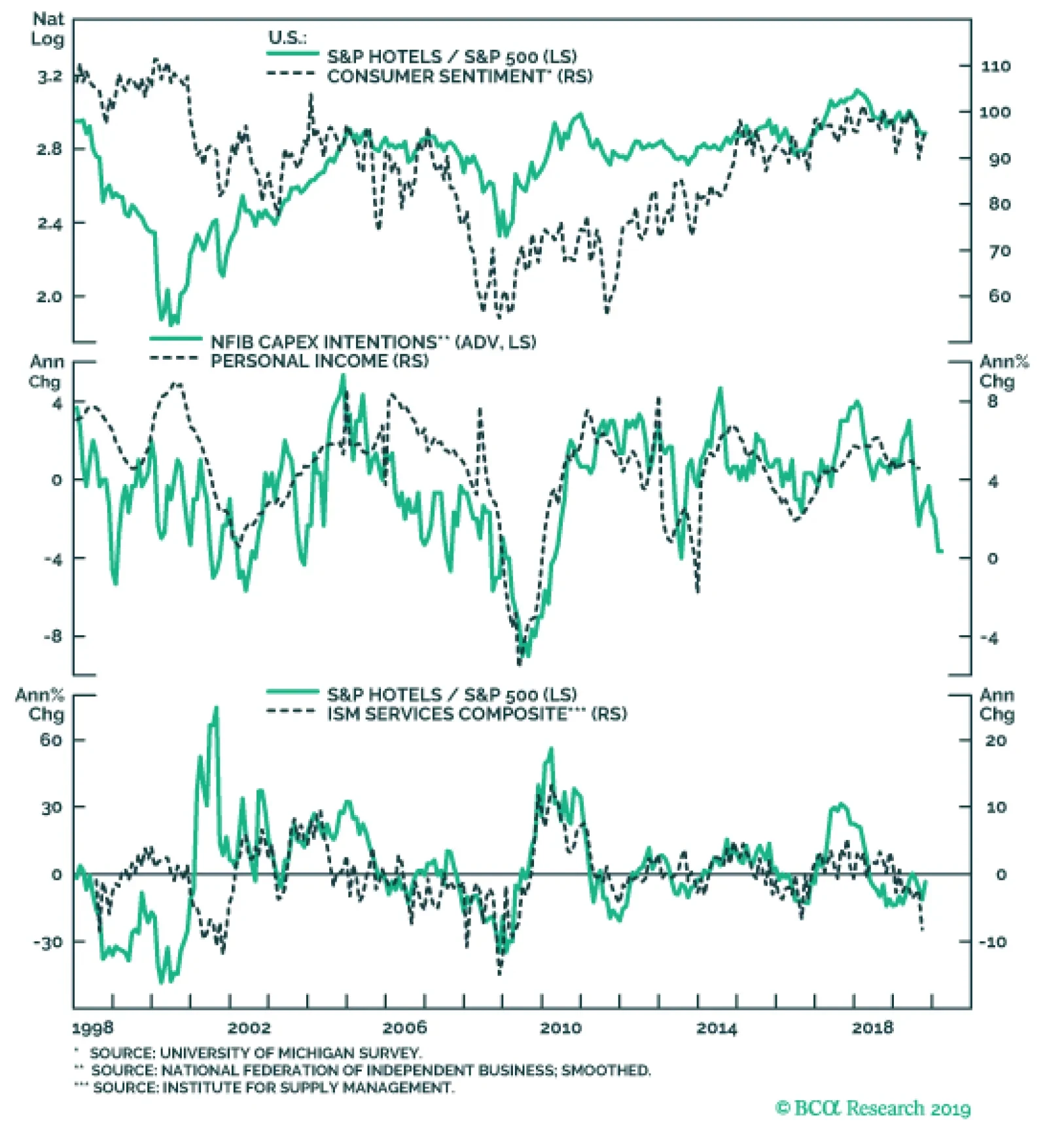

Last Wednesday’s Hilton Worldwide Holdings earnings call was littered with cautious commentary during the Q&A section of the call. Specifically, Hilton mentioned that global uncertainty, whether it is Brexit, Trade…

Underweight This Wednesday’s Hilton Worldwide Holdings earnings call was littered with cautious commentary during the Q&A section of the call. Specifically, Hilton mentioned that all around global uncertainty be it…

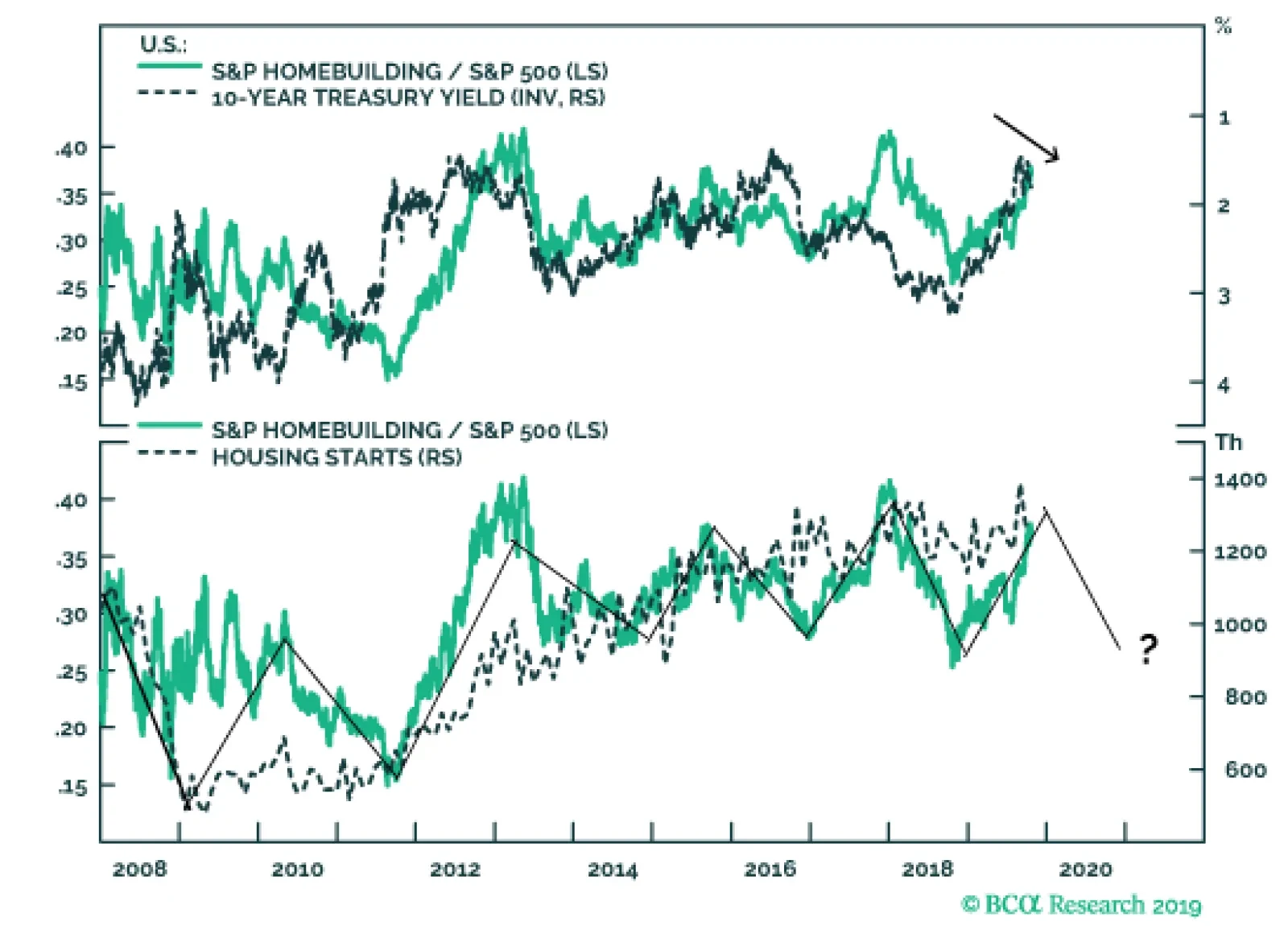

We are downgrading the niche S&P homebuilding index to underweight, as most positive profit drivers are already reflected in relative share prices. Specifically, the drop in interest rates has been more than accounted…

Underweight In yesterday’s Weekly Report1 we recommended downgrading the niche S&P homebuilding index to underweight, as most, if not all, positive profit drivers are already reflected in relative share prices. The…

Highlights Portfolio Strategy Soft housing demand, the trough in interest rates, new home price deflation and weak industry employment prospects suggest that an underweight stance is now warranted in the S&P homebuilding index.…

Highlights New structural recommendation: long GBP/USD. The substantial Brexit discount in the pound makes it a long-term buy for investors who can tolerate near-term volatility. The most powerful equity play on a fading Brexit…

Highlights MARKET FORECASTS Investment Strategy: Markets have entered a “show me” phase. Better economic data and meaningful progress on the trade negotiations will be necessary for stocks to move sustainably…

Highlights European and global growth will rebound in the fourth quarter but the rebound will lack longevity. Bonds: Expect bond yields to edge modestly higher, especially for those yields that are deeply in negative territory.…