According to BCA Research’s China Investment Strategy team, China’s fiscal support will be limited due to political and economic factors. China has heavily relied on government expenditure support to sustain its…

The Politburo meeting in late July will set the course for economic policy for 2H23. We think China will only resort to "irrigation-style" stimulus if something breaks in the economy and/or financial markets. Furthermore, the gradual…

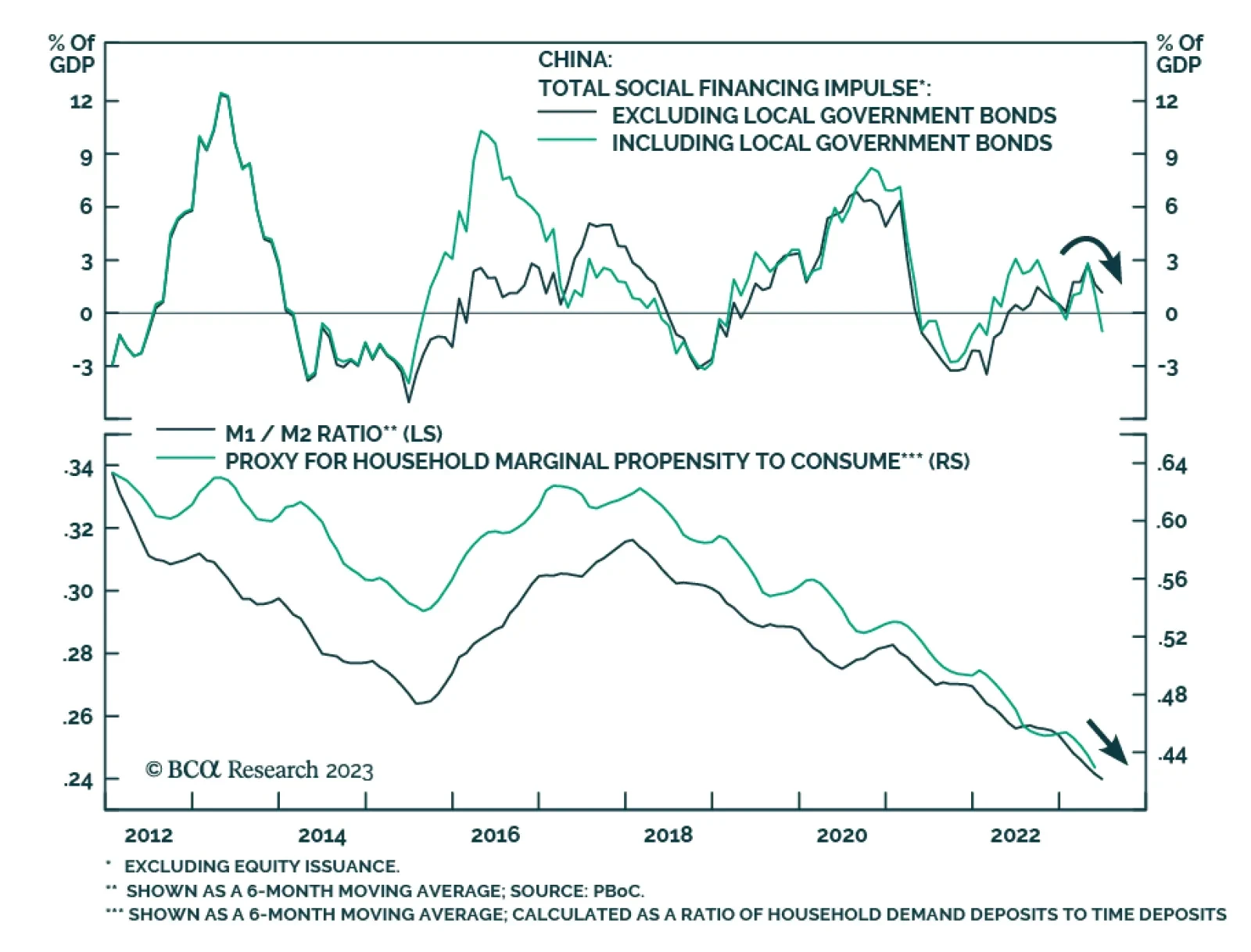

China’s credit expansion surprised to the upside in June. Aggregate social financing totaled CNY 4.22 trillion – above expectations of CNY 3.10 trillion and exceeding CNY 1.56 trillion in the prior month. Similarly,…

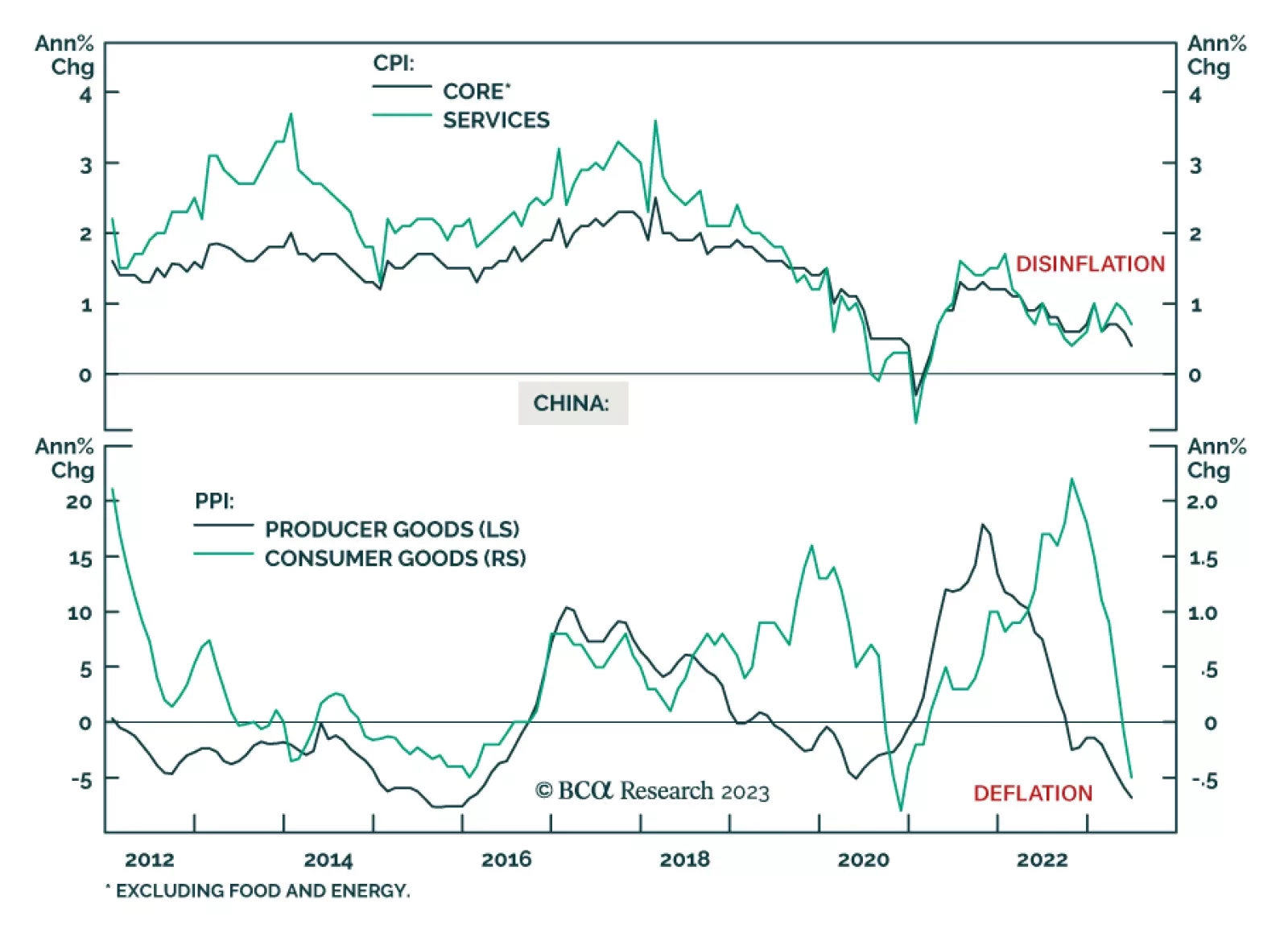

China’s CPI and PPI inflation updates indicate that deflationary pressures continue to dominate the domestic economy in June. Producer prices declined at a faster pace than in the prior month, falling by -5.4% y/y following…

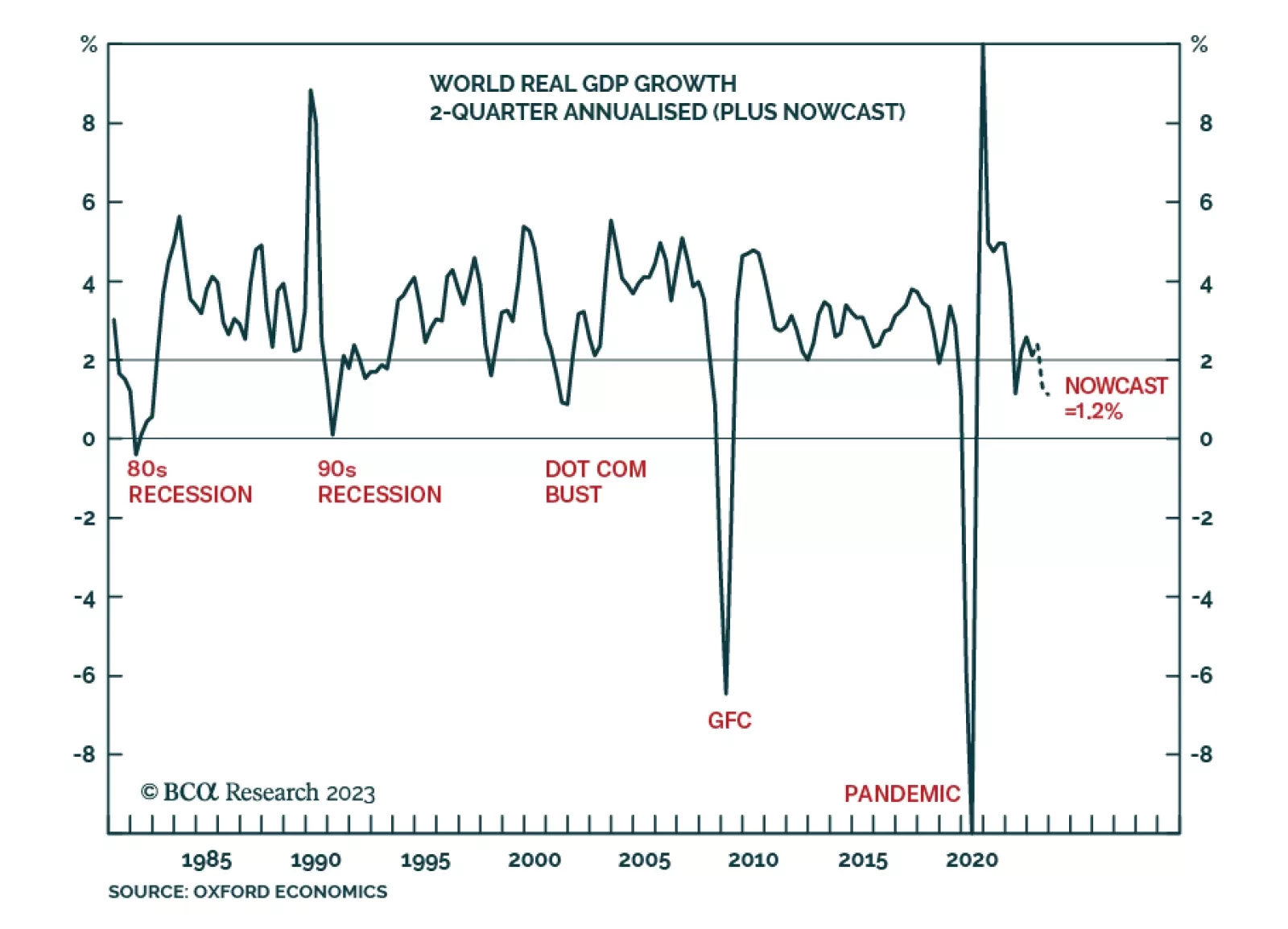

Positive economic surprises have delayed the onset of recession in the United States. But tighter monetary and fiscal policy, slowing global growth, and a looming rebound in policy uncertainty and geopolitical risk suggest that…

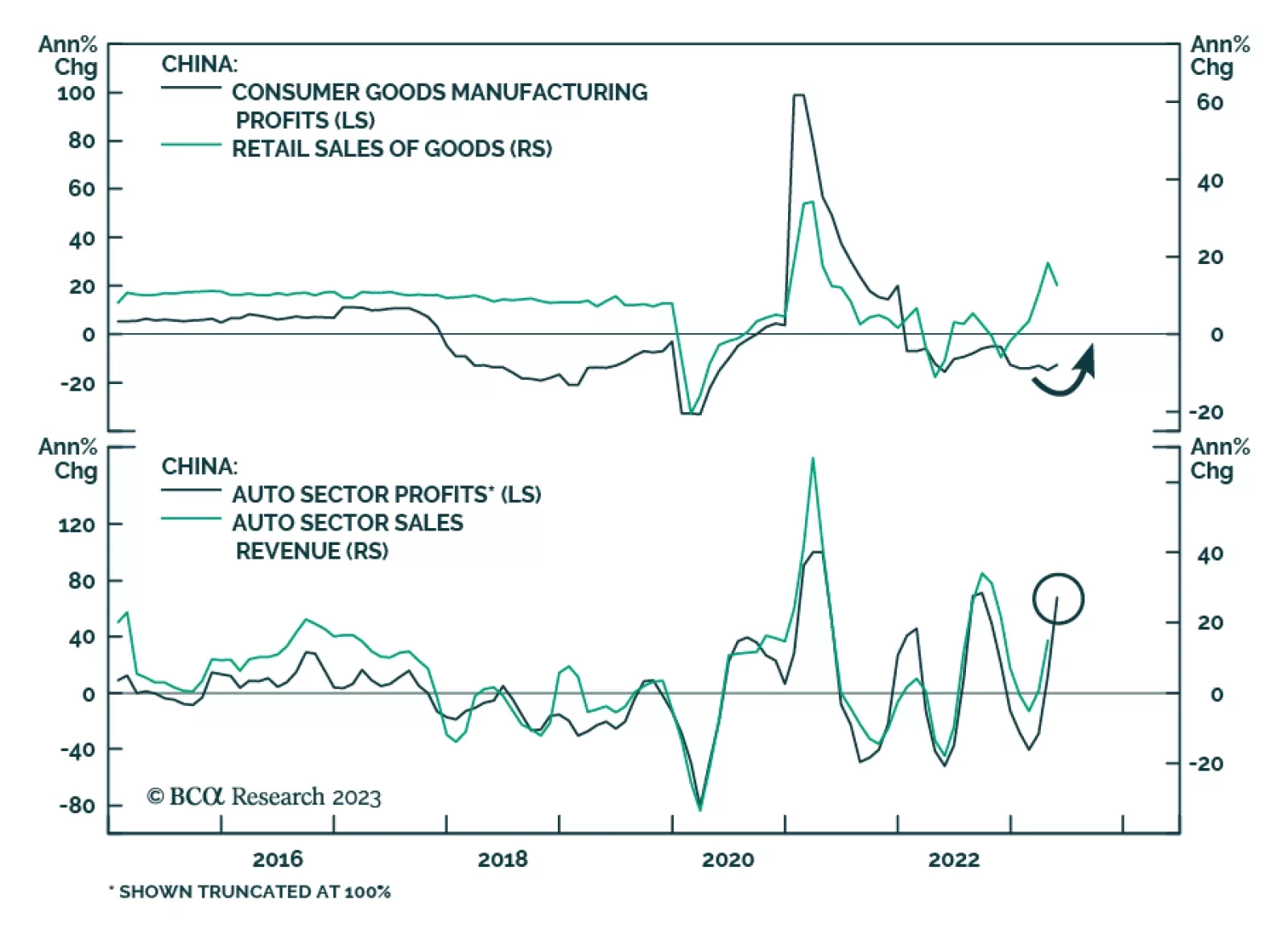

According to BCA Research’s China Investment Strategy service, although the recovery in overall Chinese industrial profits will be subdued, there will be a silver lining among China’s consumer goods producers, autos…

According to our Counterpoint strategy service, latest nowcasts indicate that world growth has likely slowed to sub-2 percent, thereby passing the threshold of a typical world recession as experienced in the early 1970s, early…

On one hand, China will be exporting deflation to the rest of the world. On the other hand, core inflation is sticky in the US, making the Fed err on the hawkish side. Altogether, these crosscurrents are creating a toxic mix for risk…

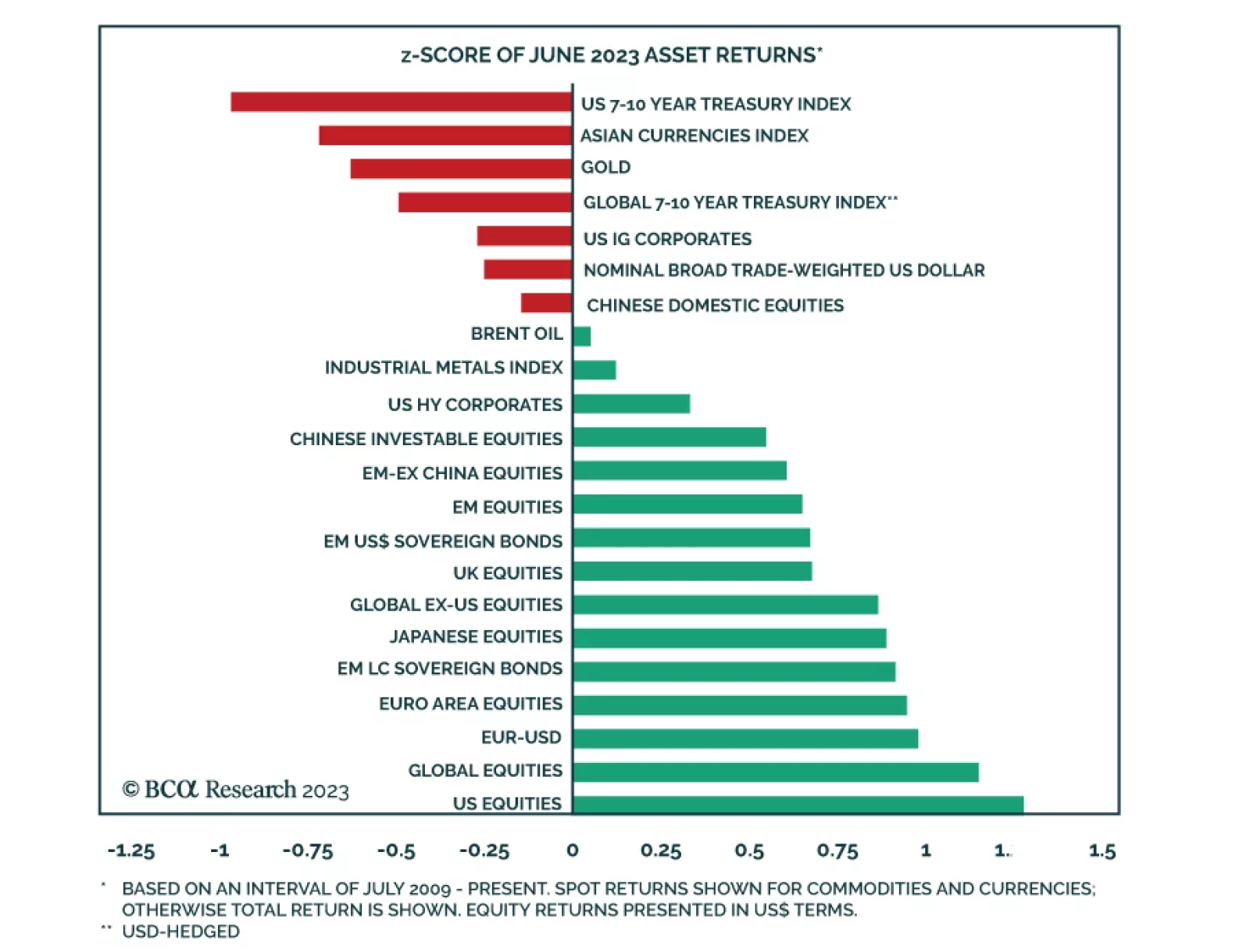

The performance of financial markets continued to improve in June, with most of the major financial assets we track generating positive abnormal returns. The US equity rally – which had been narrowly concentrated among…