Europe is about to become President Trump’s next target. The good news: a US/EU trade war will be short as common ground to achieve a deal exists. The bad news: European assets remain at the mercy of heightened uncertainty. How…

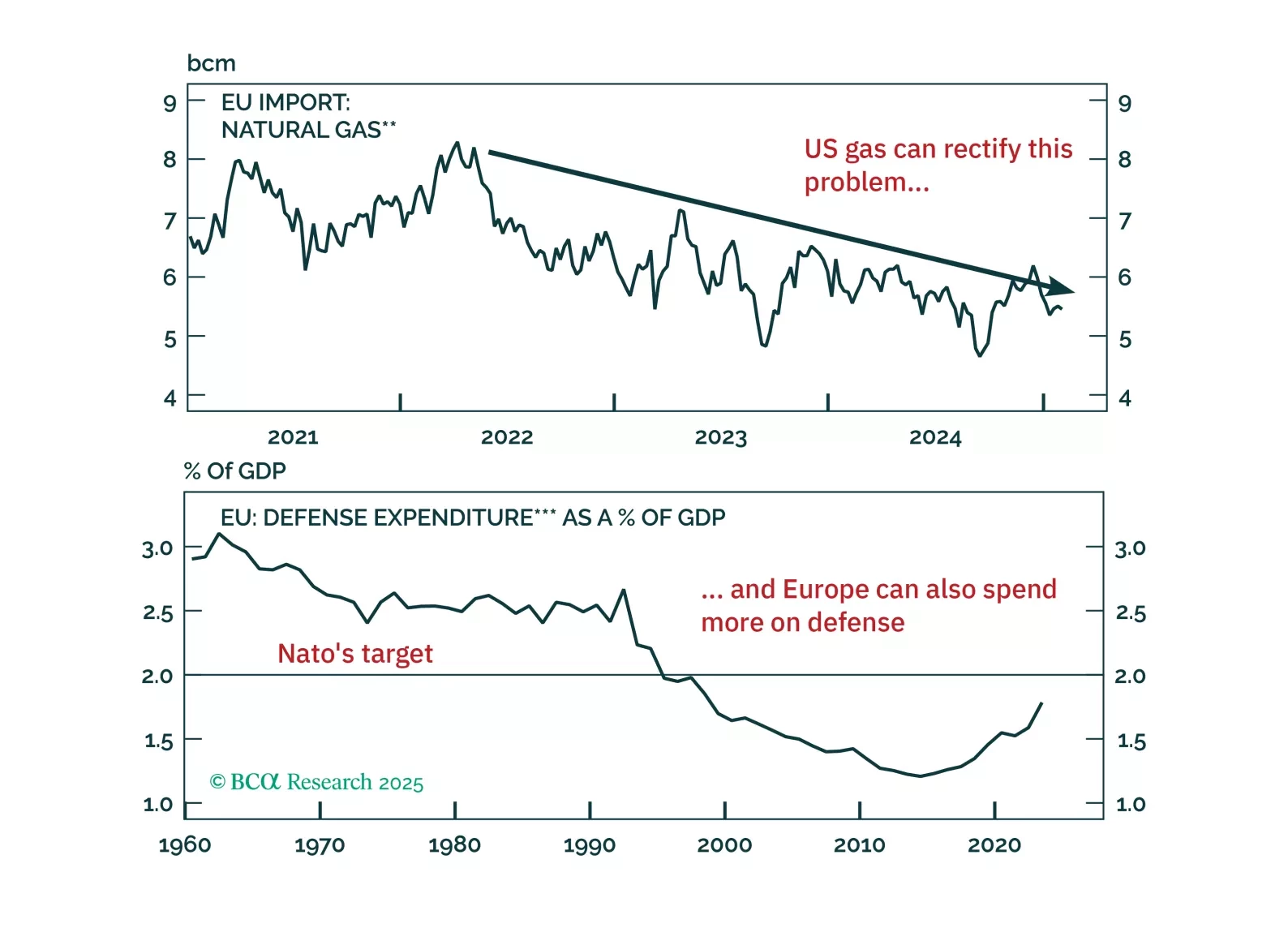

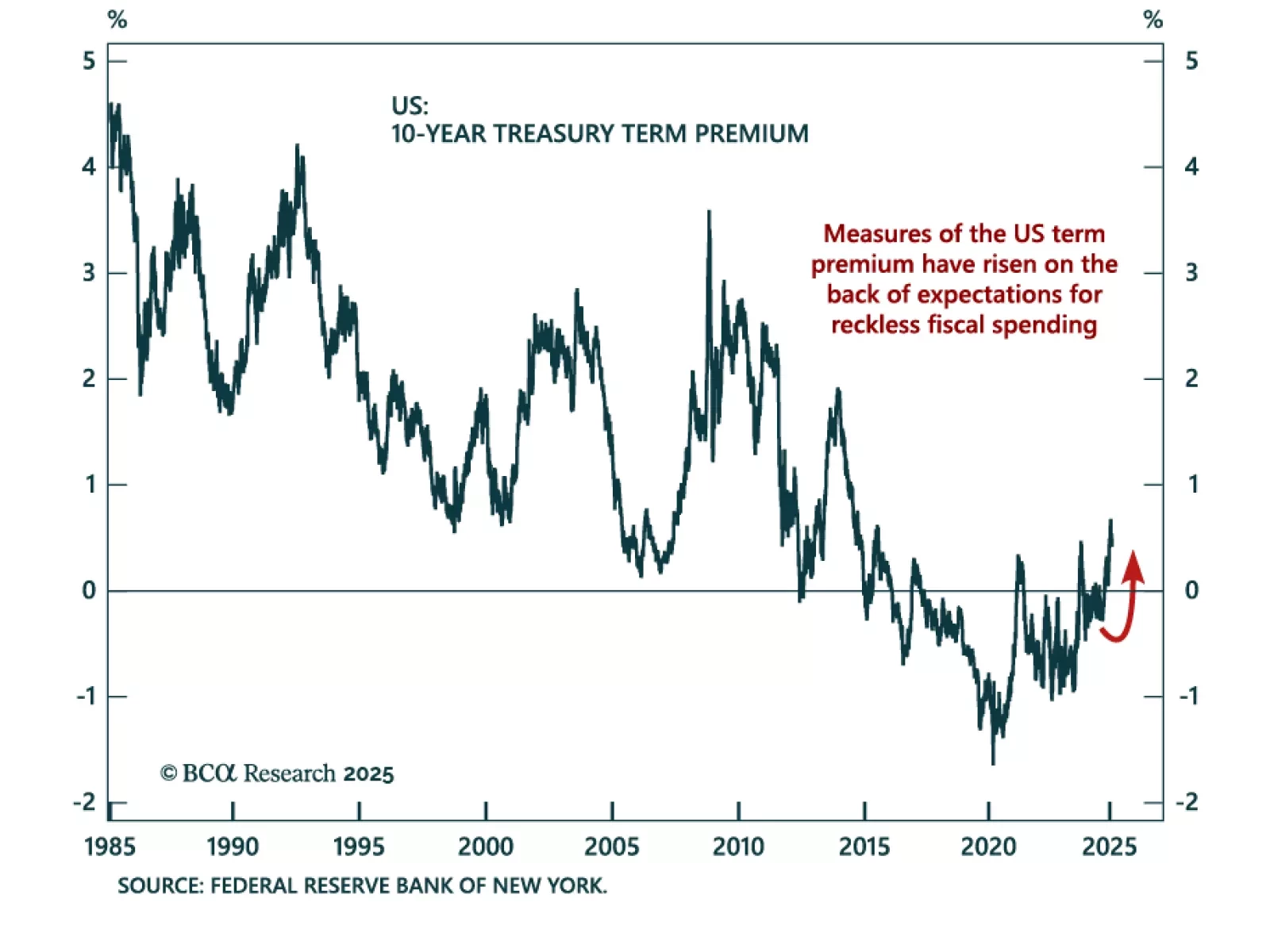

Treasury Secretary Scott Bessent commented that one of the Trump administration’s priority was lowering 10-year bond yields. Bessent’s 3/3/3 plan, boosting growth to 3% from deregulation, increasing US oil production by 3 mmb/d, and…

While the US dollar has outperformed every single DM currency in the past few months, the only monetary asset it did not outperform is gold. The greenback is up between 5-10% against DM currencies since September of last year, but…

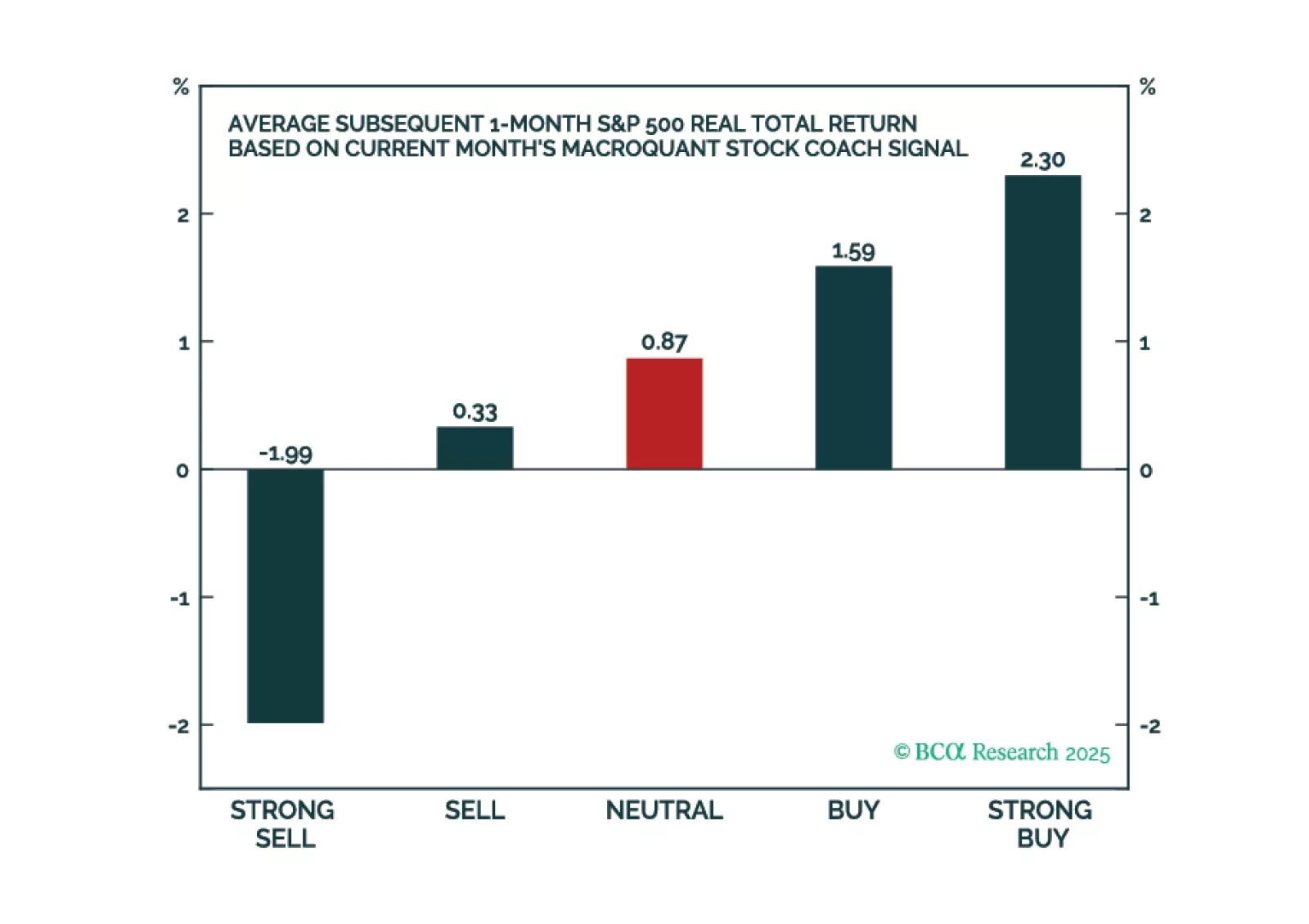

The latest version of the MacroQuant model suggests that the bull market in US stocks is winding down. The model expects Treasury yields to fall later this year but is not ready to go long duration just yet.

The latest version of the MacroQuant model suggests that the bull market in US stocks is winding down. The model expects Treasury yields to fall later this year but is not ready to go long duration just yet.

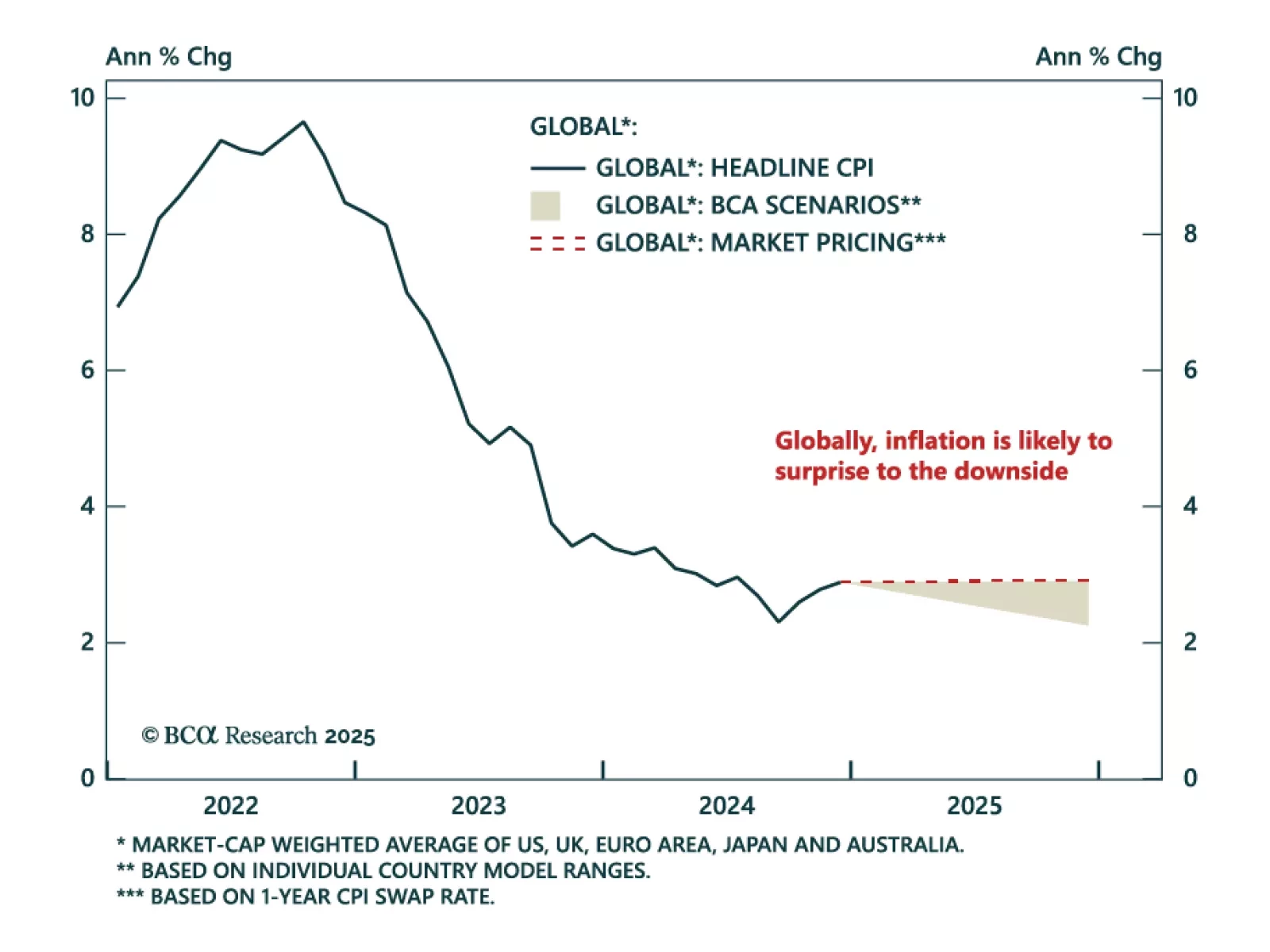

Our Global Fixed Income strategists assessed the risk of a second wave of inflation, and discussed the opportunities within the inflation-linked bond (ILB) market. Global disinflation remains on track, though energy prices and…

Please join BCA Research's Commodity & Energy Strategist, Roukaya Ibrahim for a Webcast on Thursday, January 30 at 10:30 AM EST (3:30 PM GMT, 4:30 PM CET).

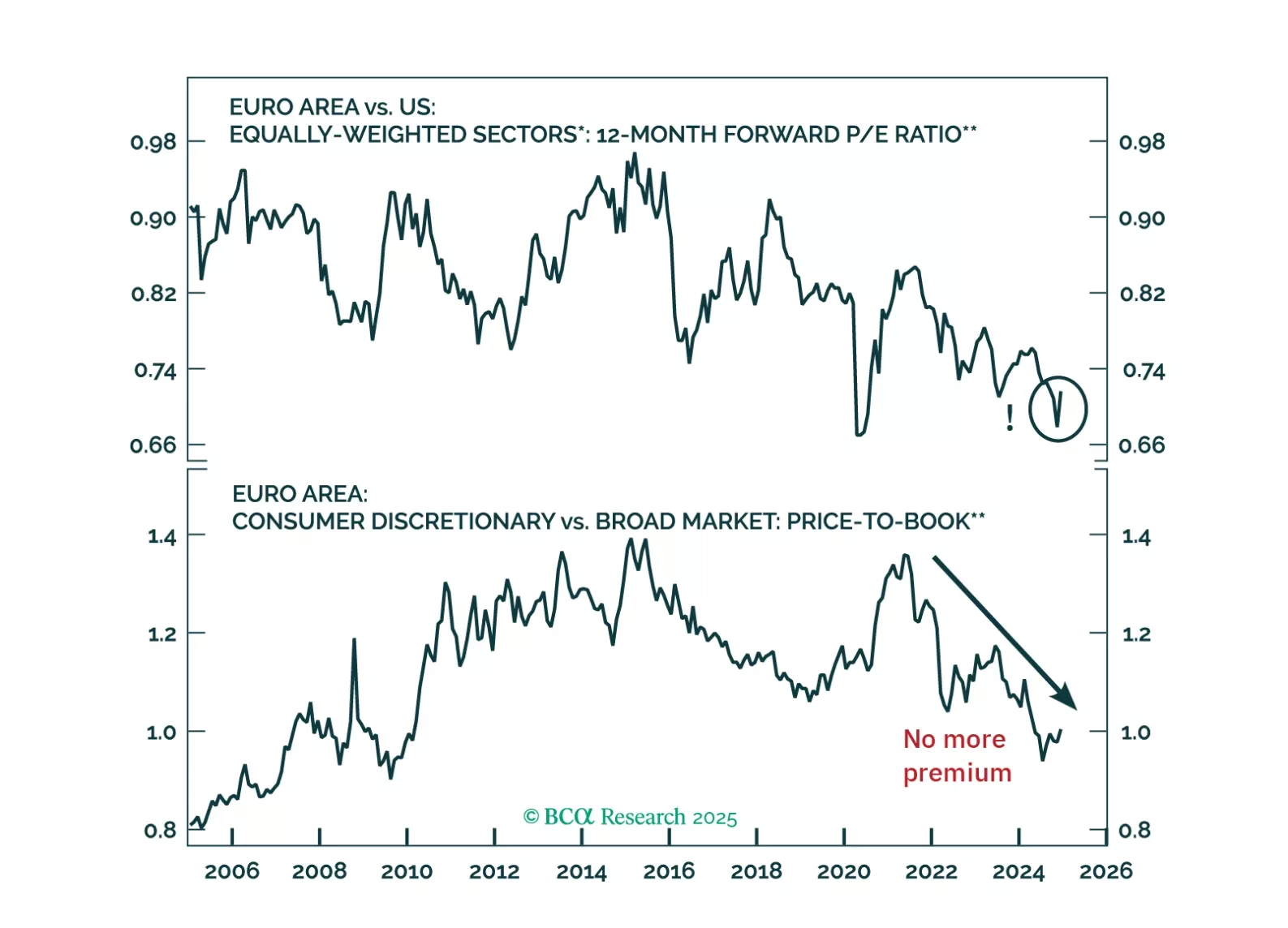

Global risk assets are engulfed in a wave of euphoria, which is pulling Europe higher along the way. However, risks still abound. How should investors adjust their allocation to Europe under these highly uncertain conditions?

Despite the choppy price action of the last few weeks, equity sentiment remains elevated. Surveys of investor sentiment remain at the top end of the bullish spectrum, and the S&P 500 is trading over 22x forward earnings, levels…

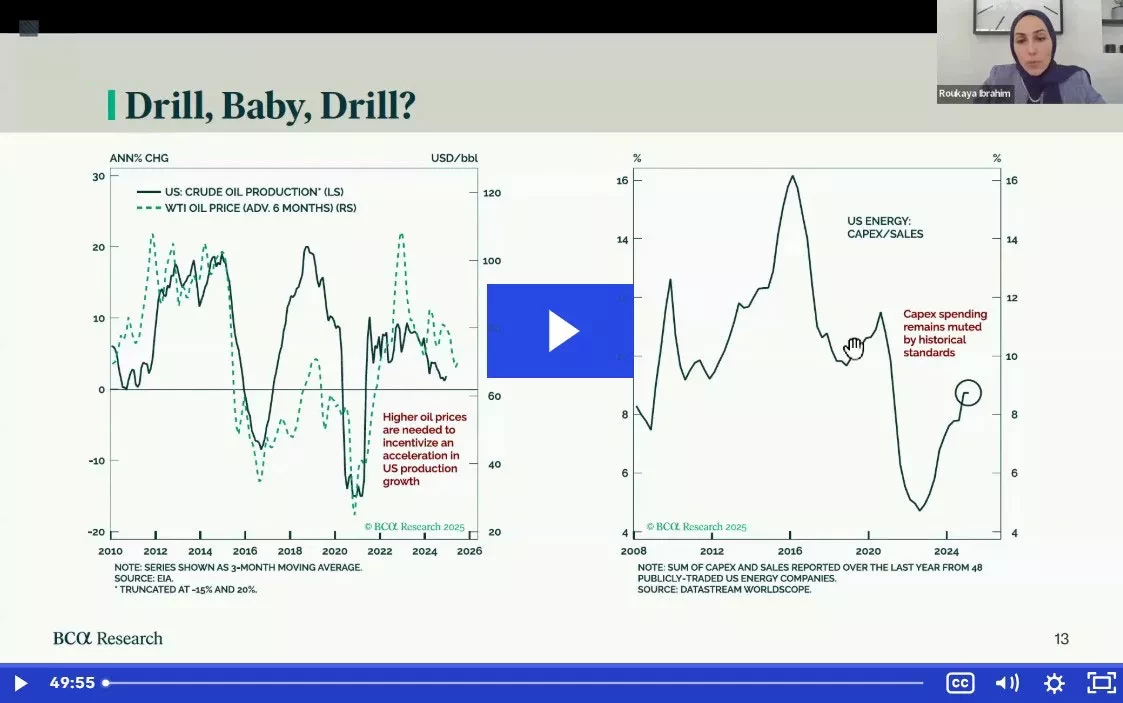

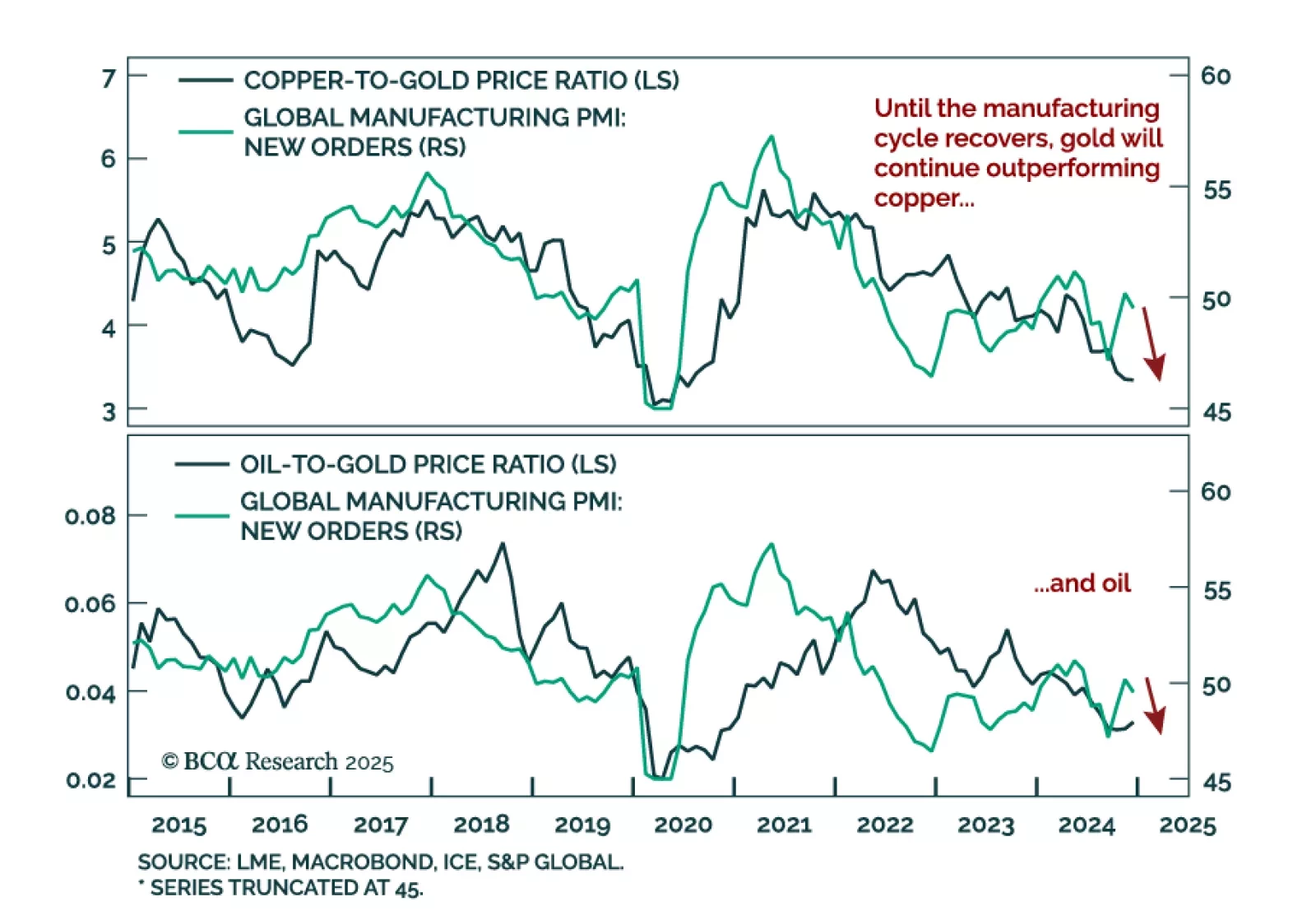

Our Commodities & Energy strategists published a special report outlining three themes they see in the space for 2025. The themes are the following: Sluggish global demand and weak industrial activity will likely weigh…