Consumer

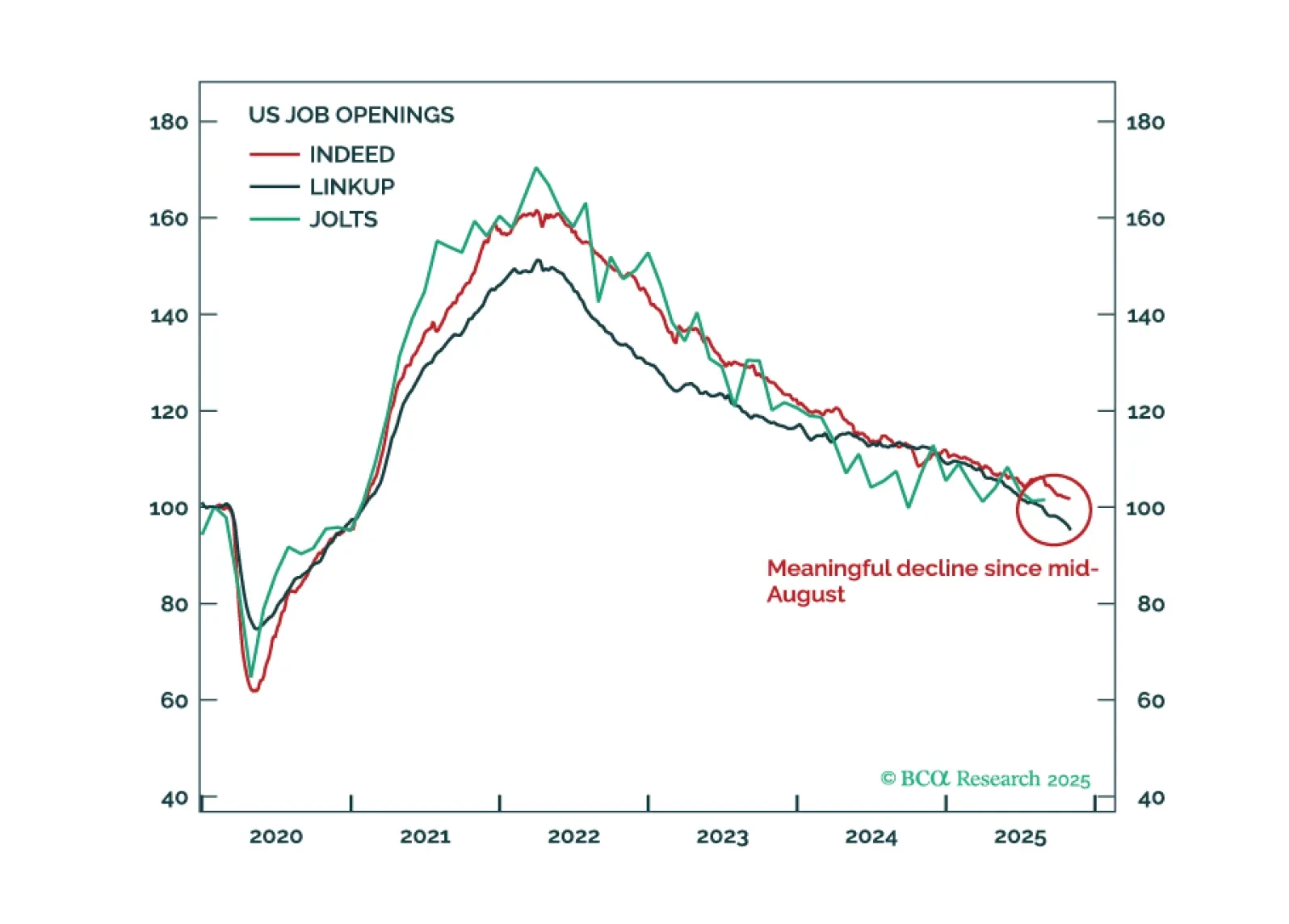

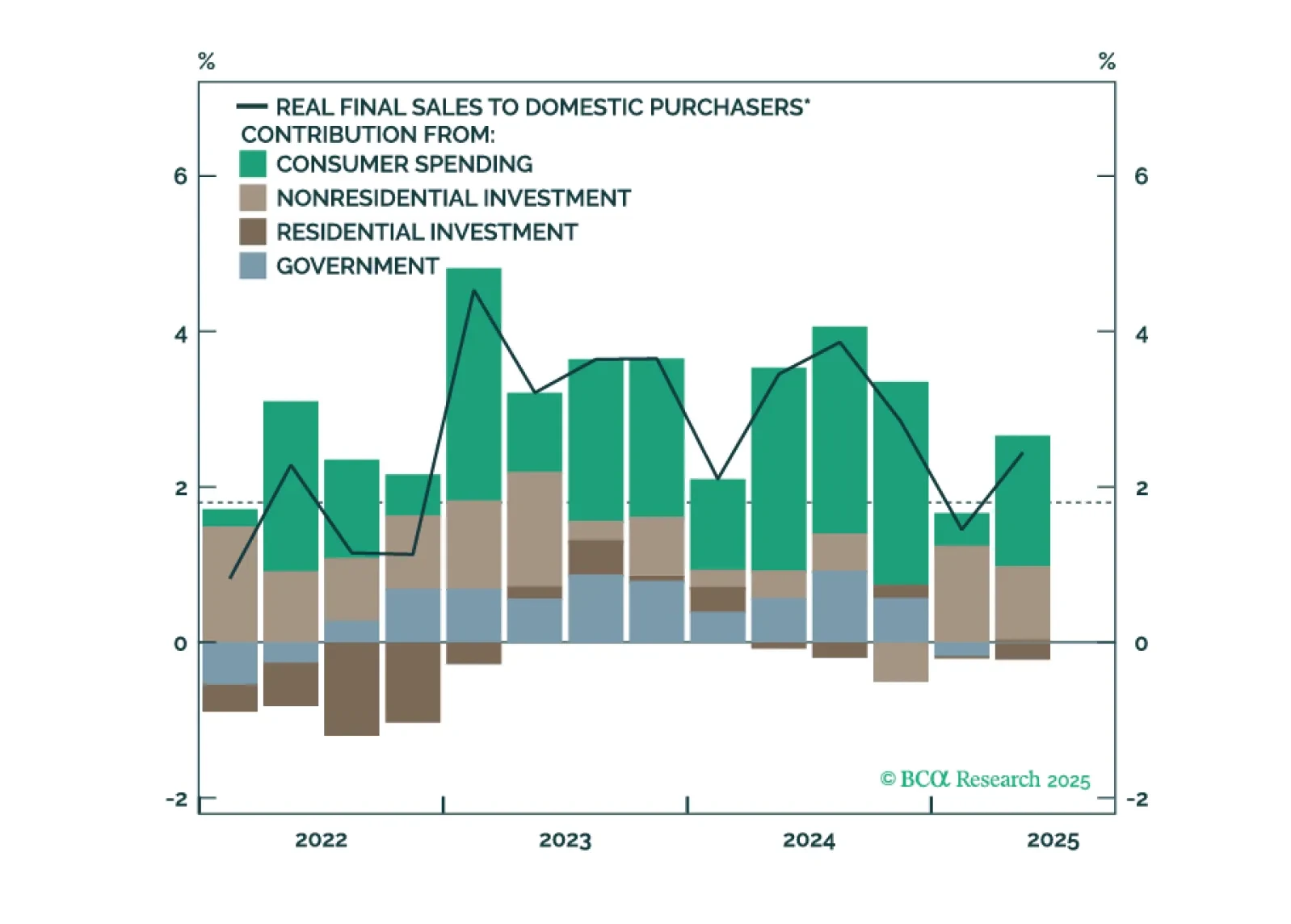

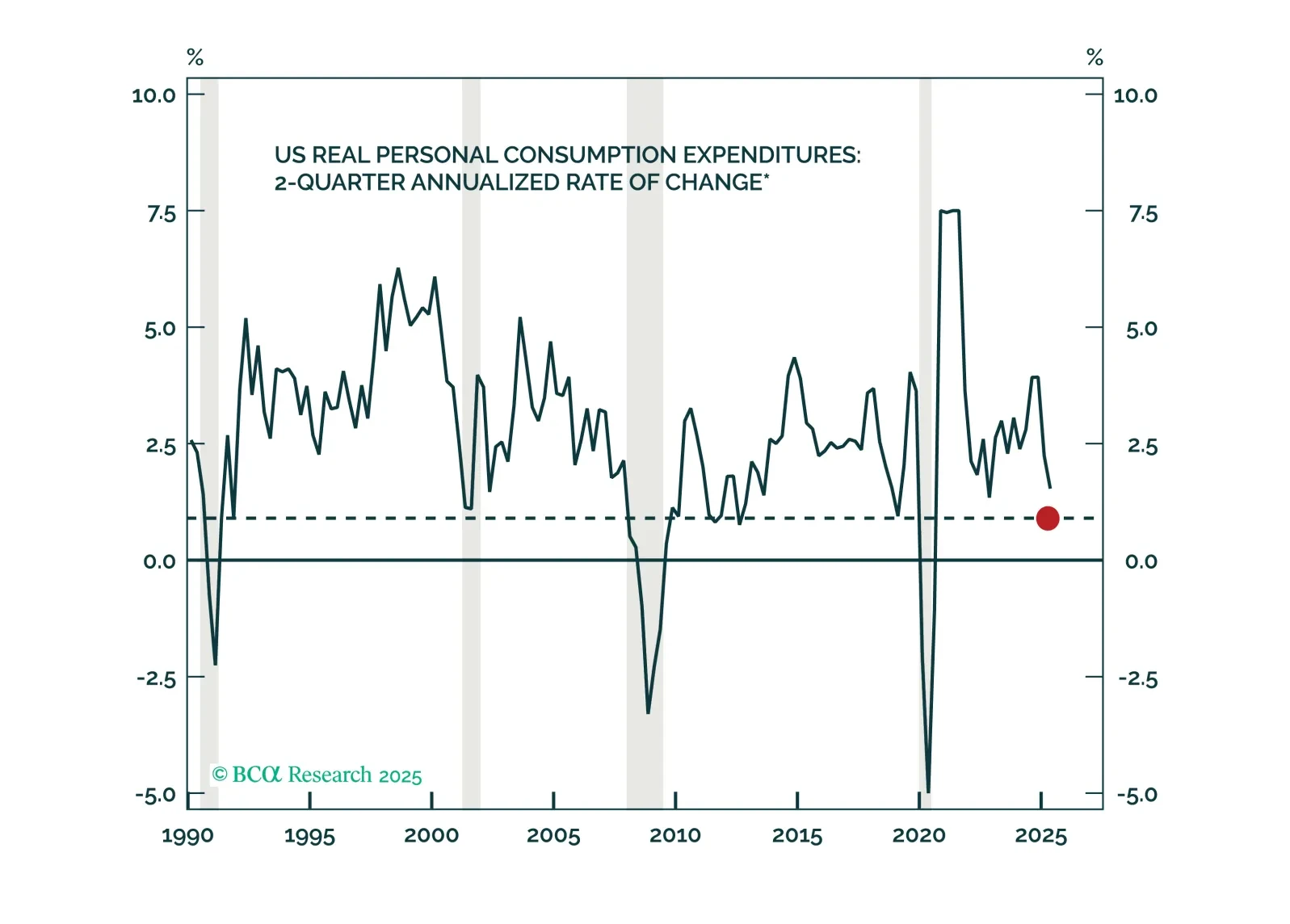

In the absence of official government data, investors are turning to alternative sources to gauge the direction of the US economy. Our analysis of this data suggests that the economy has continued to expand at a moderate pace over the past two months. If the Supreme Court were to strike down the tariffs, this would reduce the near-term odds of a recession while raising the odds of overheating.

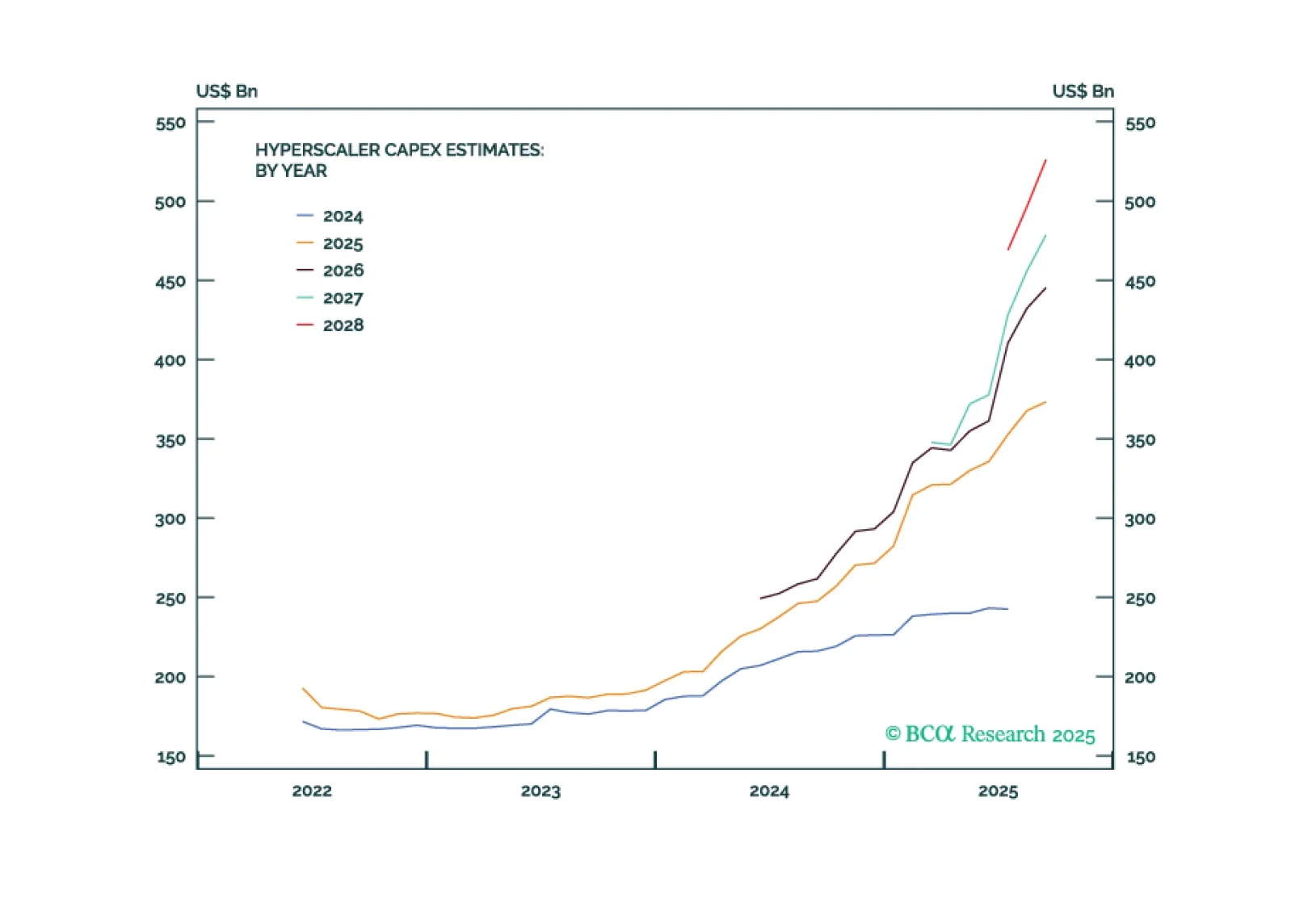

In Section II, Doug and Global Investment Strategy’s Miroslav Aradski consider the implications of the AI investment boom.

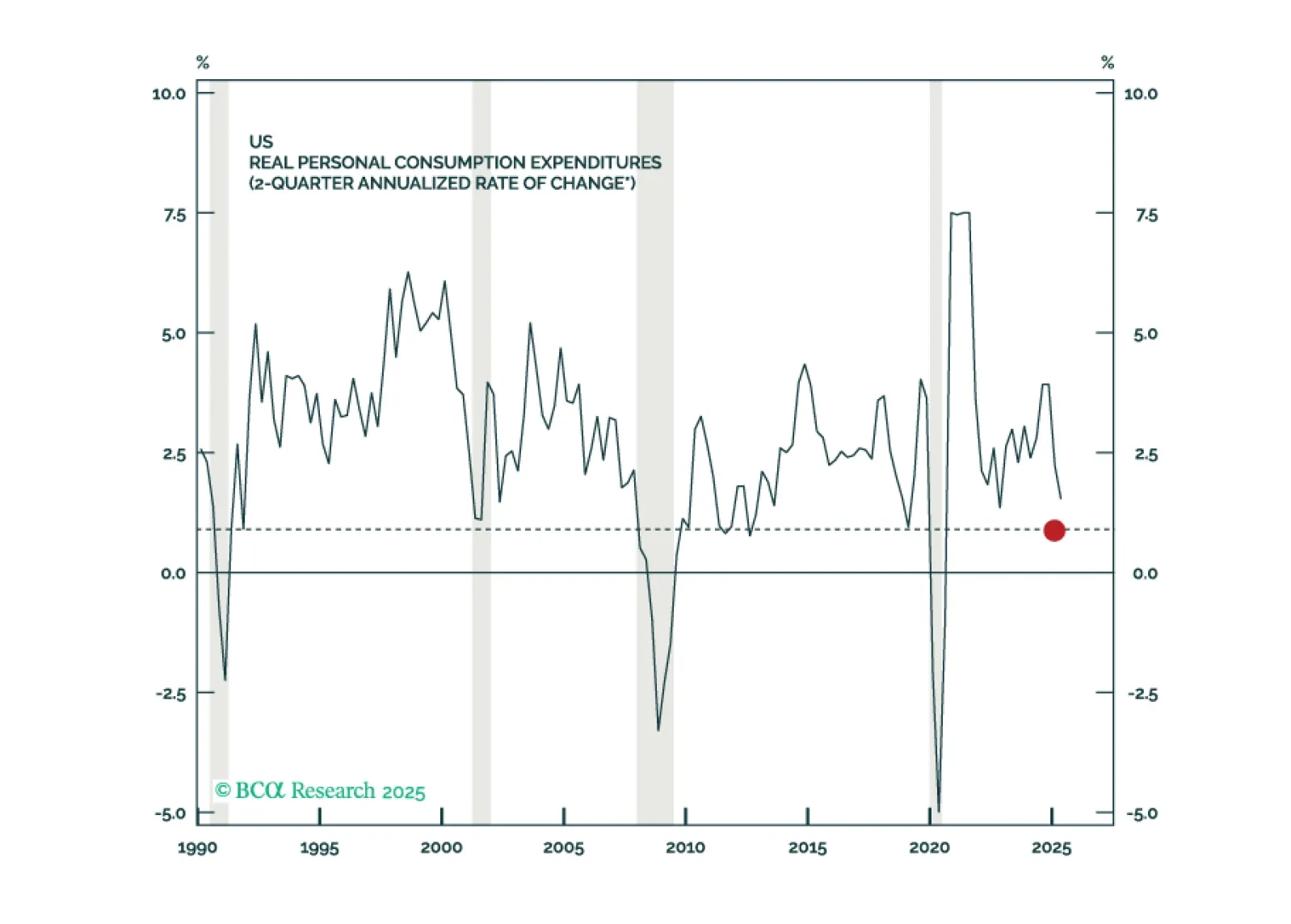

In Section I, Doug explains how the sharp upward revision to second-quarter consumption in the final GDP estimate has reduced our recession conviction and could lead us to abandon our recession call altogether. The situation is fluid, though, as typified by the striking weakness of stocks in consumer-facing and cyclically exposed subindustries. In Section II, Doug and Global Investment Strategy’s Miroslav Aradski consider the implications of the AI investment boom.

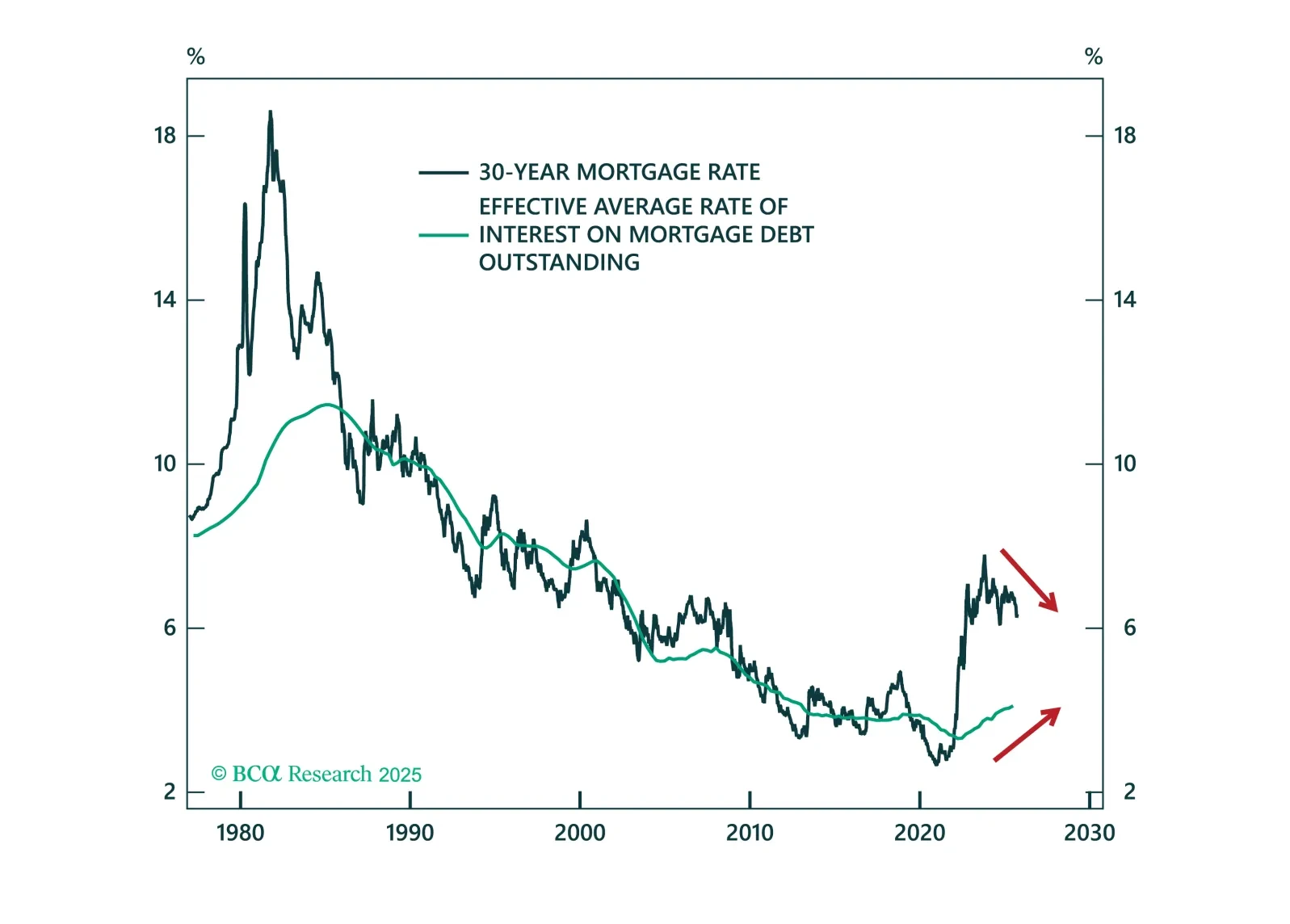

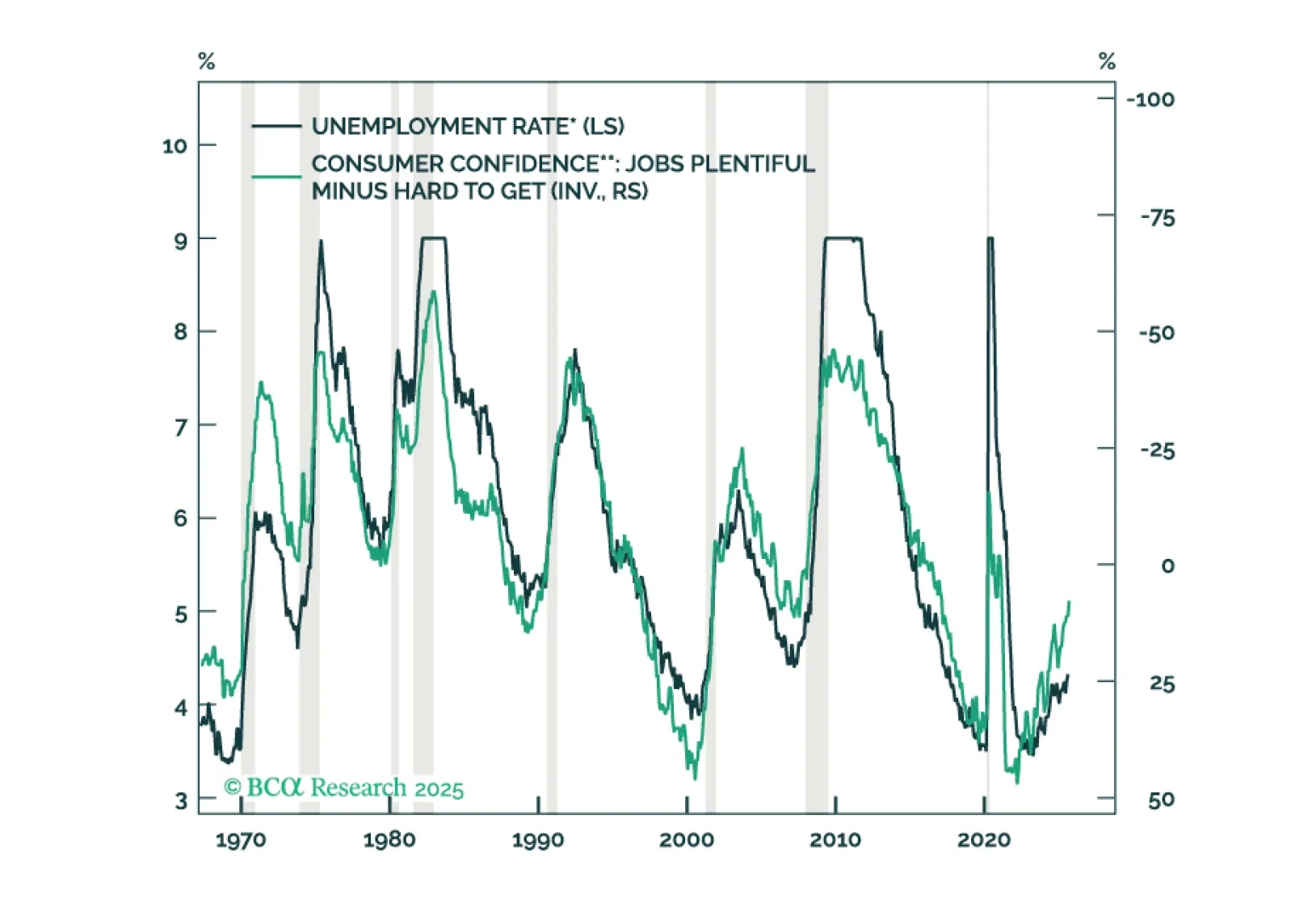

The Fed is poised to deliver a 25-basis-point rate cut this month, but a follow-up rate cut in December will depend on how the divergence between strong consumer spending and weak employment growth is resolved.

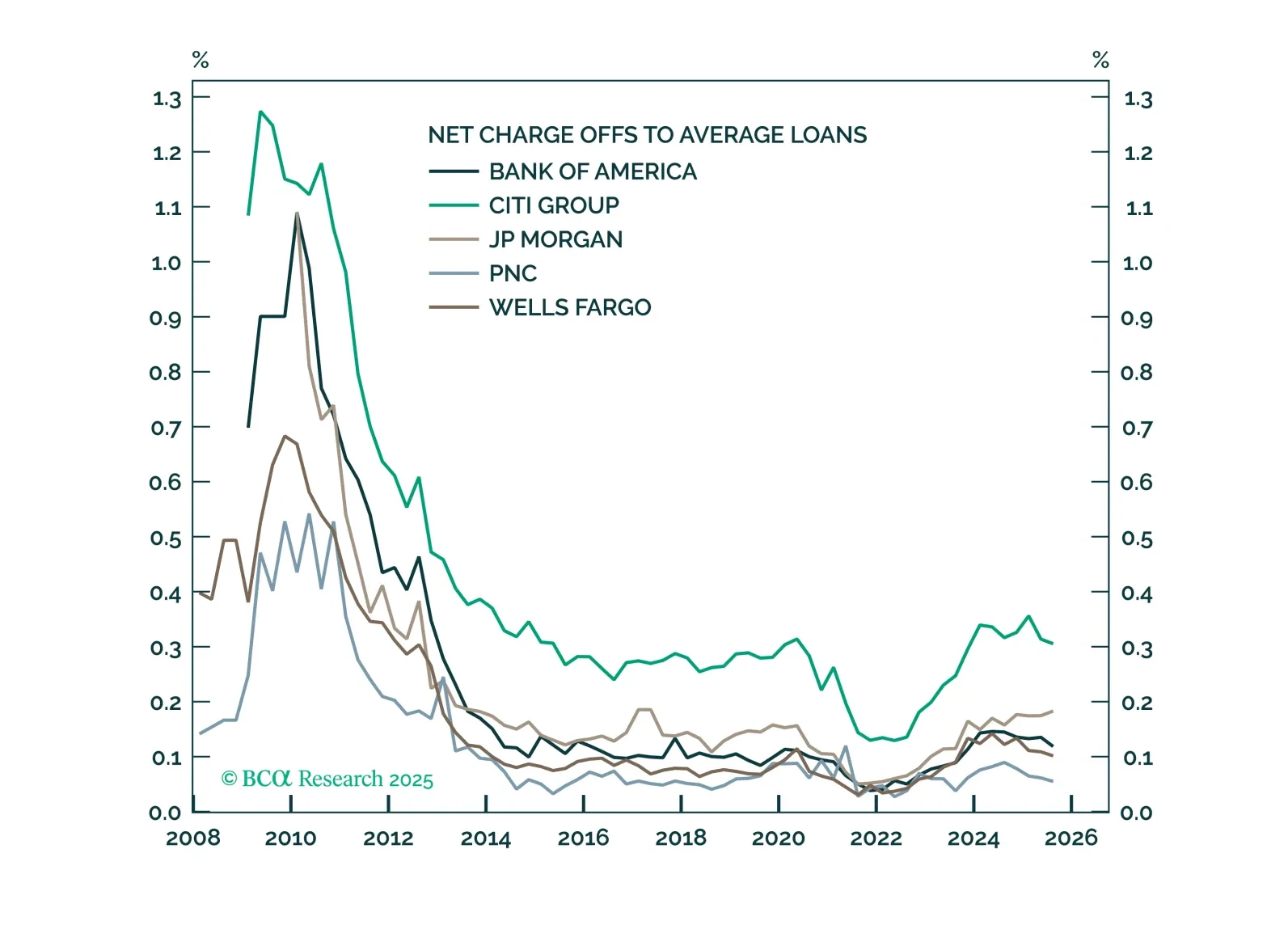

Strong results and constructive commentary from the US’s largest banks are encouraging: Consumers remain in solid shape, and the macro backdrop continues to favor equities. The outlook for the largest banks is positive, and they are unlikely to be affected by isolated credit events.

The most significant divide in the stock market and the economy is the gap between companies positioned to benefit from the AI boom and companies without a link to it. The former are surging while many of the latter are struggling.

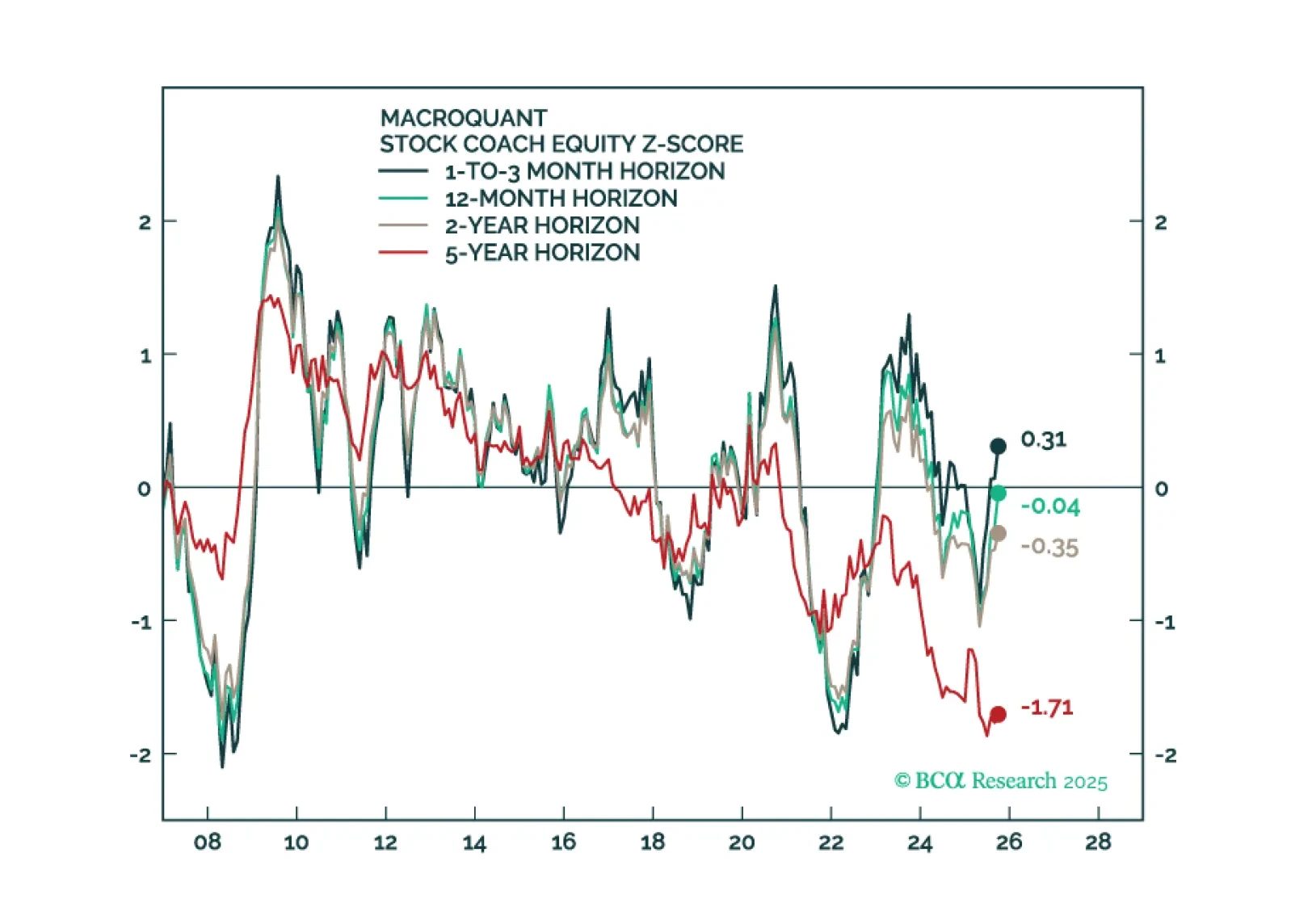

In this Q4 Strategy Outlook, we discuss where we stand on our recession call, the outlook for stocks and bonds in various scenarios, why investors are misunderstanding the impact of AI on corporate profits, whether the US dollar has entered a structural downtrend, our perspective on the yen, gold and other commodities, and much more.

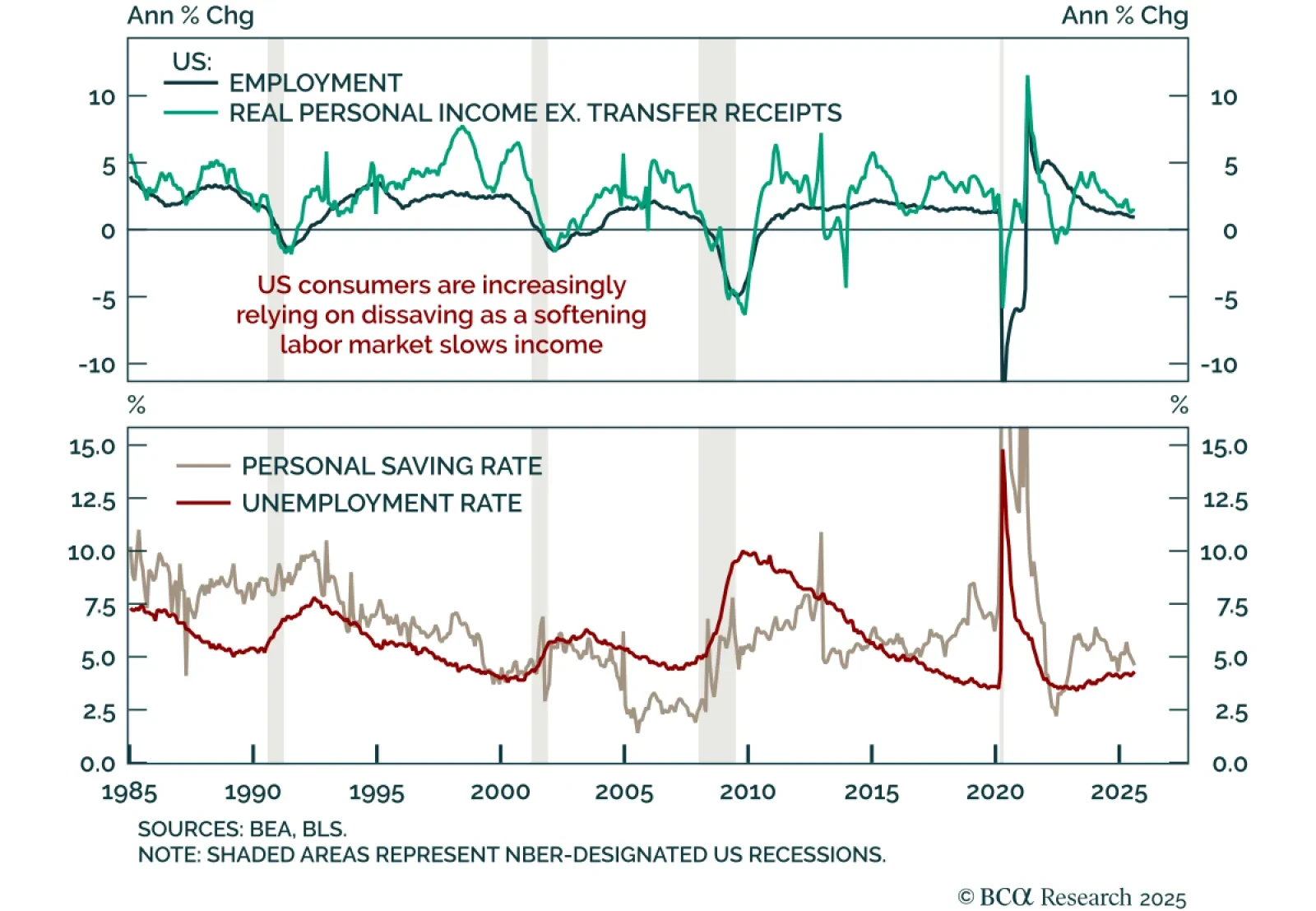

The K-shaped economy aptly describes the bifurcation between low- and high-end households but it’s not something investors should celebrate if they want the expansion to continue.

Our Portfolio Allocation Summary for October 2025.