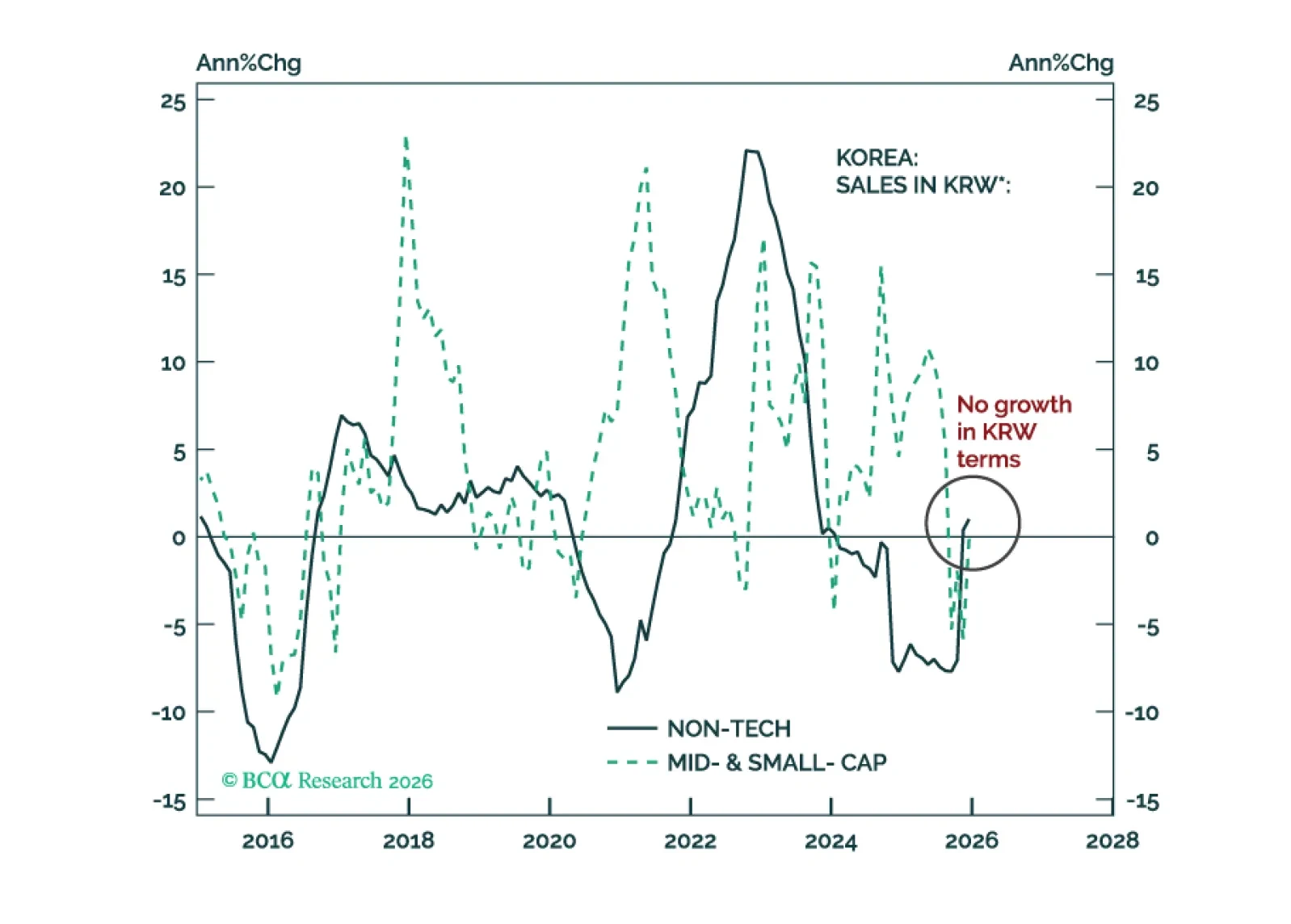

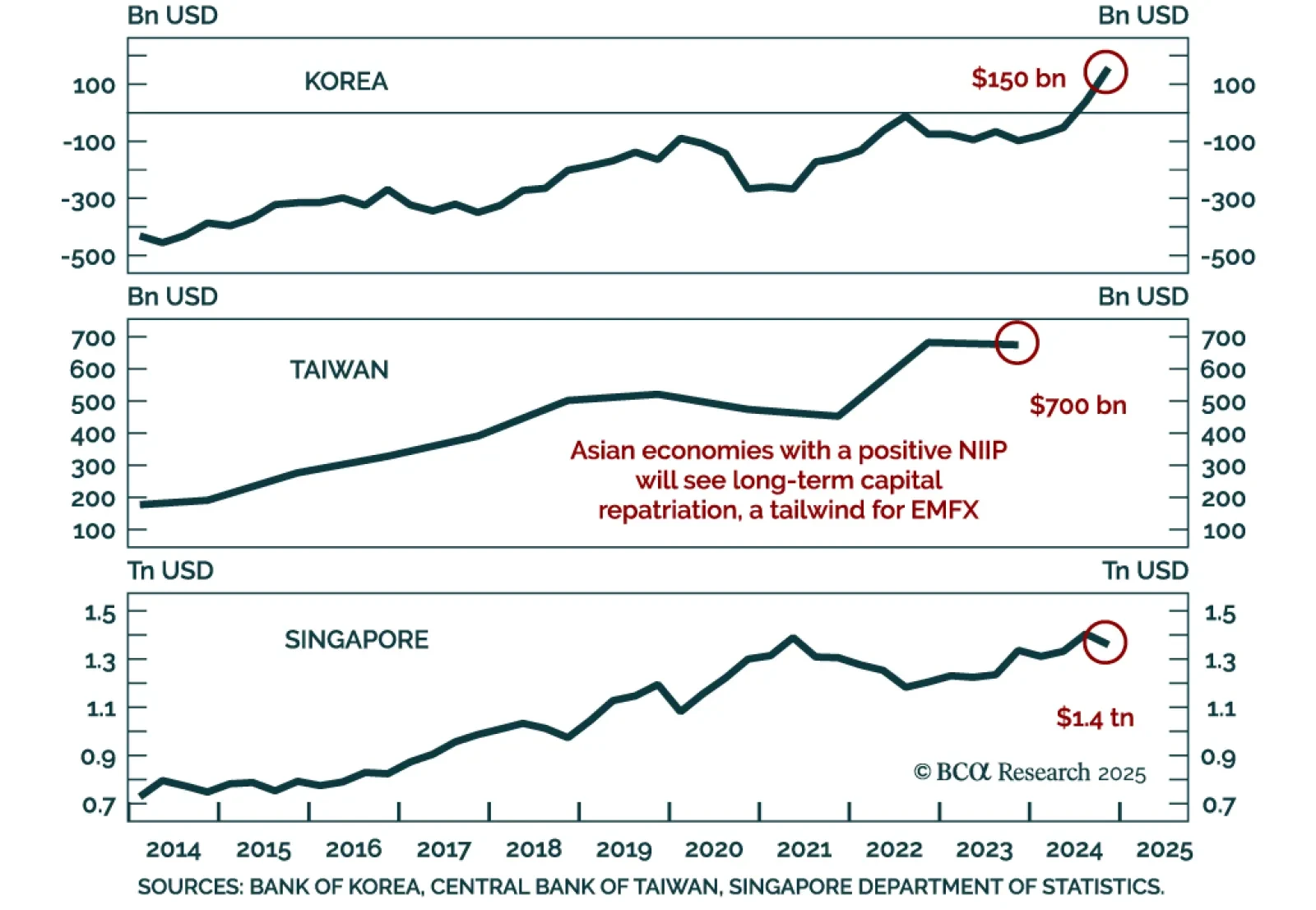

Go long KRW versus USD. Within an EM equity portfolio, overweight Korean tech and stay neutral on Korean non-tech. However, we are not bullish on the Korean bourse's absolute performance.

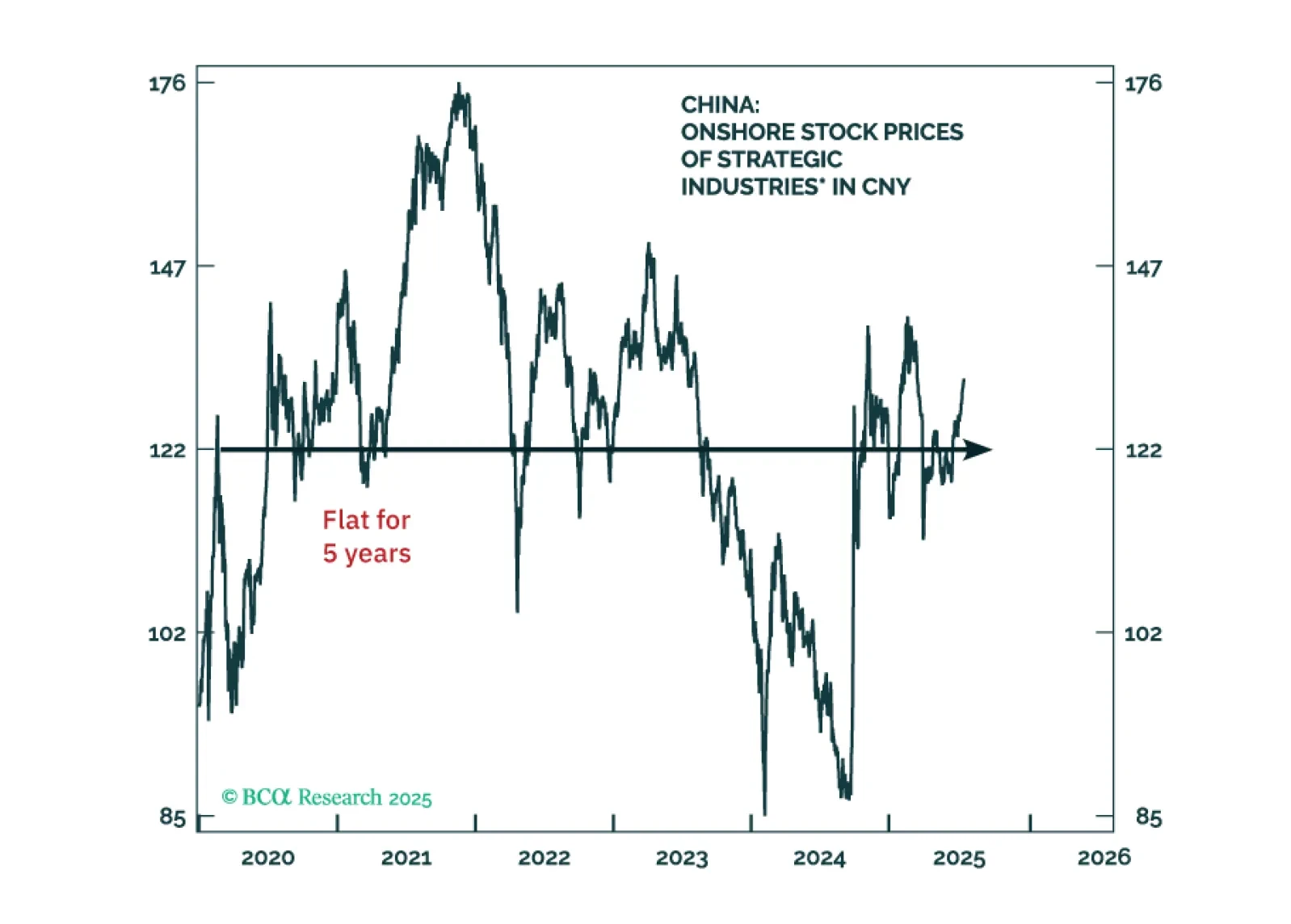

A world of political churn favors safe havens — buy yen, stay overweight US stocks, and avoid chasing the fragile rally in China.

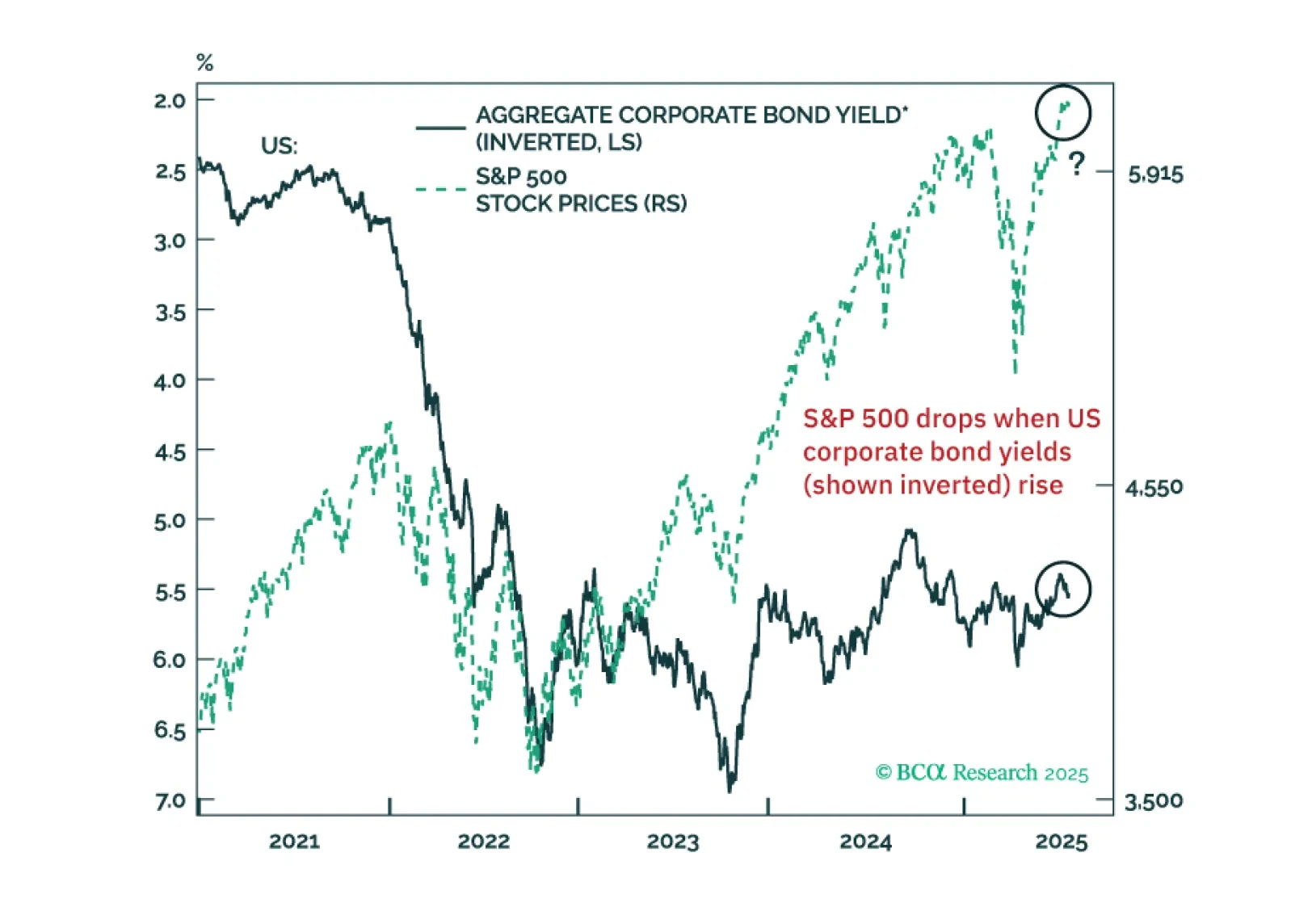

US equity investors should heed warning signals from US corporate bond yields. There are early red flags for EM share prices. Global trade will shrink in H2 2025. China’s economic tailwinds from H1 2025 – fiscal and export…

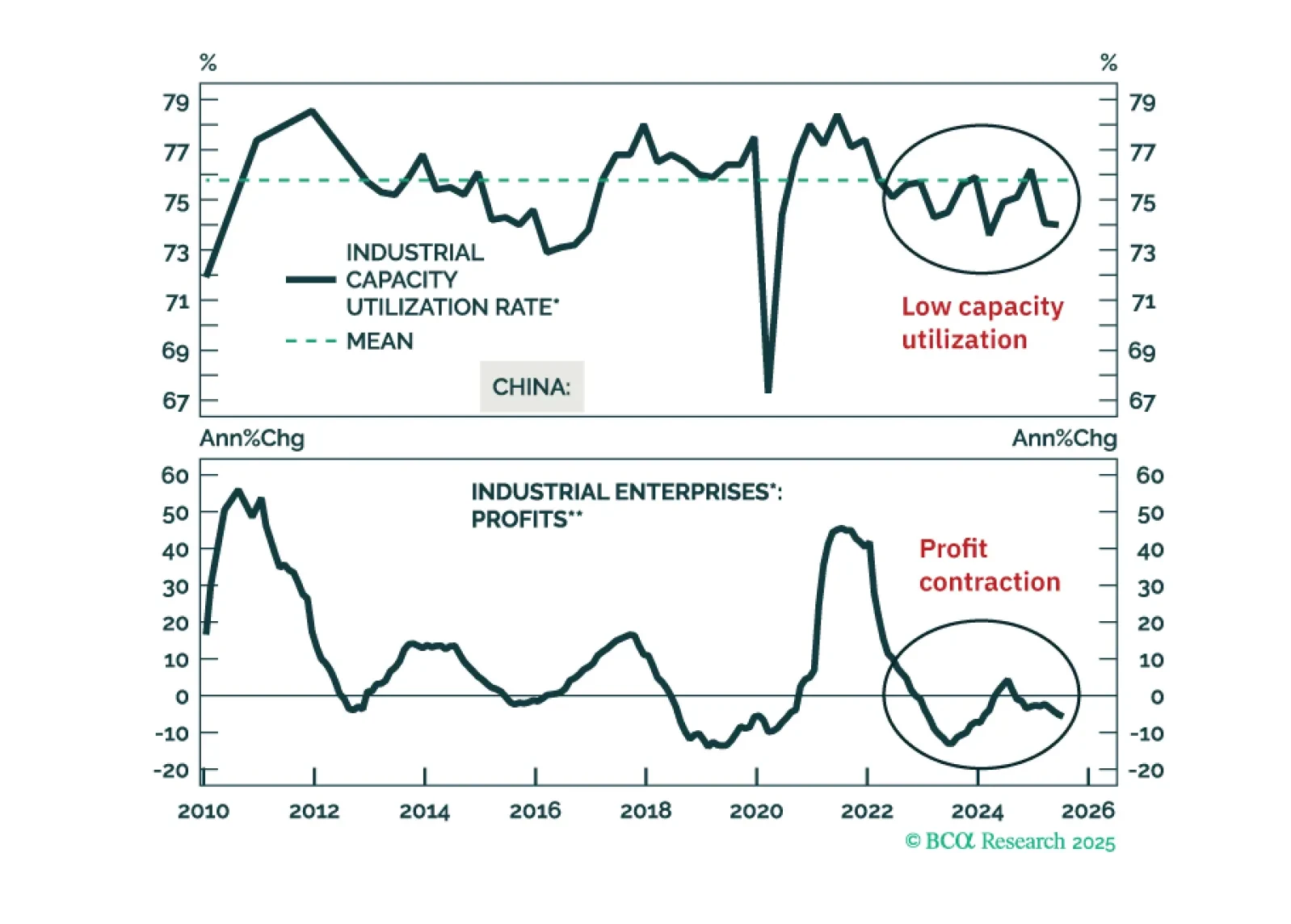

Acute geopolitical risks, like a massive oil shock, may be abating. But structural geopolitical risk remains high and could upset a blithe market. Cyclical economic risks are underrated as the US slows down and China continues to…

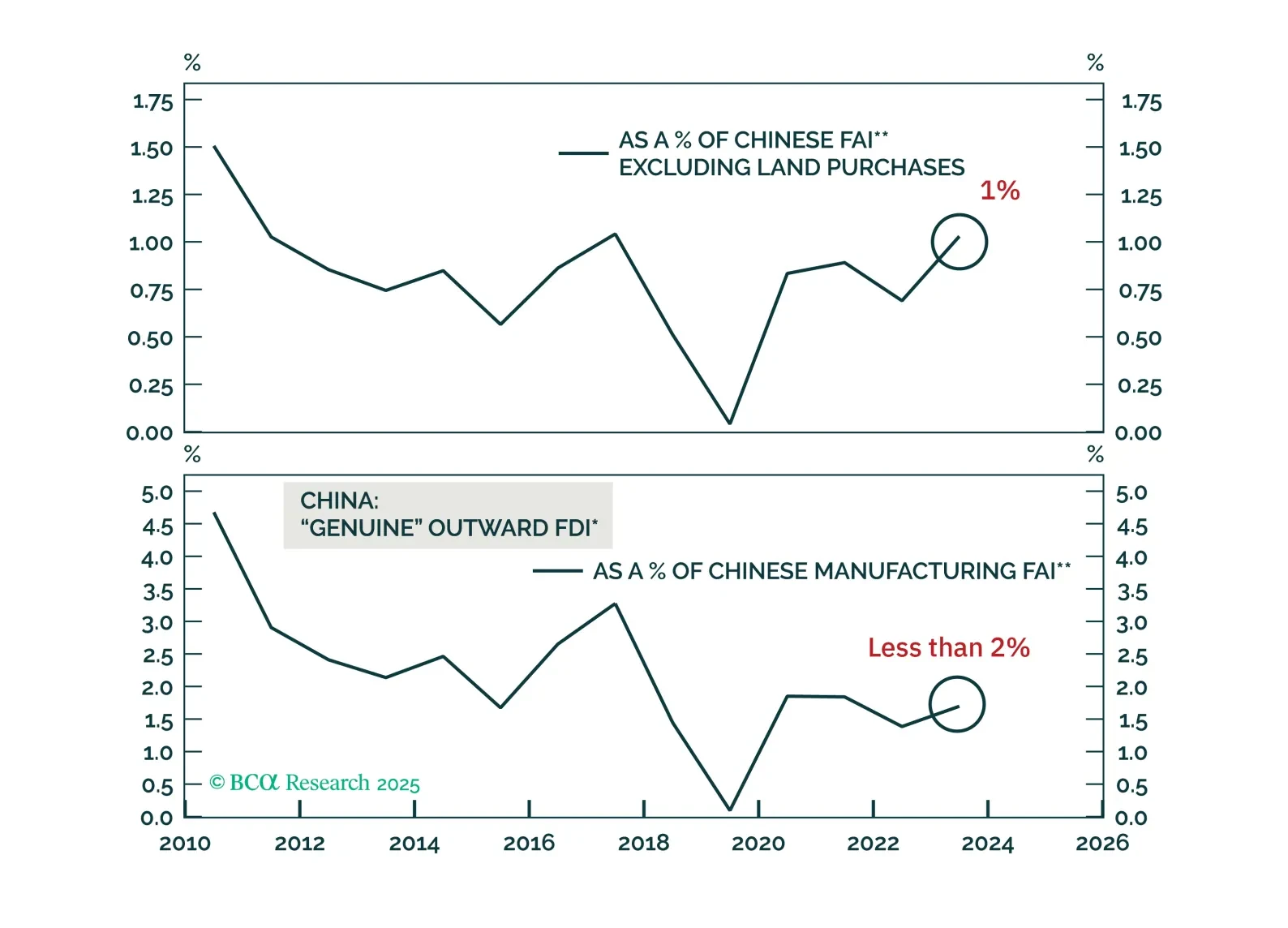

Our EM strategists see rising odds of a structural regime shift in Emerging Asian currencies. However, they expect a USD rebound and are looking to close short positions in IDR, PHP, and TWD. Severe deflationary shocks will drive…

Negotiations on trade, Iran, and Ukraine will prove critical this month. Markets will remain volatile because positive data surprises enable the White House to press its hawkish tariff hikes, while negative surprises force the White…