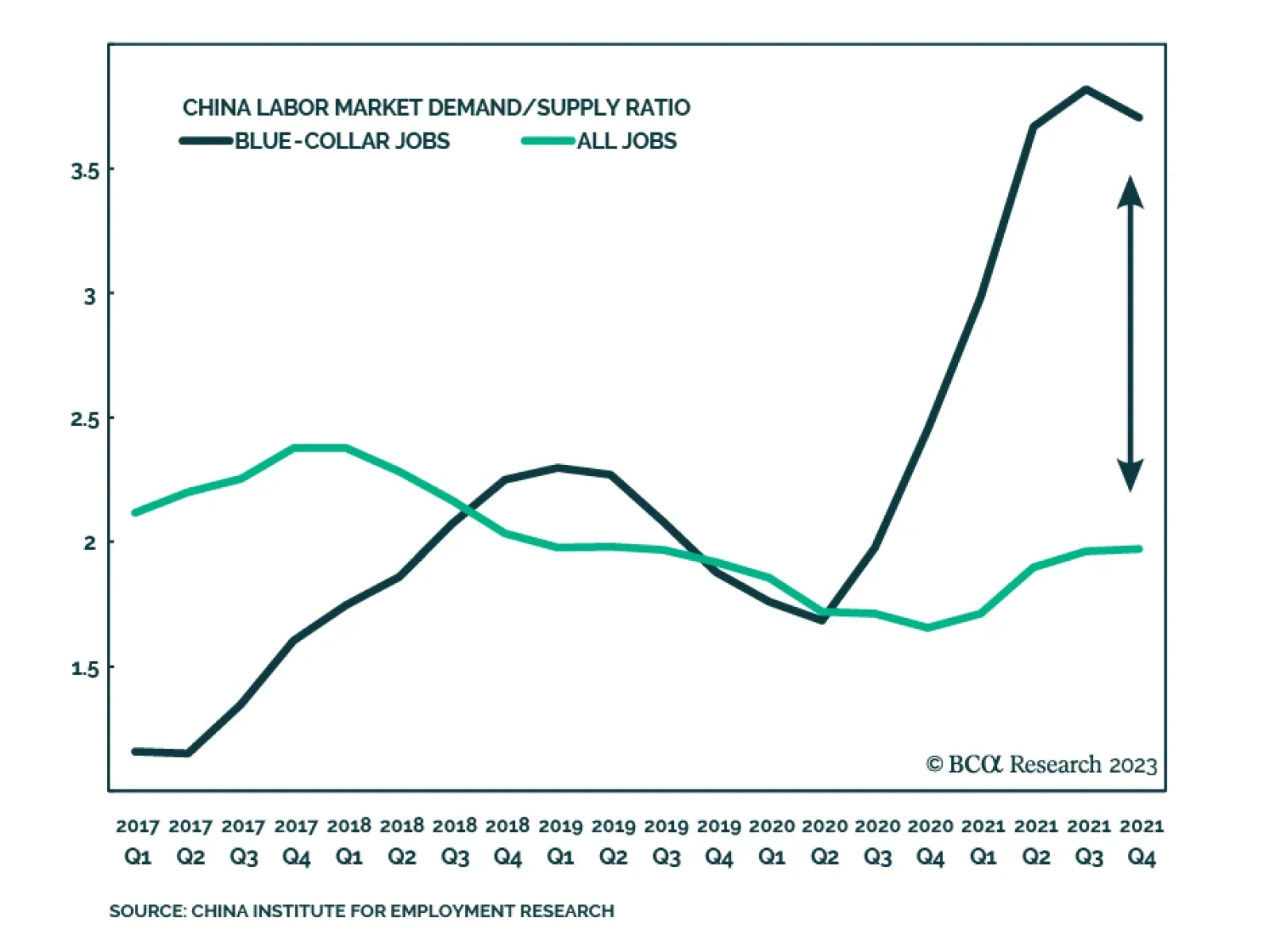

BCA Research’s China Investment Strategy service concludes that given the structural scarcity of blue-collar workers, the authorities will be less inclined to resort to their old playbook of stimulating infrastructure,…

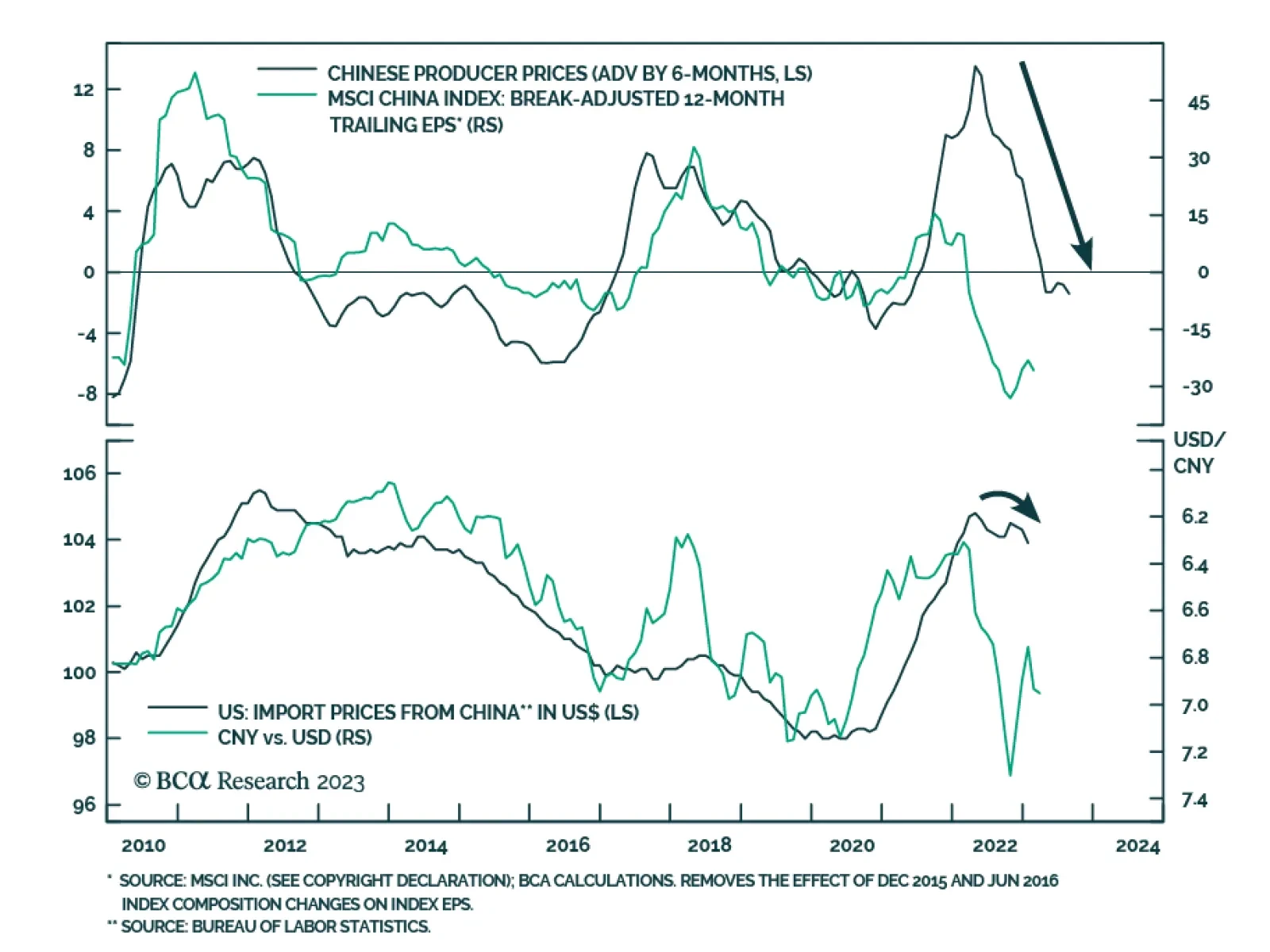

China’s CPI and PPI releases indicate that price pressures remained subdued in February. CPI inflation slowed from 2.1% y/y to 1.0% y/y, falling below expectations of a milder deceleration to 1.9% y/y. Meanwhile, factory-…

The development of trading blocs and the rise of economic warfare will lead to the inefficient allocation of resources. Higher fiscal outlays and tight commodity supplies will feed into energy prices driving headline inflation. It…

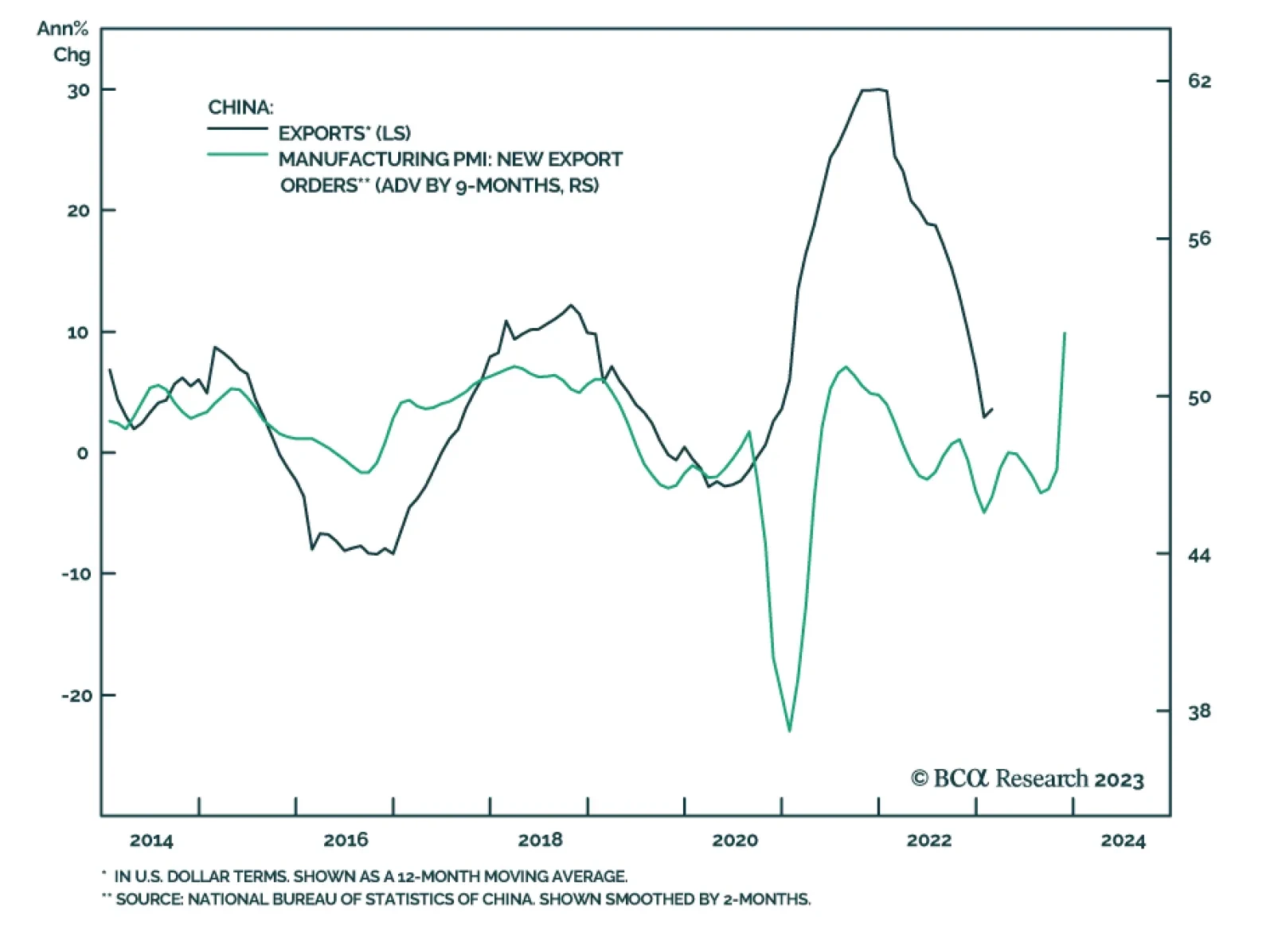

BCA Research’s China Investment Strategy service believes that the combination of a lack of new stimulus in China and the hawkish stance of the Fed remains a threat for global reflation trades and China plays. Currently…

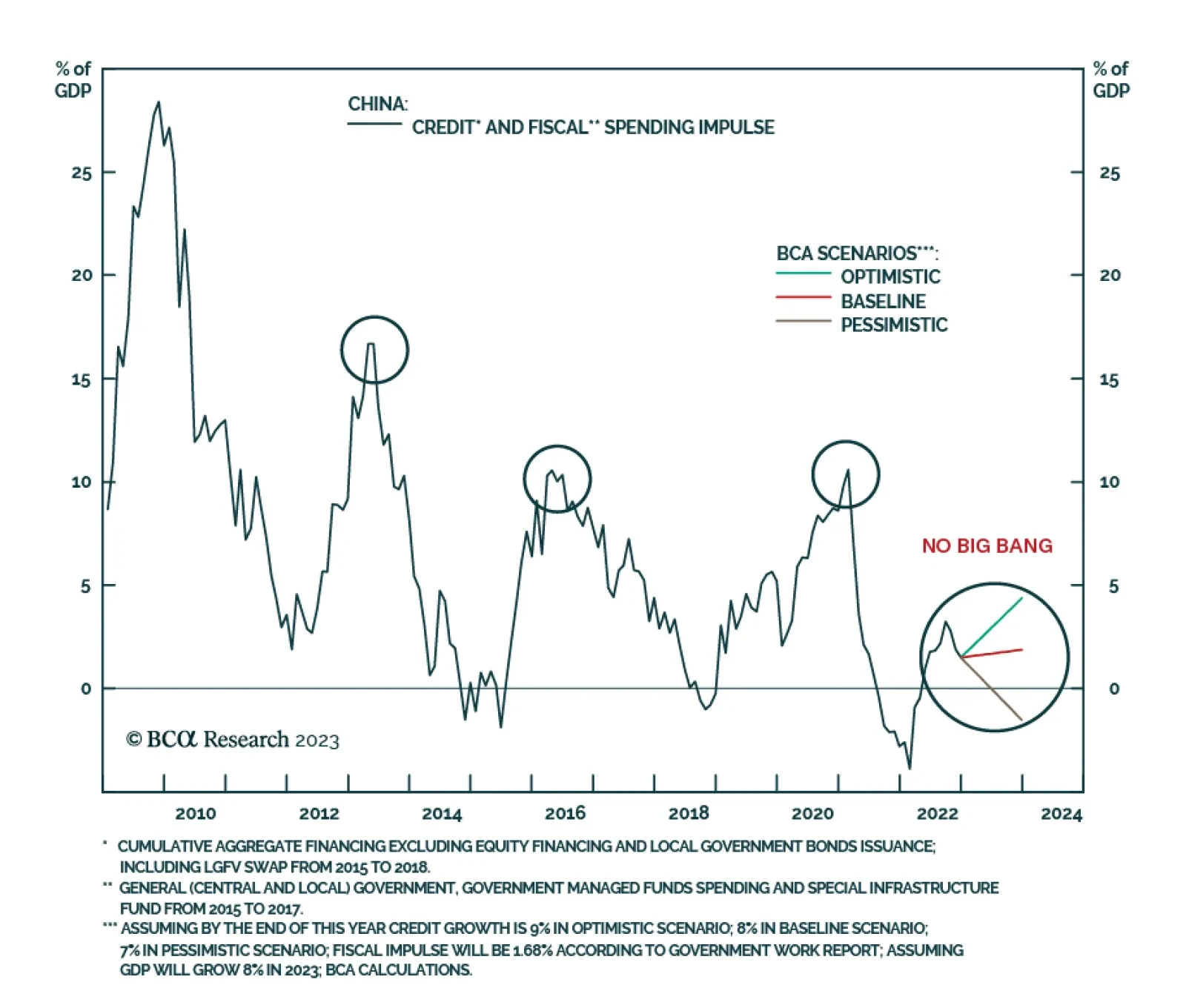

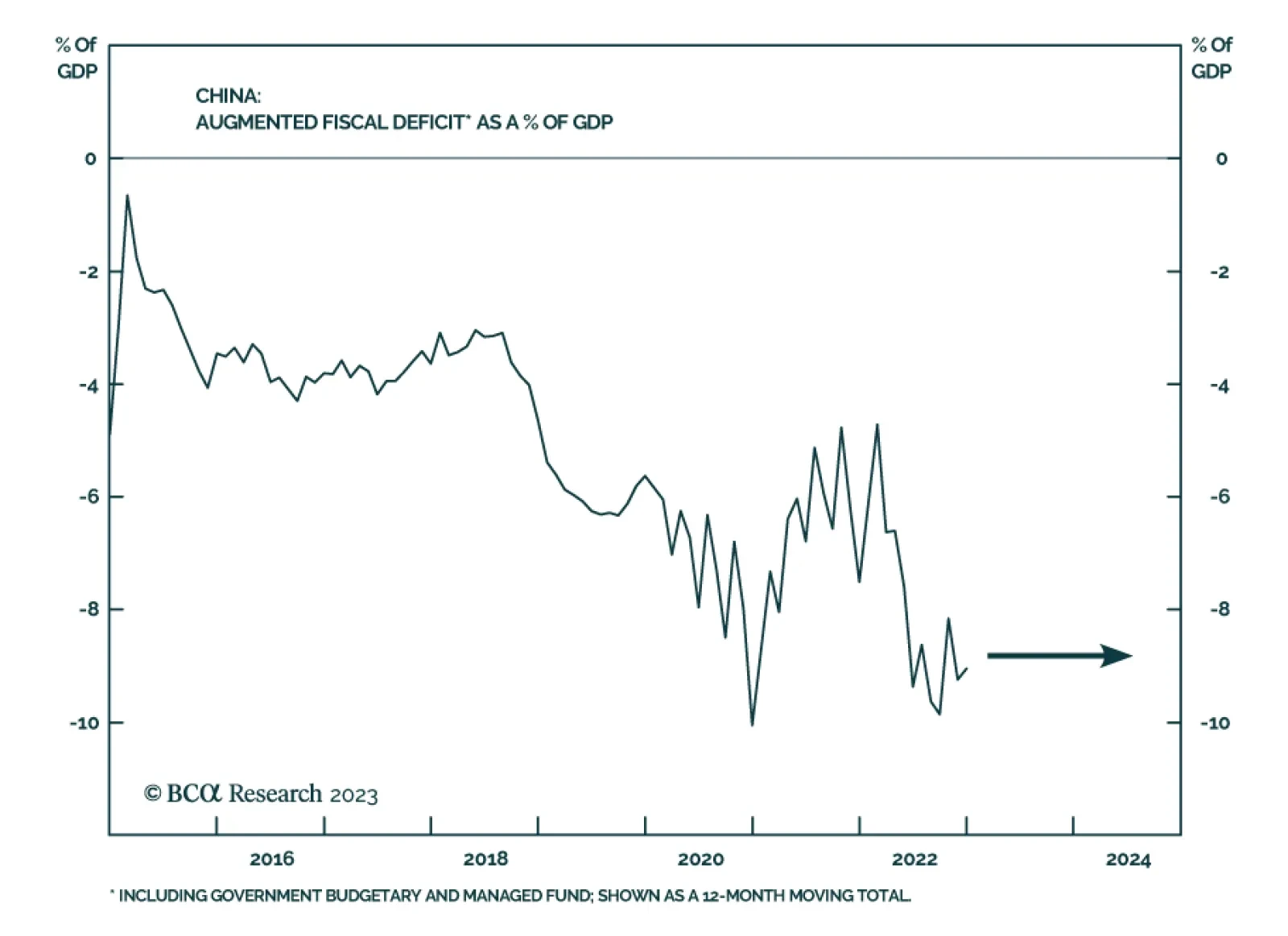

There has been a paradigm shift in Beijing’s approach to policy stimulus. The main purpose of government policy is now managing downside risks to the economy in both the short and long term. The priority for the central government is…

Chinese trade data remained weak in the first two months of the year. Exports in USD terms contracted by 6.8% y/y while imports dropped by 10.2% y/y. Declining exports reflect poor global demand for Chinese products as goods…

China’s legislative session, which formally opened on March 5, should be seen as a tentative disappointment for global risk assets and cyclical markets and sectors. While China is reopening from strict Covid-19 restrictions…

Rather than teetering into recession, global growth has firmed since the start of the year. While we still expect inflation to decline, the risk that central banks will need to lift rates more than discounted has increased. Long-term…