According to BCA Research’s Geopolitical Strategy service, the demographic and property bust combined with US-China geopolitical competition have permanently damaged China’s growth potential. The year has started…

The risk-on rally is challenging our annual forecast so we are cutting some losses. But we still think central banks and geopolitics will combine to reverse the rally later this year.

The US economy will experience a period of benign disinflation over the next few quarters. Beyond this goldilocks period, either the economy will slip into a mild recession in 2024, or more ominously, a second wave of inflation will…

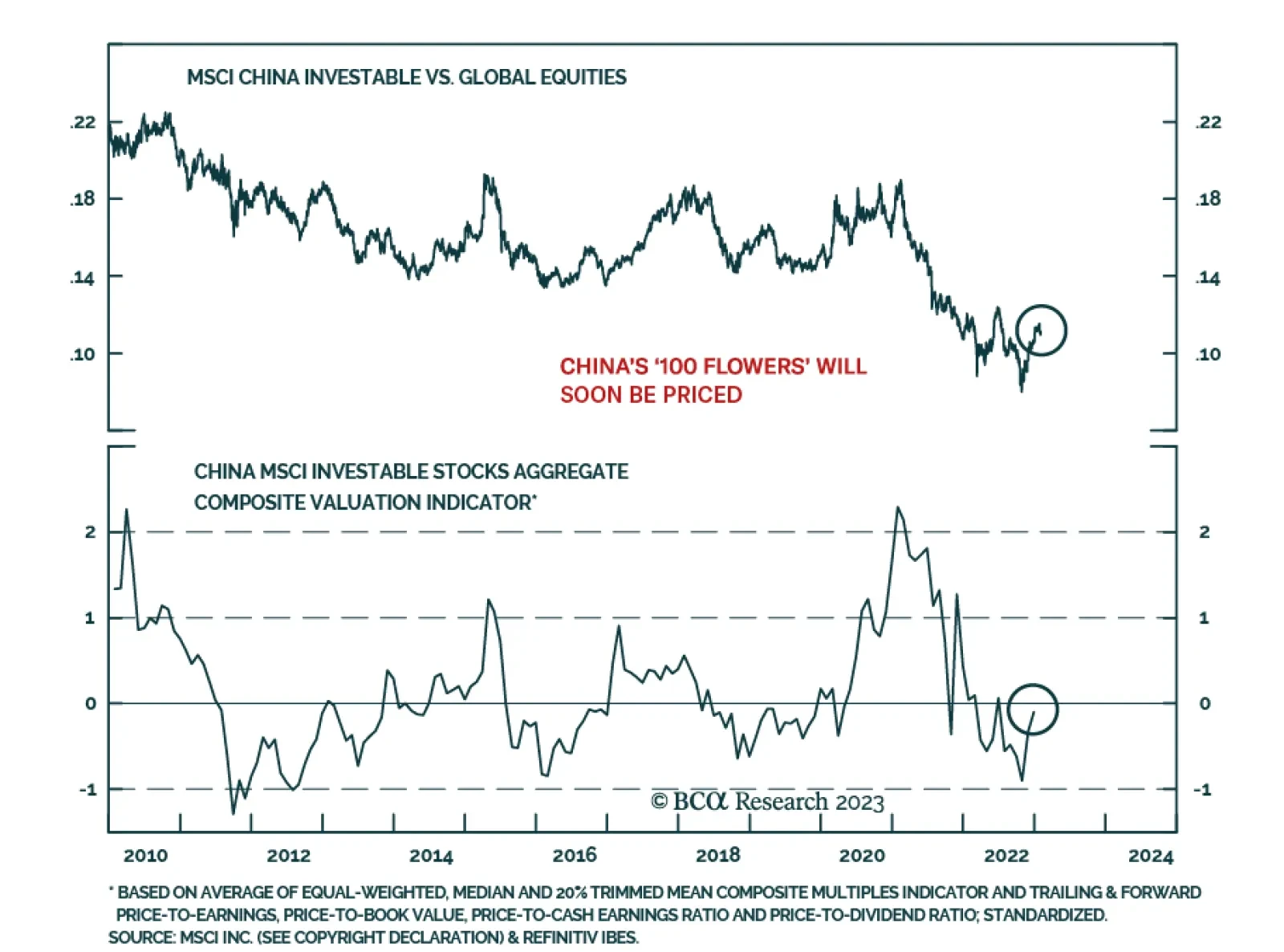

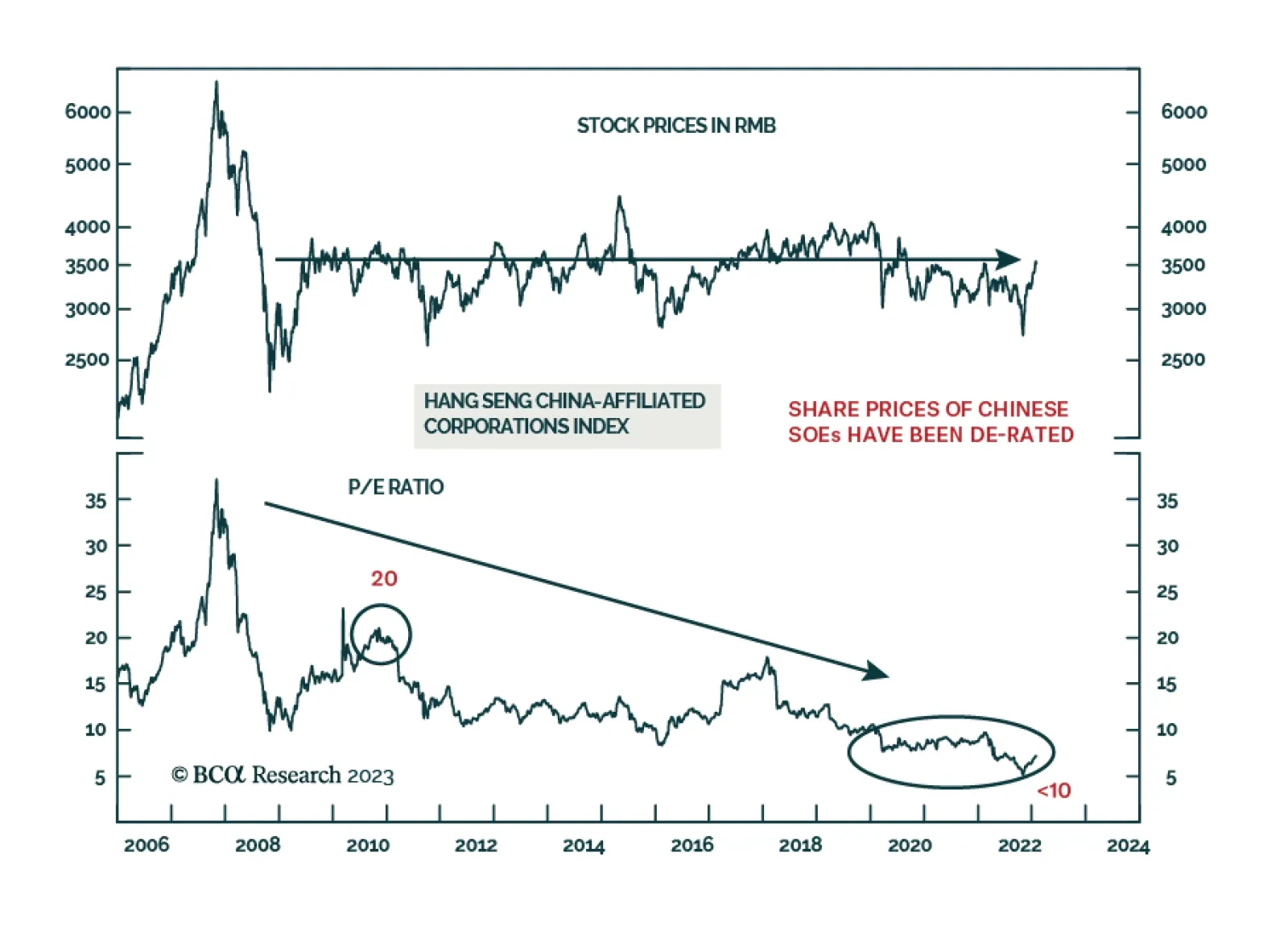

According to BCA Research’s China Investment Strategy service, the stocks of China’s largest platform companies are unlikely to experience a structural uptrend. Over time, Chinese platform companies will likely…

When does rising unemployment become a bigger problem than inflation? The Fed won't cut rates until that happens, probably thwarting market hopes of big cuts in 2H.

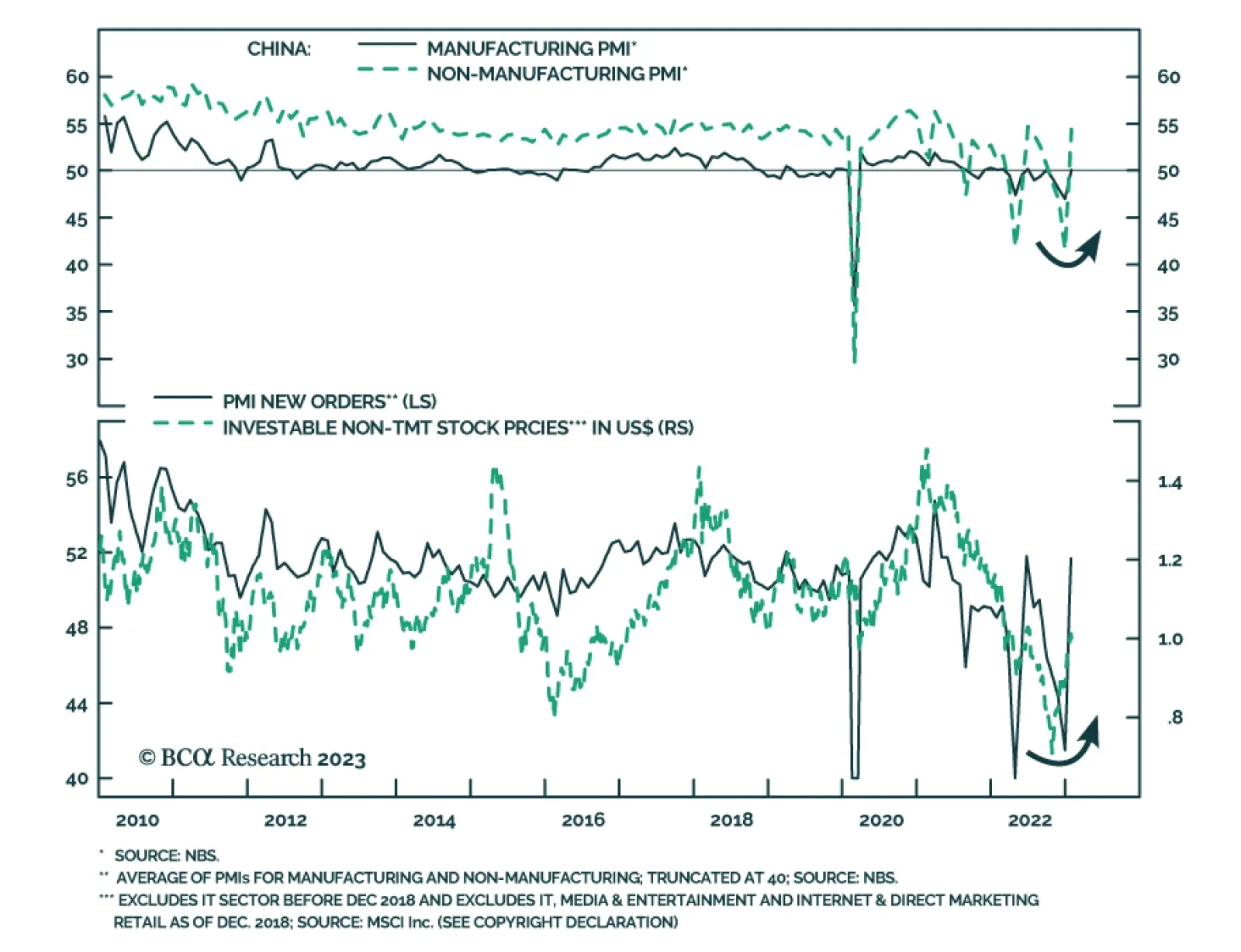

China’s NBS PMI release delivered a positive surprise for January. Both the manufacturing and the non-manufacturing indices returned to expansion, suggesting that economic activity is gaining momentum following Beijing…

Remain cautious and defensive overall. Stay long DM Europe over EM Europe. Look for EM opportunities in Southeast Asia and Latin America over Greater China.

In Section I, we explain why we do not see the deceleration in US inflation, the likely near-term pickup in European growth, and the end of China’s dynamic zero-COVID policy as signs of a sustainable rebound in global economic…