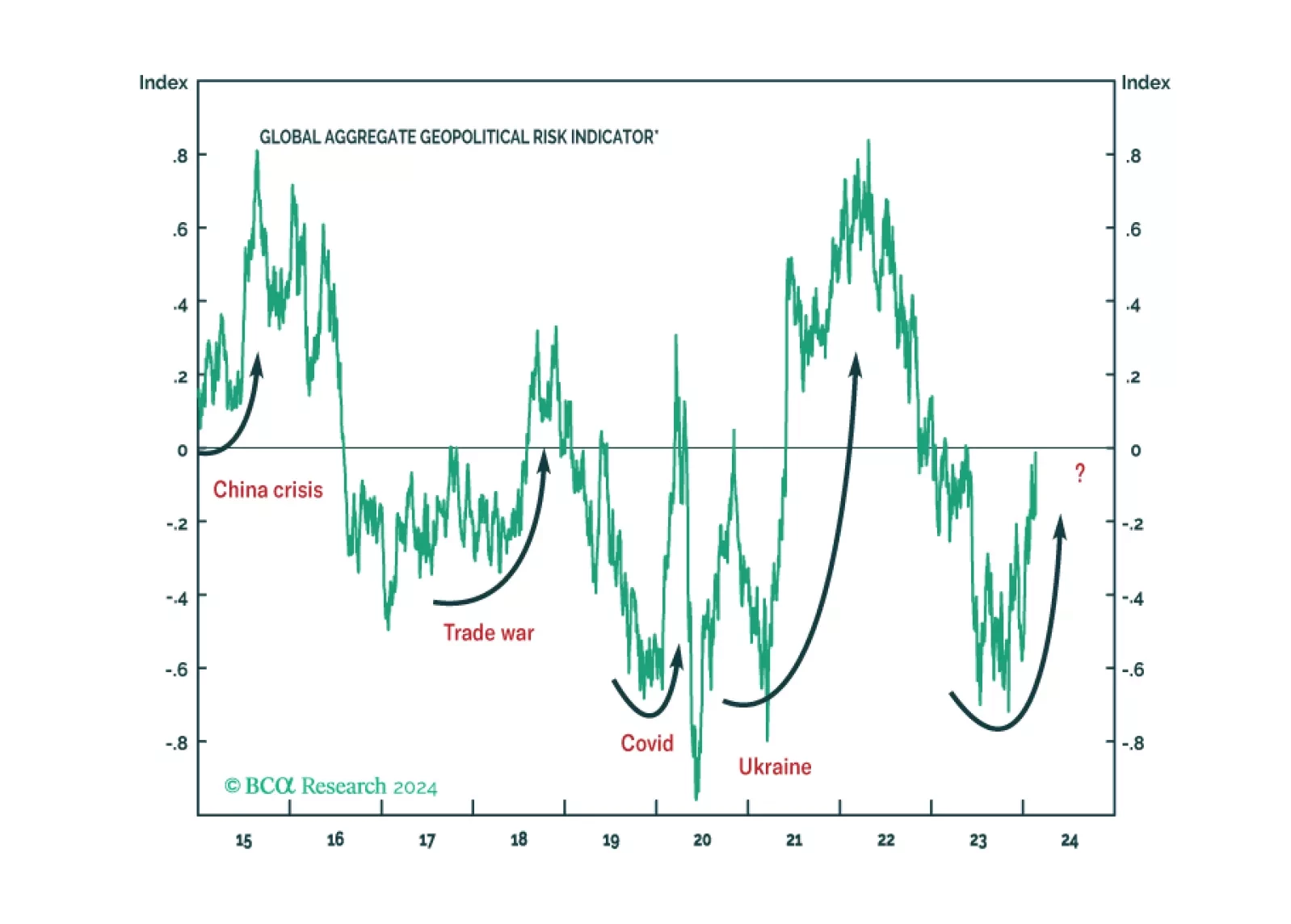

While 2024 will see various election risks, global geopolitical uncertainty is driven by the US election and its struggle with Russia, China, and Iran. The stock market can manage local domestic political risk. But it will correct…

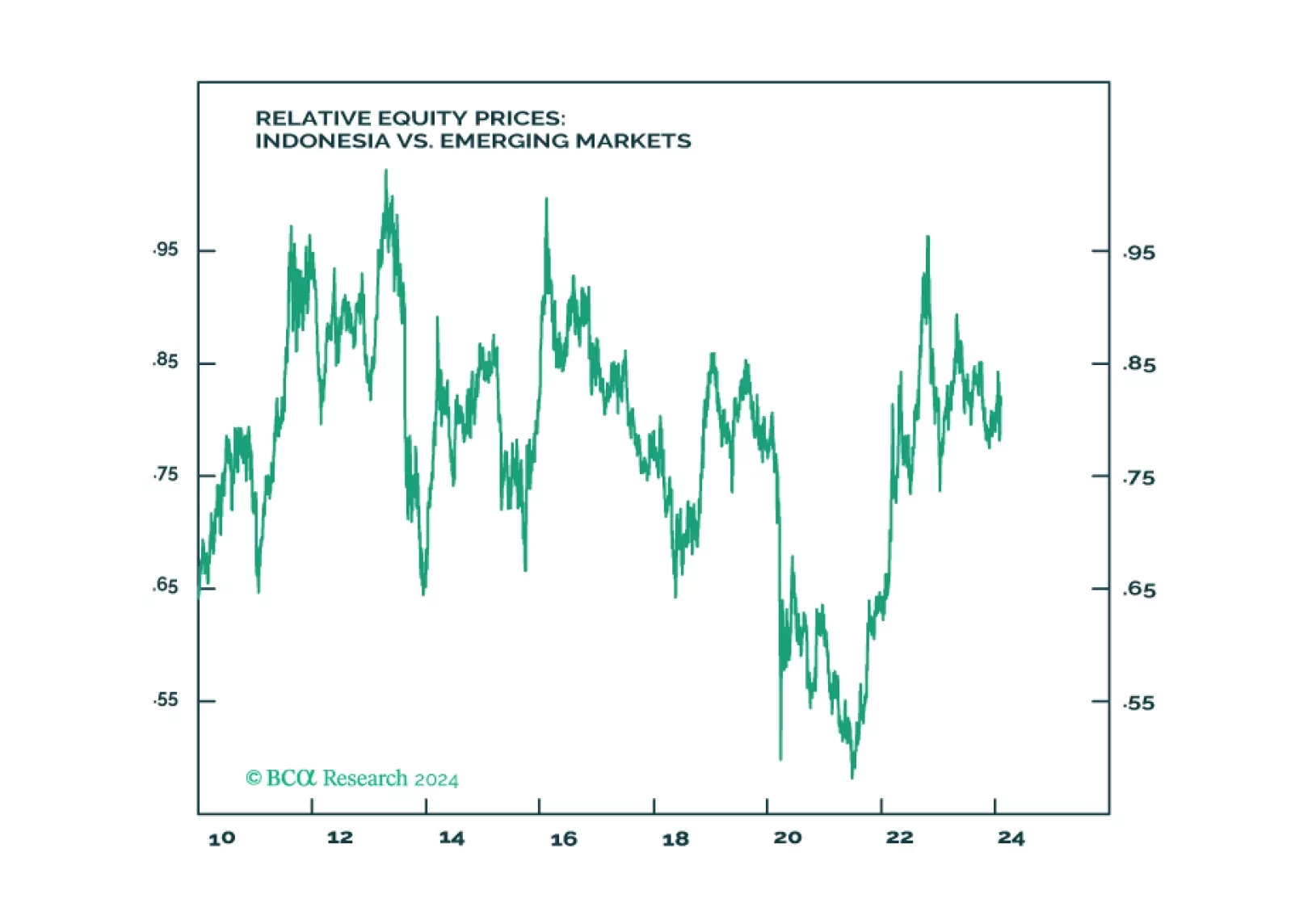

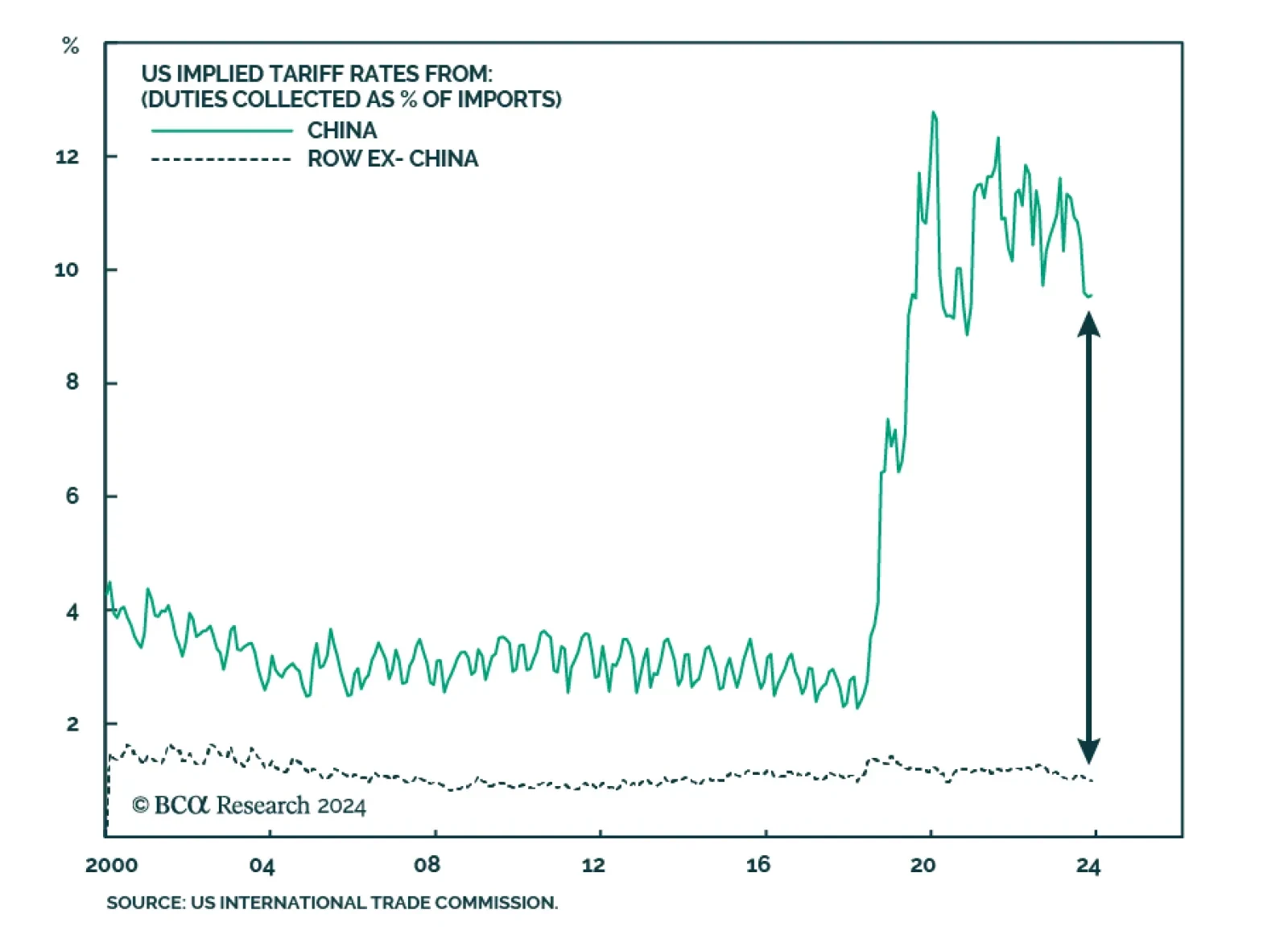

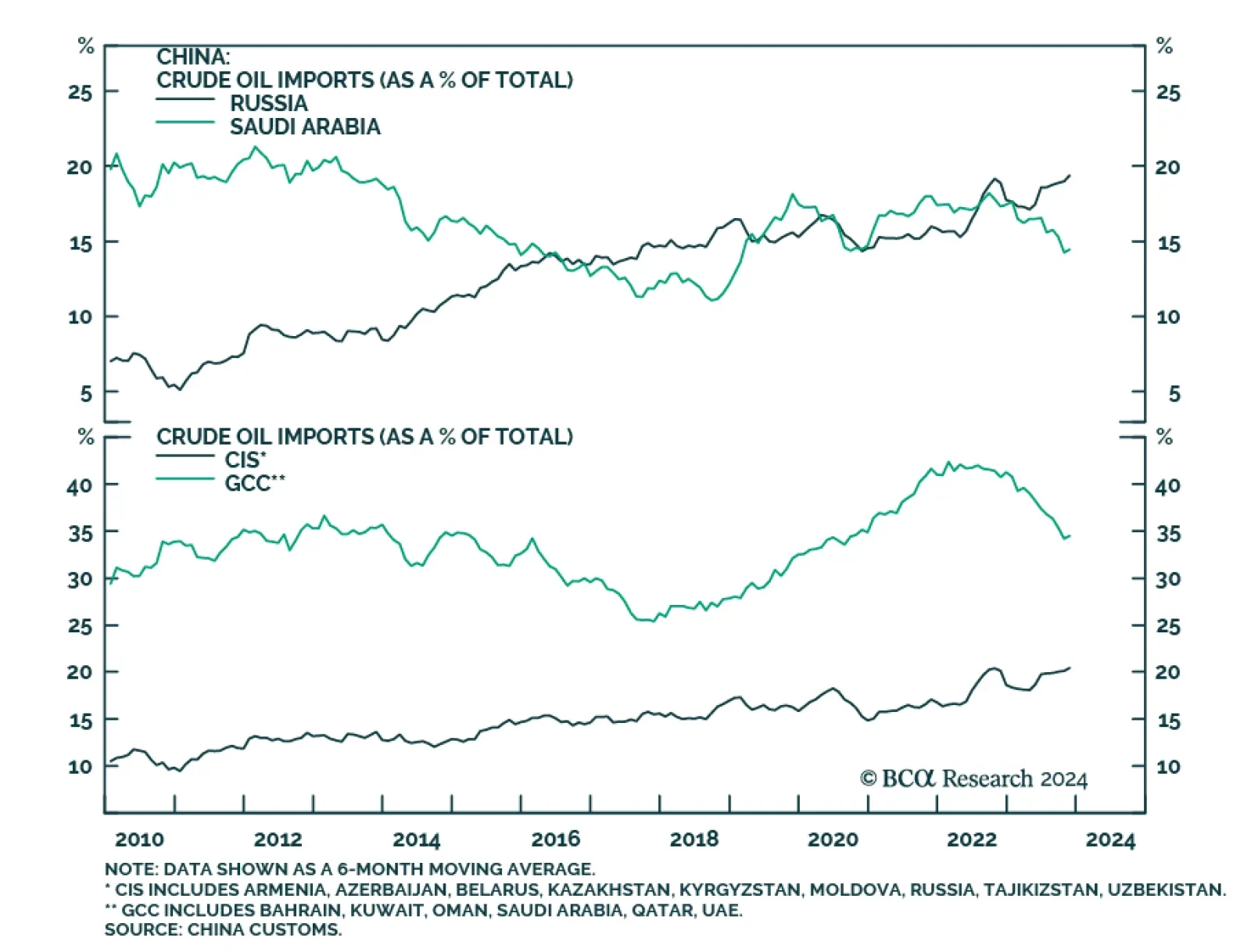

The Chinese economy continues to face deflationary pressures, reducing the odds that any intervention-driven rebound in equities will be sustained. In addition, our Geopolitical strategists have argued that US-China relations…

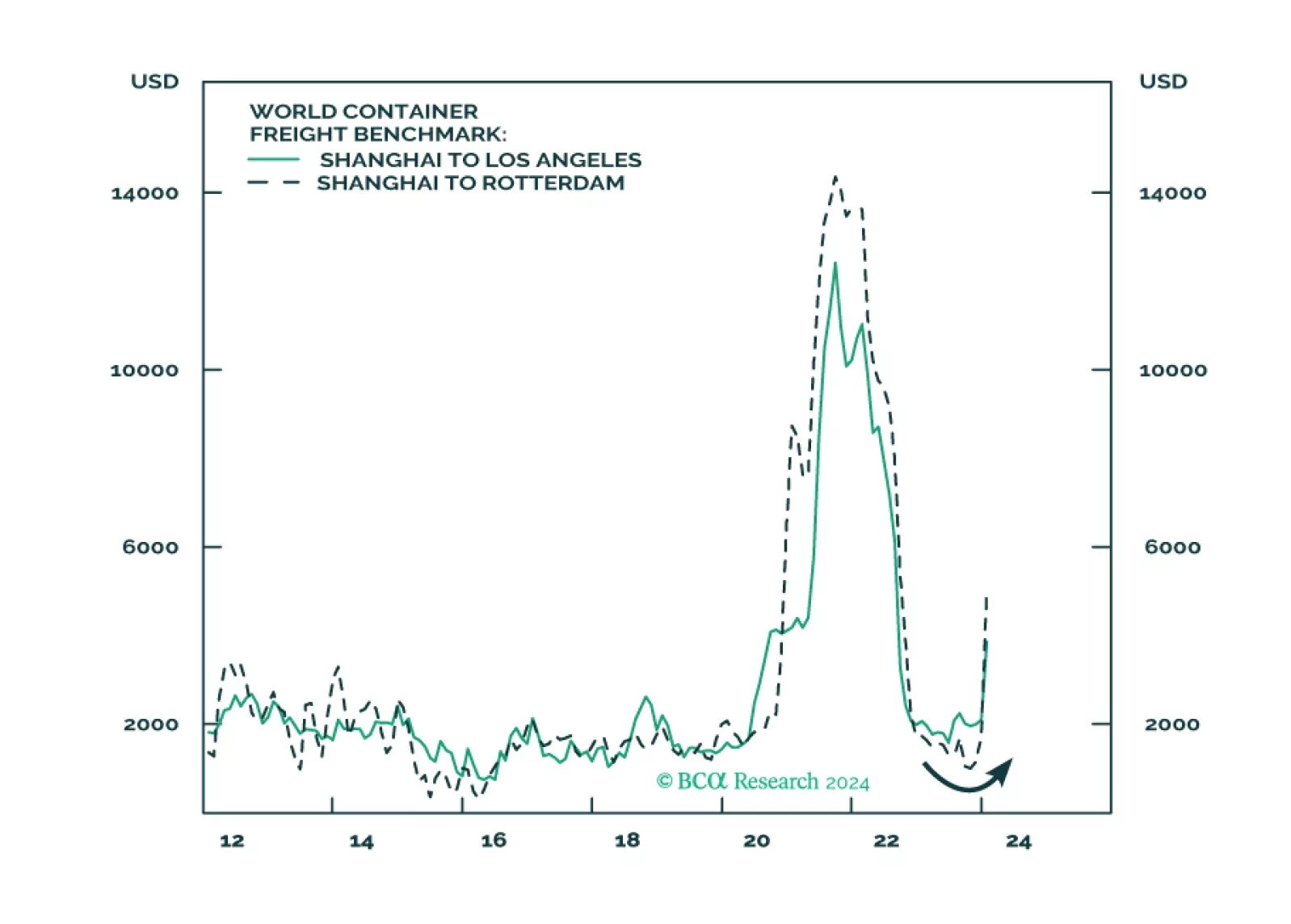

Middle East conflict, extreme US policy uncertainty, Chinese economic slowdown, US-Russian proxy war, and Asian military conflicts do not create a stable investment backdrop for 2024. Our top five “black swan” risks may be highly…

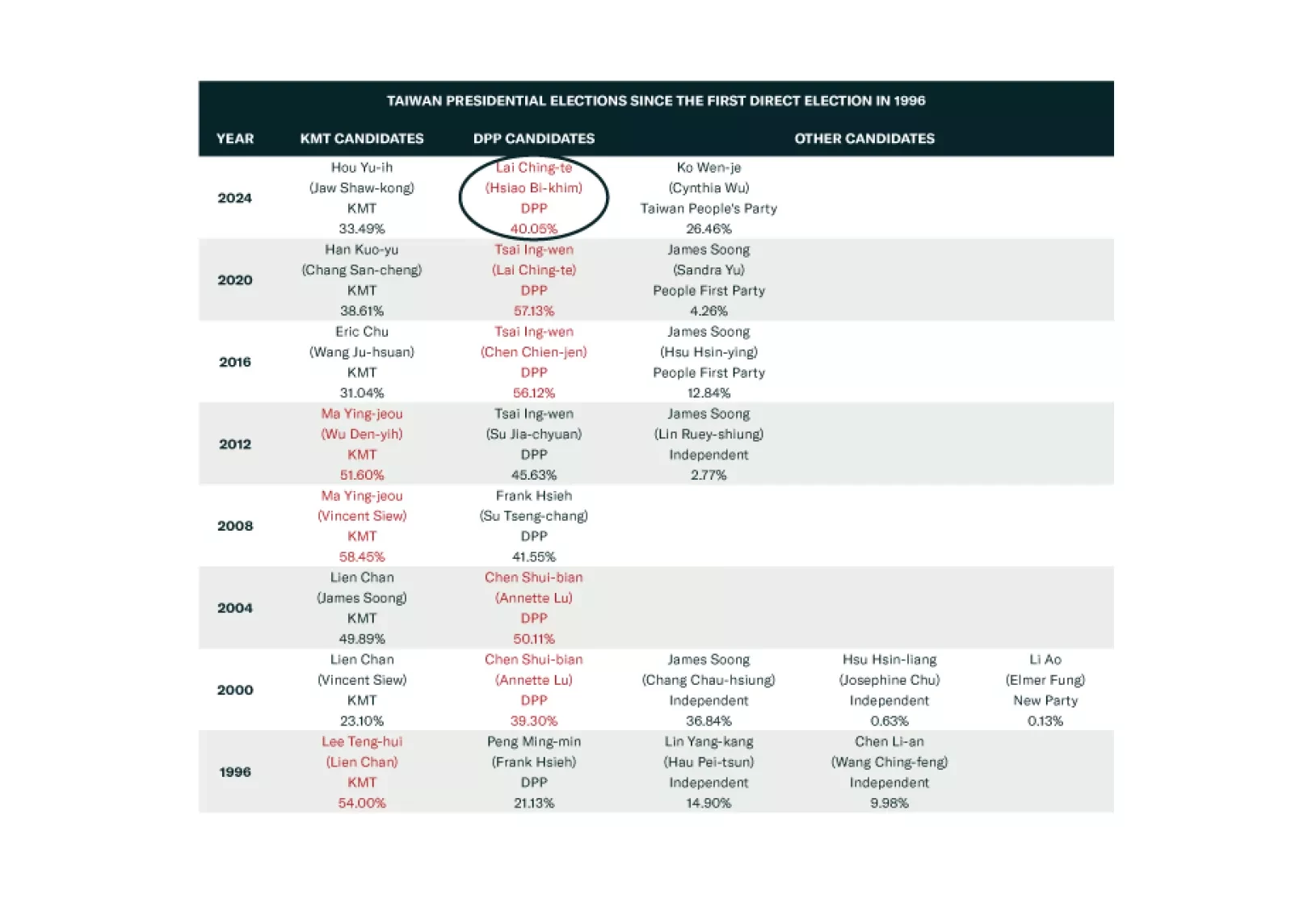

China will increase economic and military pressure on Taiwan but there is no basis for immediate full-scale war. That is the takeaway from the Taiwanese election on January 13, which returned the nominally pro-independence…

Taiwan’s election will lead to serious Chinese military and economic pressure but not full-scale war. War is a long-term concern. Investors should short TWD-USD.

The market’s pricing of a soft landing means that geopolitical risks are becoming more, not less, relevant in 2024. US domestic divisions will invite challenges as foreign powers rightly fear that US policy will turn more hawkish…