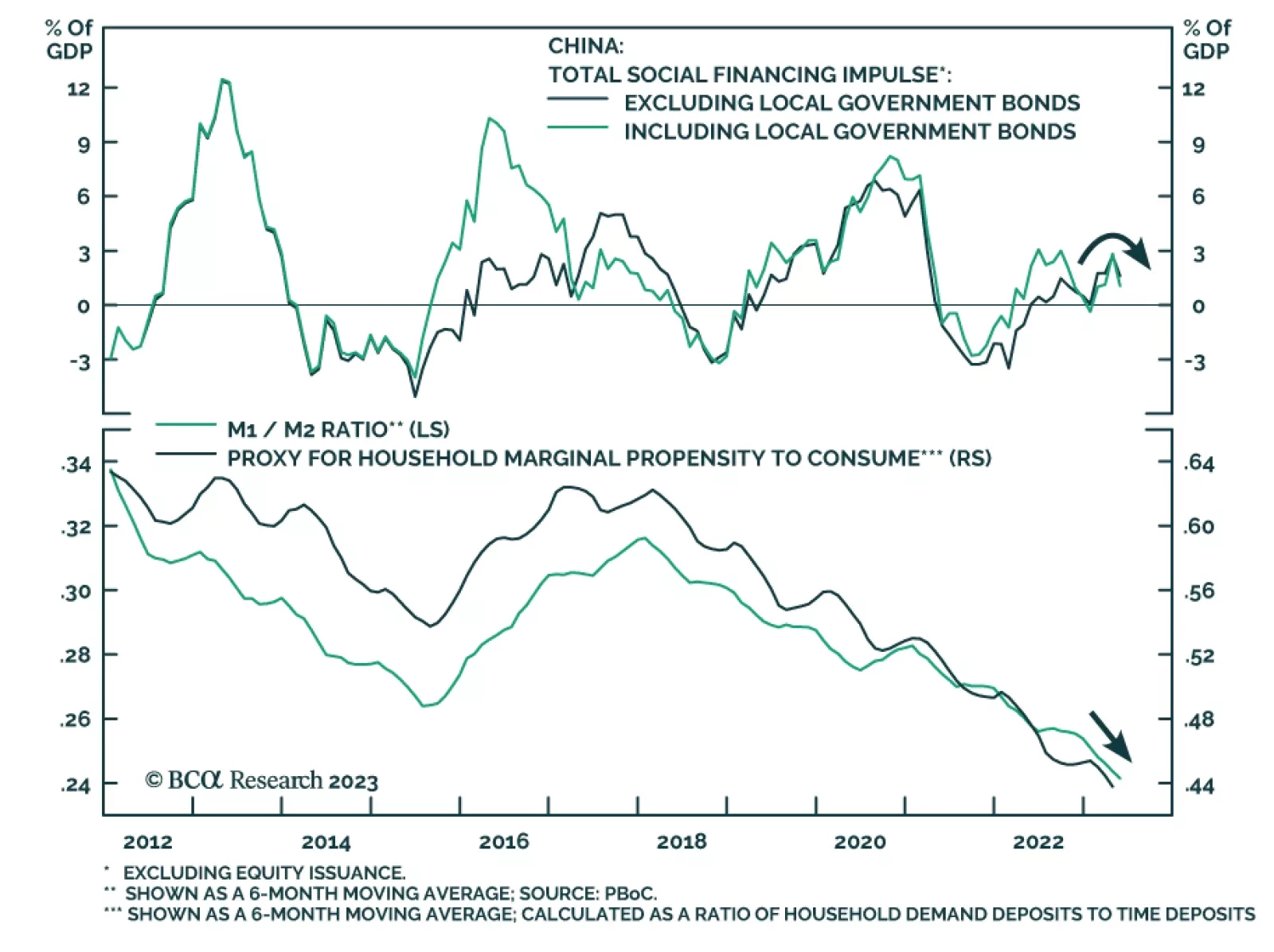

China’s money and credit update for May continues a string of disappointing Chinese data releases. The CNY 1.56 trillion increase in total social financing fell below expectations of a CNY 1.90 trillion rise. Similarly, the…

Oil and metals reacted positively to the PBOC's 10 bp cut in the seven-day reverse repo rate, which will be part of the larger monetary and fiscal support needed to revive the economy. While deposit rates at state-owned banks have…

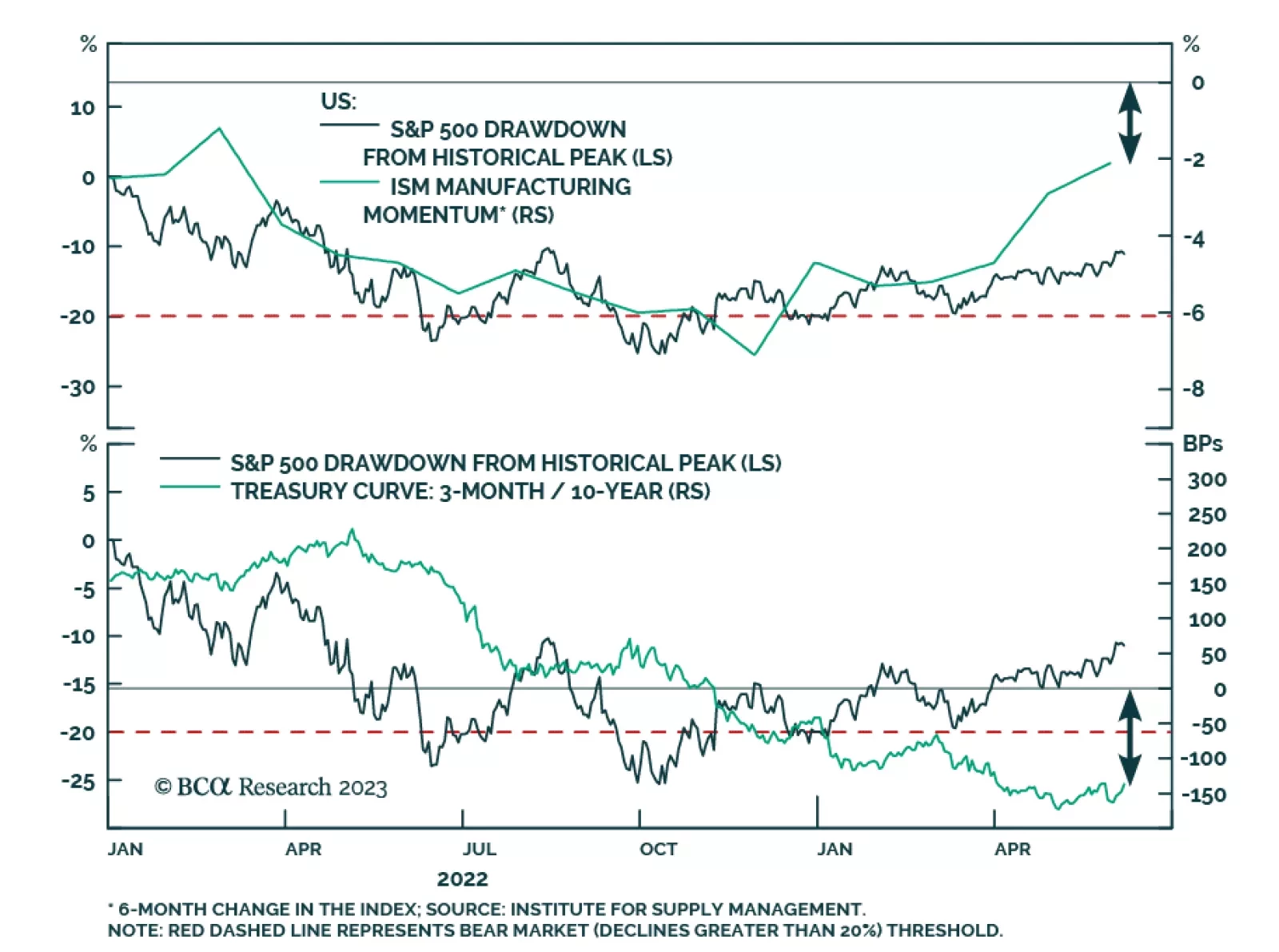

In response to the first-ever federal indictment of a former President, investors should focus on the state of the economy and not on Trump’s legal trouble. They should also use the current market rally to stock up on protection, as…

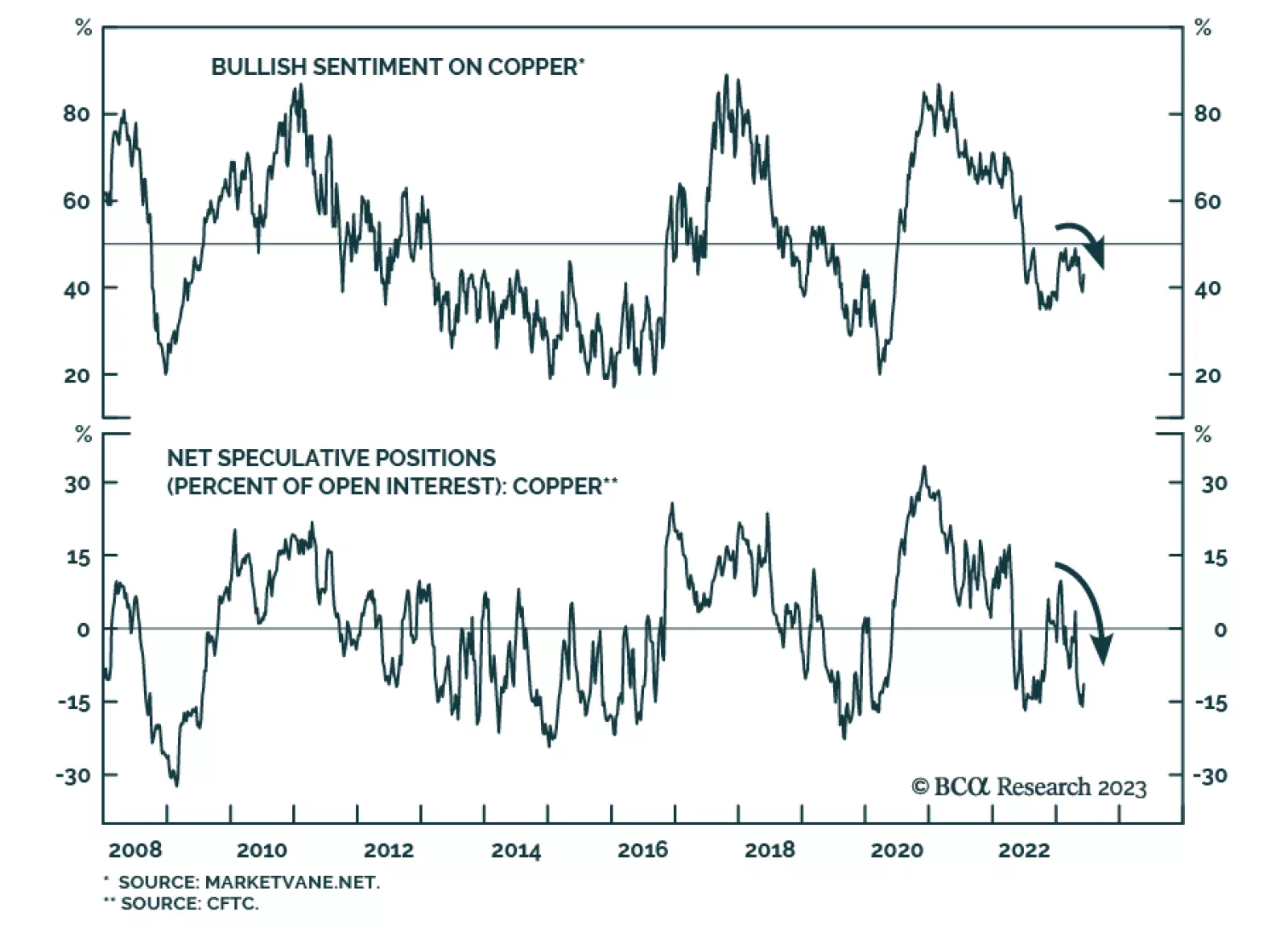

In our May In Review Insight, we highlighted that last month, industrial metals generated the largest abnormal losses among the major global financial assets we track. This continues a downtrend that started at the beginning of…

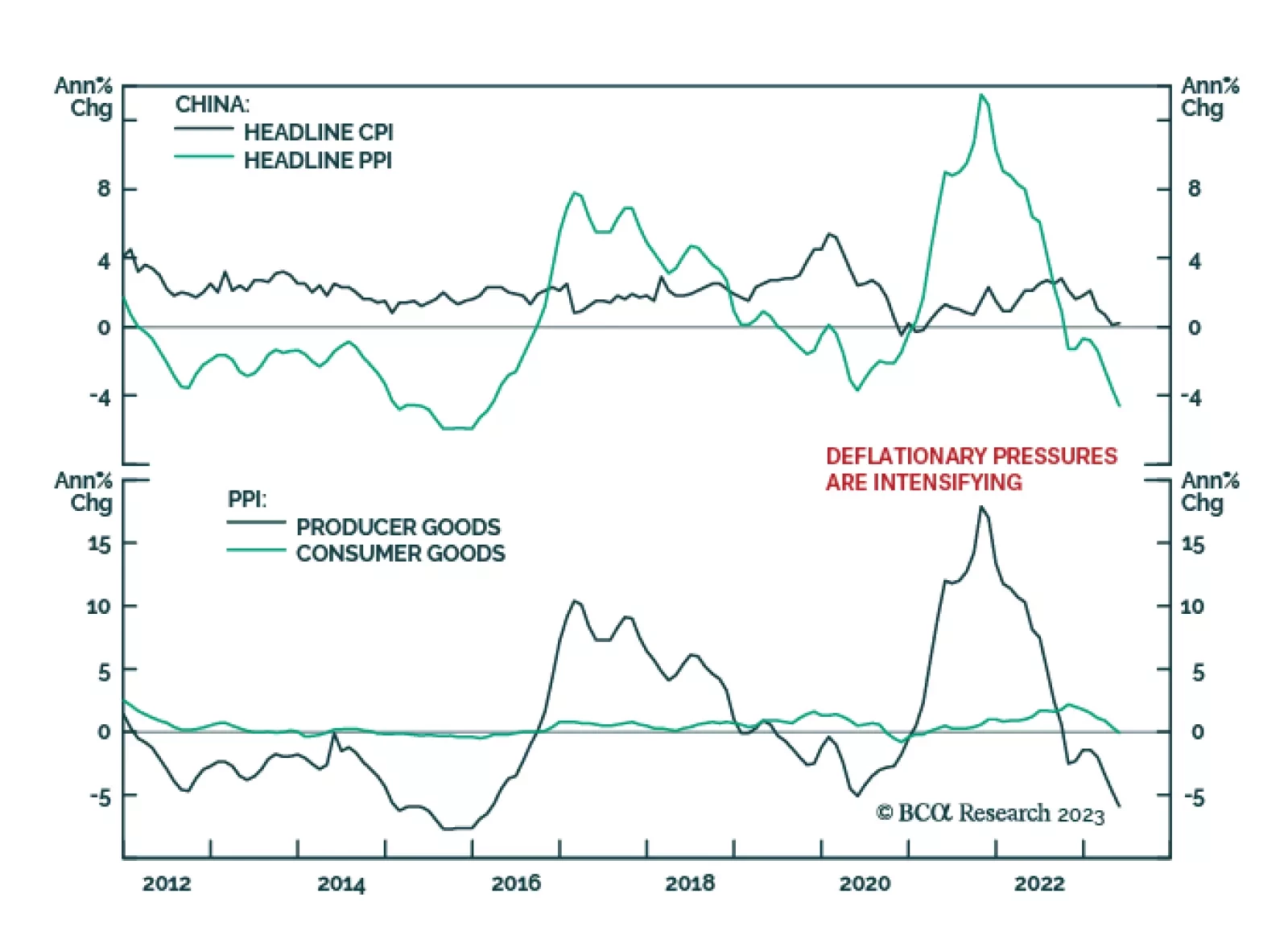

Chinese producer prices sent a disappointing signal about the domestic economy on Friday. The pace of decline in producer prices accelerated from -3.6% in April to -4.6% in May – worse than expectations of a -4.3% drop. The…

Near the half-year mark, it is safe to say 2023 has been different than 2022 for equity investors. After being brought down in bear market territory by Europe’s energy crisis and sudden global shift to hawkish monetary…

Slowing manufacturing PMI indices globally indicate the slowdown in economic activity will persist. Manufacturing demand for commodities will also soften, weighing on industrial commodity prices. Geopolitical tensions and the race to…

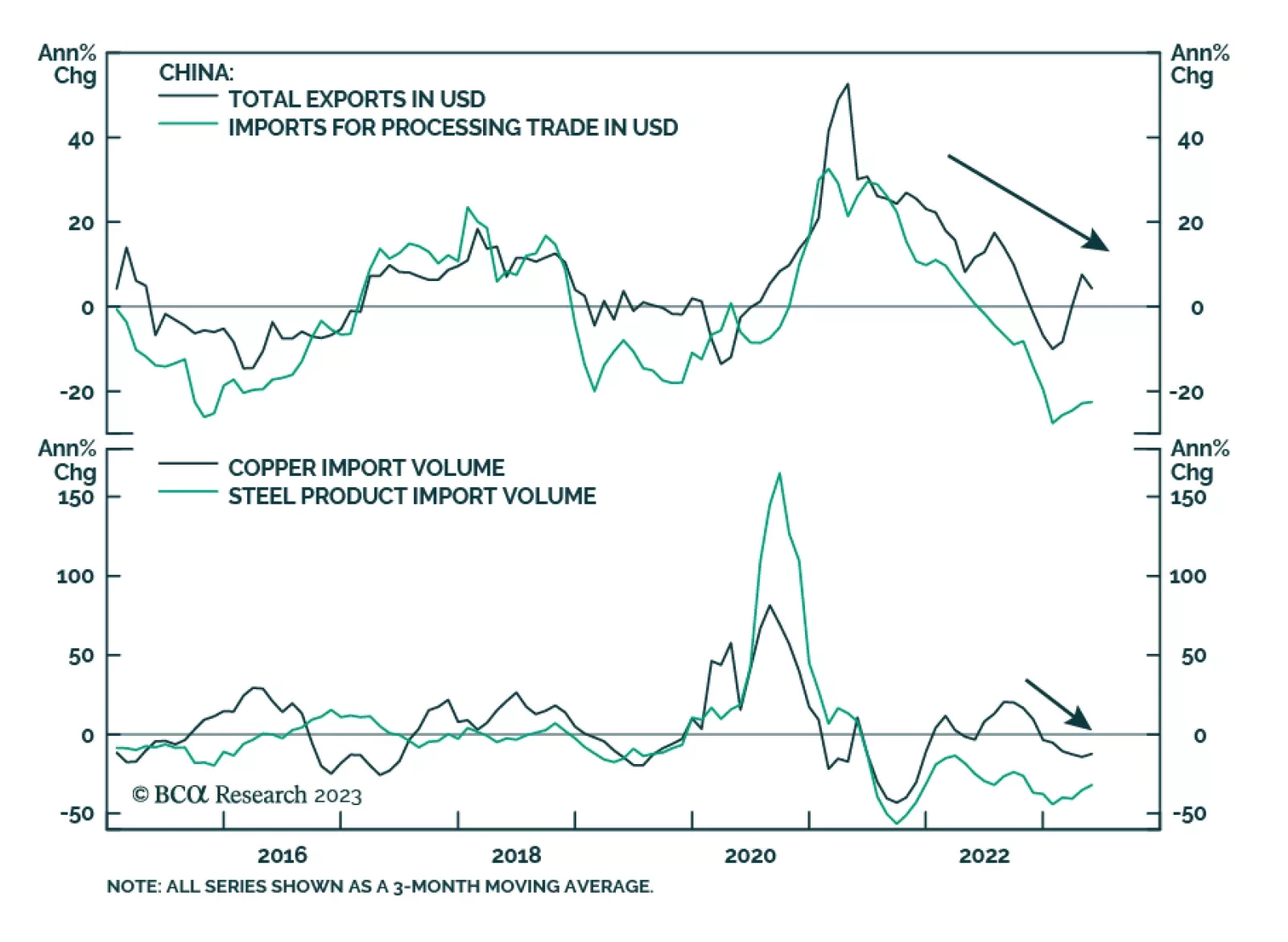

Chinese trade data delivered a disappointing signal about the global manufacturing cycle. After a brief rebound in March and April, exports dropped by 7.5% y/y in USD terms last month – below consensus estimates of a 1.8% y…

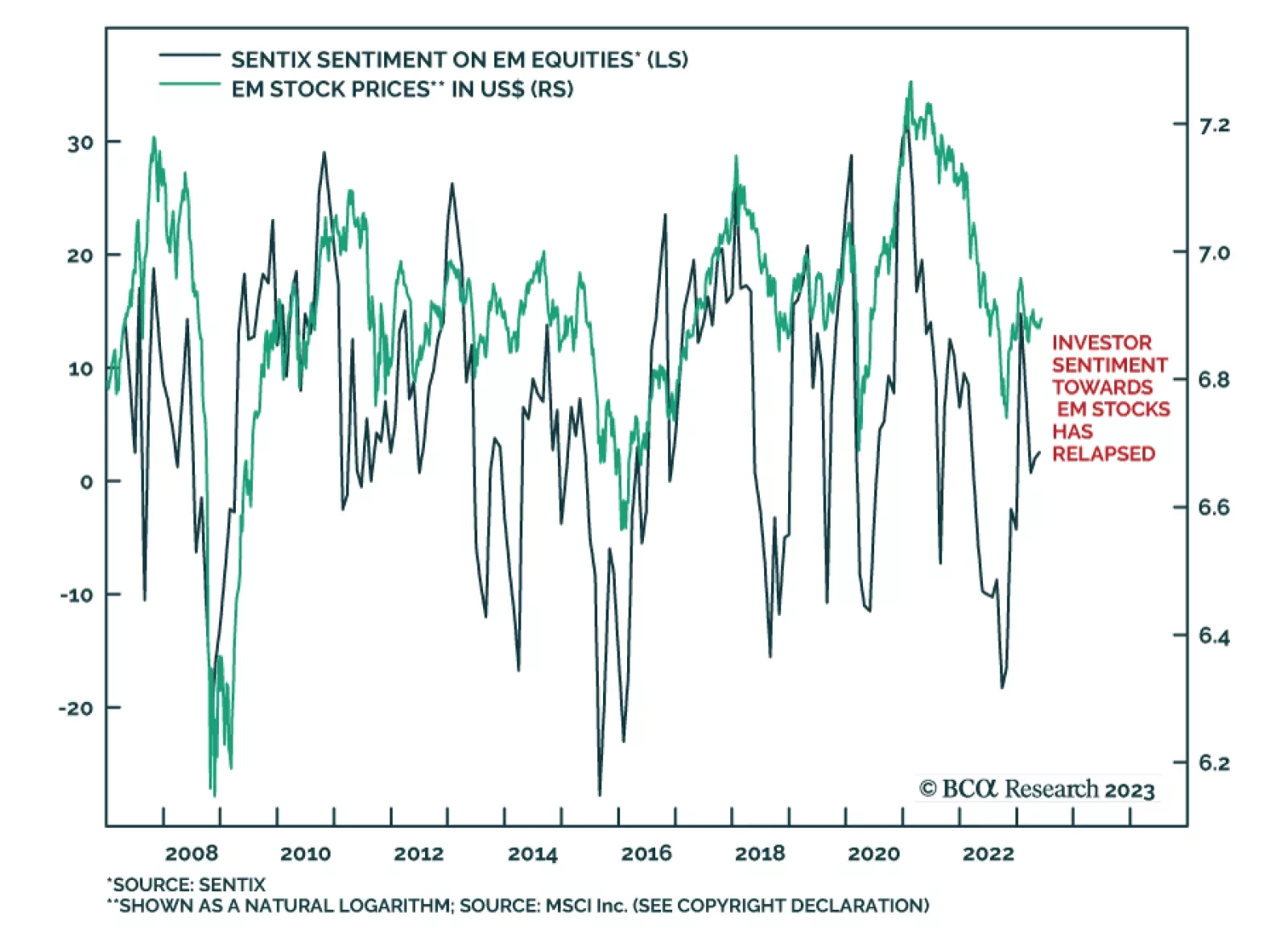

After a brief period of outperformance in late-2022/early-2023, Emerging Market stocks have been underperforming their Developed Market counterparts since January 19. While the DM equity benchmark is up 6.9% over this period, the…