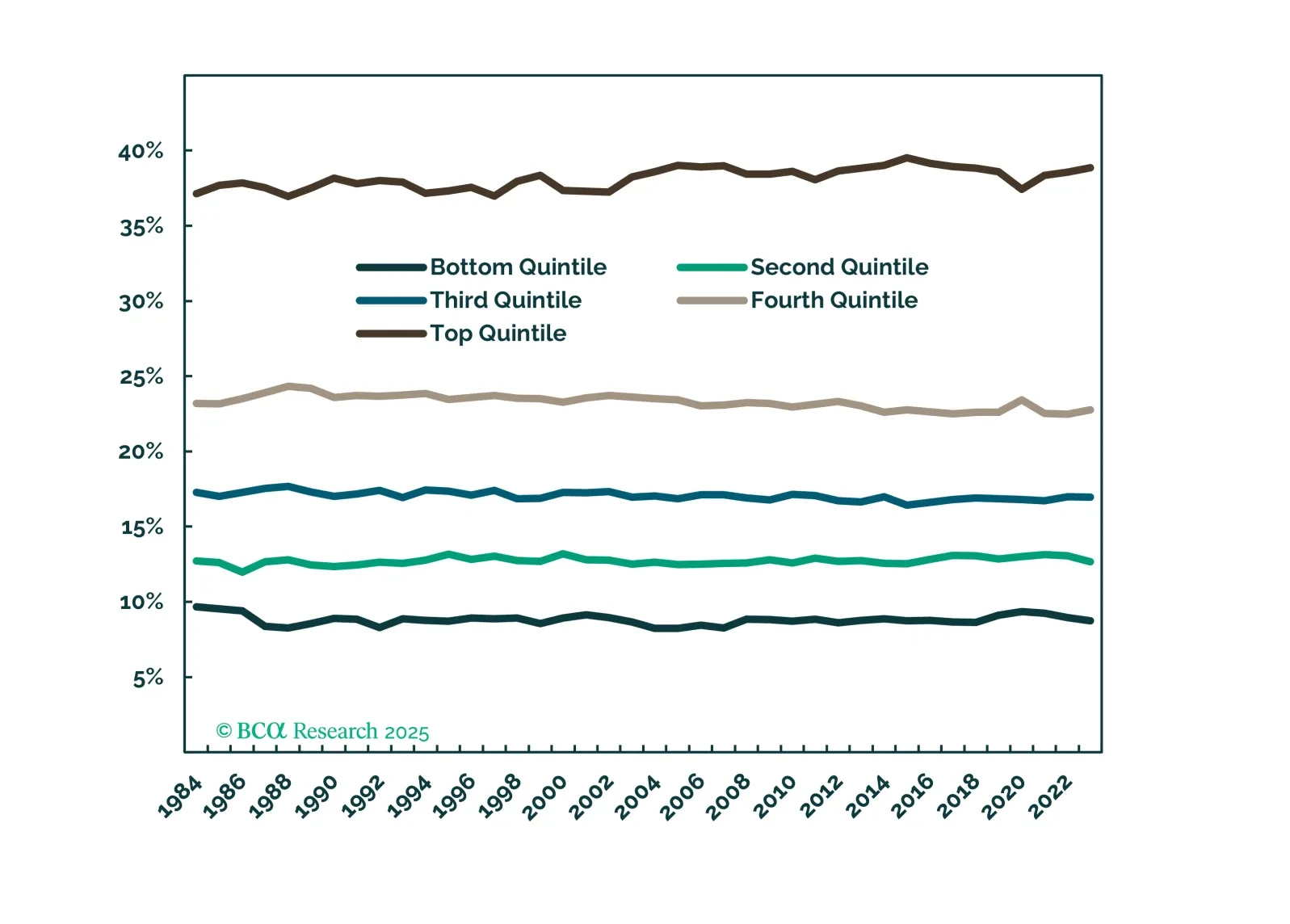

The K-shaped economy aptly describes the bifurcation between low- and high-end households but it’s not something investors should celebrate if they want the expansion to continue.

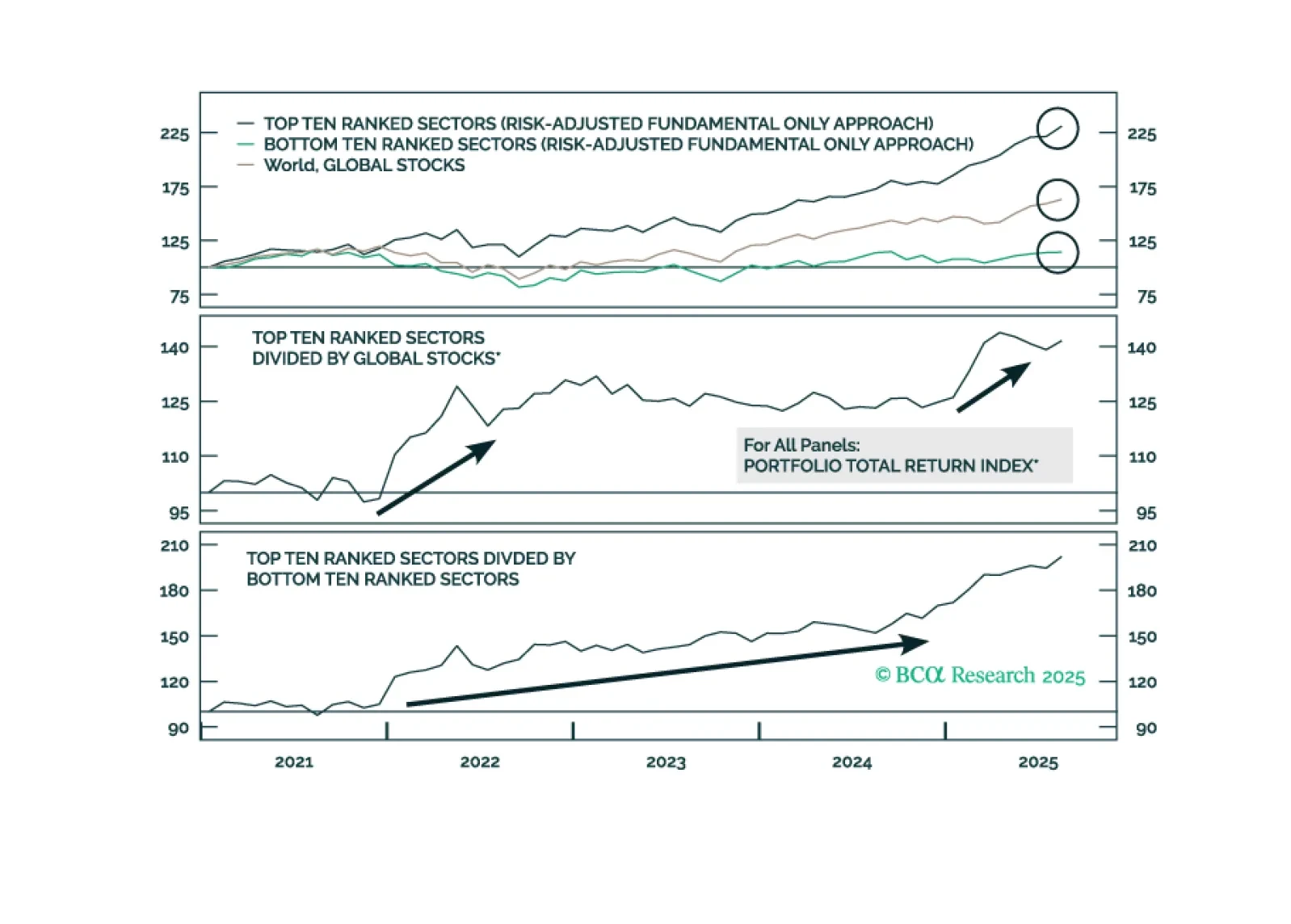

Our Portfolio Allocation Summary for October 2025.

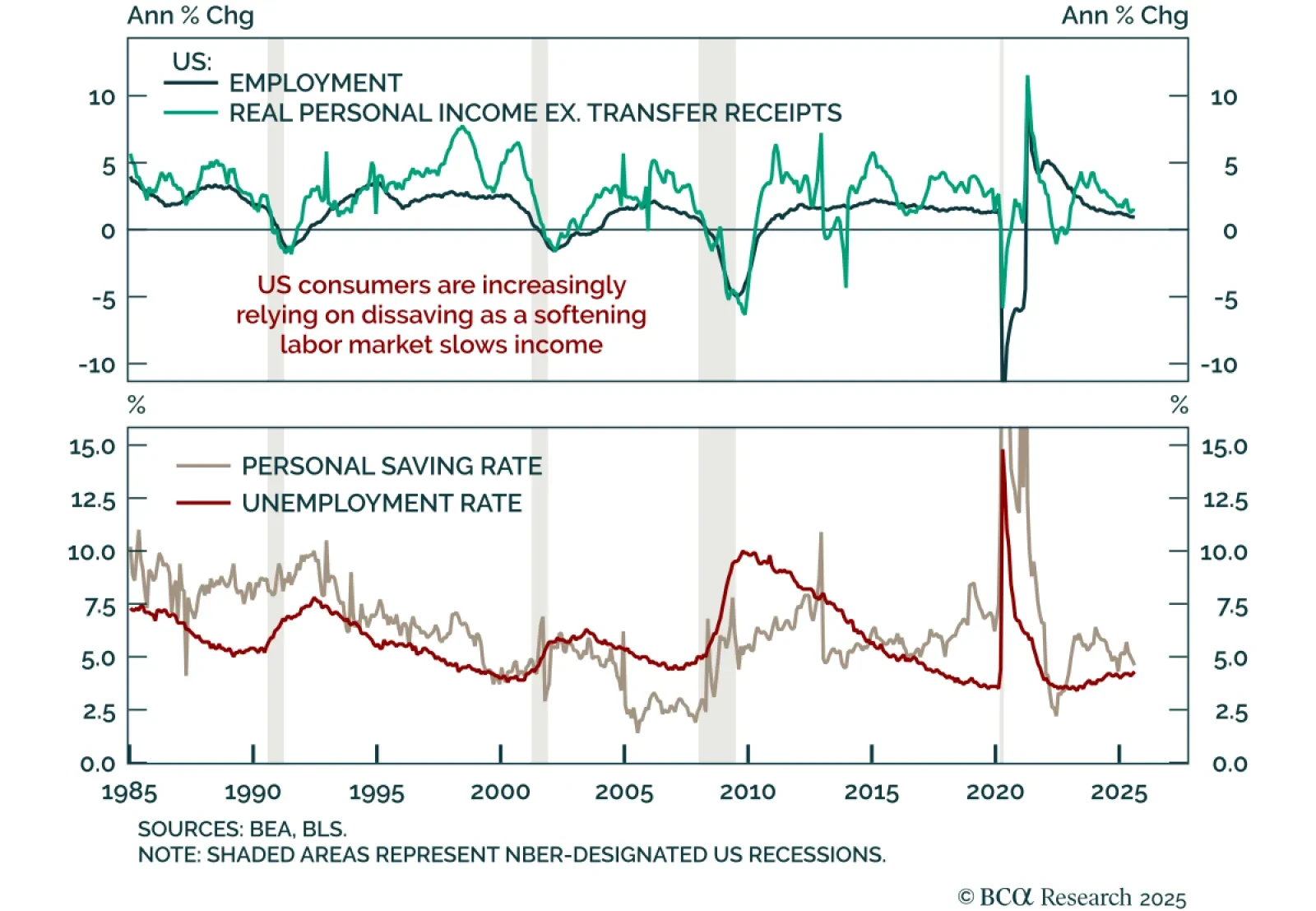

September consumption and income data beat estimates, showing a resilient US consumer but leaving the outlook fragile. Personal spending rose 0.6% m/m, outpacing income at 0.4%, pushing the saving rate down to 4.6%, its lowest level…

In Section I, Doug highlights that benchmark positioning in equities, fixed income and cash is now recommended. Still, the US macro situation warrants continual monitoring, given weakening labor market momentum. In Section II,…

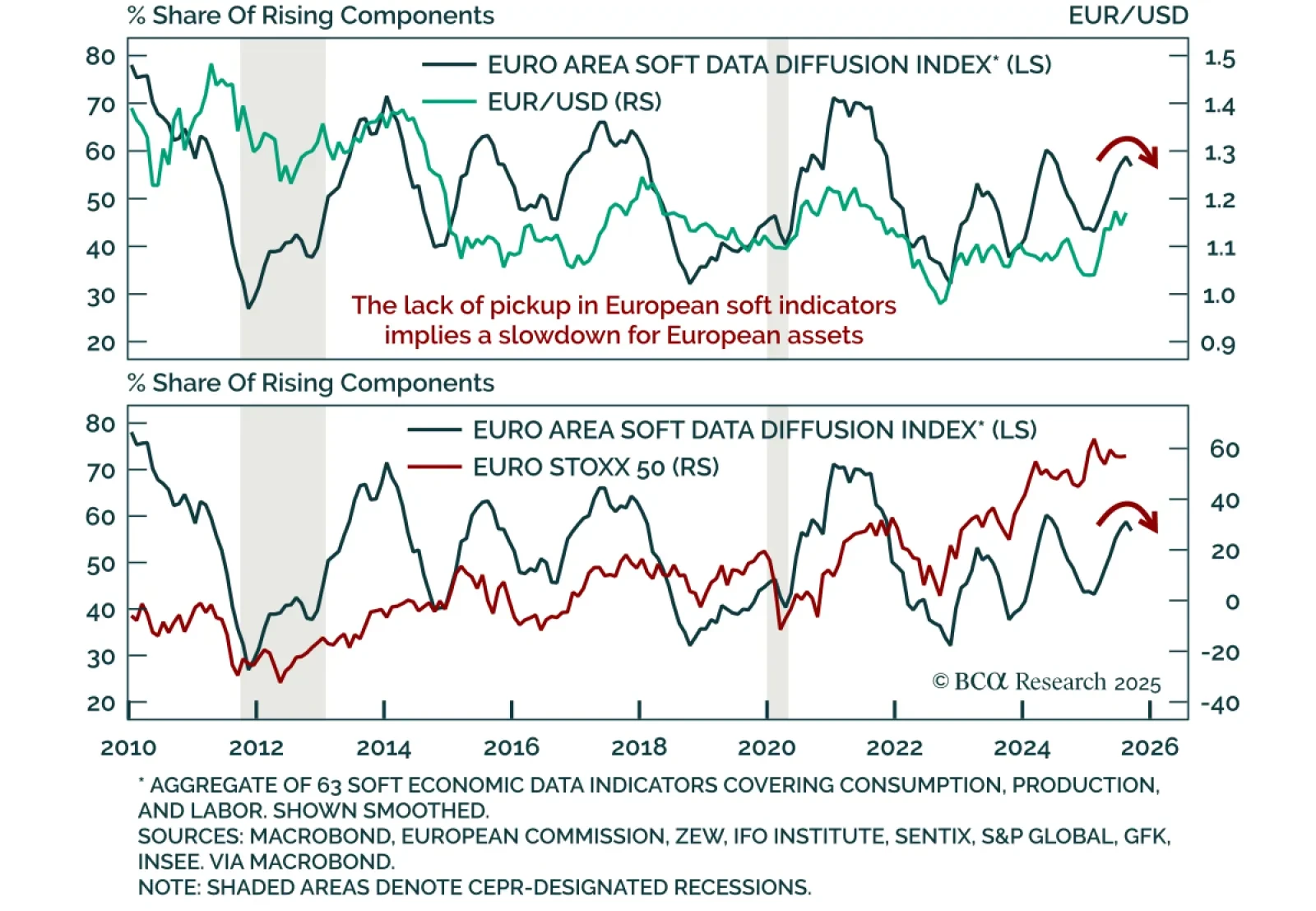

European sentiment indicators weakened again in August and September, reinforcing tactical US outperformance. While the September flash consumer confidence print beat expectations, it is still sluggish. Surveys such as Sentix and ZEW…

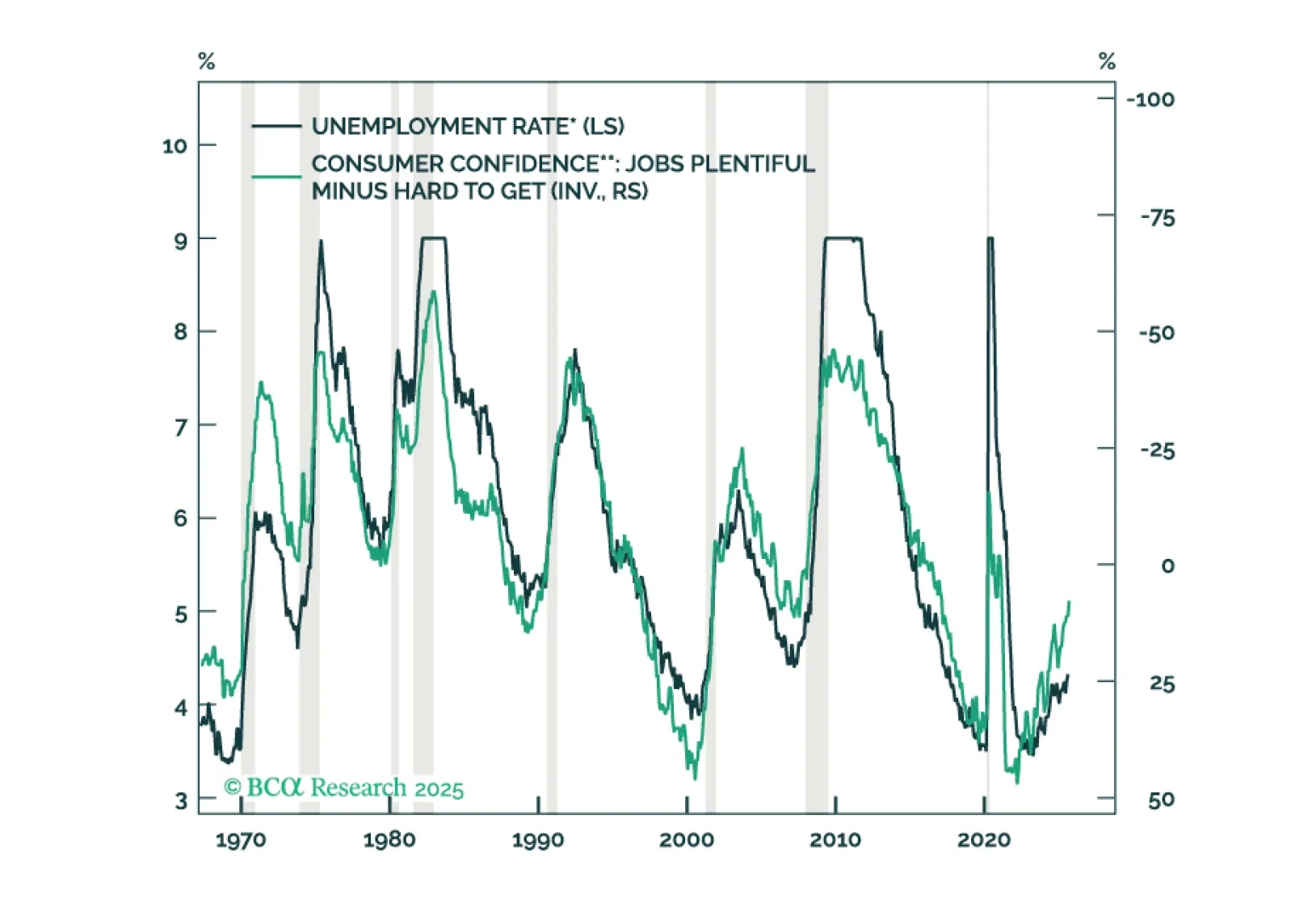

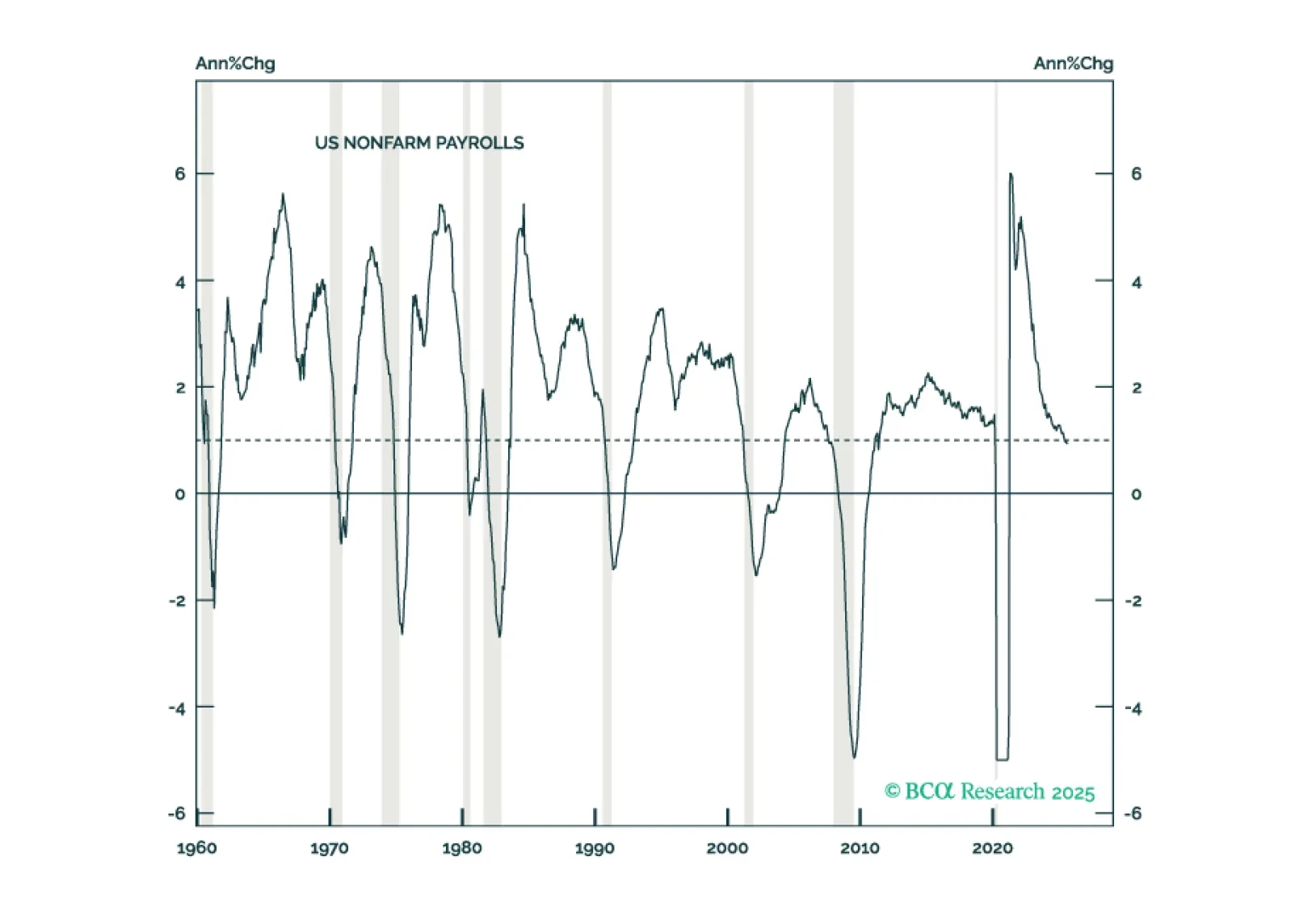

While it is not yet time to bet against risk assets, we push back on the increasingly popular ideas that the wealthiest households and/or AI-related capex can keep the expansion going despite the wobbling labor market.

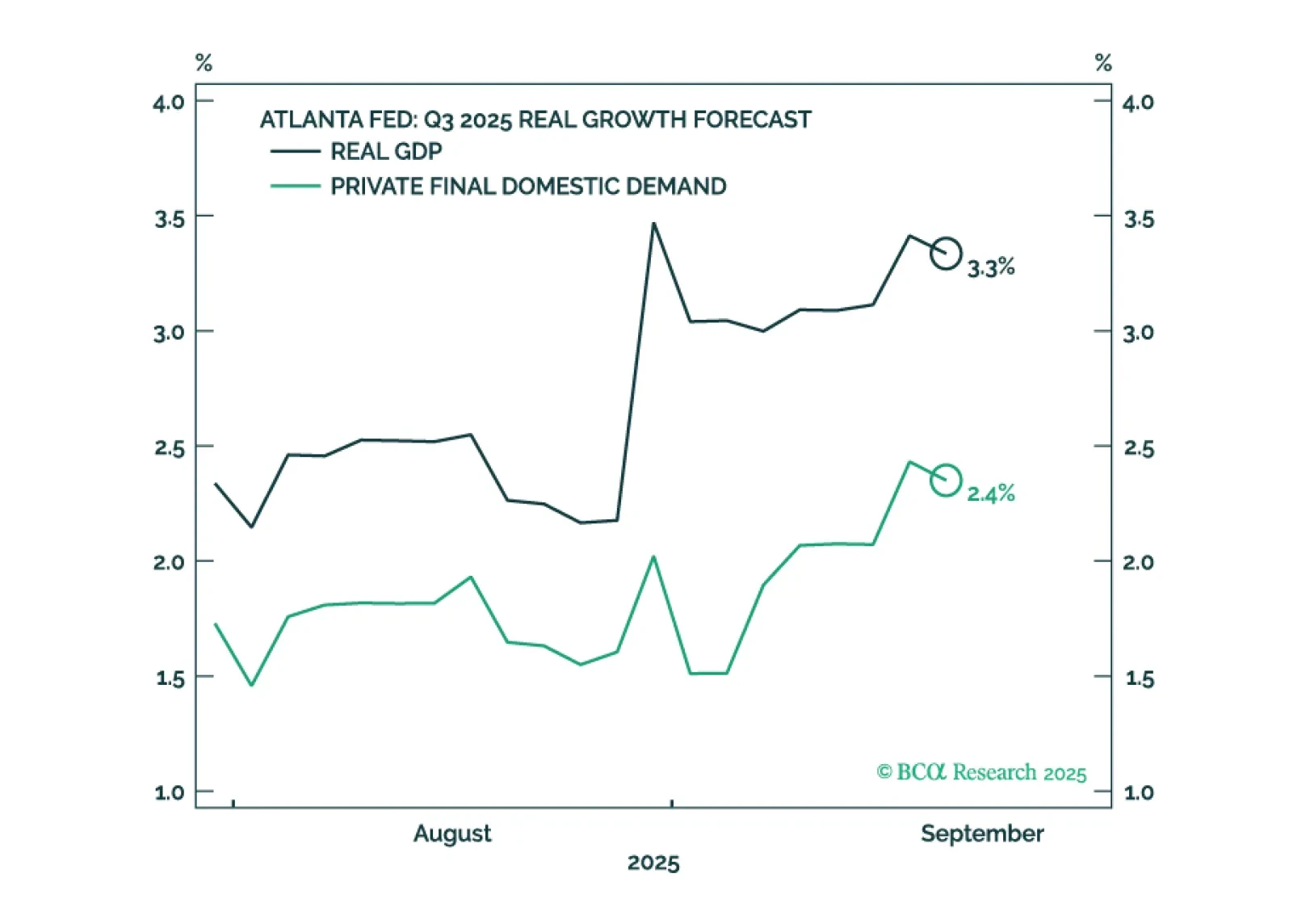

US GDP growth appears to have accelerated even as employment growth has faltered. We will make a final decision in early October when we publish our next Strategy Outlook, but most likely, we will cut our 12-month US recession…

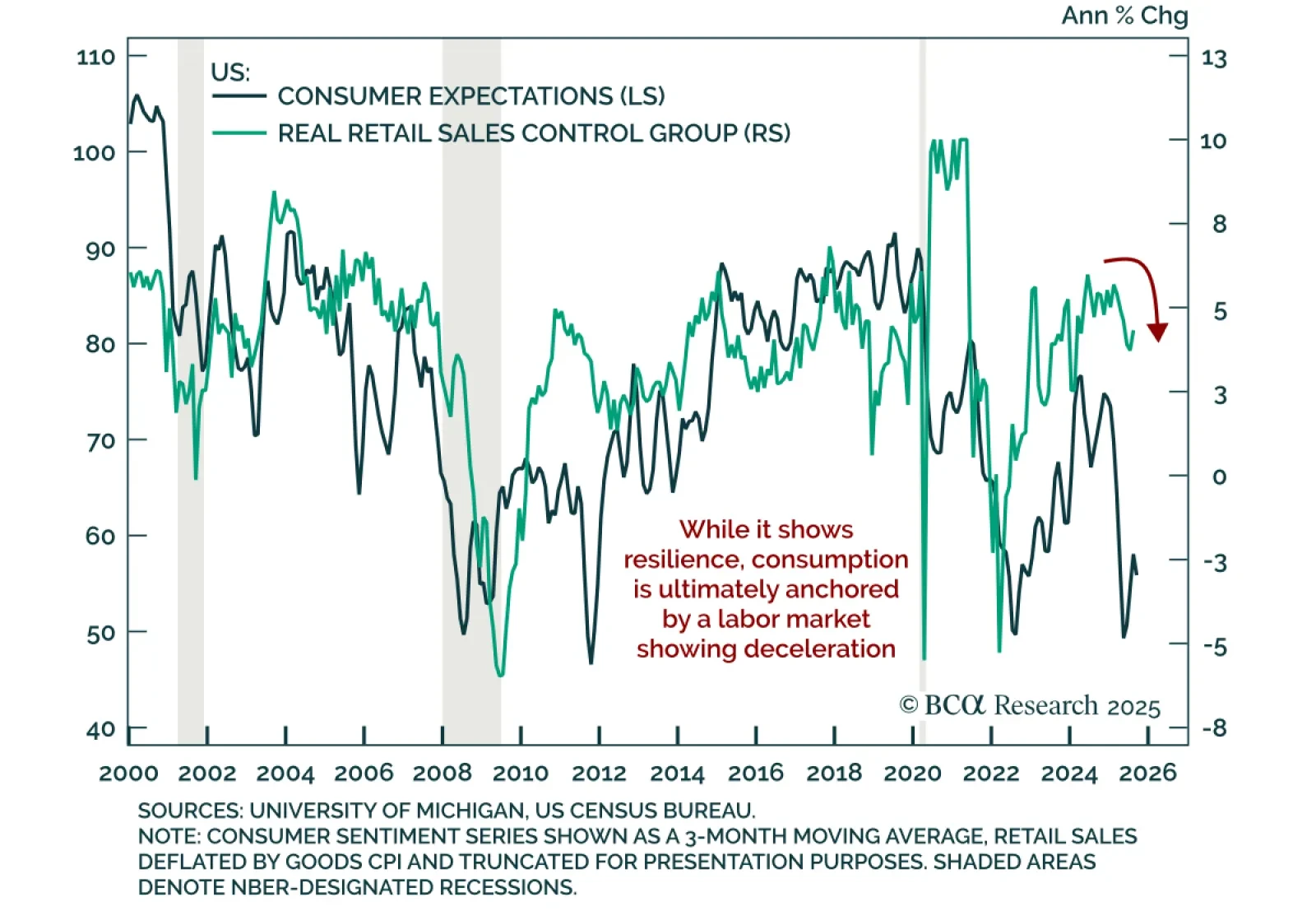

August retail sales beat expectations, but resilience in consumption does not alter a defensive stance as labor momentum weakens. Headline sales rose 0.6% m/m, unchanged from July, while core ex-autos and gas accelerated to 0.7% from…

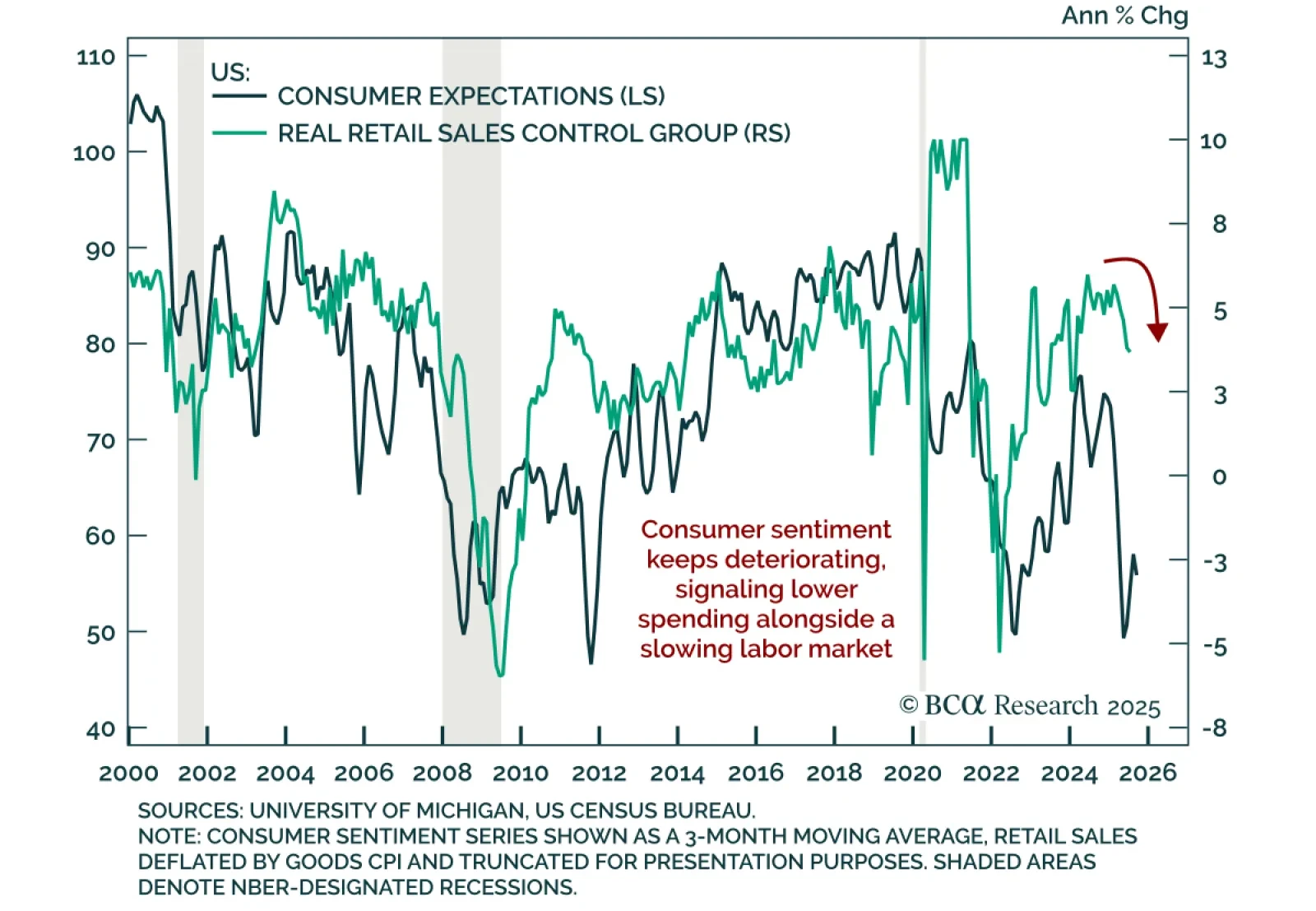

US consumer sentiment deteriorated in September, reinforcing signs of slowing consumption and supporting a defensive stance. The preliminary University of Michigan Consumer Sentiment Index dropped more than expected to 55.4 from 58.2…