Highlights The euro has entered a period of acute stress. Some of the EUR/USD’s plunge reflects the dollar’s broad-based strength. The dollar is supported by the market’s pricing of the Fed and China’s…

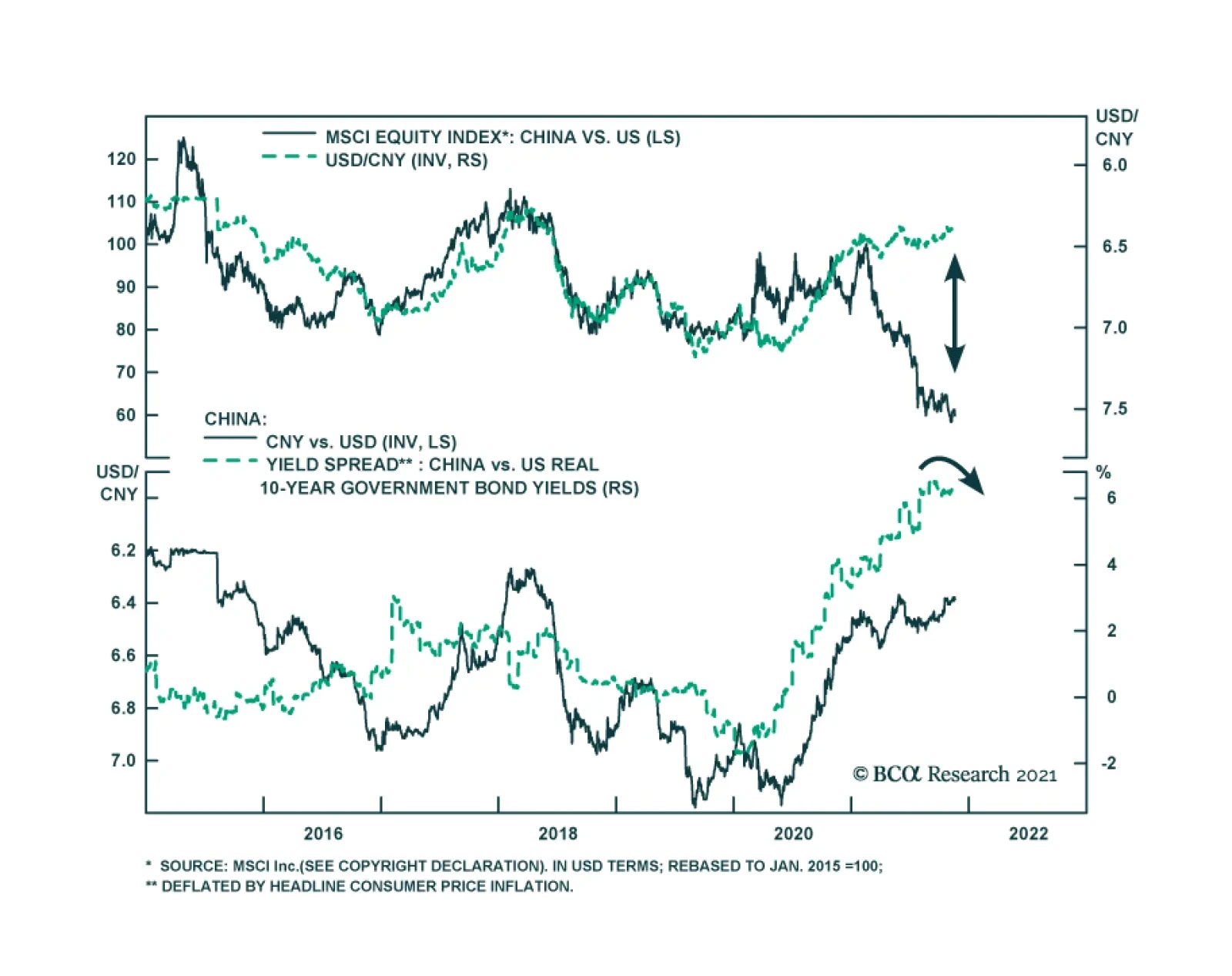

Despite broad-based dollar strength, USD/CNY has been depreciating recently. The CNY’s outperformance stands out as it marks a break from its correlation with China’s relative equity performance vis-à-vis the…

Dear Client, There will be no report next week as we will be working on our Quarterly Strategy Outlook, which will be published the following week. In the meantime, please keep an eye out for BCA Research’s Annual Outlook,…

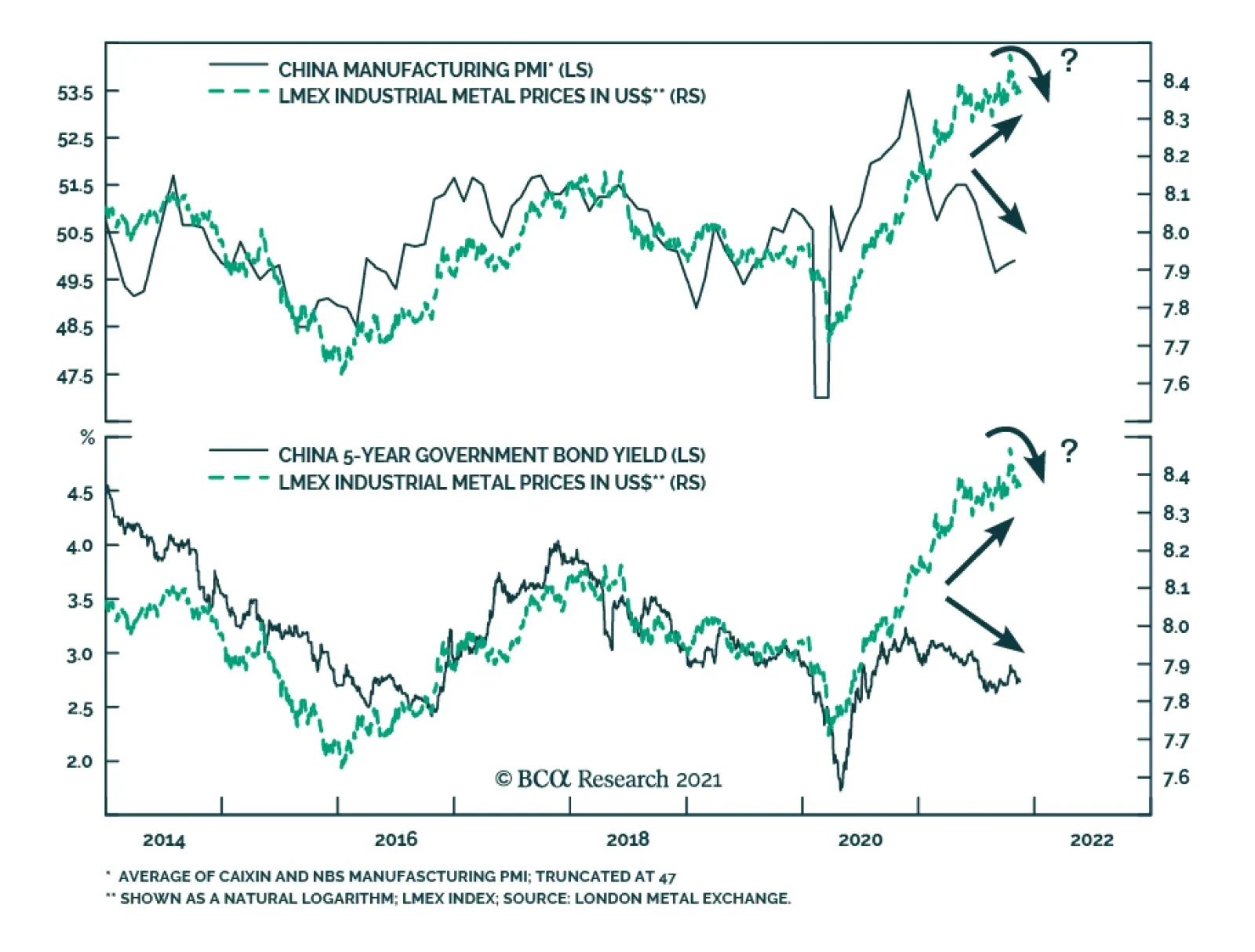

China’s construction sector is a key source of global demand for industrial commodities and in turn the prices of raw materials such as copper, iron ore, steel, and aluminum. As such, the LMEX has historically tracked…

Highlights China’s slowdown will deepen, and US bond yields will likely rise. This augurs well for the US dollar but will produce a toxic cocktail for EM. The recent weakness in the commodity complex will continue. EM markets…

The virtual summit between Presidents Joe Biden and Xi Jinping on Monday evening did not produce a major change in the bilateral relationship. President Biden initiated the meeting with the objective of ensuring that any…

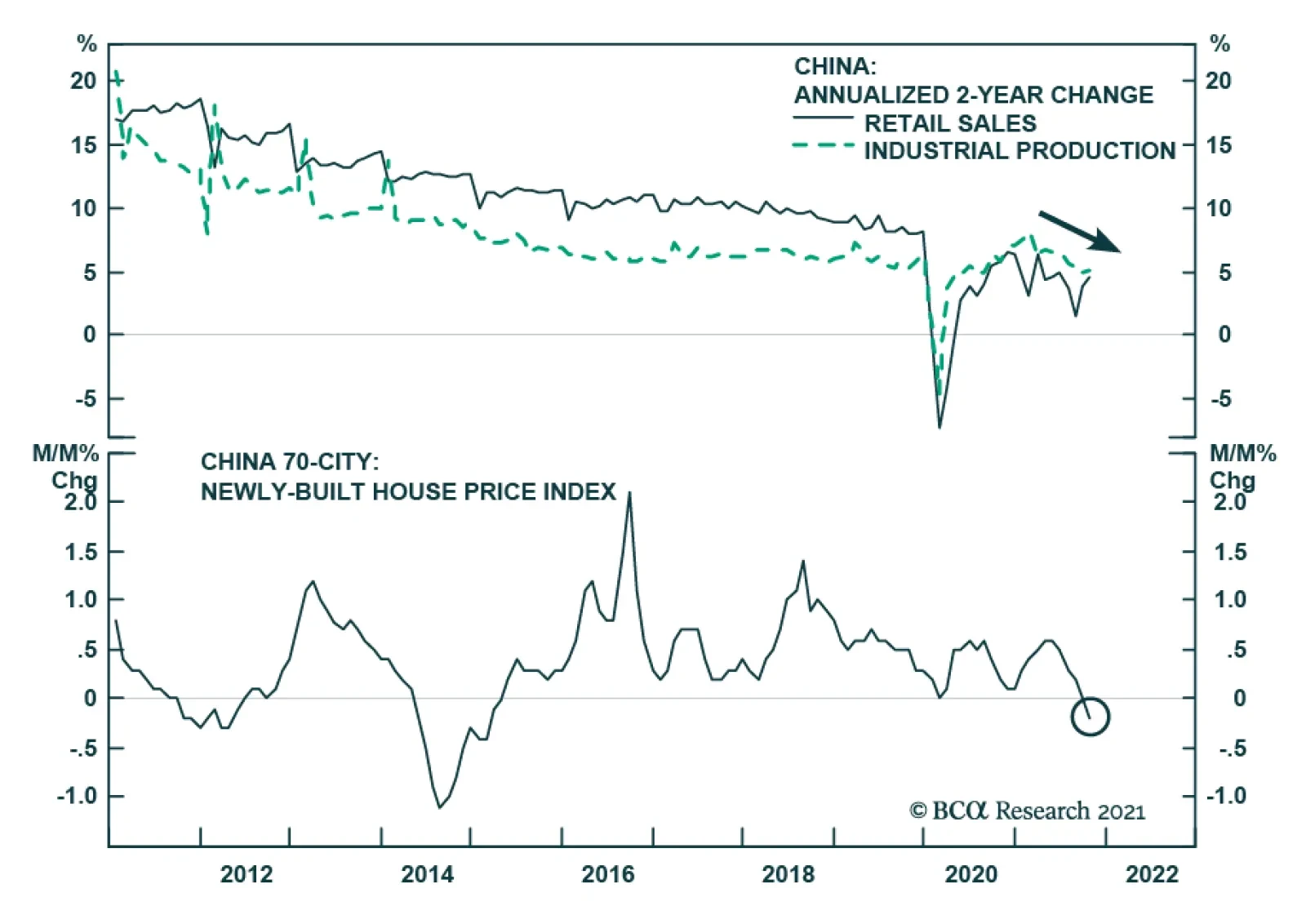

Chinese retail sales and industrial production data for October surprised to the upside. Retail sales growth accelerated slightly from 4.4% to 4.9% y/y and beat expectations of a slowdown to 3.7%. Similarly, industrial production…

Highlights Geopolitical conflicts point to energy price spikes and could add to inflation surprises in the near term. However, US fiscal drag and China’s economic slowdown are both disinflationary risks to be aware of. …

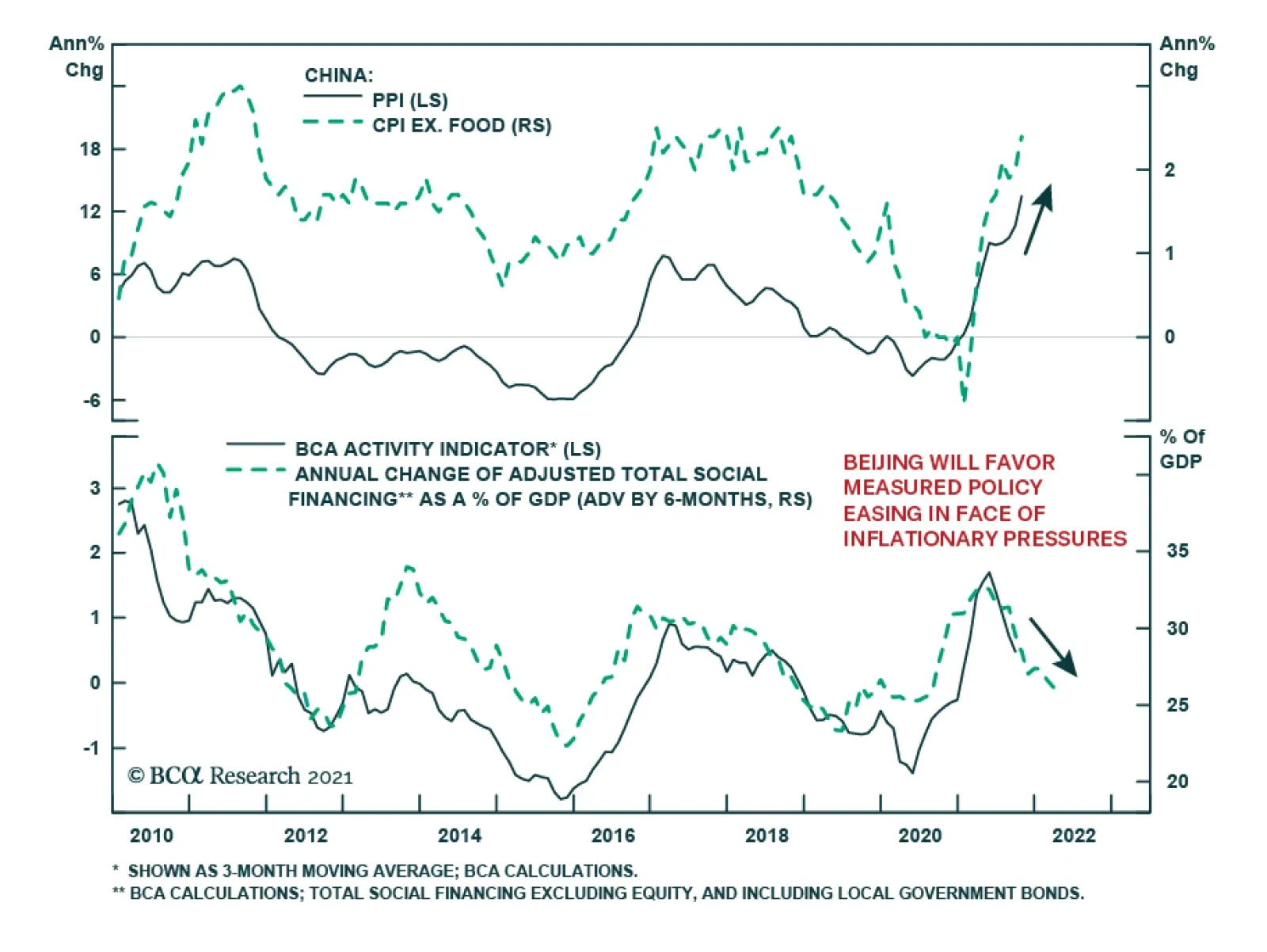

Chinese inflationary pressures intensified in October. PPI inflation accelerated from 10.7% to a 26 year high of 13.5% y/y, beating the anticipated 12.3% increase. Price pressures are particularly acute among PPI producer goods:…

Dear Client, Next week I will be hosting and attending client events, both virtual and in person. Our next report, on November 24 will be a recap of my observations from the meetings with our clients. Best regards, Jing Sima China…