The US is not out of the woods when it comes to inflation, which means that it is too early to conclude that the Fed can stop raising rates. Any further increase in inflation risk would prompt us to turn more cautious on stocks.

Among the critical materials needed for the global energy transition, Li is expected to see the largest increase in demand from 2022 to 2050. Li supply is not constrained, but continued investment in mining and refining will be…

Stay cautious on Chinese stocks. Equity investors should use any rebound in onshore stock prices to downgrade A-shares from overweight to neutral within global and EM equity portfolios. Remain underweight Chinese investable/offshore…

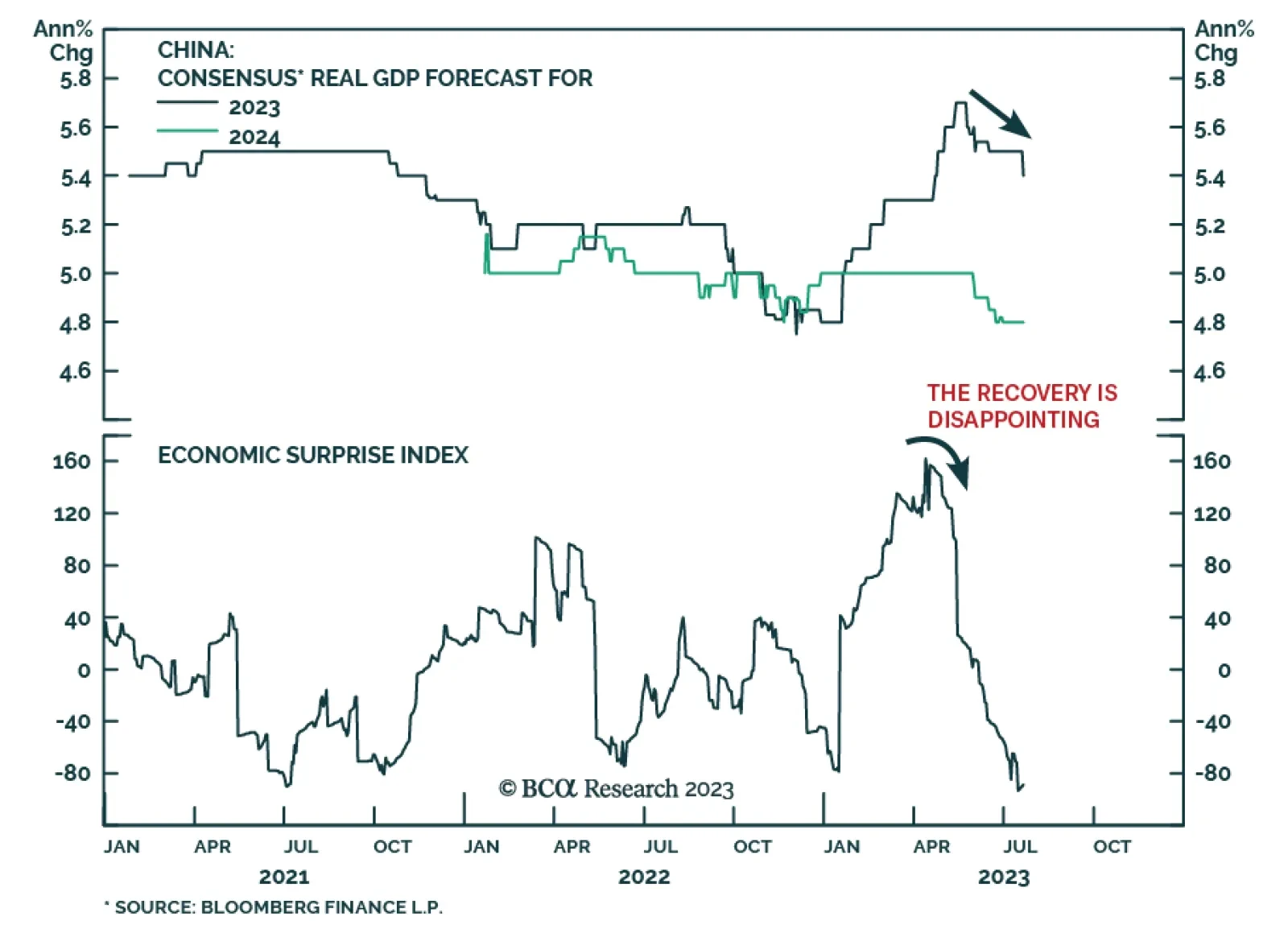

China’s Politburo meeting delivered a disappointing signal about Beijing’s willingness to deliver meaningful stimulus. Although policymakers pledged support for domestic demand, consumer sentiment, and risk prevention…

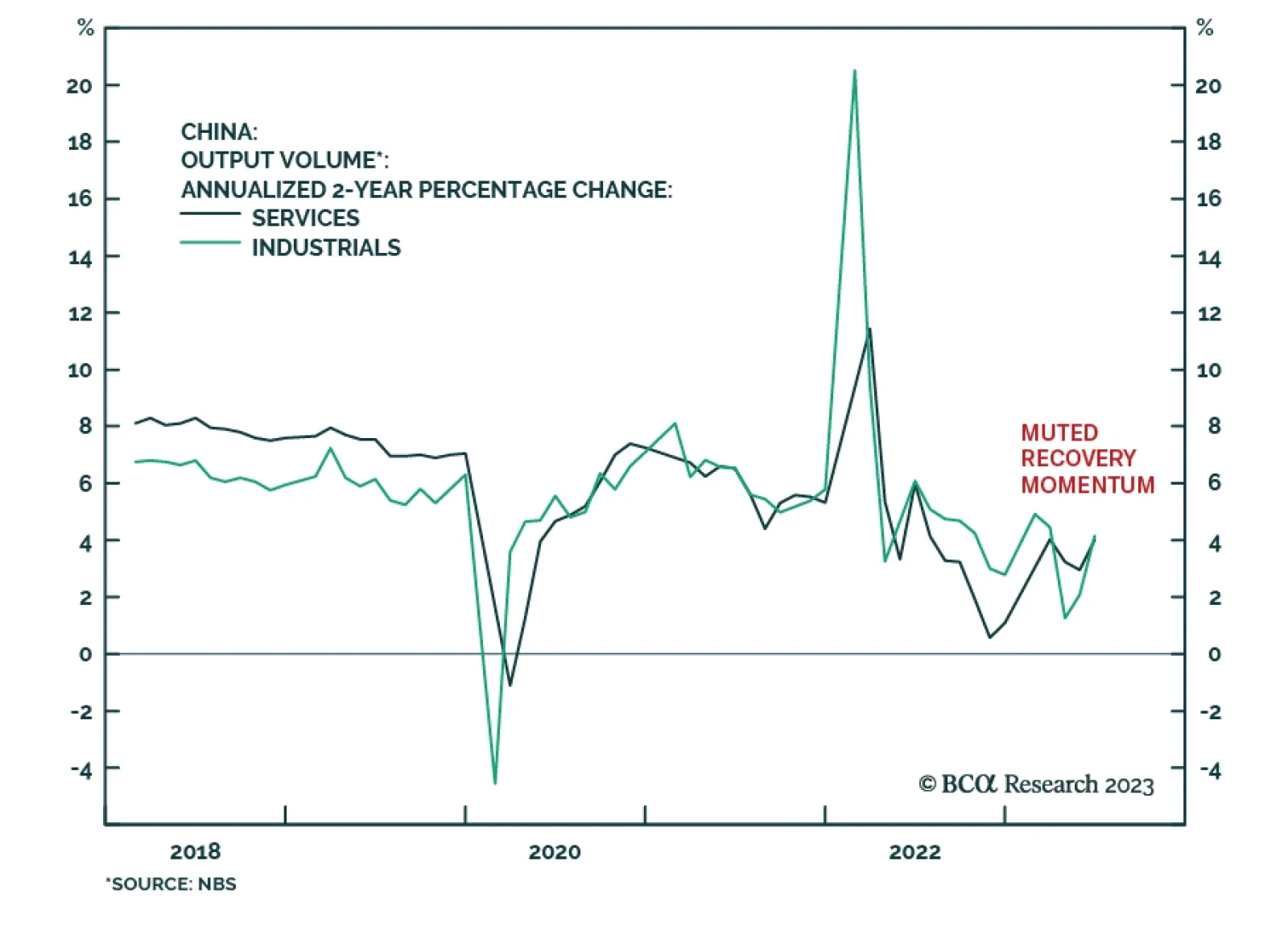

China’s economy is cruising at a very low altitude where gravity forces are intense. Downbeat consumer and business sentiment will reduce the effectiveness of stimulus. Anything short of “irrigation-style” stimulus will be…

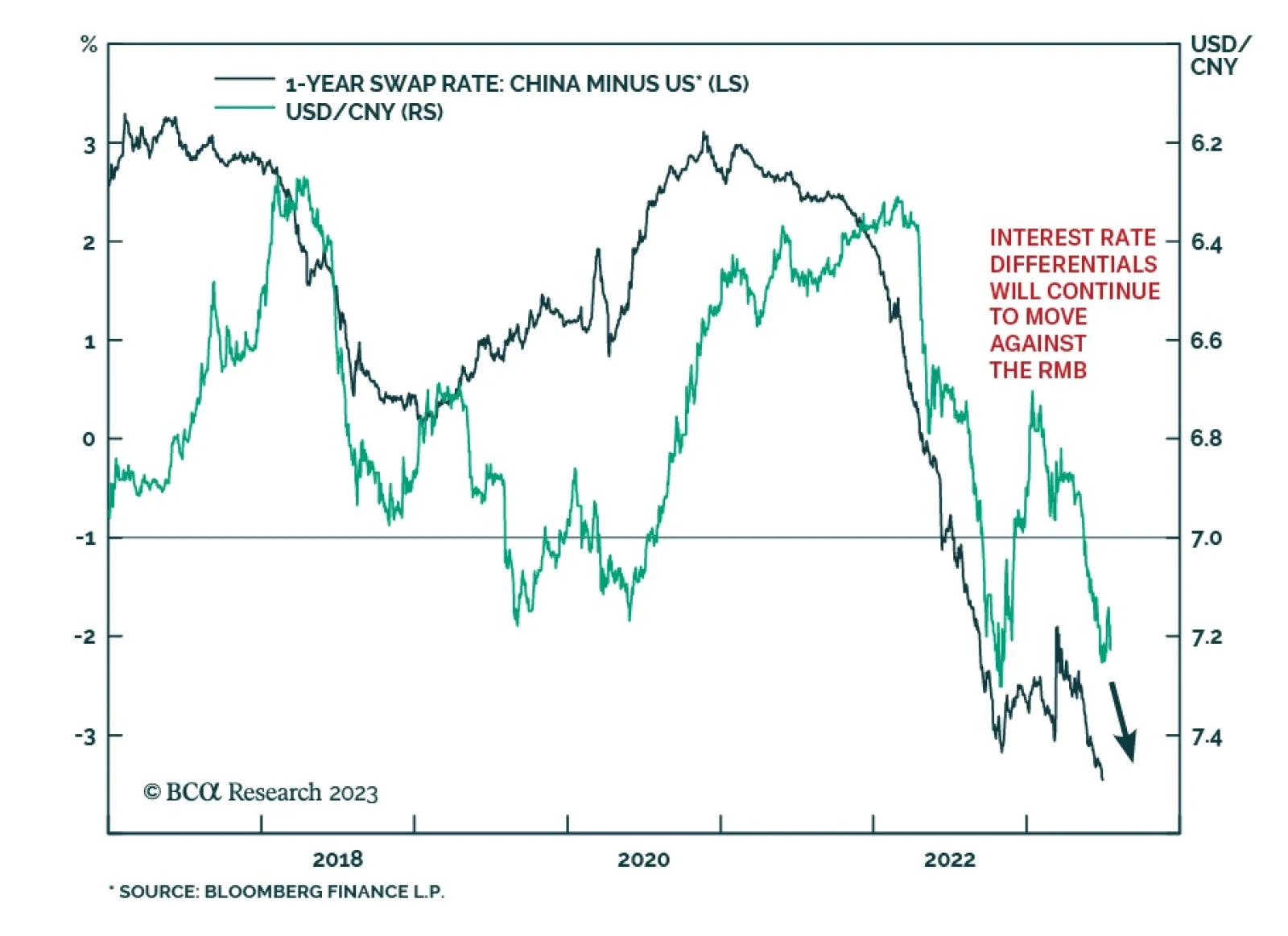

The Chinese yuan was among the best performing currencies on Thursday after authorities implemented measures to support the yuan. Specifically, the People’s Bank of China (PBoC) set its daily fixing at a stronger-than-…

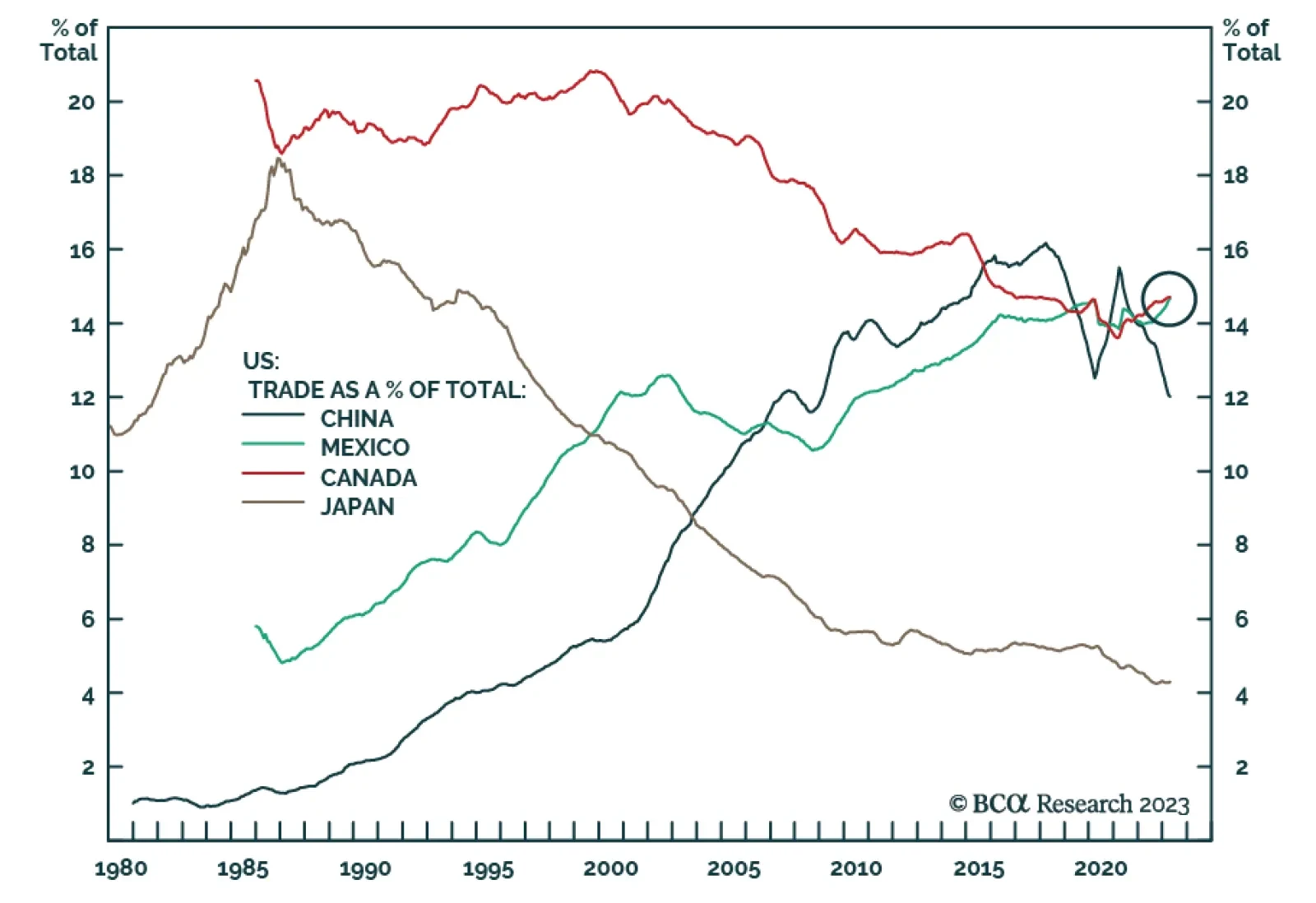

China’s slowdown confirms BCA’s Geopolitical Strategists’ view that persisting structural challenges would cause China’s economic reopening to disappoint (see The Numbers). In this context, Canada and…

On the surface, the latest batch of Chinese economic data released on Monday shows a deterioration in consumer spending with retail sales growth slowing sharply from 12.7% y/y to 3.1% y/y in June – slightly below consensus…

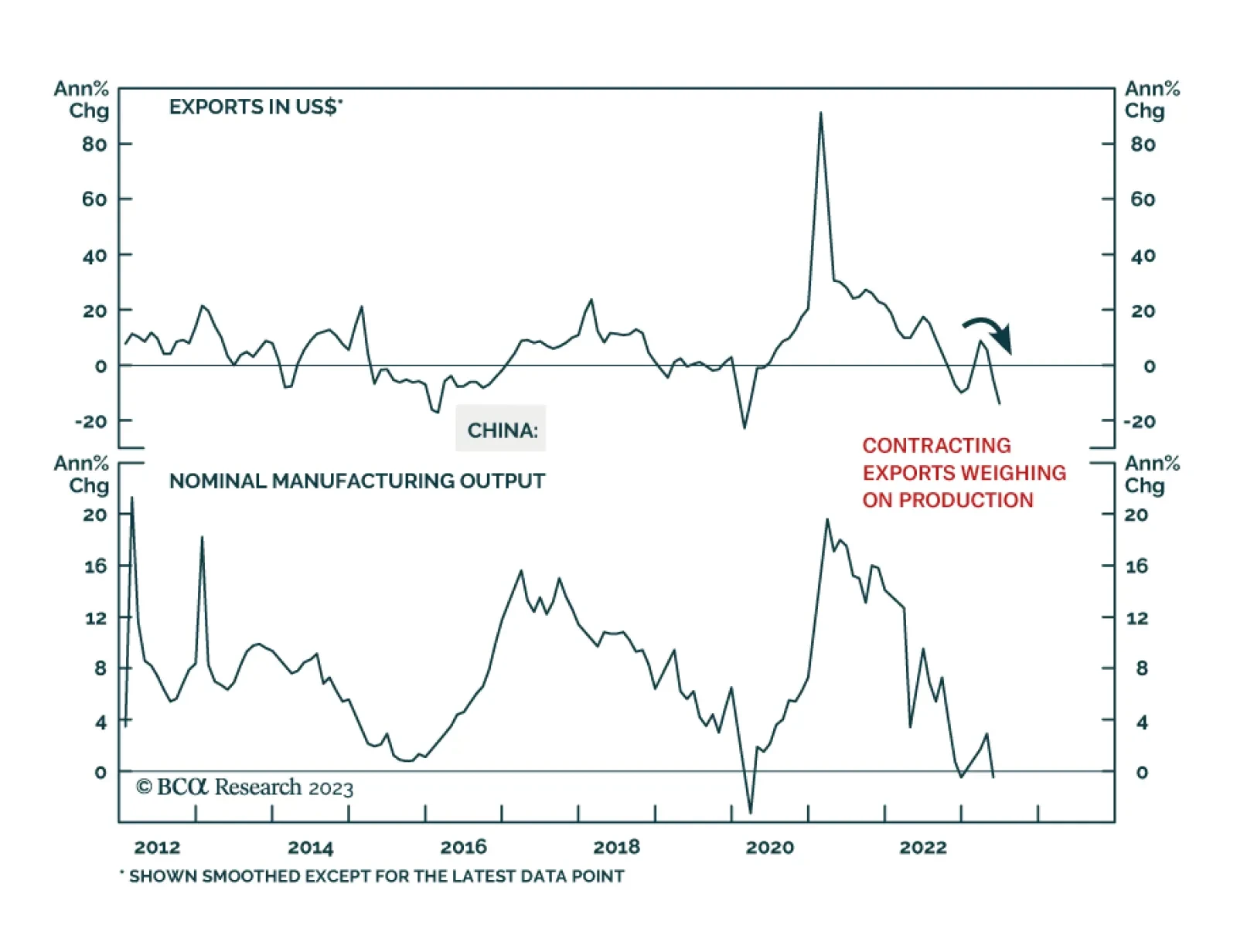

China’s June export data sent a negative signal about global manufacturing conditions. The -12.4% y/y drop in the dollar value of Chinese exports fell below expectations of a -10% y/y decline, registering the steepest…

Falling inflation enables central banks to pause rate hikes, which is good news. But time goes on. Restrictive monetary policy, Chinese debt-deflation, energy supply shocks, US and global policy uncertainty, and extreme geopolitical…