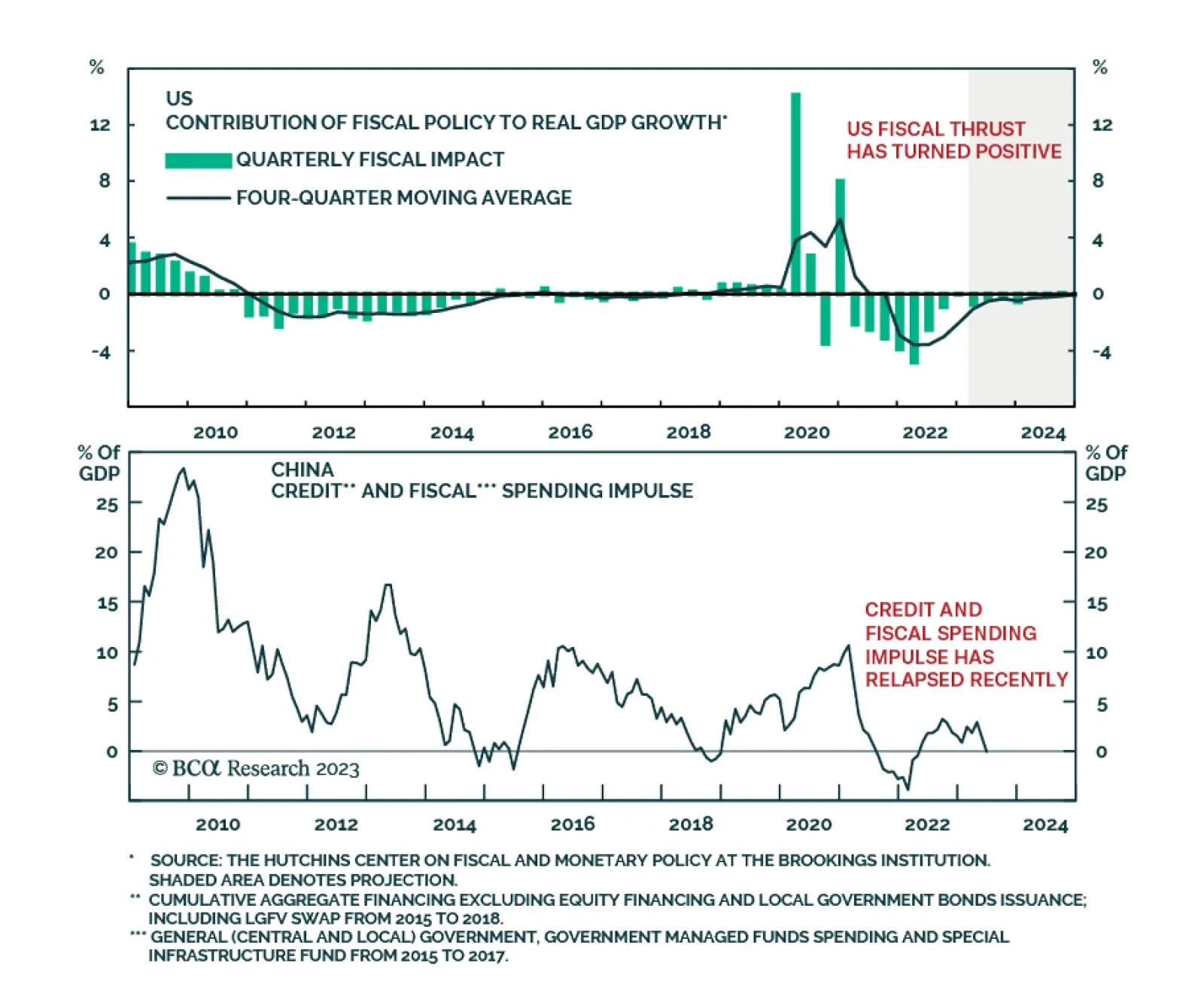

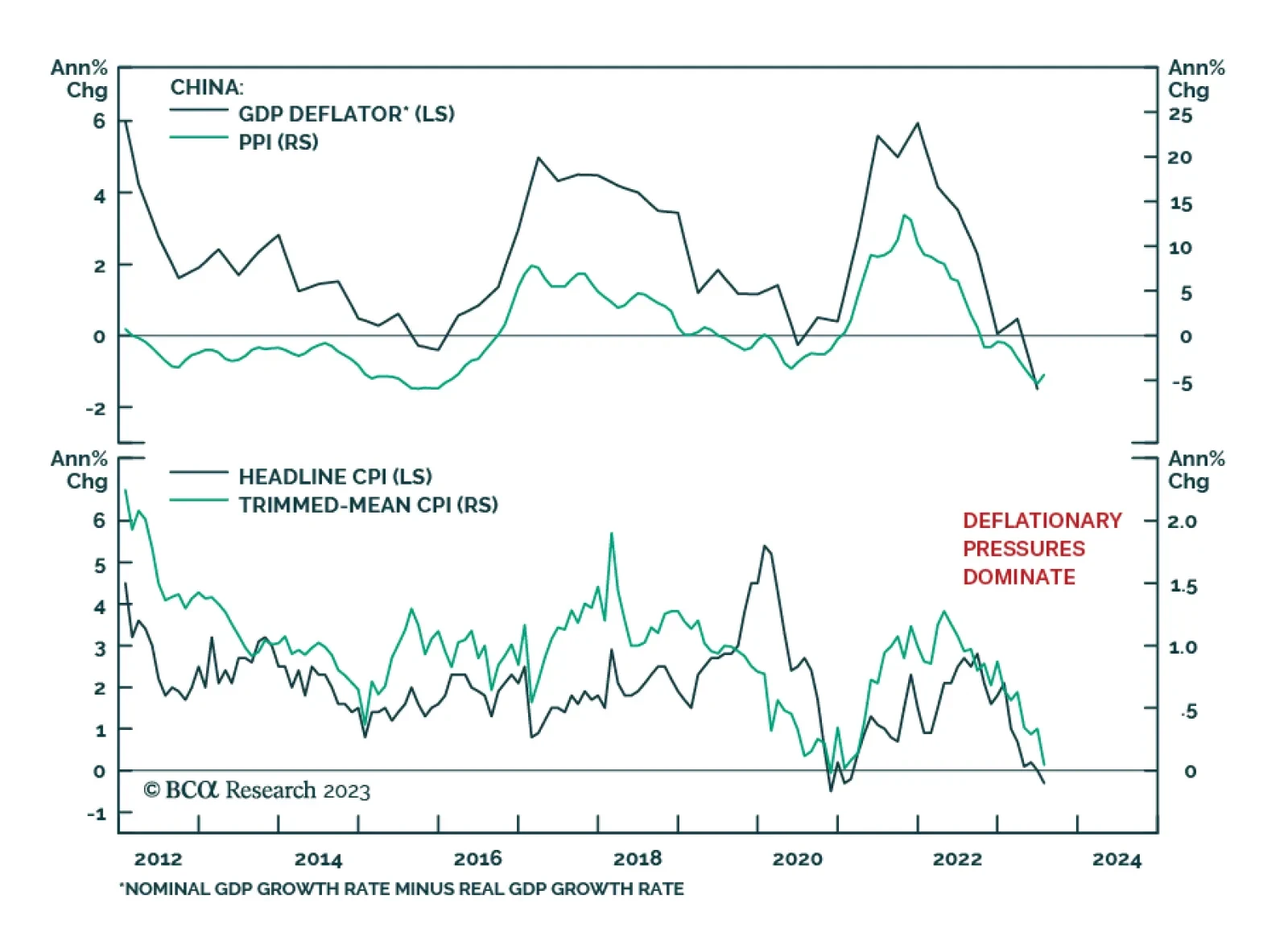

We continue to expect China to deploy stronger fiscal and monetary stimulus to avoid prolonged deflation brought about by a liquidity trap and sub-zero growth. All the same, a lower-growth risk has been added to our ensemble forecast…

The fiscal impulse philosophies of the two largest economies of the world are set to pull in opposite directions in 2023. After the massive fiscal stimulus of 2020, the US had been cutting back on its deficit. But US fiscal…

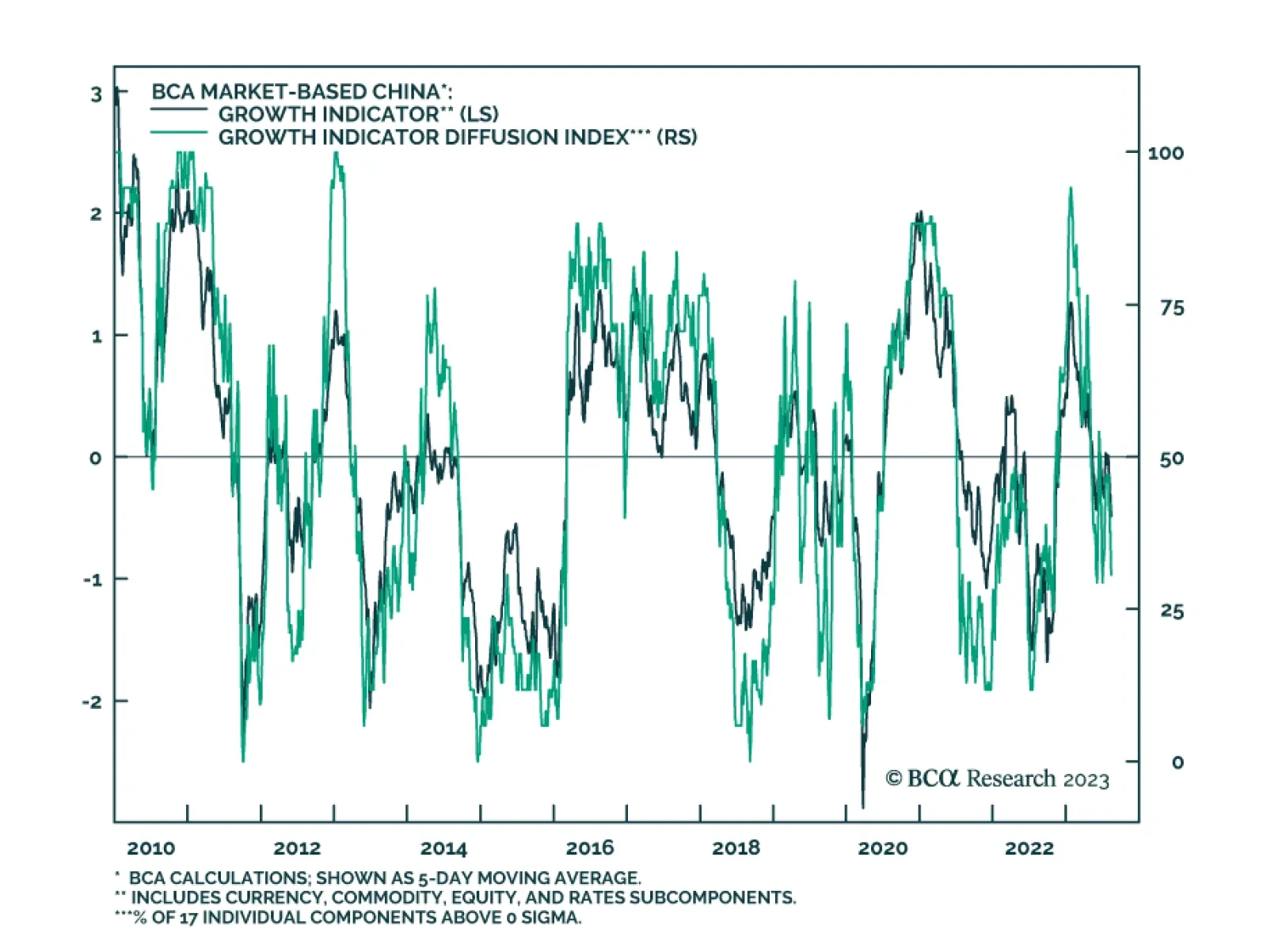

The above chart illustrates the BCA Market-Based China Growth Indicator, which is made up of 17 series grouped into four asset class subcomponents: currencies, commodities, equities, and rates/fixed-income. The purpose of the…

On Monday, Asia Pacific equity markets closed in the red due to the news that China’s largest real estate developer, Country Garden, is suspending the trading of some of its bonds. This recent episode is a continuation of…

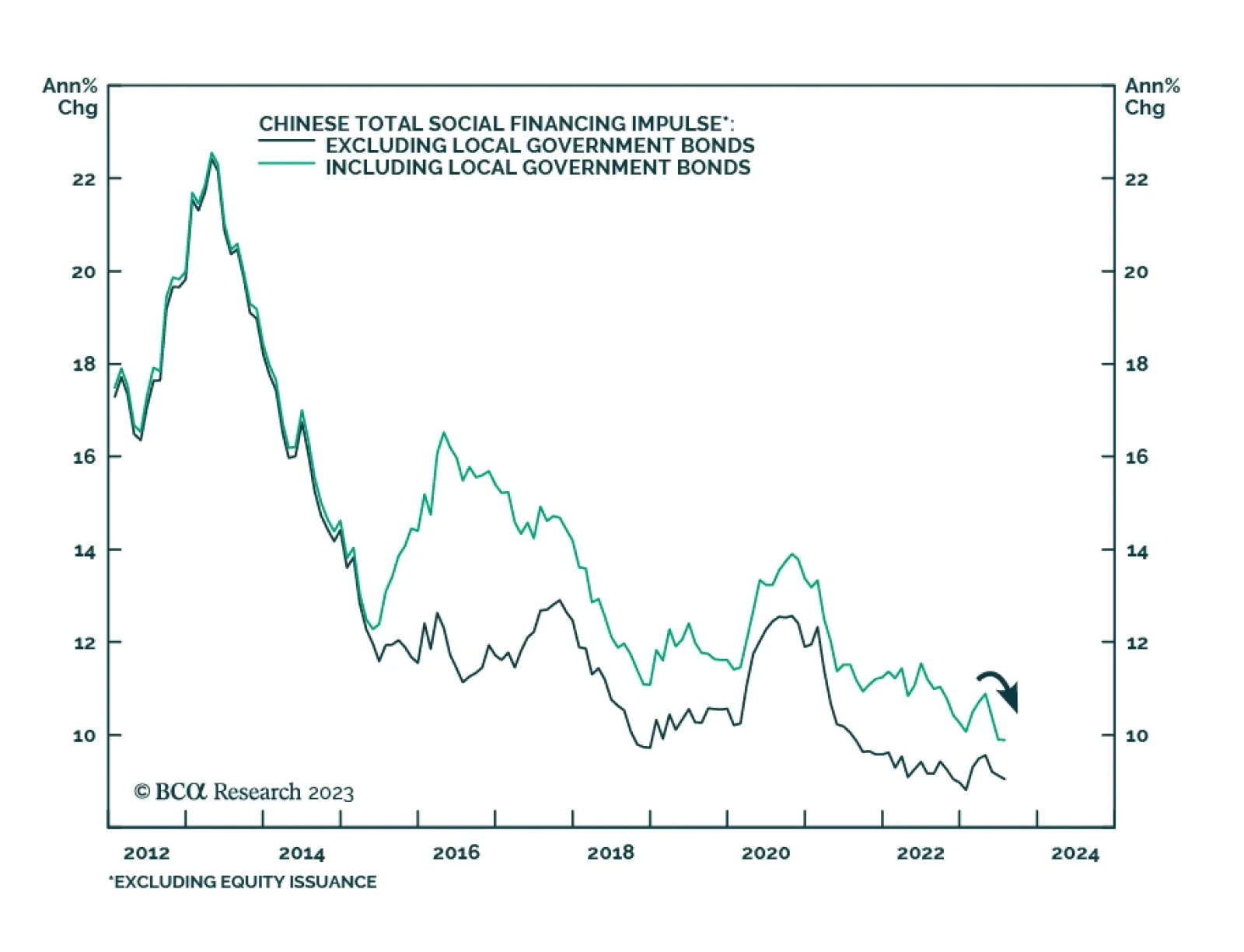

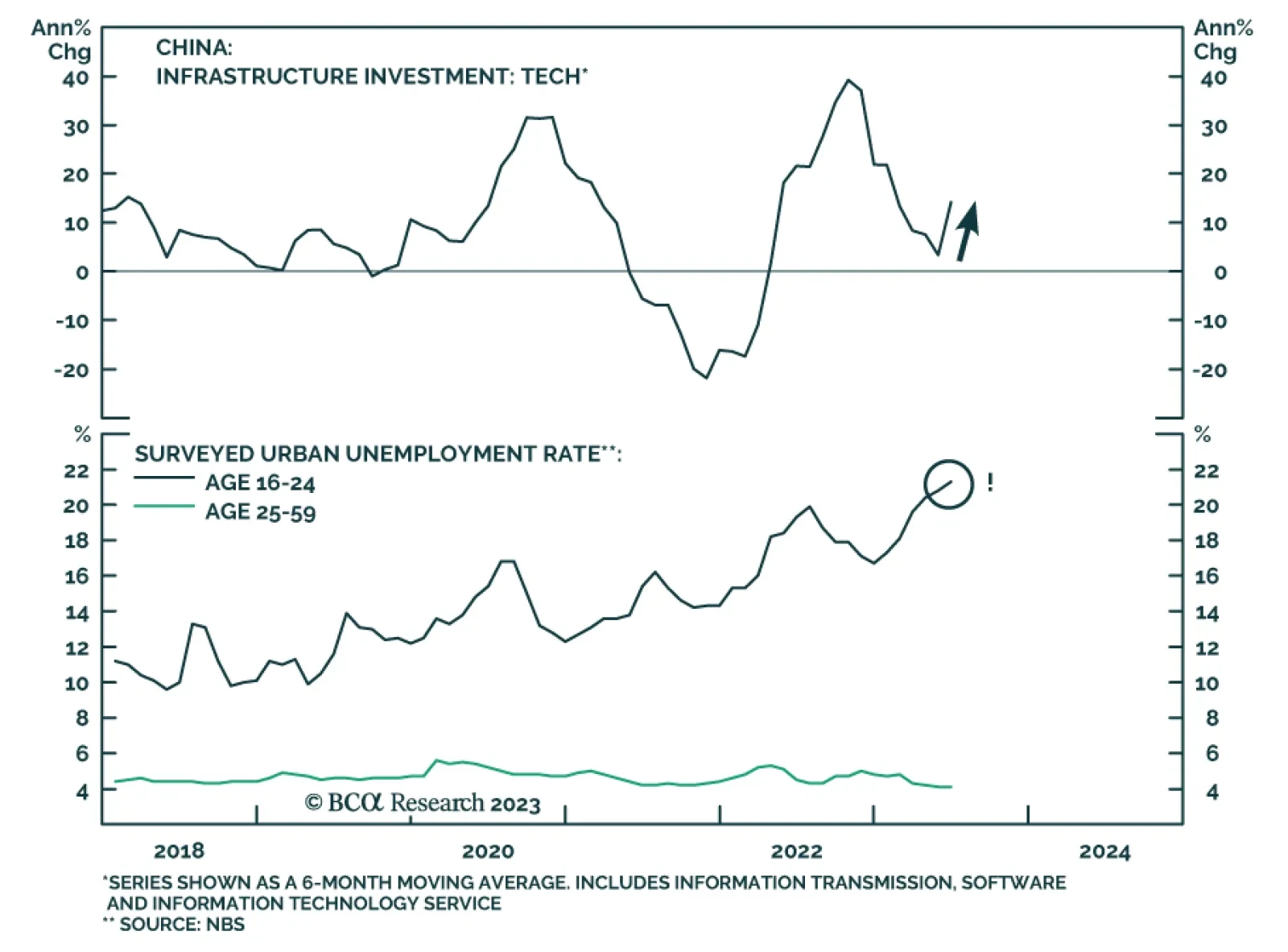

Chinese credit and money data fell significantly below expectations in July. The CNY 0.53 trillion increase in aggregate social financing marks a significant slowdown from CNY 4.22 trillion in June and came in significantly below…

Numerous divergences have opened up between global risk assets and global business cycle variables. These gaps are unsustainable, and odds are that the recoupling will occur to the downside with risk assets selling off.

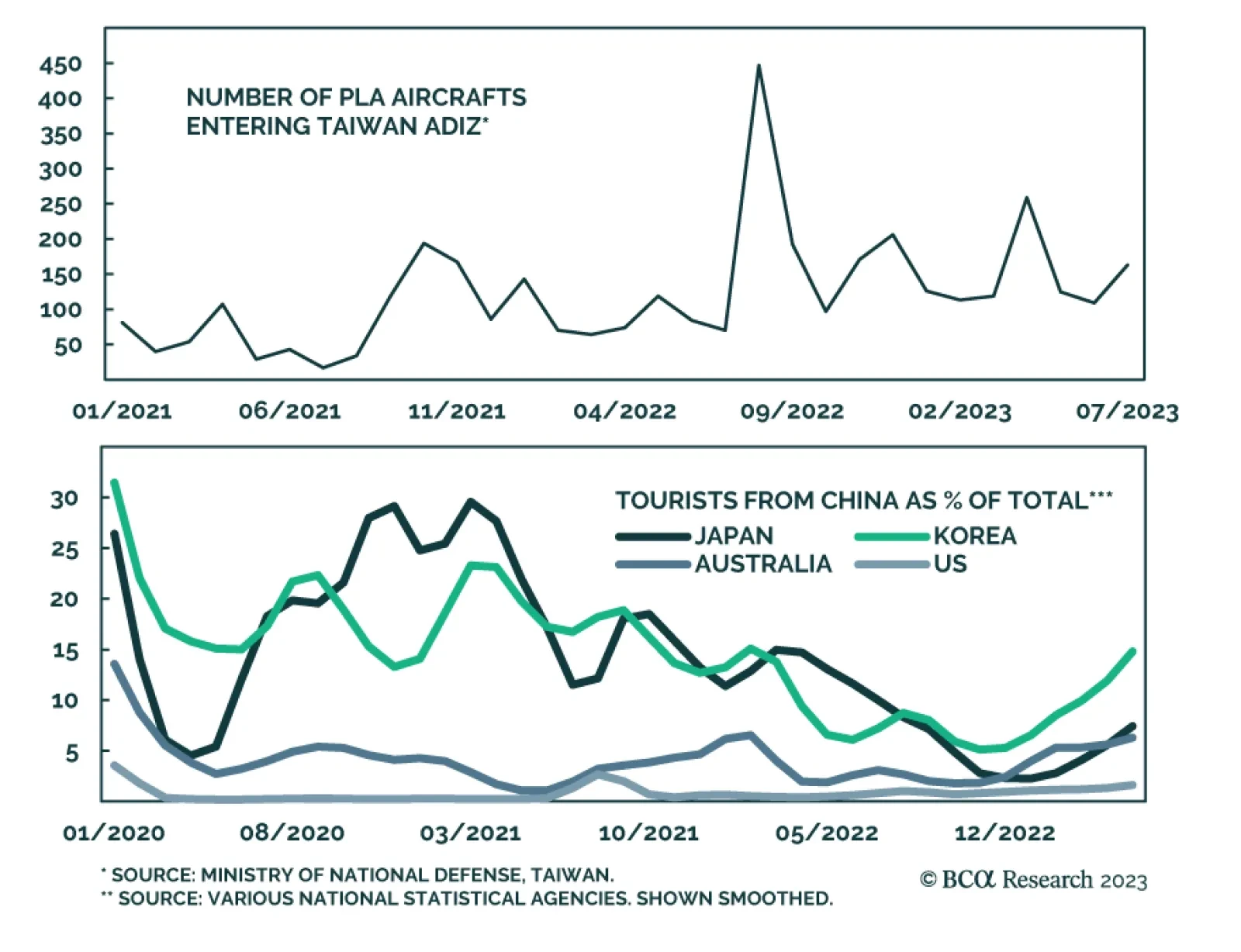

On Wednesday, President Joe Biden announced that a new ban on some US investment into China’s quantum computing, advanced chips and artificial intelligence sectors will come into force next year. This latest escalation is…

The downgrade of the US credit rating highlights the risk of fiscal dominance overriding the Fed’s long-standing monetary dominance focused on its dual mandate. This threatens to push inflation and long-term interest rates higher. It…

China’s CPI and PPI inflation release for July indicates that deflationary pressures dominate the domestic economy. After remaining unchanged in June, consumer prices fell by 0.3% y/y. Meanwhile, the 4.4% y/y drop in…

China has generated 41 percent of the world’s economic growth through the past ten years, al-most double the 22 percent contribution from the US. Now that the Chinese growth engine is failing, we explain why it is arithmetically…