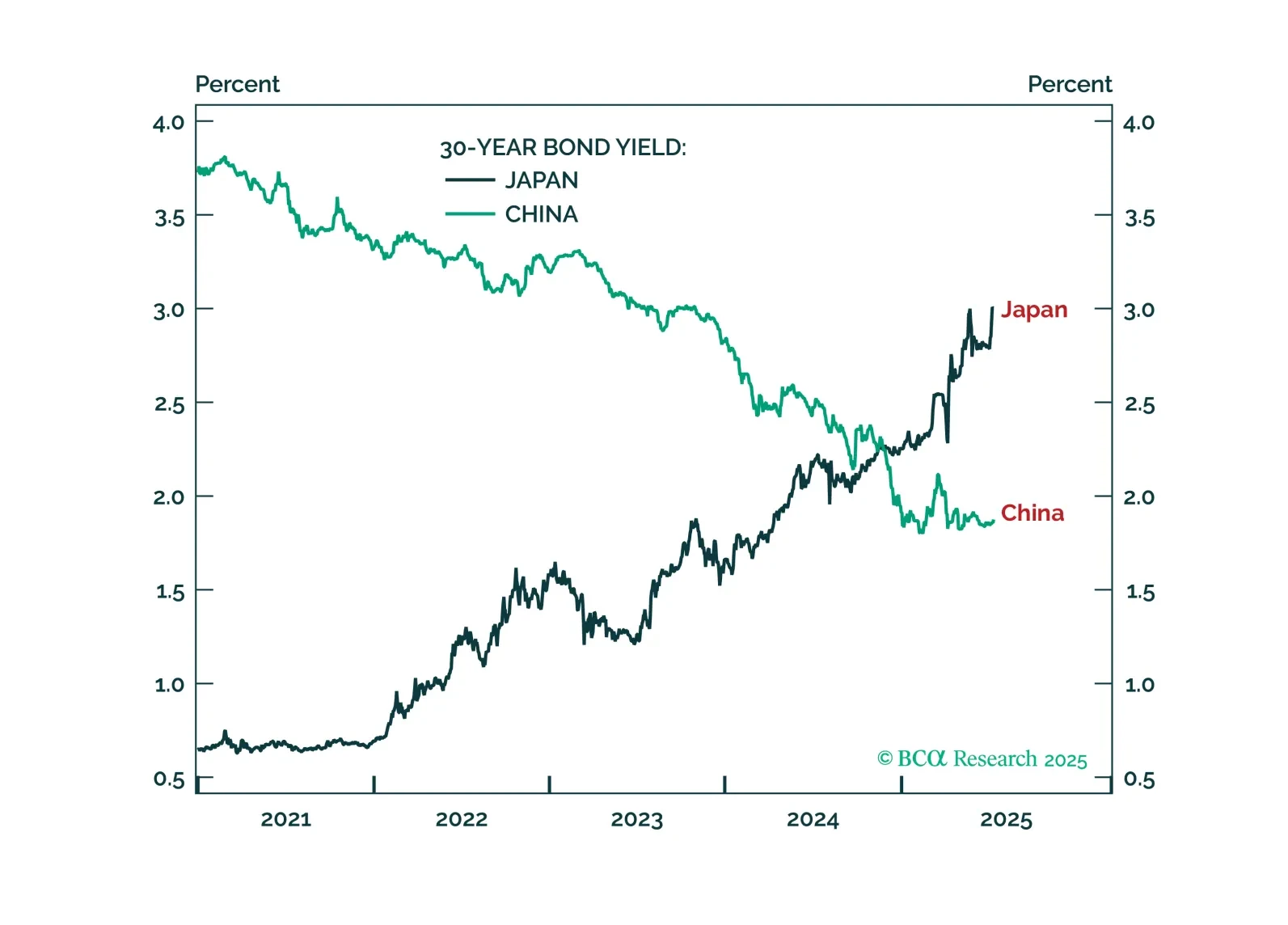

Euro area and Chinese interest rates must fall much further to prevent monetary policy from becoming ultra-restrictive. But Trump’s attempts to force unwarranted rate cuts from the Fed risks a vicious backlash from the bond…

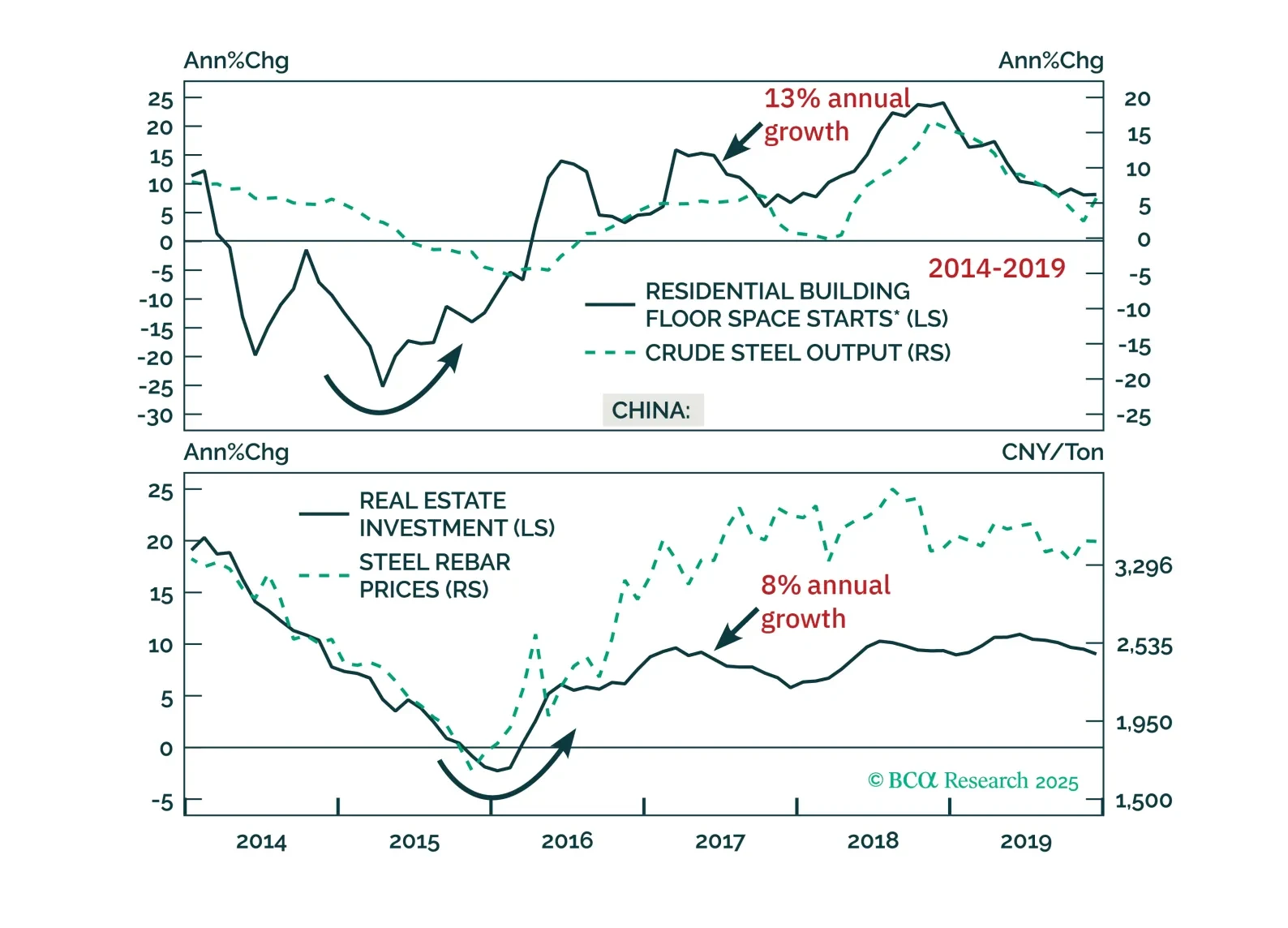

Beijing’s supply-side push faces steeper hurdles than in 2016. With limited demand support and tighter constraints on cutting capacity, today’s reforms are unlikely to pack the same punch.

In this chartbook, we look at the balance of payments across DM and EM countries. The US does not fare well, but neither do a few other countries.

Upward pressure on Japan’s real bond yield justifies overweighting the yen and underweighting overvalued tech. Plus: two new tactical trades are long JPY/EUR and short platinum.

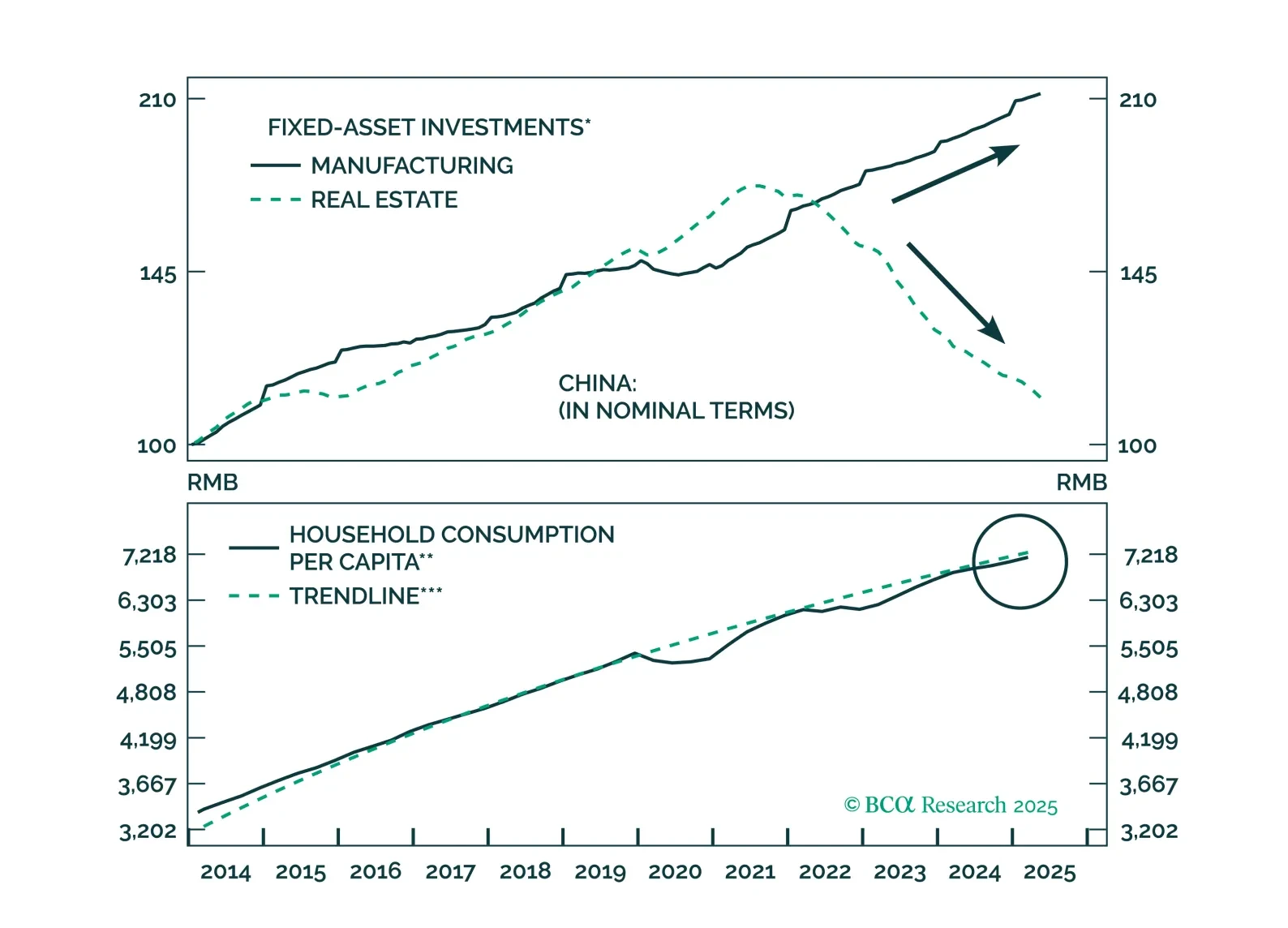

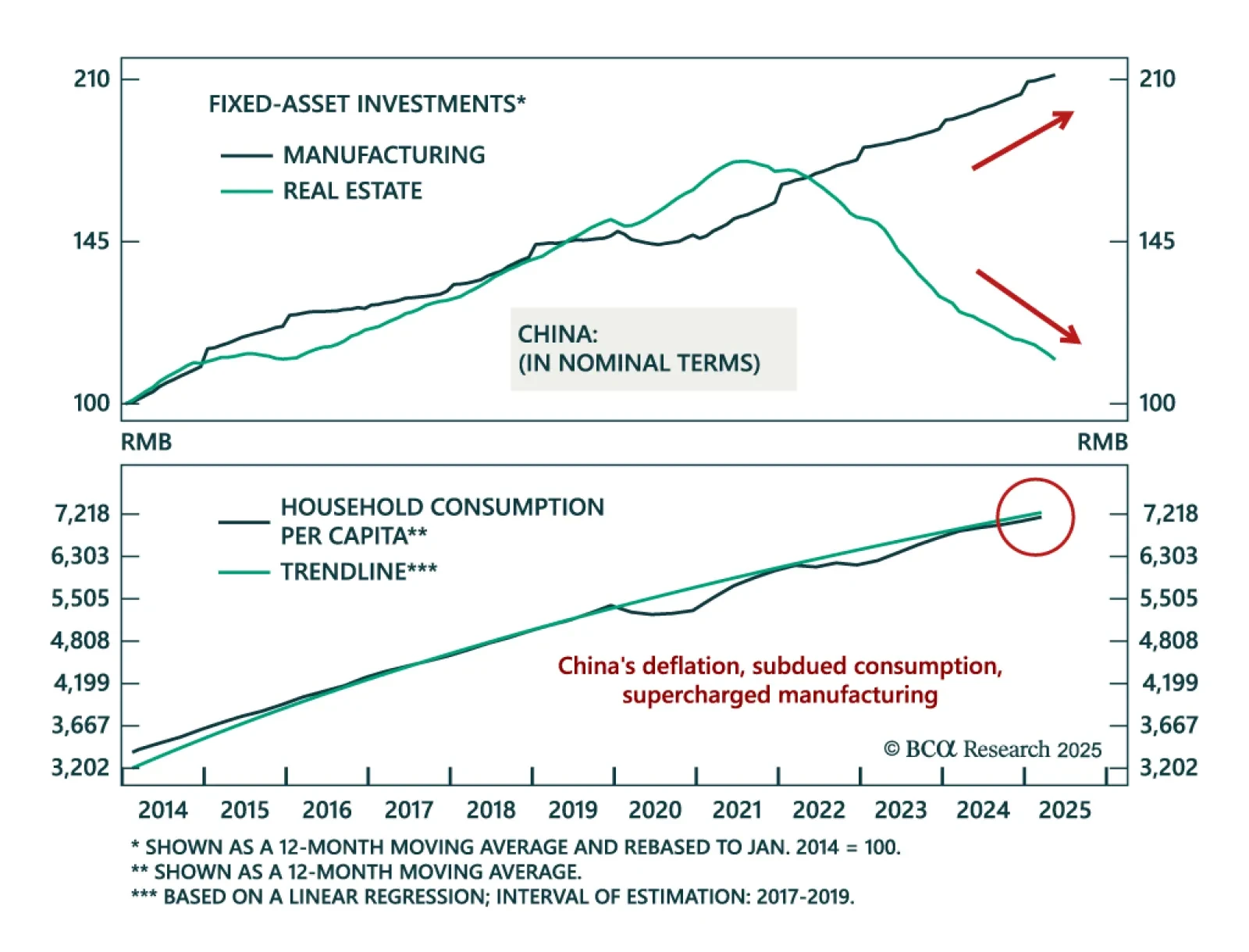

Our China strategists maintain a defensive stance on equities, favoring government bonds and high-dividend sectors as deflation persists. China’s deflationary pressures are supply-driven, with manufacturing capacity expanding faster…

Our Geopolitical strategists warn that structural and cyclical risks remain elevated despite a fading threat of acute shocks, and recommend booking profits ahead of tariffs and weaker data. President Trump is passing his signature…

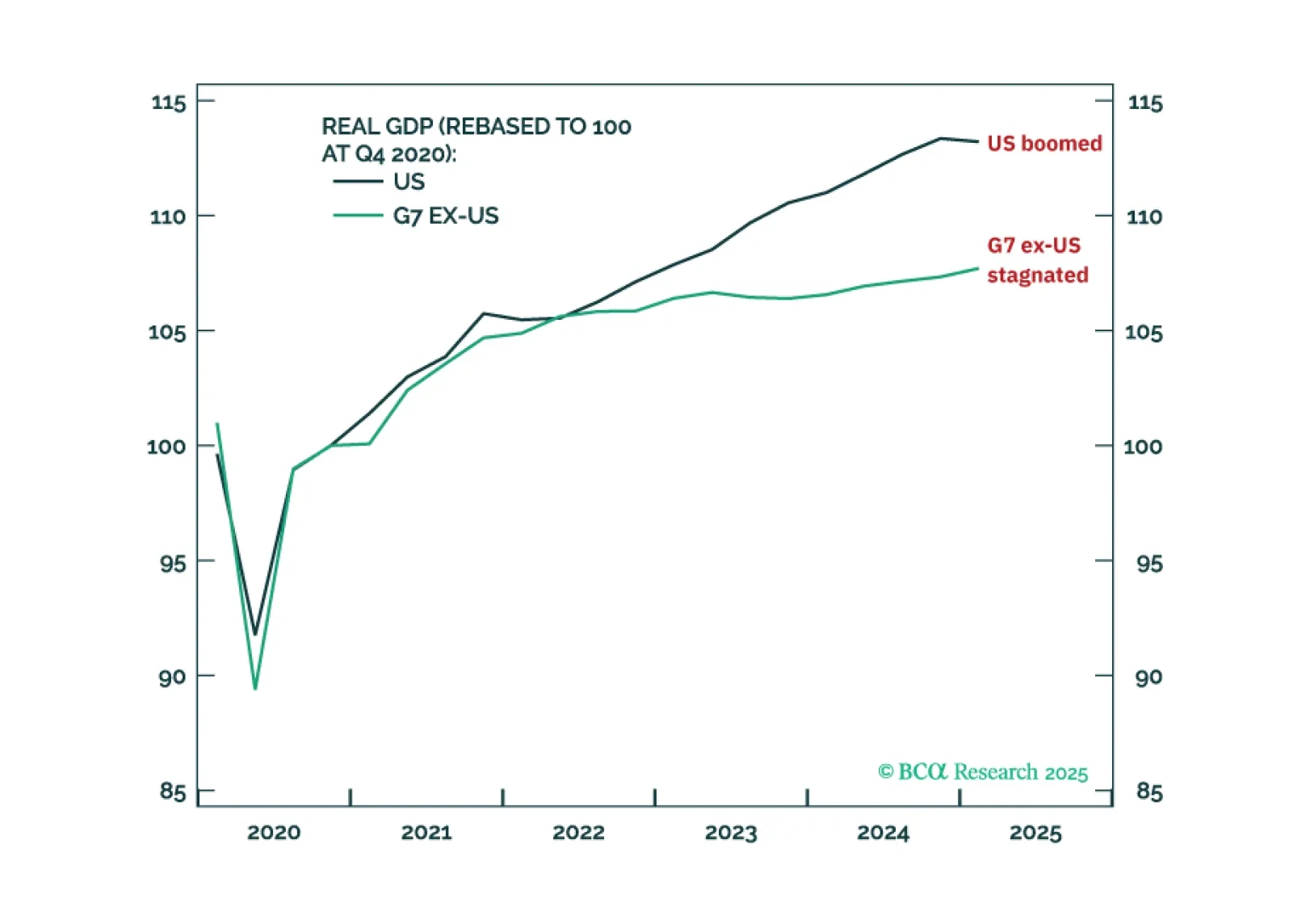

Acute geopolitical risks, like a massive oil shock, may be abating. But structural geopolitical risk remains high and could upset a blithe market. Cyclical economic risks are underrated as the US slows down and China continues to…

This report analyzes China’s persistent deflation, which is rooted in supply-side forces. Consumption support will be slow and incremental, keeping deflationary pressures elevated for the next 6–12 months.

Investors should modestly underweight equities in their portfolios and look to turn more aggressively defensive once the whites of the recession’s eyes are visible. We think that will happen within the next few months.

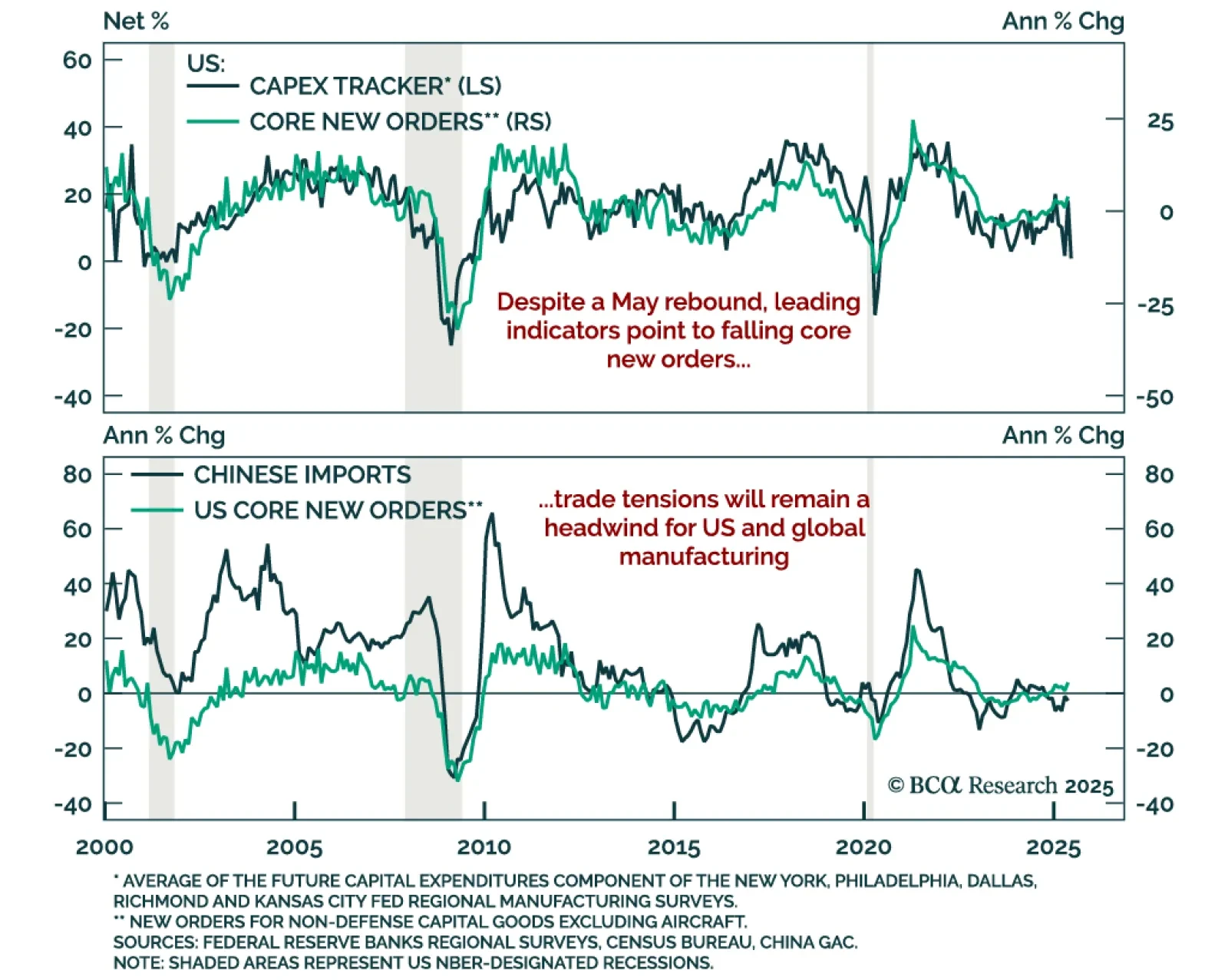

Headline strength in US capital goods orders is unlikely to last, reinforcing our defensive stance and preference for steepeners. New orders for core capital goods (nondefense ex-aircraft) rose 1.7% m/m in May, beating expectations…