Highlights US natural gas prices will remain well supported over the April-October injection season, as the global economic expansion gains traction, particularly in Europe, which also is refilling depleted storage levels. China's…

Highlights Rising CO2 emissions on the back of stronger global energy growth this year will keep energy markets focused on expanding ESG risks in the buildout of renewable generation via metals mining (Chart of the Week). …

Highlights Continued upgrades to global economic growth – most recently by the IMF this week –will support higher natgas prices. In our estimation, gas for delivery at Henry Hub, LA, in the coming withdrawal season (…

Highlights Yesterday we published a Special Report titled EM: Foreign Currency Debt Strains. We are upgrading our stance on EM local currency bonds from negative to neutral. Before upgrading to a bullish stance, we would first need…

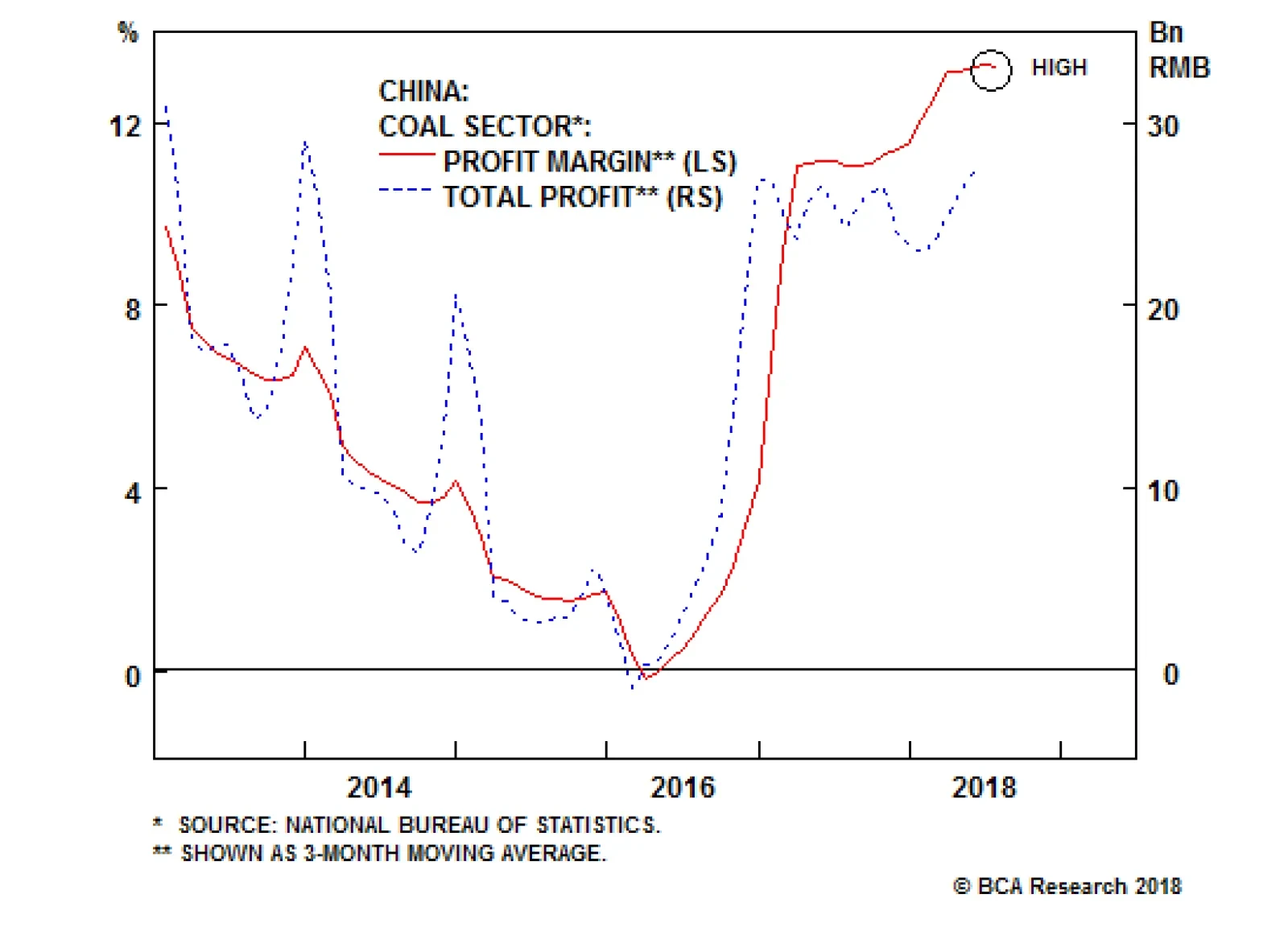

Chart II-1Is Deflation In Steel And Coal Back? Unlike 2015 when steel, iron ore and coal prices collapsed, in the current downturn they have so far held up reasonably well. They have begun falling only recently (Chart II-1).…

Highlights The current global trade downtrend has primarily been due to a contraction in Chinese imports. The latter reflects weakness in China's domestic demand in general and capital spending in particular. The current global…

On the supply side, coal output will rise only moderately (i.e., 2-3%) in 2019. There are three drivers pushing up Chinese coal output. In May the government asked domestic coal producers to ramp up coal output. 660 million…

Highlights China stands out as the most likely candidate to send negative shock waves through EM and commodities in 2018. Granted the ongoing policy tightening in China will likely dampen money growth further, the only way mainland…