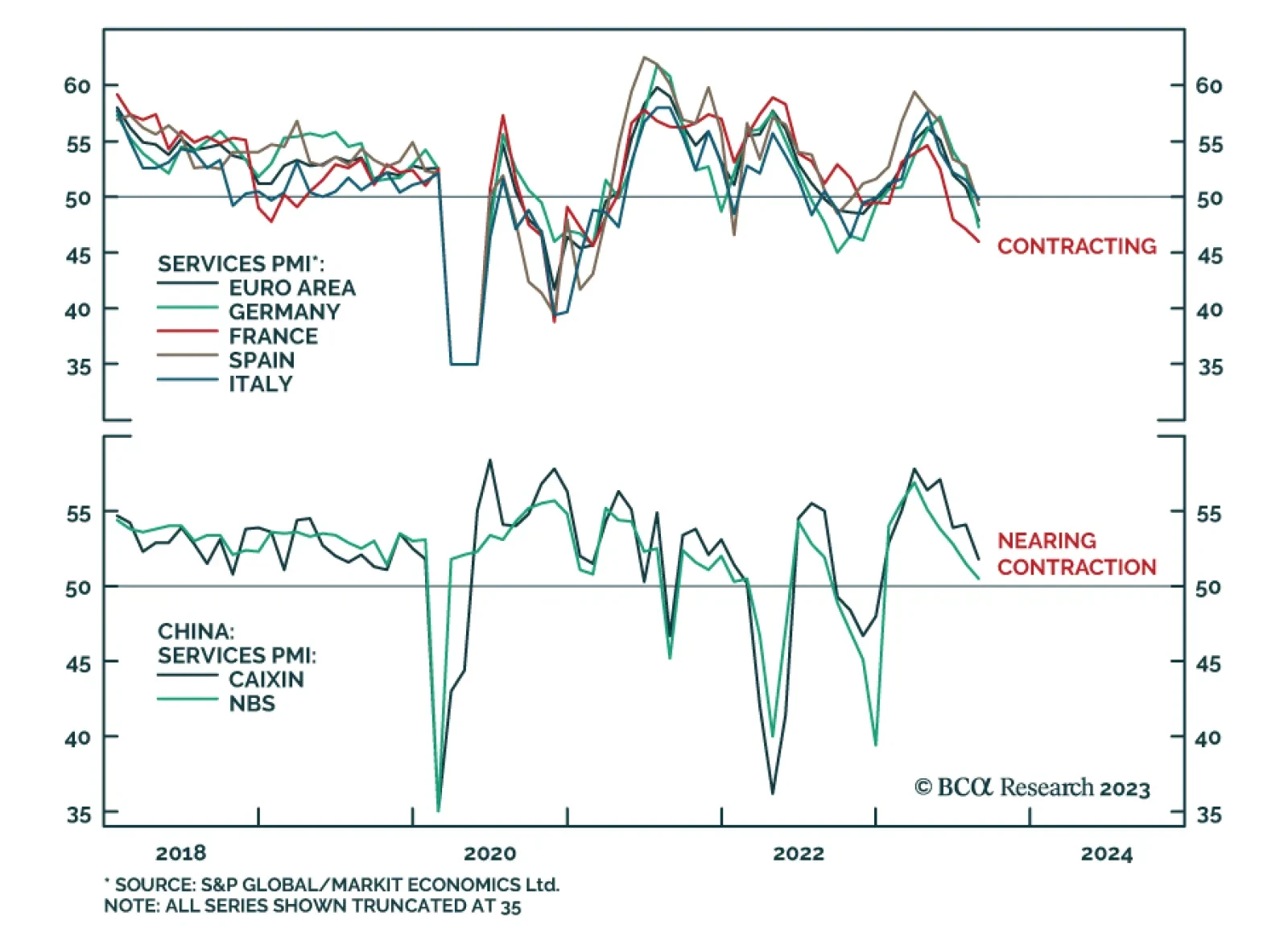

The final PMIs for August delivered a pessimistic update on service sector conditions in the Euro Area and China. The Eurozone services index was unexpectedly revised down from 48.3 to 47.9 – indicating a more pronounced…

A global recession continues to be likely over the next 12 months. The impact of tighter monetary policy is slowly being felt. Government bonds look increasingly attractive as a safe haven.

The stock market’s pre-eminent growth sector is not US tech, it is French luxuries. No other sector can compare with French luxuries’ massive and sustained pricing power. The risk for French luxuries is not a China slowdown, the risk…

The US and China agreed to hold trade talks more regularly on August 28, even as they fell short of establishing a strategic détente or general reduction of tensions. US Commerce Secretary Gina Raimondo visited Beijing…

Investors should underweight global equities and risk assets; overweight US stocks relative to global; and overweight defensive sectors versus cyclicals.

The ongoing profit contraction among Chinese industrial firms underscores that deflationary headwinds dominate the domestic economy. Although the annual pace of decline of industrial profits slowed from 8.3% y/y in June to 6.7% y…

Most diagnoses of China’s liquidity trap miss the point that policies arising from these theories were developed for market-based economies with governments accountable to their electorates, not autocracies pursuing autarky. As the…