In this Strategy Outlook, we present the major investment themes and views we see playing out for the rest of 2023 and beyond.

BCA Research’s China Investment Strategy service estimates that China’s oil demand growth will decline from 12% year-on-year in the past eight months to a still robust 4%-6% in the next six-to-nine months. China…

US fiscal, monetary, and foreign policies are unlikely to deliver any dovish surprises for investors in Q4, due to the impending government shutdown, persistent inflation, and instability among OPEC+ and China.

The global downturn will be shallower than it was in 2008 and in 2020 but will last for longer. The primary reason for a more prolonged downturn is that policymakers in the US, Europe, and China will be reluctant to proactively and…

We continue to expect Brent crude to trade just above $101/bbl in 4Q23, and to average $118/bbl in 2024. Higher volatility looms. We expect Russia will cut oil production next year as part of a concerted effort to undermine Biden’s…

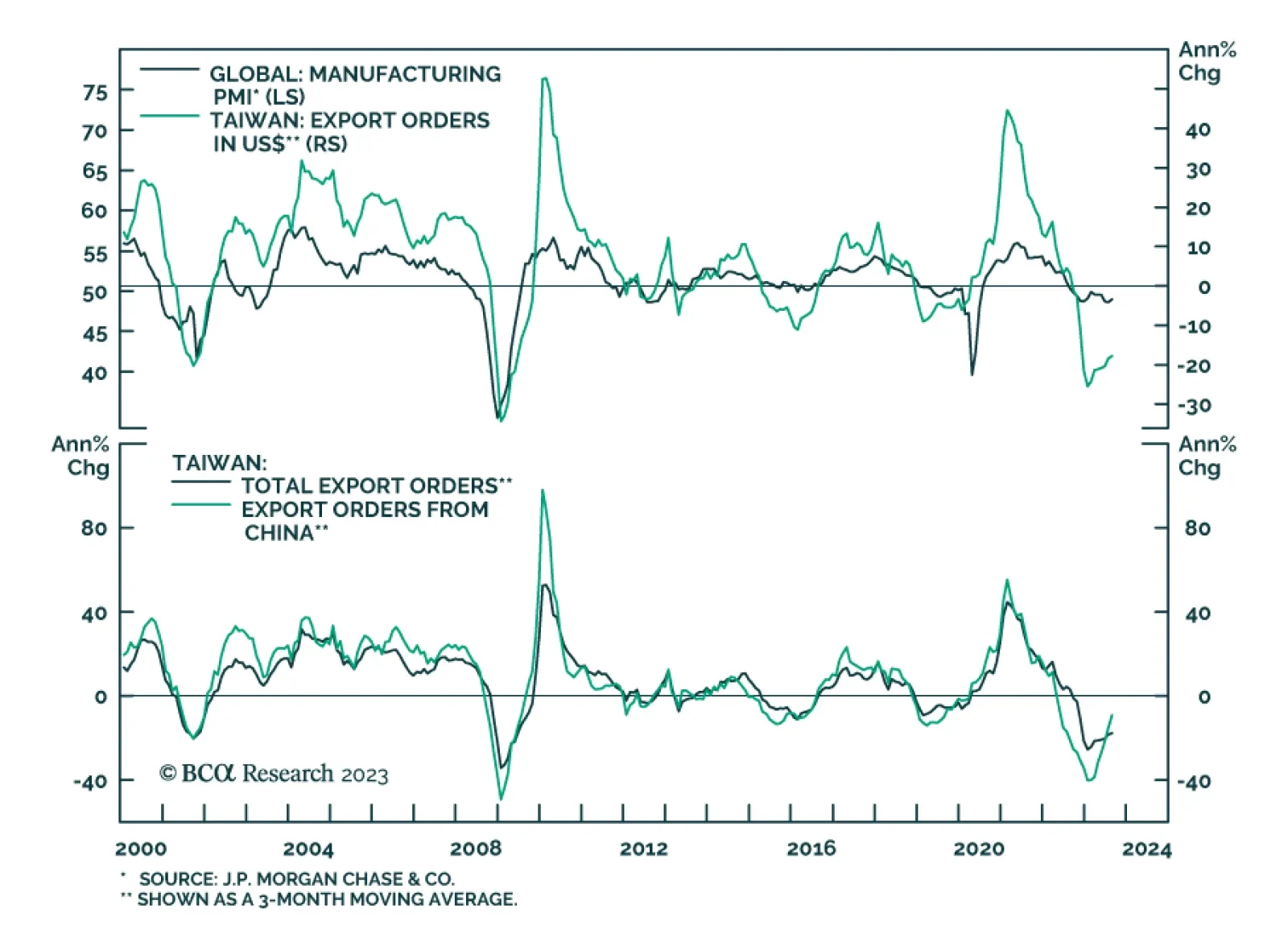

Taiwanese export orders sent a disappointing signal about global manufacturing conditions on Wednesday, corroborating the message from Singapore’s NODX release earlier this week. The pace of decline in export orders…

China’s reopening faltered and now it is applying moderate stimulus. OPEC 2.0’s production discipline is getting results, with oil prices climbing. The Fed will not be able to deliver dovish surprises in Q4 2023. Investors should…

The Chinese economy will not recover without significant “irrigation-style” stimulus. The latter is still unlikely for the time being. Dim economic fundamentals justify lower valuations of Chinese equities. Lingering deflationary…

While we are sympathetic to the view that the Fed could temporarily achieve a soft landing, we are skeptical that it could stick that landing for very long. Stocks could strengthen into year-end, with small caps potentially leading…