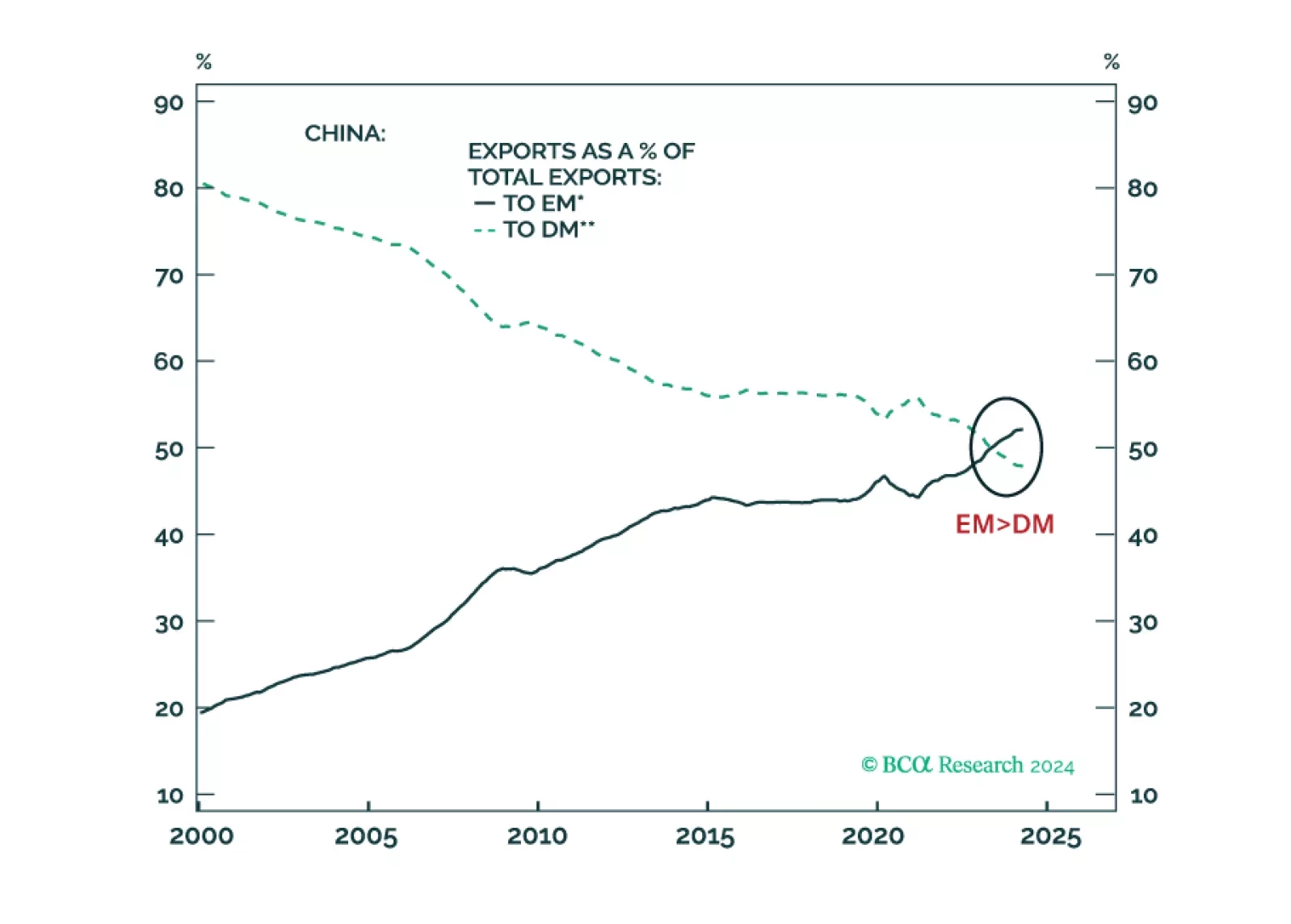

The global political system is destabilizing and the US will turn more hawkish in foreign policy, trade policy, or both, regardless of the election outcome. Tactically go long the dollar.

In this report, we discuss why we are lifting our US recession probability from 60% to 65% and explain why China’s latest stimulus announcements are welcome, but probably are “too little, too late.”

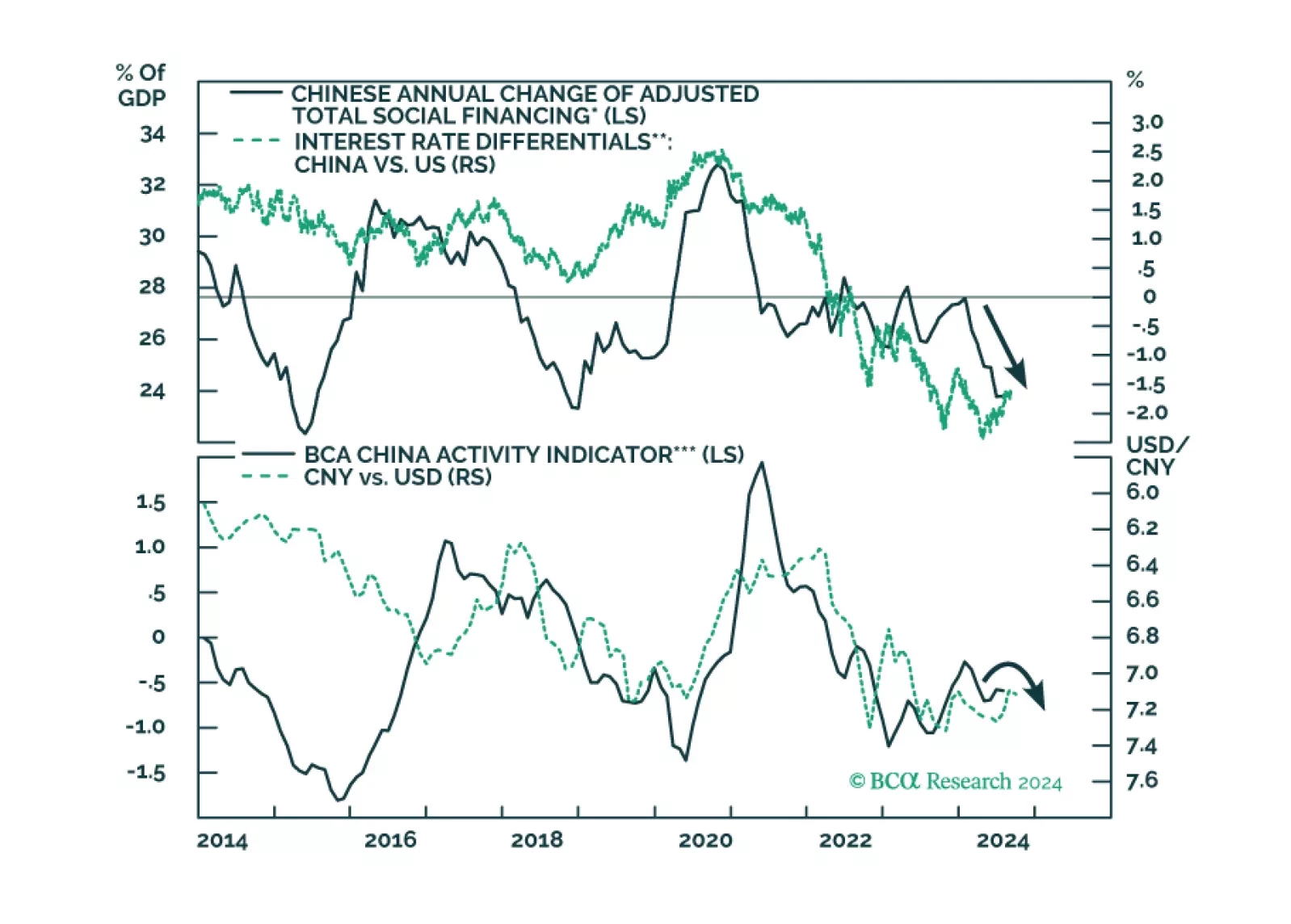

To produce a moderate economic recovery, at least RMB 3 trillion in additional government expenditures is needed in H1 2025. Our bias is that Beijing is not yet ready to launch such a massive fiscal support measure. Hence, volatility…

The webcast addressed the following topics:

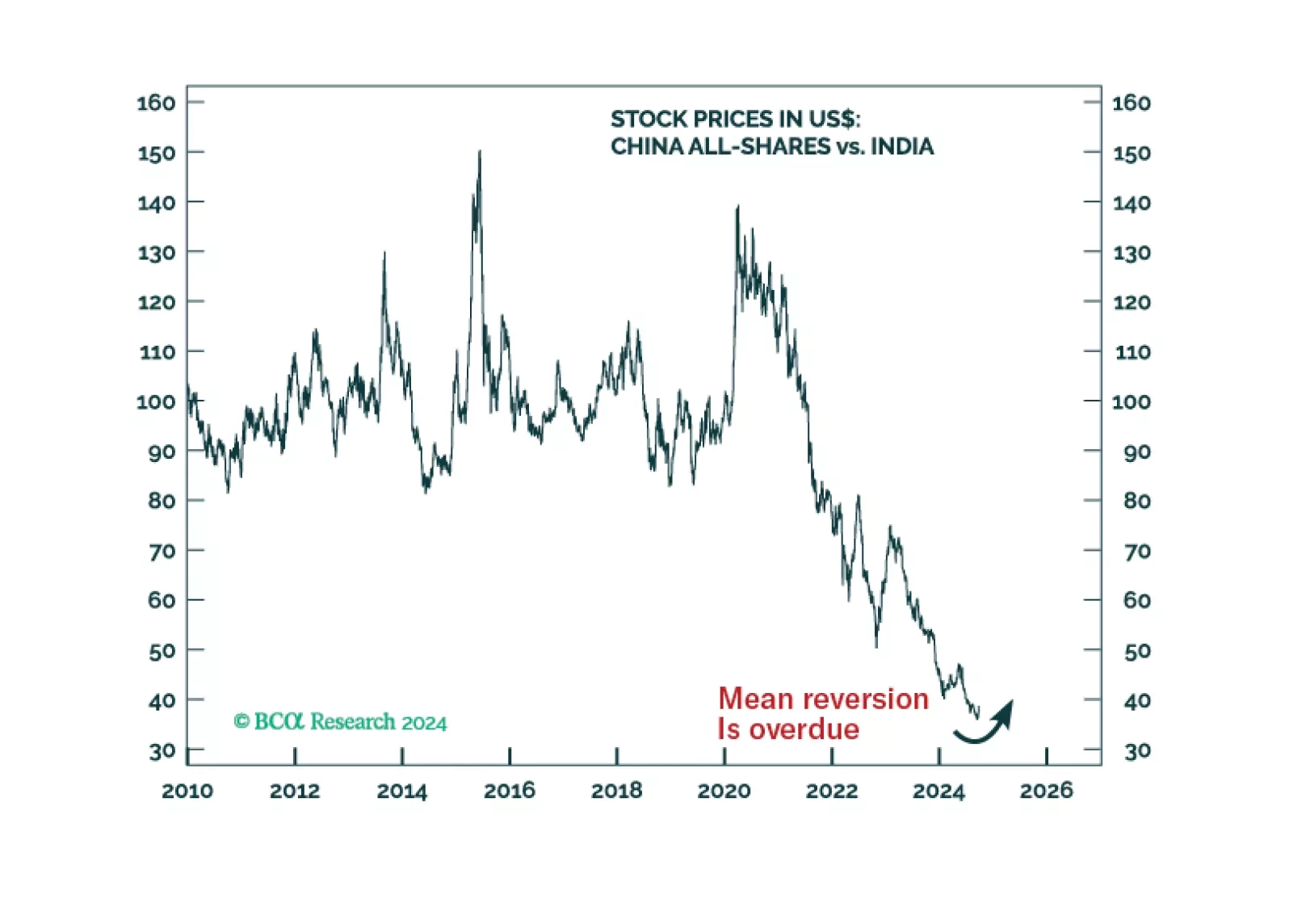

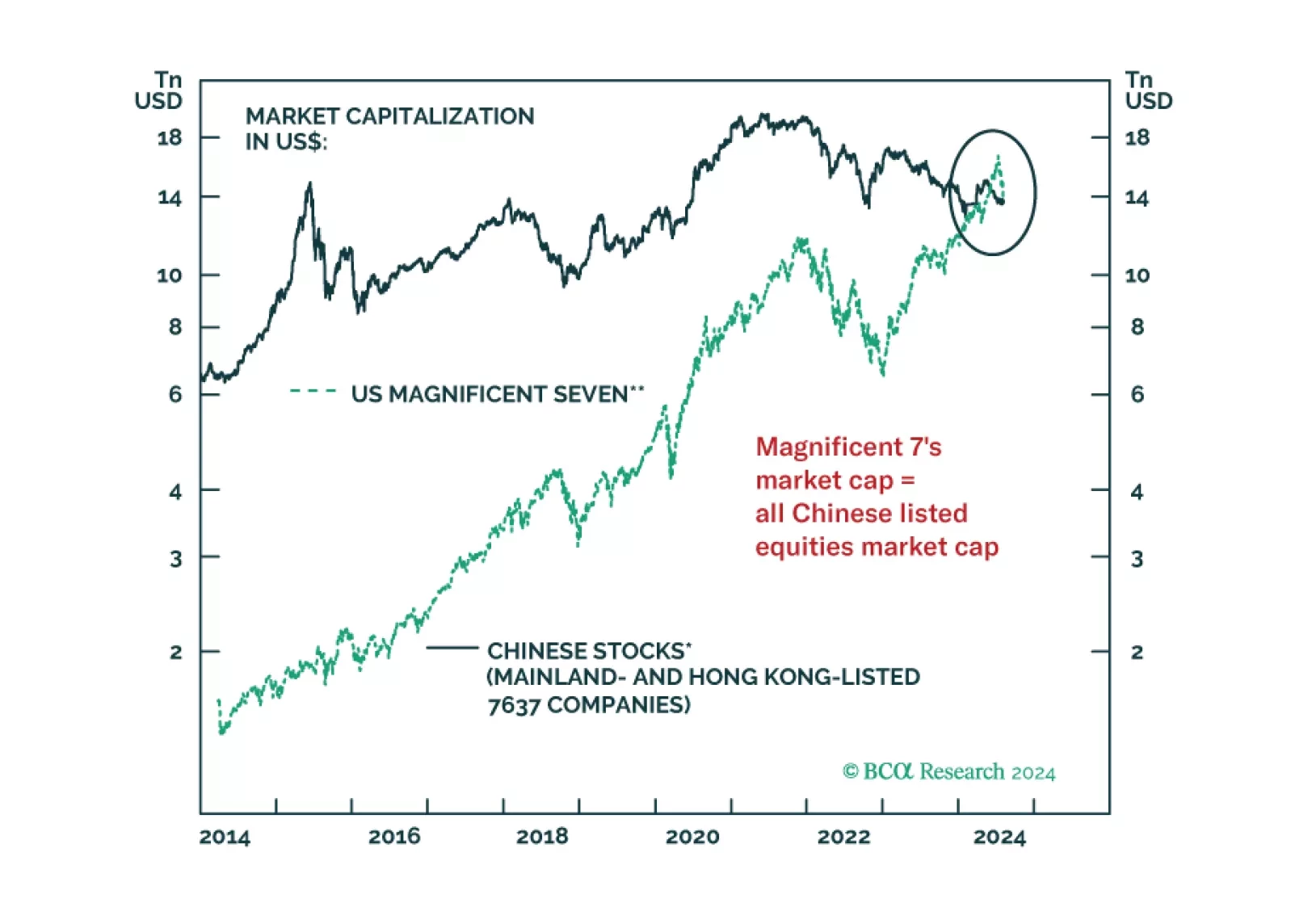

Is the latest surge in Chinese share prices the beginning of a bull market or a bull trap?

Are Chinese policy announcements sufficient to stabilize growth or create a cyclical recovery?…

Both the Chinese and US central banks will likely take policy actions in the coming weeks. What is the potential impact of a mortgage rate cut on China’s household consumption and the broader economy? Will the anticipated Fed easing…

Chinese property developers will require at least RMB 500 billion in additional government funding to prevent further declines in housing completions for the rest of 2024. However, without addressing the underlying challenges, any…

The prices of multiple financial assets have failed to break above their technical resistances. When this occurs, a breakdown ensues. In brief, global risk assets remain vulnerable. We are upgrading Chinese onshore stocks from…