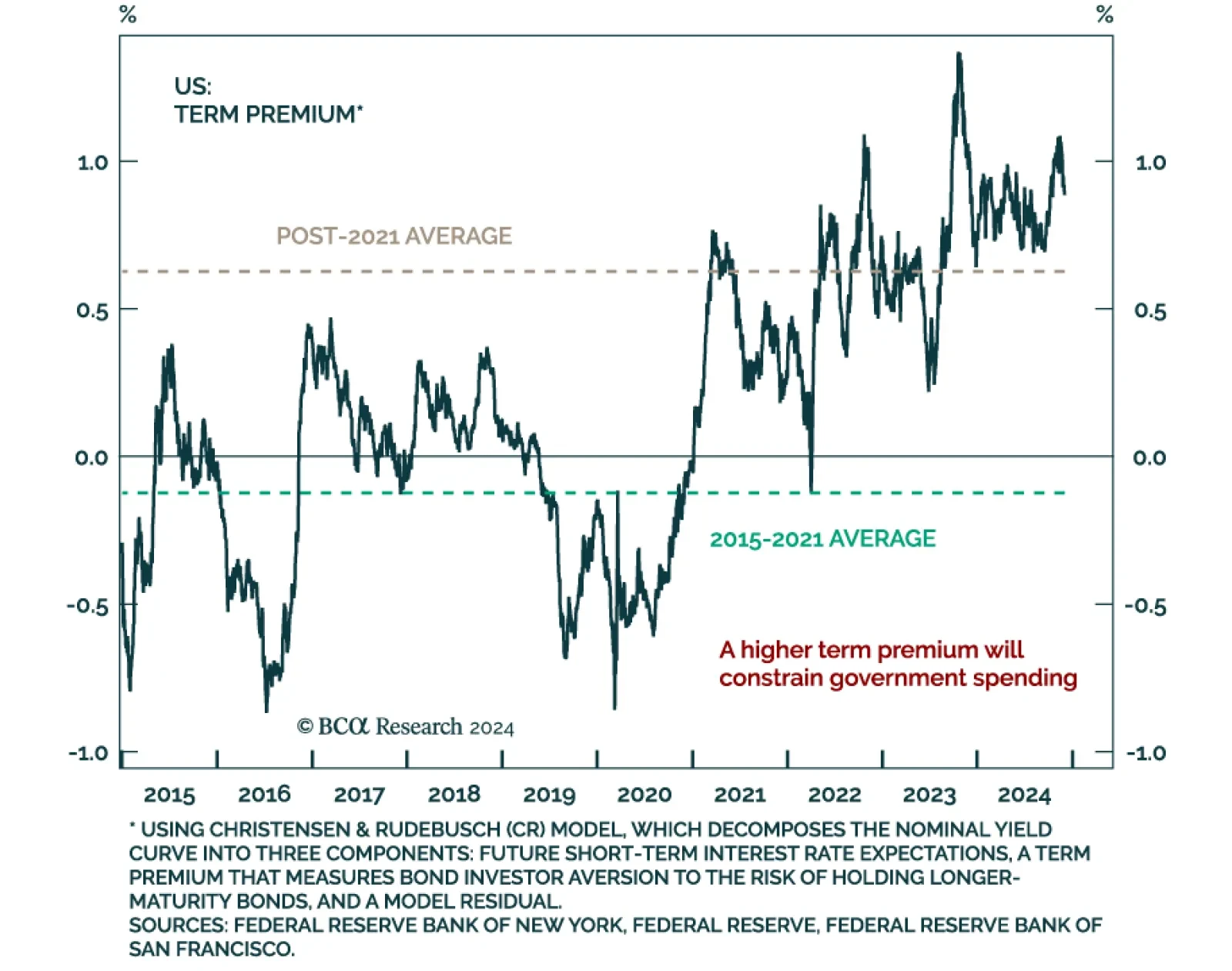

Congress will pass tax cuts by end of 2025 producing a fiscal thrust of about 0.9% of GDP in 2026. Trump will count on that stimulus as a basis for slapping tariffs on leading trade partners.China will retaliate against Trump…

After more than 10 years of civil war, Bashar Al-Assad’s rule came to an abrupt end when rebels captured Damascus. Syria might not be a significant country in economic or financial terms, but it is part of the Middle…

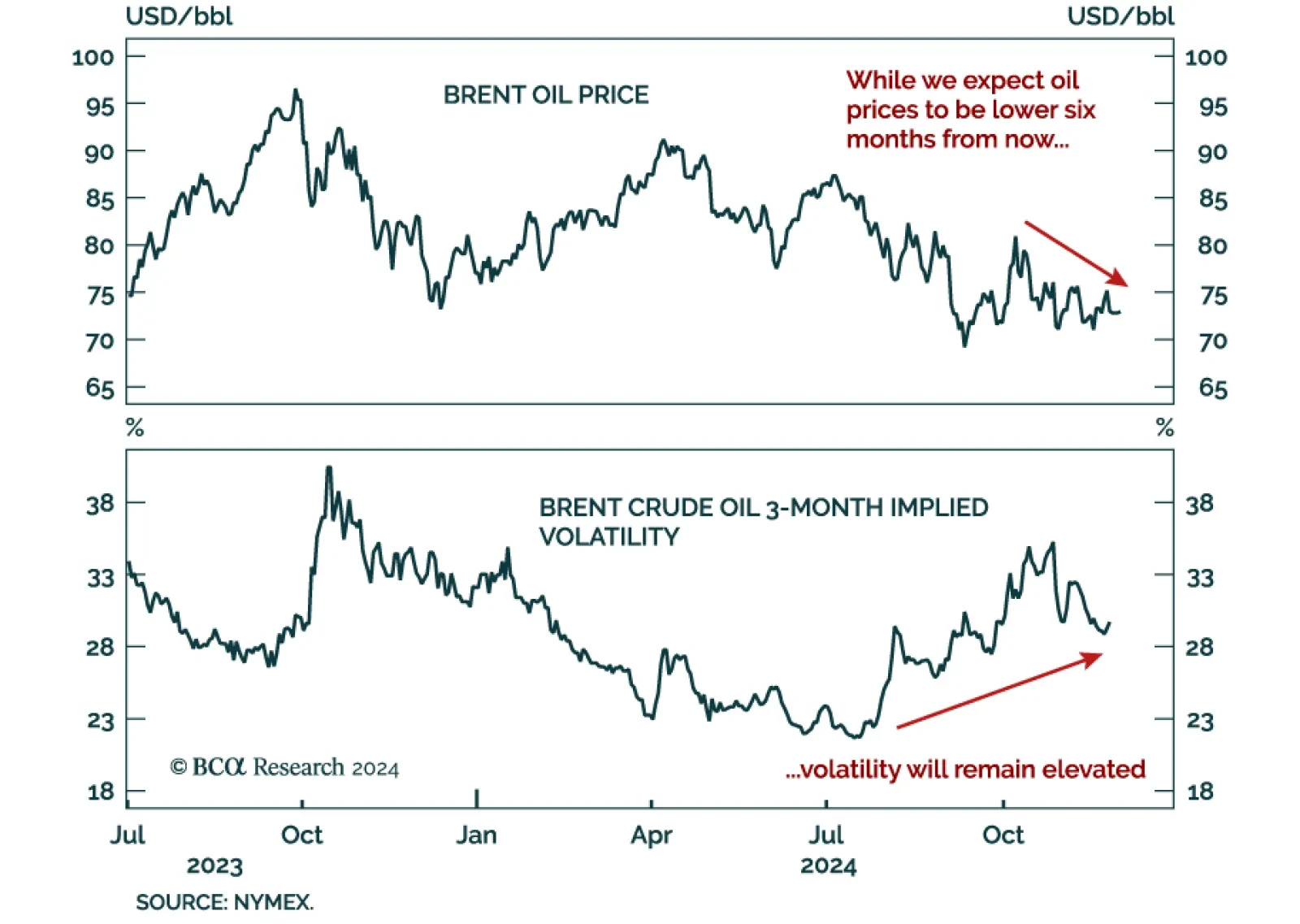

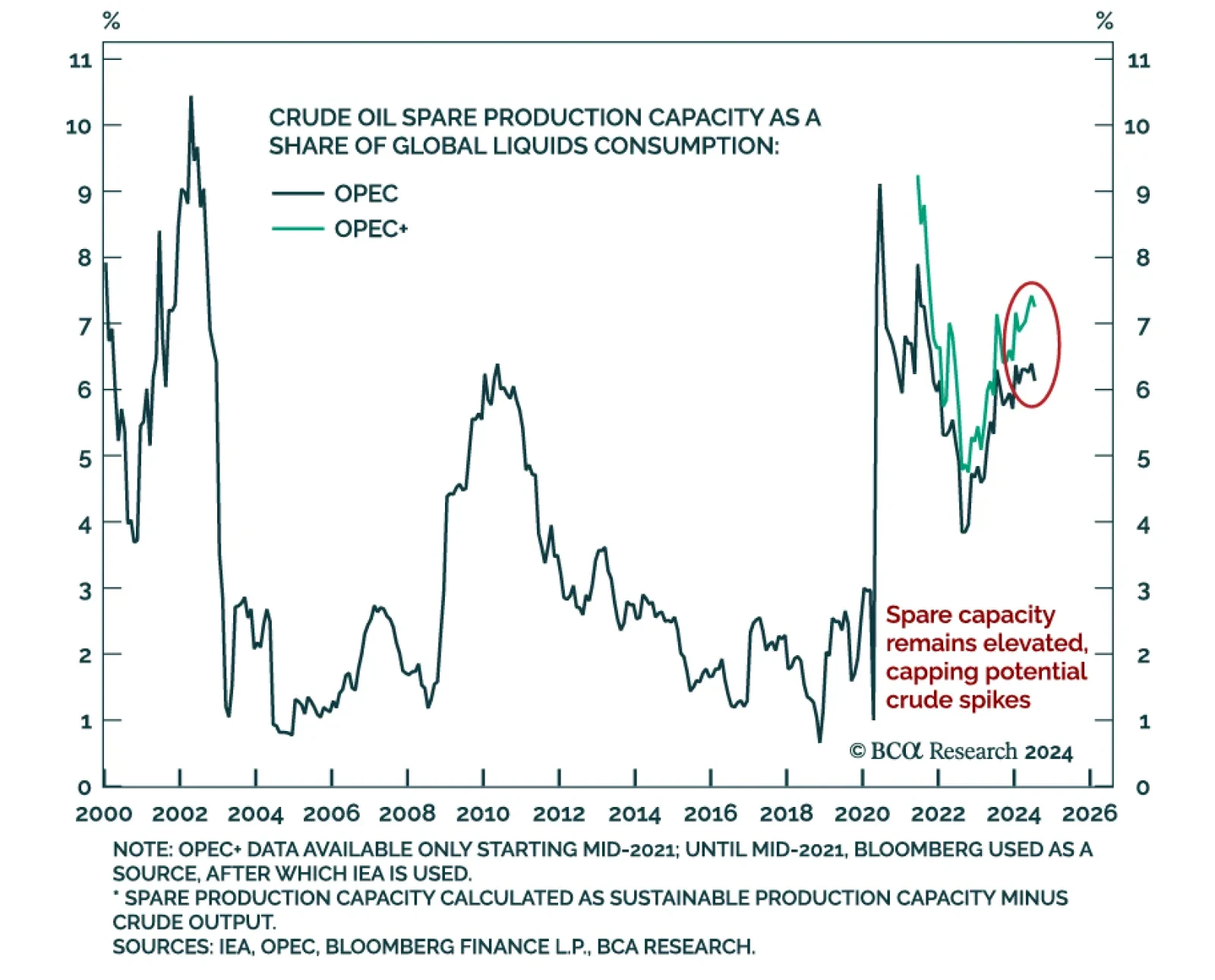

OPEC+ extended its production cuts for the third time, and lengthened the period over which it plans to bring spare capacity back online. Oil prices continue to trade near the bottom of their trading range despite the…

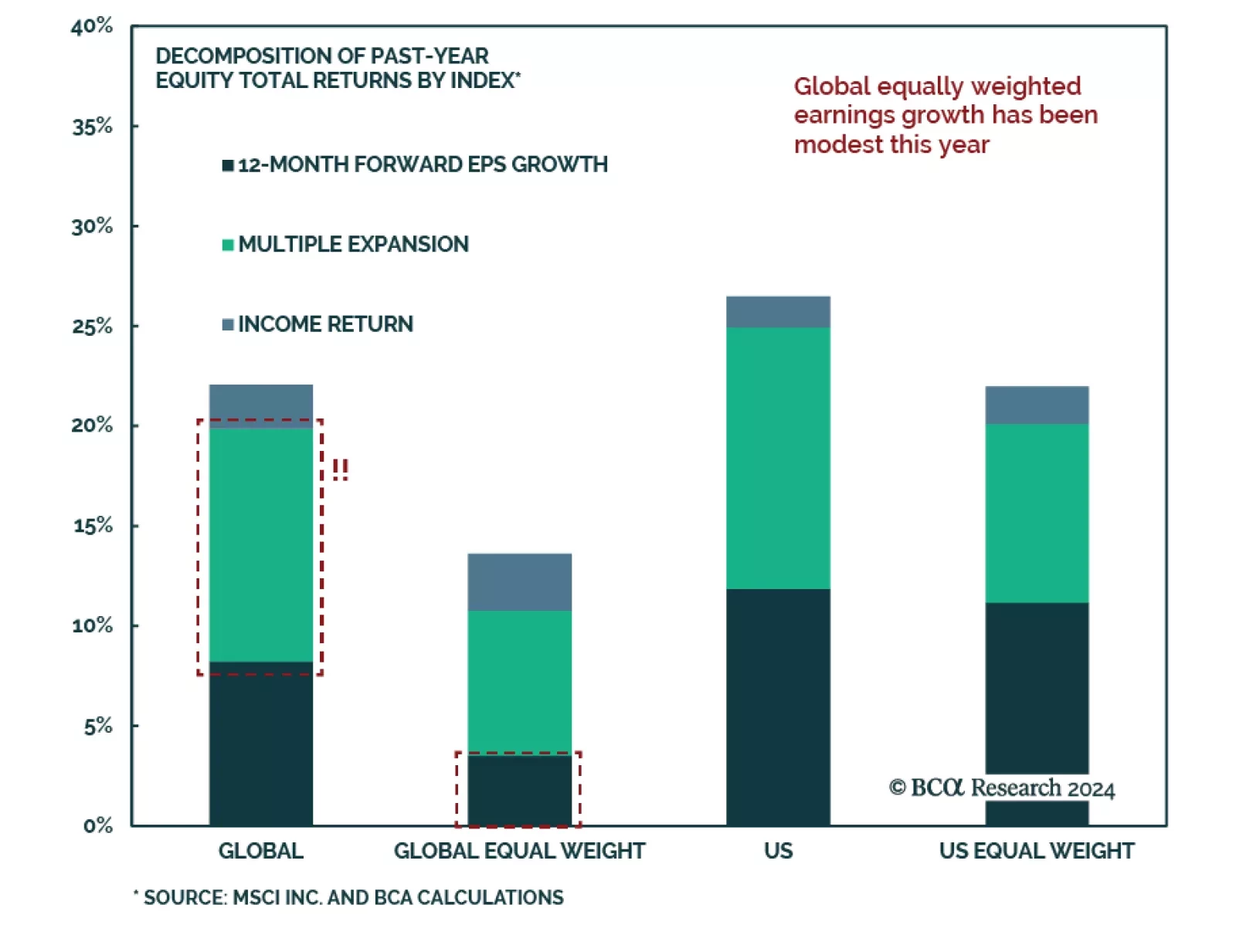

Our Global Asset Allocation strategists published their monthly tactical asset allocation report and foresee a change of trend for 2025. “Thin is back in” for government budgets, growth, and valuations. The post-…

Investors have given up on European assets, which now suffer exceptional discounts to US ones. However, tighter US fiscal policy, the end of Europe’s austerity and deleveraging, the LNG Tsunami about to hit European shores, and the…

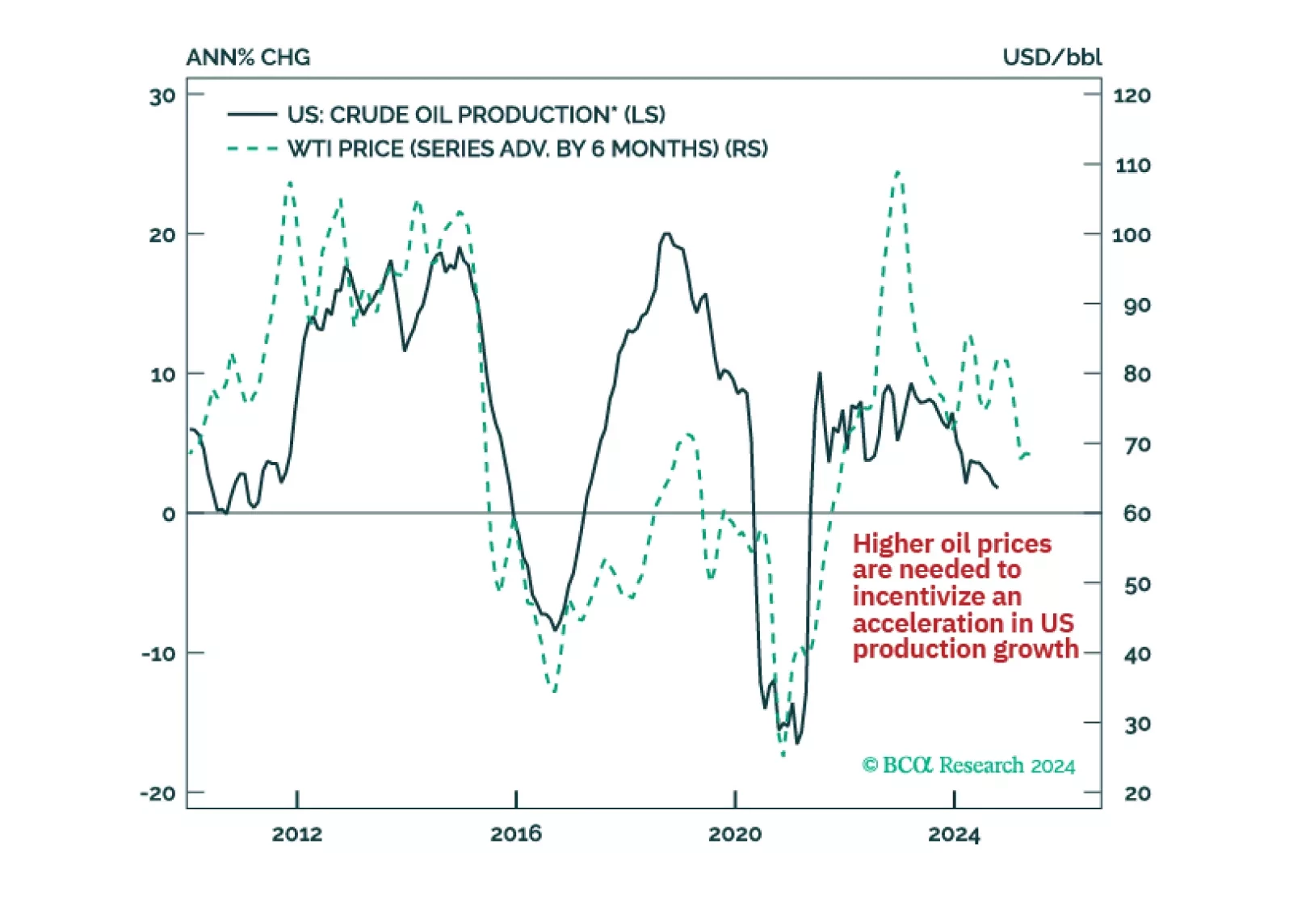

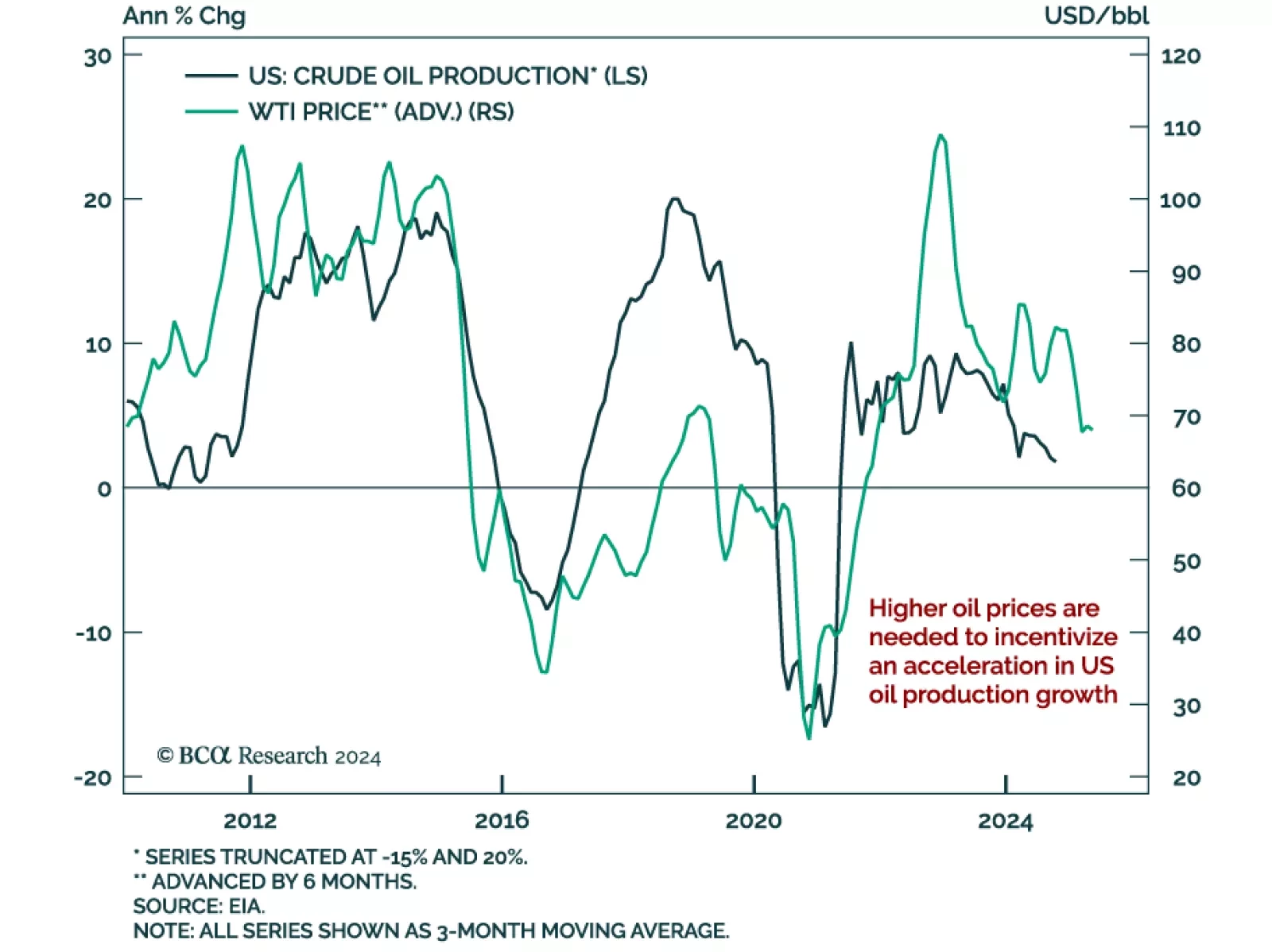

Our Commodity & Energy Strategy team evaluated the impact of president-elect Trump’s policies on commodity markets. Trump’s energy policies, while promoting increased domestic oil production, are unlikely to…

President Trump’s victory has injected a dose of uncertainty into the outlook for commodity markets. Most notably, the new administration’s energy policies are likely to be part of the early agenda. Changes in US domestic and foreign…

Our 2025 Outlook was just published. We revisit this year’s calls and discuss what we think is ahead for the global economy and markets for the next 12 months and beyond. The recent US election has significantly shifted…

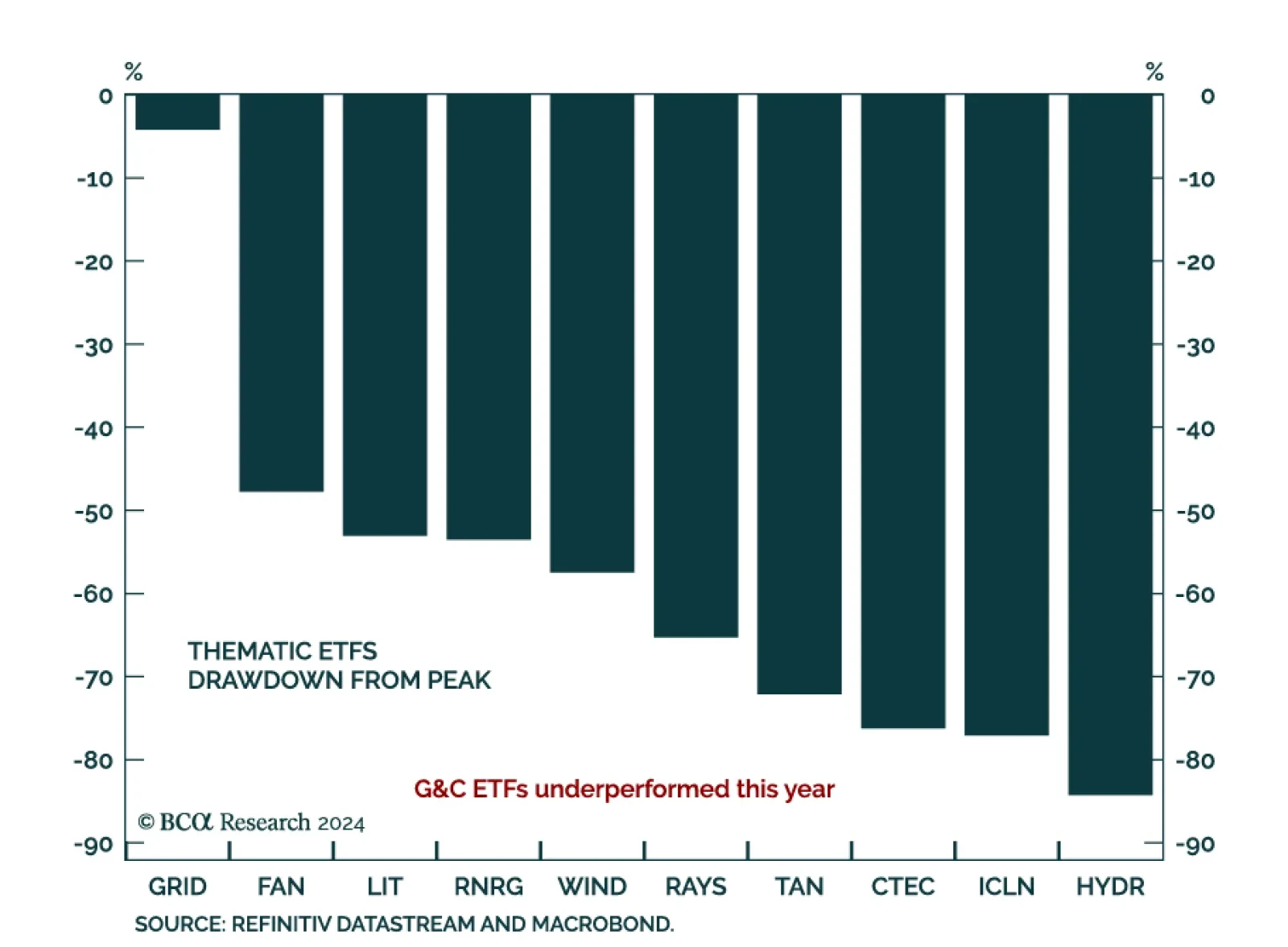

Our US Equity strategists investigated the underperformance of the Green and Clean (G&C) investment theme, in the context of an incoming US administration expected to be less friendly towards green initiatives. The G…