Executive Summary Petrocurrencies Have Lagged Terms Of Trade Petrocurrencies have lagged the surge in crude prices. This has been specific to the currency space since energy stocks have been in an epic bull market.Both cyclical and…

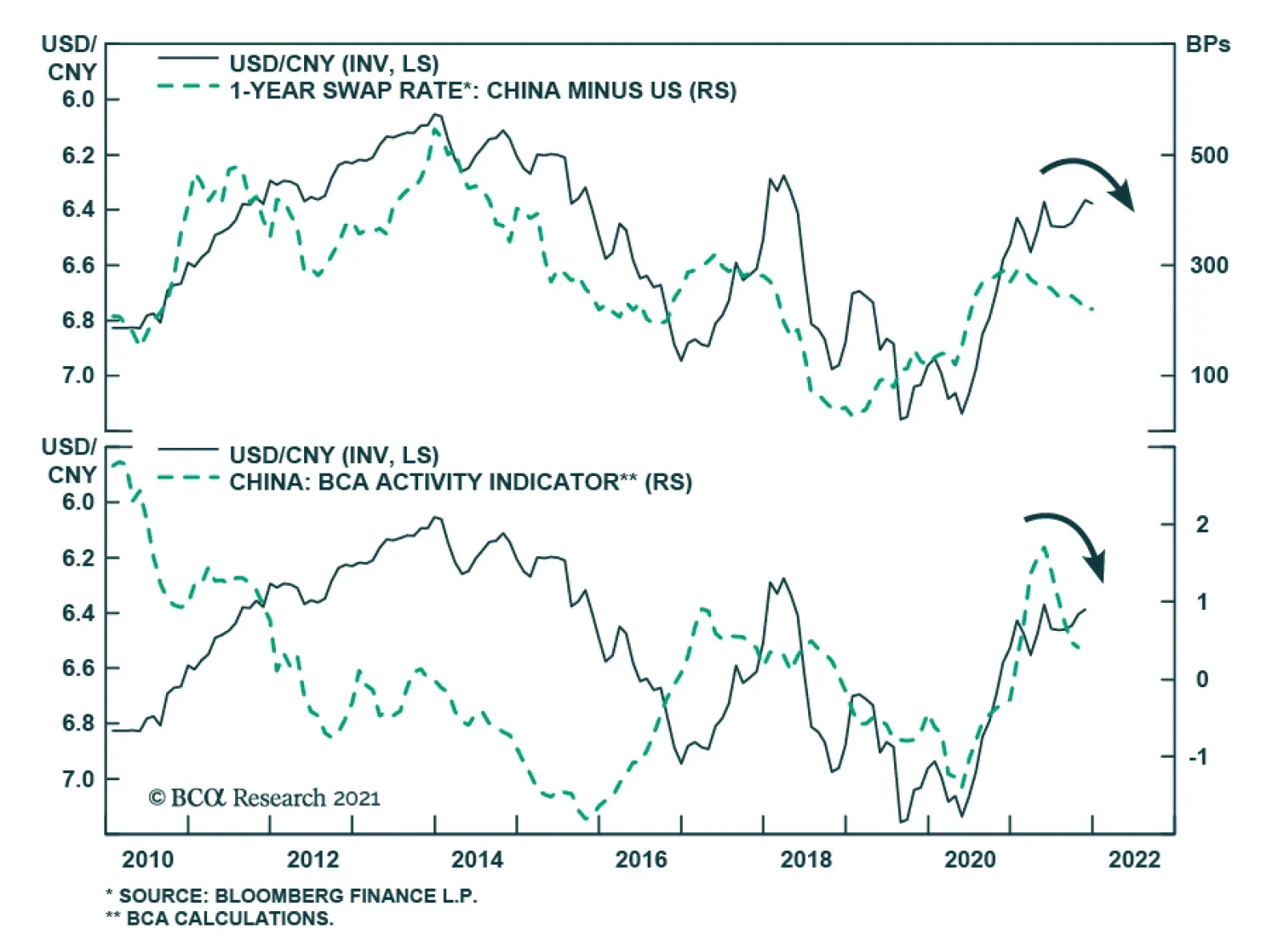

Executive Summary The RMB And Real Interest Rates The RMB has overshot and will likely consolidate gains in the coming months. The said, the yuan remains underpinned by a current account surplus, positive real rates, and a…

Executive Summary Chinese Onshore Stocks Are Less Impacted By External Factors We are upgrading Chinese onshore stocks from underweight to neutral relative to global stocks. At the same time, we are closing our tactical…

Highlights The bull run in Vietnamese stocks is due for a pause as the weakness in overall EM markets spreads to this bourse. Household consumption will stay constrained as new COVID-19 cases remain high and fiscal and monetary…

Highlights Our three strategic themes over the long run: (1) great power rivalry (2) hypo-globalization (3) populism and nationalism. The implications are inflationary over the long run. Nations that gear up for potential conflict and…

The world’s two largest economies are diverging on monetary policy. The Fed is starting to normalize policy by tapering its asset purchases and preparing to hike interest rates next year. Meanwhile, the PBoC is easing…

Dear Client, We will be working on our 2022 Outlook for China, which will be published on December 8. Next week we will be sending you BCA Research’s Annual Outlook, featuring long-time BCA client Mr. X, who visits towards the end…