soon, they will test the bottom of their recent trading range. Which sectors can protect investors against this downdraft?

The Equity Analyzer Platform uses a 30-factor model called the BCA Score to help our clients build robust portfolios. Multi-factor models are constructed to avoid the common pitfalls of focusing on one factor dimension, such as…

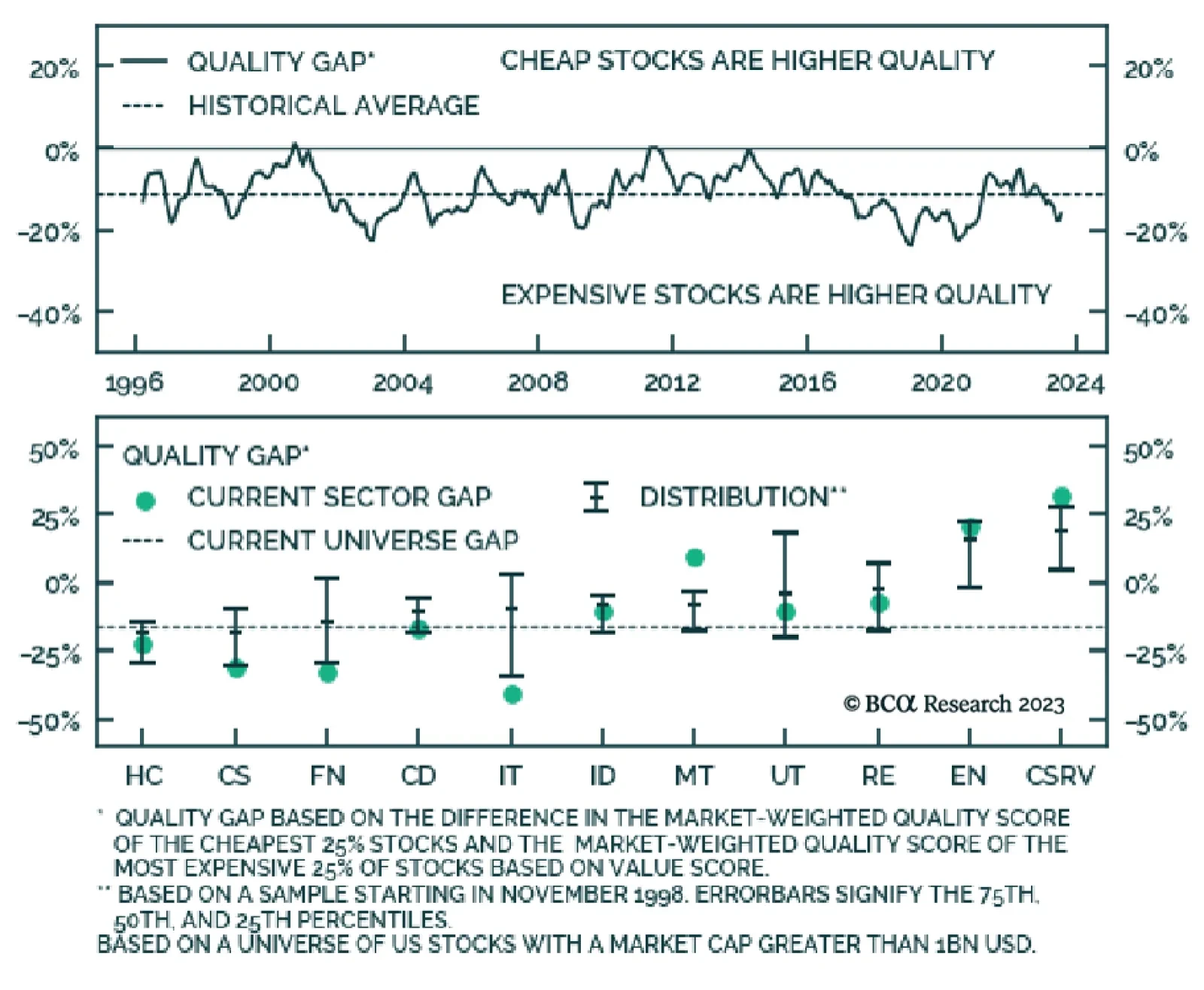

In June, the rally gained momentum and broadened due to positive economic data, particularly in the housing market. We expect cheaper cyclical sectors and styles to mark a change in leadership as the rally broadens, helped on by…

Investors are still cautious and have significant cash that needs to be put to work. Trickle-down of it into the US equity market may extend the rally. Overly bearish futures positioning is also a strong contrarian indicator.…

Symptoms of a liquidity trap for Chinese households are appearing. Our proprietary indicators for the marginal propensity to spend among households and enterprises continue falling. There has been a paradigm shift in Beijing’s…