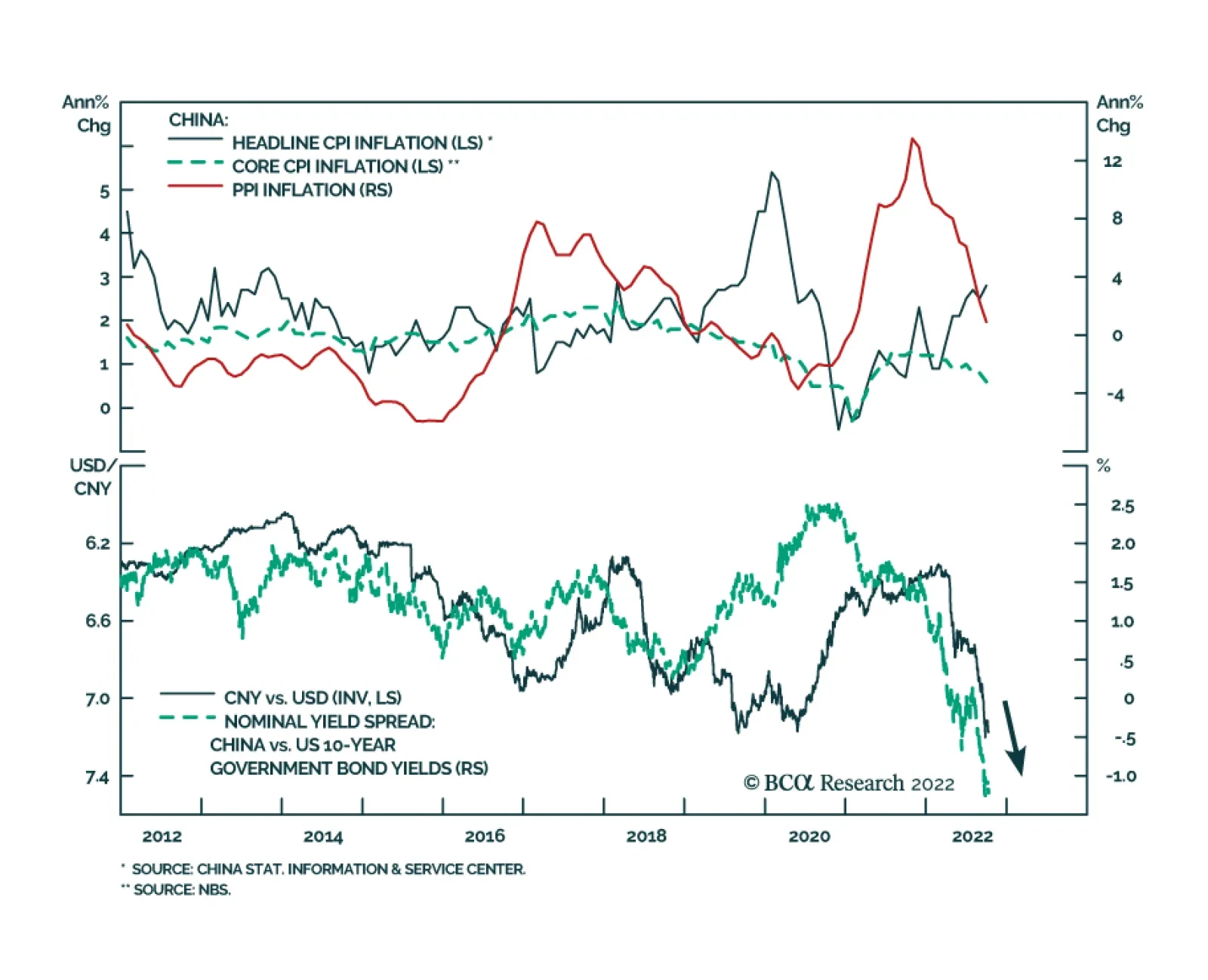

Chinese headline CPI inflation accelerated from 2.5% y/y to 2.8% y/y in September. However, this headline figure overstates the extent of price pressures in the Chinese economy. The increase was led by an 8.8% y/y rise in food…

BCA’s Emerging Markets Strategy team’s view remains that US inflation will prove to be sticky. That said, in this report, we examine under what conditions a considerable drop in US core inflation, whenever it transpires, would be…

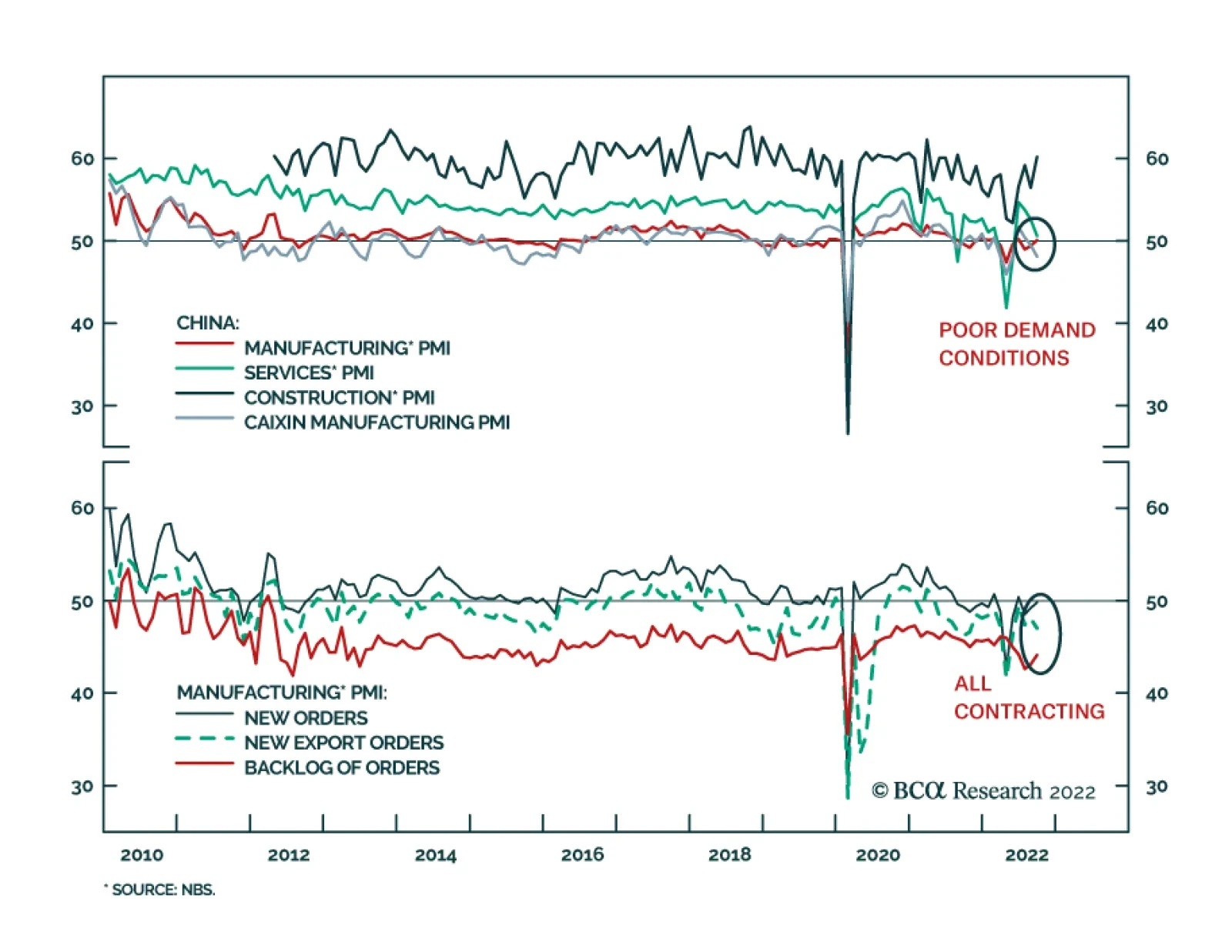

China’s Official PMI data continues to paint a bleak picture of domestic demand conditions. Although the manufacturing index increased by 0.5 points, at 50.1 it is barely above the boom-bust line, and instead suggests…

Investors should go long US treasuries and stay overweight defensive versus cyclical sectors, large caps versus small caps, and aerospace/defense stocks. Regionally we favor the US, India, Southeast Asia, and Latin America, while…

This week’s Global Investment Strategy report titled Fourth Quarter 2022 Strategy Outlook: A Three-Act Play discusses the outlook for the global economy and financial markets for the rest of 2022 and beyond.

Executive Summary EU Metal Industry Under Threat Russia’s threat to cut off all remaining exports of natural gas to the EU via Ukraine will further imperil the bloc’s struggling metals industry, particularly…