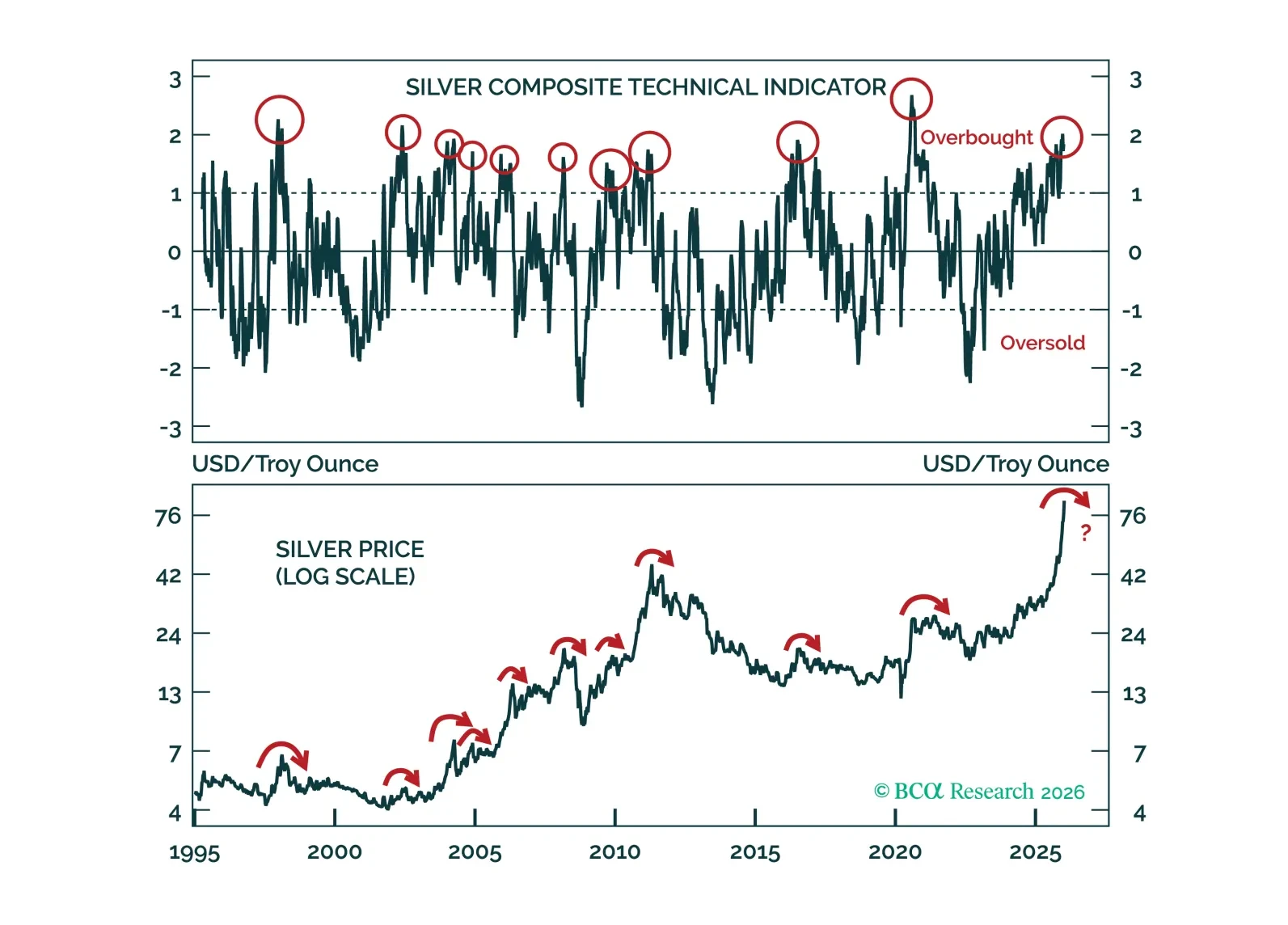

After silver's parabolic surge, we assess the rally's vulnerability by examining its weakest links. We conclude that silver is ripe for a pullback.

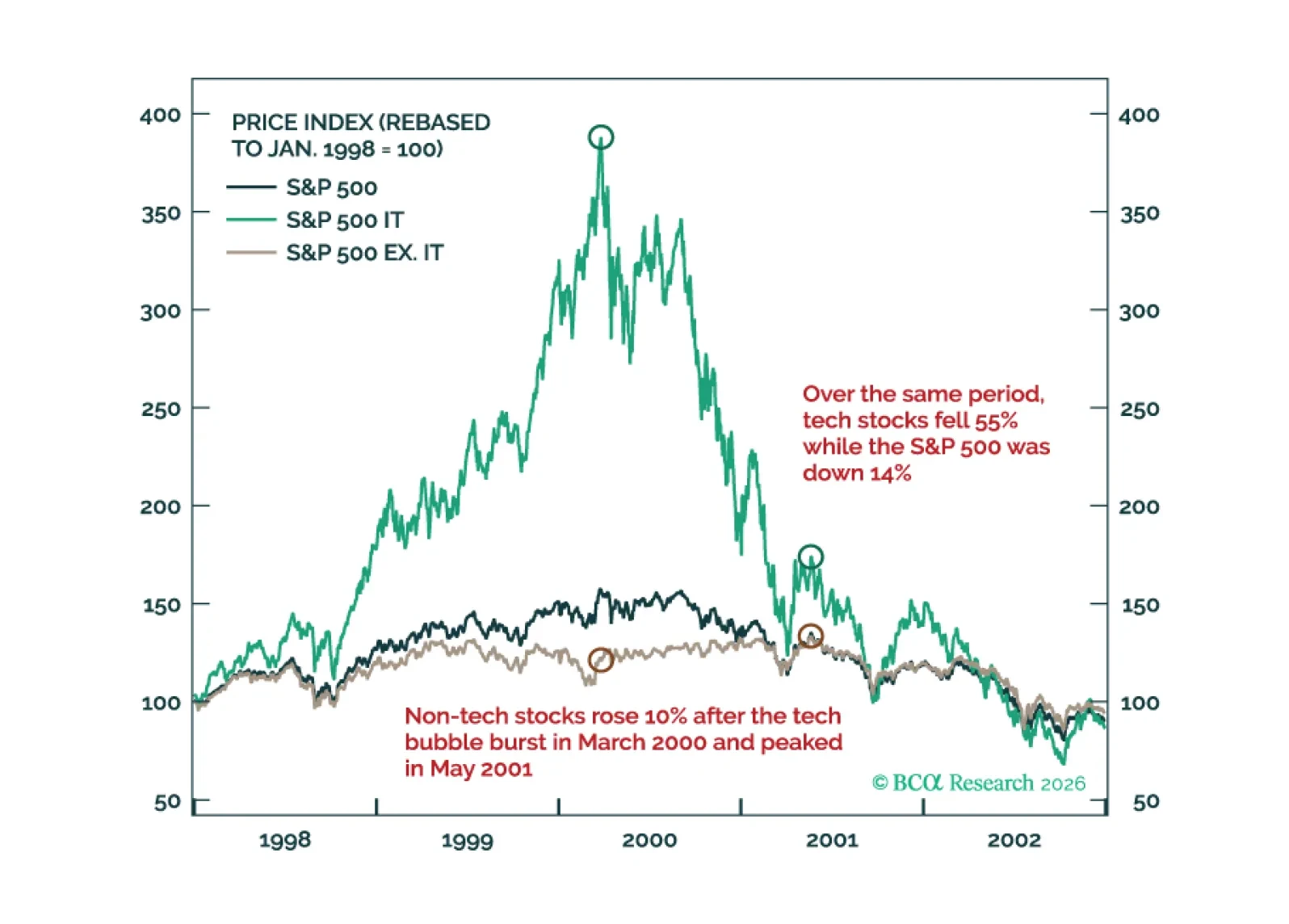

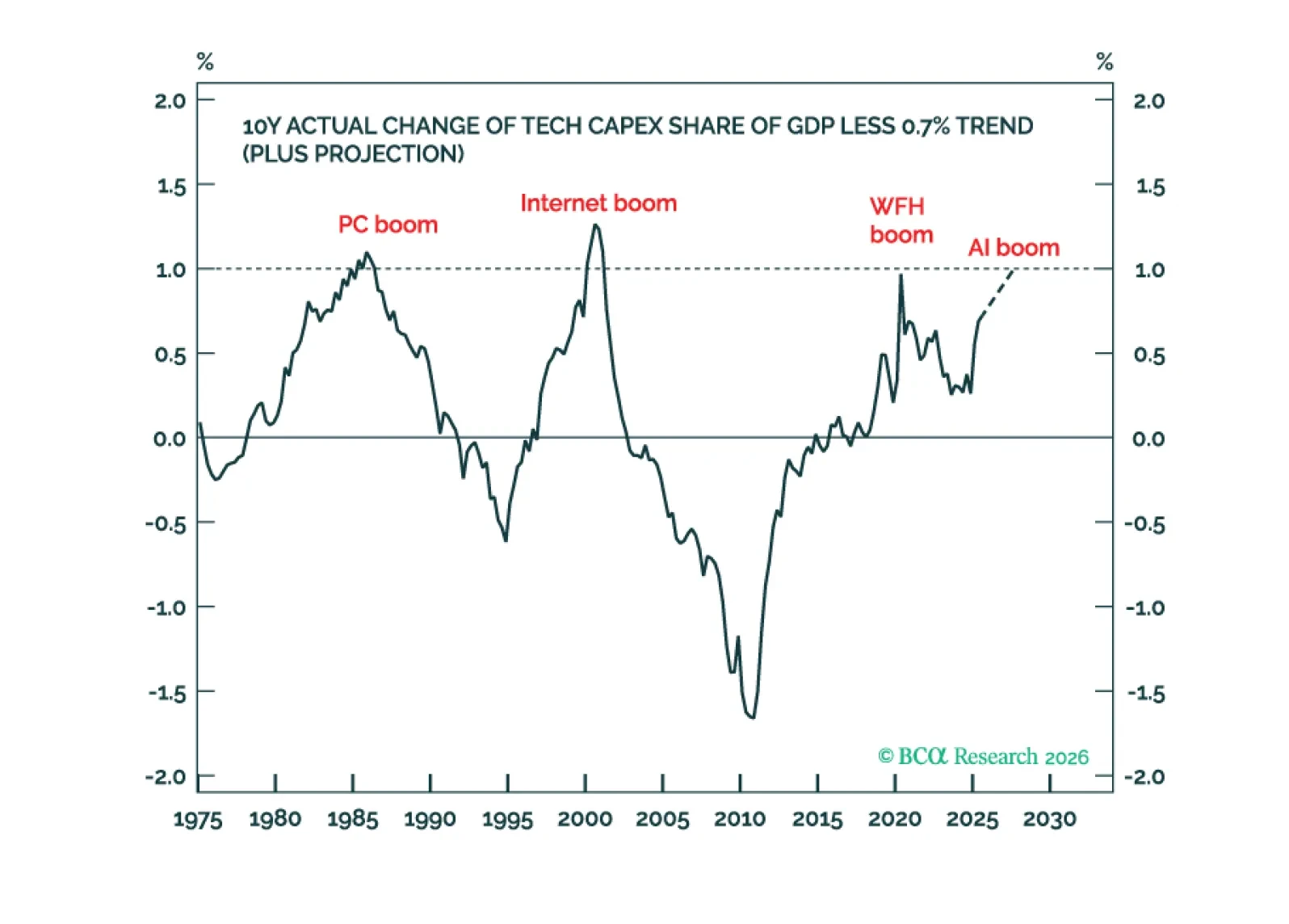

Much like the 2000 episode, we expect this year to unfold in two stages: A “Great Rotation” from tech stocks to non-tech names in the first half of 2026 followed by a broad-based selloff in stocks in the second half on the back of a…

2026 has closer parallels with 2021 than with 2000 because an ultra-accommodative Fed can prolong the stock market rally even as a tech capex boom ends. Plus, a new tactical trade is short silver versus gold.

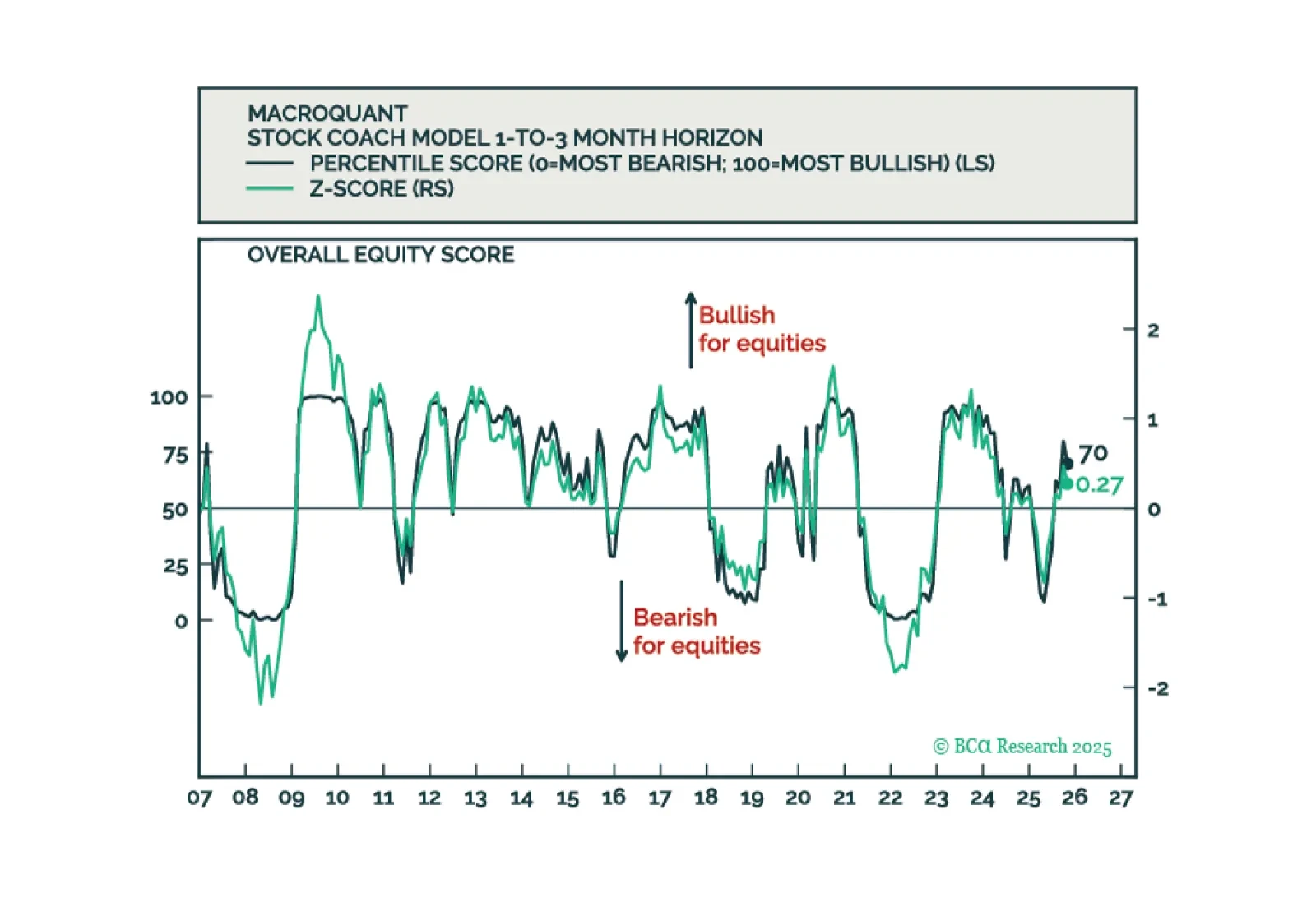

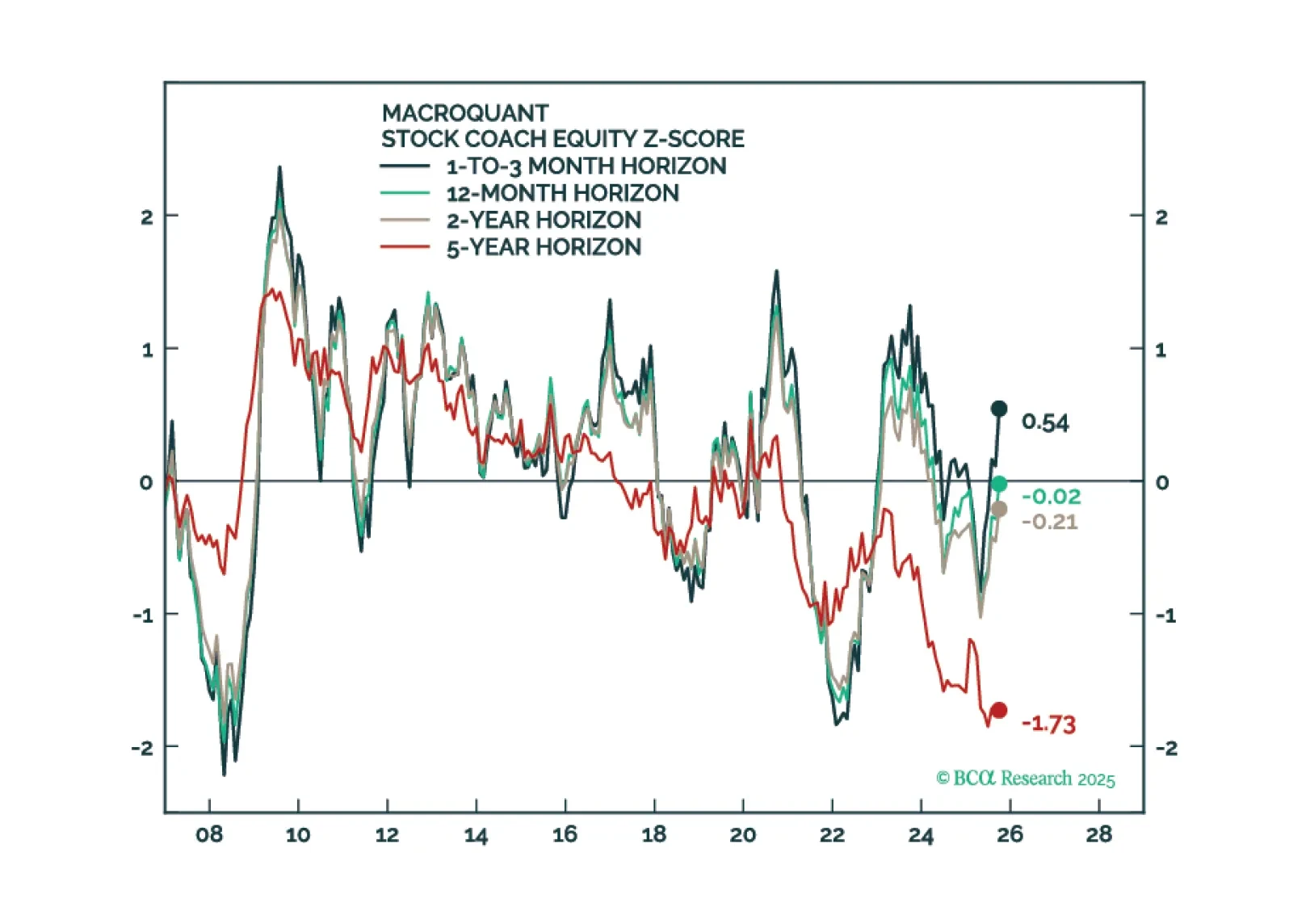

MacroQuant has downgraded equities to underweight, favors a below-benchmark duration stance in fixed-income portfolios, remains bearish on the US dollar, and is still bullish on gold.

This year, we once again present our 2026 outlook as a retrospective from the future – a future in which the AI boom turned to bust.Next week, please join me for a Webcast on Wednesday, December 17 at 10:30 AM EST (3:30 PM GMT, 4:30…

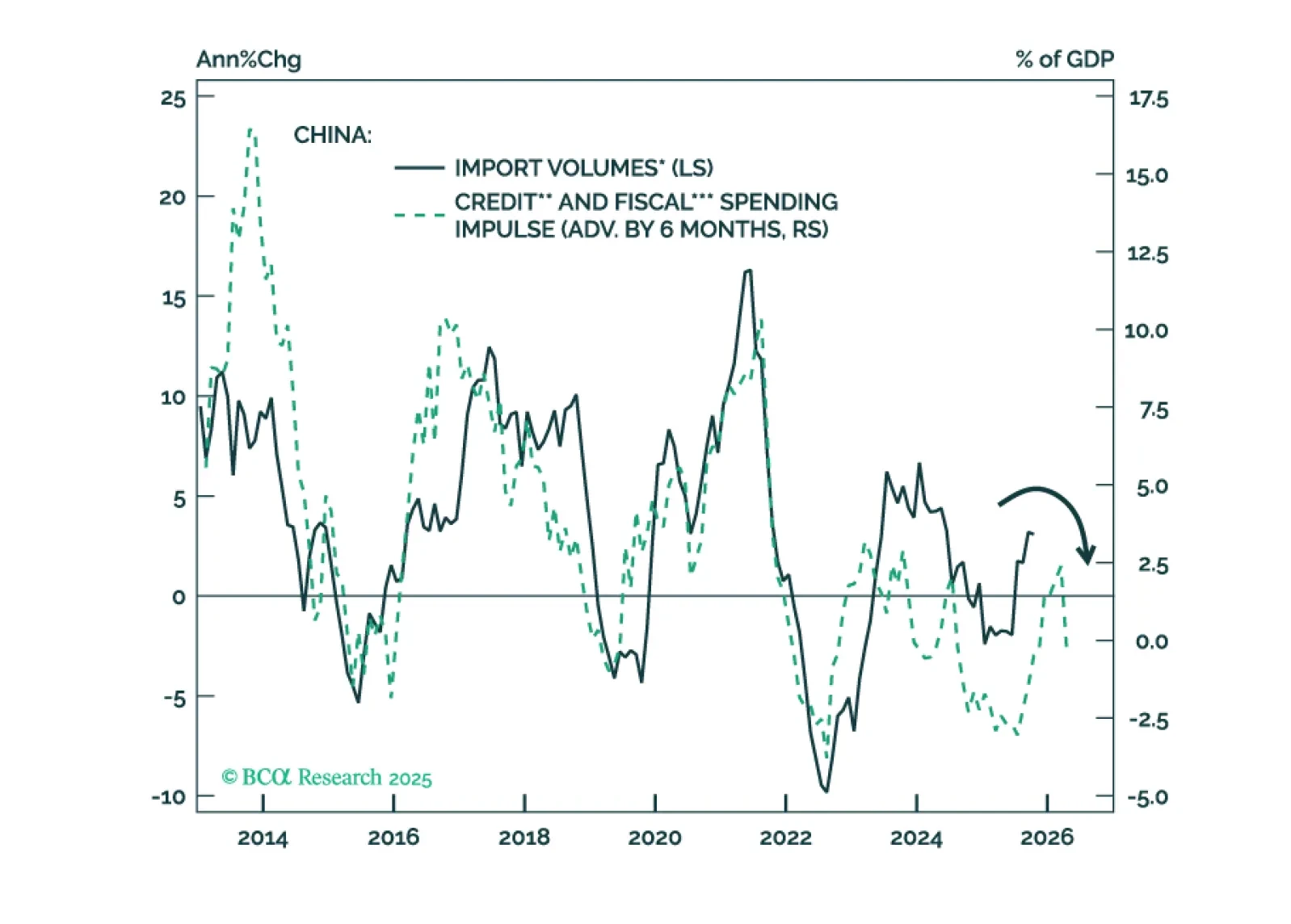

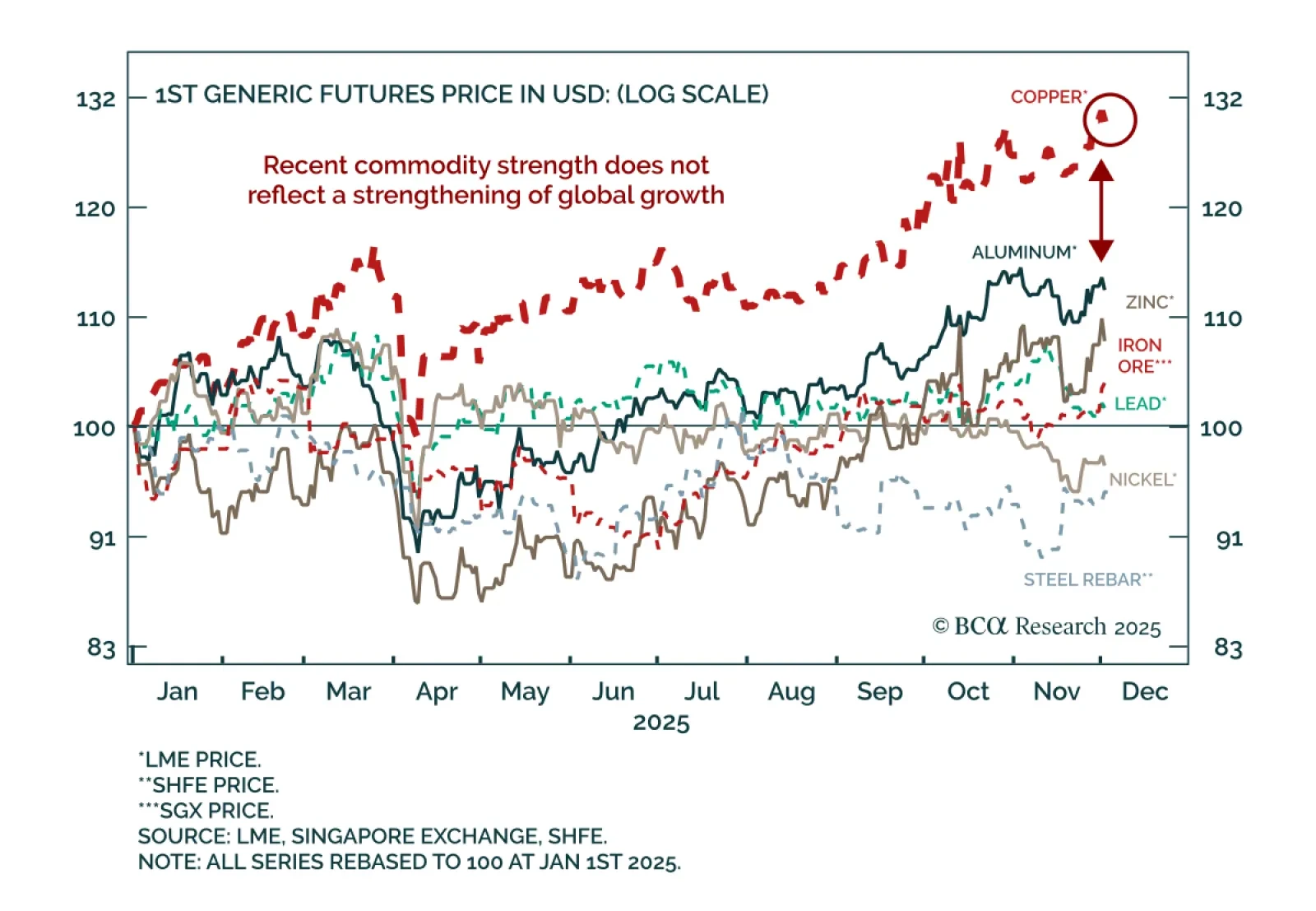

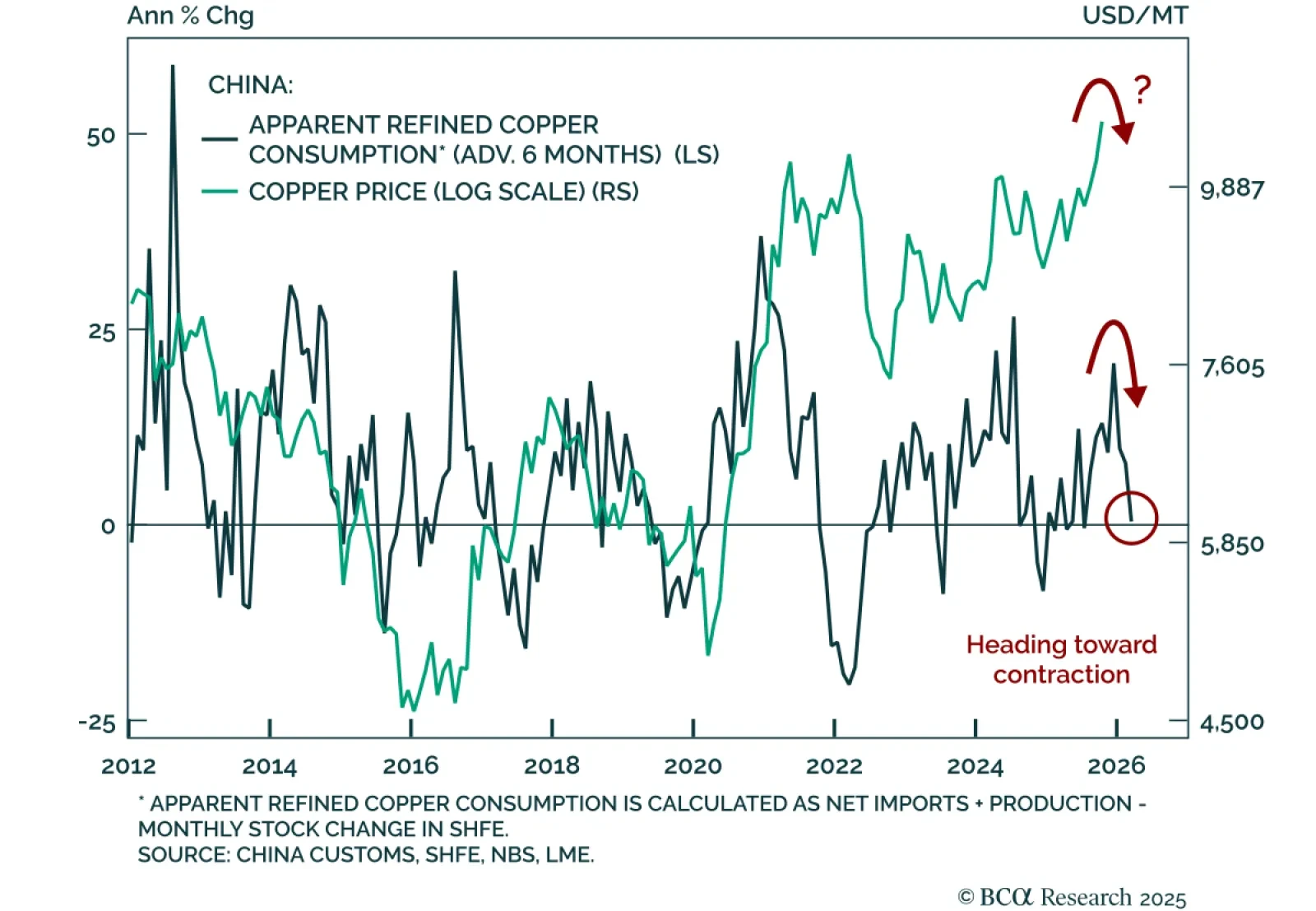

Maintain defensive commodity positioning as recent rallies reflect tariff distortions, not a turn in global growth. Despite soft global growth, copper, silver, gold, and shipping rates have rallied. Our Commodity strategists do not…

MacroQuant remains tactically overweight equities, favors an above-benchmark duration stance in fixed-income portfolios, remains bearish on the US dollar, and is bullish on gold.

Our Commodity strategists remain cyclically short LME copper and introduce a stop-loss at $11,500, as supply-driven strength faces growing demand headwinds. While recent price gains have been fueled by production disruptions and…

MacroQuant is tactically overweight equities, favors an above-benchmark duration stance in fixed-income portfolios, remains bearish on the US dollar, and is bullish on gold and copper.