Tech stocks led the Hang Seng higher on Thursday, pushing the index up 3.1%. The improvement was broad-based with all but three constituents of the Tech index rising on the day. Meituan was the top performer, gaining nearly 10…

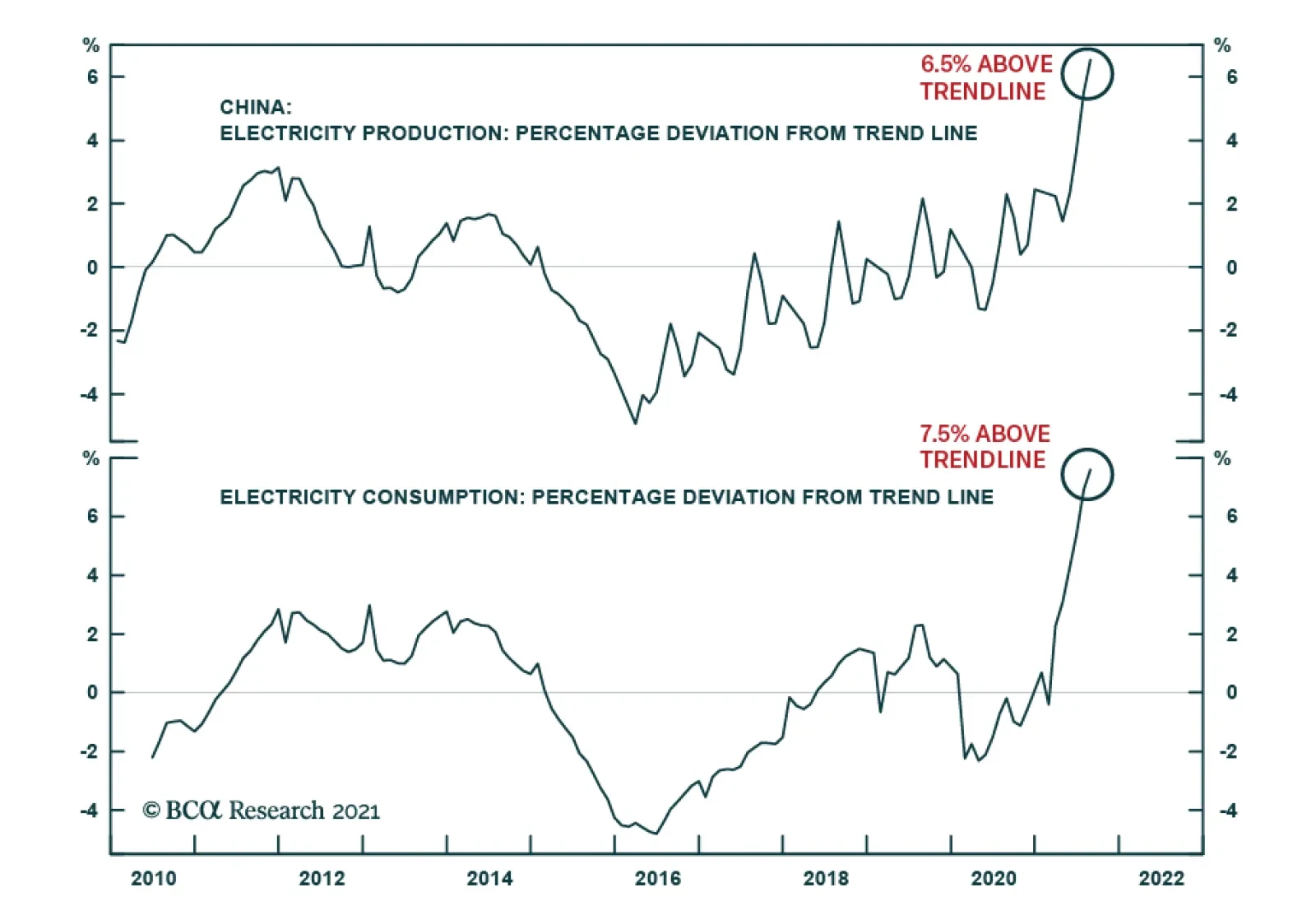

According to BCA Research’s Emerging Markets Strategy service, China’s electricity crisis is caused by excessive demand, rather than supply shortages. While both electricity consumption and production have been expanding,…

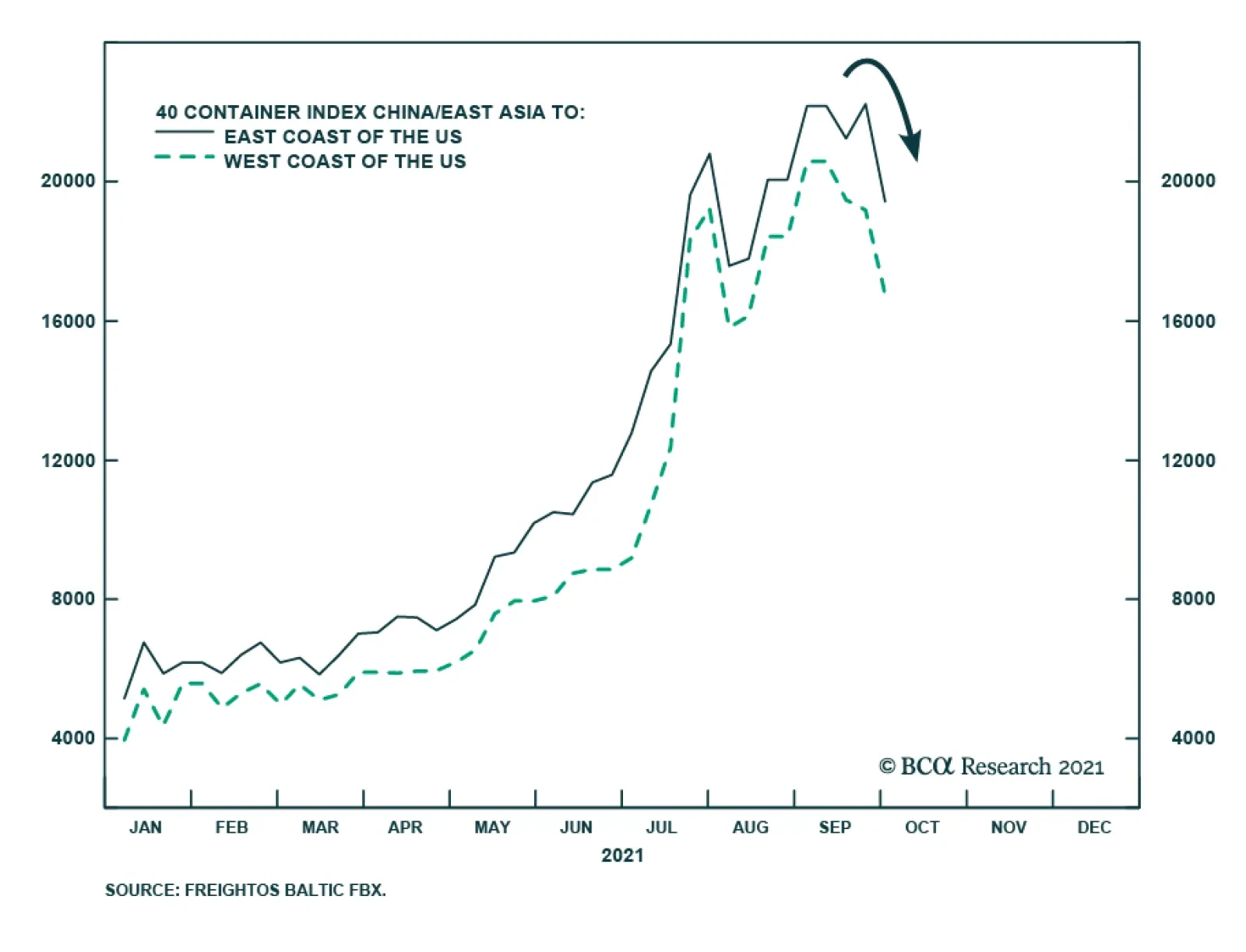

Following an eye-popping 313% rally in the Baltic Dry Index this year, there is some sign of reprieve. Shipping costs for the China – US route appear to be in the process of peaking. The latest weekly data show that the price…

Highlights Gold prices will continue to be challenged by conflicting information flows regarding US monetary policy; higher inflationary impulses from commodity prices and supply-chain bottlenecks; global economic policy uncertainty,…

Highlights Electricity shortages in China are largely due to excessive power demand rather than a matter of shrinking electricity production. Chinese electricity consumption has been supercharged by the export sector’s booming…

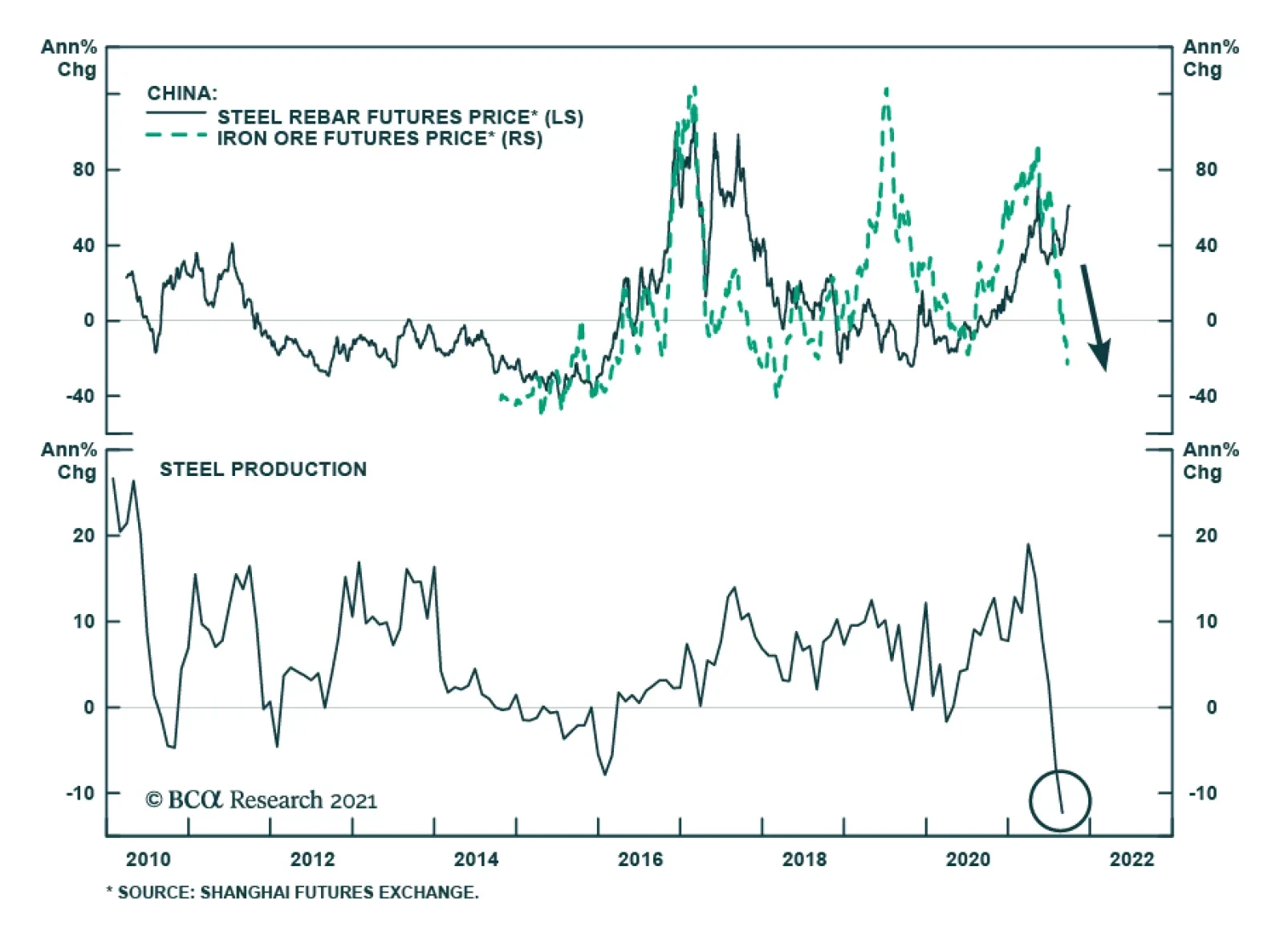

China’s energy crunch is spilling over into metal markets. Chinese steelmakers – which already face seasonal production curbs to curtail emissions during the winter months – are now being forced to lower output amid the…

Highlights Recommended Allocation The global economy will continue to grow at an above-trend rate over the next 12 months and central banks will remove accommodation only slowly.But the second year of a bull market is often…

Highlights The fourth quarter will be volatile as China still poses a risk of overtightening policy and undermining the global recovery. US political risks are also elevated. A debt default is likely to be averted in the end. Fiscal…

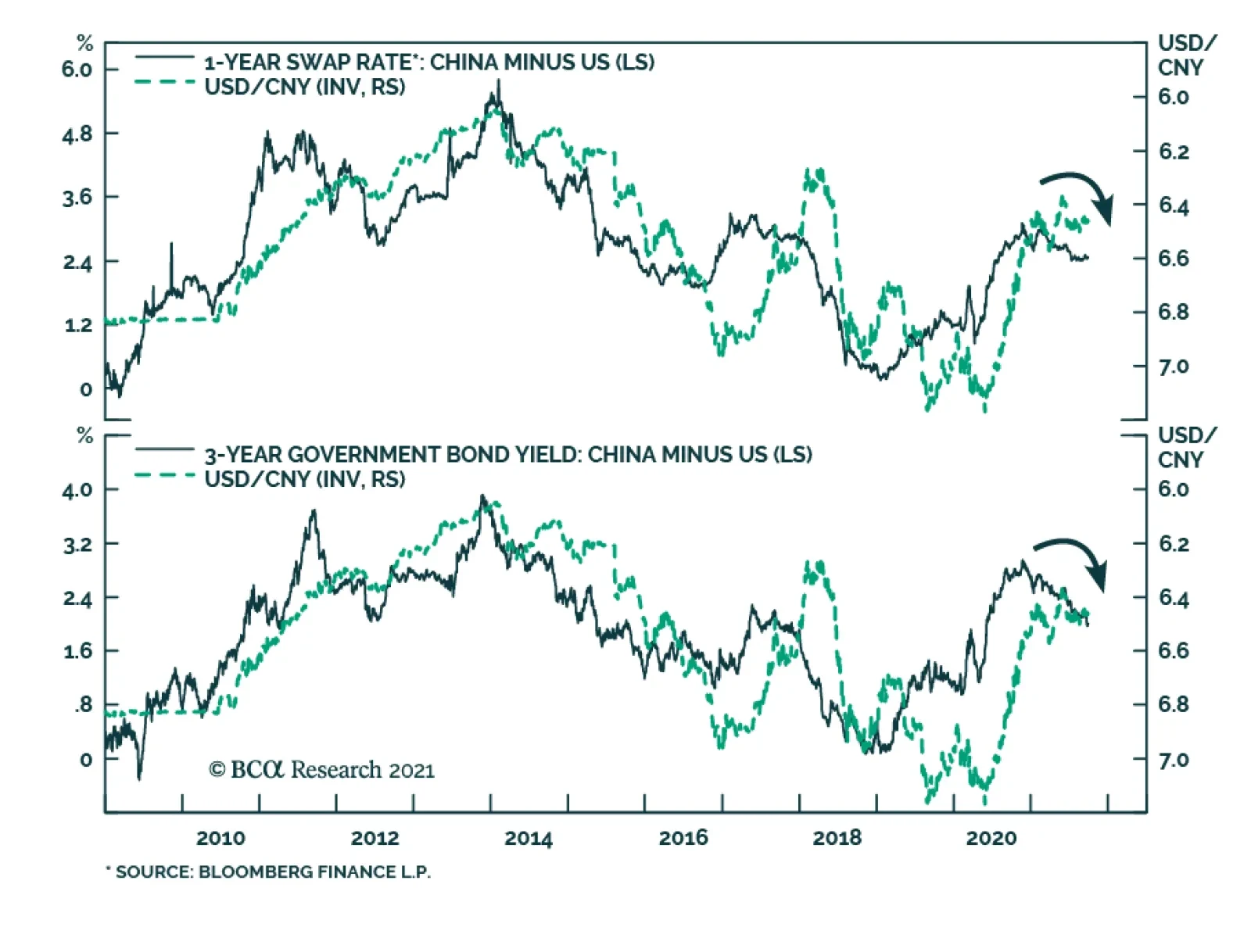

The performance of USD/CNY can often be explained by relative rates. The widening of the China-US yield differential in the second half of last year coincided with a sharp appreciation in the CNY vis-à-vis the USD. However, this…

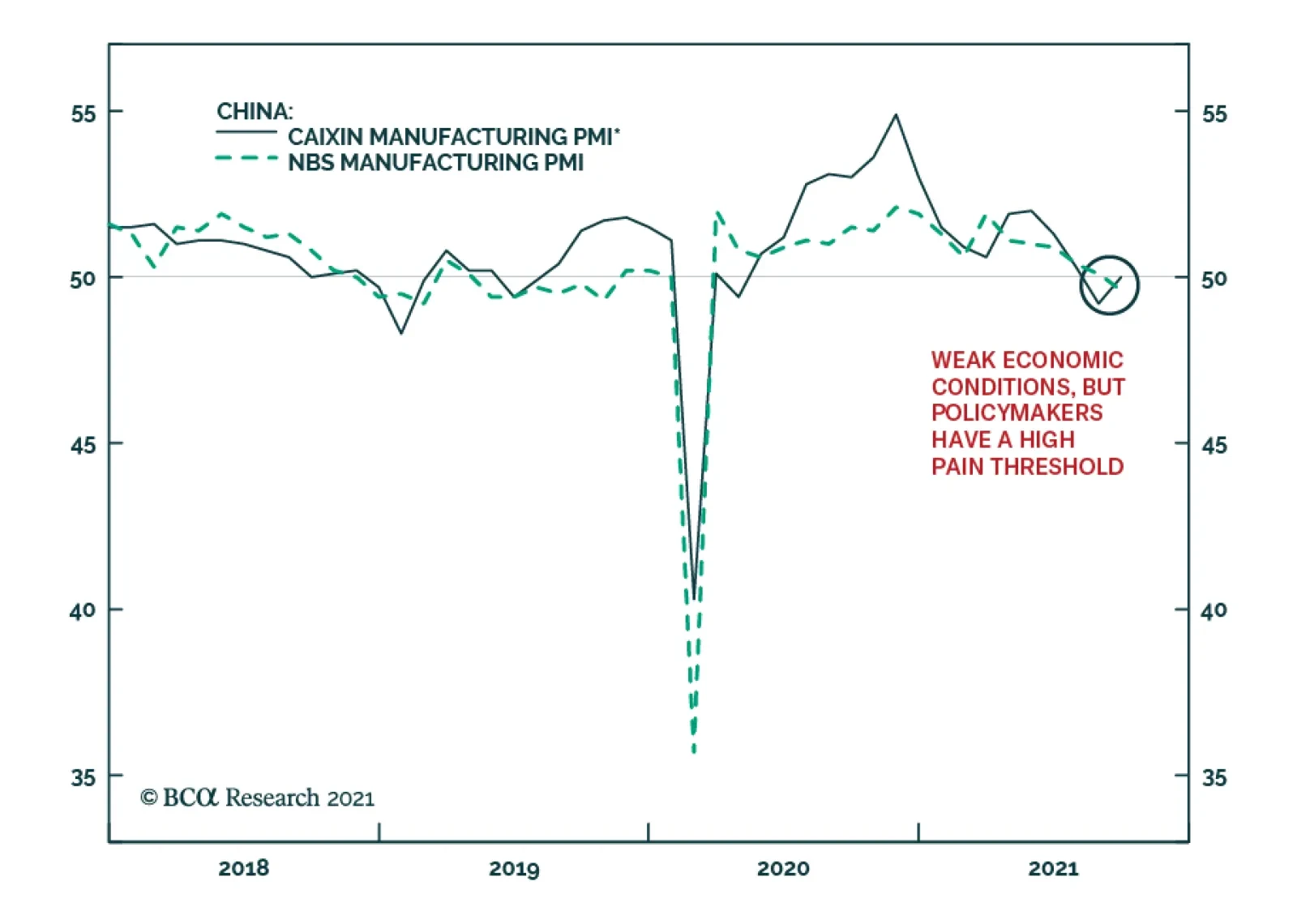

China’s NBS and Caixin Manufacturing PMIs sent a contradictory signal for September. The official manufacturing index slipped into contractionary territory after declining 0.5 points to 49.6. Consensus estimates anticipated a…