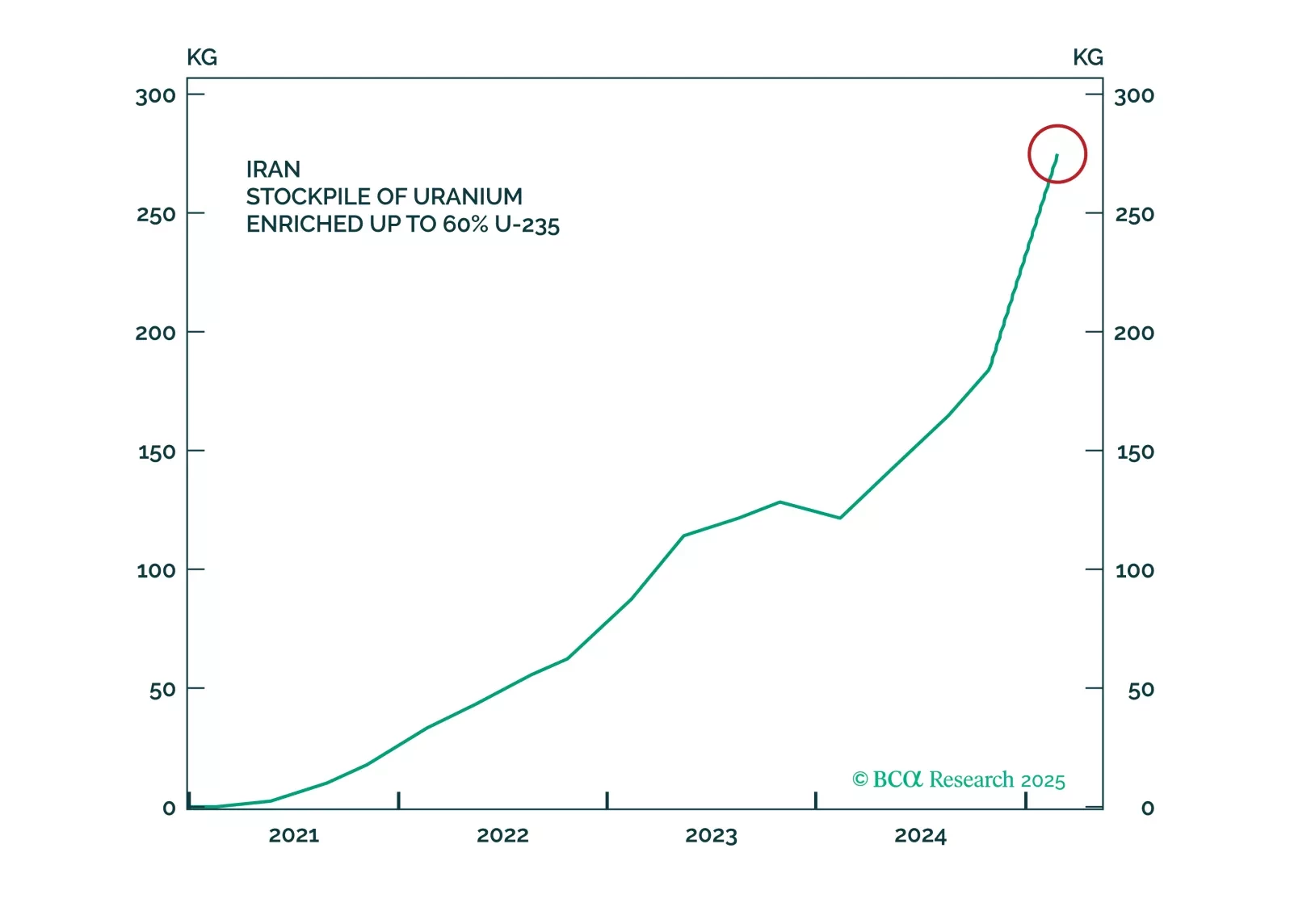

The tariffs on Canada and Mexico will come into effect as scheduled while the tariffs on China will be doubled. In the Middle East, Iranian response to any attack will threaten Middle Eastern oil supply. Meanwhile, Chinese fiscal…

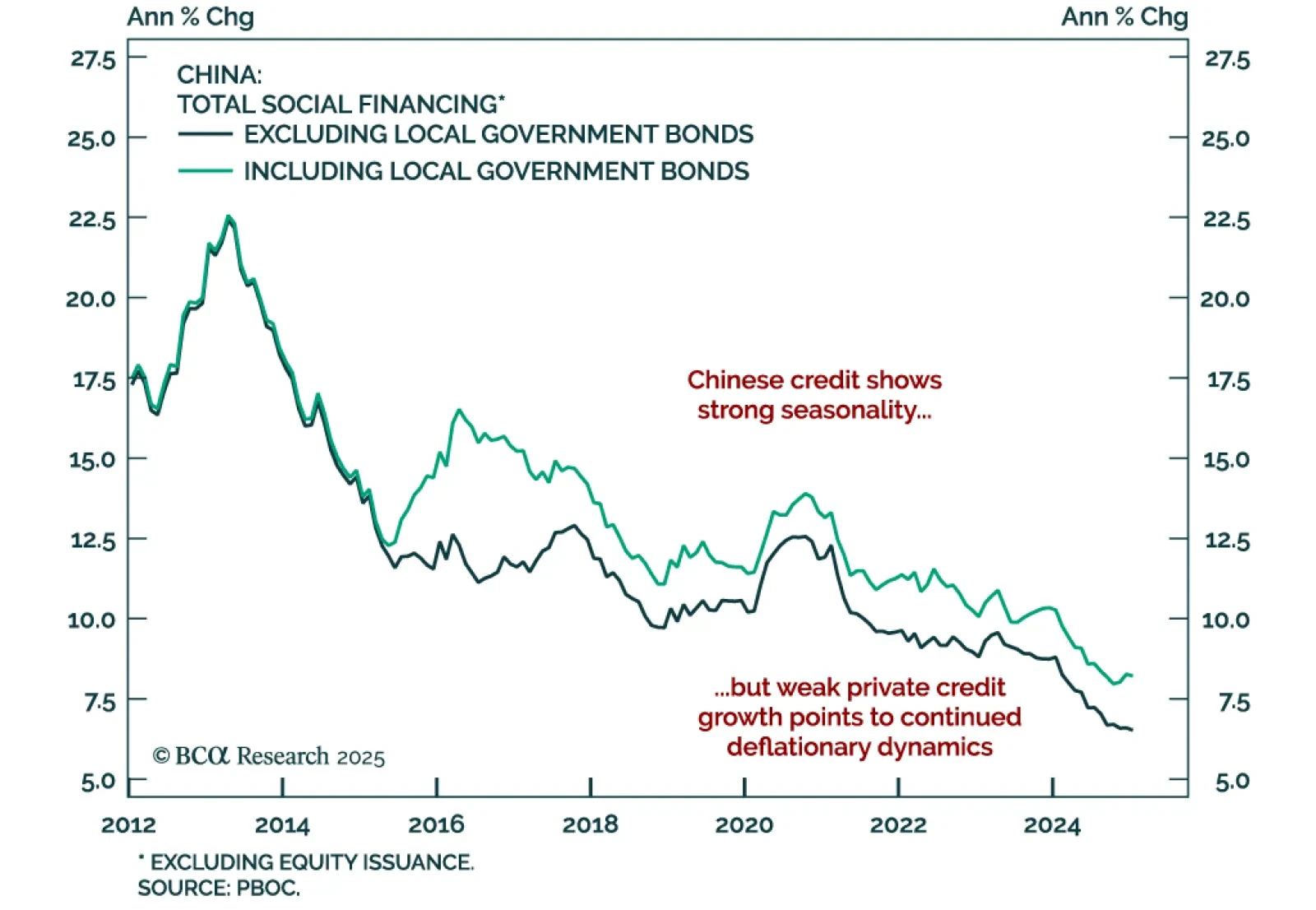

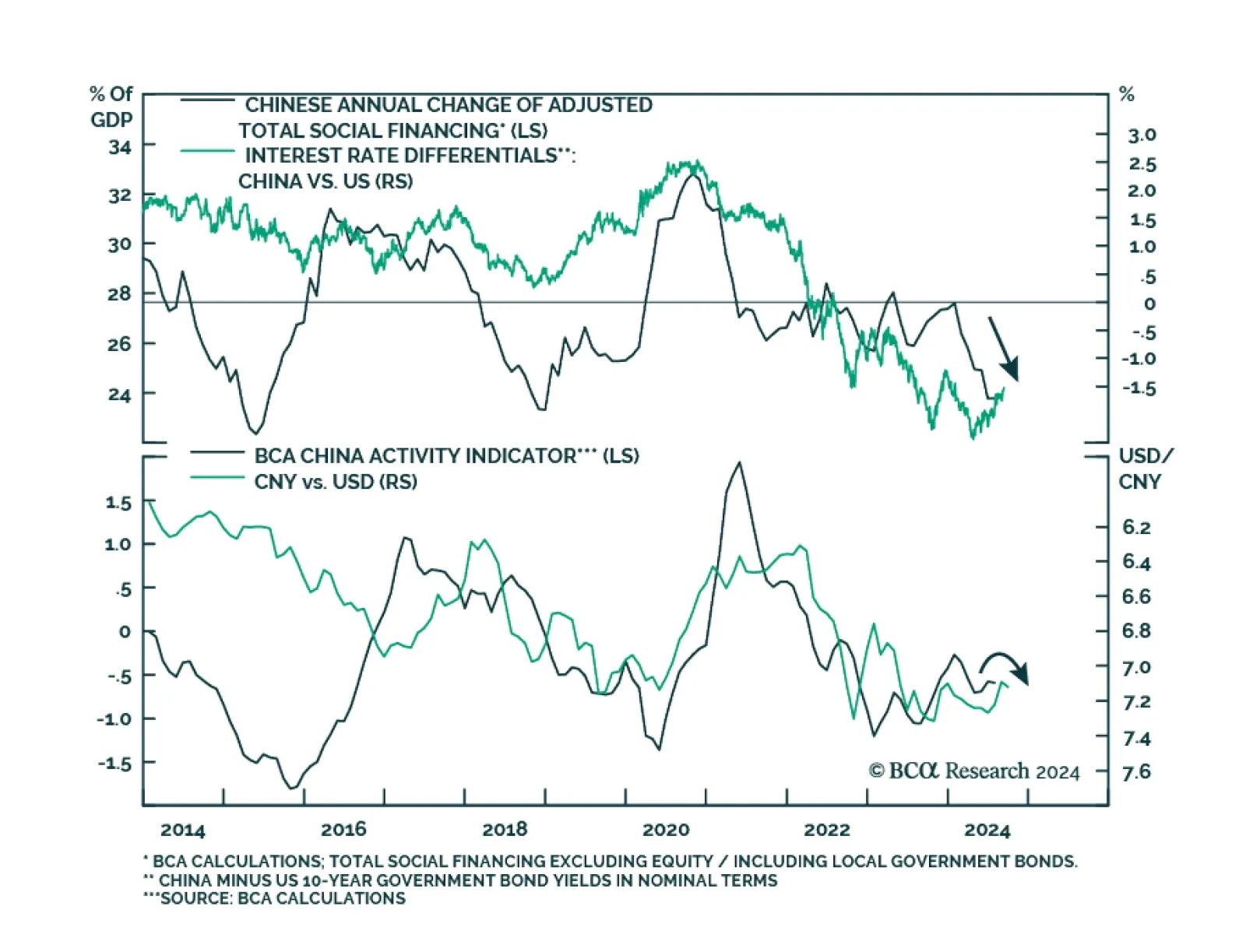

China’s January monetary and credit data was solid. New yuan loans increased by CNY 5.1 trillion, while aggregate financing was up by 7.1 trillion. M1 also increased after contracting 1.4% y/y in December. Seasonality plays a…

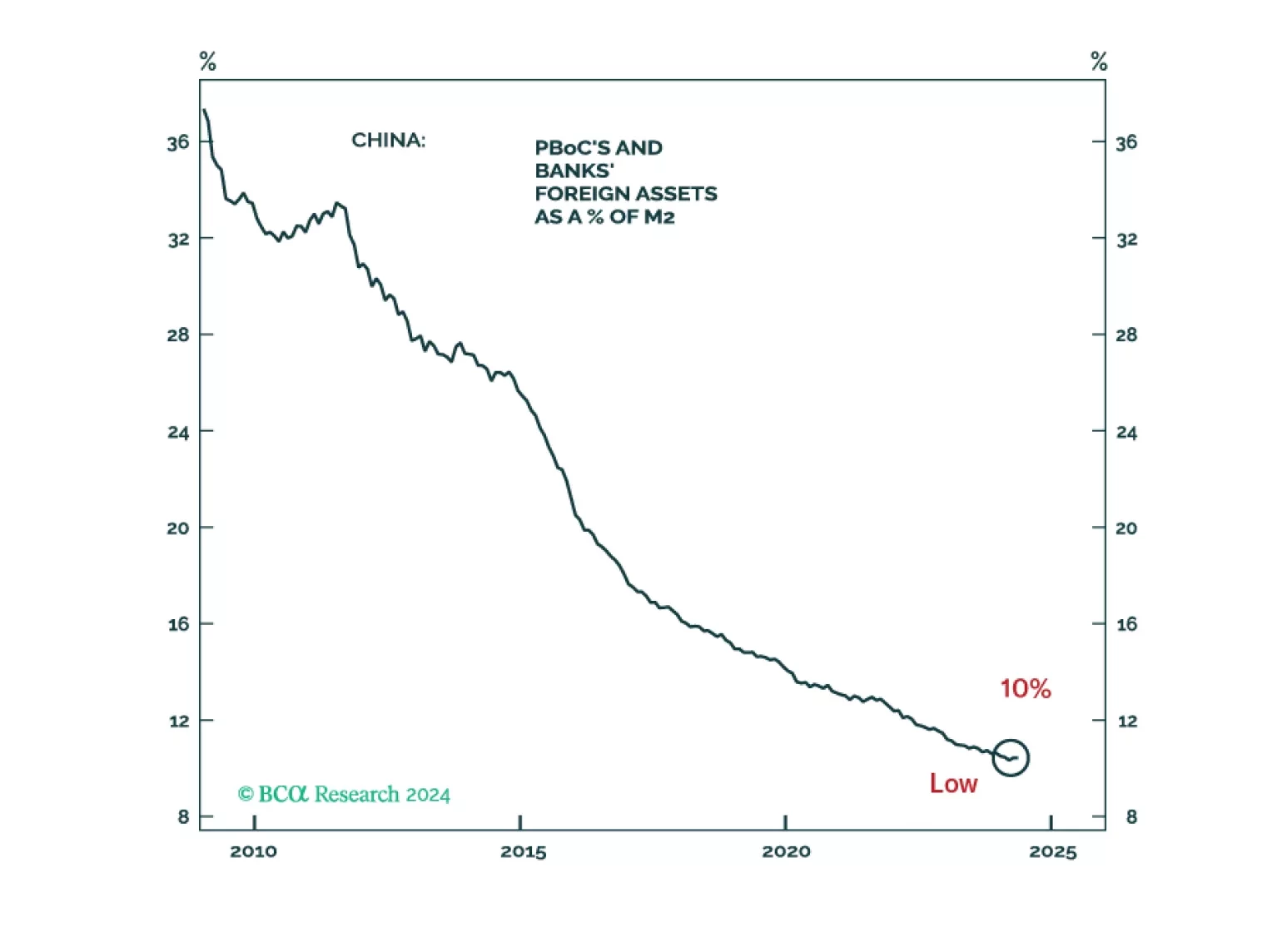

China’s October data for inflation and money disappointed. Headline CPI decelerated to 0.3% year-over-year from 0.4% in September, and PPI deflation worsened at -2.9% vs. -2.8% a month prior. While broad measures such as M2…

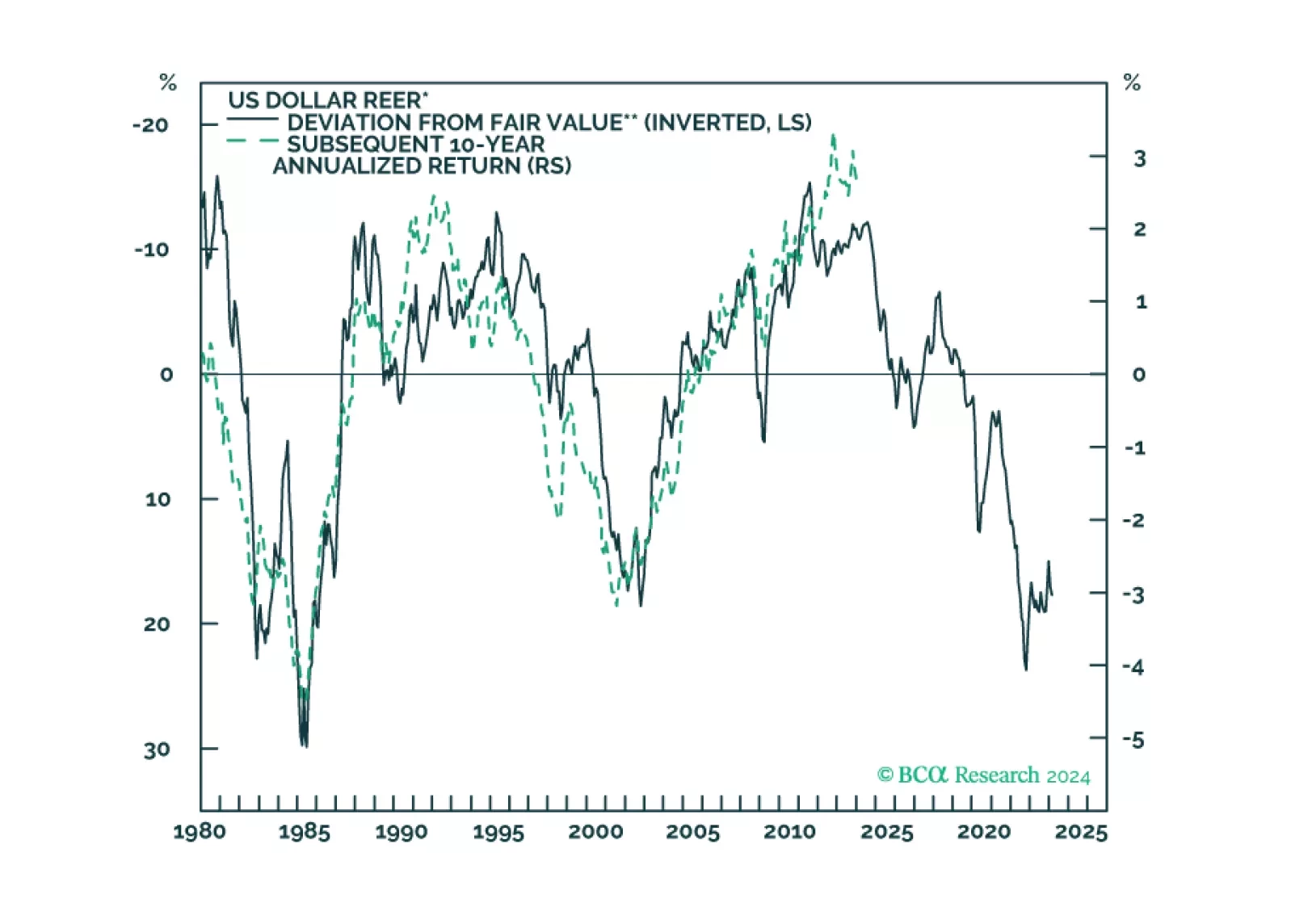

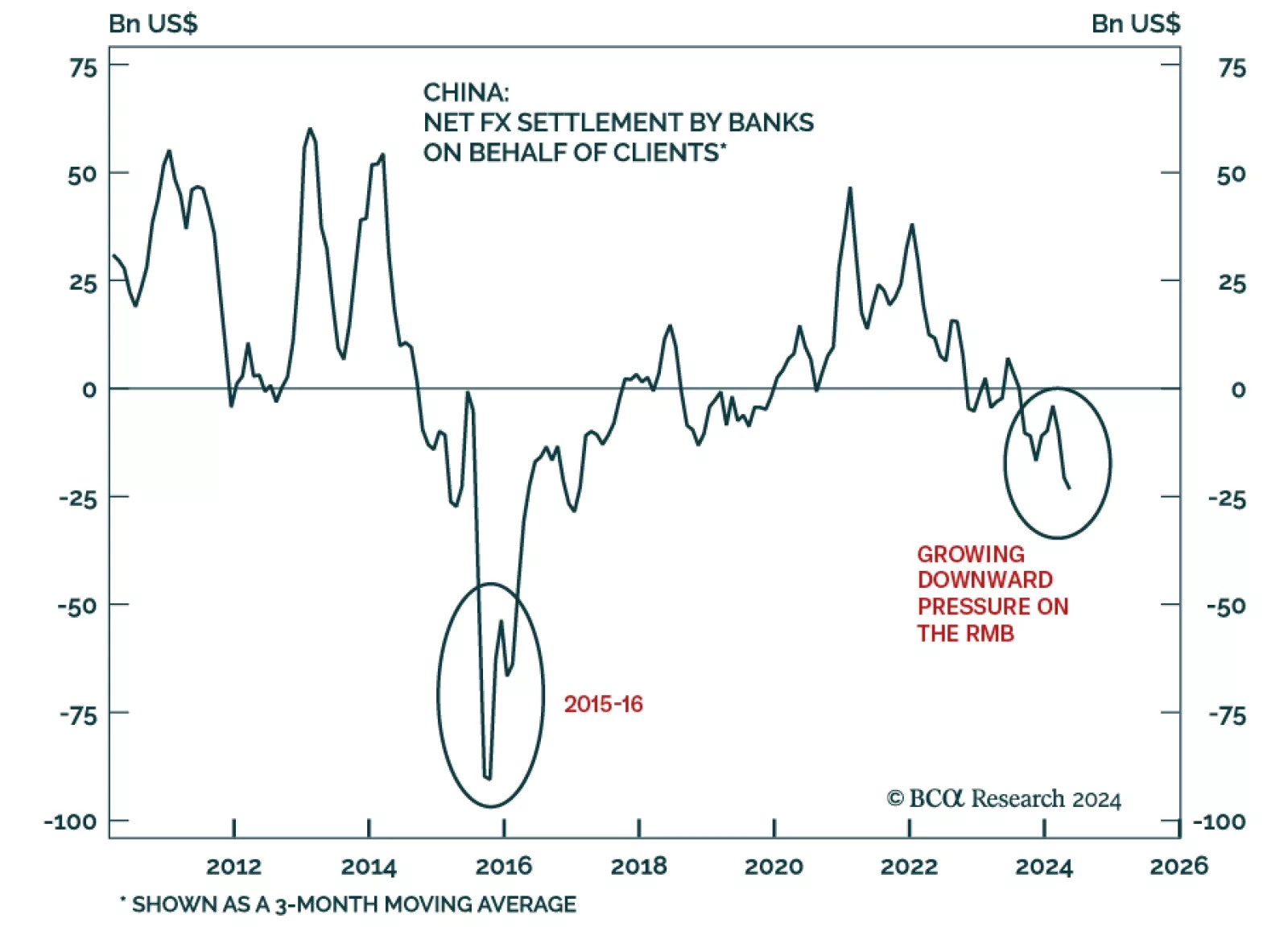

According to BCA Research’s China Investment Strategy service, the Fed’s upcoming rate cut will temporarily alleviate some of the downward pressure on the RMB, but beyond the short term the USD will likely rebound in…

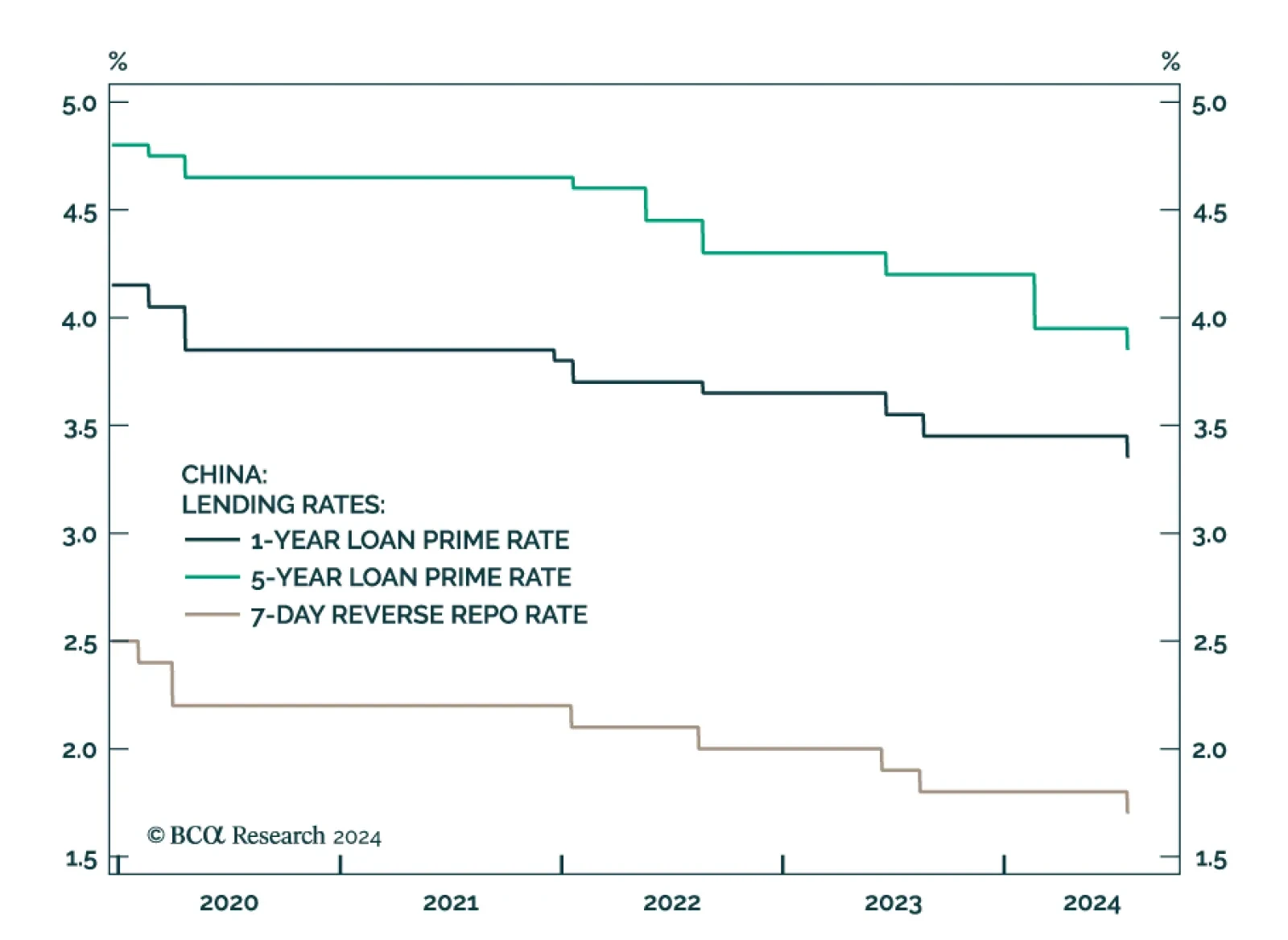

The PBoC lowered the 7-day reverse repo rate from 1.80% to 1.70% on Monday. The 5-year and 1-year loan prime rates declined by 10 basis points (bps) to 3.85% and 3.35%, respectively. However, this 10-bps cut is unlikely to…

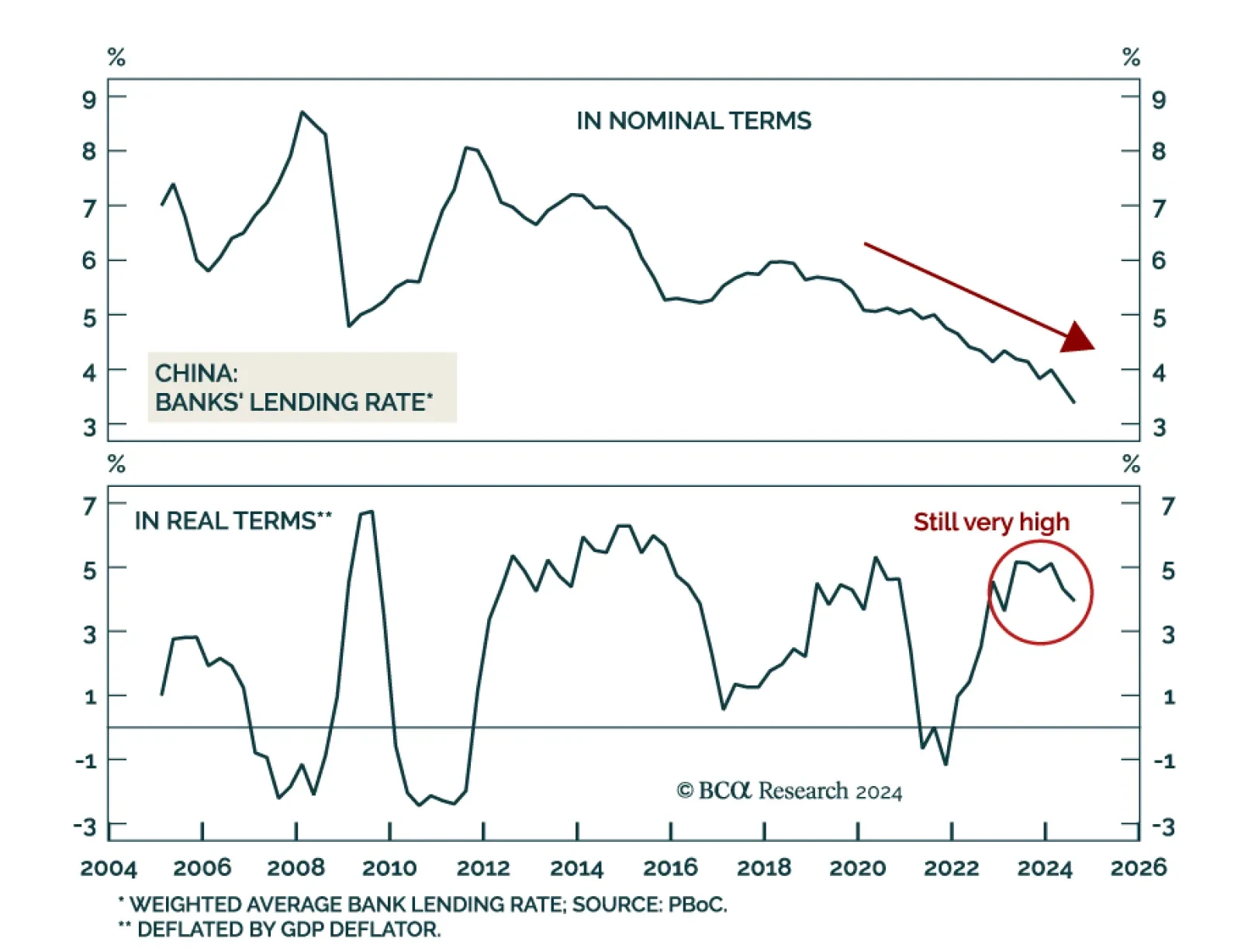

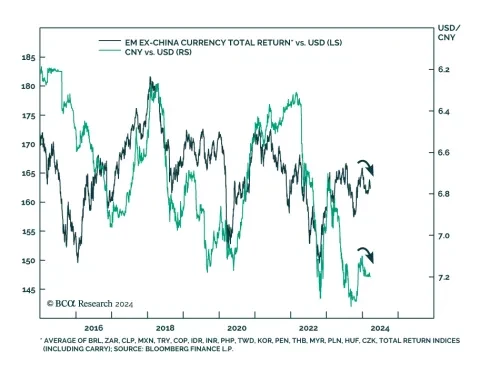

The Chinese currency has been under considerable depreciation pressure due to capital outflows. Additionally, the economy is grappling with debt deflation and a balance sheet recession, conditions that typically call for lower…

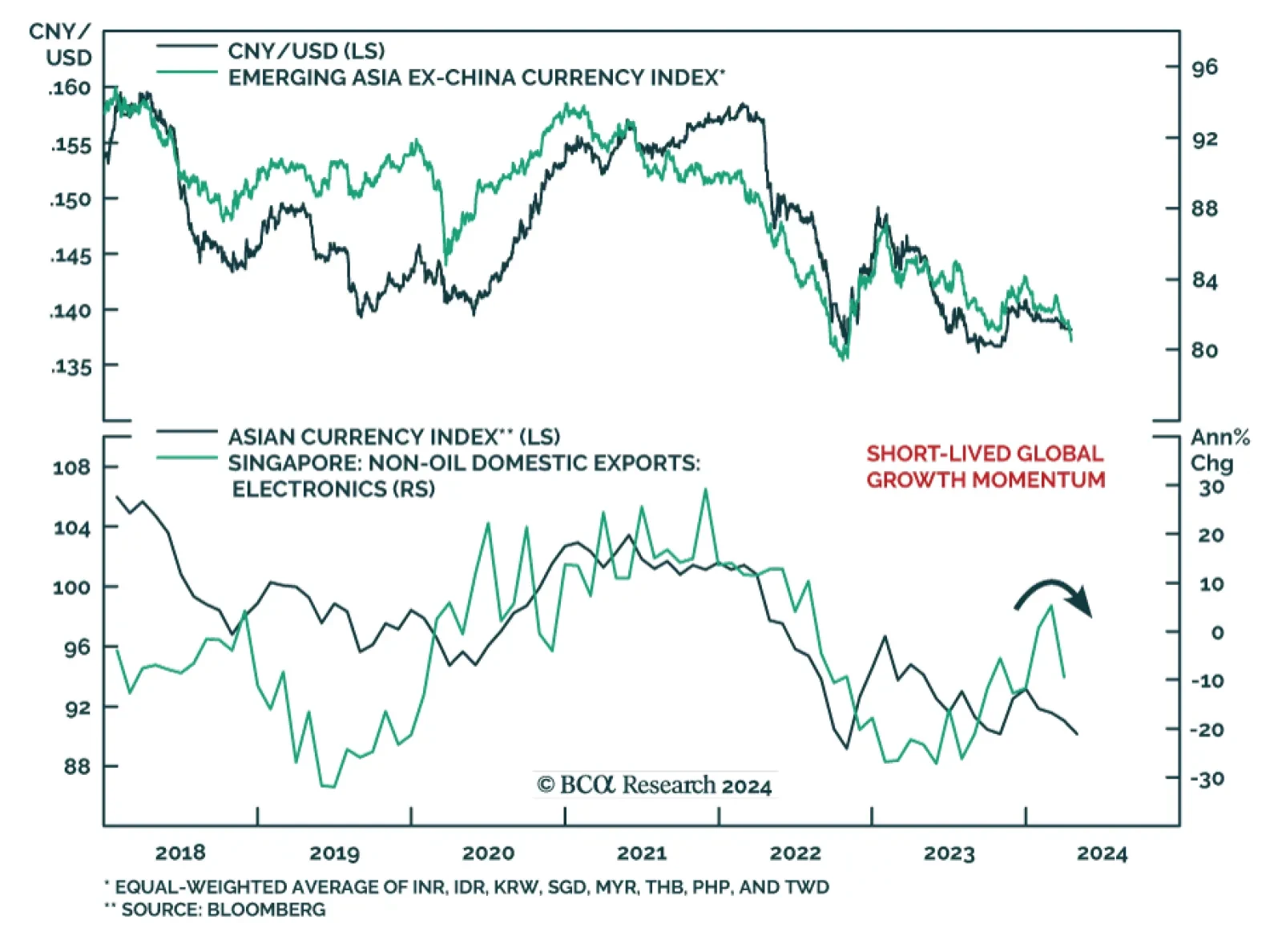

The Asian currency index posted the largest negative post-GFC abnormal returns (z-score) among the major financial markets we tracked in March. Indeed, Asian currencies have been on a general downtrend since early 2023, and more…

The Chinese yuan slide sharply against the US dollar on Friday, breaching the 7.2 level. The weakness comes after the PBOC loosened its hold on the currency by setting a weaker-than-anticipated daily fixing. The move…