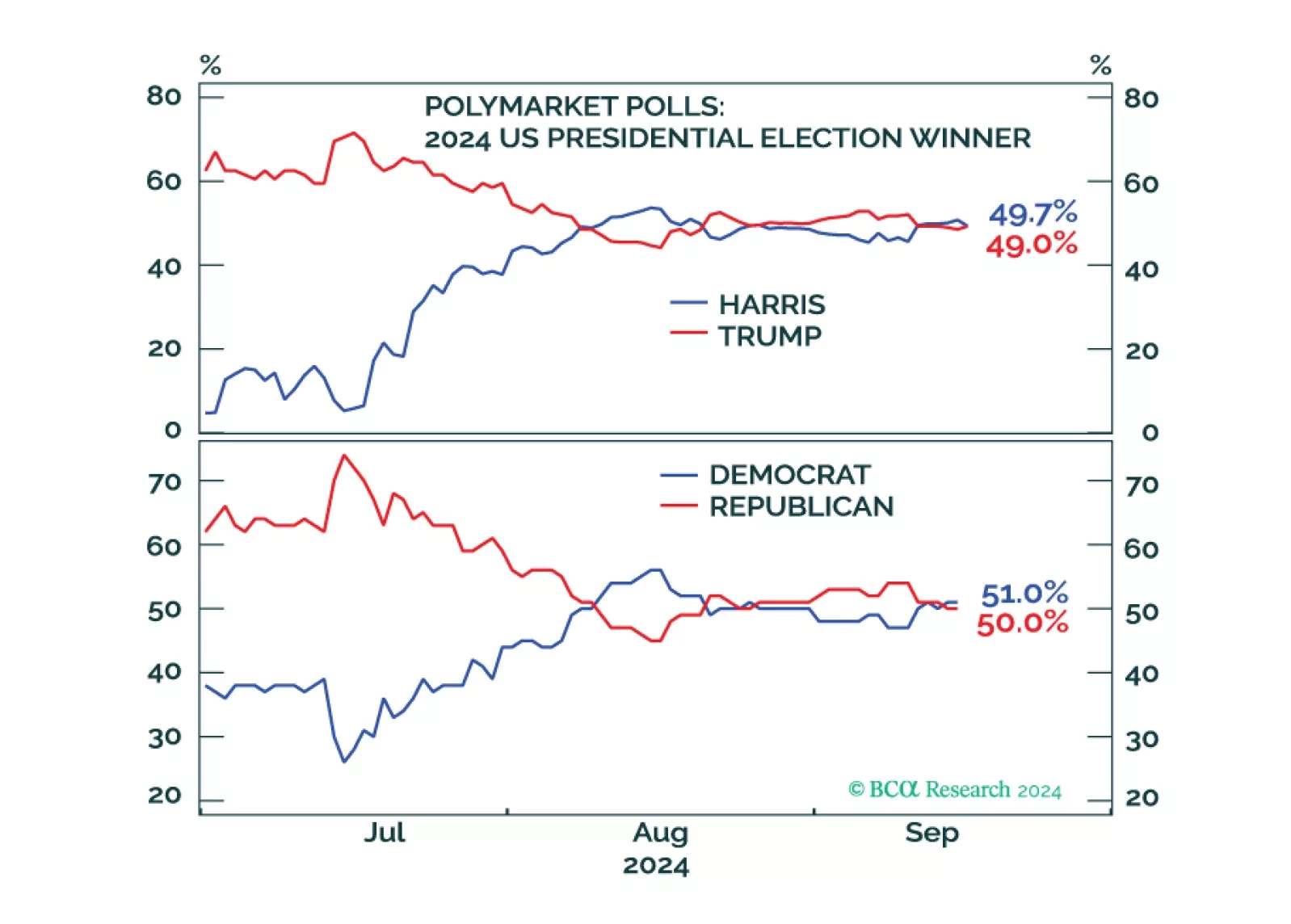

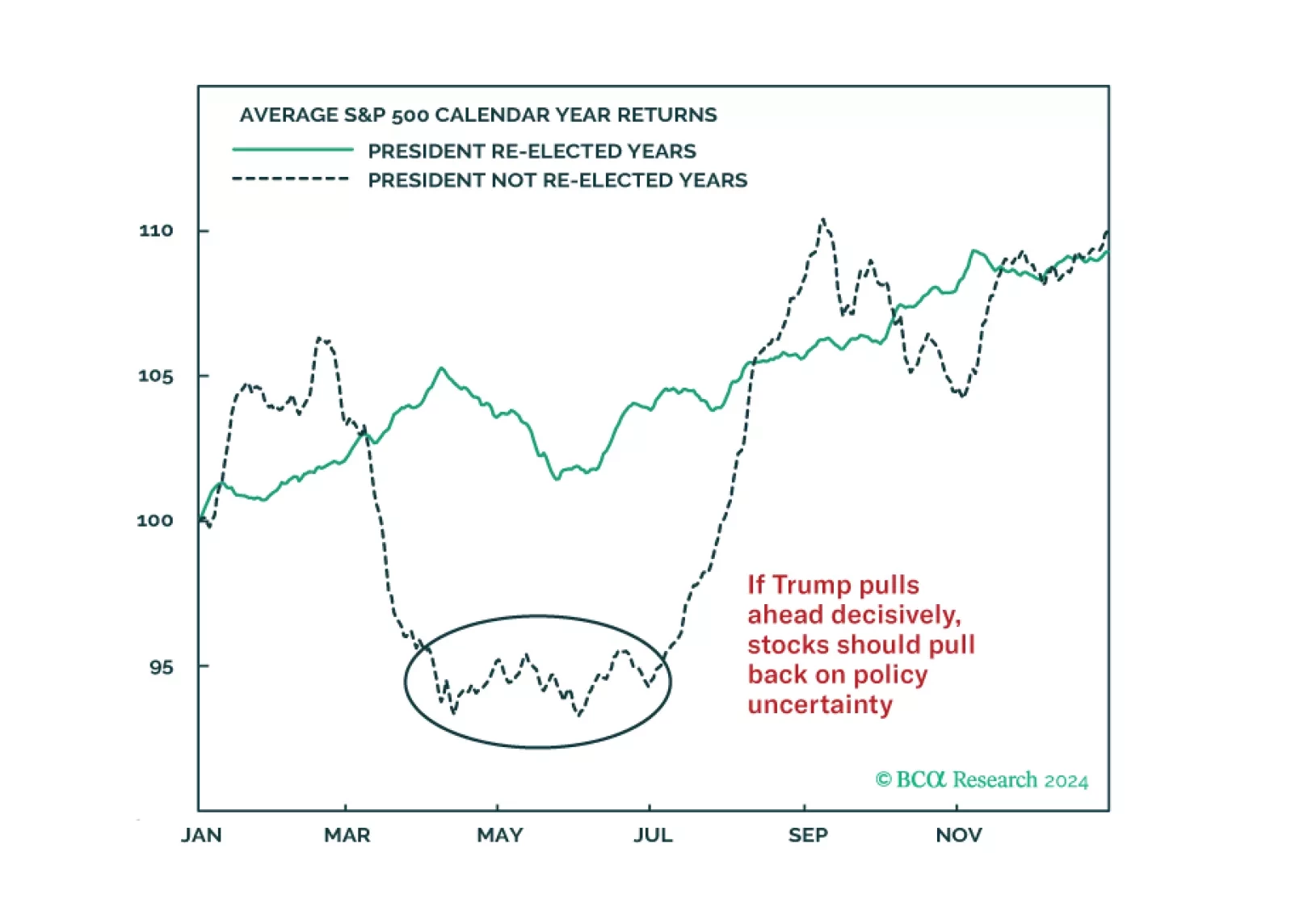

Investors should de-risk tactically in expectation of shocks and surprises ahead of the US election and an uncertain aftermath. Democratic victory with a gridlocked Congress is our base case but would bring minor tax hikes and…

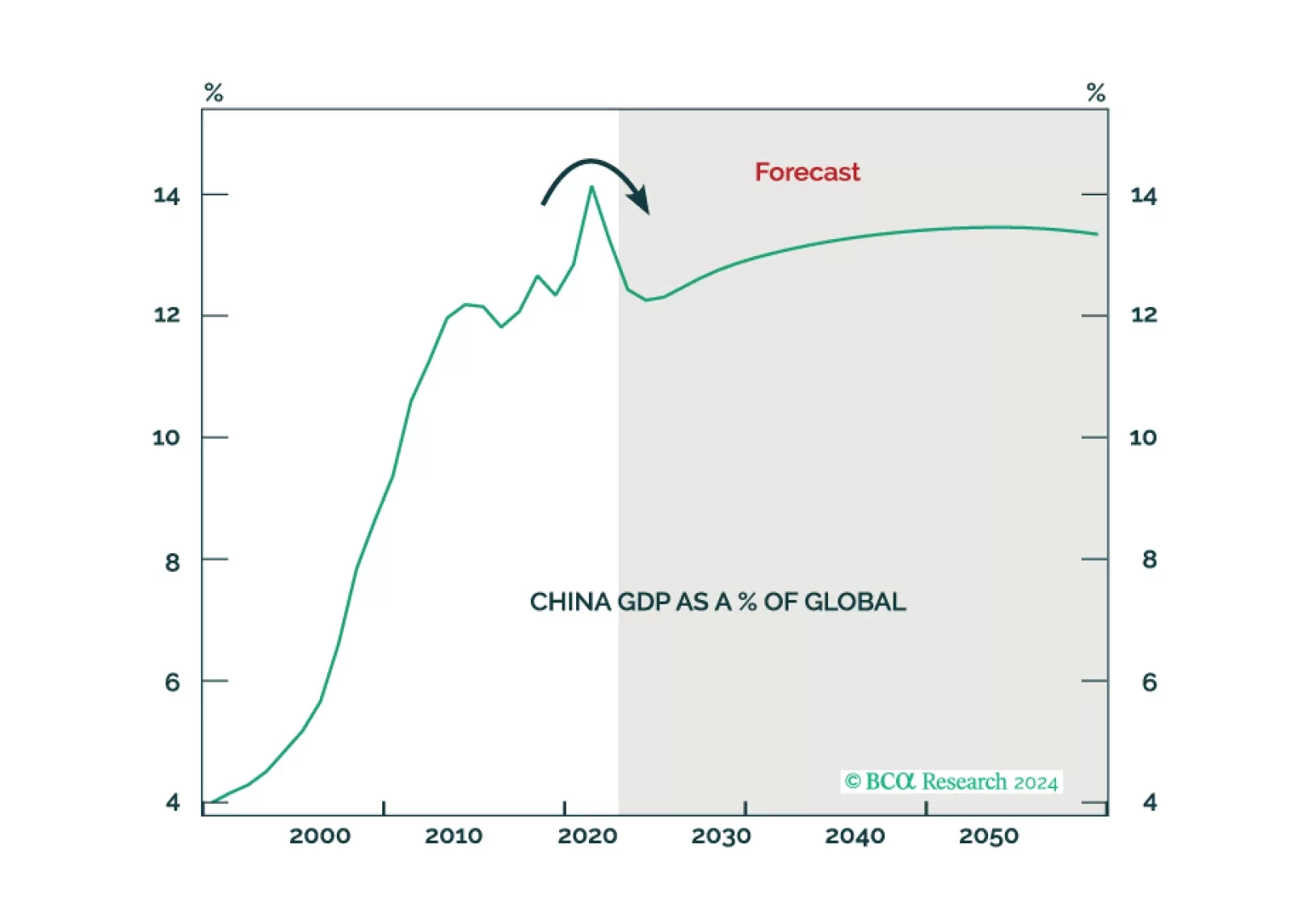

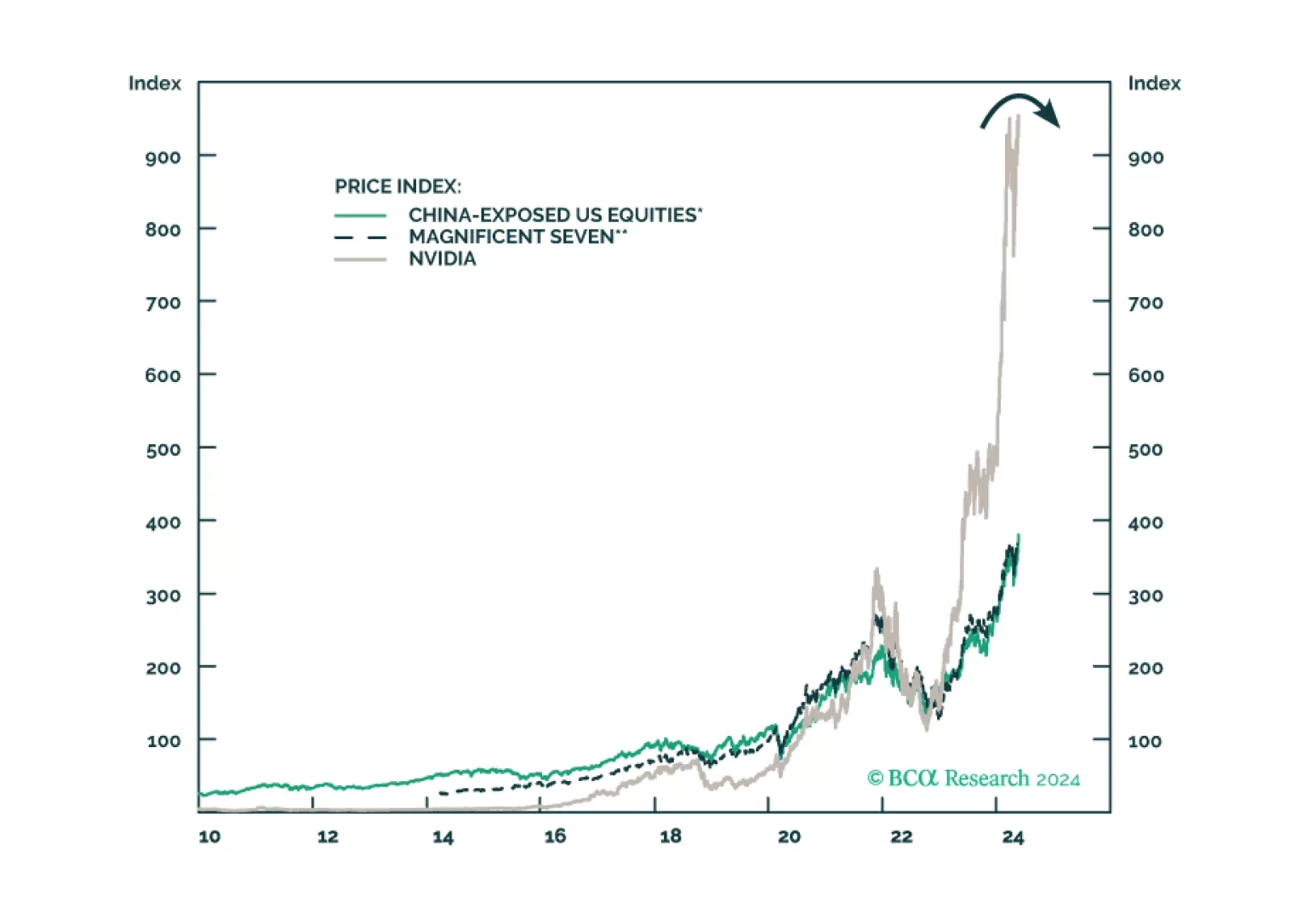

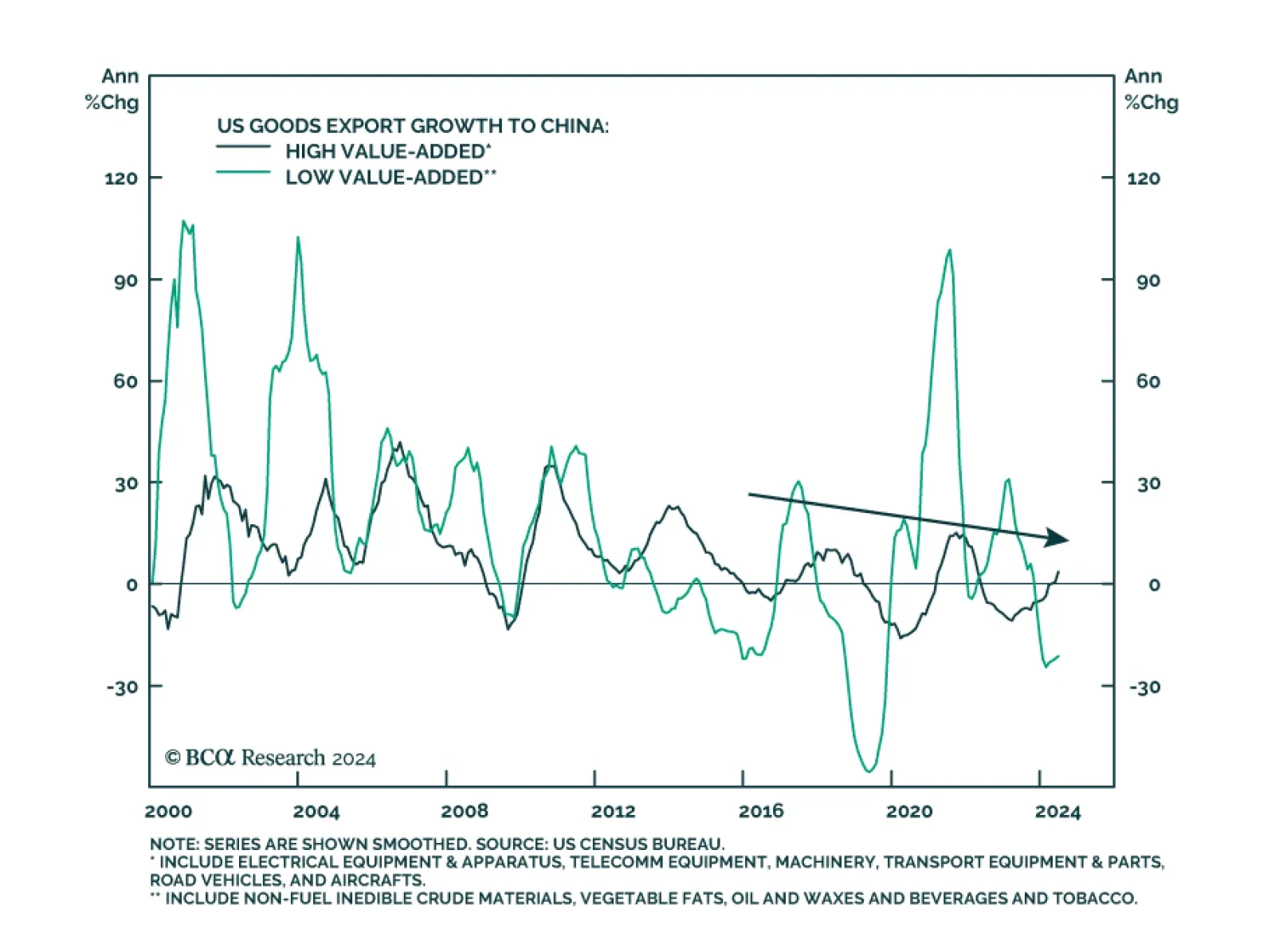

"There's no supply chain in the world that's more critical to us than China." — Tim Cook, CEO of Apple, March 2024 According to BCA Research’s China Investment Strategy and Emerging Market…

According to BCA Research’s Geopolitical Strategy service, US policy will have an impact on China’s willingness to adopt a preemptively hawkish foreign policy. But the US is in the middle of a chaotic election that…

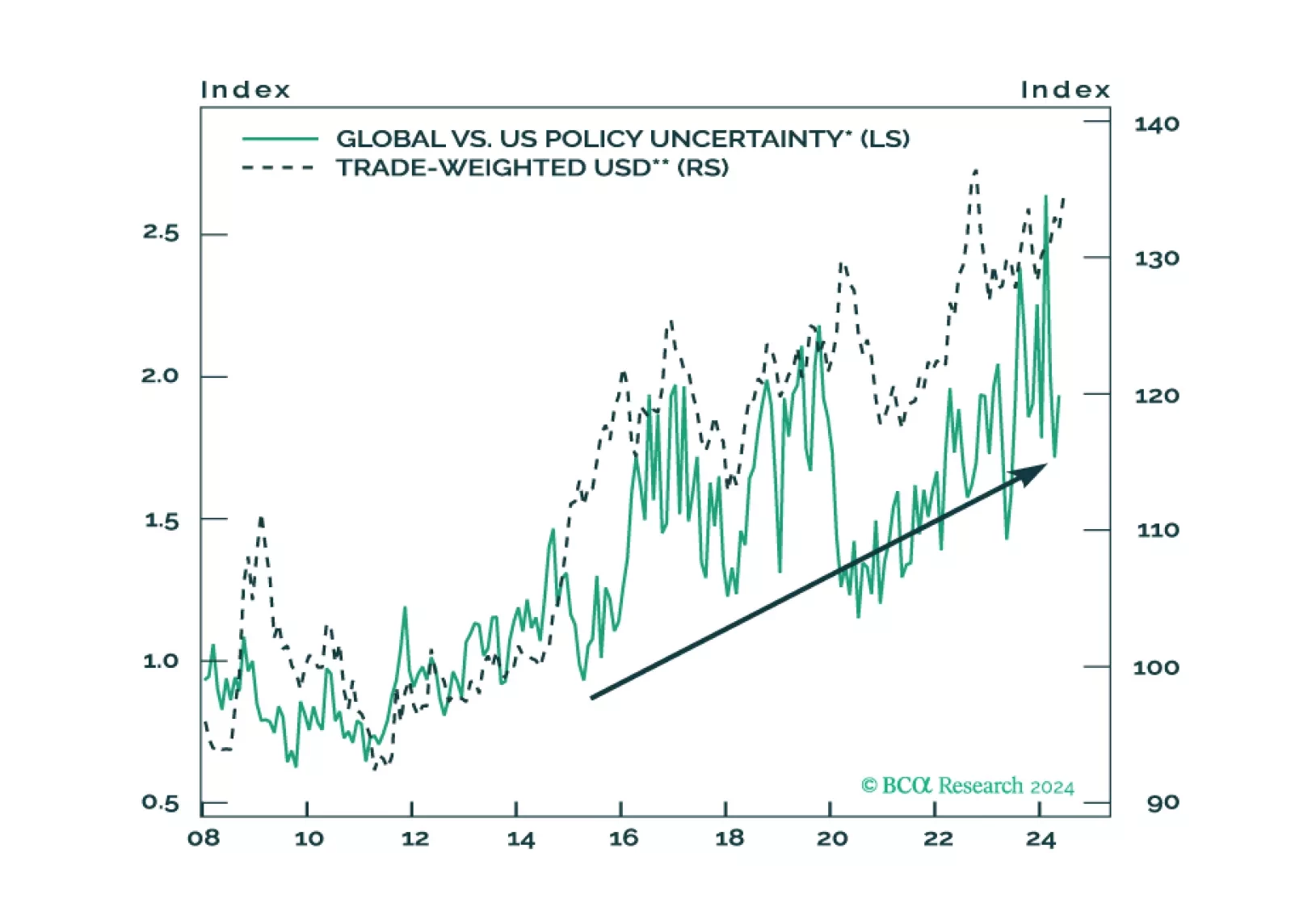

Investors should overweight US assets and de-risk their portfolios in anticipation of a major increase in policy uncertainty and geopolitical risk surrounding the US election and its global ramifications.

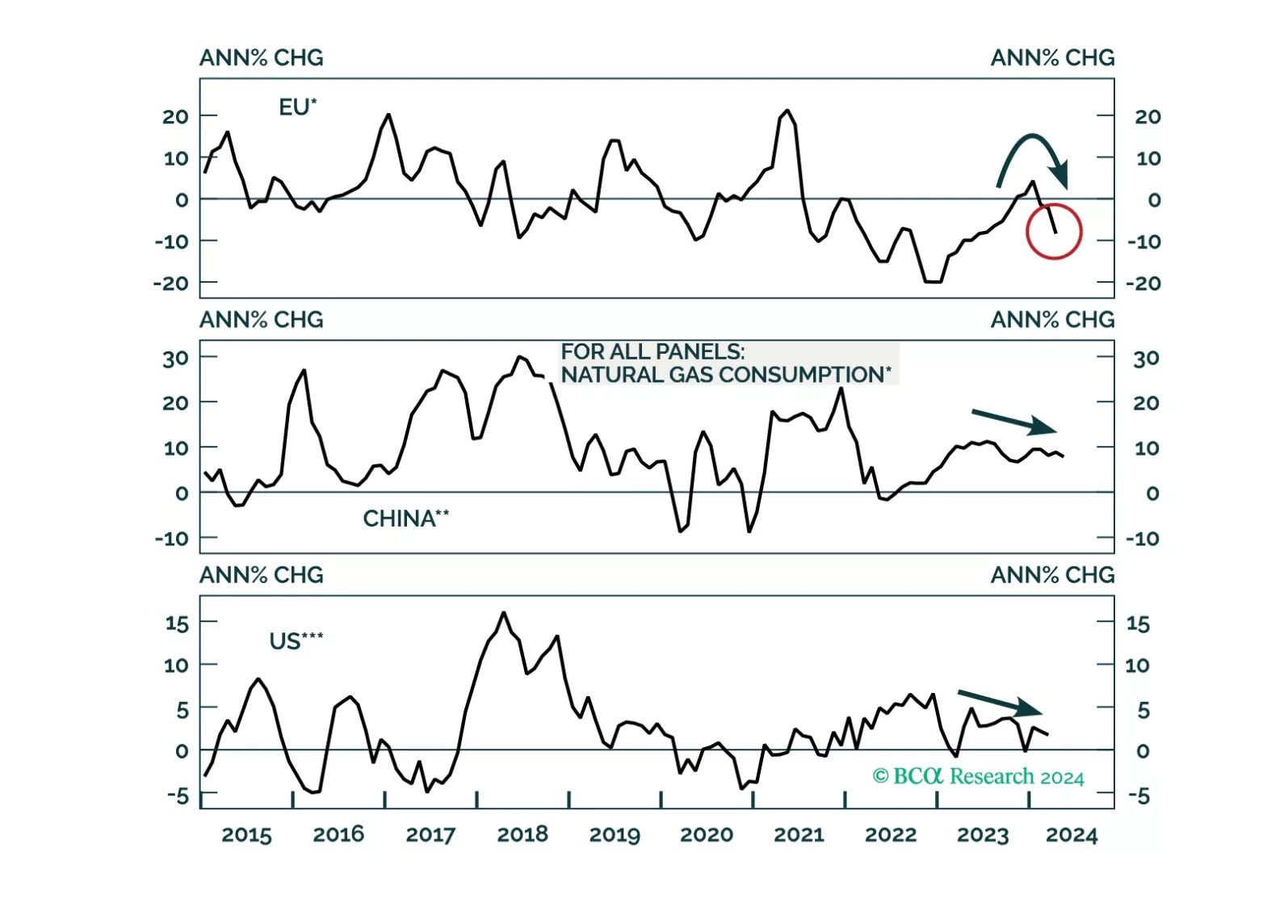

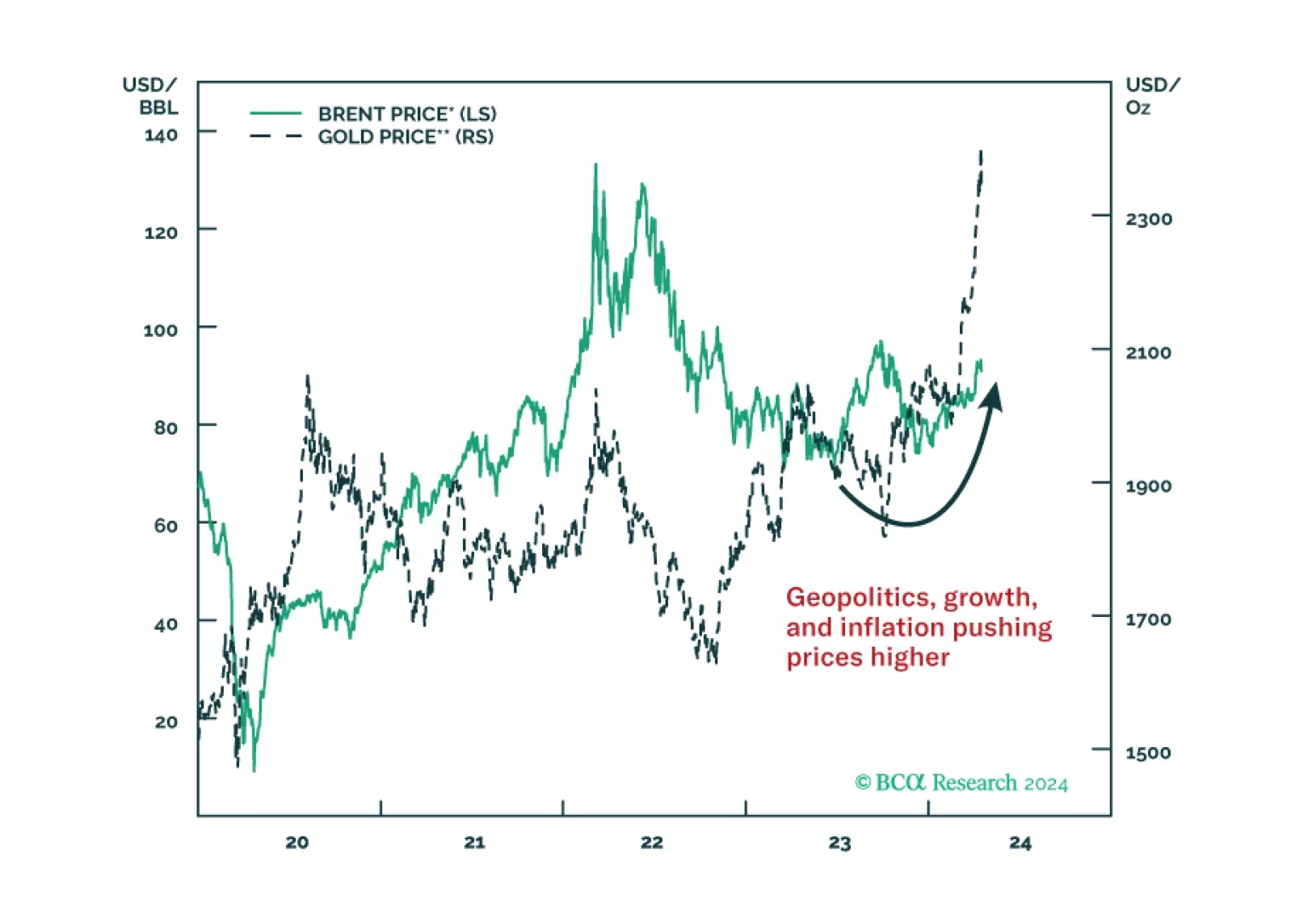

A global economic downturn will be a headwind for natgas prices over the cyclical horizon. Thereafter, LNG capacity additions will help keep the market in balance into the end of the decade. That said, Europe’s increased dependence…

Although a strategic détente between the US and China would benefit both sides, BCA Research’s Geopolitical Strategy service warns that the trade war will continue. The team has argued that Biden and Xi would fail to…

In the near term, favor oil and oil producers outside the Gulf Arab states. Over a 12-month horizon, favor US and North American equities, defensive sectors over cyclicals, and safe-assets. Within cyclicals, stick to energy and…

Investors around Europe and North America are concerned that the stock market is increasingly overbought and vulnerable to exogenous risks. We agree and have good reasons to fear that festering geopolitical risks and the US election…