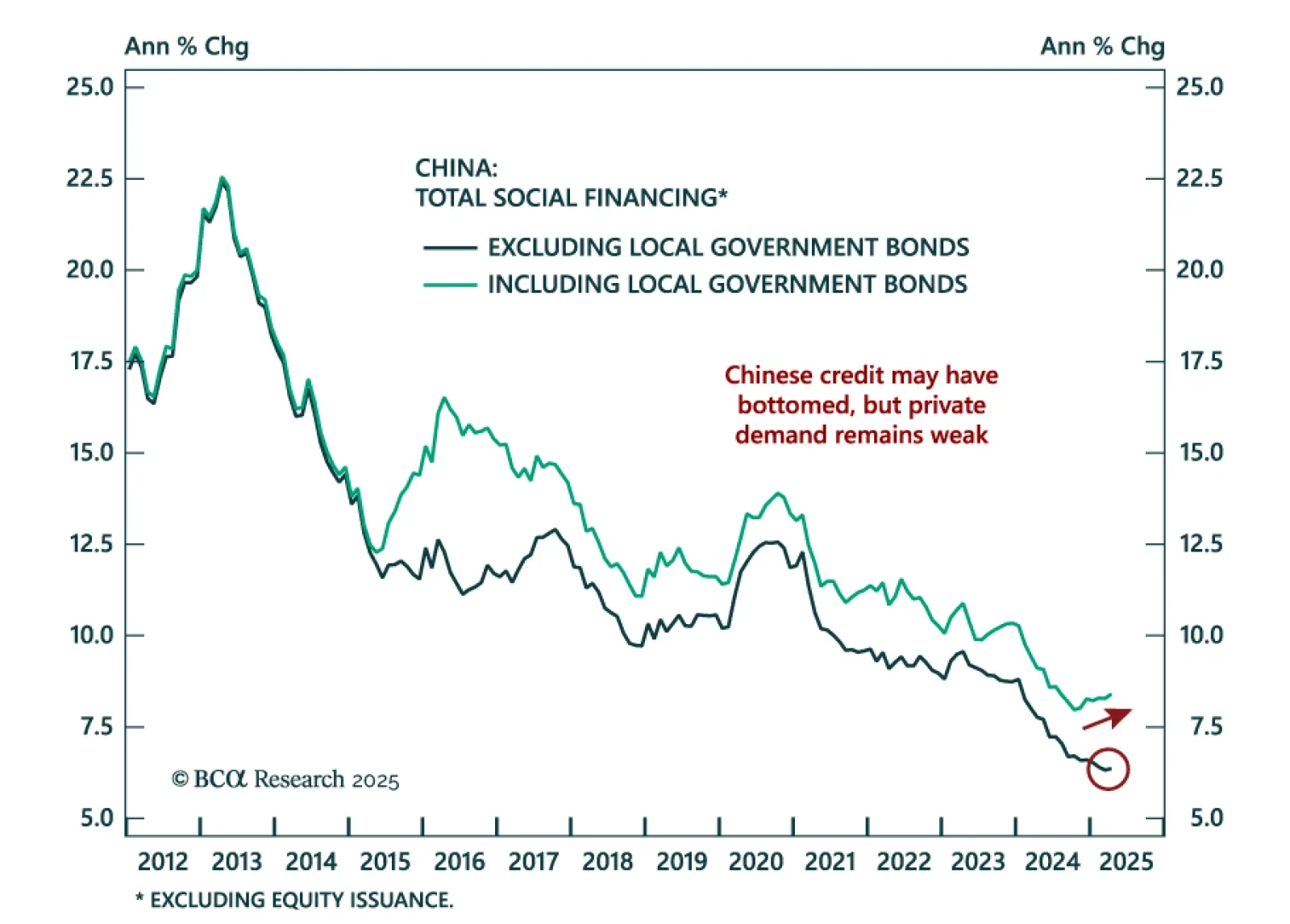

China’s weak April credit data reinforces the case for defensive positioning, with policy aimed at stability, not recovery. New yuan loans and aggregate financing both rose less than expected. While credit growth may have bottomed,…

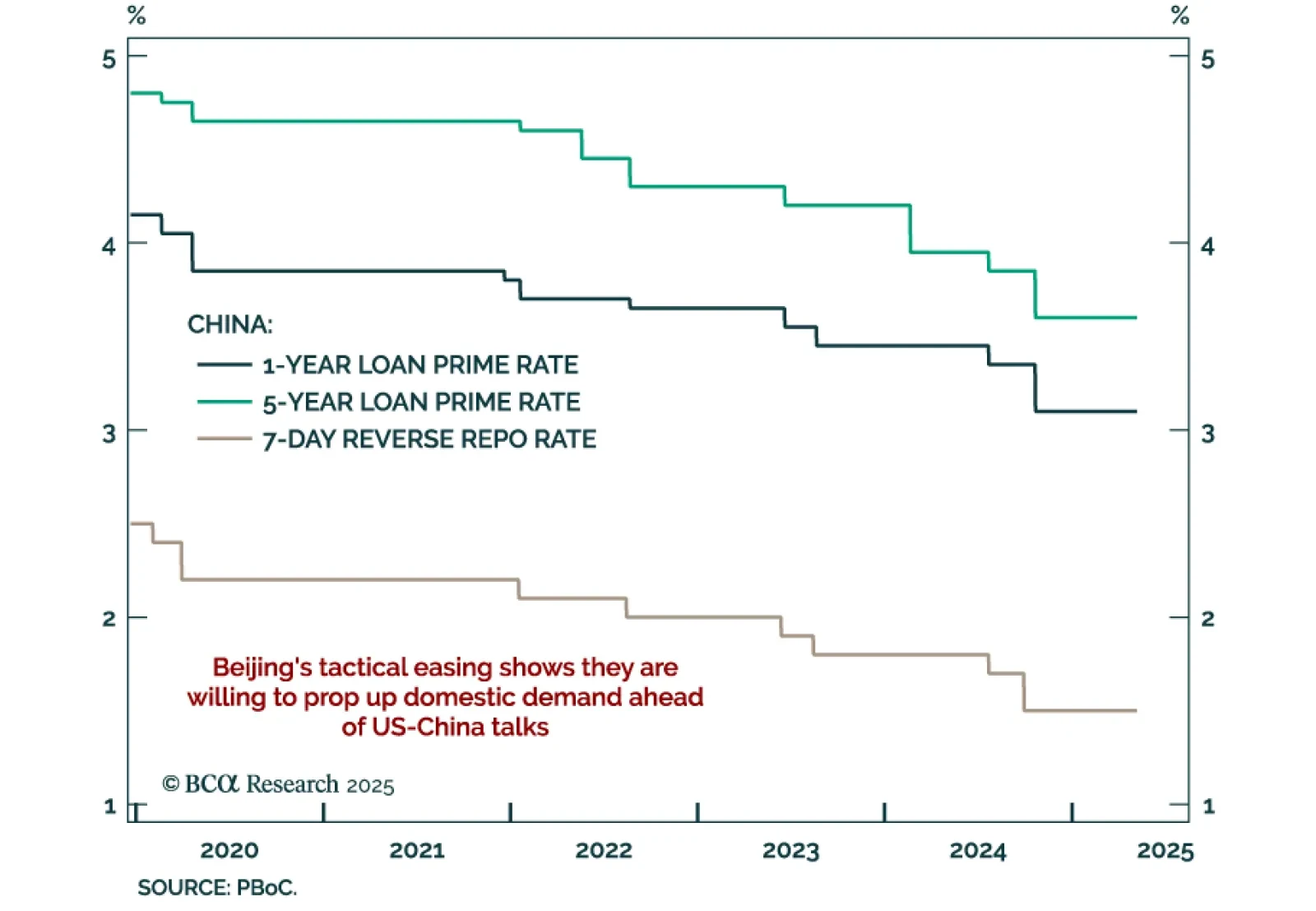

The PBoC’s latest easing aims to cushion growth risks and strengthen Beijing’s position ahead of US trade talks. In a rare pre-announced decision, China’s central bank cut its policy rate by 10 bps and the reserve requirement…

Negotiations on trade, Iran, and Ukraine will prove critical this month. Markets will remain volatile because positive data surprises enable the White House to press its hawkish tariff hikes, while negative surprises force the White…

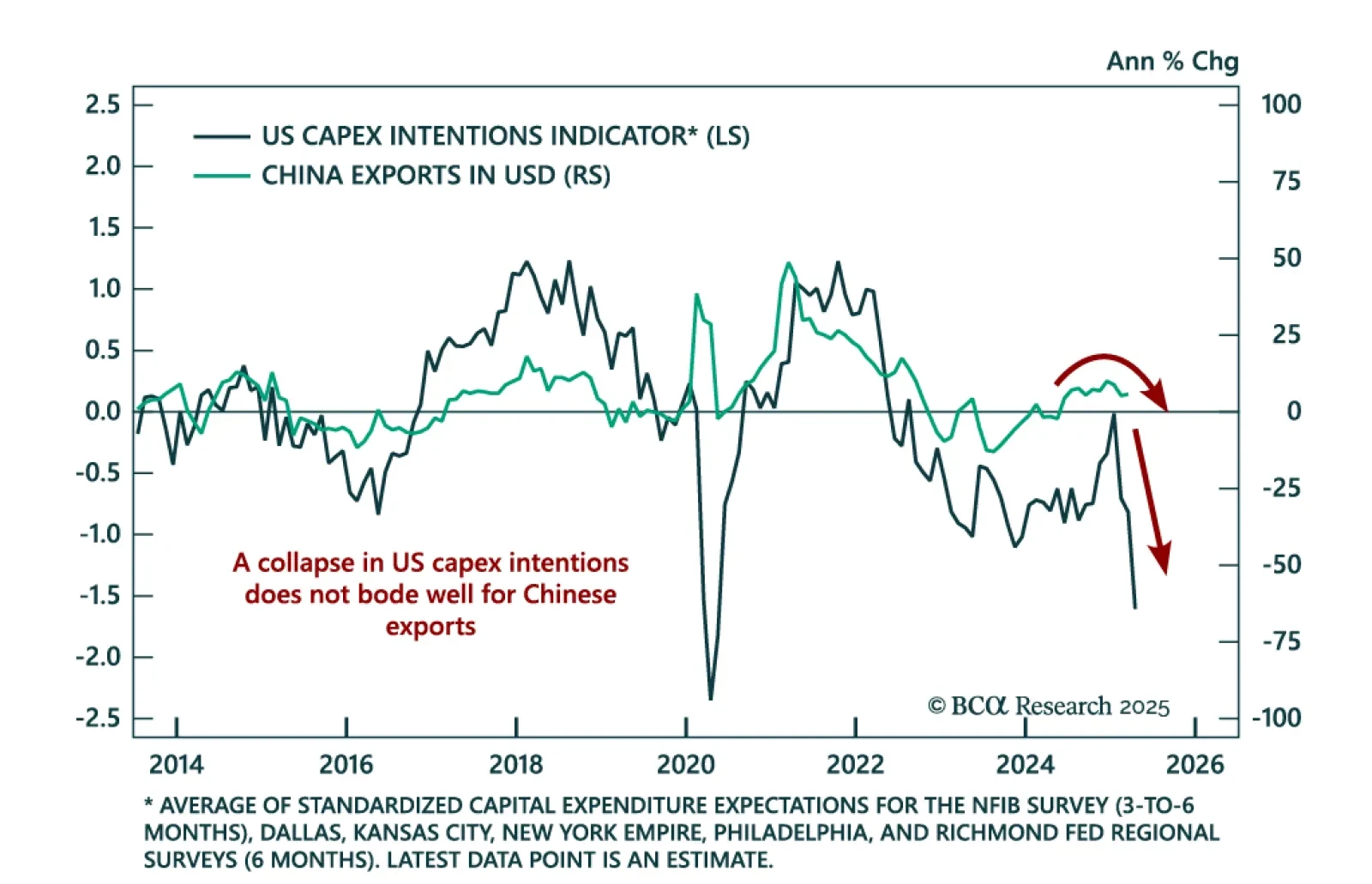

BCA’s China Investment Strategists remain defensive as China’s growth outlook is still weak. Even if some US tariff rates are rolled back, export headwinds and lagging stimulus will continue to weigh on Chinese equities. The…

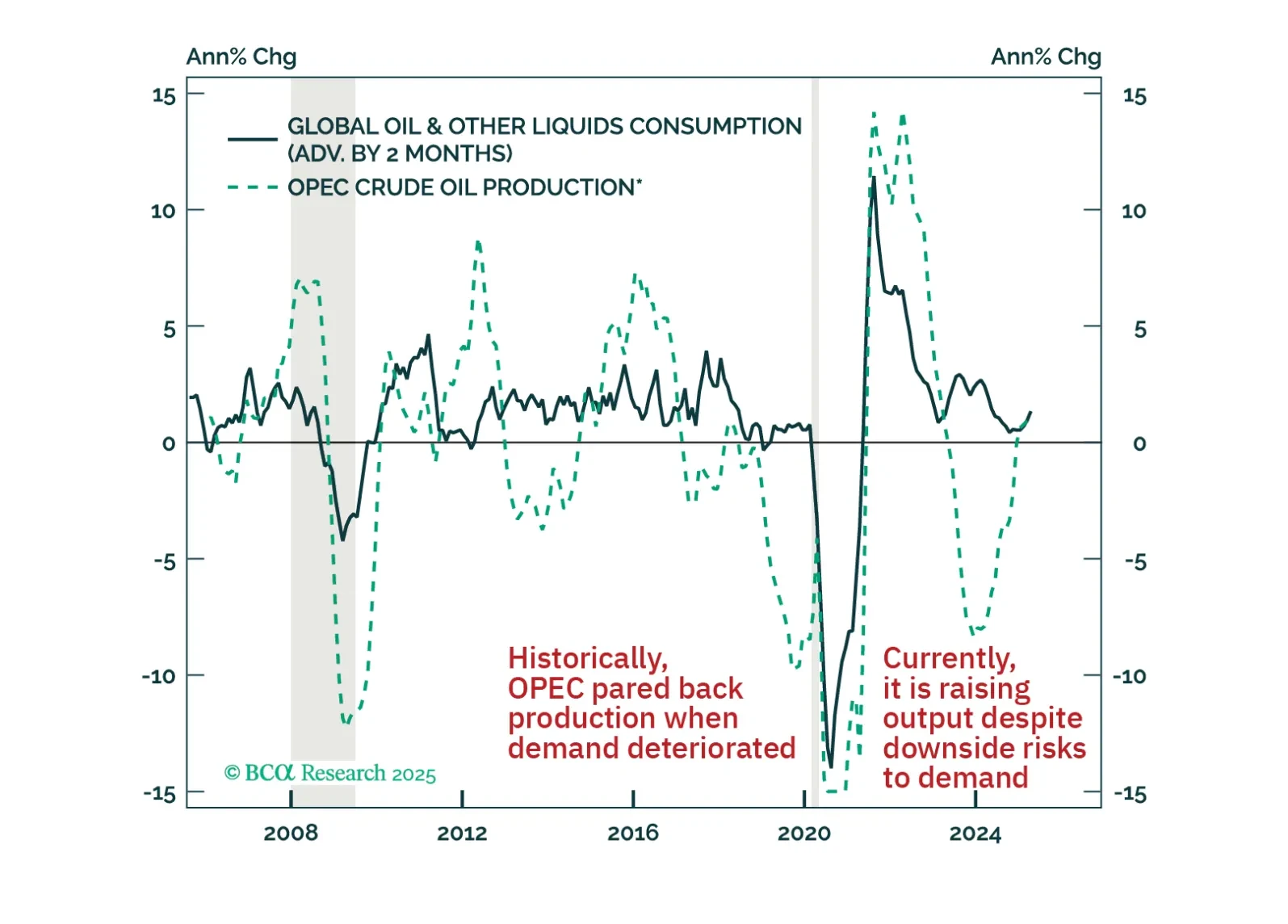

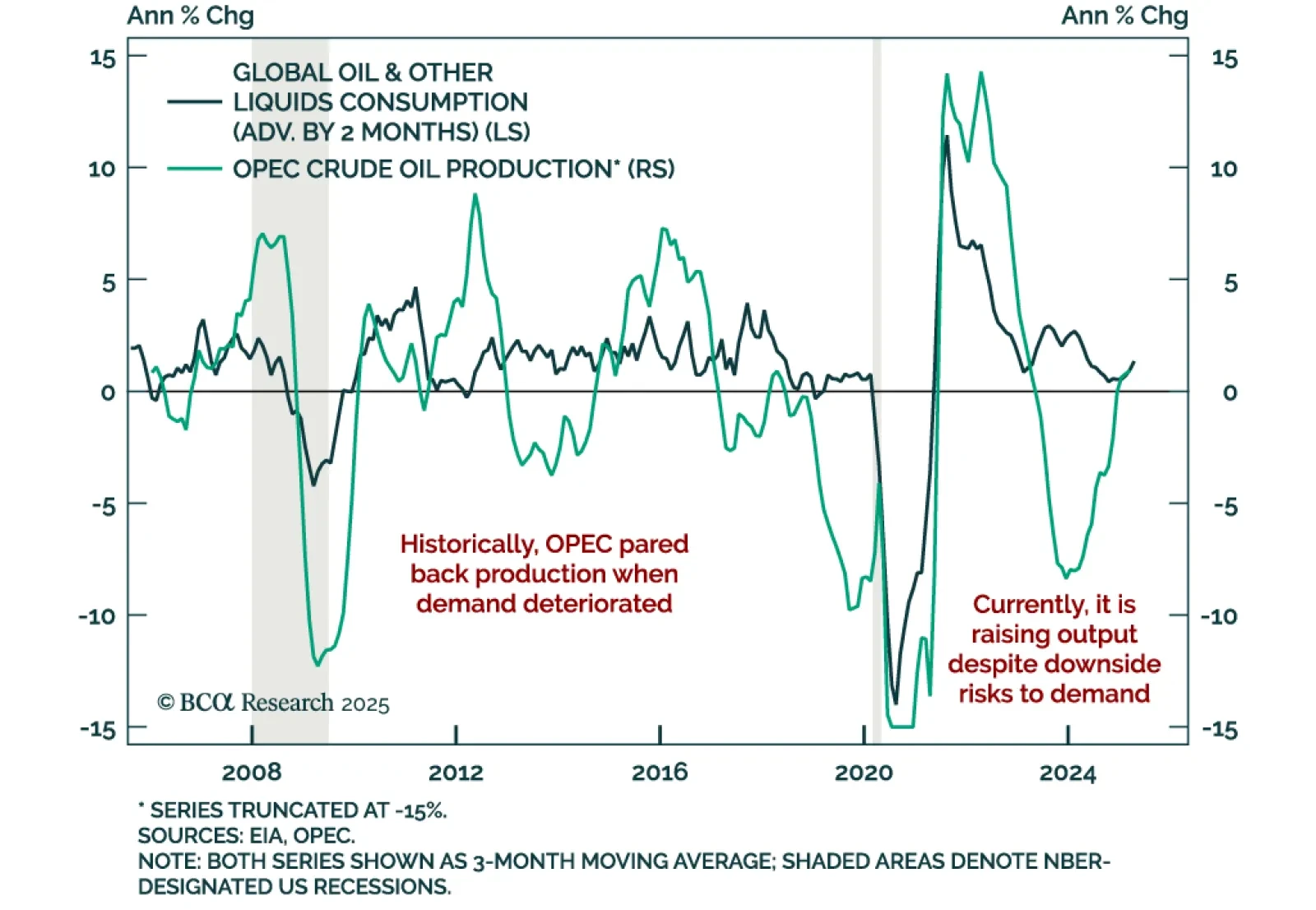

Our Commodity strategists stay short oil and long gold as global demand weakens and OPEC+ offers no support. Brent’s floor has likely fallen to $50, and bearish supply and demand forces continue to dominate the price outlook. …

Oil has borne the brunt of the year-to-date deterioration in cyclically sensitive financial assets. It is a key underperformer both within the commodity space and among global risk assets. This underperformance underscores that in…

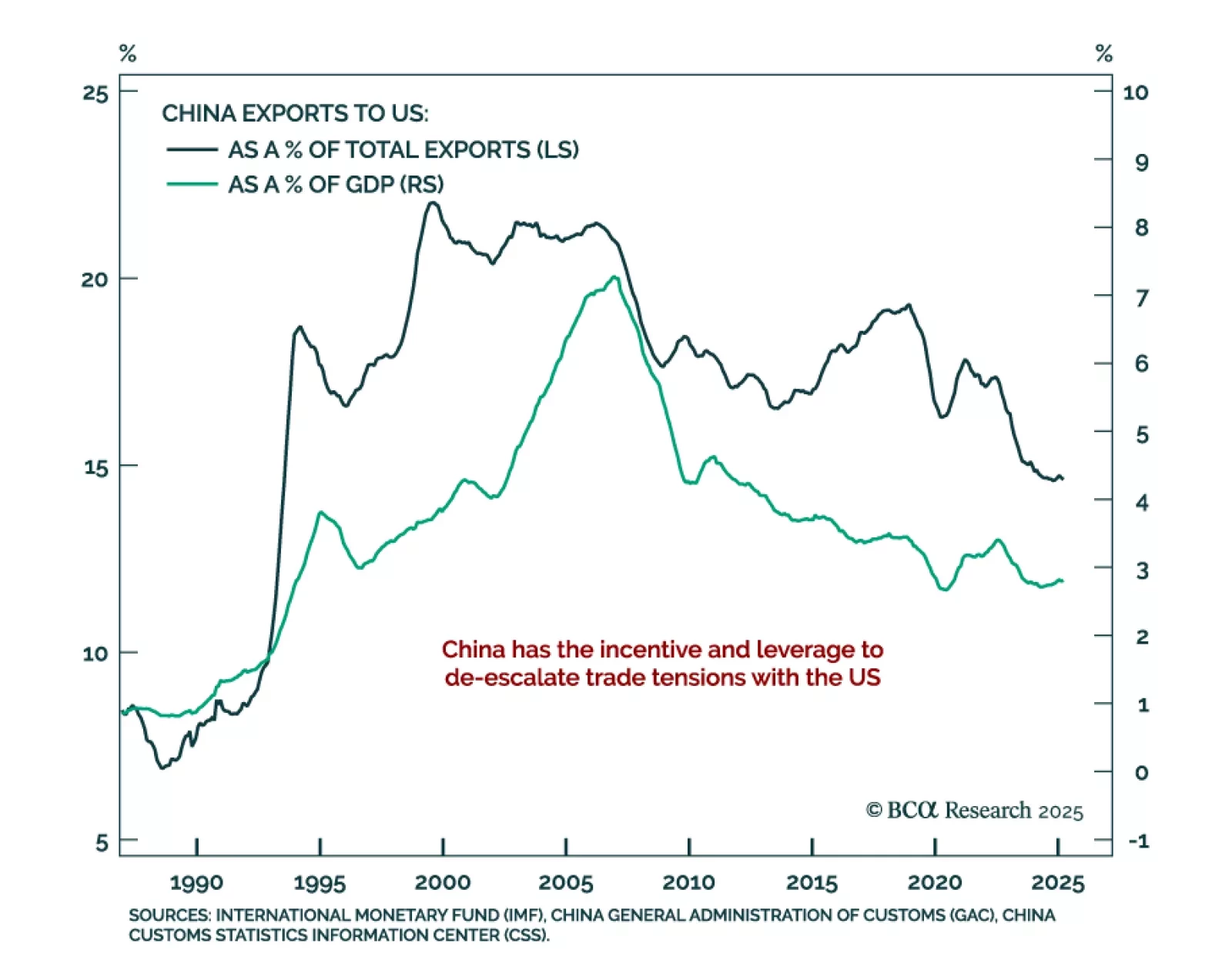

Despite marginal de-escalation in tariffs between the US and China, a sustainable trade agreement remains elusive. In the meantime, economic damage continues to mount, and Chinese equities have yet to fully price in the tariff-…

Trade headlines shift too fast to interpret reliably, but cutting through the noise reveals the US is pivoting from escalation to de-escalation. As the equity and bond selloff intensified, the tone from Washington softened,…

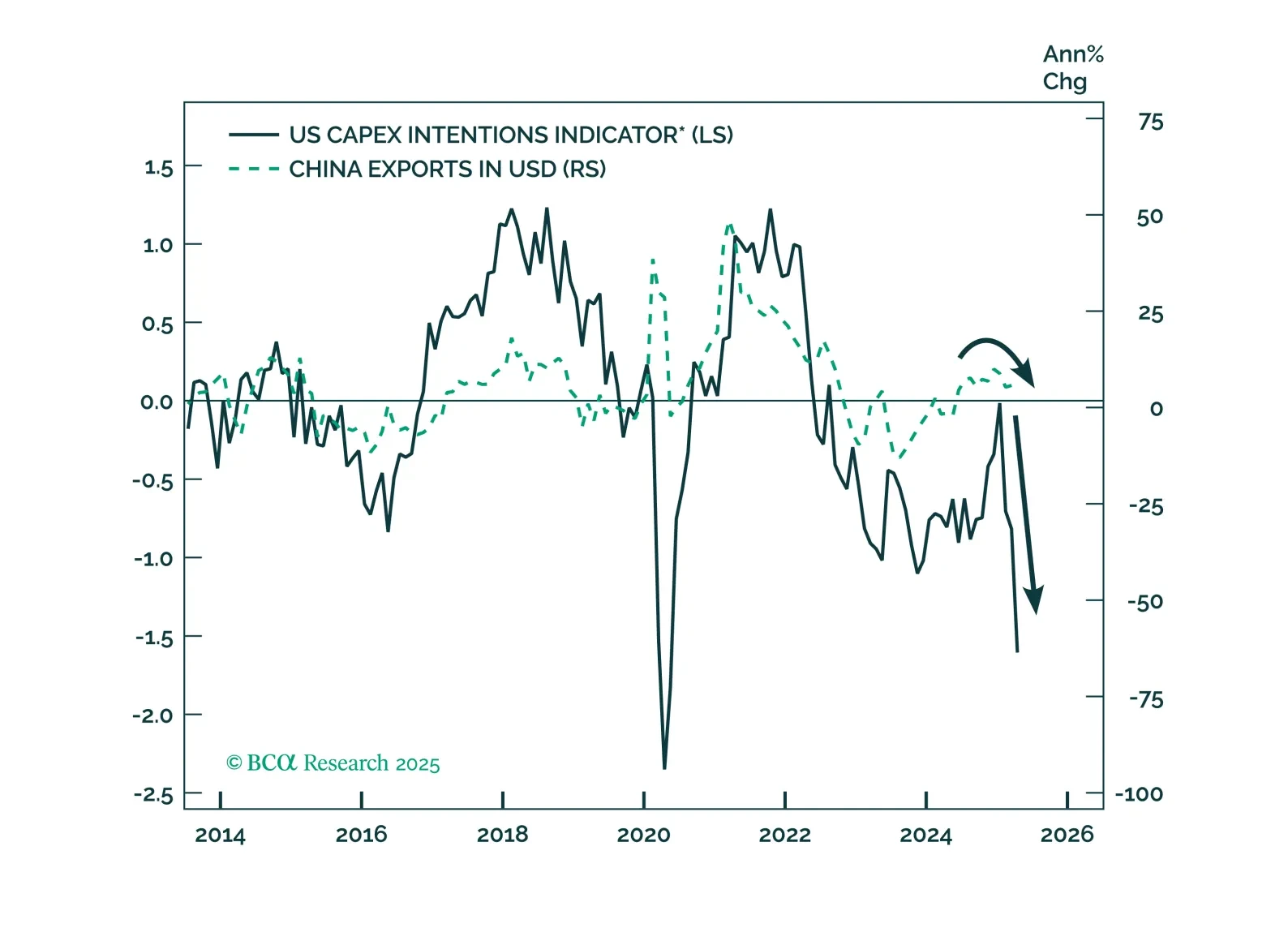

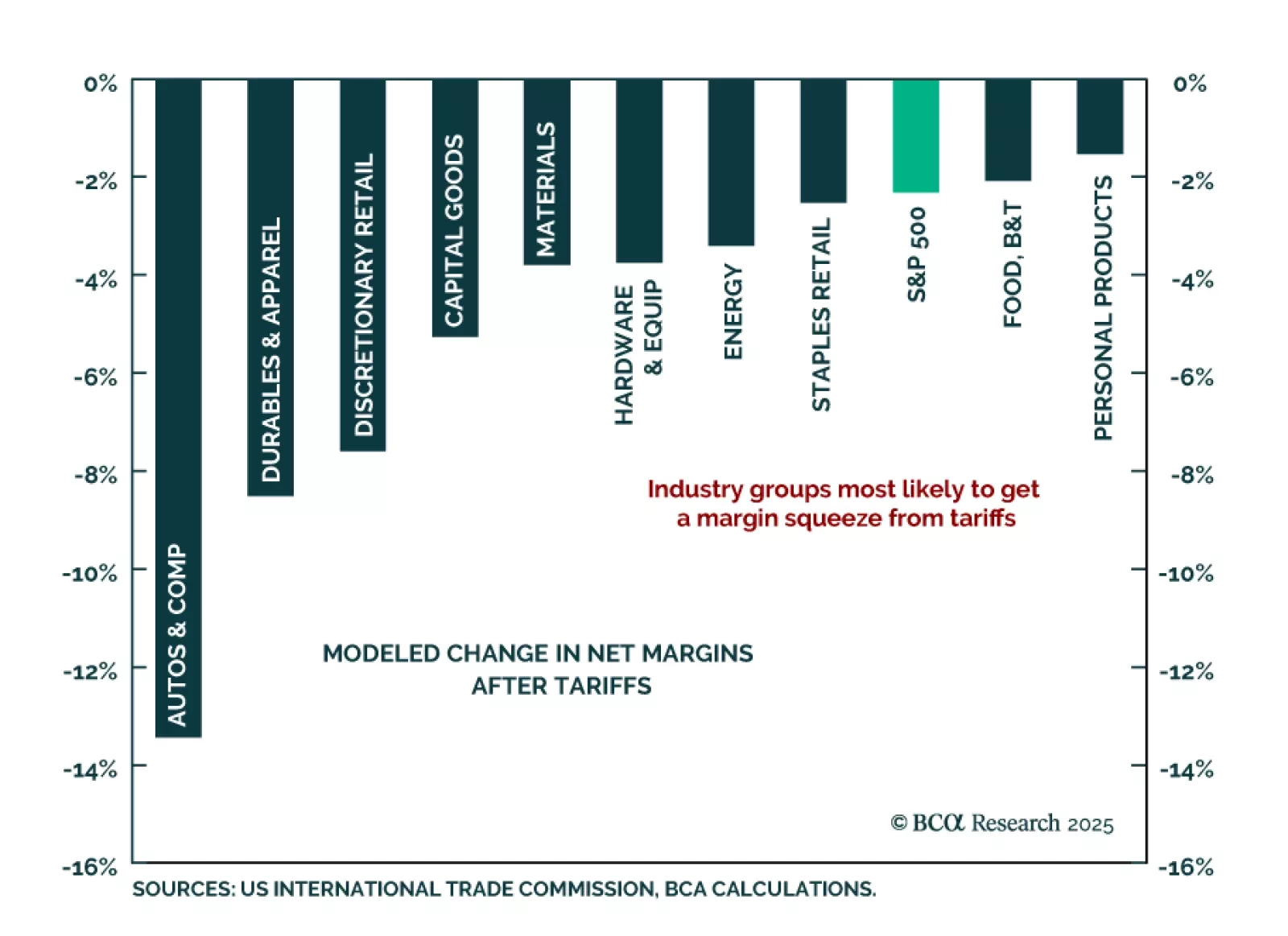

Our US Equity strategists warn that tariffs will meaningfully compress S&P 500 margins, with little pricing power to offset rising input costs. A two-point hit to net margins and falling multiples will drive earnings downgrades…