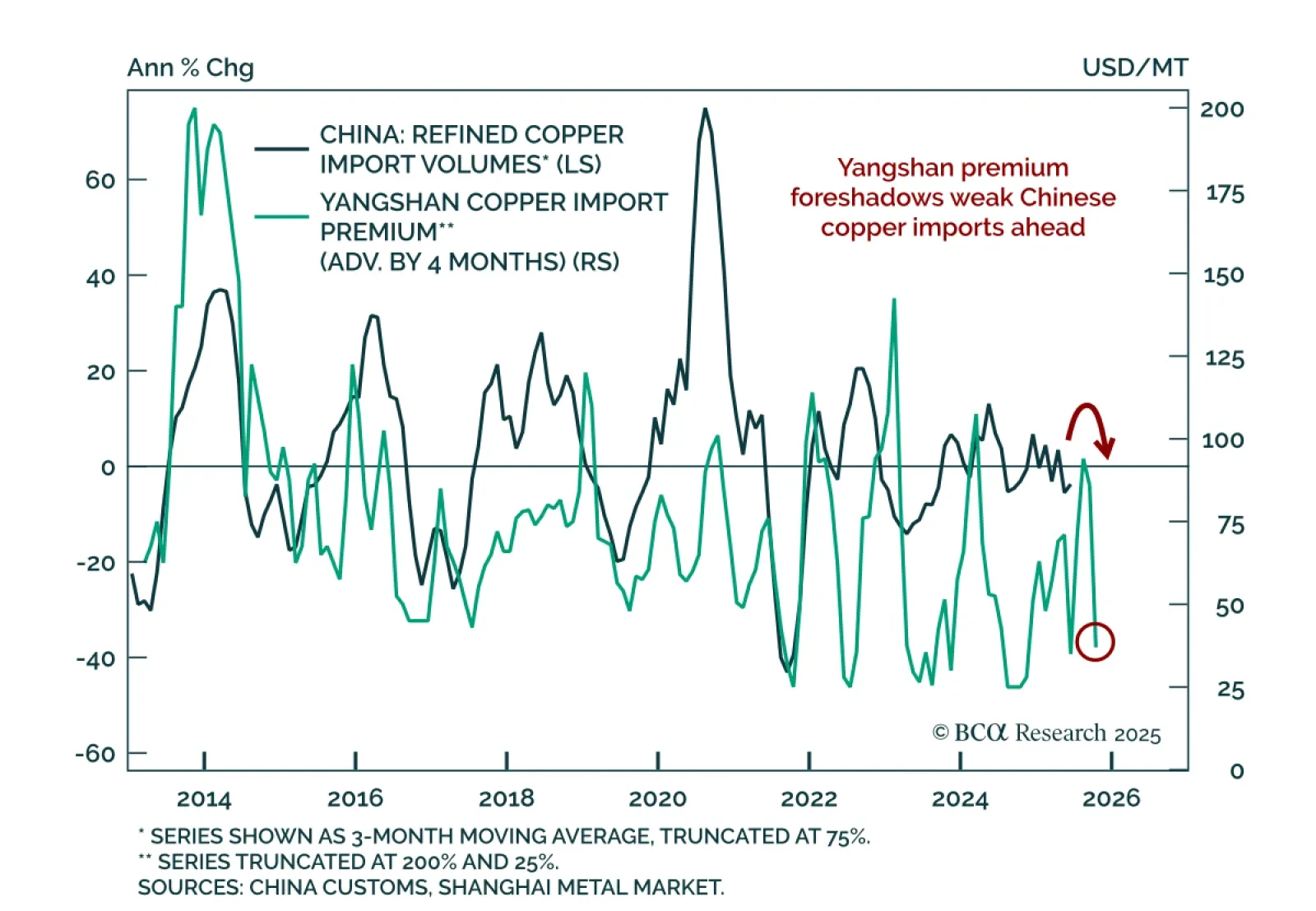

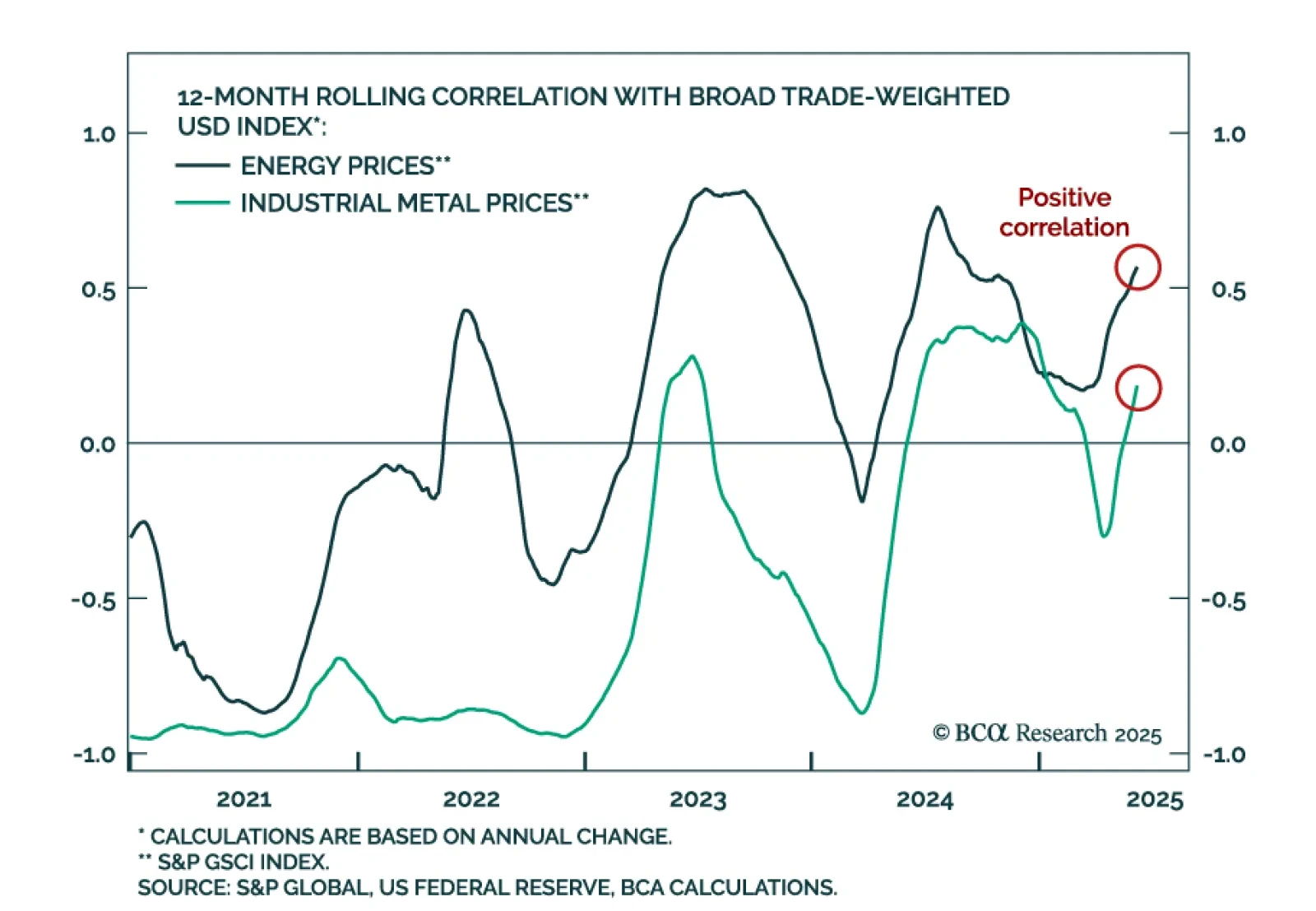

Our Commodity strategists recommend staying short LME copper outright and long gold/short LME copper on a cyclical basis. The unwind in copper, set off by the US tariff exemption on refined metal, is not yet complete. An inventory…

BCA’s Commodity strategists remain long gold/short LME copper and have initiated an outright short in LME copper as a cyclical trade. The US copper tariff will redirect supply away from the US, replenishing depleted inventories…

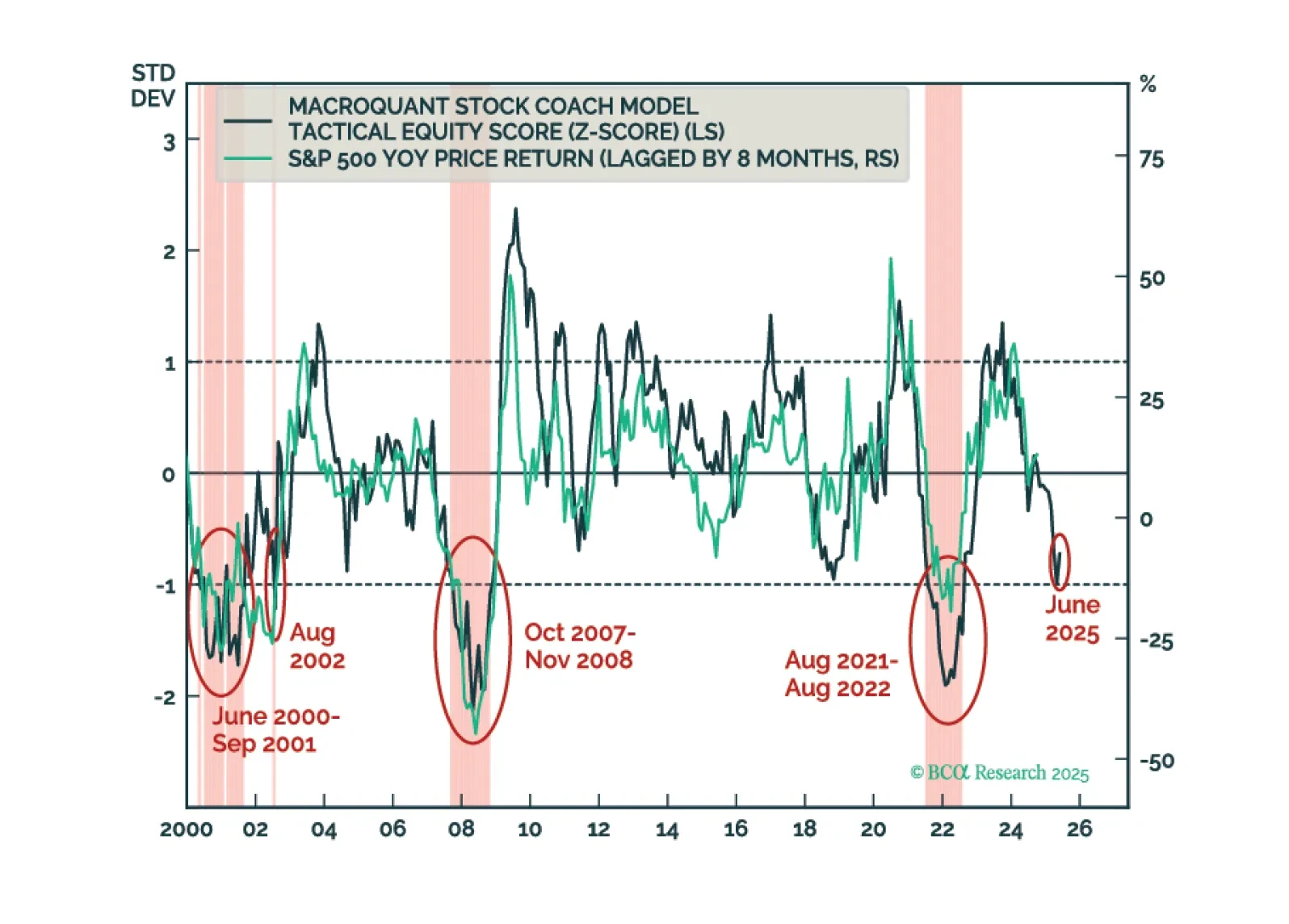

MacroQuant’s US equity z-score is dangerously close to the -1 threshold. Moves below that threshold have reliably coincided with equity bear markets in the past. As such, MacroQuant recommends an underweight on stocks, offset by an…

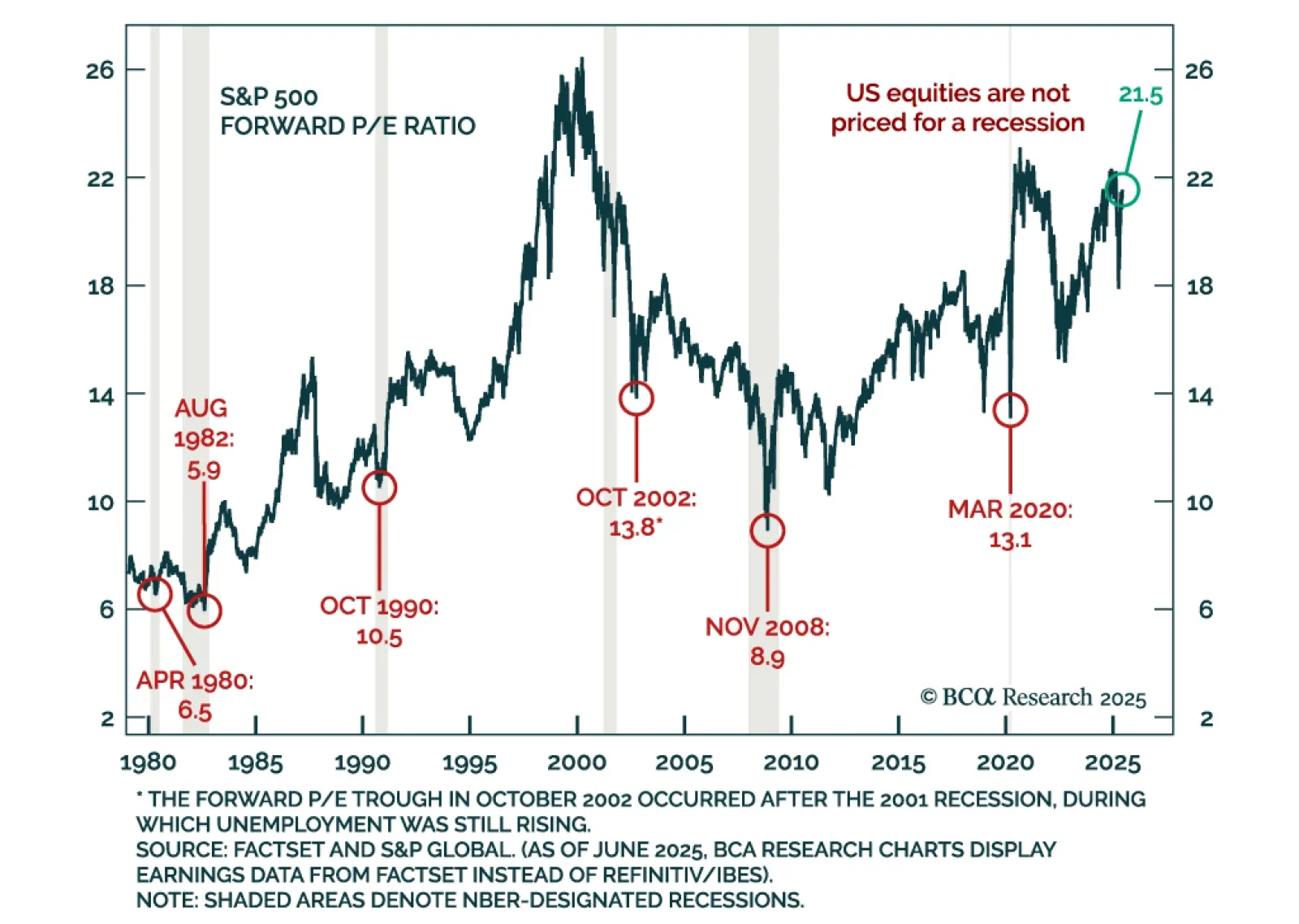

Investors should modestly underweight equities in their portfolios and look to turn more aggressively defensive once the whites of the recession’s eyes are visible. We think that will happen within the next few months.

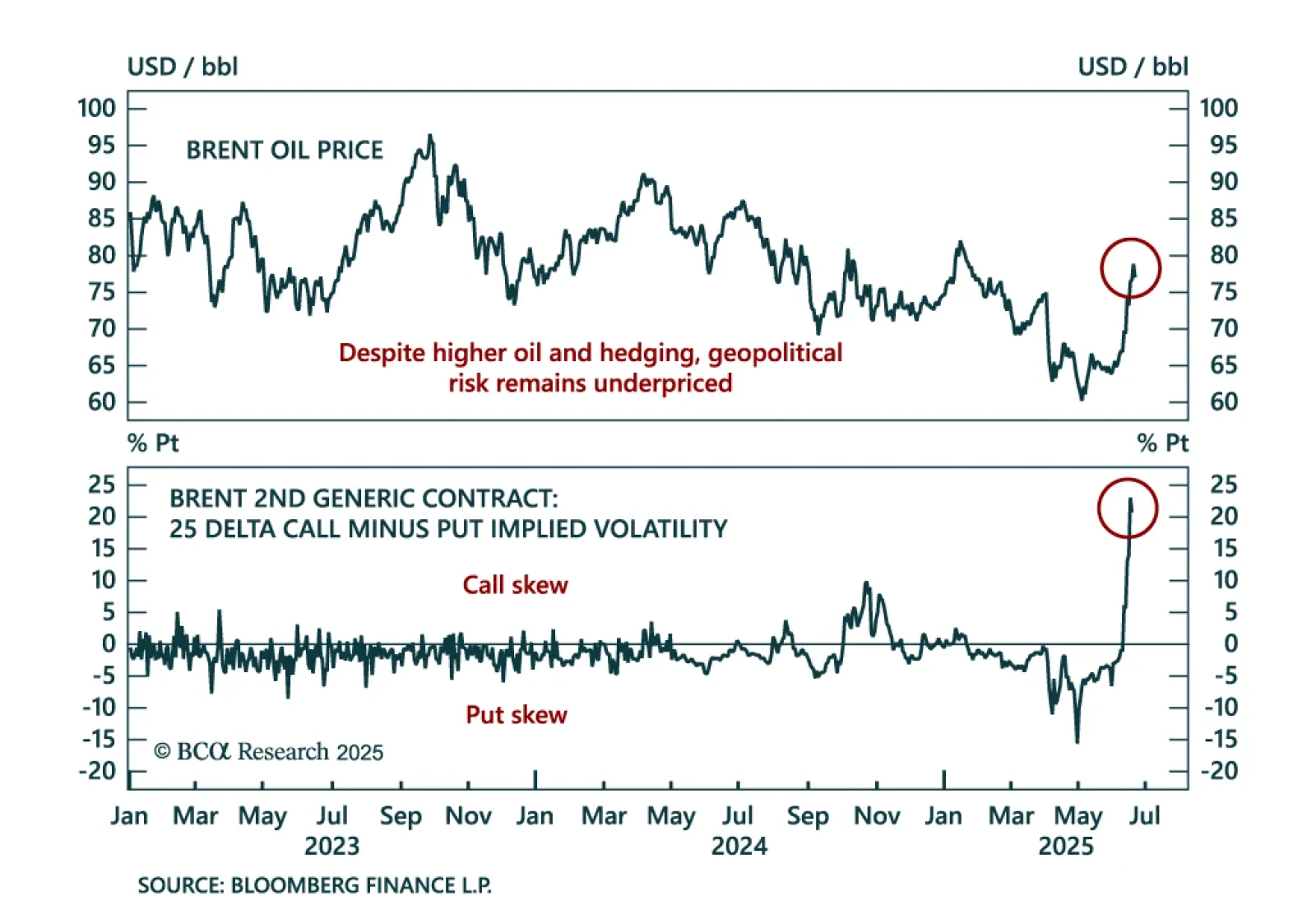

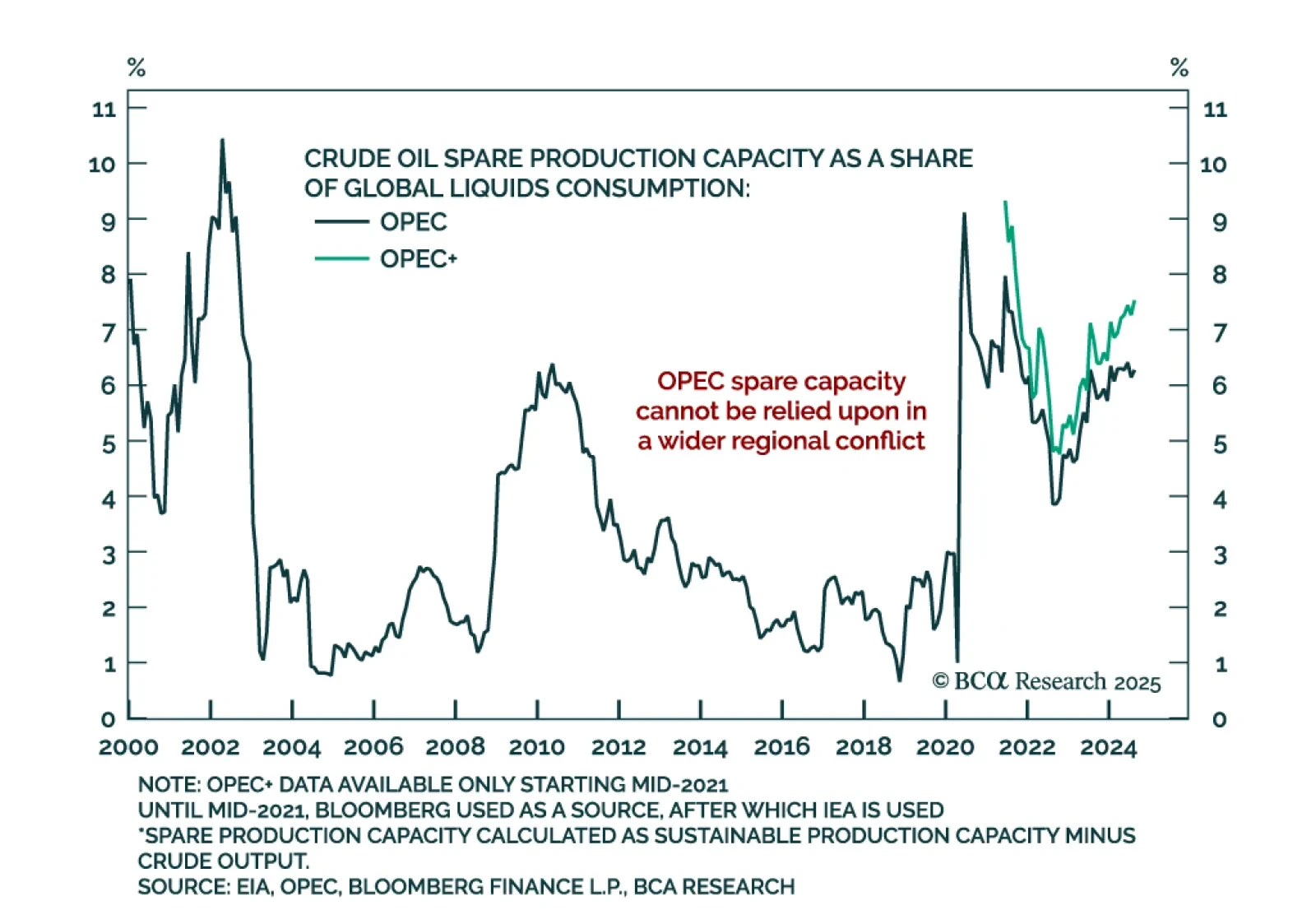

Elevated market complacency contrasts with high geopolitical risk as oil disruption remains a key threat. Middle East tensions escalated over the weekend after the US struck Iran’s nuclear capabilities, yet markets have reacted…

Geopolitical risks and fragile margins reinforce a defensive allocation stance, as oil shocks and high US equity valuations pose growing downside risks. At this month’s Views Meeting, our strategists discussed the potential fallout…

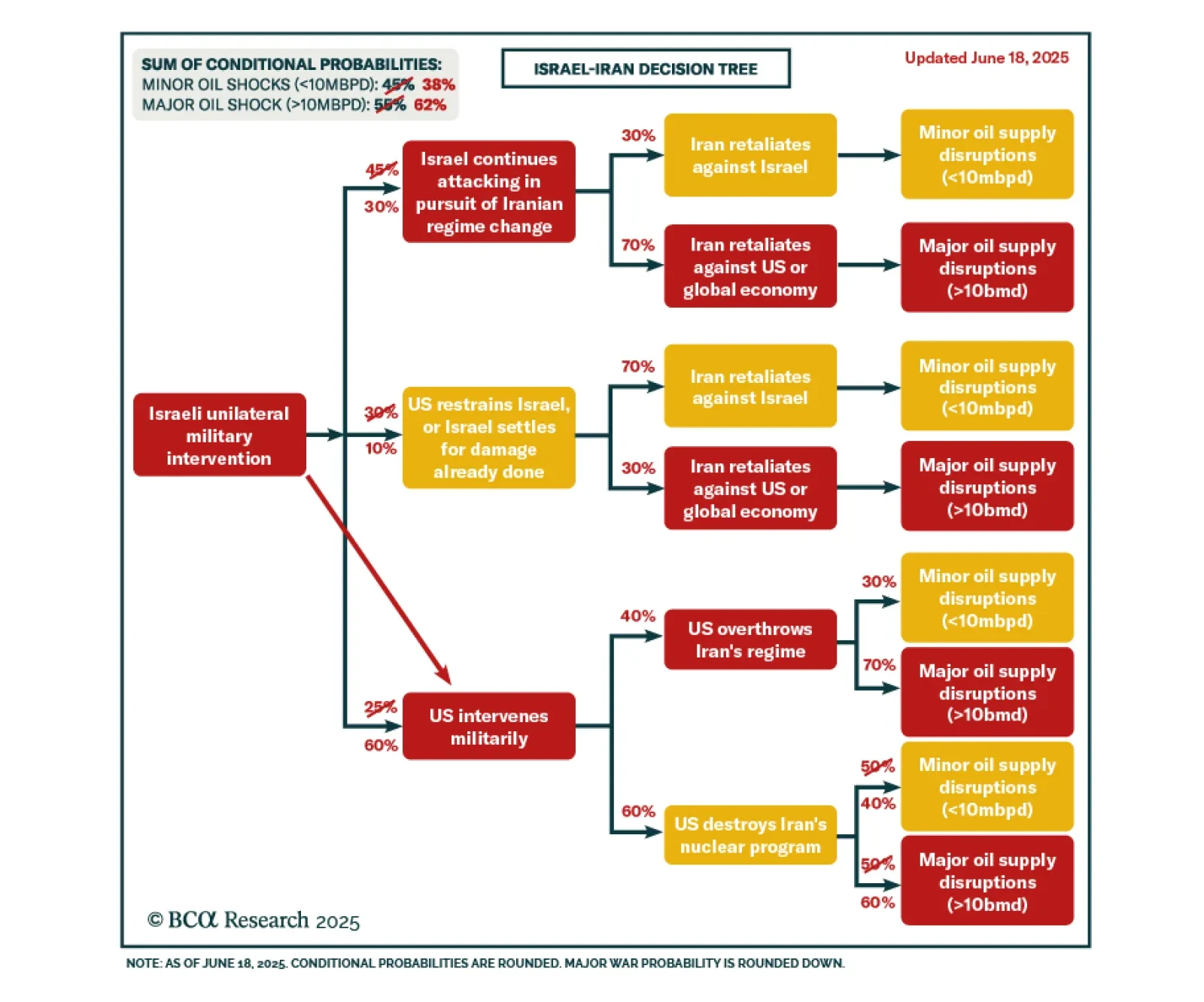

Our Geopolitical strategists expect US involvement in Israel’s military campaign against Iran, raising near-term risks to oil supply and market stability. Iran is likely to retaliate by targeting regional oil production and transport…

The Israel-Iran conflict is escalating, raising the odds of a major oil supply shock and reinforcing the case for cash, US equity overweight, and tactical energy exposure. Our Chart Of The Week comes from Matt Gertken, Chief…

Our Commodity strategists see a breakdown of historical commodity correlations. The US dollar now shows a positive correlation with commodities, particularly energy, and a weaker dollar will no longer guarantee upside for commodity…

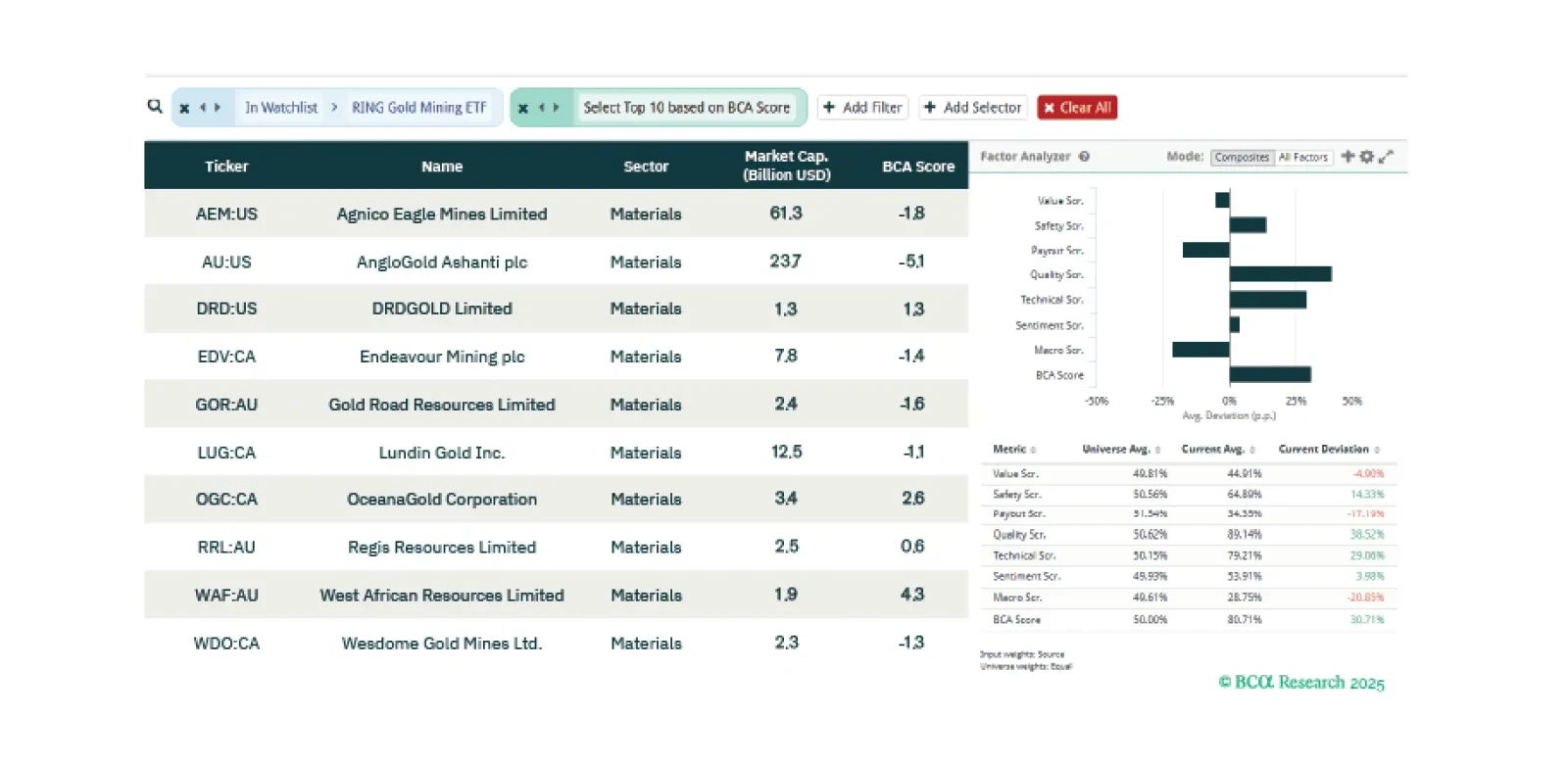

This week our three screeners explore equity trades in gold mining stocks, European banks, and US stocks ex-Tech should a recession not be imminent.