Highlights Fed: Fed policymakers are sending a unified message that they want to keep rates on hold until they see a significant increase in inflation. However, our reading of their recent remarks suggests that they will be reluctant to…

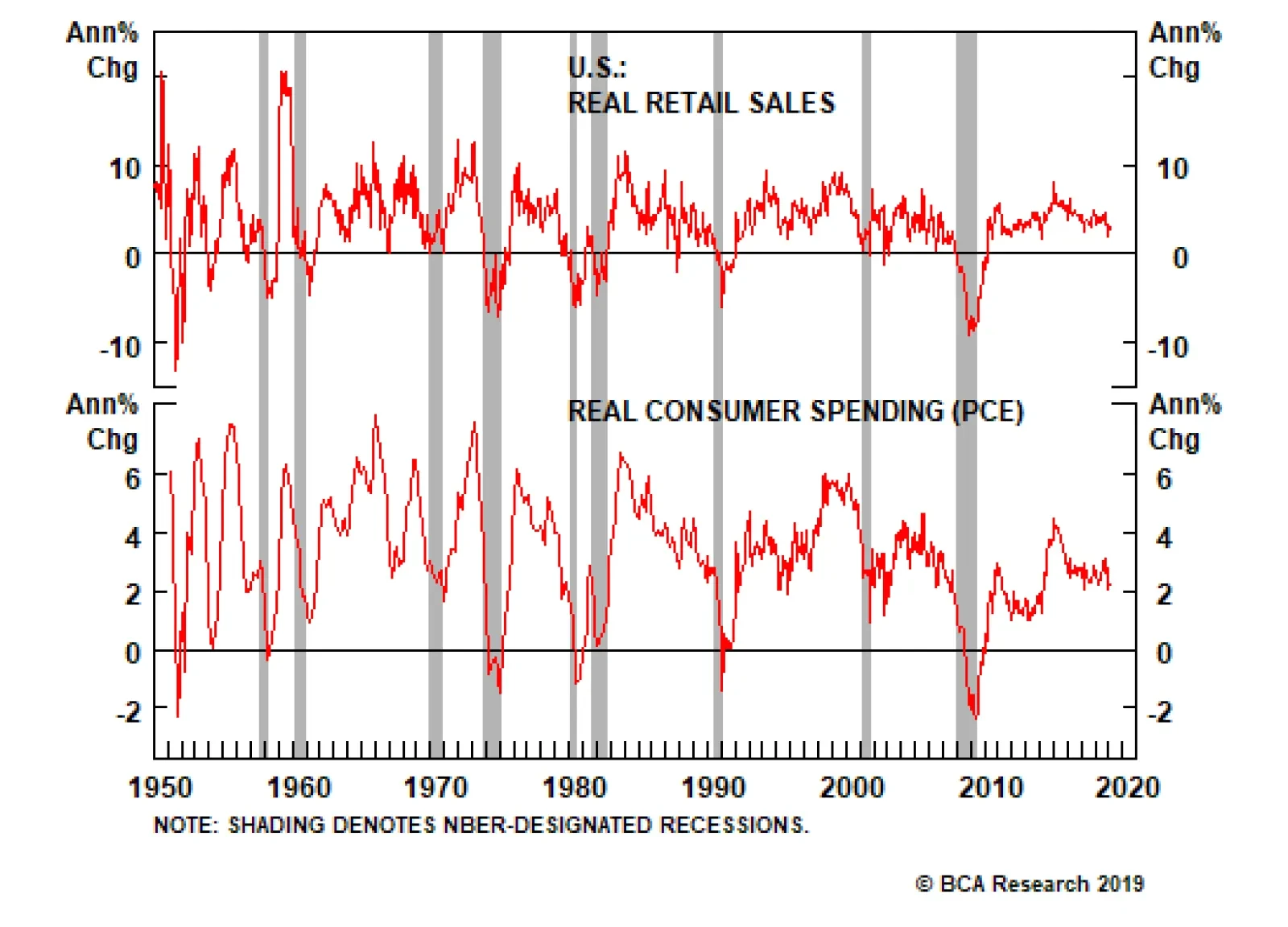

Retail sales contracted month-over-month in February, though upward revisions to the January data made the release something of a wash. Year to date, however, retail sales growth has not been strong enough to erase the…

Highlights We remain constructive on the U.S. economy, …: It was another uneven week, but conditions remain broadly favorable for the U.S., and the expansion is intact. … and things seem to be perking up in the rest of…

Highlights Odds are that the recent improvement in Chinese manufacturing PMIs could be due to inventory re-stocking rather than a decisive turnaround in final demand. “Hard” data have not shown meaningful improvements in…

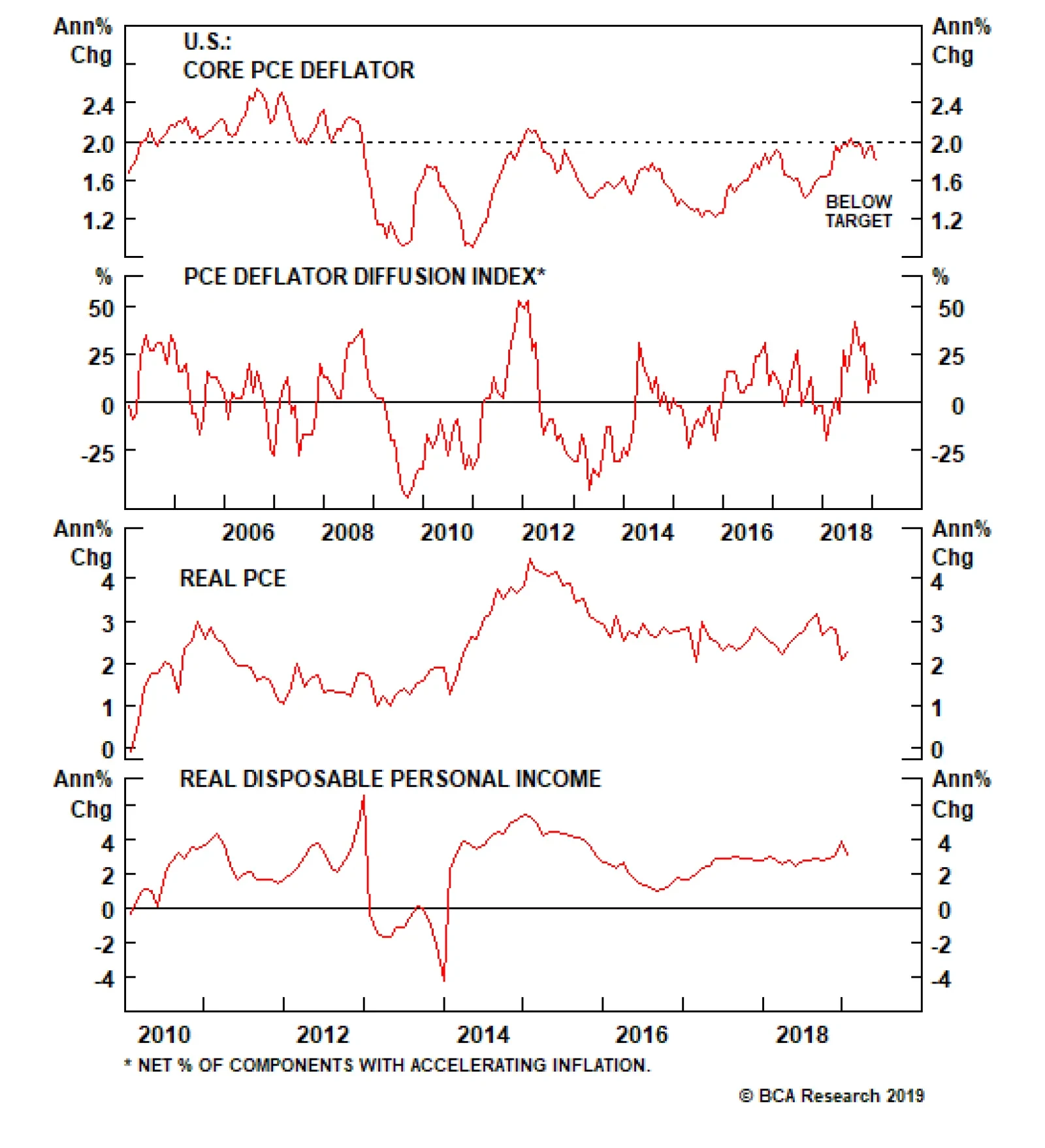

This morning’s core PCE deflator for January came in at a lower-than-expected 1.8% annual growth rate. The base effect was not the only culprit, behind the weakness, the annualized month-on-month rate of change was only 0.8…

This stunningly poor retail sales number is obviously worrisome, especially as the control group, which enters in the calculation of GDP, fell sharply as well. This catastrophic dataset, along with a poor industrial production…

Dear Client, I will be meeting clients in Europe next week. Instead of our usual weekly bulletin, I will be sending you a Special Report discussing how “The Most Important Trend In The World” – a trend that has been…

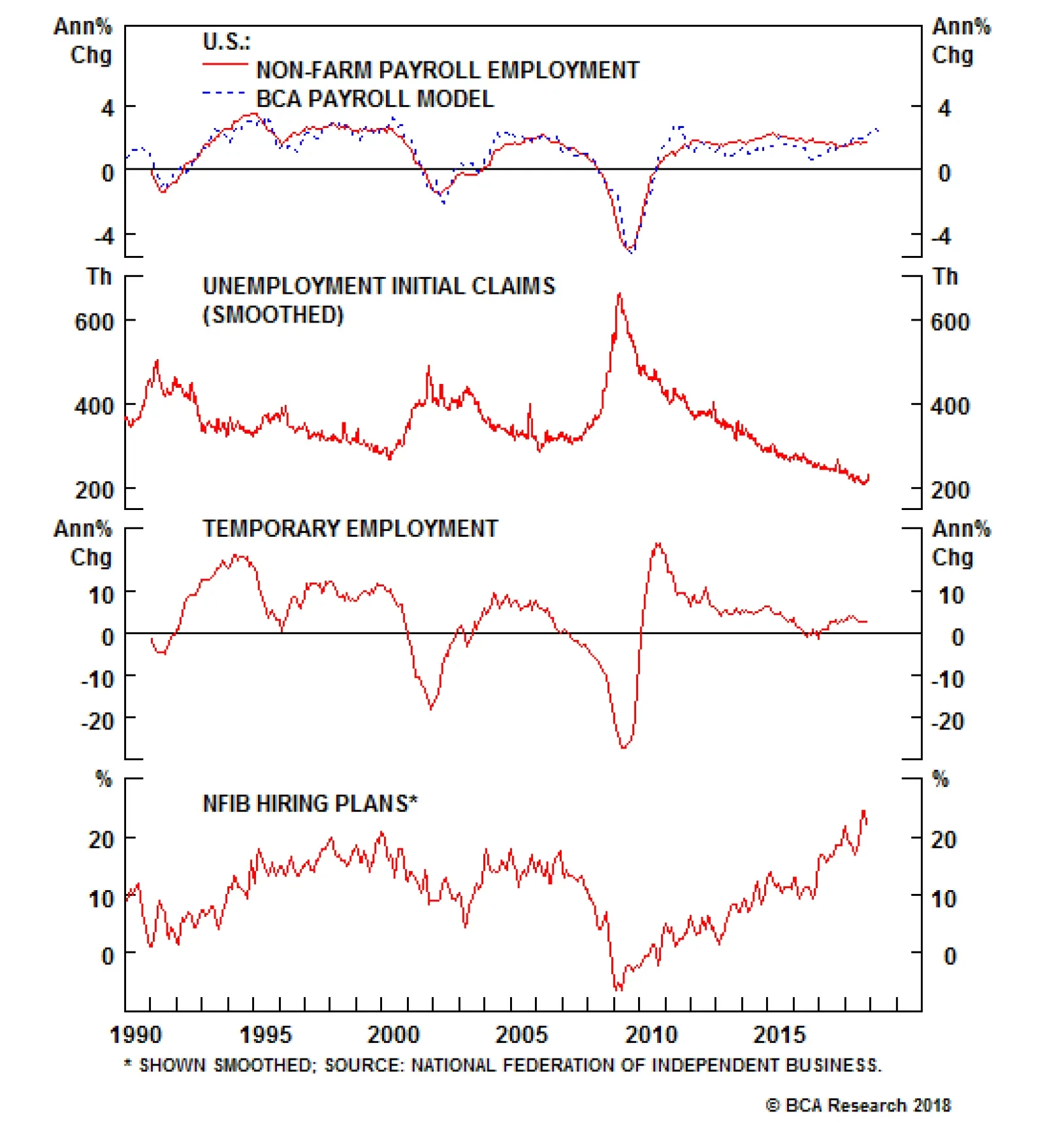

In BCA we pay close attention to nonfarm payrolls. Employment may be a coincident indicator, but it is powerfully self-reinforcing, and the sub-NAIRU unemployment rate looms large in the Fed’s policy calculus. Payroll…

Highlights Differences of opinion are what make a market, and we’ve got a big one when it comes to the Fed: The money market says the fed funds rate goes no higher than 2.75%; BCA says 3.5% by the end of 2019, and possibly 4%…