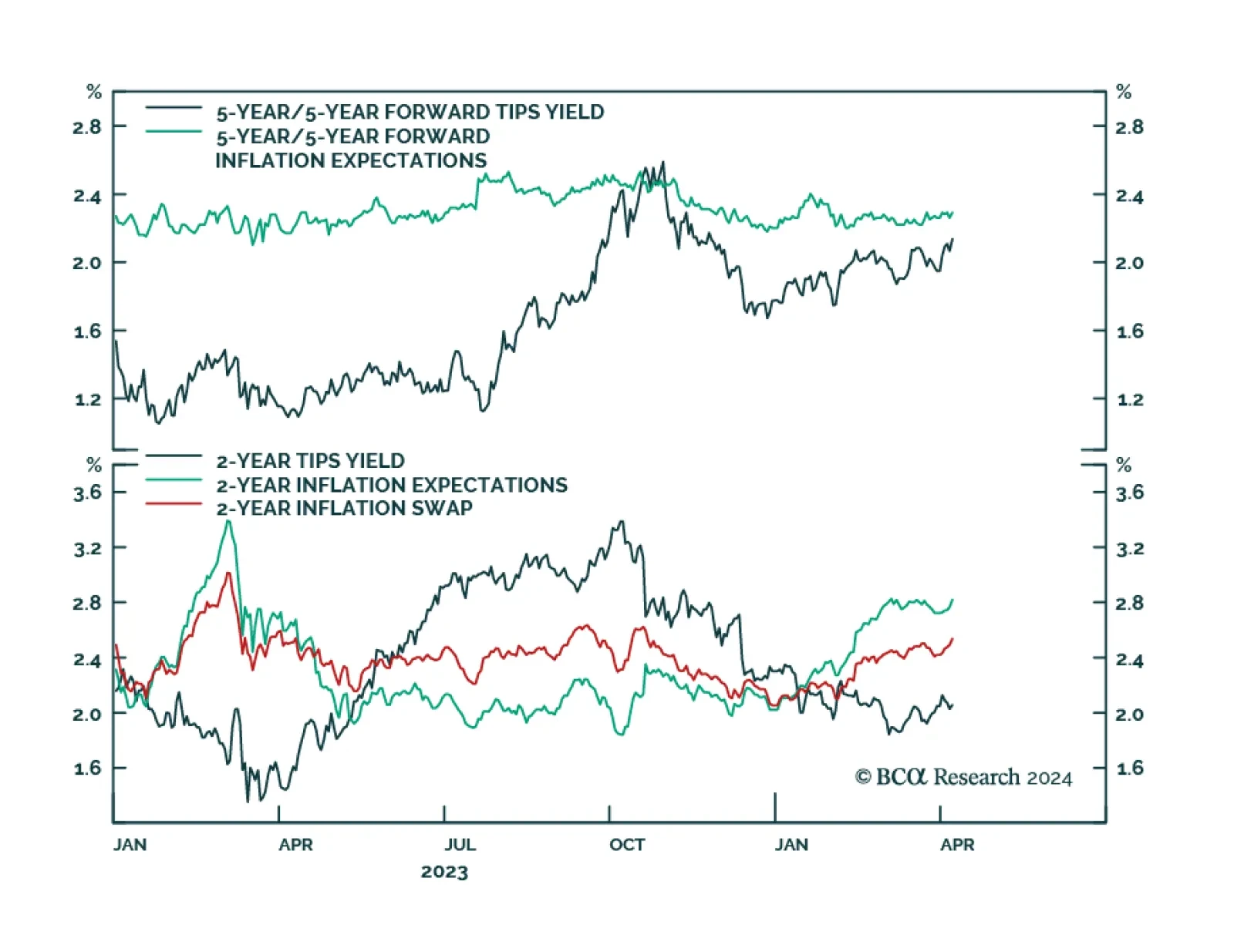

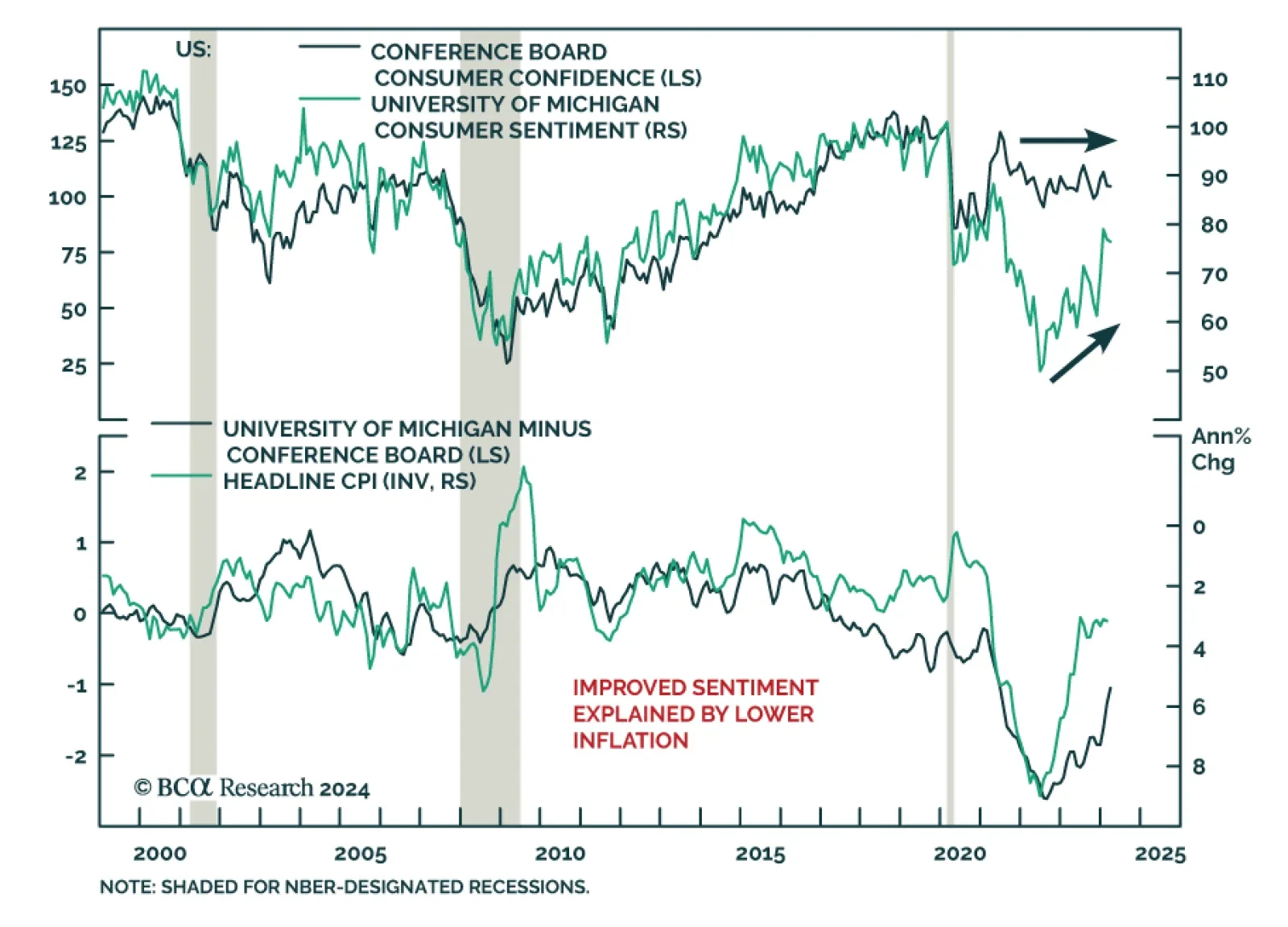

The recent rise in market-based inflation expectations has caught the attention of market participants. Some investors have begun to worry that the Federal Reserve might be losing control of its inflation mandate by cutting rates…

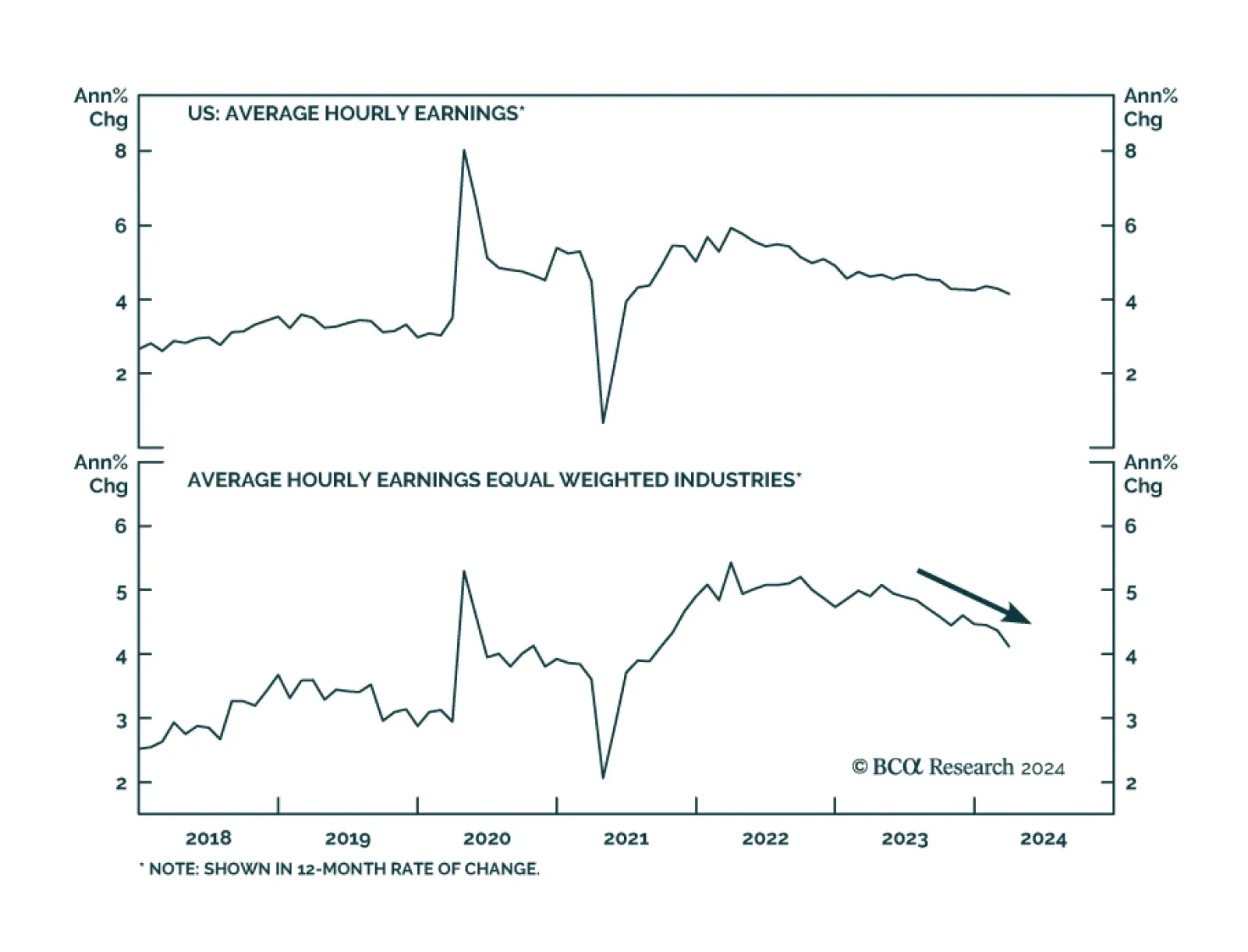

The 303-thousand increase in nonfarm payrolls in March came in well above consensus expectations of a moderation from 270 thousand to 214 thousand. Healthcare, the public sector and construction were the top contributors to…

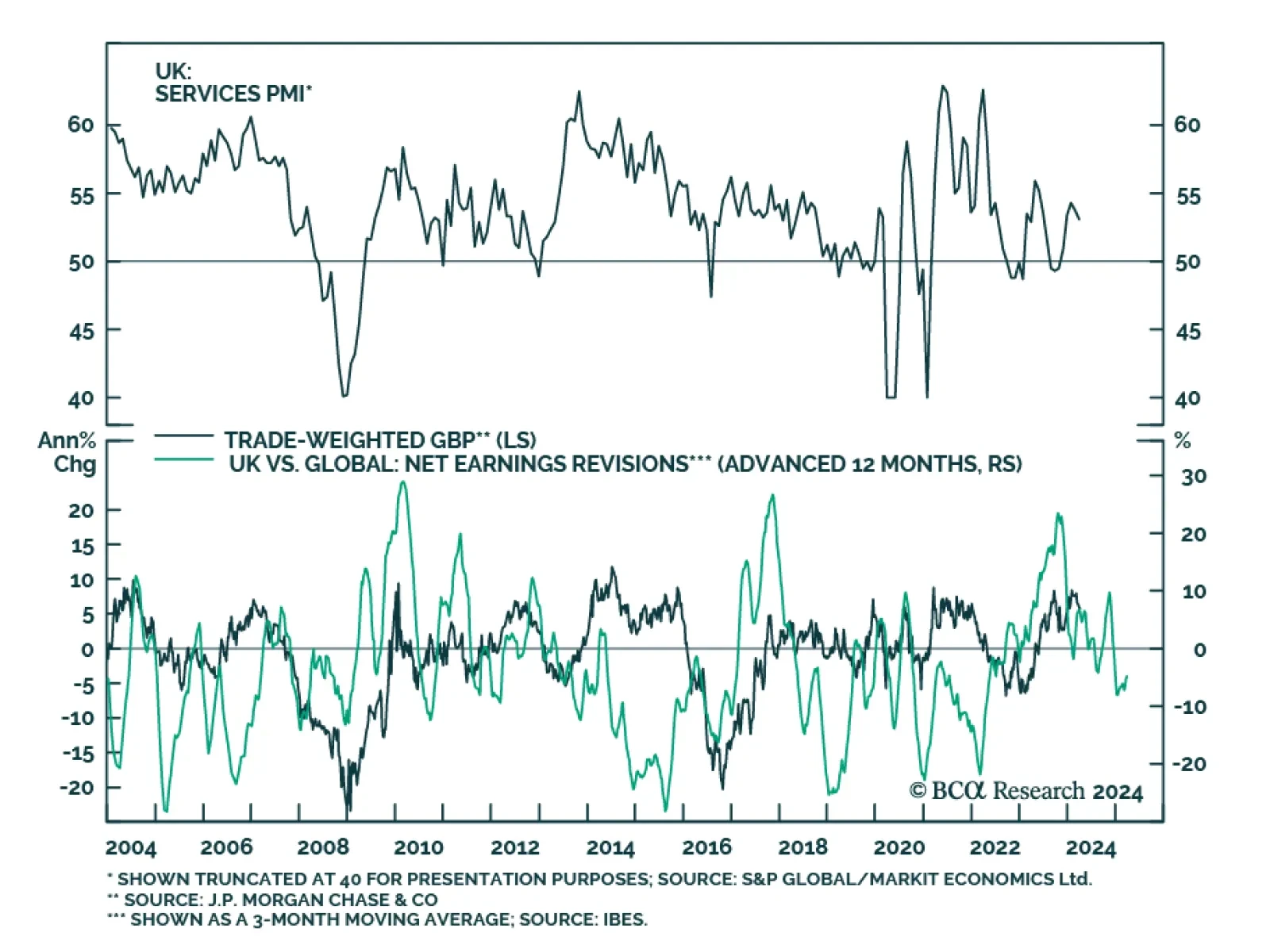

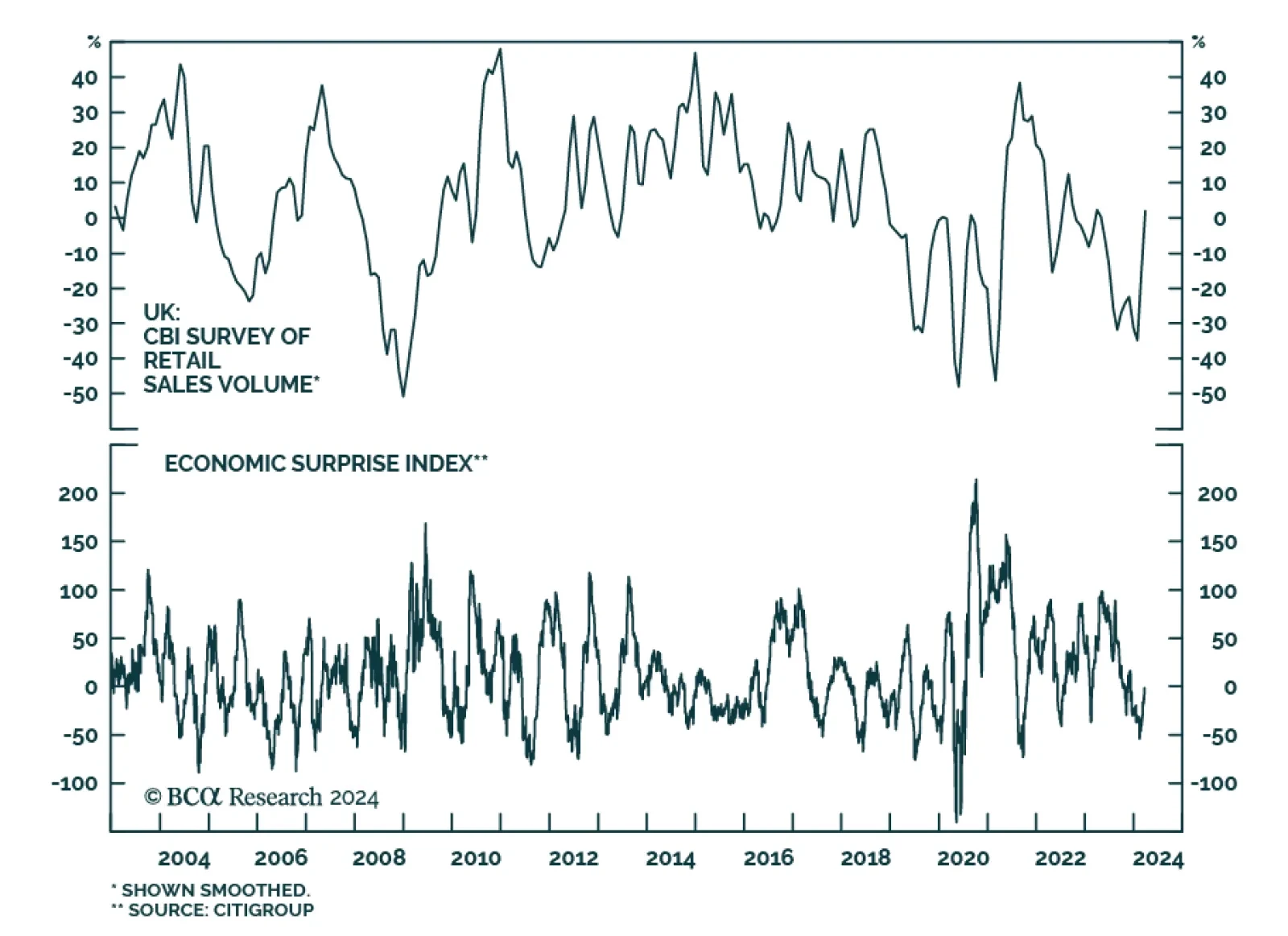

The final UK S&P Global Services and Composite PMIs for March were both revised down slightly from their flash estimates. While the report indicates that activity is still expanding, there has been a clear loss in momentum…

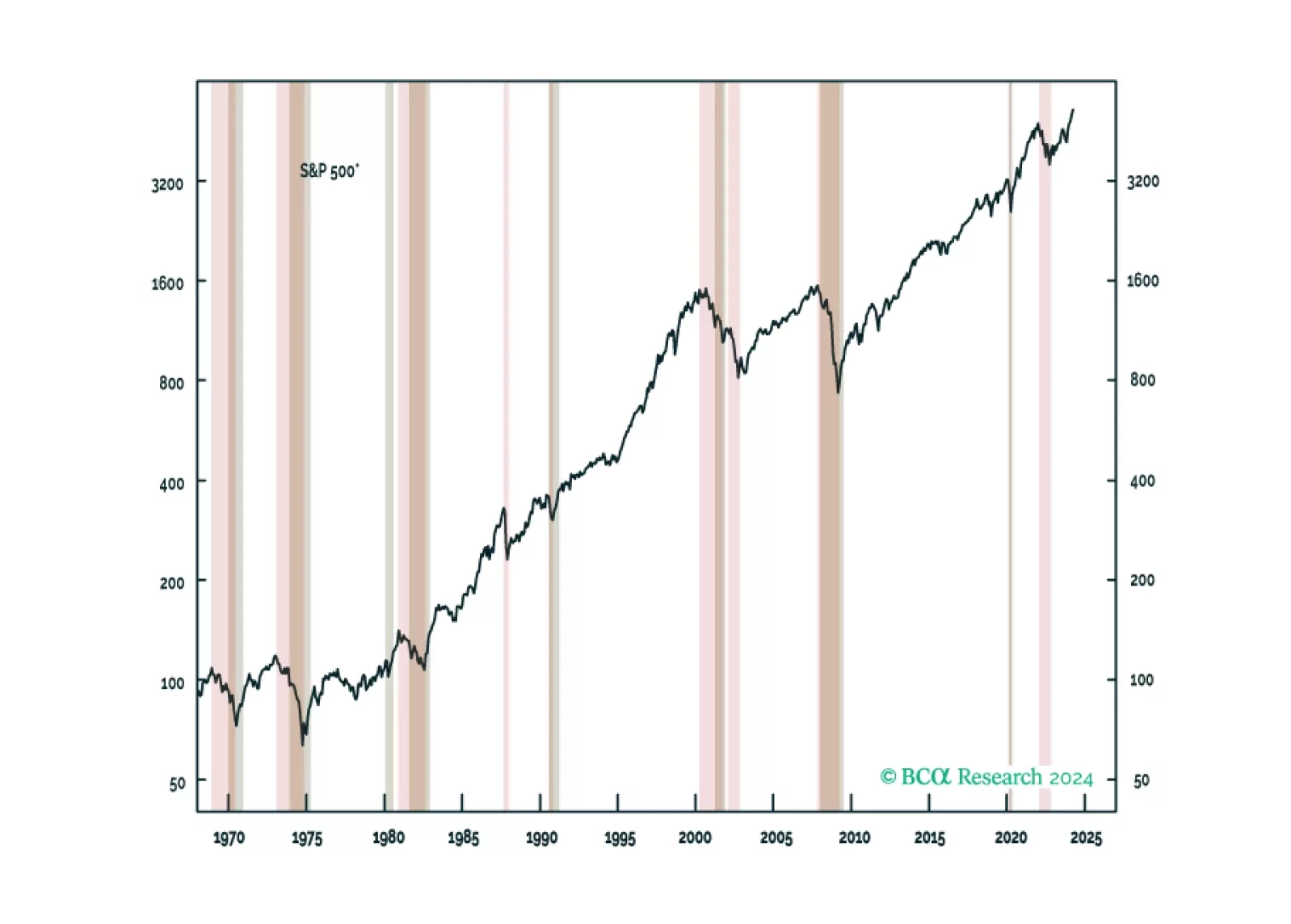

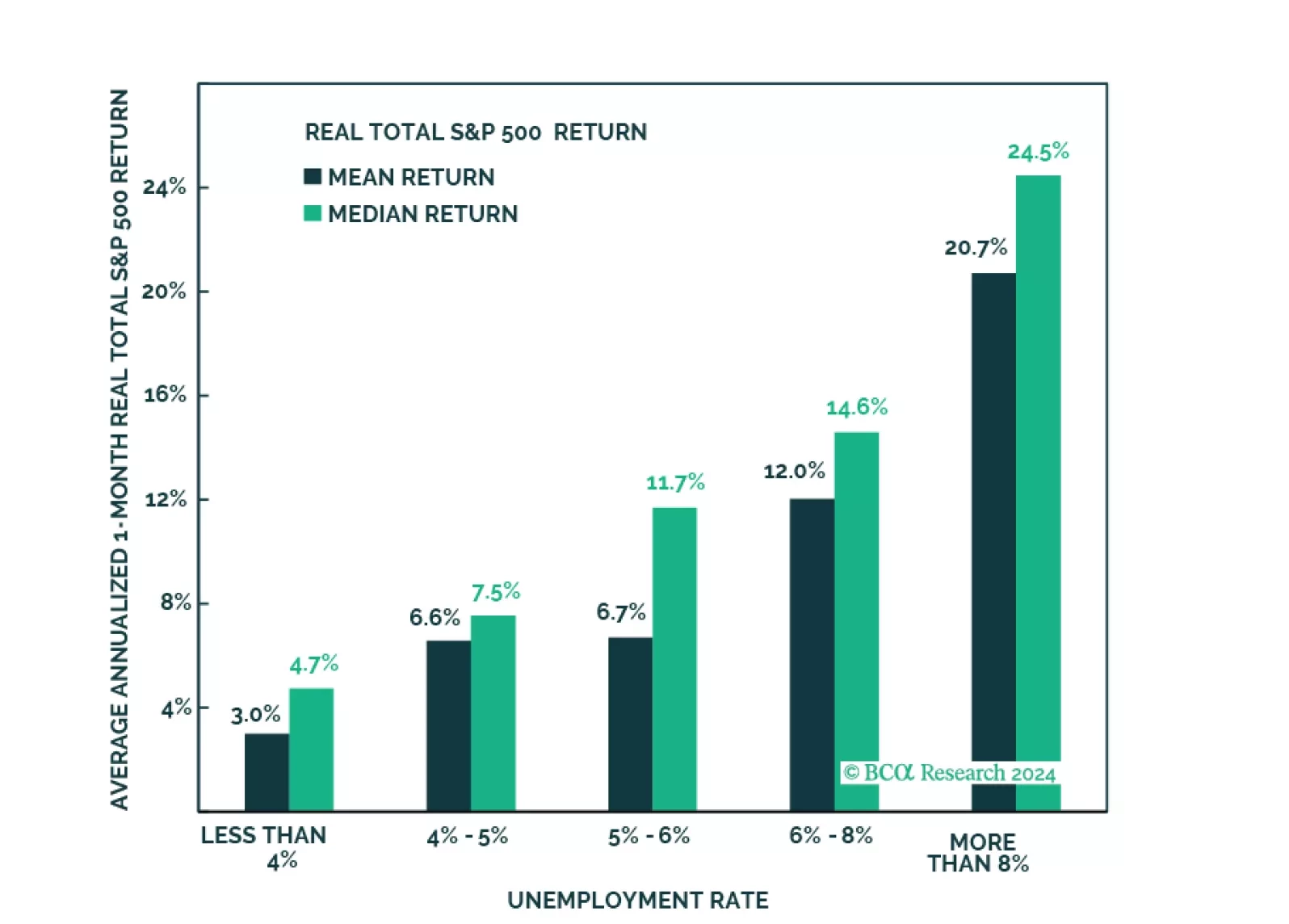

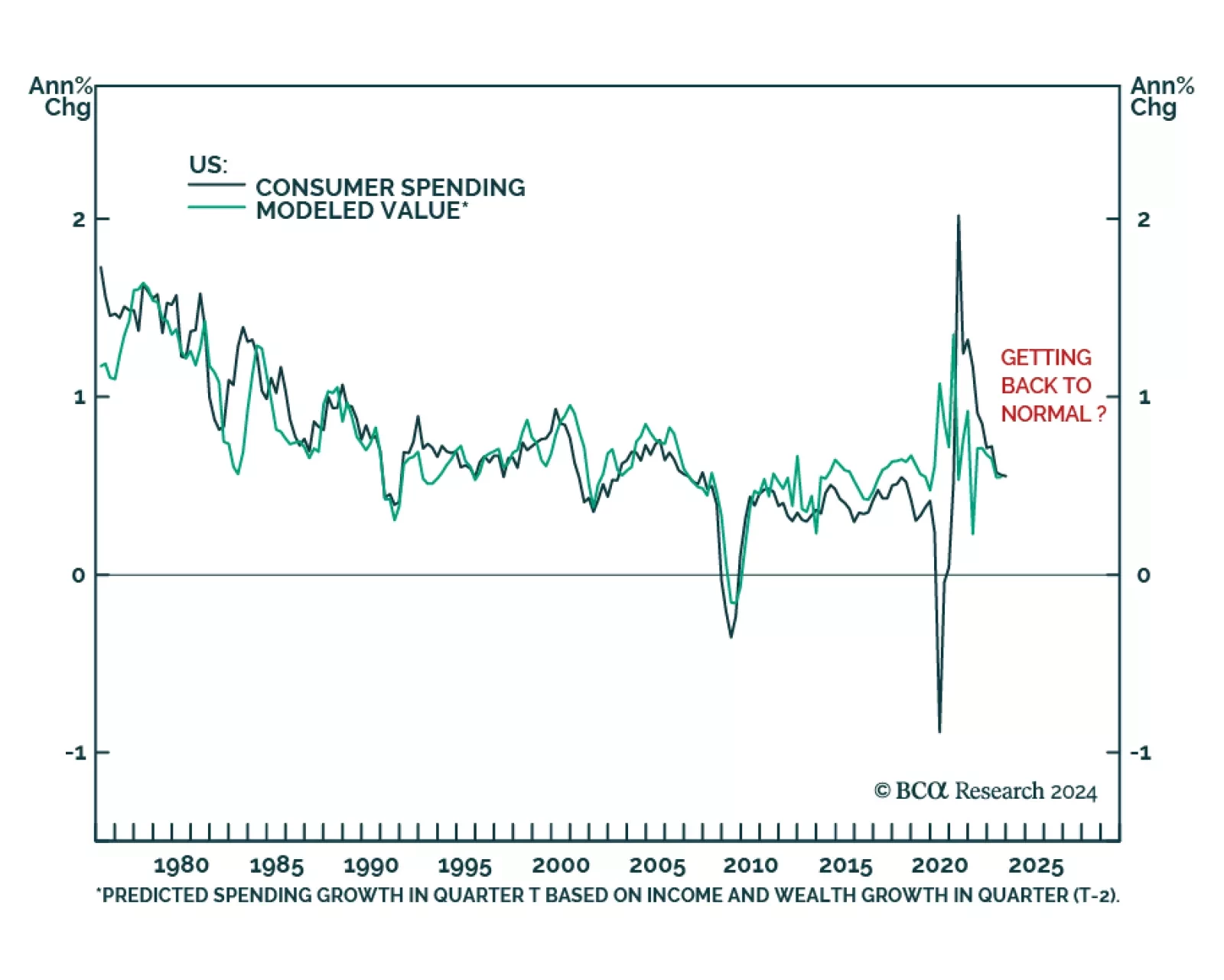

BCA Research’s US Investment Strategy service is watching households, the labor market and consumer credit for signs of a business cycle inflection and the all-clear signal to underweight equities. Equity bear markets…

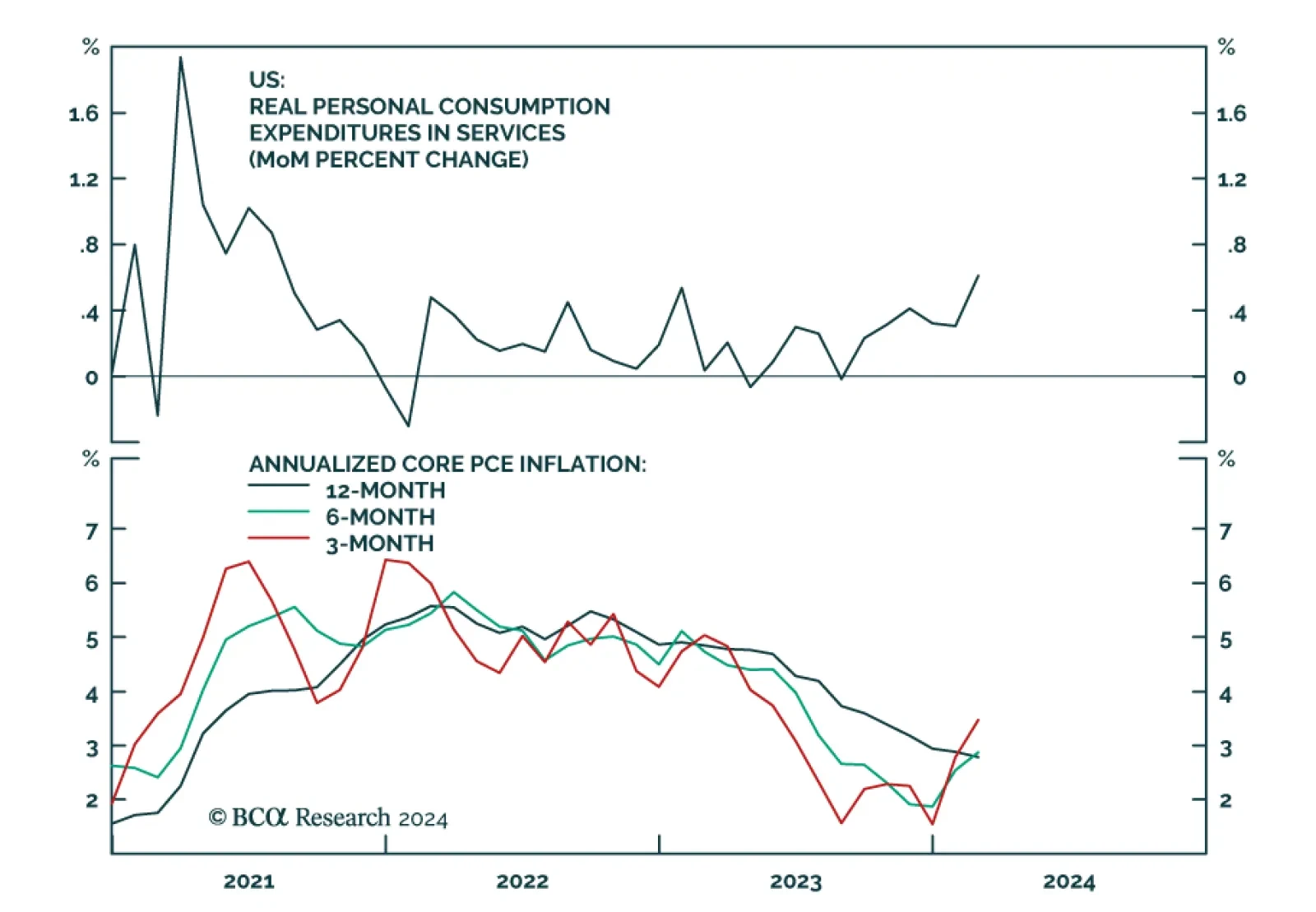

Friday’s PCE report showed a resilient US economy. Real personal consumption increased by 0.4% m/m in February, beating expectations of 0.1% m/m and remaining above its pre-pandemic trend. Both services and goods…

We are not yet ready to downgrade equities on a tactical basis but continue to expect we will eventually do so. We present a checklist of indicators that we are watching to determine when to de-risk.

The Conference Board’s gauge of US consumer confidence came in at 104.7 in March – broadly unchanged from a downwardly revised 104.8 in February and below expectations of an improvement to 107. The Expectations Index…

In this Strategy Outlook we examine why, contrary to popular perception, the odds of a global recession over the next 12 months are rising not falling.

The latest batch of economic data out of the UK suggests that economic conditions have recently stabilized. The flash Manufacturing PMI rose by a stronger-than-anticipated 2.4 points to a 20-month high of 49.9 in March –…

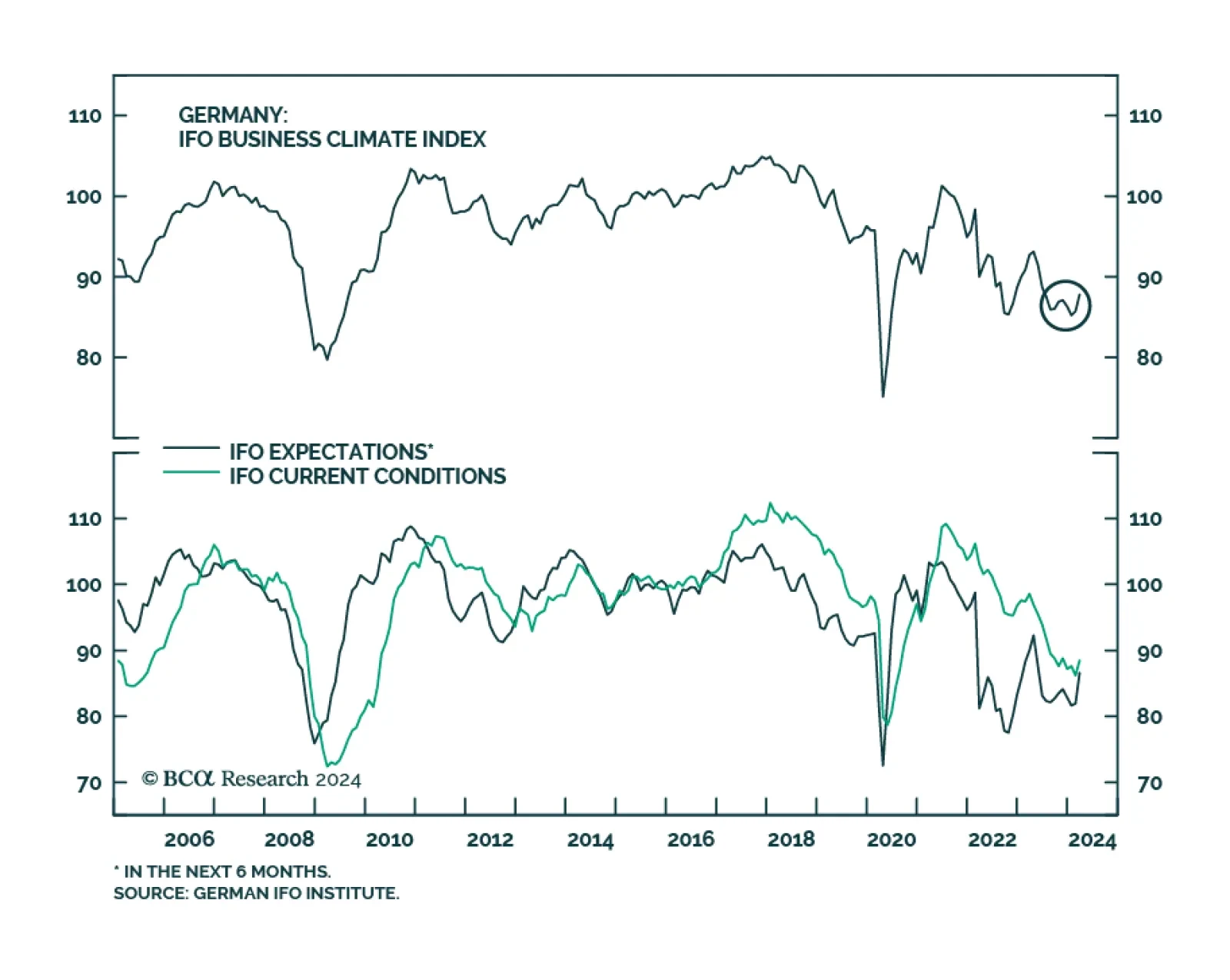

The 2.1-point increase in Germany’s Ifo Business Climate index in March brought it to a 9-month high of 87.8 and beat expectations of a more muted rise to 86.0. Both current economic conditions (+1.2 to 88.1) as well as…