Investors are still cautious and have significant cash that needs to be put to work. Trickle-down of it into the US equity market may extend the rally. Overly bearish futures positioning is also a strong contrarian indicator.…

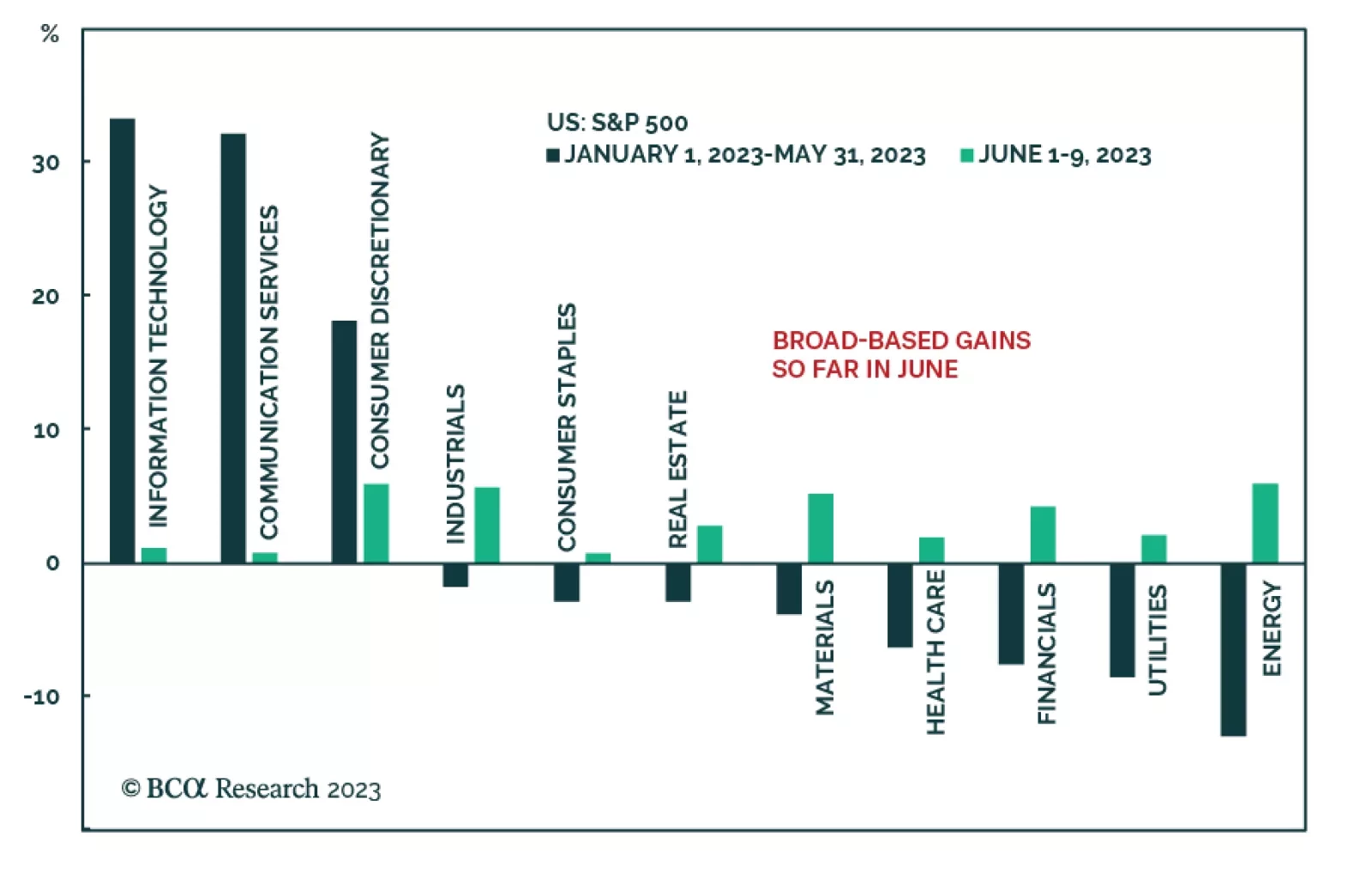

As we’ve highlighted in recent Insights, the S&P 500’s year-to-date rally has been concentrated among a few mega cap stocks. In particular, companies that benefit from the AI craze have driven the gains. This…

Indian EPS growth is set for major disappointments vis-à-vis the lofty expectations. Weak domestic demand amid tight fiscal and monetary policy entails more downside in stock prices. Stay underweight.

We Introduce our new macro models for the Eurozone’s equity earnings, which include sectoral forecasts. Find out what they predict for the next six-to-nine months.

The equity market is back to the 2019 level on an inflation-adjusted basis. However, it is still not cheap as it is not pricing in the possibility of a prolonged and deep earnings recession or a higher interest rates regime. Many…

The US equity market is in the midst of an earnings contraction driven by slowing sales growth – a manifestation of the weakening economic demand and loss of corporate pricing power that accompany disinflation. The telecommunications…

Executive Summary If a loss of wealth persists for a year or more, it hurts the economy. The recent $40 trillion slump in global financial wealth is larger than that suffered in the pandemic of 2020, the global financial crisis of…

Executive Summary Analysts Have Little Confidence In Their Forecasts In the front section of the sector chart pack, we conduct cross-sectional comparisons. Profitability: Earnings expectations for the cyclical sectors are…

Chart 1 The S&P Media & Entertainment (M&E) index remains under fire due to its exposure to high beta names like GOOG(L), NFLX, FB, and DIS. These four companies dominate the industry group, comprising nearly 80% of…