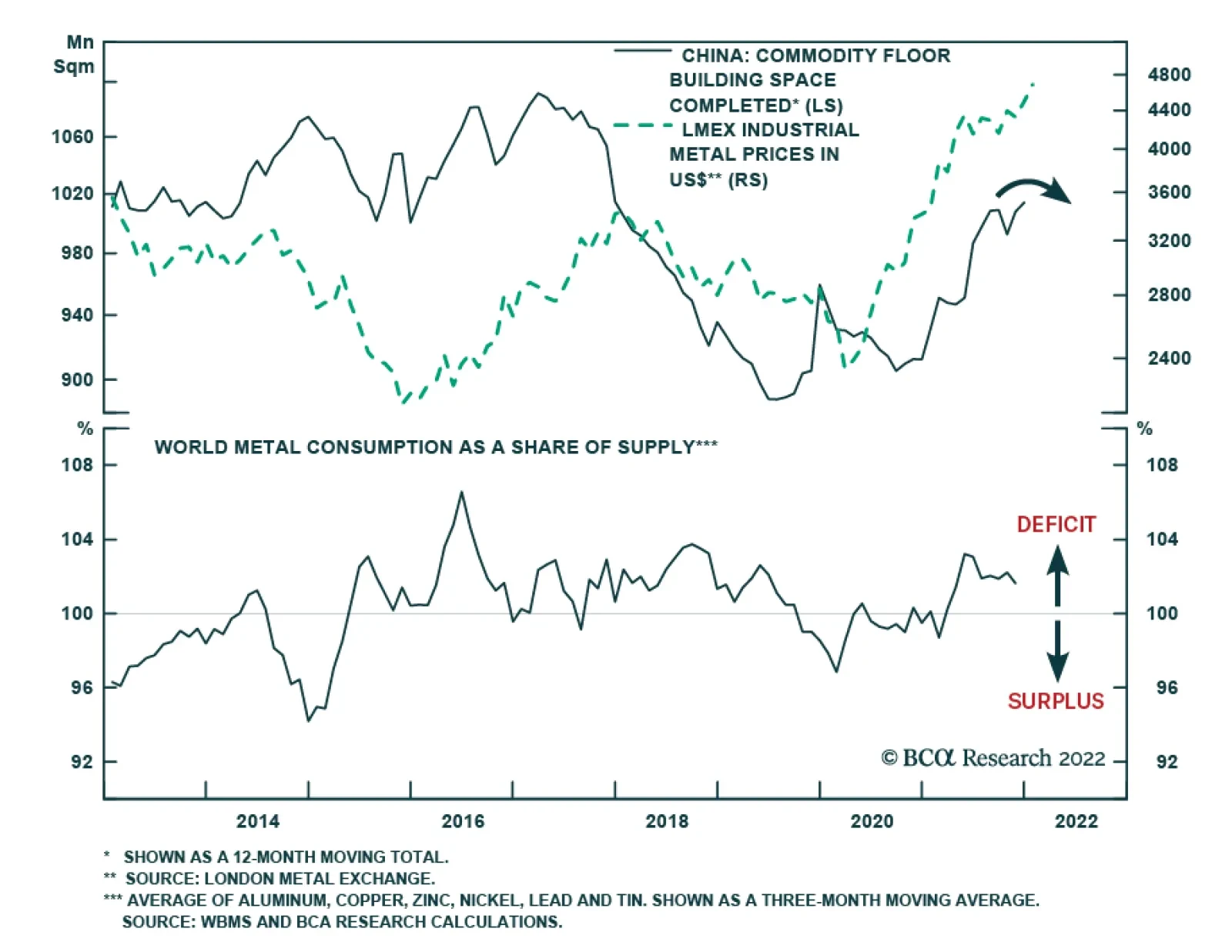

Highlights The faster-than-expected oil-demand recovery from the COVID-19 omicron variant points to higher EM trade volumes this year and next, which, along with a weaker USD, will boost base-metals demand and prices (Chart of the Week…

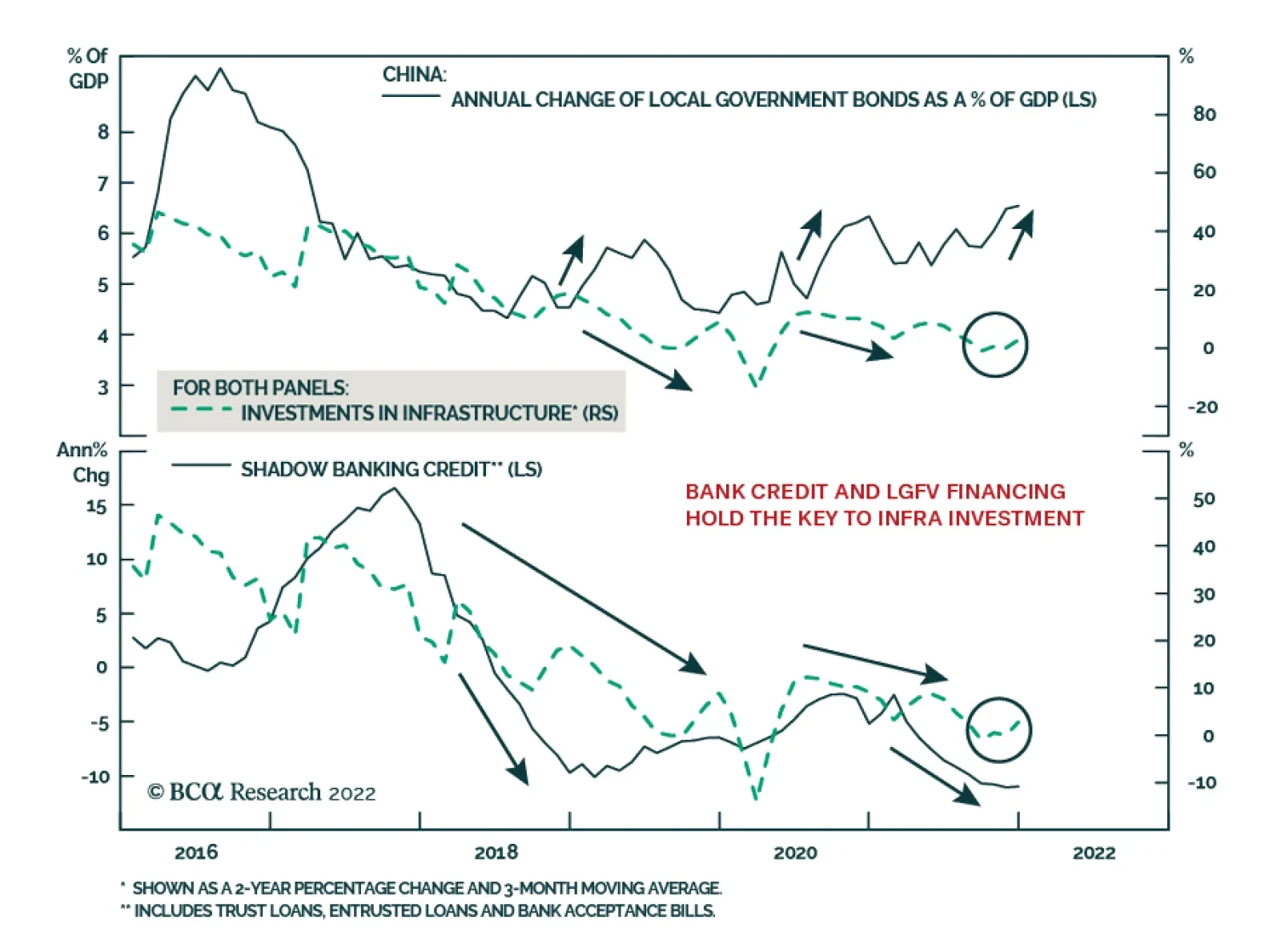

BCA Research’s China Investment Strategy service concludes that proactive fiscal policy will have a limited impact on infrastructure investments this year. The team expects the total SPBs quota for 2022 to be roughly the…

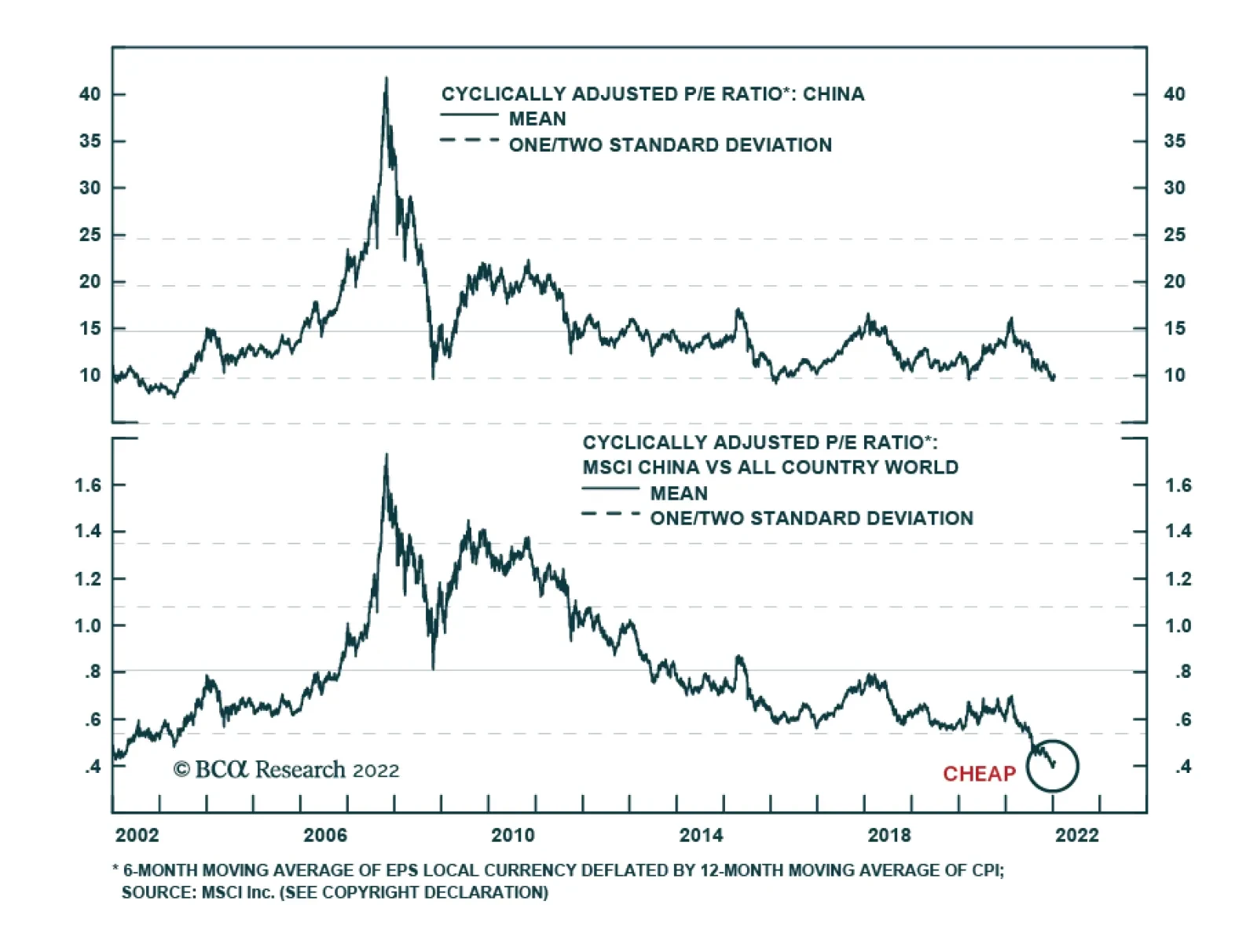

Feature Chart 1Weak Economic Fundamentals Undermine Stock Performance Monetary policy easing has intensified in the past two months. The PBoC reduced one-year loan prime rate (LPR) by 10 bps and five-year by 5 bps following…

Highlights Our top five “black swan” risks for 2022: Social unrest in China; Russian invasion of all of Ukraine; unilateral Israeli strikes on Iran; a cyber attack that goes kinetic; and a failure of OPEC 2.0. Too early…

On Thursday, China cut the one-year loan prime rate (LPR) by 10 basis points to 3.7% and decreased the five-year LPR by 5 bps to 4.6%. It is the second consecutive month that the one-year LPR is decreased and the first time in…

Highlights The Kingdom of Saudi Arabia (KSA), Iraq, the UAE and Kuwait – the OPEC 2.0 states capable of increasing production this year – will have to step up for coalition members unable to lift output, including Russia.…

Highlights On US inflation and the Fed: If the Fed adheres to its mandate, it has no choice but to hike rates until core inflation drops toward 2% (from its current level above 4%). Yet, share prices will sell off before inflation…

The shift in Chinese policymakers’ stance towards policy easing is thus far not enough to trigger a rebound in the Chinese economy. Policy stimulus affects domestic economic conditions with a lag and the profit outlook…

Highlights We reformatted and added three sections to our existing trade tables: strategic themes, cyclical asset allocations and tactical investment recommendations. An extensive audit of our current trade book shows that our country…

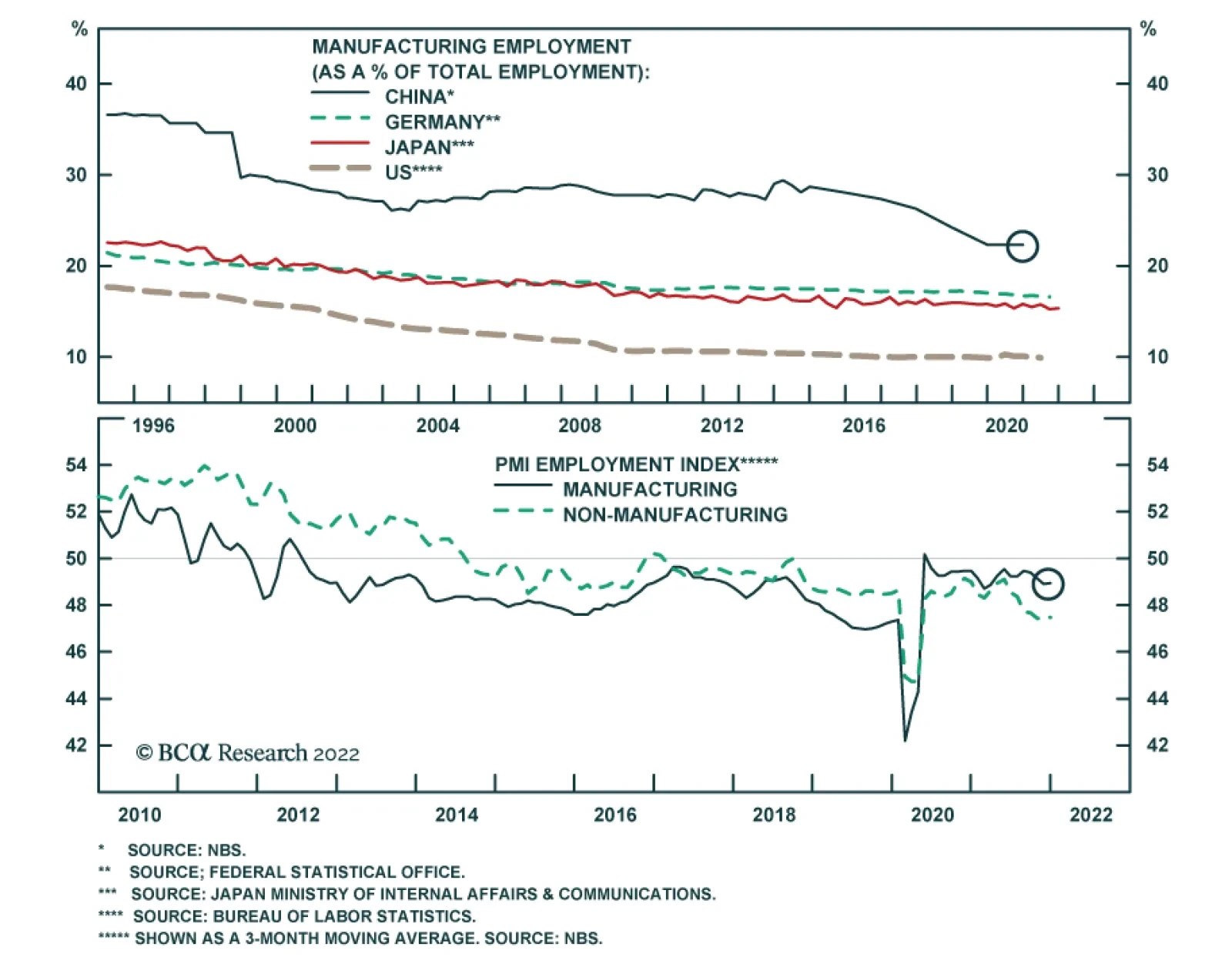

Chinese employment in the manufacturing sector as a share of total employment declined steadily from 29% in 2014 to 22% in 2019. However, the latest annual figure for 2020 is unchanged from the previous year. Similarly, the…