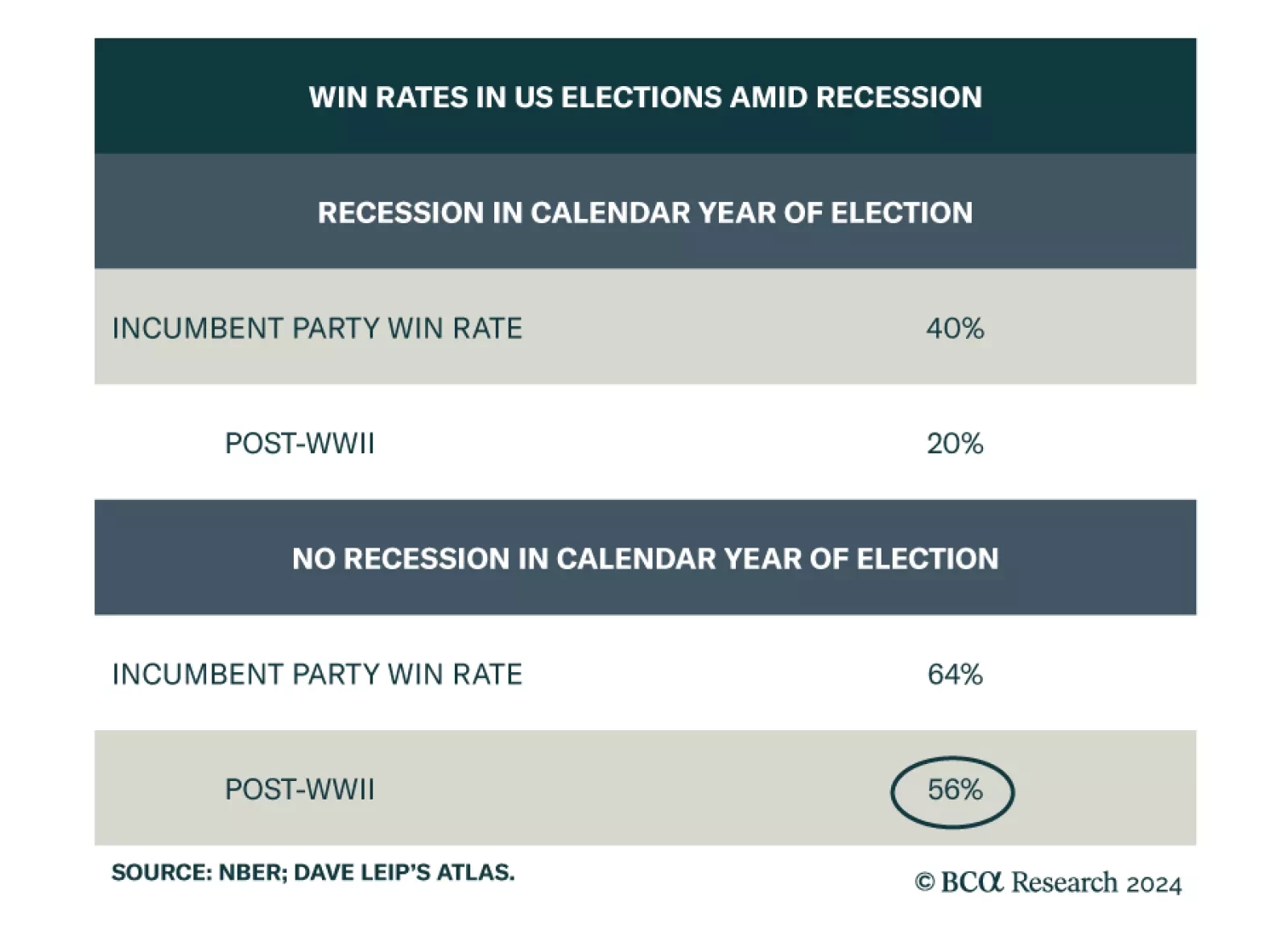

According to BCA Research’s Geopolitical Strategy service, seven surprises with non-negligible odds could tip the scale in favor of Republicans for the White House by November 5. One of them is a war between Israel and Iran…

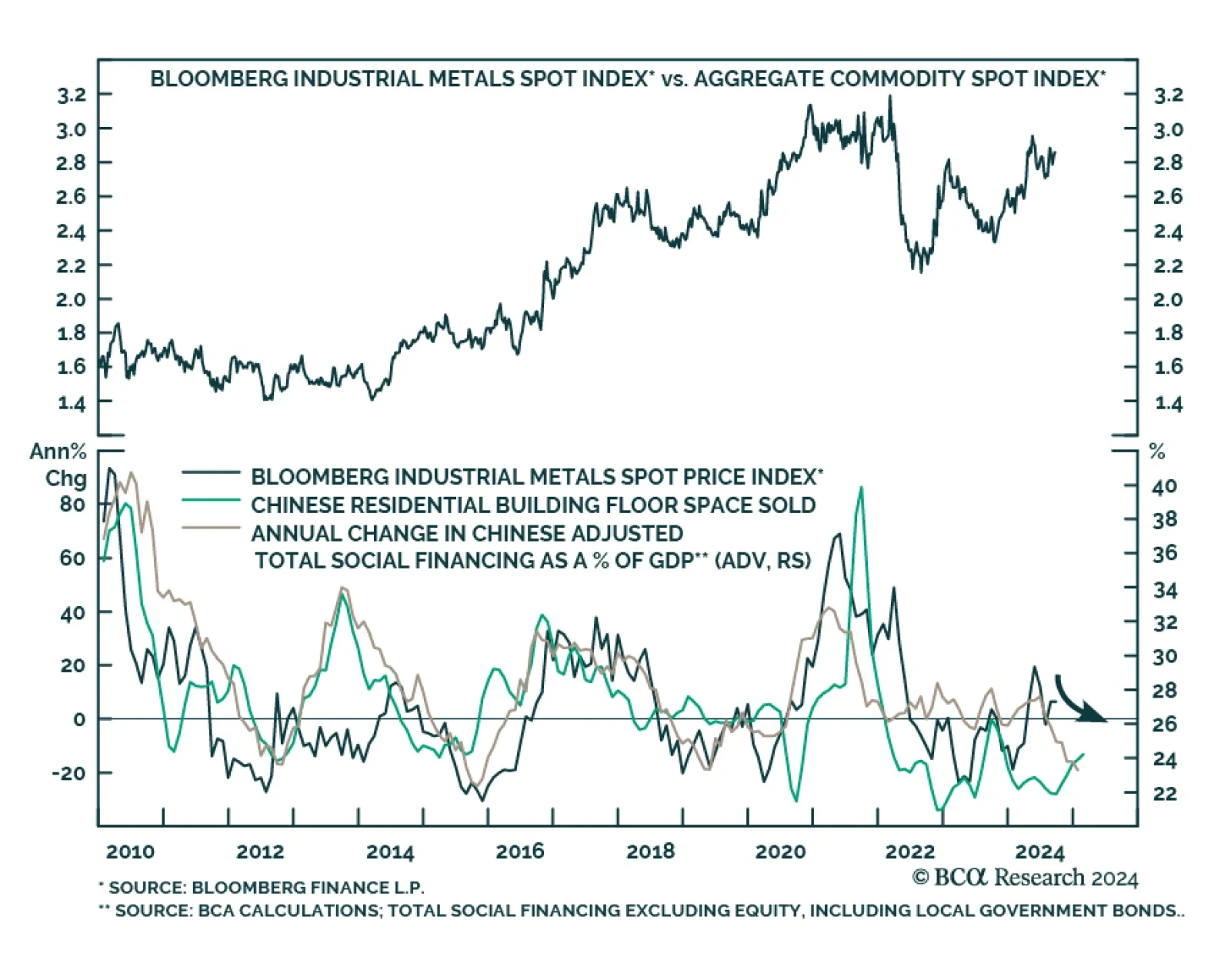

Industrial metals returned a whopping 6% over the past week. Bullish investor sentiment is likely driving these gains. The soft-landing narrative has been gaining traction in recent days with markets pricing in increased odds…

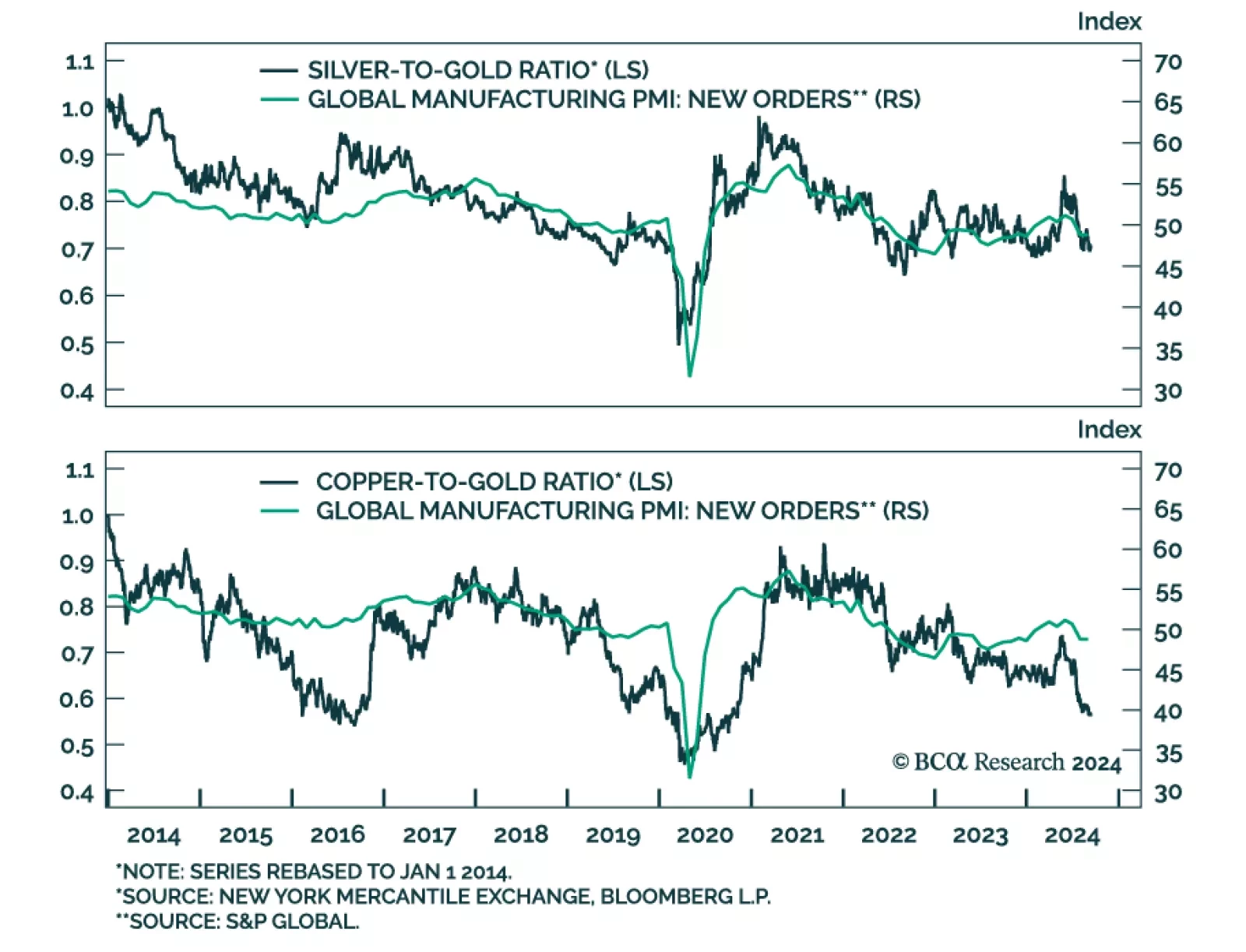

As an industrial metal, copper acts as a barometer of economic activity. Silver and gold are safe-haven assets with inflation-hedging properties, though silver is relatively more sensitive to global growth developments given that…

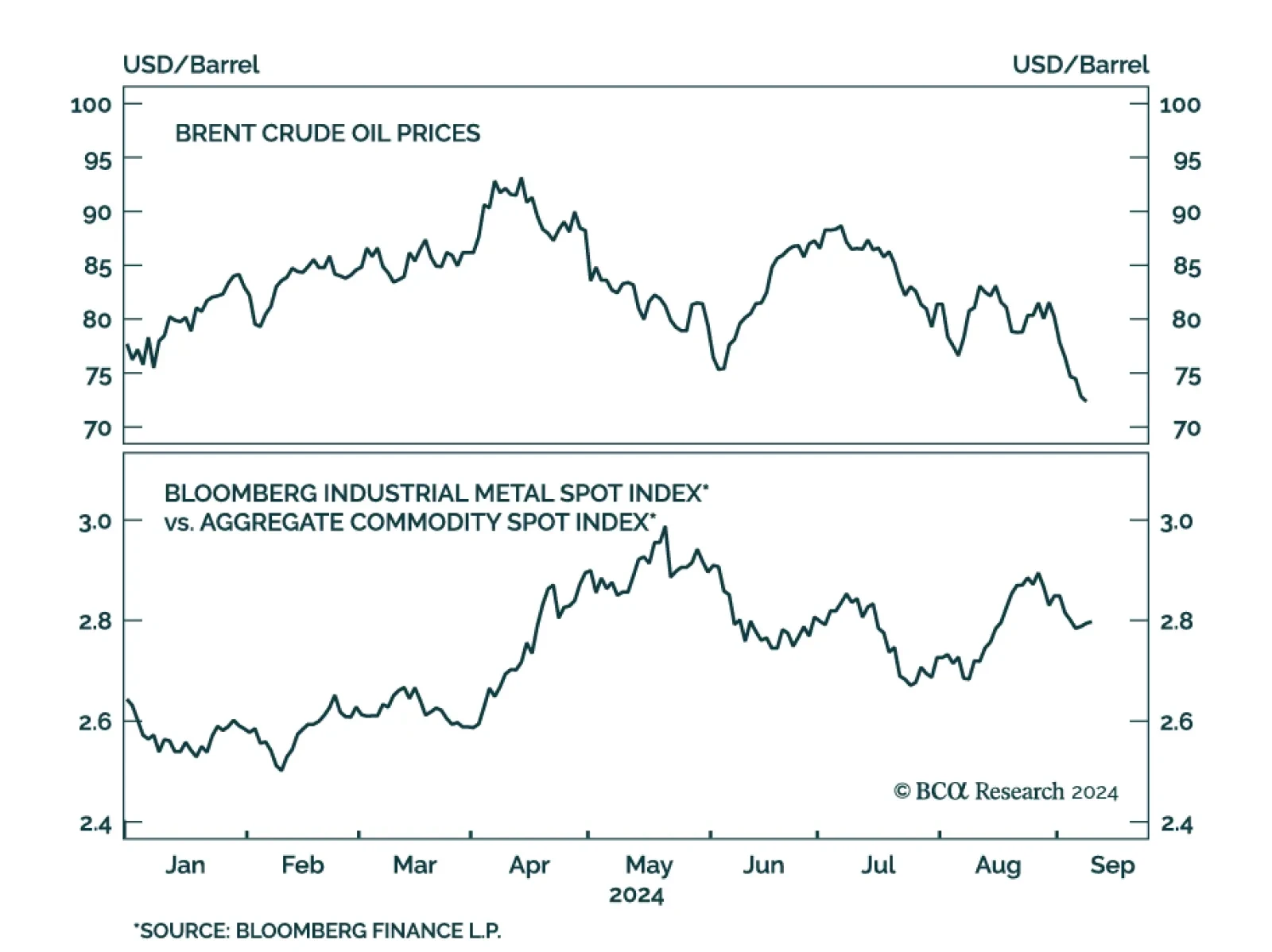

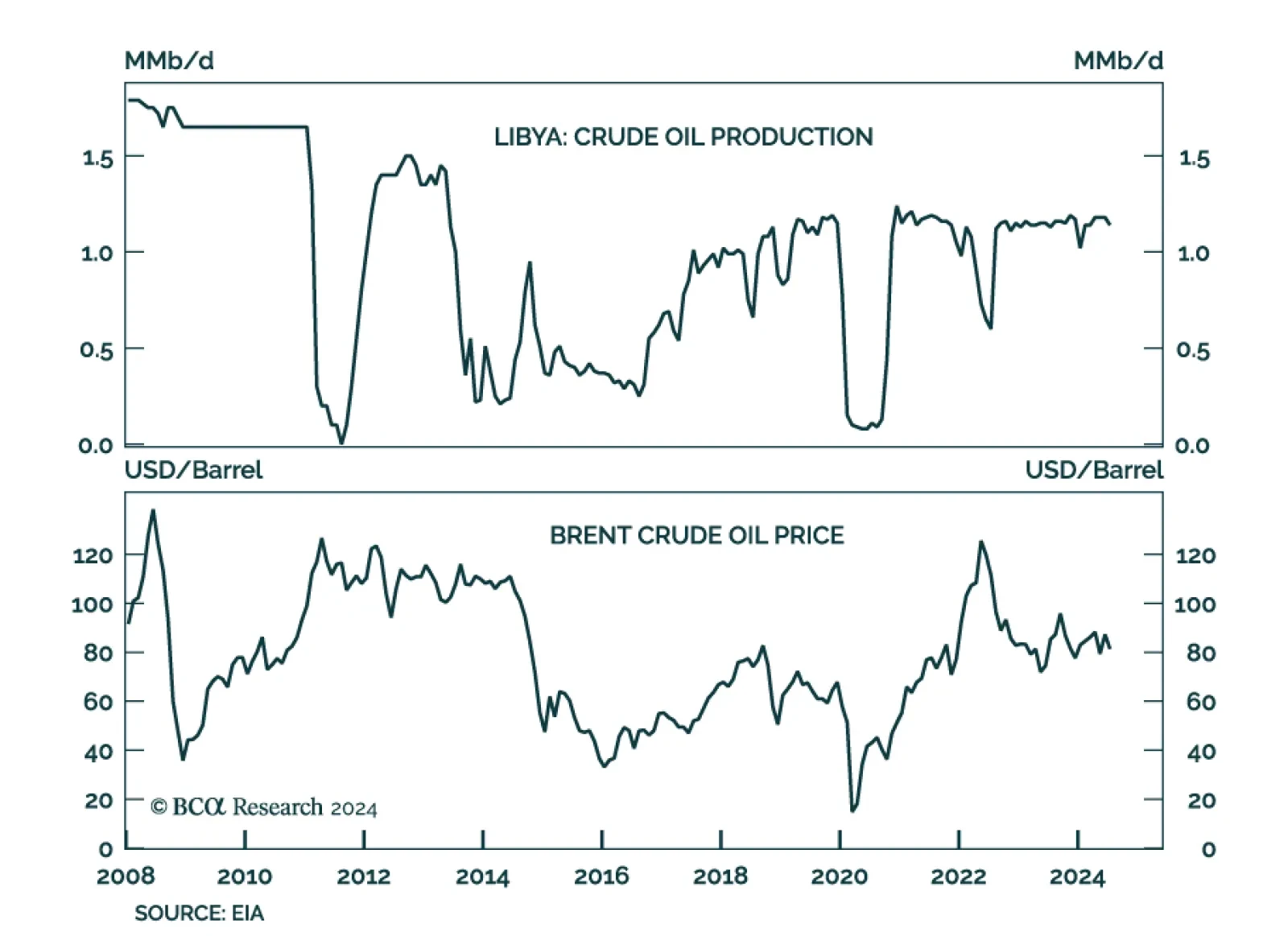

The decline in oil prices accelerated this month. Although Wednesday’s moves reversed Tuesday’s sharp daily declines, Brent and WTI have fallen 11% and 10% so far in September, and 30% and 33% from their April peaks…

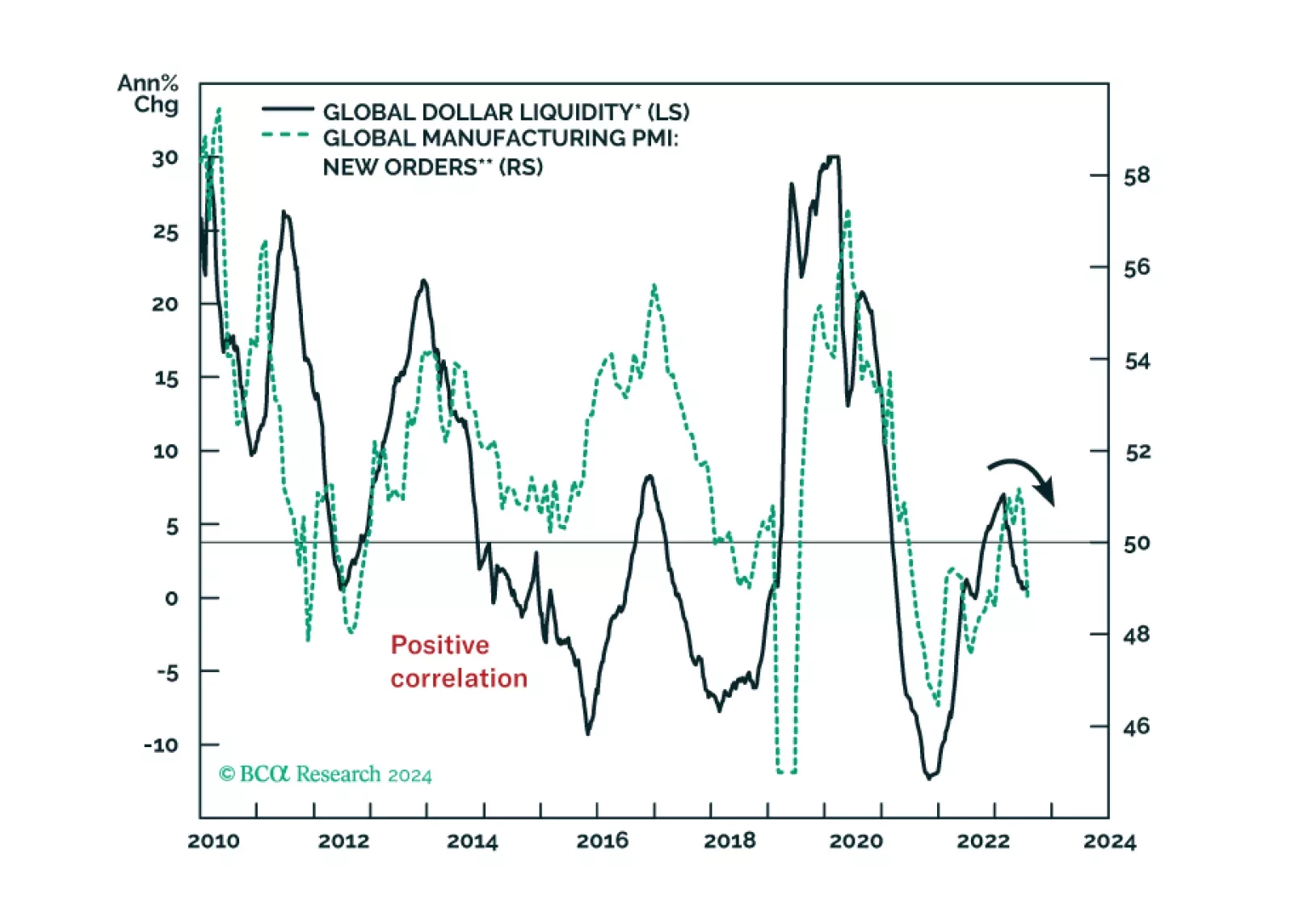

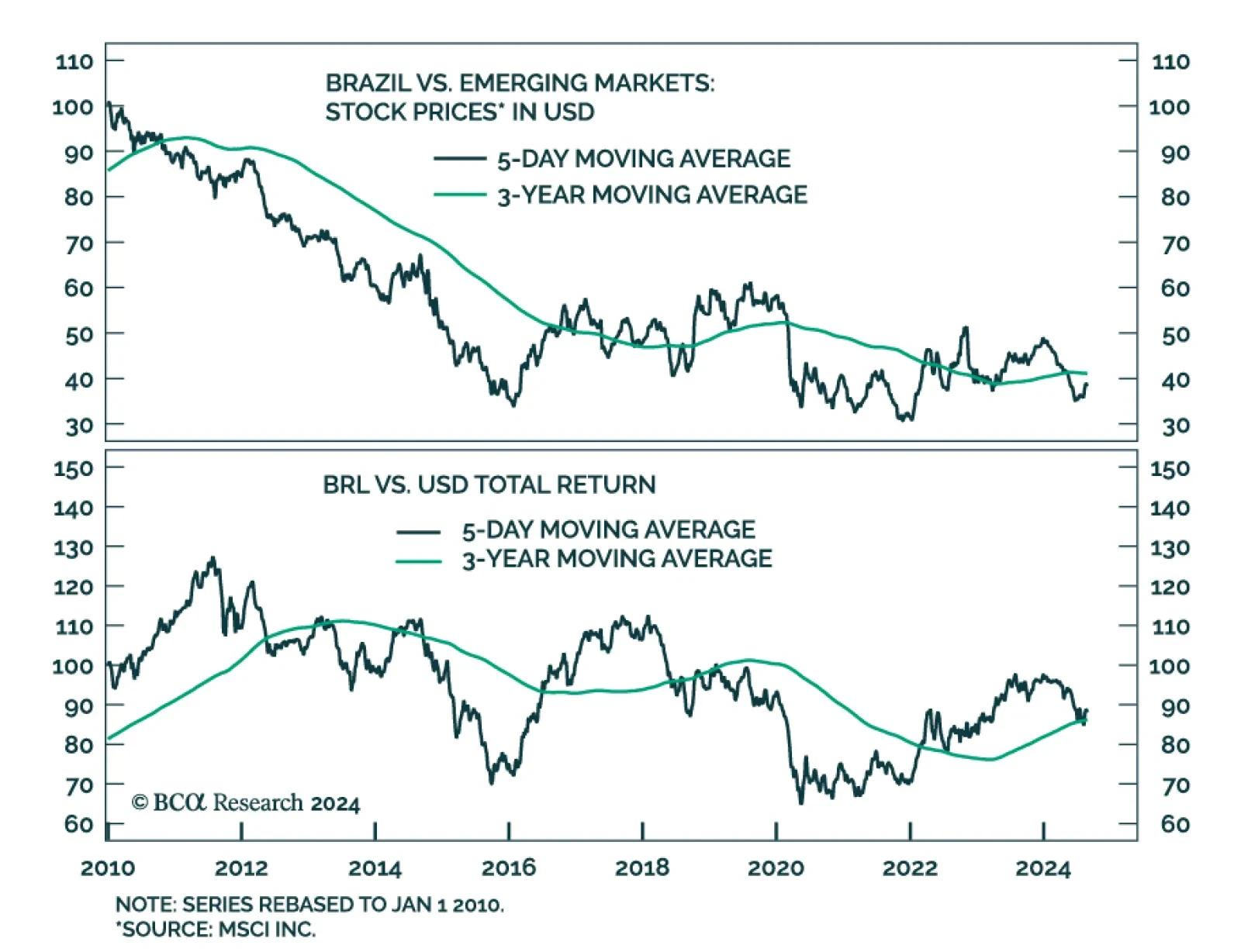

The undercurrents of global financial markets signal deteriorating global growth conditions. There is little cash on the sidelines in the US, the Euro Area, and Japan. If the budding bear market resembles the 2000-2003 one, EM stock…

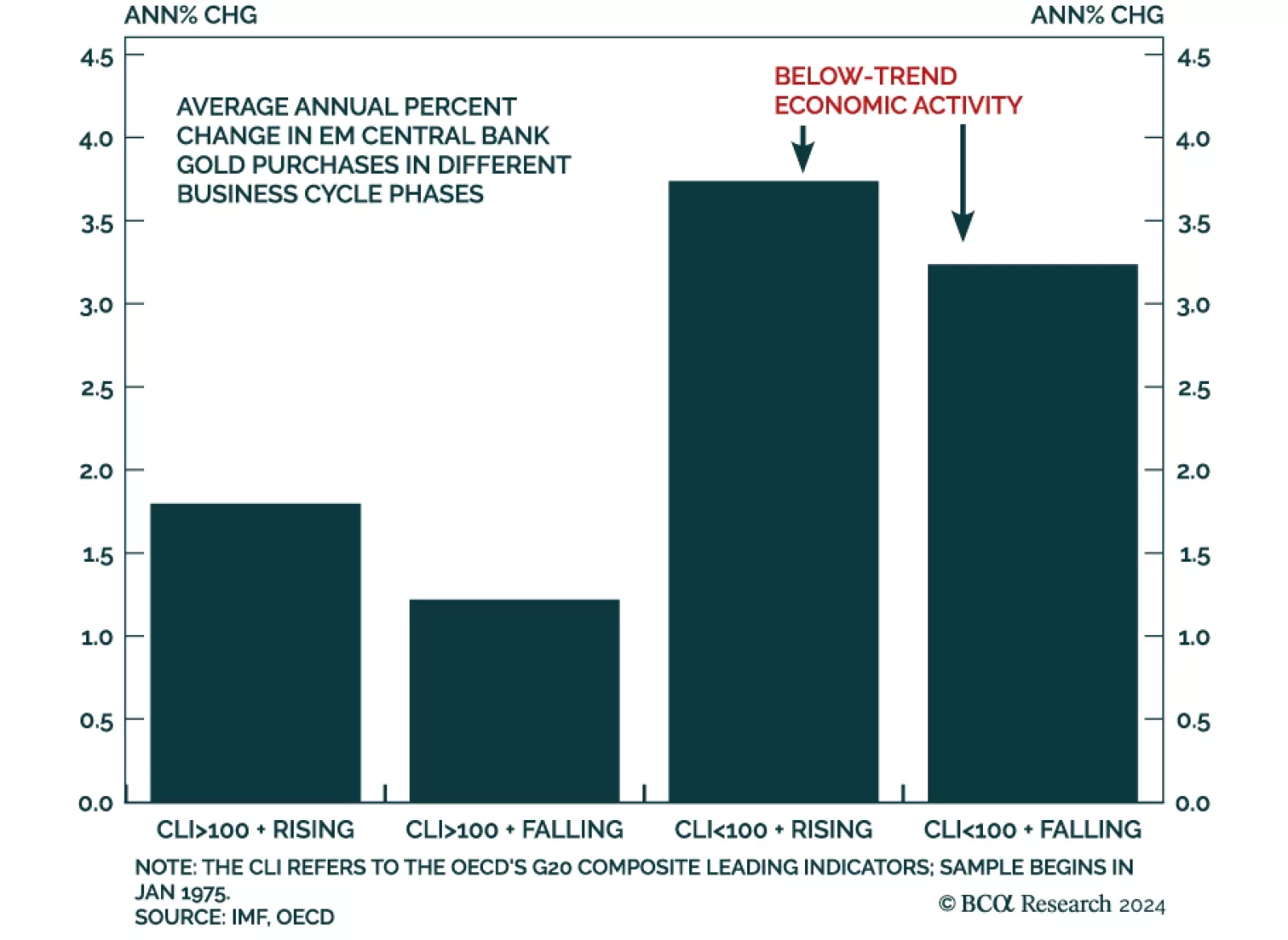

According to BCA Research’s Commodity & Energy Strategy service, central banks will continue to be a key source of gold demand. Central bank purchases in the first half of this year exceeded first-half purchases in…

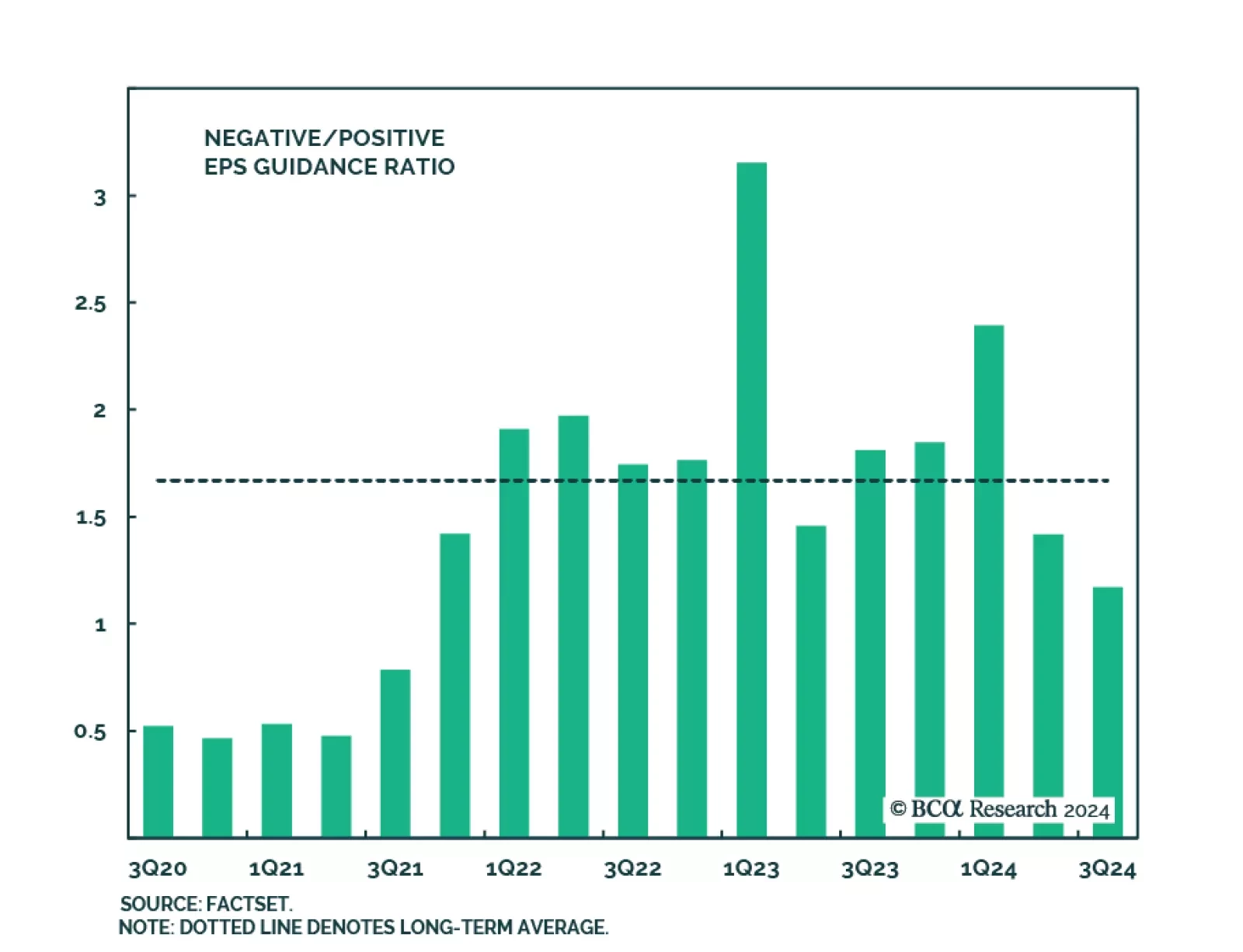

The Q2 2024 earnings season is drawing to a close with 93% of S&P 500 companies having reported results as we go to press. Nearly 80% (60%) of companies have topped earnings (sales) expectations in Q2, according to Factset…

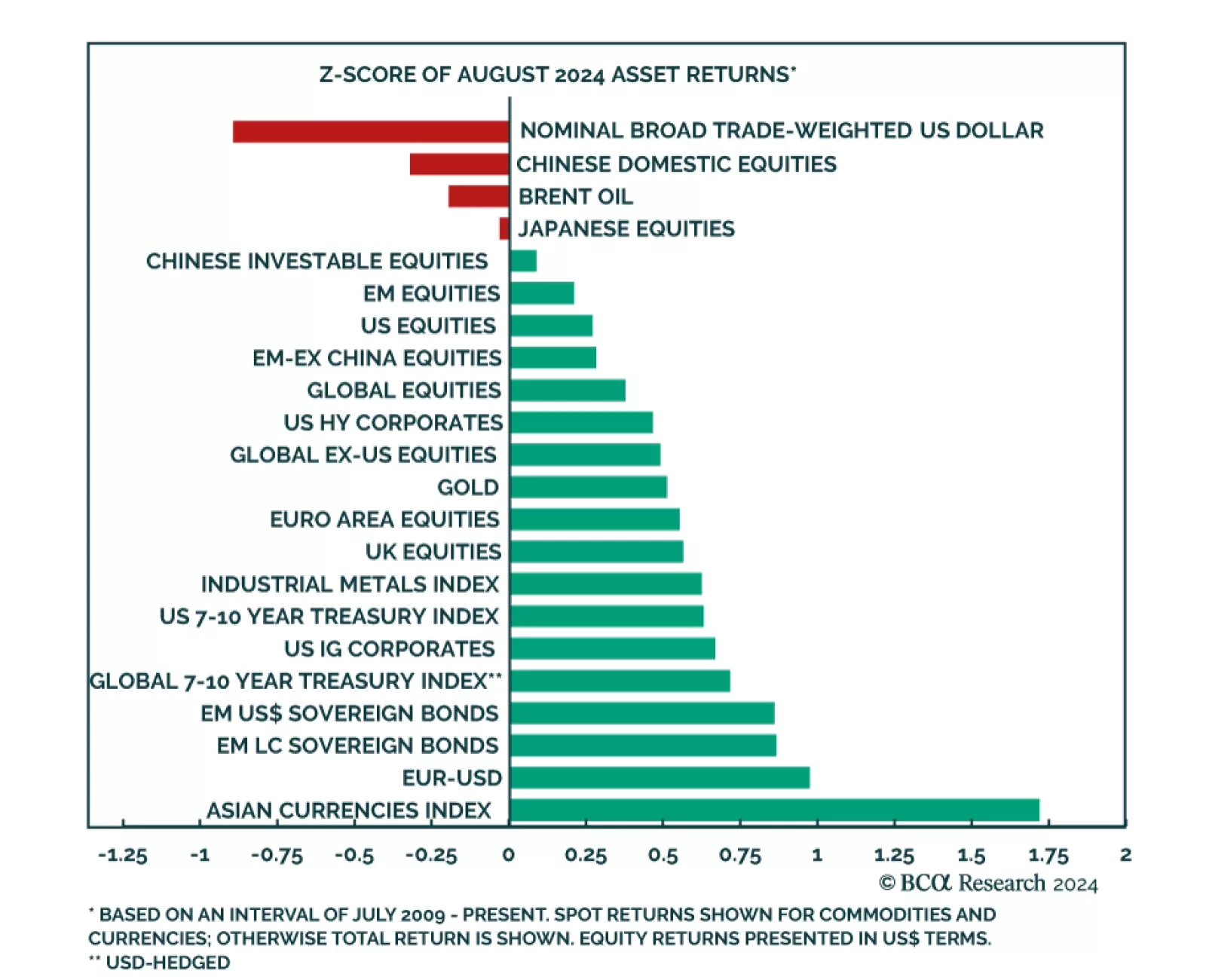

The risk-on soft-landing narrative dominated investors’ psyche last month and pro-cyclical assets topped the August return ranking. Asian currencies led the pack by a wide margin, while the dollar was the largest laggard…

According to BCA Research’s Commodity & Energy Strategy service, oil markets are caught in a tug-of-war that has kept oil prices in a trading range since H2 2023. Bearish demand concerns are enforcing an upper limit on…

Brazilian equities have largely underperformed their EM peers in USD terms since the beginning of the year. Rising public debt and inflation are the two main forces weighing on the Brazilian bourse. Our Emerging Market…