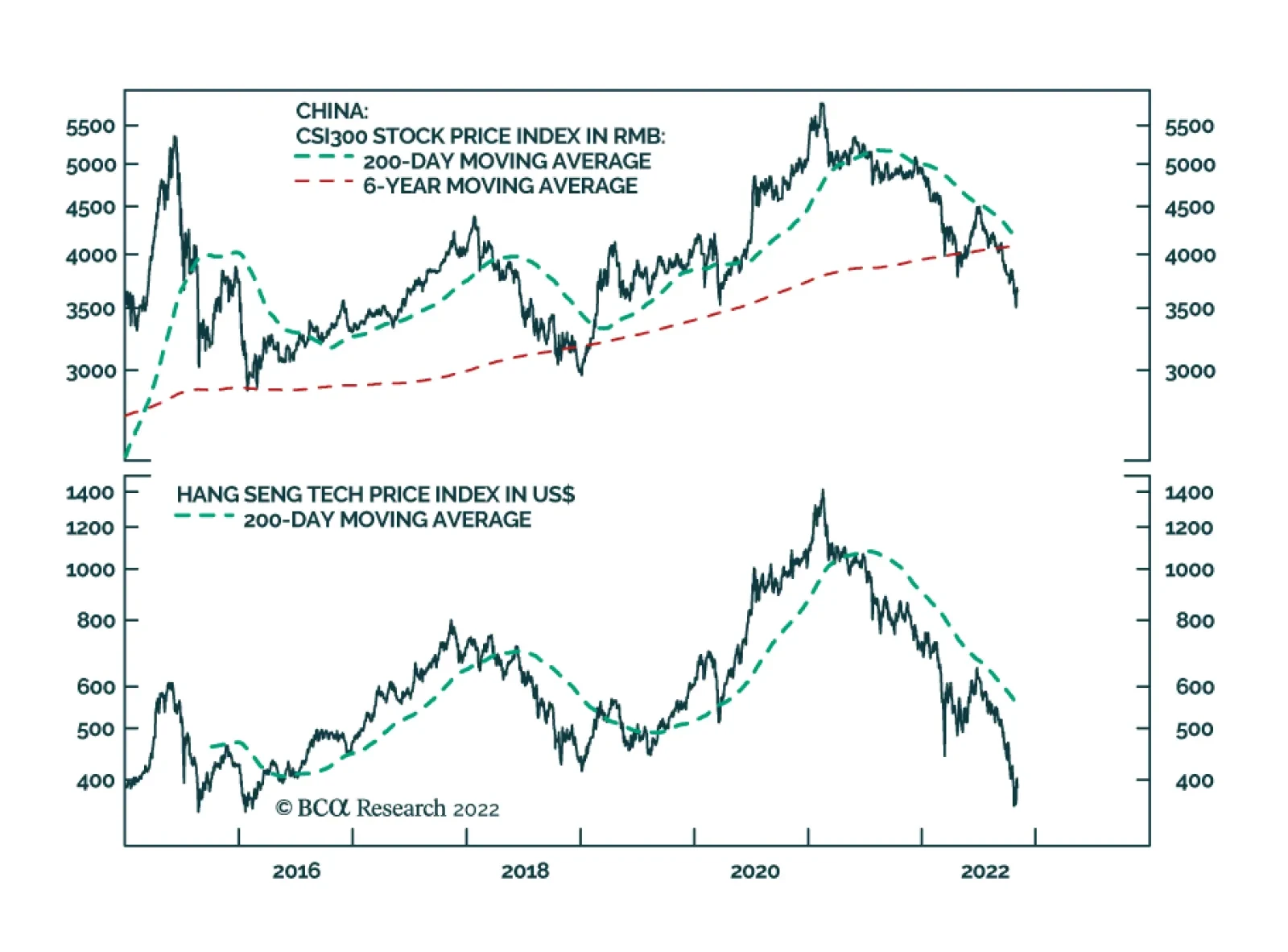

The conditions for a sustainable rally in Chinese stocks have not been met. In this report we discuss the four signposts which we will closely monitor to gauge when it will be warranted to upgrade our stance on Chinese equities both…

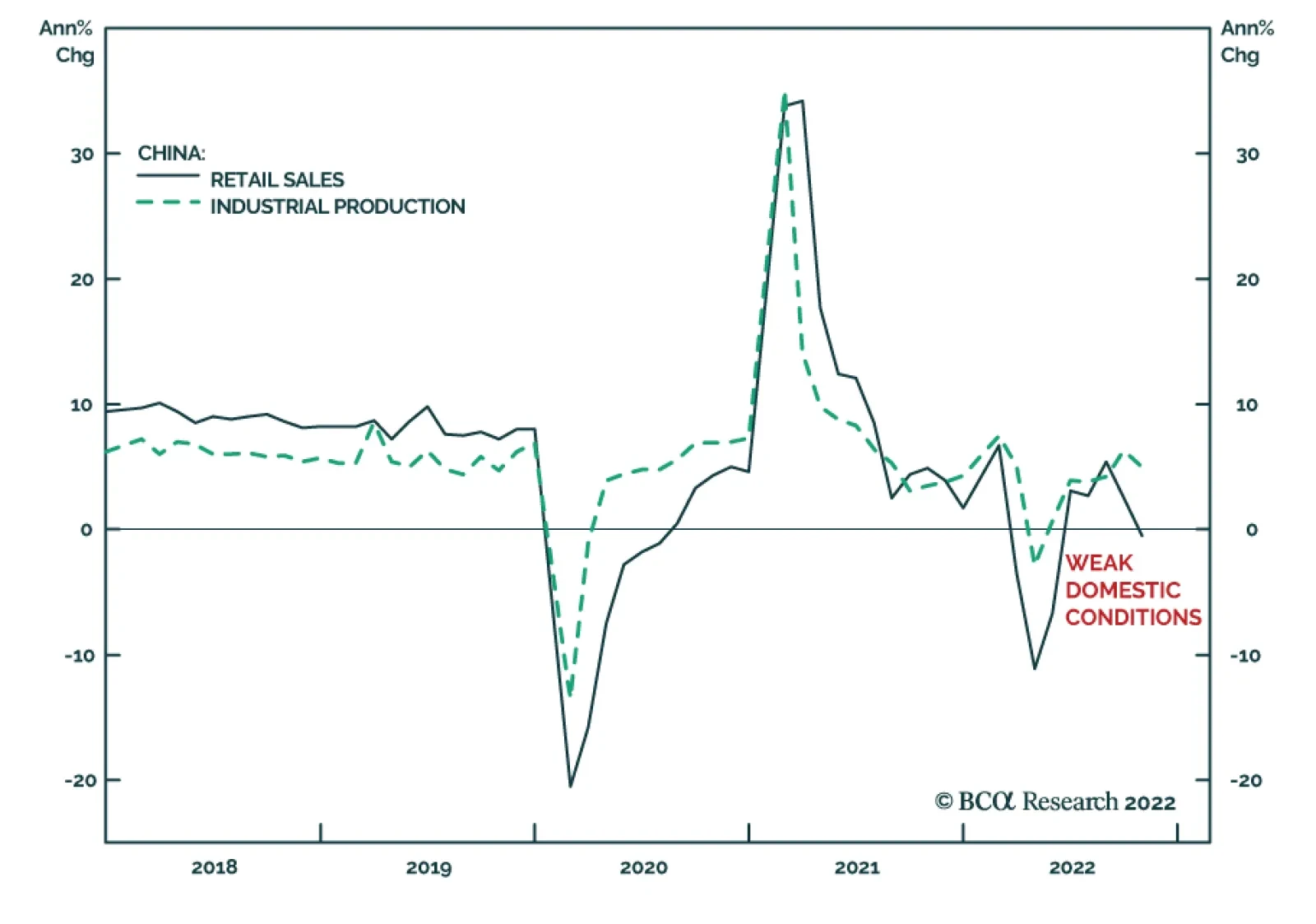

Key indicators of Chinese domestic economic activity in October generated negative surprises. Retail sales contracted by 0.5% y/y, weaker than expectations of a growth slowdown from 2.5% to 0.7%. Similarly, industrial production…

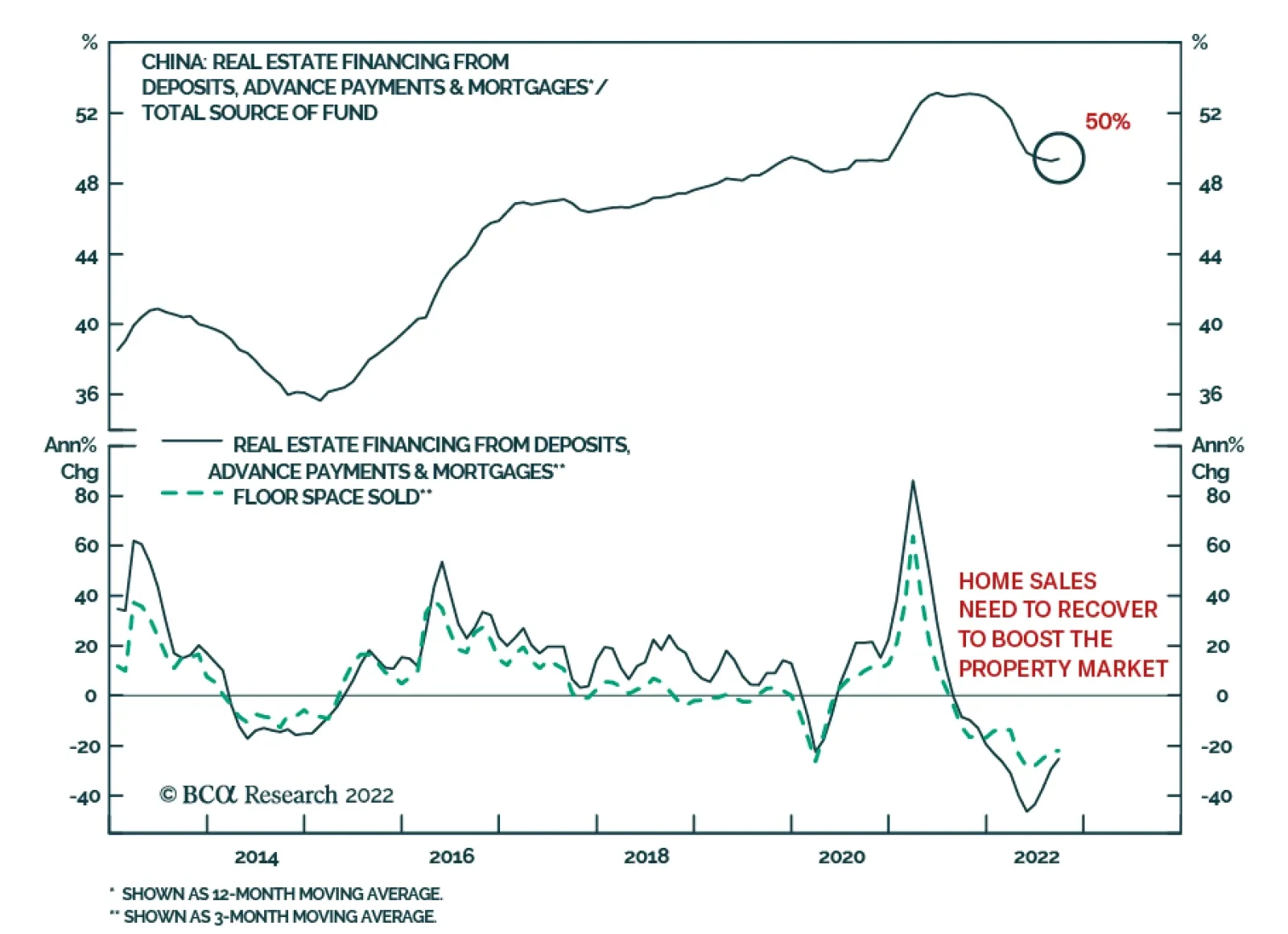

Shares of Chinese property developers rallied sharply on Monday following news of Beijing’s 16-point plan to help resuscitate its struggling property market. The measures announced include extensive support for both…

The HK dollar is under an assault from rising US interest rates and a weak economy. To defend the exchange rate peg, the HKMA will continue to tighten liquidity, which will boost HK interest rates above those in the US across the…

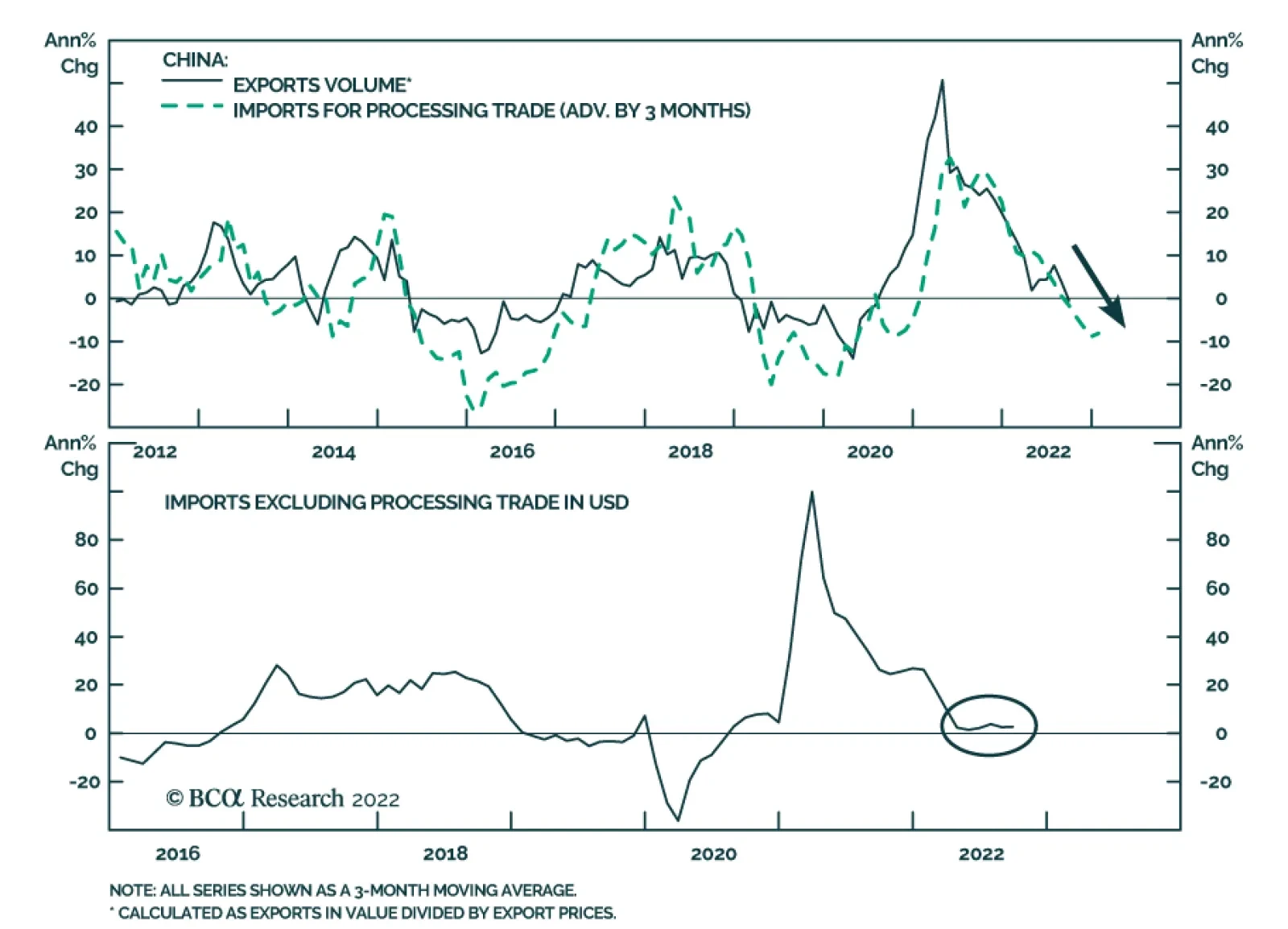

China’s October trade data was a big miss. Exports is USD terms contracted by 0.3% y/y following 5.7% y/y in September, below expectations of a mild deceleration to 4.5%. Similarly, imports contracted by 0.7% y/y following…

Chinese equities are starting November on a positive note. The Hang Seng and CSI 300 are up 10% and 7.4% respectively since the beginning of the month. In particular, tech stocks have been outperforming, with the Hang Seng Tech…

Copper markets will remain tight on the back of growing physical deficits and pressure on capex. Policy-rate increases by central banks, uncertainty over re-opening in China and its fiscal-stimulus plans in the short run restrain…

Provided that US inflation is due to excess demand rather than supply constraints, demand destruction will likely be needed to bring core inflation below 3.5%. Such growth contraction is positive for counter-cyclical currencies like…

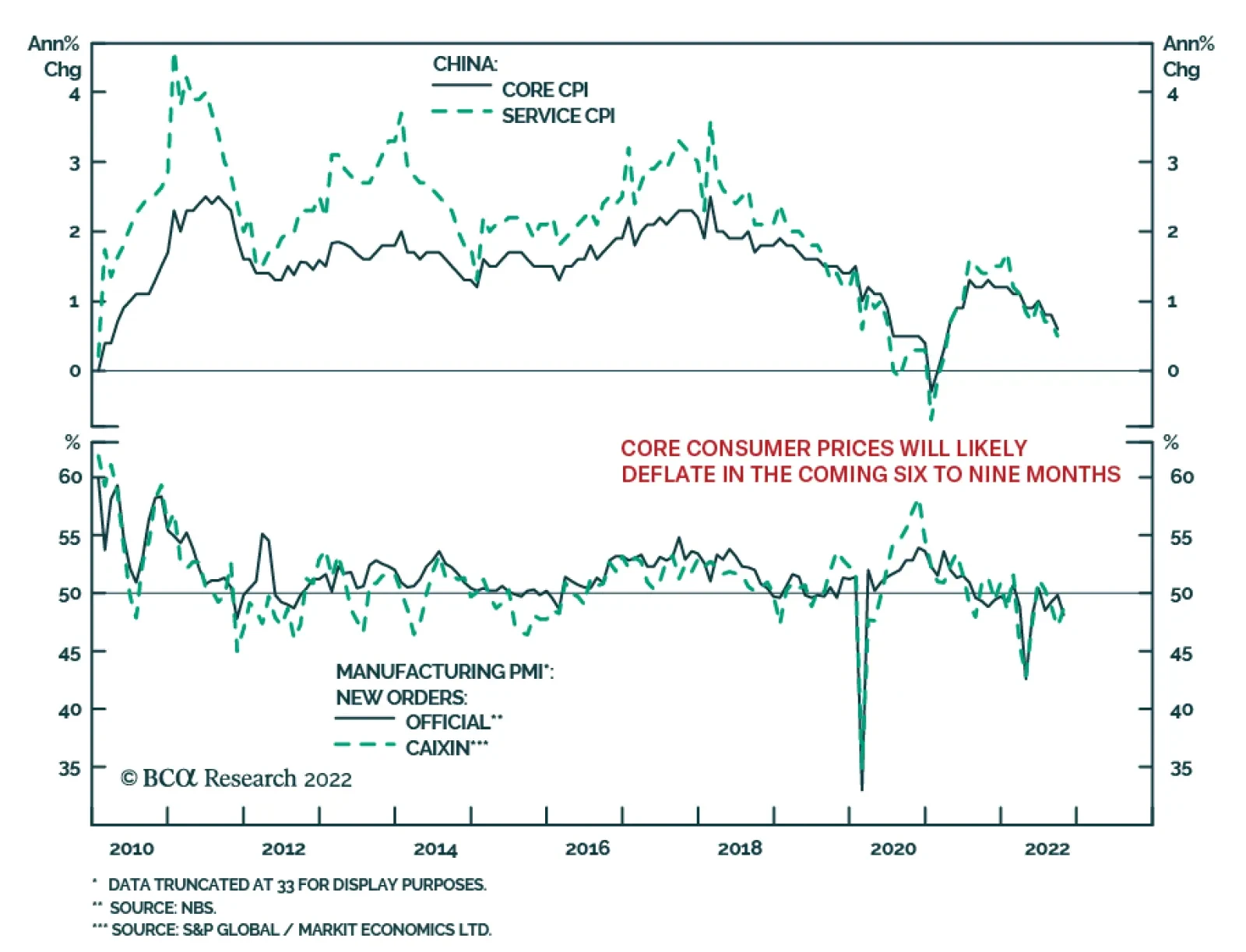

The predominant risk to China’s economy is demand-driven deflation. Very weak demand-side data highlight that a lack of demand, rather than supply-side improvements, is driving disinflation in China. Core and service…