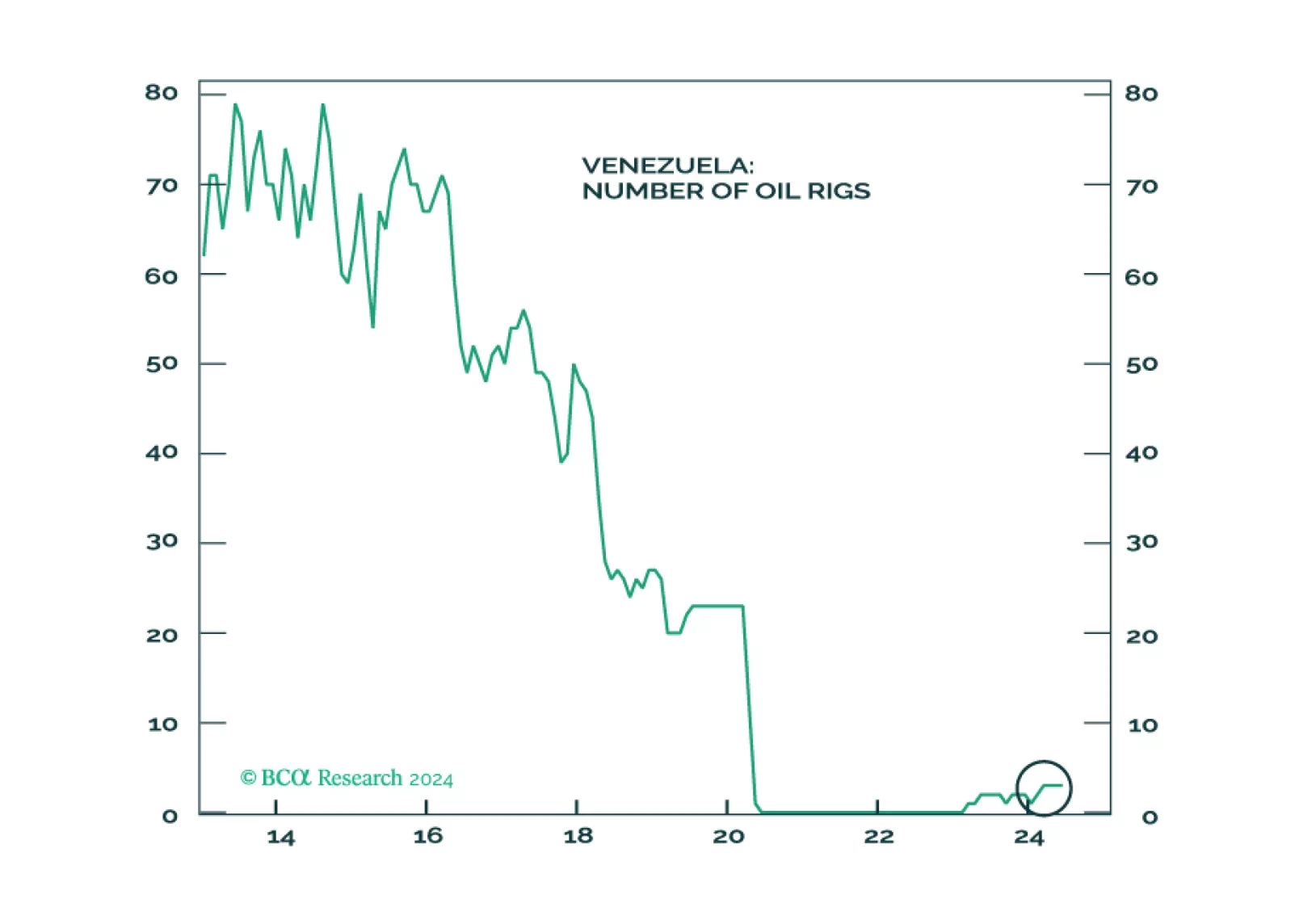

There will be little market and macro implications from the US intervention in Venezuela. Fade away any near-term moves in global oil markets. However, Colombian and Peruvian assets will benefit from lower political risk premiums.…

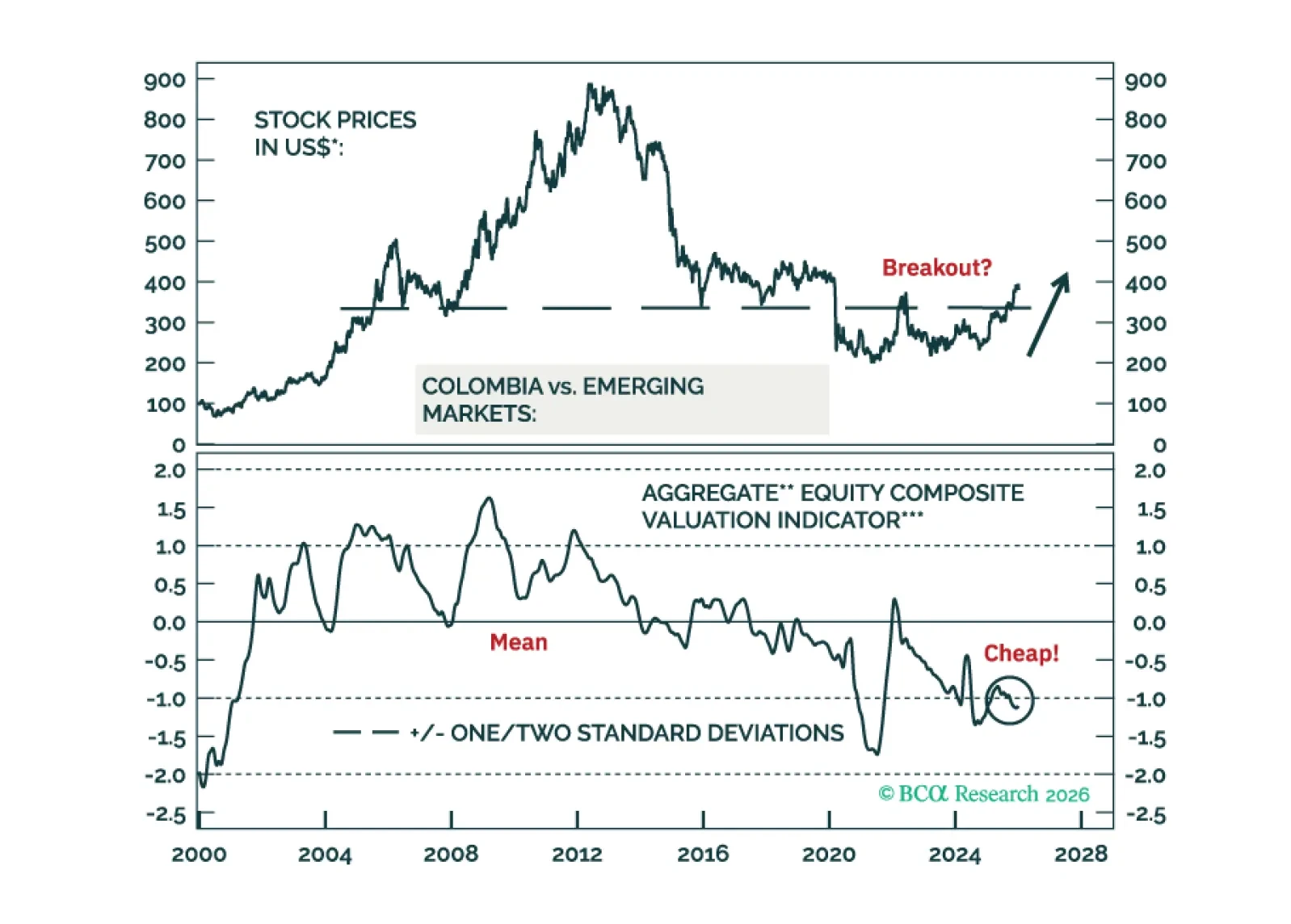

Our Emerging Markets strategists have upgraded Colombian equities, local bonds, and sovereign credit from underweight to neutral relative to EM benchmarks. Markets are caught between optimism about a potential rightward policy shift…

Colombian markets will be torn between expectations of future orthodox policies and the reality of a worsening macro backdrop in the next 12 months. To balance risks, we are upgrading Colombian equities, local bonds, and sovereign…

In this chartbook, we look at the balance of payments across DM and EM countries. The US does not fare well, but neither do a few other countries.

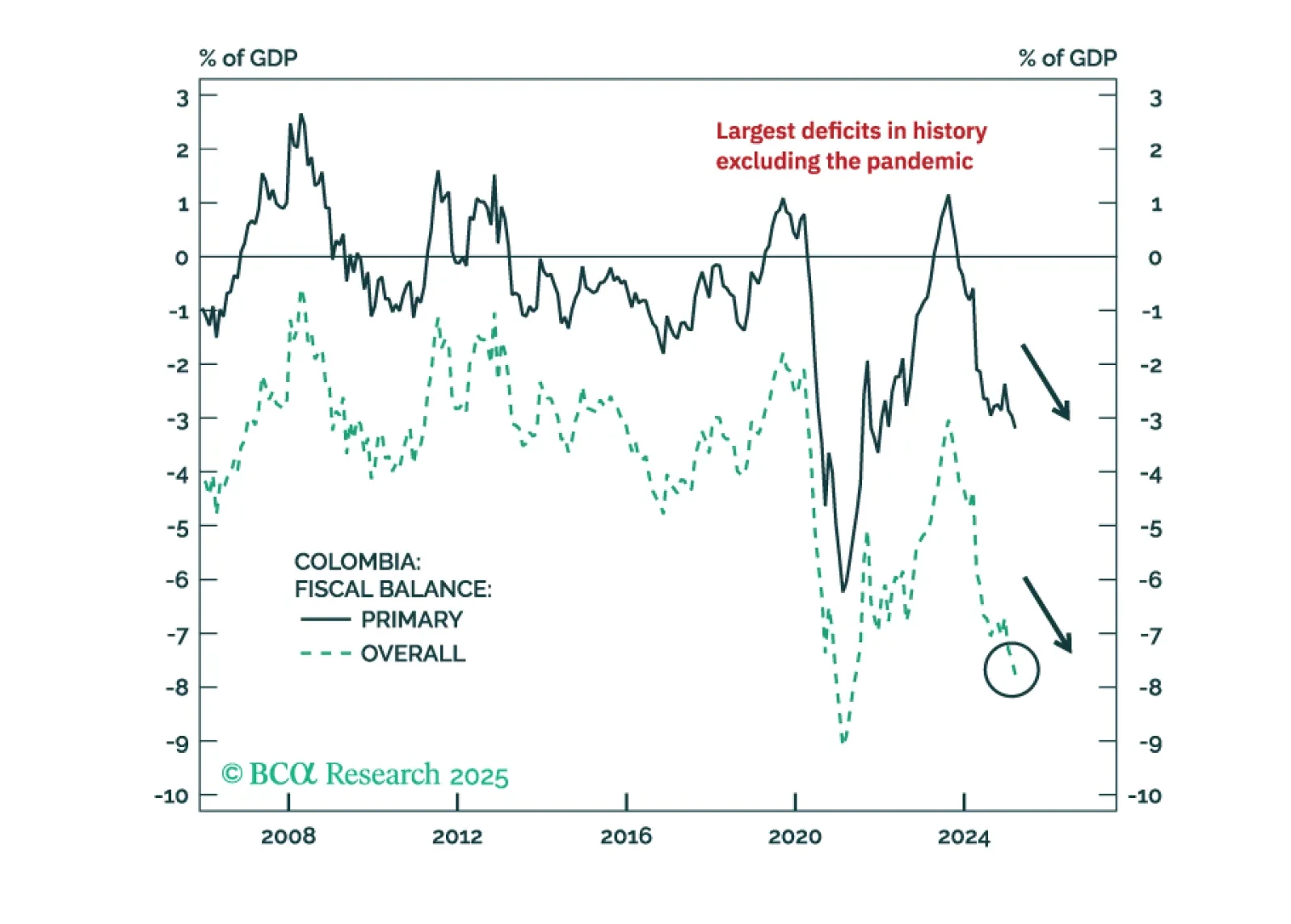

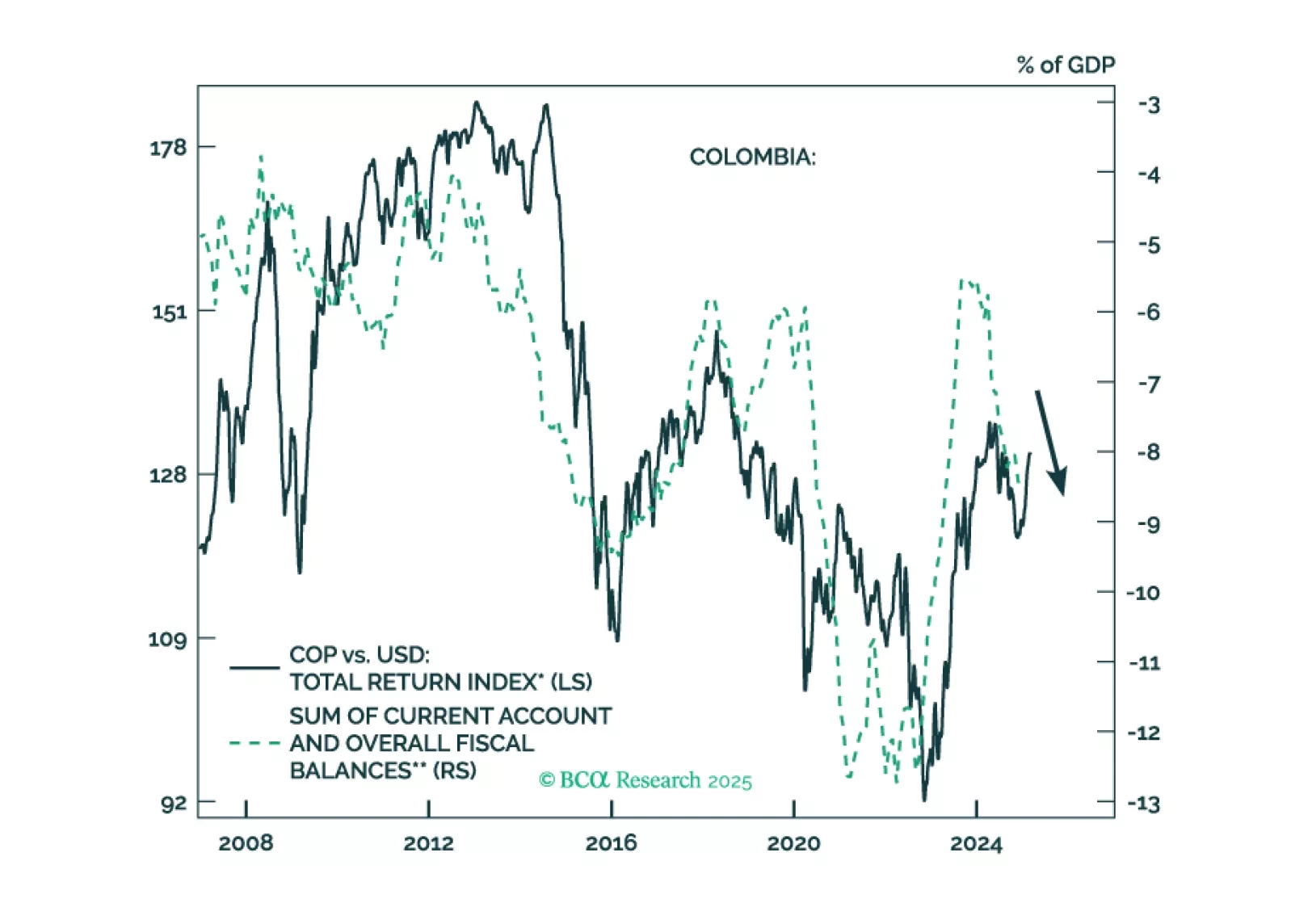

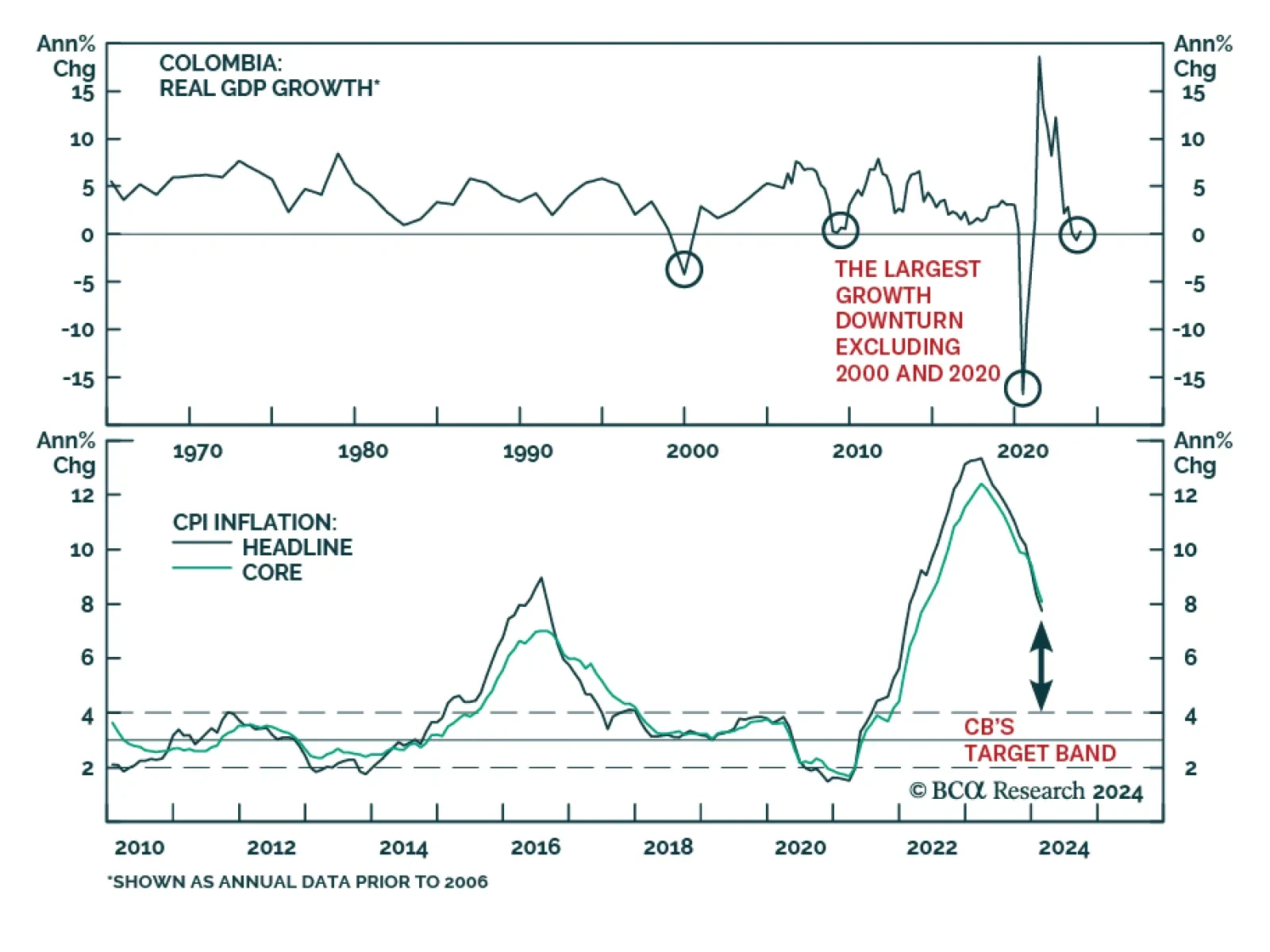

Our Emerging Markets strategists assessed Colombian assets after a significant rally. Colombia faces deep-rooted macroeconomic challenges that will not be easily reversed by a right-wing government in 2026. Public debt is on an…

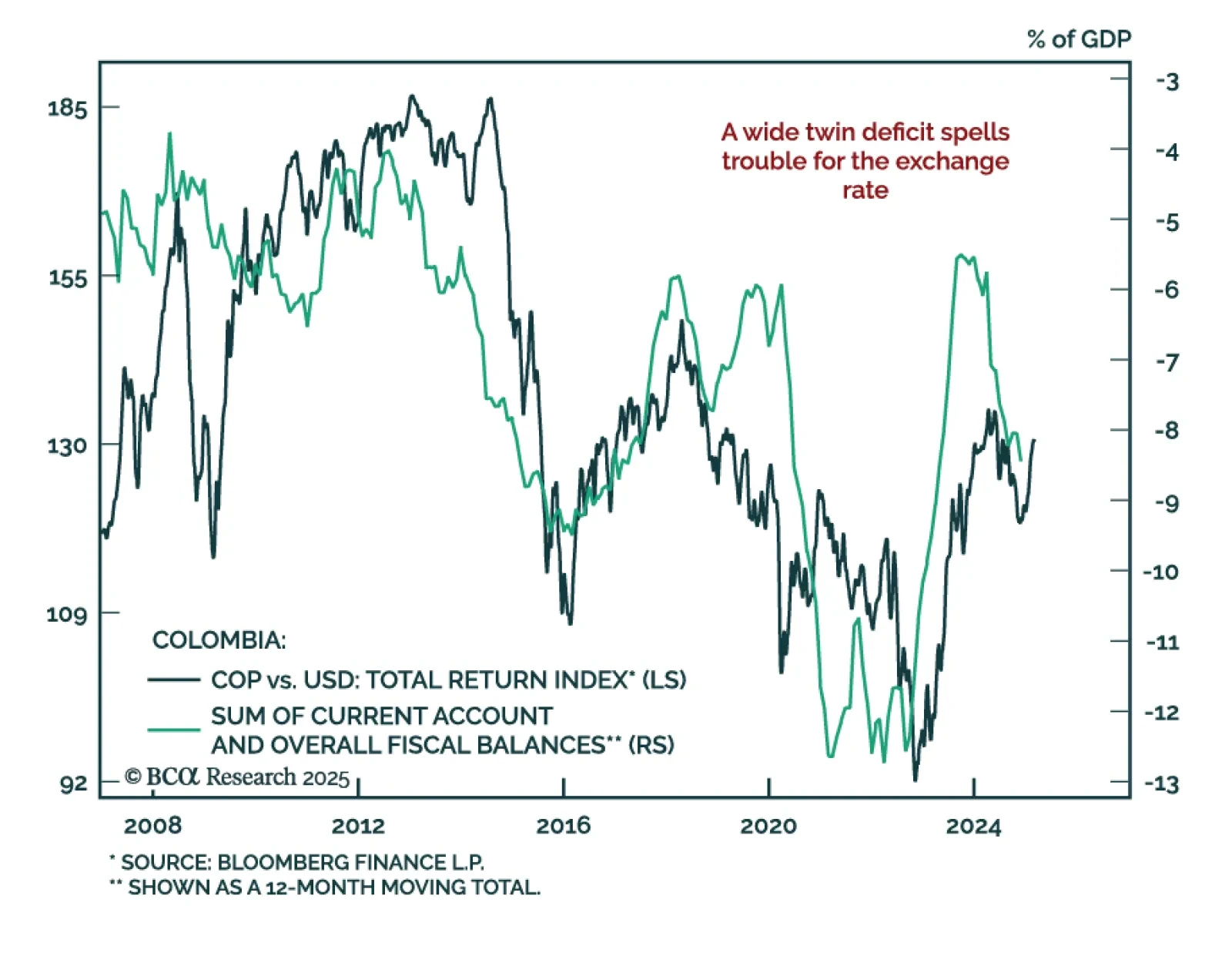

Colombian financial markets have rallied on the expectation that a right-wing government will be elected in 2026. We take a contrarian bearish stance on the nation's financial markets. Colombia is suffering from two…

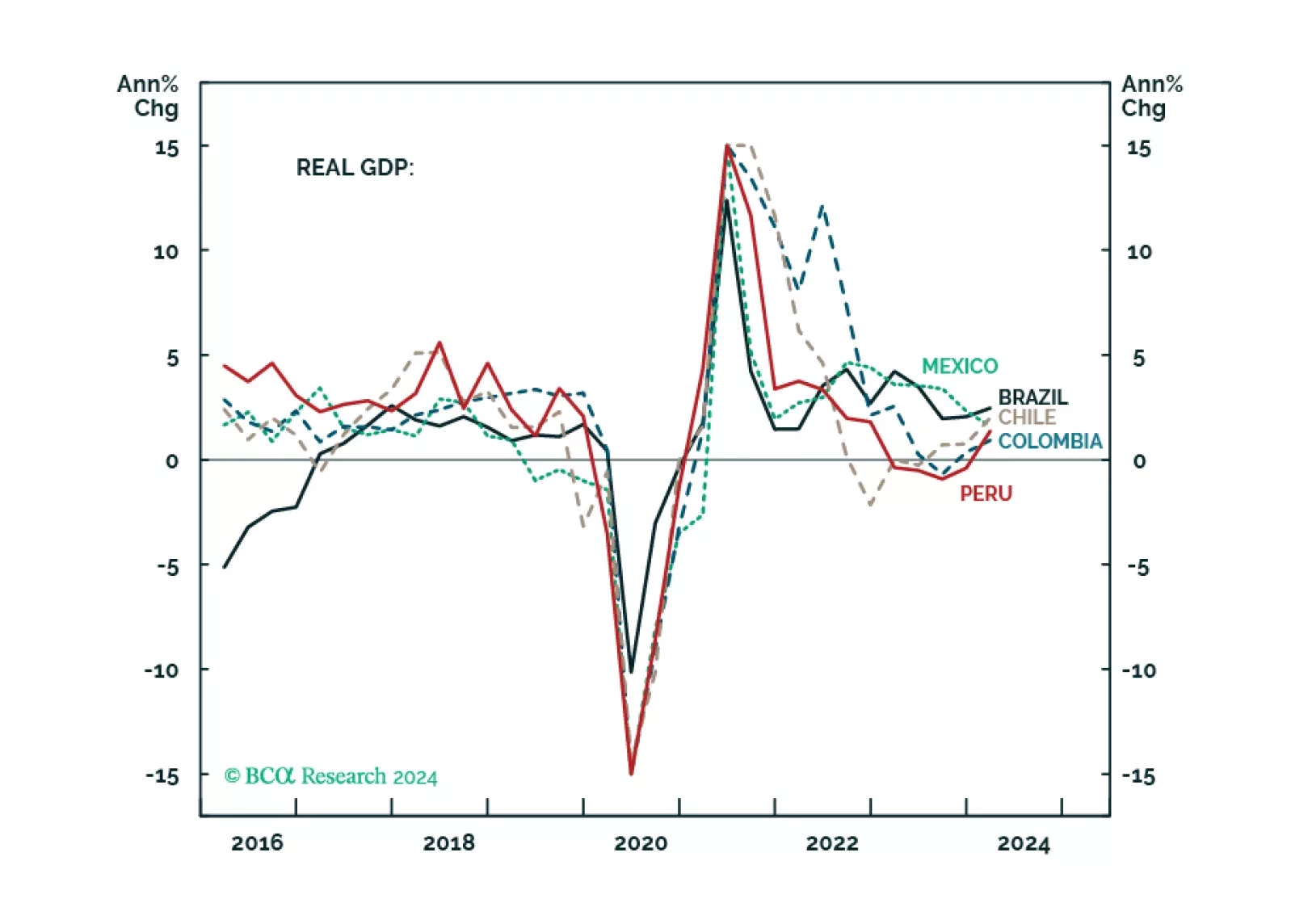

Non-trivial macro divergences have emerged between mainstream LATAM economies. This report compares and ranks Brazil, Mexico, Colombia, Chile, and Peru based on their business cycle outlook, macro policy stance, external accounts,…

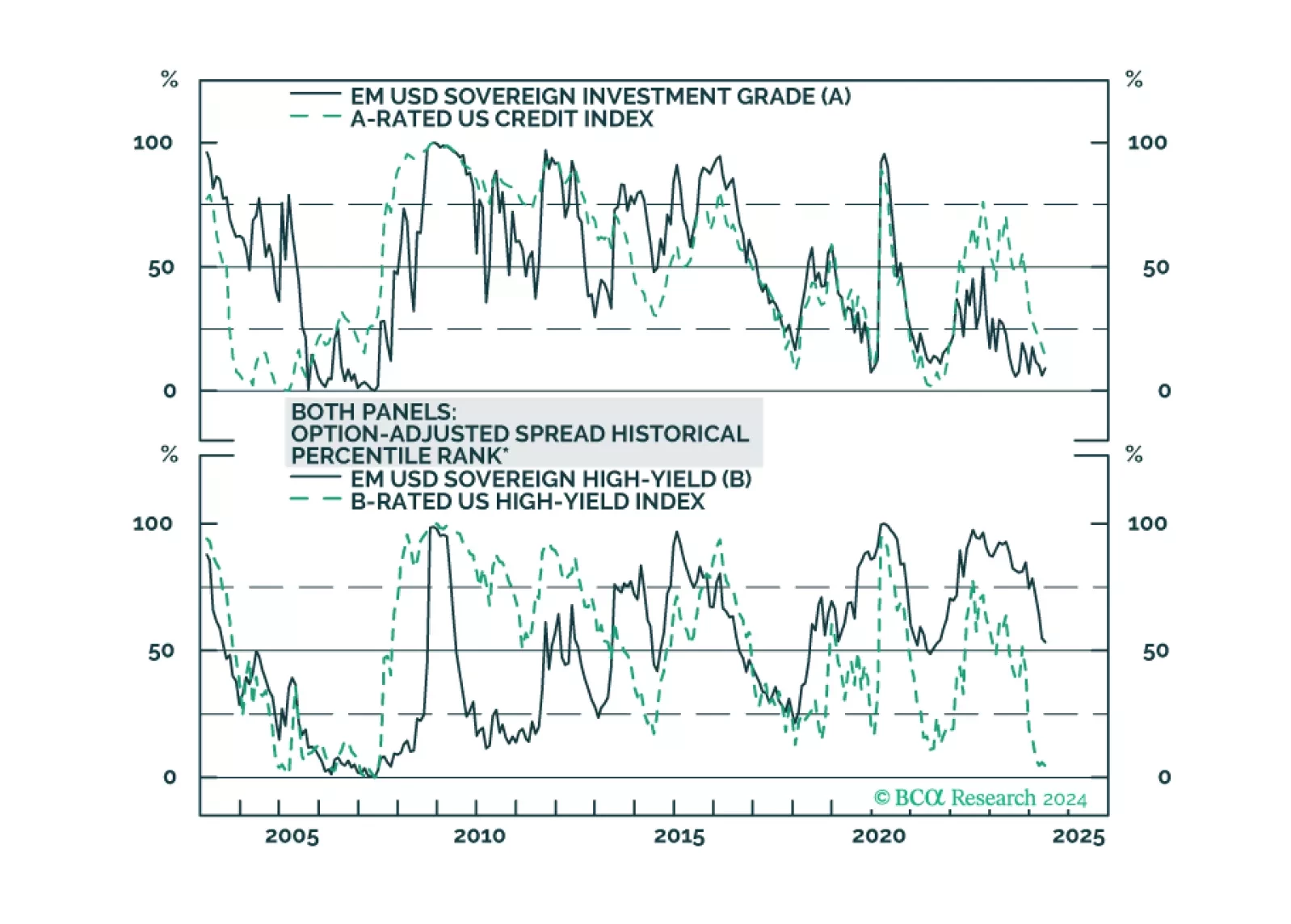

We dig into the USD-denominated Emerging Market Sovereign Index to see which credit tiers and countries offer value relative to US Credit.

Colombia: Macroeconomic Fundamentals, Public Finances, And Political Uncertainty Warrant Underweight

BCA Research’s Emerging Markets Strategy service argues that Colombia has fallen from grace in terms of its healthy macroeconomic fundamentals, business-friendly government policies, and conservative fiscal stances.…