Data released on Tuesday painted a mixed picture of the Chinese economy. On the one hand, Chinese credit growth accelerated and beat consensus estimates. Total social financing jumped by CNY 5.38 trillion in March, exceeding…

Is there a lot of cash on the sidelines ready to be deployed? Would the US recession not be bearish for the US dollar and help EM like it did in the early 2000s? Why can the US investment playbook of the past 15-25 years not be used…

Bullish equity sentiment may persist in the second quarter on the Fed’s pause, but tight monetary policy, financial instability, elevated recession odds, extreme US polarization and policy uncertainty, and still-high geopolitical…

High rates have hurt real estate and, now, banks. The next shoes to drop: Loan growth, profits, and employment. Stay defensive. Recession is probable, but risk assets have not priced it in.

Stay defensive in the second quarter. We can see a narrow window for risky assets to outperform but we recommend investors stay wary amid high rates, supply risks, extreme uncertainty, peak polarization, and structurally rising…

In this Strategy Outlook, we present the major investment themes and views we see playing out for the rest of 2023 and beyond.

In Section I, we discuss the implications of the banking crisis that emerged in March. We do not expect what happened in the US or Europe to morph into a full-blown meltdown of the financial system, but this month’s events will…

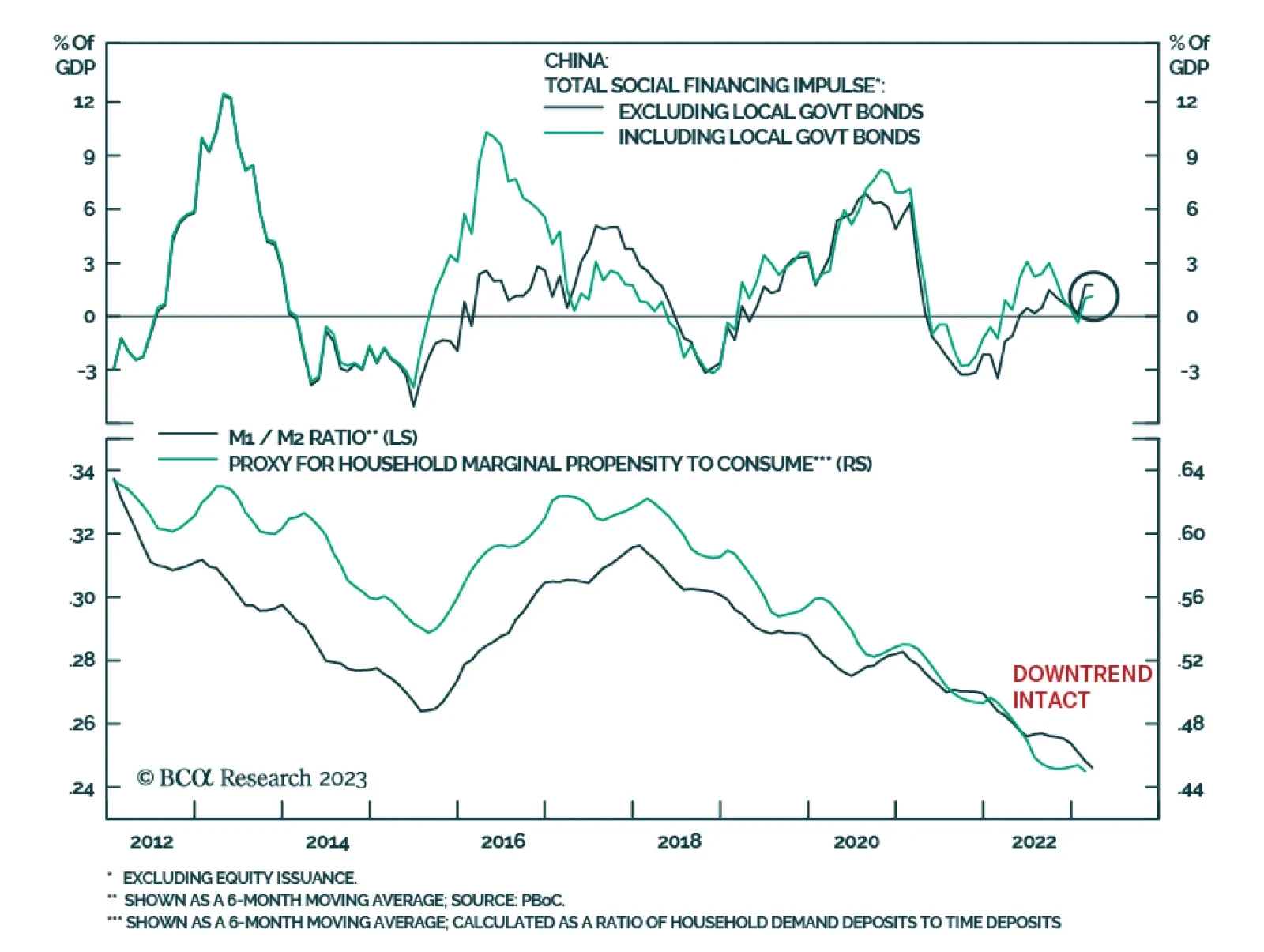

CCP officials are discussing policy options for breaking out of a deepening liquidity trap. Anything policymakers come up with will be additive to existing spending and to the multi-trillion-dollar fiscal-stimulus packages being…

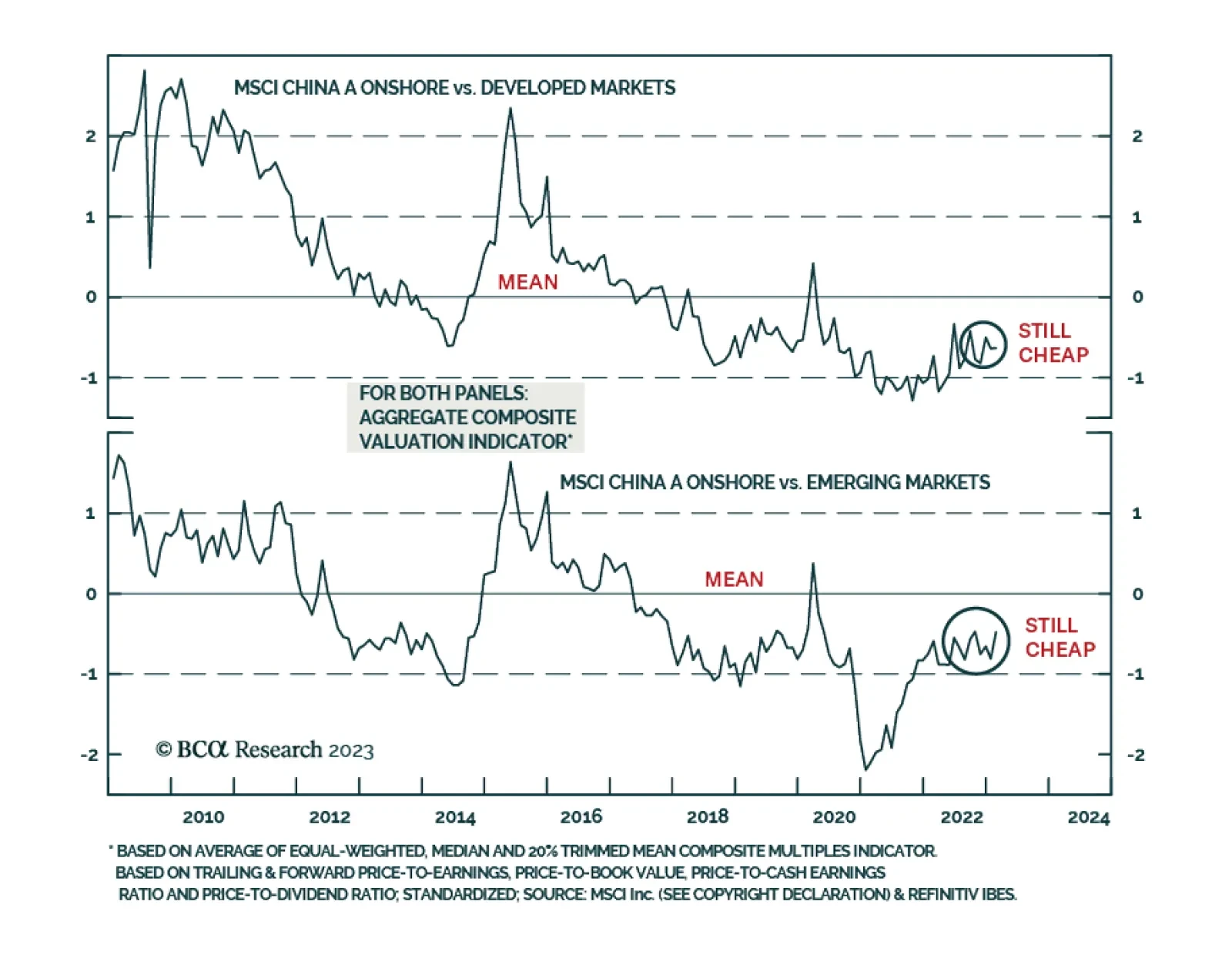

According to BCA Research’s China Investment Strategy service, a diverging corporate profit cycle and cheaper valuations should support a cyclical outperformance in Chinese onshore stocks versus global equities. In the…

Chinese onshore stocks are attractive on a risk-reward basis relative to their global counterparts. If the global equity bear market continues, our bias is that Chinese onshore stock prices will also drop, but they will likely fall…