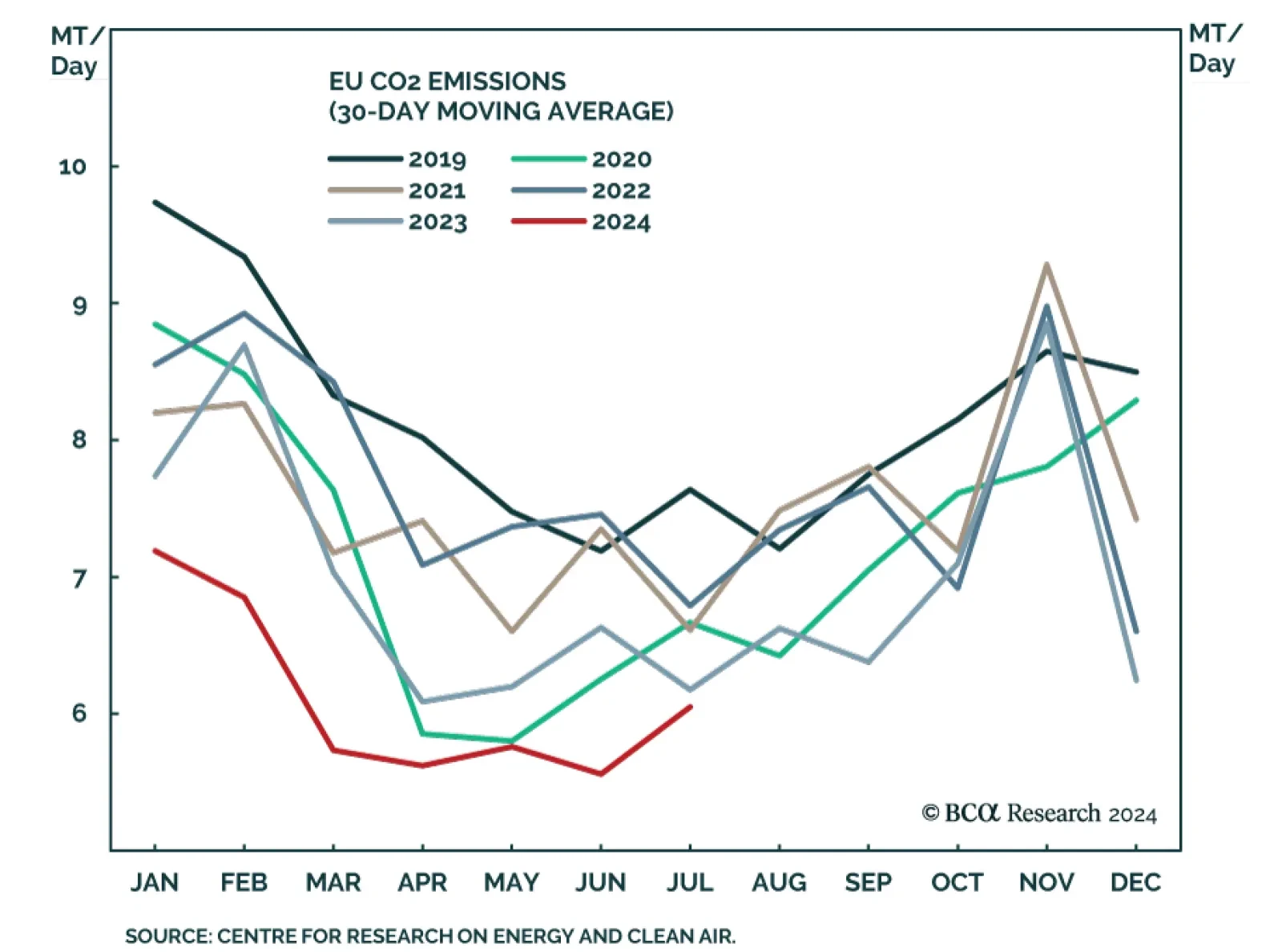

European regulatory carbon credits (EUAs) are becoming increasingly investable as an asset class. In a Special Report published last September, our Global Investment strategists agreed to the strategic bull case for EUAs, but…

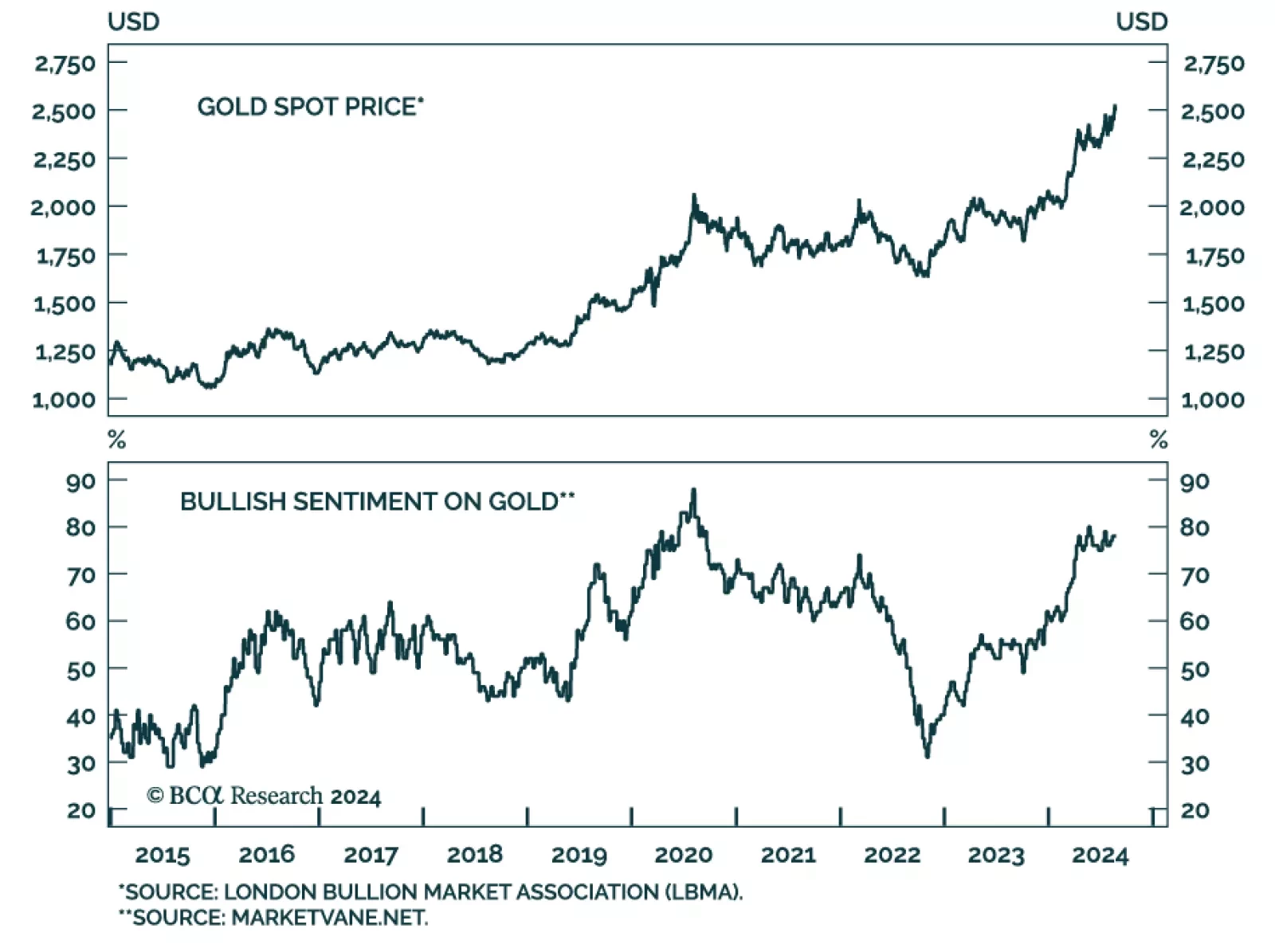

Gold reached new all-time highs earlier this week. The yellow metal has returned a whopping 20.2% YTD, with the rally reaccelerating over the past month. Gold prices are inversely correlated with the dollar, and the expectations…

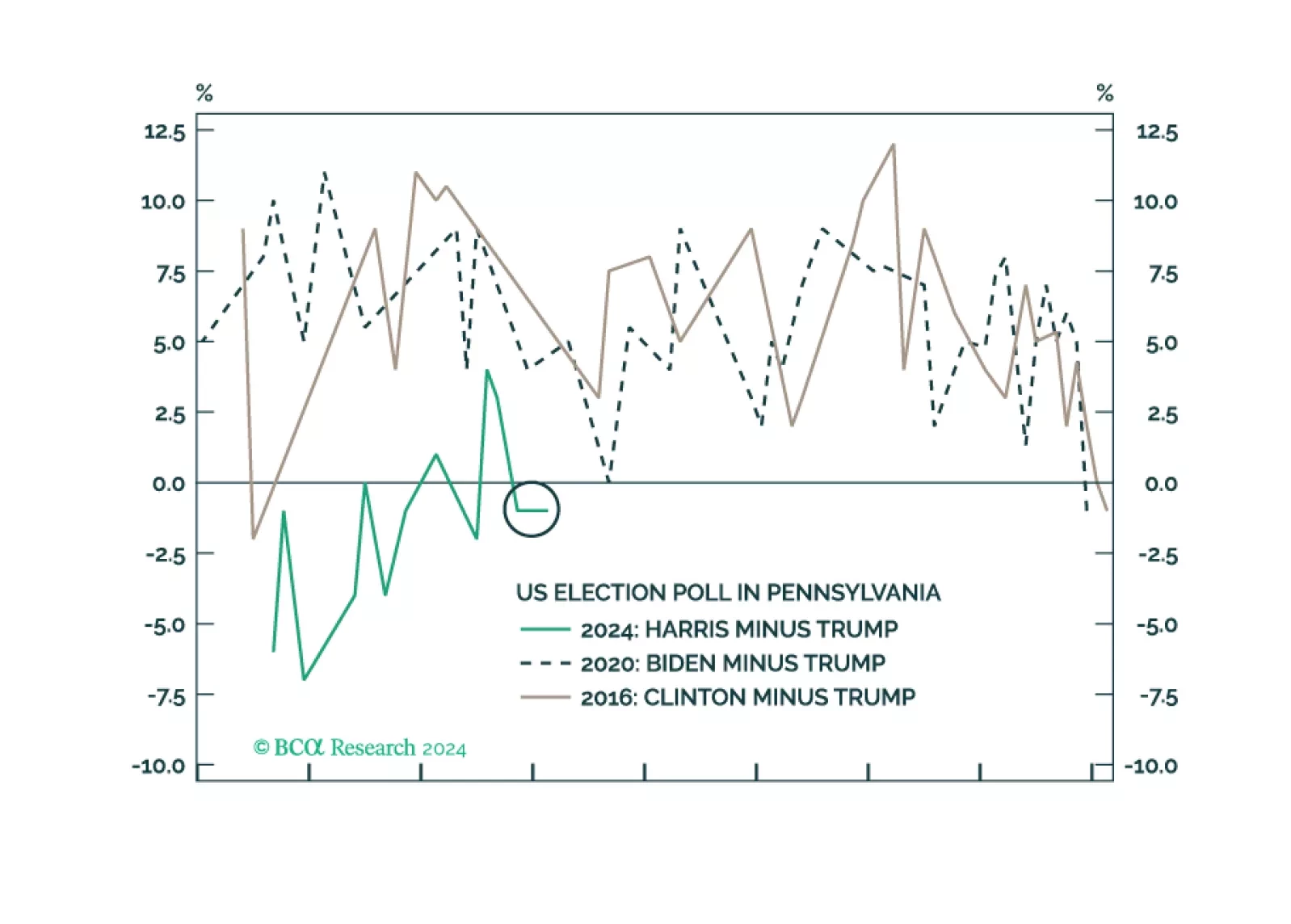

Investors should buy protection against further volatility. The shakeup in early August was a taste of things to come. The US election is a pivotal moment in modern history that will drive up uncertainty, while other countries take…

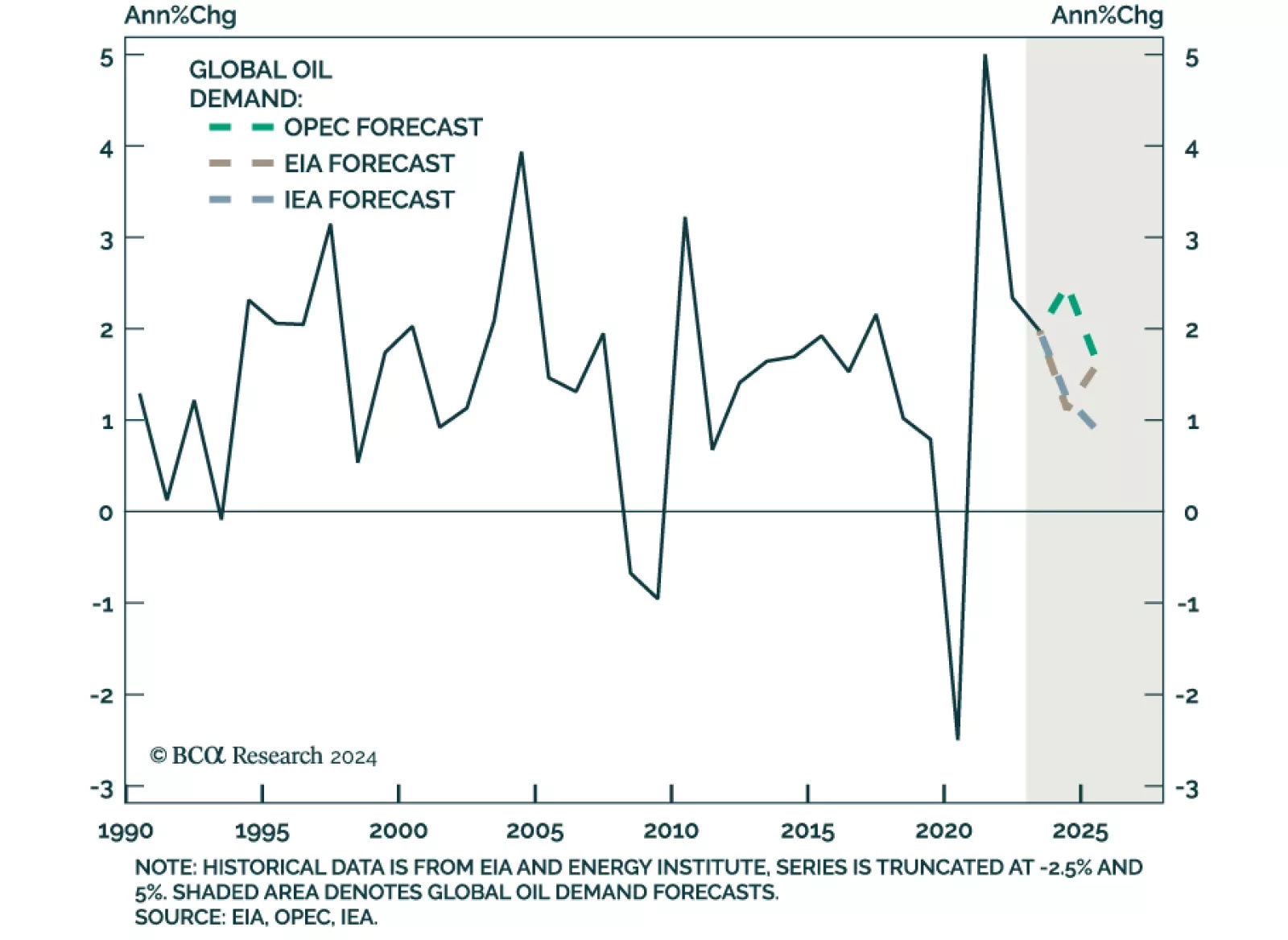

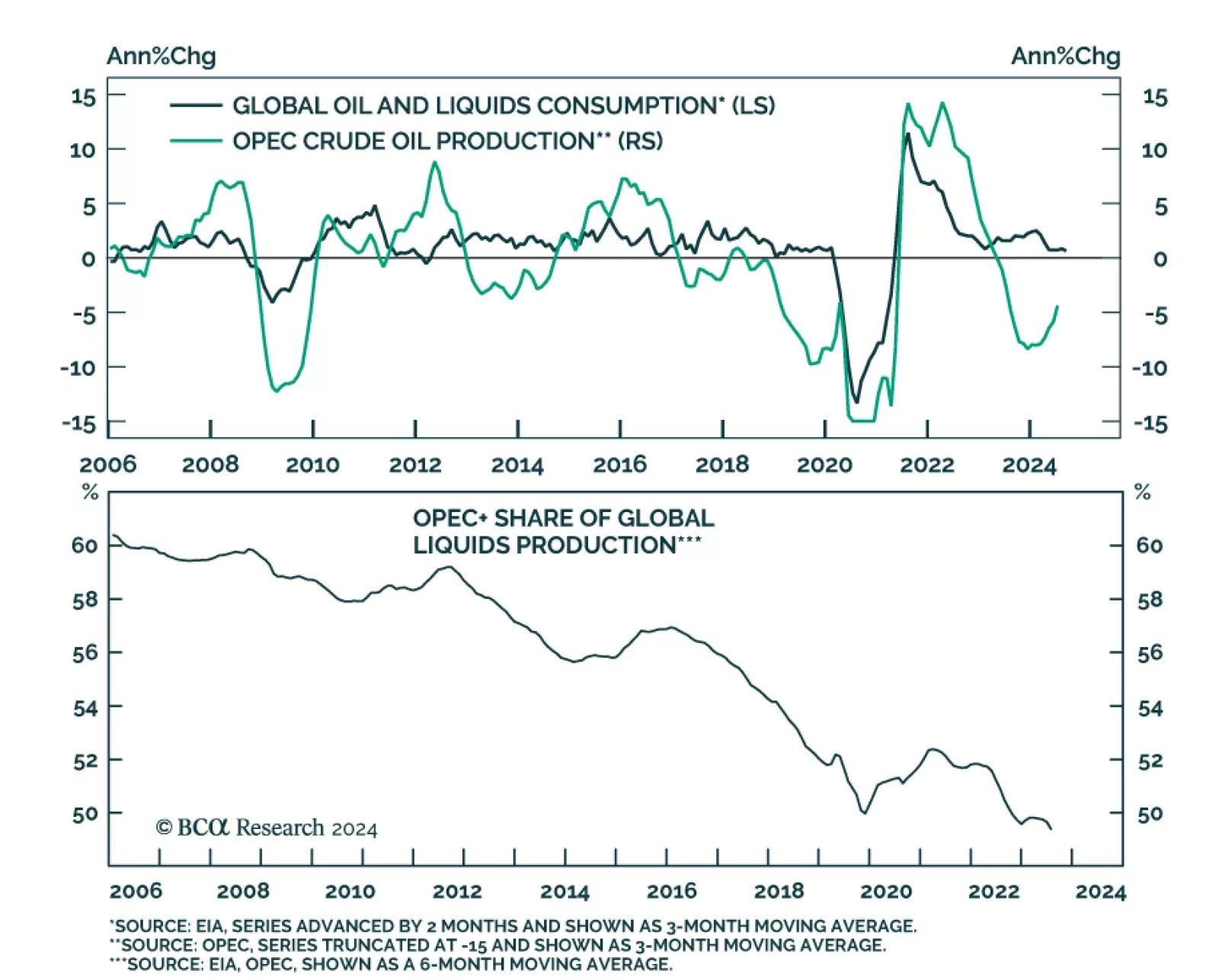

Back in May, our Commodity and Energy strategists argued that OPEC, EIA, and IEA oil demand forecasts were likely too optimistic. Indeed, while all three major oil price forecasters projected a moderation in demand this year,…

According to BCA Research’s Commodity and Energy Strategy service, soft oil demand growth raises the likelihood that OPEC+ will back down from its plan to begin unwinding some of its production cuts later this year. However…

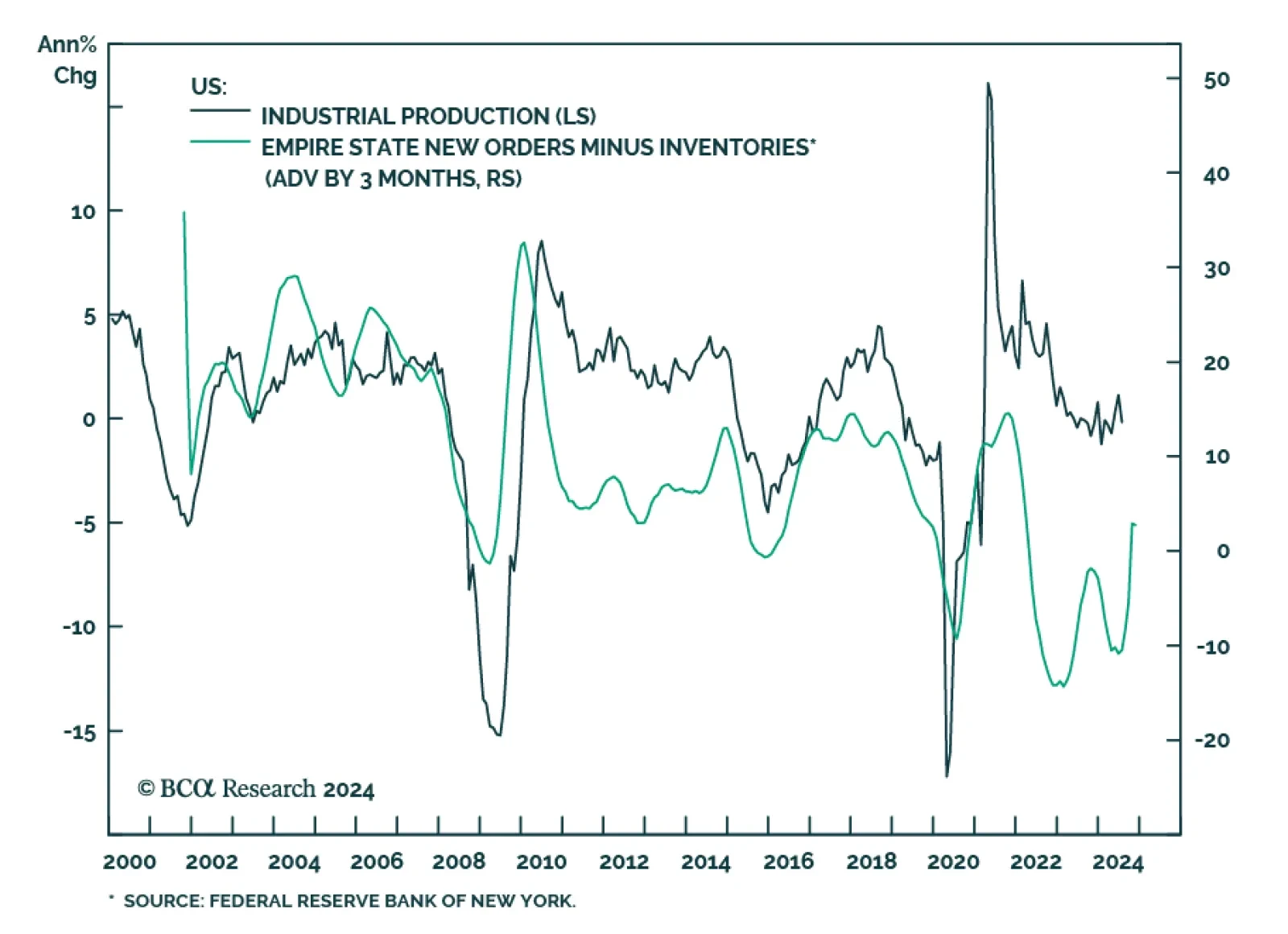

US industrial production fell by a larger-than-expected 0.6% m/m in July, the largest monthly decline so far this year. Capacity utilization also decreased a full percentage point to 77.8% Although Hurricane Beryl distorted…

Regular readers are familiar with our expectation that the stabilization in global growth this year will be fleeting. The US has been the main source of demand in this cycle. We view the latest string of US employment data as…

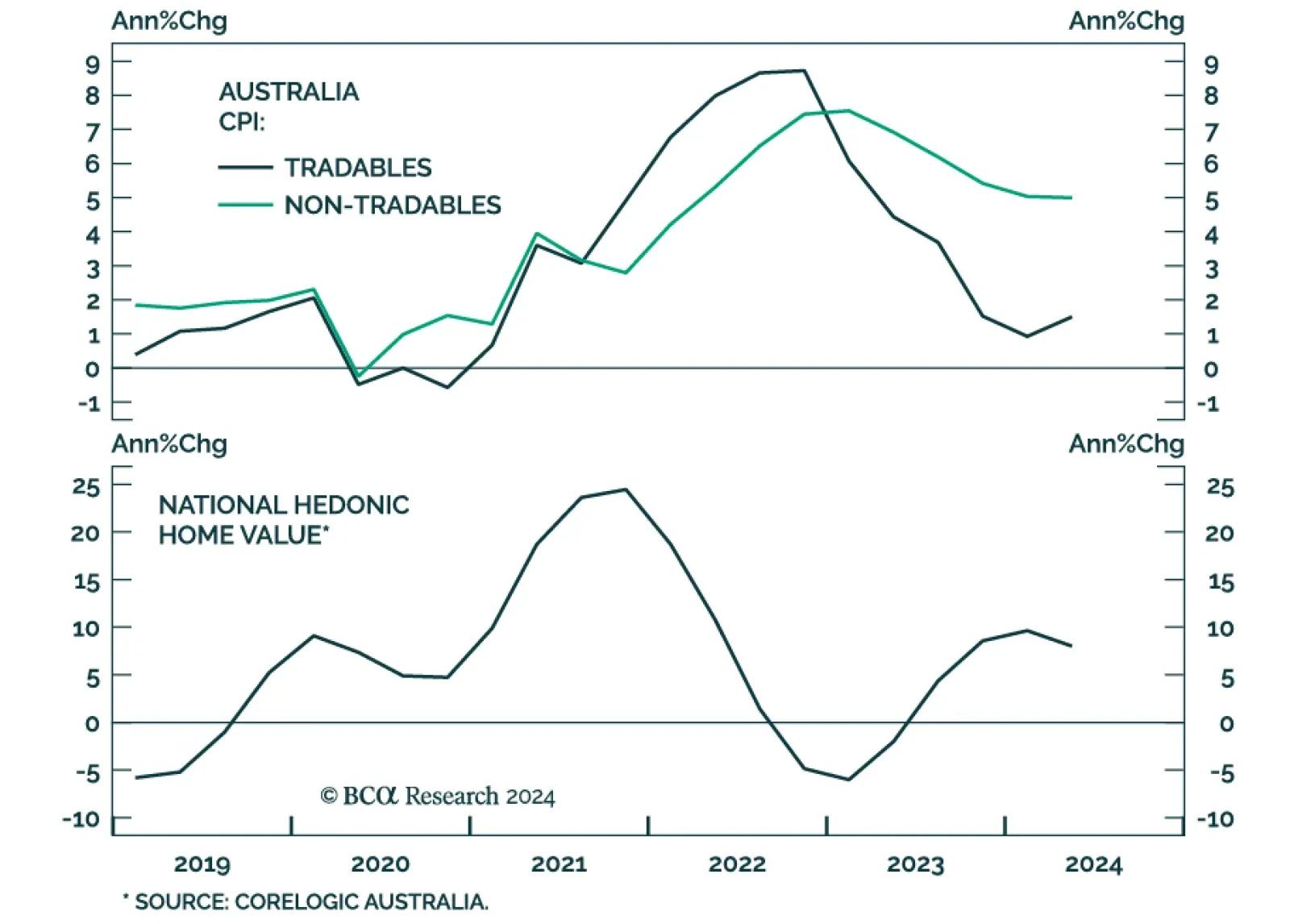

The RBA kept its cash rate unchanged at 4.35% in August, in line with expectations. However, it lifted its trimmed-mean inflation forecast to 3.5% y/y in Q4 2024 and to 2.9% by Q4 2025 (up from 3.4% and 2.8% in its May forecast,…

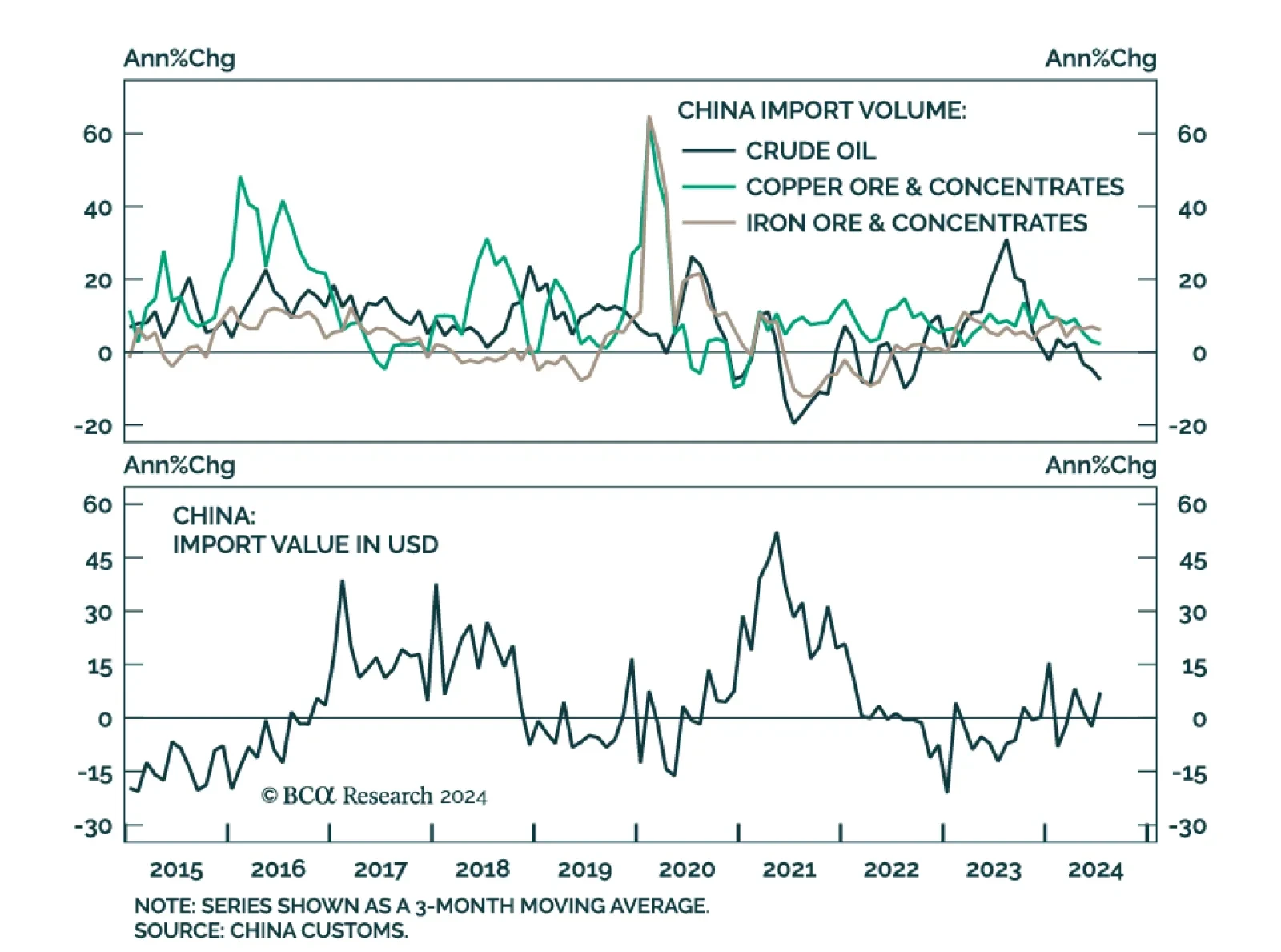

Chinese exports in USD terms missed expectations in July, growing by 7.0% y/y, down from 8.6% in June. Conversely, imports rebounded smartly from a 2.3% contraction, rising by 7.2% in July and upending expectations of 3.2%.…

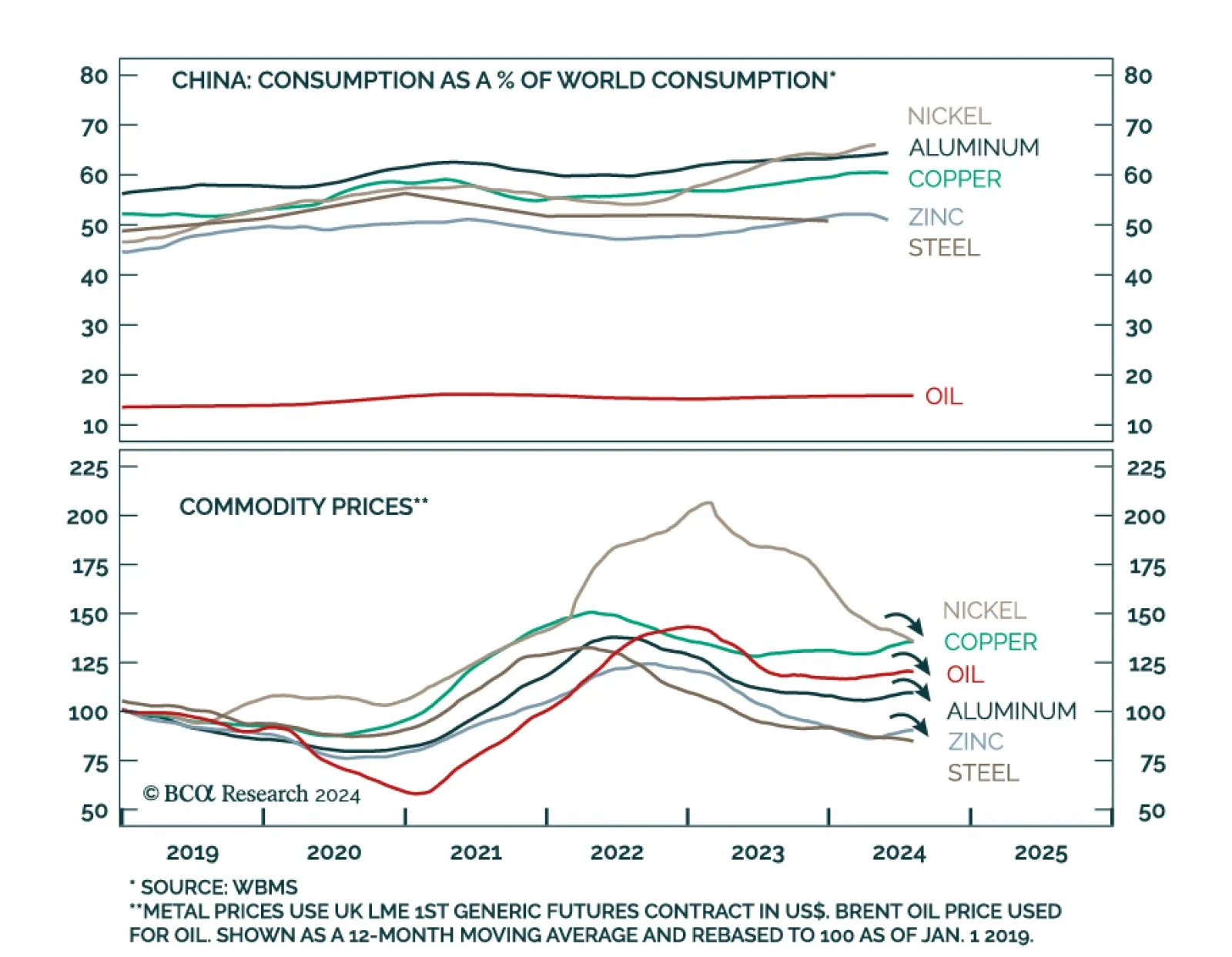

Industrial metals were one of the worst performing asset classes last month. Have prices declined enough to make them an attractive investment? The outlook for industrial commodity prices is bearish over a 12-month horizon…