We expect the CCP to pivot toward more fiscal stimulus – and less credit stimulus – this year, which will put a bid under energy and metals prices. On the back of this view, at tonight’s close we are getting long 4Q23 Brent futures…

In Section I, we review the three possible economic scenarios over the coming year, and underscore that the “soft landing” scenario remains improbable. A “no landing” scenario could occur, but it would ultimately lead back to the…

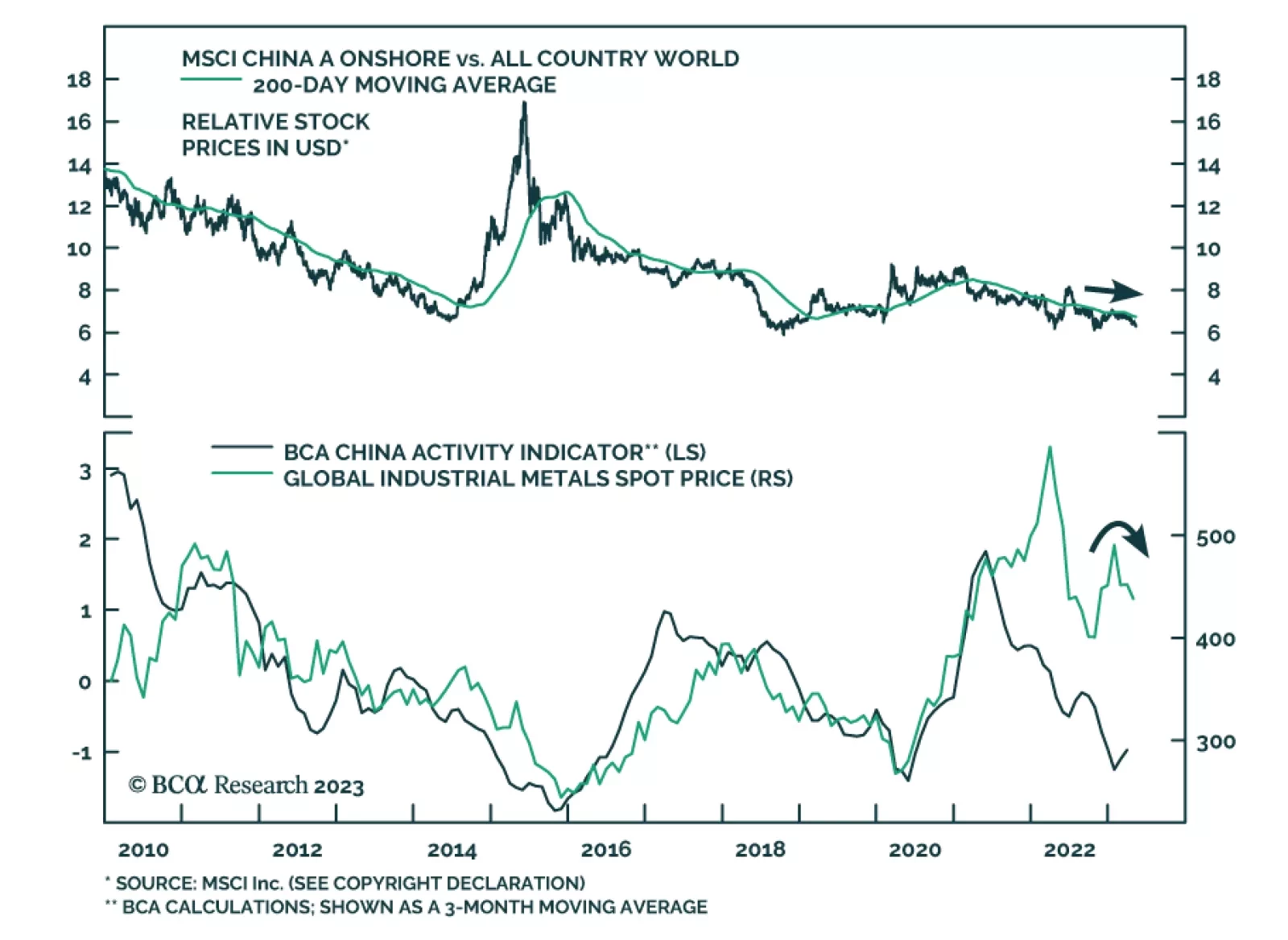

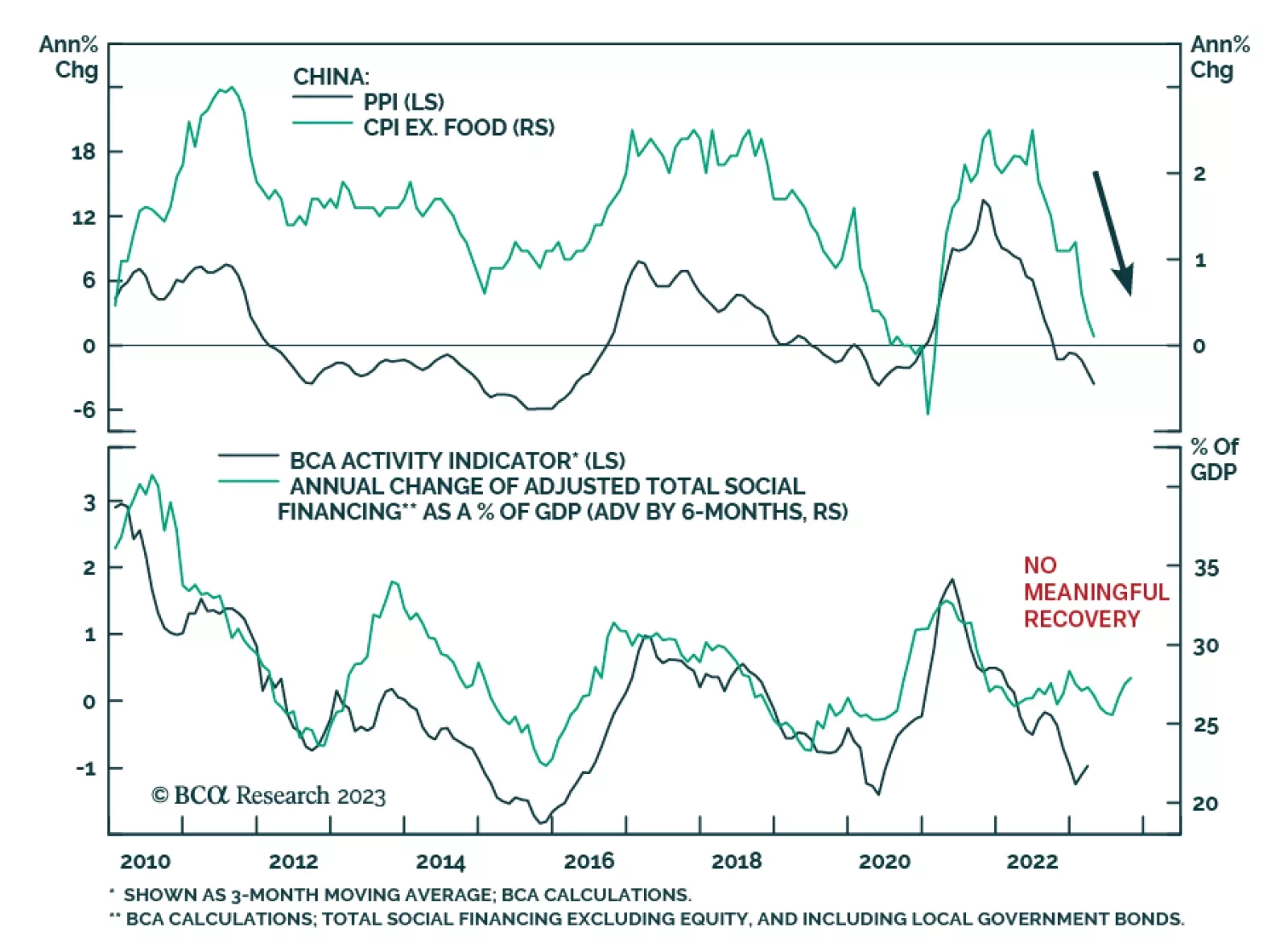

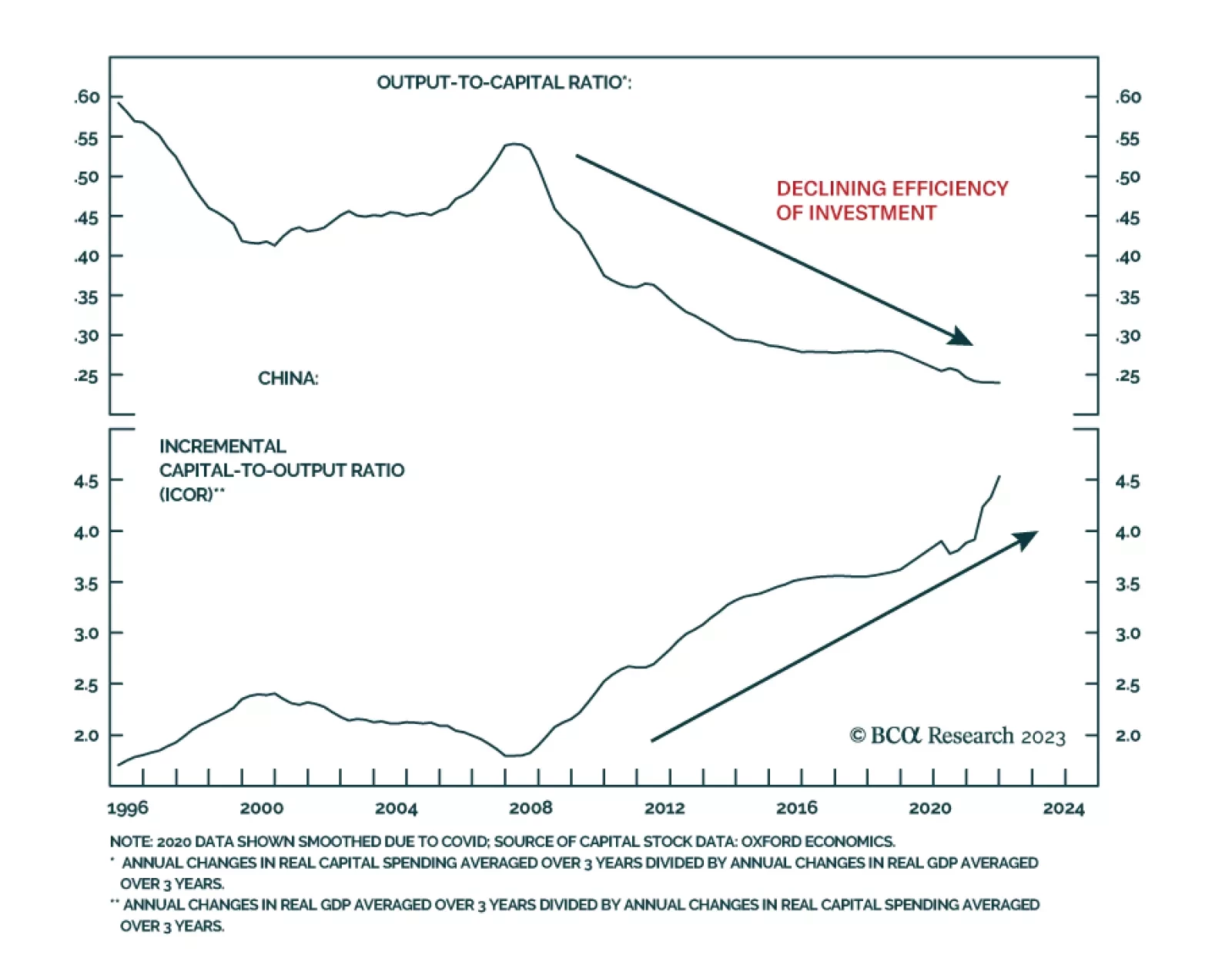

China’s recovery is losing steam. Its industrial segments will disappoint, while the pace of consumer spending will be moderate. Overall, the Chinese economic recovery will underwhelm in the months ahead. Odds are that interest rate…

Global growth will weaken in the coming months, yet monetary authorities worldwide will be reluctant to ease policy. This state of affairs foreshadows a clash between markets and policymakers in the months ahead. China’s recovery is…

EM oil demand remains resilient and will continue to be propelled by global growth this year. Supply management by OPEC 2.0 and production discipline outside the coalition will be maintained, forcing inventories lower. Recent price…

The latest Chinese economic data releases for April signal a disappointing domestic recovery. Weak economic conditions during the Shanghai lockdown last April created a low base effect which boosted the annual comparison.…

Chinese economic data sent a disappointing signal about the country’s economic recovery. CPI inflation moderated to 0.1% y/y – its slowest pace since February 2021. Similarly, the pace of decline in producer prices…

BCA Research’s China Investment Strategy service expects the recovery in China’s economy (other than the consumer sector) to underwhelm. A recent conversation with a one of China’s most prominent and…