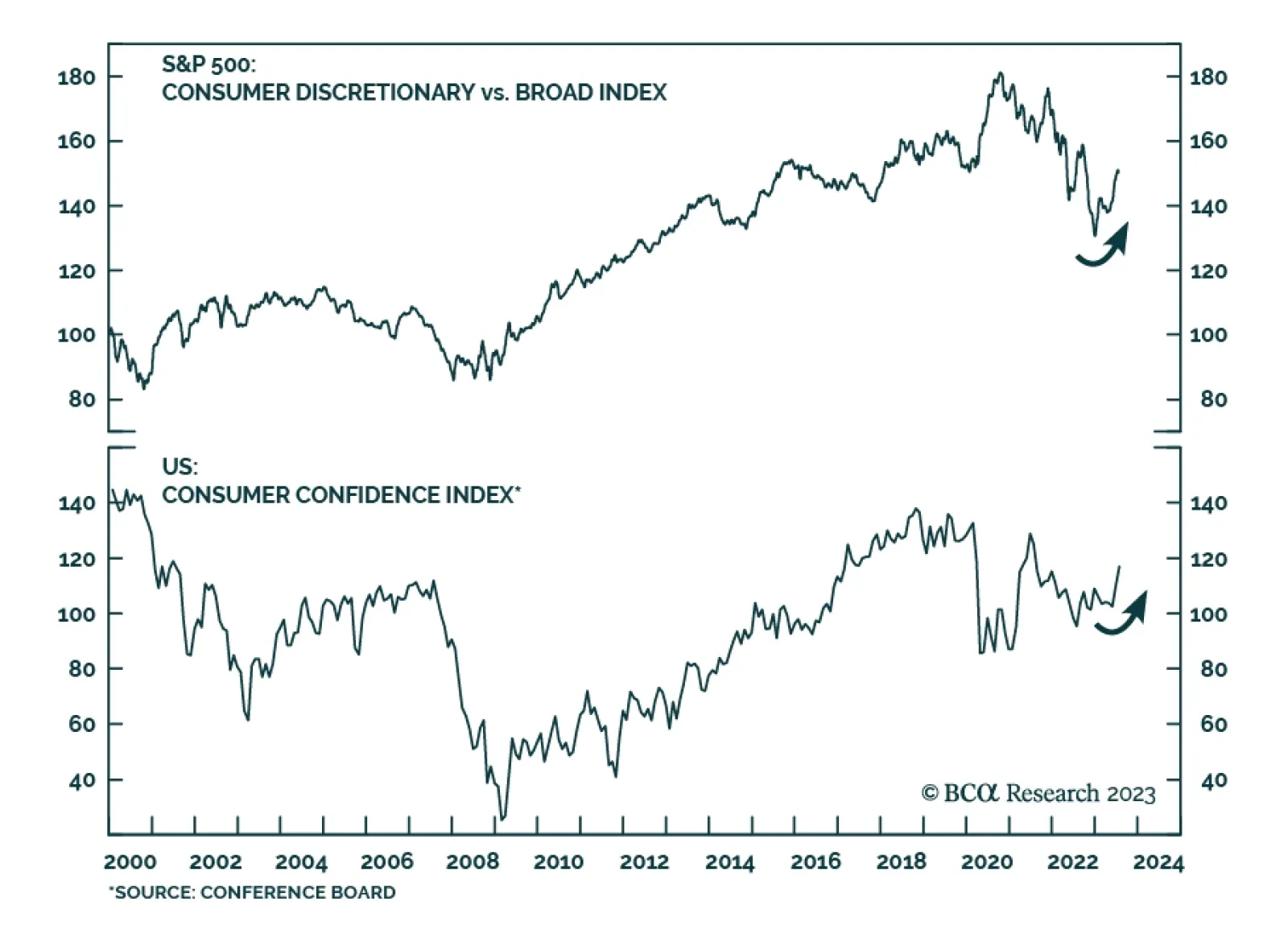

The resiliency of consumers through 2023 has surprised investors. However, consumer strength will fade into yearend as factors supporting growth in income and spending are waning. i.e., job gains are slowing, wage growth is…

Investors remain cautious about the US economy and still have significant cash that needs to be put to work which could extend the rally further. Earnings rebound later in the year will be supported by rising sales growth and surging…

The US Consumer Discretionary sector has been one of the top winners since the equity rally broadened two months ago. Its 13% gain since the end of May outpaces the S&P 500’s rally by 3.8 percentage points This…

Both EV and Green Energy themes still hold strategic promise for investors, posing large upside, despite prevailing macro headwinds. While both themes have yet to claw back their pandemic peaks, a broadening of the rally supports a…

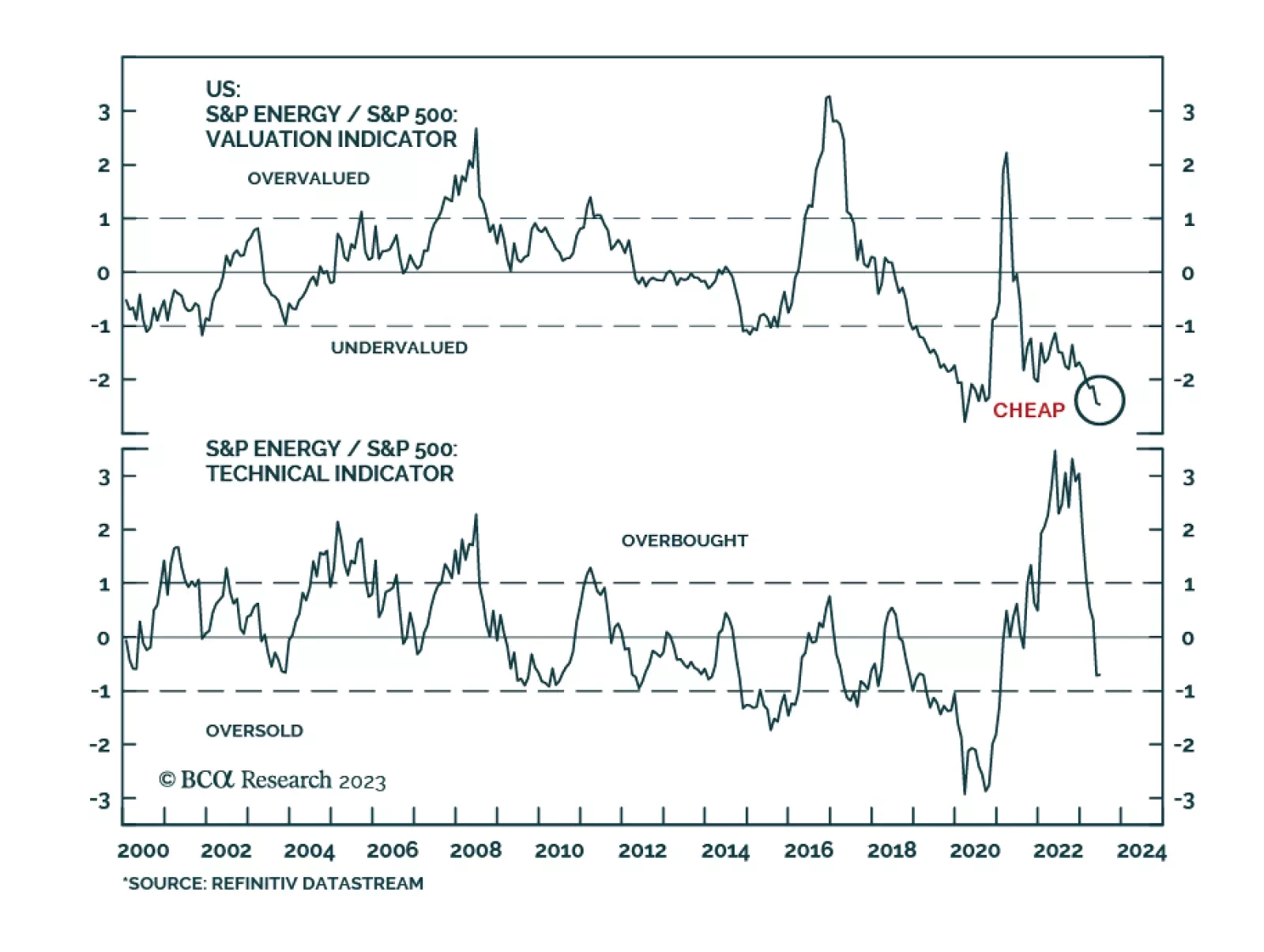

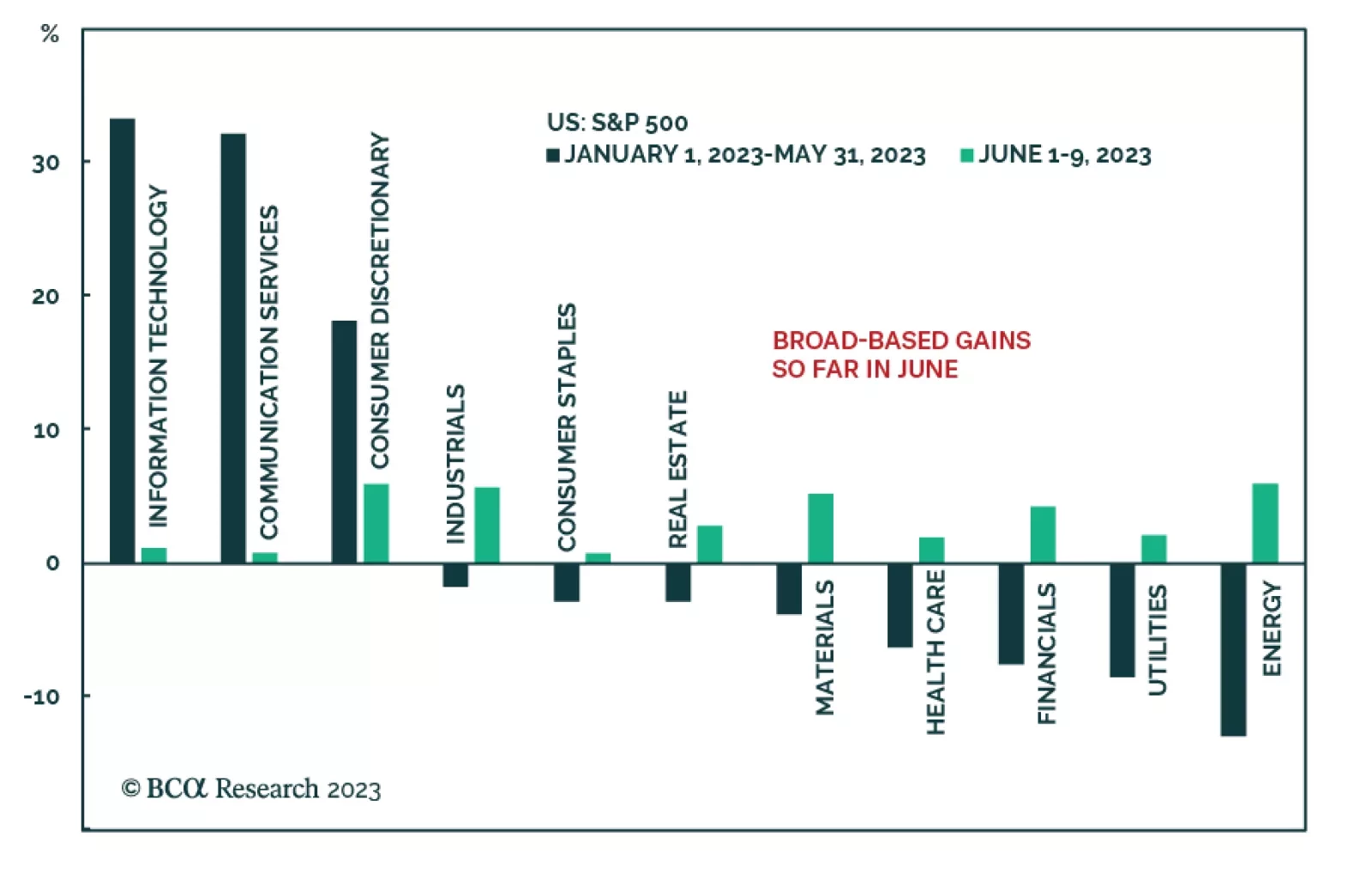

In June, the rally gained momentum and broadened due to positive economic data, particularly in the housing market. We expect cheaper cyclical sectors and styles to mark a change in leadership as the rally broadens, helped on by…

For the most part, the US equity rally has been rather narrow this year – concentrated among stocks that investors perceive will be the key winners of recent AI developments. In the first five months of the year, only three…

Investors are still cautious and have significant cash that needs to be put to work. Trickle-down of it into the US equity market may extend the rally. Overly bearish futures positioning is also a strong contrarian indicator.…

As we’ve highlighted in recent Insights, the S&P 500’s year-to-date rally has been concentrated among a few mega cap stocks. In particular, companies that benefit from the AI craze have driven the gains. This…

Symptoms of a liquidity trap for Chinese households are appearing. Our proprietary indicators for the marginal propensity to spend among households and enterprises continue falling. There has been a paradigm shift in Beijing’s…