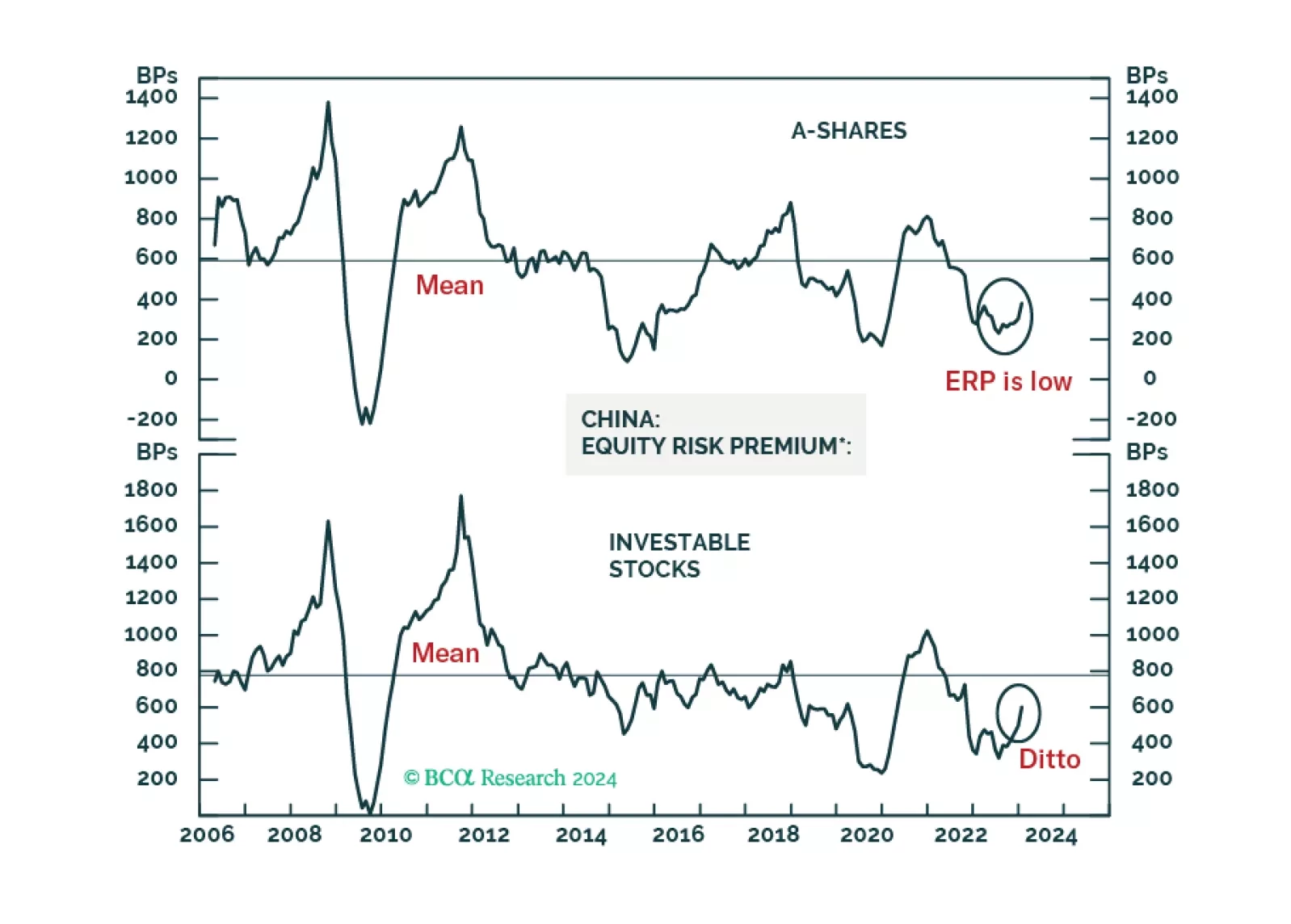

Chinese A-shares will probably begin forming a volatile bottom. The basis is that authorities will likely throw the kitchen sink at the onshore market in an attempt to stabilize share prices. The same is not true for offshore listed…

Our political forecasting scored wins in 2023 but we failed to capitalize on it adequately in our trade recommendations.

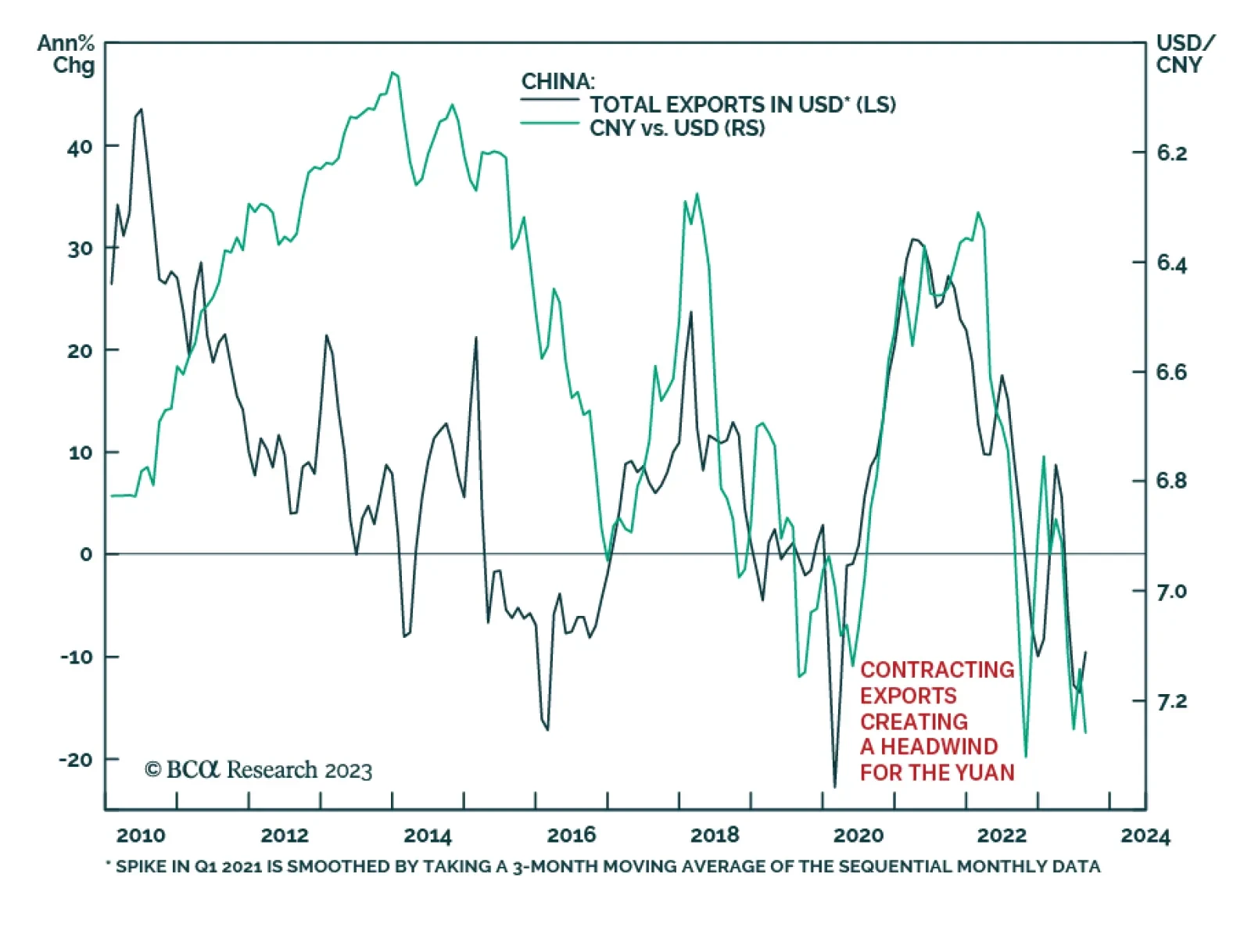

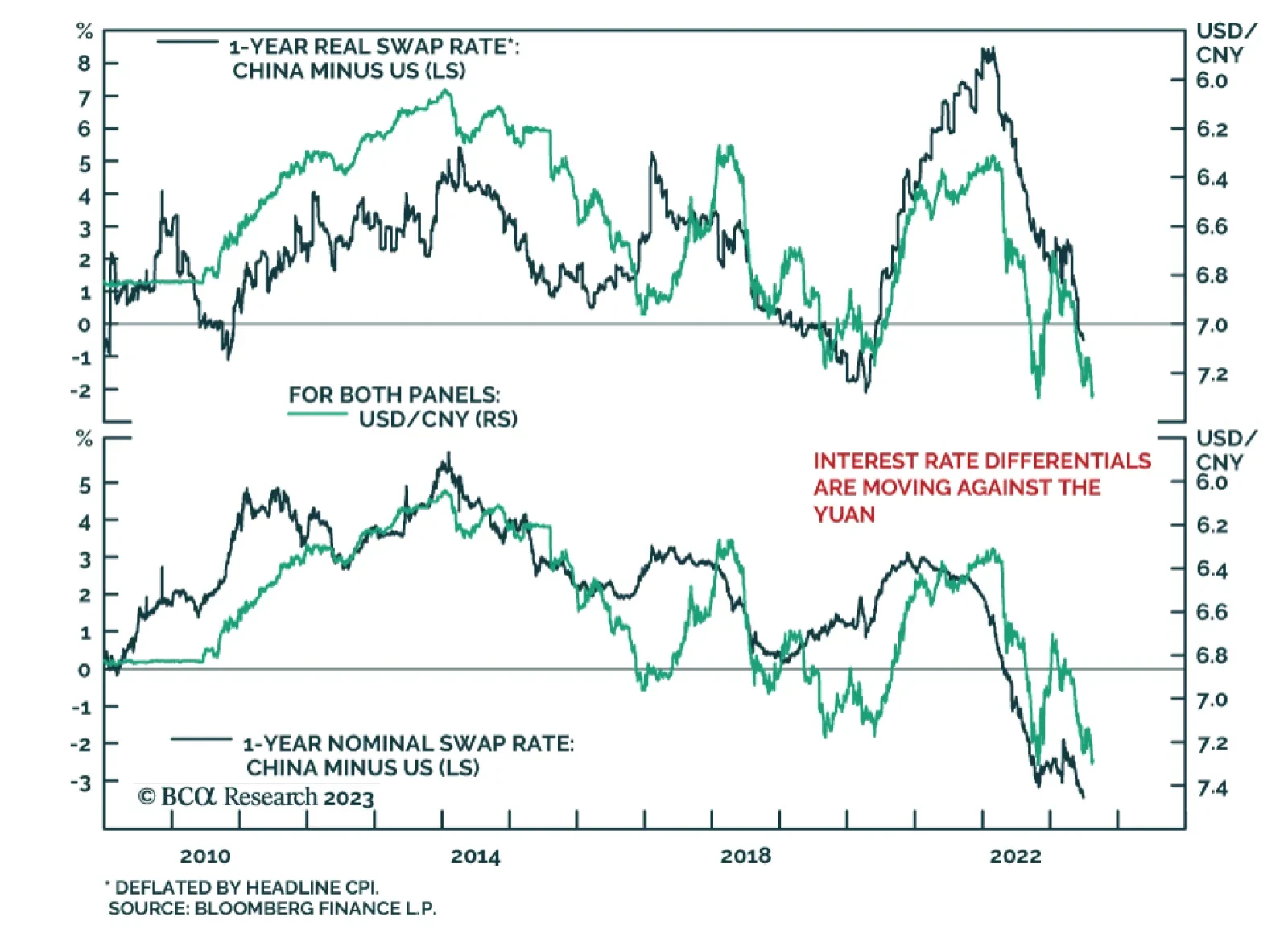

The Chinese yuan fell to its lowest in nearly 16 years vis-à-vis the US dollar on Thursday following the release of Chinese trade data. Although the pace of export contraction slowed from 14.5% to 8.8% y/y in August (and…

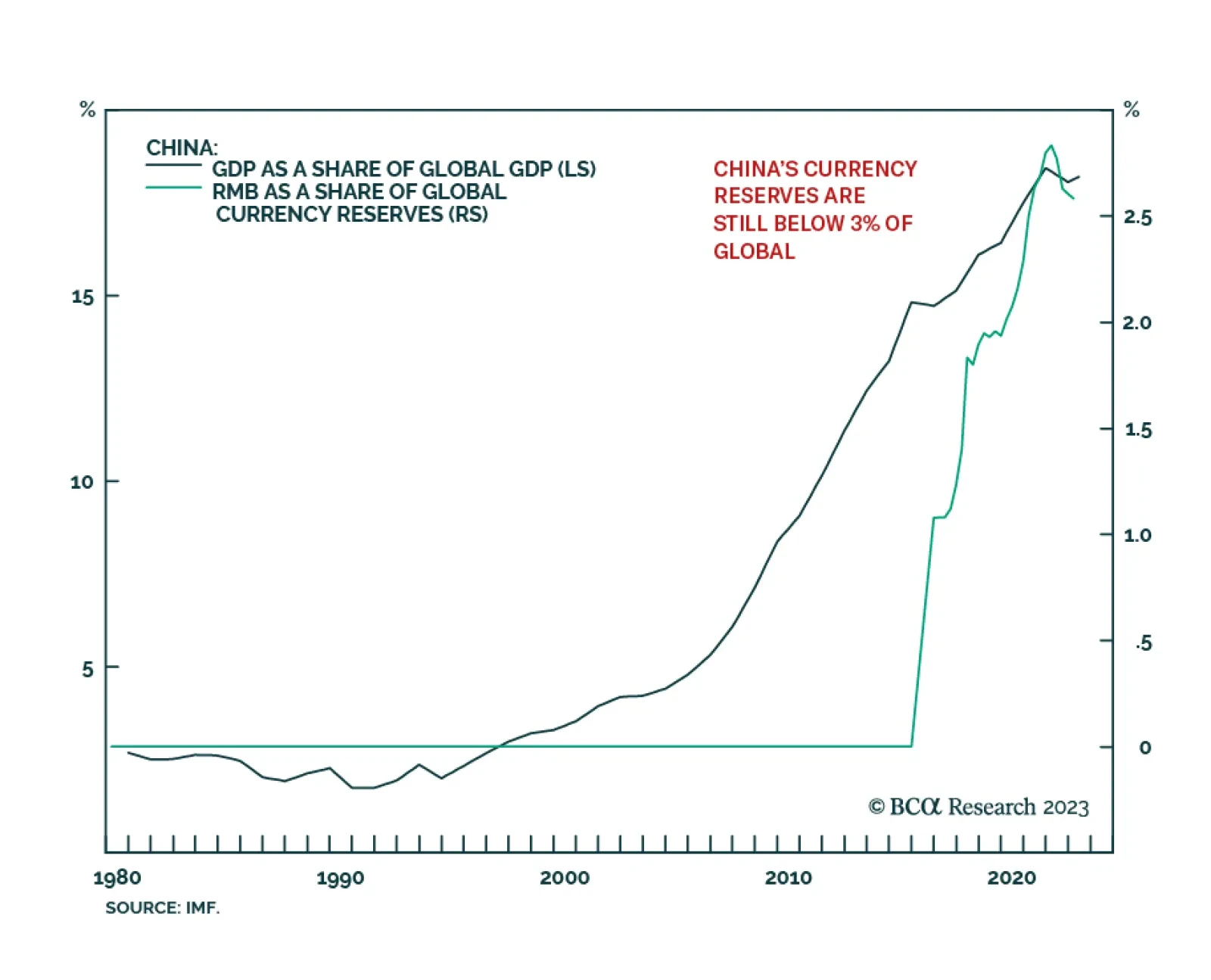

According to BCA Research’s Foreign Exchange Strategy service much of the new BRICS+ countries lack the fundamental basis of making a credible monetary union. A reserve currency needs the military might to control the…

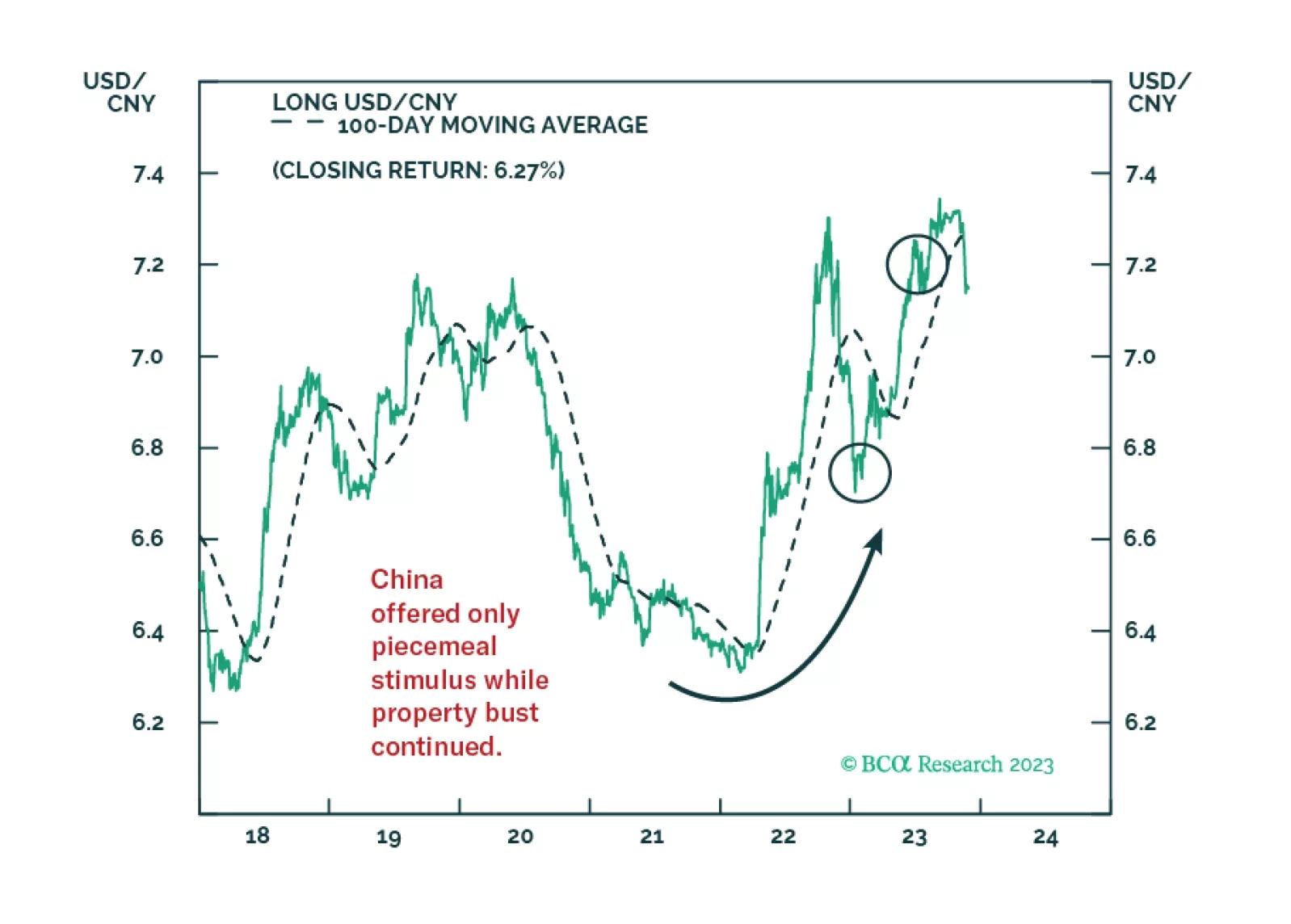

Chinese authorities have recently ratcheted up support for the currency. The PBoC continues to set its daily yuan fixing at a stronger-than-expected rate, with the yuan midpoint (a reference for trading that caps the range…

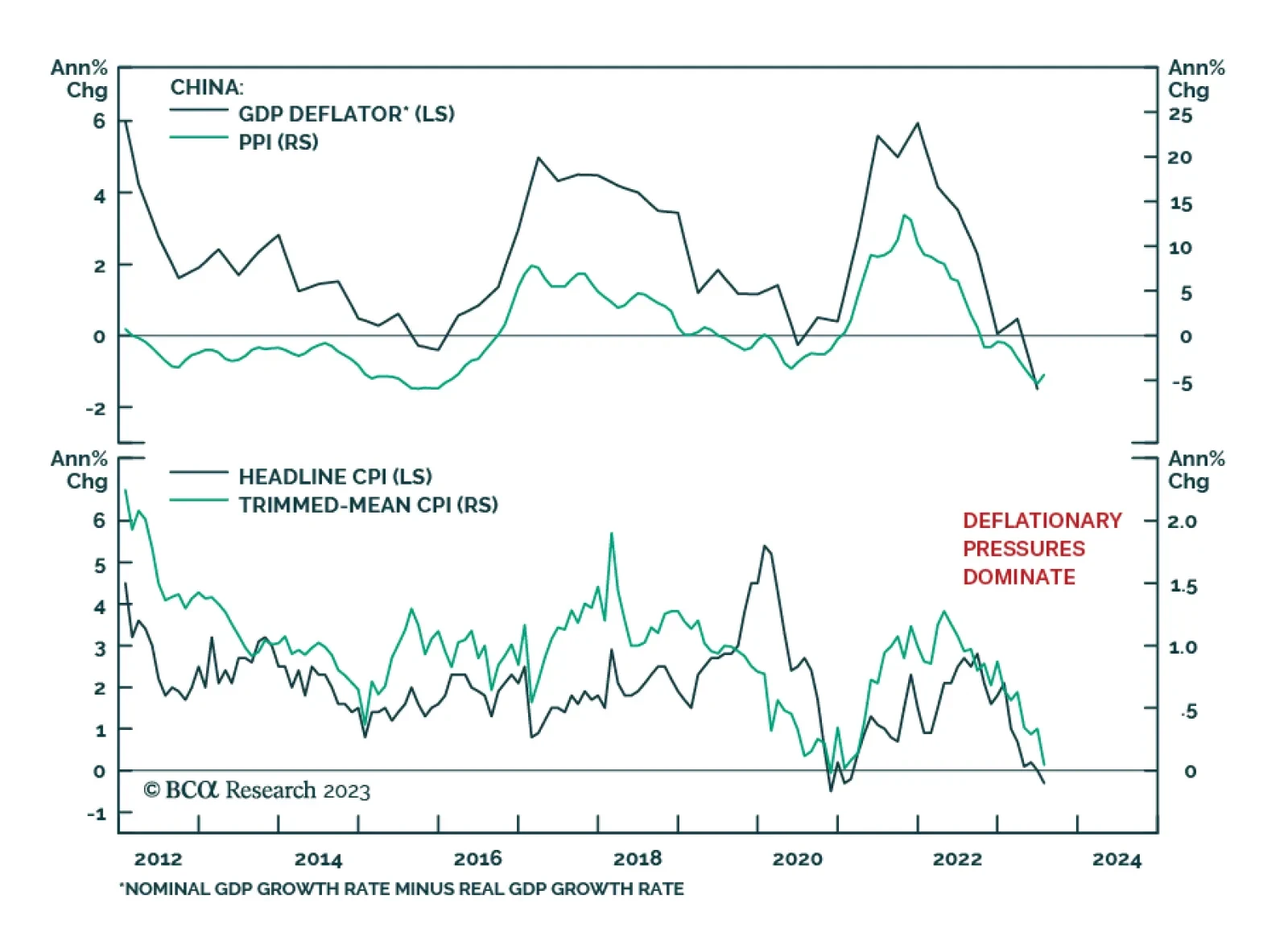

China’s CPI and PPI inflation release for July indicates that deflationary pressures dominate the domestic economy. After remaining unchanged in June, consumer prices fell by 0.3% y/y. Meanwhile, the 4.4% y/y drop in…

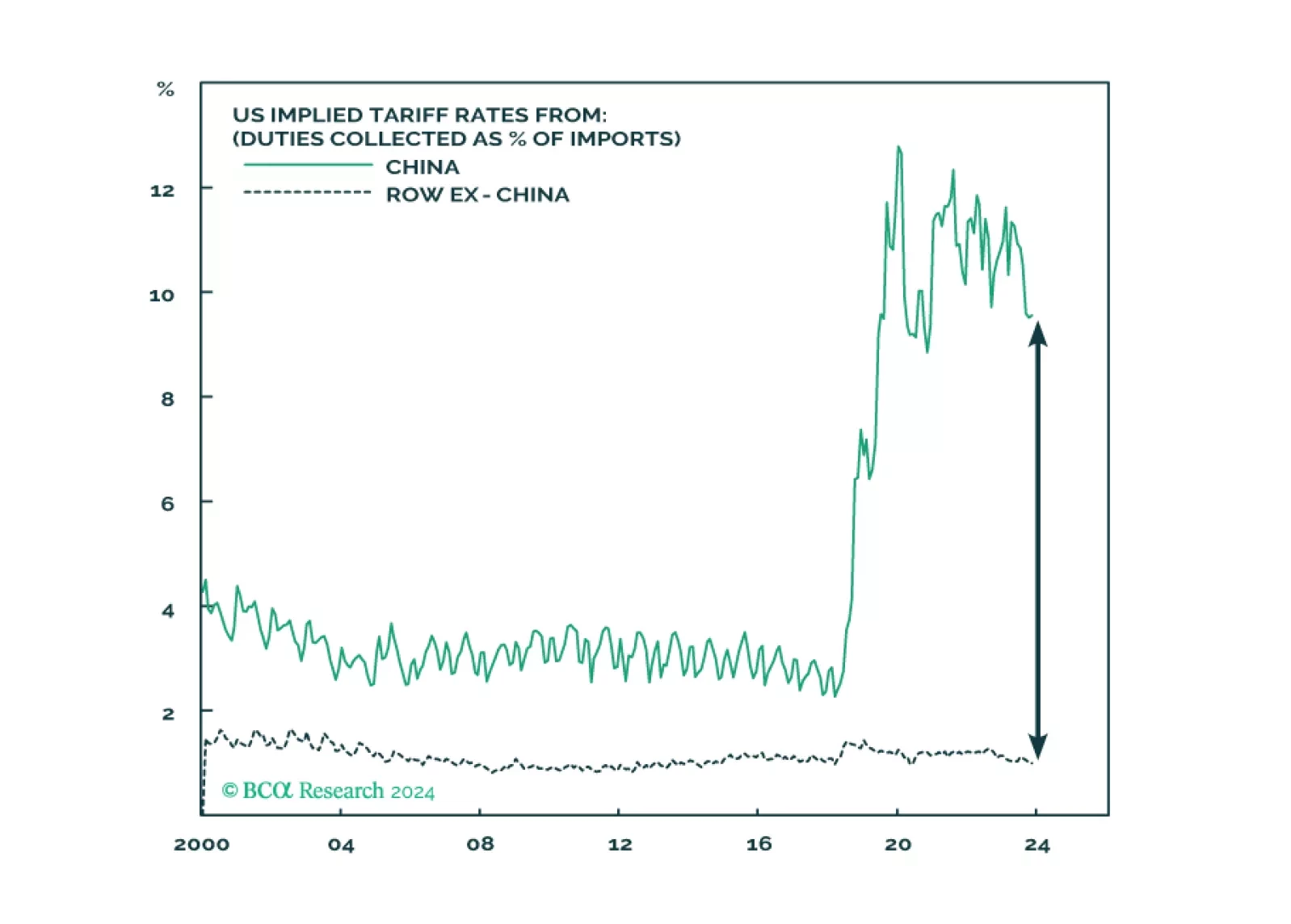

Although the RMB has cheapened, macro conditions are not yet favorable for the Chinese currency. We expect the RMB to decline by at least another 5% in the next six months. A weak currency and subdued economic growth lead us to…